On this page, you will find a large number of reviews from the real ICMarkets If you are already working with If you are already working with ICMarkets please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

IC Markets Review 2021

IC Markets (International Capital Markets) is an international Forex broker, which was established in 2007 in Sydney, Australia. The broker is a Forex and CFD provider with over 250 assets in 6 markets from currency pairs and stocks to cryptocurrencies and bonds.

The broker can be considered reliable as it is regulated in three countries, including Australia and Cyprus. In addition, IC Markets is an ECN broker (Electronic Communications Network). ECN is a digital system that connects the buyers and the sellers directly, without intermediaries. This eliminates a possibility of price manipulation and delays on the part of the broker.

ECN technologies and the servers in the liquidity centers allow for offering better conditions for the customers: competitive quotations, narrow spreads and quick order execution. Market monitoring shows that in terms of the commission rates and order execution speed, IC Market offers some of the best conditions in the market.

Pros and cons

The key benefits of IC Markets include low spreads and commissions and also quick order execution. The broker offers very low spreads – from 0.0 pips. IC Markets liquidity pool is formed from over 25 largest suppliers, according to the company.

The next advantage of the broker is the super-fast order execution within 1 ms, which is provided by automation of the trading process, connection of the servers to the supplies of prices via a special fiber-optic line.

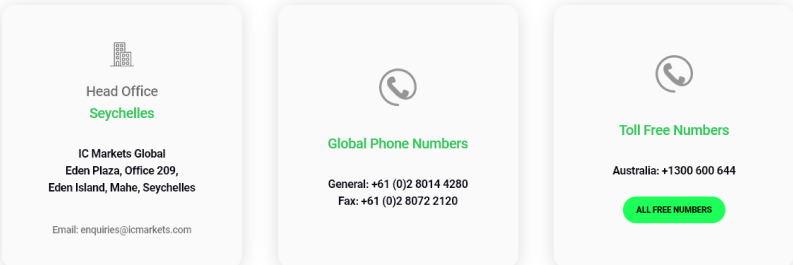

In terms of the drawbacks, one of the branches, IC Markets Global, is registered in the Seychelles, which is an offshore territory with weak control over the operation of foreign financial companies.

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features of IC Markets

| Regulation | Australia, the Seychelles, Cyprus |

|---|---|

| License number | ASIC: No. 335692; FSA: No. SD018; CySEC: №362/18 |

| Commissions and fees | Low |

| Inactivity fee | No |

| Minimum deposit | $200 |

| Leverage | Up to 1:500 |

| Markets | Forex, акции, облигации, индексы, сырьевые товары, энерготовары, металлы, криптовалюты |

| Supported languages | 18 |

| Withdrawal fee | No |

| Withdrawal to credit/debit card | Visa, MasterCard |

| Deposit from electronic wallets | PayPal, WB, Skrill, Neteller, Union Pay, Bpay, FasaPay, Poli, Rapidpay, Klarna and others |

| Supported currencies | 10 base currencies, 64 currency pairs |

| Trading platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Demo account | Yes |

Geography of broker’s customers

IC Markets is one of the most popular brokers in the world. Taking into account its Australian registration, it is not surprising that a large share of its customers are based in that region. Nevertheless, the broker is also just as popular in Southeast Asia (primarily Vietnam, Indonesia and Thailand), Brazil and Europe, especially in the UK and Poland.

| Country | Percentage of customers |

|---|---|

| Australia | 11.2% |

| Brazil | 11% |

| Vietnam | 9% |

| Poland | 8% |

| UK | 7% |

| Thailand | 5% |

| Indonesia | 5% |

Commissions and fees

Australia-based IC Markets offers very low commission in the majority of the markets it provides access to.

We have analyzed all commissions IC Markets charges and for simplicity, will provide real examples of how much a trader will have to pay in US dollars for order execution for a specific amount. We will compare IC Markets trading accounts between themselves to single out the most beneficial one for active trading, and will also compare them to other brokers – FxPro and Forex4You.

Note! All calculations of the commissions charged by IC Markets were made based on the information as of 27.11.2020. For more detailed and accurate information, visit the broker’s website.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on IC Markets

| Asset | Commissions |

|---|---|

| EUR/USD | On Standard Account – average spread 1.1 pips, on Raw Spread Account – $3.5 per standard lot (side) |

| CFD on S&P 500 | Average spread 0.6 |

| CFD on Apple | Average spread 0.02 |

| CFD on BTCUSD | Average spread 10.0 |

| Non-trading commissions | No |

Commissions on Forex market

We estimated IC Markets commission on the Forex market as very low. This particularly applies to major currency pairs trading on the Raw Spread account, where the broker only charged $3.5 per lot (one side). The spread on this account is extremely low thanks to the aggregation of liquidity from top 25 suppliers of liquidity, which is why it starts from 0.0. pips.

To begin with, let’s compare the conditions on different types of accounts on IC Markets. As an example, let’s see how much a trader will have to pay for the execution of a standard lot in several currency pairs of different classes. In the table, we provide the amount in US dollars, the spread and possible commission per lot included.

| Standard | Raw Spread* | |

|---|---|---|

| EURUSD | $11 | $4.5 |

| EURGBP | $18 | $8.7 |

| USDZAR | $33 | $29.9 |

* We specified the commission per lot (one side). It must also be taken into account that the broker charges a fee for opening and for closing the trade on the Raw Spread account.

We discovered that the conditions for trading on the Forex market are much more beneficial on the Raw Spread account. This account is excellent for scalping, as IC Markets does not impose any restrictions on the strategies. The Standard Account is mainly designed for discretionary traders, who use investor funds.

Let’s also find out how attractive the commissions of IC Markets (Raw Spread Account) are compared to FxPro (cTrader Account) and Forex4You (ProSTP Account). In all three cases, these are the account types with minimum commissions. For comparison, we used an average size of the commission a trader will have to pay for execution of a standard lot of 100,000 units of base currency.

| IC Markets | FxPro | Forex4You | |

|---|---|---|---|

| EURUSD | $4.5 | $8.2 | $9 |

| USDJPY | $5.4 | $8.4 | $12.38 |

| EURGBP | $8.7 | $15.5 | $16.3 |

| AUDJPY | $7.3 | $14.15 | $13.5 |

| USDZAR | $29.9 | $47.2 | - |

As you can see, IC Markets compares favorably also with other brokers.

Swaps on IC Markets

As a reminder, a rollover of a position to the following day causes emergence of a swap on the Forex market. It is charged based on the interest rates of banks that issue currencies in the currency pair. Some brokers charge additional fee for the rollover, which is why swaps may differ.

We estimated swaps on IC Markets as low, which makes long-term strategies on the Forex market beneficial.

Another reminder. When the swap is positive, a certain number of points is accrued to the account, and when the swap is negative, they are written off the account.

| Swap Long | Swap Short | |

|---|---|---|

| EURUSD | -4.34 | -0.24 |

| USDJPY | -1.26 | -3.06 |

| EURGBP | -3.26 | -0.88 |

A number of brokers offer accounts without swaps for Muslim traders. IC Markets has an Islamic account. For its details, please visit the broker’s website.

| IC Markets | FxPro | Forex4You | |

|---|---|---|---|

| Swap free | Yes | Yes | Yes |

Commissions on CFD

The majority of markets on the IC Markets platform are available via contracts for differences (CFD). We determined the level of spread as low or average, depending on the type of the account.

We calculated how much a trader will have to pay for the execution of a USD 5,000 lot of CFD on different assets and compared the broker’s conditions with the competitors. We will review such market segments and CFD on stocks and cryptocurrencies separately.

| Spread | IC Markets | FxPro | Forex4You |

|---|---|---|---|

| CFD on S&P 500 | $0.92 | $1.19 | $1.57 |

| CFD on S&P 500 | $6.57 | $8.8 | $4.01 |

Conclusion: It is more beneficial to trade CFD on the IC Markets platform in the majority of positions.

Commission on stock market

IC Markets provides access to trading stocks of American and Australian companies via CFD exclusively on the MT5 platform. We estimated the level of commission on the American market as low.

On the Australian stock market, a minimum fee of AUD 7 or an equivalent in another currency is charged since September 1, 2020, regardless of the volume of the trade. In addition, for trading CFD on Australian stocks, a trader will have to pay AUD 22 for market data provision.

As an example, let’s see the average amount a trader will have to pay for purchasing a USD 5,000 lot of CFD on IC Markets, FxPro and Forex4You.

| IC Markets | FxPro | Forex4You | |

|---|---|---|---|

| USA. CFD on Apple (AAPL) | $0.92 | $26.13 | $8.58 USD |

| USA. CFD on Coca-Cola (KO) | $1.01 | $10.98 | $8 USD |

| Australia. CFD on BHP Billiton (BXP) | $6.24 | Not available | Not available |

| Австралия. CFD на акции Rio Tinto (RIO). | $6.24 | Australia. CFD on Rio Tinto (RIO). | Australia. CFD on Rio Tinto (RIO). |

As we can see, IC Markets offers much better conditions on the U.S. market compared to its competitors.

Commissions on cryptocurrency market

IC Markets provides access to cryptocurrency trading via CFD on the MT4 platform. As a commission, the broker uses spread. We estimated the level of commission for BTC trading as low, and altcoins as average in the market. As an example, we will use the purchase of cryptocurrency for the amount of $2,000.

| IC Markets | |

|---|---|

| BTCUSD | $1.54 |

| ETHUSD | $23.41 |

As of November 2020, FxPro and Forex4You did not provide access to cryptocurrency trading.

Non-trading commissions

Non-trading commissions on IC Markets are low. No inactivity fee is charged. The broker does not charge deposit and withdrawal fees for most methods, although the banks and payment systems used by the customer may charge a fee.

| IC Markets | FxPro | Forex4You | |

|---|---|---|---|

| Inactivity fee | No | No | No |

| Withdrawal fee | No | No | No |

| Deposit fee | No | No | No |

Reliability and regulation

IC Markets gets a high rating for security and reliability. The company has three legal entities, licensed in different regions, including such reliable ones as Australia and Cyprus. The European customers of the broker are also additionally protected by the deposit guarantee fund in the amount of up to EUR 20,000.

Other advantages of the broker also include its extensive experience of operation in the market since 2007. Over this period, the company has preserved its good reputation.

The one disadvantage is that the customers of the international branch (IC Markets Global) are not protected by the deposit guarantee fund, while the license issued by the Seychelles is not considered “top”, because the country cannot boast strict control over the operation of financial companies.

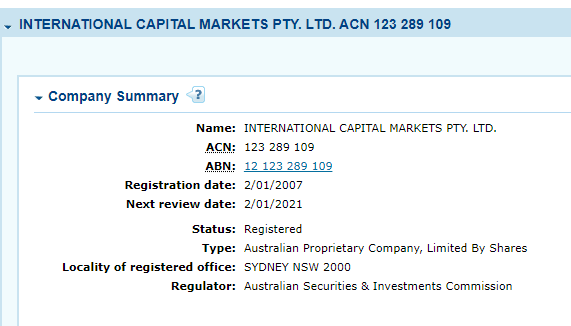

We also checked the information about the broker’s licenses.

IC Markets AU (Australia)

The Australian branch, International Capital Markets Pty. Ltd., which operated under the name IC Markets AU, holds the license No. 335692 issued by the Australian Securities and Investments Commission and is a member of the Australian Financial Complaints Authority.

Customers’ funds are kept on the segregated discretionary accounts at the banks of Australia – National Australia Bank (NAB) and Westpac Banking Corporation (Westpac), and also Barclays Bank (headquartered in London, UK). Electronic payments are processed with the use of SSL (Secure Socket Layer) technology.

On ASIC website, we found the following information about the company, which confirms its registration:

Information about the license is available on the AFSL website (Australian Financial Services Licenses, provided by ASIC):

IC Markets EU

IC Markets EU is licensed by Cyprus Securities and Exchange Commission (CySEC), No. 362/18. The information about the broker’s license is available on CySEC website:

IC Market Global

Raw Trading Ltd, which operated under the name IC Markets Global, holds the license of securities dealer No. SD018, issued by the Financial Services Authority of Seychelles (FSA). The information about the company can be found in the list of regulated companies on the website of FSA of Seychelles:

Conclusion: We checked the licenses of IC Markets and confirmed the information. Based on the information we gathered, the broker is considered reliable.

Markets and products

Availability of markets on the IC Markets platform leaves a mixed impression. We give the broker an average rating here. On the one hand, it provides access to a wide range of markets, including currency pairs, indices, commodities, bonds, futures, cryptocurrencies and stocks. On the other hand, in the majority of cases the access is granted via CFD, while the total number of instruments does not quite reach 300.

Passive investors have the opportunity to invest in PAMM accounts and can also test ZuluTrade, a copy trading service. There are also several bonds and dividend payment is available on CFD on stocks.

IC Markets does not provide access to direct stock trading, which is a serious drawback. CFD on stocks are only available on the MT5 platform.

We believe that the diversity of markets will be quite sufficient for the majority of traders, while the advanced investors won’t have “enough space” on the IC Markets platform.

| Pros |

|---|

|

| Cons |

|---|

|

Forex market

Forex is the best represented market on IC Markets. There are 65 currency pairs available on the platform, including all major pairs and cross rates. The fans of exotic pairs will also find a sufficient number of assets to trade.

Let’s compare the availability of currencies on IC Markets and its competitors – Forex4You and FxPro.

| IC Markets | FxPro | Forex4You | |

|---|---|---|---|

| Number of currency pairs | 65 | 64 | 50 |

CFD market

The majority of assets on the platform are available as CFD. We estimated market diversity on IC Markets as excellent. In terms of this indicator, the broker compares favorably with the competitors from our review. As for the number of trading instruments on each market, it could have been bigger.

Market availability via CFD

| Market | IC Markets | Forex4You | FxPro |

|---|---|---|---|

| Indices | 23 | 15 | 20 |

| Commodities | 19 | 4 | 10 |

| Bonds | 6 | No | No |

| Cryptocurrencies | 10 | No | No |

| Stocks* | 120 | 51 | 138 |

| Futures** | 4 | No | 20 |

* available only on MT5 platform

** available only on MT4 platform

As we can see, IC Markets provides access to more markets in general.

Stock market

There are certain peculiarities of trading CFD on stocks via IC Markets that need to be taken into account.

1. Stock trading is available only on one platform – MT5.

2. The broker provides access to trading 120 most liquid stocks at the U.S. exchanges (Nasdaq, NYSE) and Australian exchange (ASX).

3. It is possible to receive dividends, but for details you need to contact the support team. Conditions may differ depending on the country, mainly due to the special nature of dividend taxation.

4. From September 1, 2020, the broker charges an additional fee for market data provision in the amount of AUD 22 per month for trading on the Australian exchange (ASX).

Passive income

There are several ways to receive passive income on IC Markets. In terms of the number of options, the broker compares favorably with the competitors from our review.

| IC Markets | Forex4You | FxPro | |

|---|---|---|---|

| PAMM accounts | Yes | No | No |

| Copy trading service | Yes | Yes | No |

| ETF | No | No | No |

| Dividends on stocks | Yes | Yes | Yes |

| Bonds | Yes | No | No |

| Investment portfolios | No | No | No |

| Mutual funds | No | No | No |

Opening an account

The strong suits of IC market include quick opening and instant funding of the account. The broker offers 15 deposit methods in 10 currencies of choice: USD, EUR, GBP, AUD, SGD, NZD, JPY, CHF, HKD or CAD.

All IC Markets accounts are suitable both for experienced traders and for the beginners; the differences are in the platforms, selection of trading instruments and spread/commission. All types of broker’s accounts have a True ECN model and a wide choice of assets for trading.

Restriction on the provisions of services to citizens of some countries can be considered a certain disadvantage. The countries are USA, Canada, Israel, Japan, New Zealand and the Islamic Republic of Iran.

| Pros |

|---|

|

| Cons |

|---|

|

Before going into details about the accounts, let’s answer several logical questions.

What is the minimum deposit on IC Markets?

For all trading accounts on IC Markets – cTrader, Raw Spread and Standard, the minimum deposit is $200.

How do the accounts differ from each other?

The accounts mainly differ by the audience of traders: cTrader is for day traders and scalpers, Raw Spread is for scalpers and users of advisors, and Standard is for discretionary traders, who trade using investor funds.

Citizens of which countries cannot trade on IC Markets

The broker does not work with the residents of the USA, Canada, Israel, Japan, New Zealand and the Islamic Republic of Iran

What is required for opening an account on IC Markets?

The procedure is rather simple and fully online. You need only your personal data for opening an account, and a proof of identity for its verification.

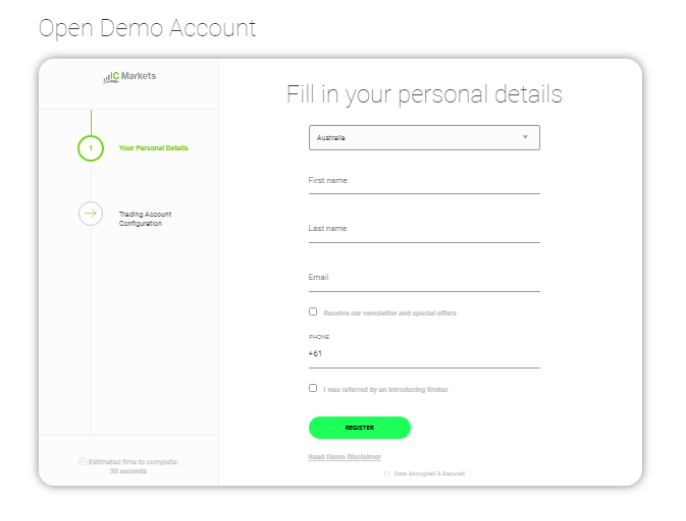

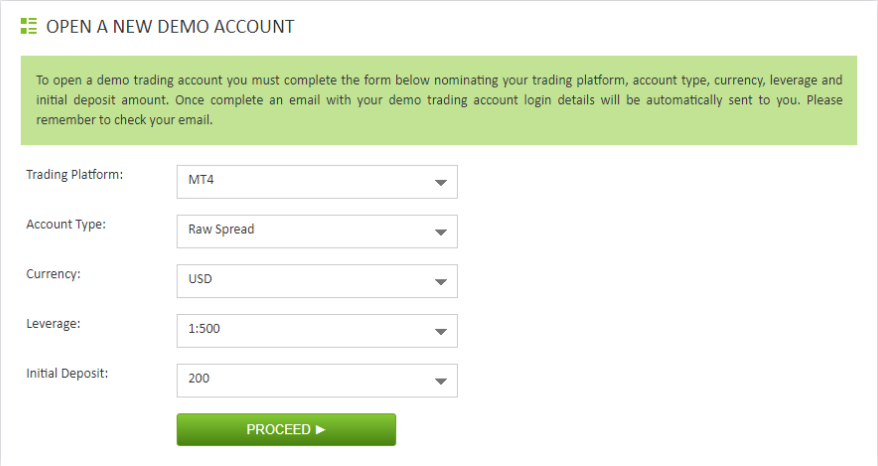

There are slight differences between opening a Demo account and a real one. Let’s see them.

Opening a Demo account: step-by-step guide

Step 1. At the first stage, you need to fill out a form on the company’s website to open a personal account. You will need to specify your country, contact information and your first and last name.

Step 2. Then, the system will ask you to specify the parameters of your demo trading account: type of trading platform (MT4, MT5 or cTrader), account type (Raw Spread or Standard), currency (10 at choice), the leverage and the minimum deposit (from $200). After you fill out the registration form, the information for accessing your demo trading account will be sent to your email.

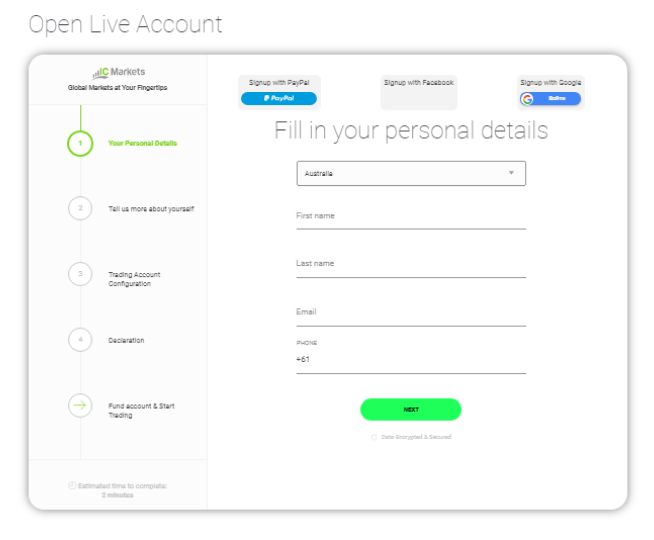

Opening a trading account on IC Markets: step-by-step guide

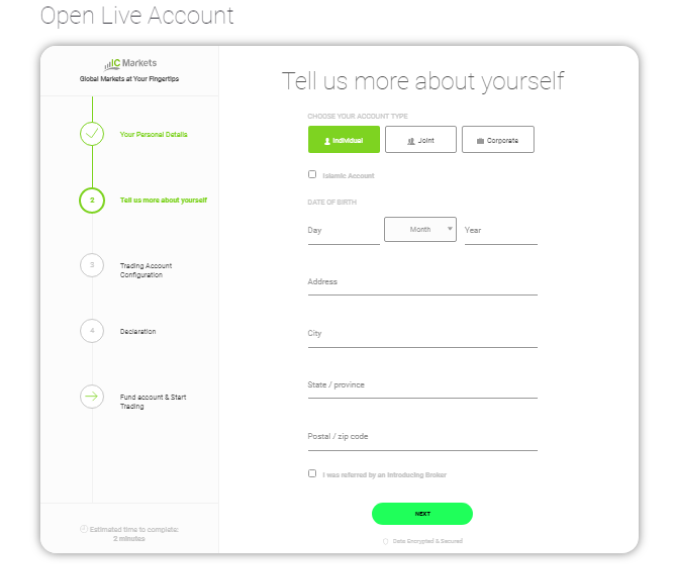

Opening a live account requires more information: more detailed personal data, declaration, deposit. Only then you can start trading.

Step 1. Fill out personal data, including your first name, your last name and contact information.

Step 2. This section requires you to provide your date of birth and your place of residence. Fill out everything here.

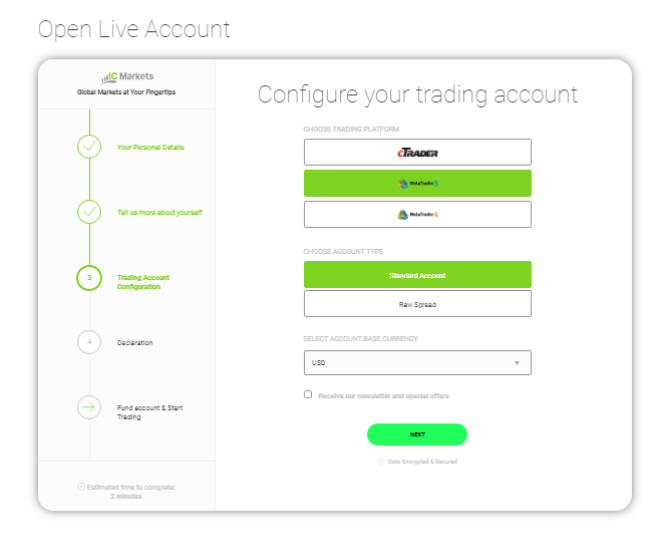

Step 3. The next step is choosing the configuration of your live account, such as trading platform, account type and base currency. Pay attention here, because the level of commissions, options and market availability depends on your choice of the platform and account type. In particular, stocks are available only on MT5, and cryptocurrencies only on MT4.

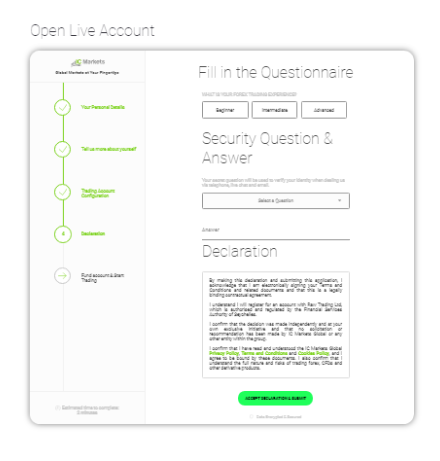

Step 4. In the Declaration section, you need to confirm that you agree with the Privacy Policy, Terms and Conditions and Cookies Policy of IC Markets Global. We advise you to read the text of the Declaration before accepting it.

Account verification

To start trading, you need to also verify your account. Below is the link to the video guide from the broker that will help you understand the procedure better.

Account types on IC Markets

The broker offers three types of accounts – Standard, Raw Spread and Raw Spread (cTrader). They are suitable both for the beginners and advanced users. There is a demo version of each of the accounts. The difference is in the size of the commissions and types of the platforms. In particular, Standard and Raw Spread accounts operate on MT4 and MT5 platforms, with their servers located in New York, while Raw Spread (cTrader) is based in London.

All styles of trading without restrictions are allowed on all account types on IC Markets.

Let’s review each account type in more detail.

Standard Account

The account is designed mainly for discretionary traders, who trade using investor funds. We have analyzed it in a comparison table with the corresponding accounts of FxPro and Forex4You.

| IC Markets Standard | FxPro MT4 Instant | Forex4You Classic | |

|---|---|---|---|

| Trading platforms | МТ4, МТ5 | МТ4 | МТ4, МТ5 |

| Base currencies | USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF и CAD. | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | USD, EUR |

| Type of Order Execution | Market Execution | Instant Execution | Instant Execution |

| Assets | 60 currency pairs, 16 commodities (including metals) and 16 stock indices | 7 currency pairs | 40 currency pairs, 2 commodities and 35 stocks. |

| Minimum deposit | 200 USD | 100 USD | 0 USD |

| Commission on traded volume | No | No | No |

| Swap-free | Yes | Yes | No |

| Spread | Floating from 1.0 pips | Fixed from 1.6 pips | Fixed from 2 pips |

| Micro Lot Trading (0.01) | Yes | Yes | Yes |

| Leverage | Up to 1:500 | Depending on the jurisdiction, up to 1:30 for major currencies | Up to 1:1000 |

| Stop Out | 50% | 50% (CySec, FCA) 20% (SCB) | 20% |

Comparison of the standard accounts on IC Markets, Forex4You and FxPro has shown that IC Market compares favorably with its competitors by the majority of indicators. The Standard account of IC Markets offers more currency pairs and assets for trading, the lowest spread, market execution of orders, which guarantees better speed of the trades. At that, the minimum deposit on IC Markets is slightly higher compared to the competitors.

Raw Spread Account

Raw Spread Account is excellent for active trading with large volume thanks to Raw Pricing. The technology allows to combine liquidity from the top providers. In particular, the average spread for EUR/USD on the Raw Spread Account is only 0.1 pips (presently the lowest average spread in the world for EUR/USD pair), while the commission per lot is $3.50, which is a very beneficial offer.

| Trading platform | MetaTrader |

|---|---|

| Commission per lot | $3.5 |

| Spread from | 0.0 |

| Minimum deposit (USD) | $200 |

| Leverage | 500:1 |

| Location of the servers | New York |

| Micro Lot Trading (0.01) | Available |

| Currency pairs | 64 |

| CFD on indices | Available |

| Stop Out | 50% |

| One-click trading | Available |

| Islamic account | Available |

| Allowed trading styles | All |

| Restriction on the order distance | No |

| Programming language | MQL4 |

| Target audience | Scalpers and users of advisors |

Raw Spread Account (cTrader)

This account is designed for working on cTrader platform, which was specifically developed for Forex trading. IC Markets server for cTrader is located in London. Order stream processing system helps offer the best quotations from ten providers with only 1 ms delay. The spread is often around 0.0-0.1 pips. Traders can place orders inside the spread and hedge positions.

| Trading platform | cTrader |

|---|---|

| Commission per lot | $3.0 |

| Spread from | 0.0 |

| Minimum deposit (USD) | $200 |

| Leverage | 500:1 |

| Location of the servers | London |

| Micro Lot Trading (0.01) | Available |

| Currency pairs | 64 |

| CFD on indices | Available |

| Stop Out | 50% |

| One-click trading | Available |

| Islamic account | Available |

| Allowed trading styles | All |

| Restriction on the order distance | No |

| Programming language | C# |

| Target audience | Active traders and scalpers |

According to the broker, Raw Spread Account is the most popular one among the traders.

Base currencies

IC Markets offers more base currencies than its competitors. The broker has 10 base currencies, which helps the customers from different countries and regions save money on conversion. As a reminder, there is conversion, when the base currency of the account and the bank account are not the same

| IC Markets | FxPro | Forex4You | |

|---|---|---|---|

| Number of base currencies | 10 | 8 | 2 |

| List of base currencies | USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF и CAD. | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR | EUR, USD |

Deposit and withdrawal

IC Markets offers an excellent choice of deposit and withdrawal methods, including classic ones, such as wire transfer, Visa/MasterCard debit/credit cards, as well as over a dozen of popular international and local payment services. In terms of benefits of the broker, in the majority of cases you only have to pay the fee charged by the payment systems.

| Pros |

|---|

|

| Cons |

|---|

|

Methods of deposit

The deposits on IC Markets are instant in the majority of cases. The procedure is longer for wire transfers and transfers from the broker’s account. It could take 2-5 business days. The broker does not charge a deposit fee, but in some cases you will have to pay the fee charged by the bank or the payment system.

| Method | Timeframe | Currency | Fee* |

|---|---|---|---|

| Cards Visa/MasterCard | Instantly | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD | No |

| Wire transfer | 2-5 business days | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, CHF | No |

| Transfer from broker’s account | 2-5 Instantly | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF | No |

| PayPal | Instantly | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF | No |

| Neteller | Instantly | AUD, USD, JPY, EUR, SGD, GBP, CAD | No |

| Skrill | Instantly | AUD, USD, JPY, EUR, GBP, SGD | No |

| UnionPay | Instantly | RMB | No |

| Bpay | 12-48 hours | AUD | No |

| POLI | Instantly | AUD | No |

| FasaPay | Instantly | USD | No |

| RapidPay | Instantly | EUR, GBP | No |

| Klarna | Instantly | EUR, GBP | No |

| Vietnamese Internet Banking | Instantly | USD | No |

| Thai Internet Banking | 15-30 minutes | USD | No |

* Some payment systems and banks charge a fee separately from the broker.

Methods of withdrawal

The traders must be aware of some peculiarities of withdrawal on IC Markets

1. The withdrawal application must be submitted in the personal account.

2. The applications are accepted only during the operating hours.

3. The money is accrued to the debit/credit card within 3-5 business days, but in some cases it can be as long as 10 business days.

4. For withdrawals to a bank account, the broker charges an AUD 20 fee (or an equivalent). The amount is written off the account.

5. Withdrawal to payment services (PayPal, Neteller, Skrill) is instant and no fee is charged, but it is possible to withdraw funds only to the account that was used to make the deposit.

Trading platforms

IC Markets uses tested and well-proven MetaTrader and cTrader platforms, which are available for all types of devices. This selection is enough to satisfy the demands of the absolute majority of customers. We give the broker a high rating for this feature.

The one thing that is missing is a proprietary platform with improved analytics for advanced users. In reality, however, not so many traders require it.

| Pros |

|---|

|

| Cons |

|---|

|

MT4, MT5 and cTrader platforms are well known to the majority of traders and have been reviewed more than once on our website. So, we will only focus on the specifics of their use on IC Markets.

MT4 platform from IC Markets

- Super-fast order execution, with less than 1 ms delay thanks to the server at the Equinix NY4 data center in New York.

- A set of 20 apps and indicators, which are not available in the basic version. They improve the quickness of interaction with the platform and provide an opportunity to analyze the market situation deeper.

- No restrictions on trading styles: scalping, trading inside the spread and hedging are allowed.

- Spread from 0 pips. For EURUSD pair, the spread does not exceed 0.1 pips for the majority of time.

- Huge liquidity thanks to the system of data aggregation from 25 large providers.

- The platform is available for all main types of devices: desktop (Win older than 7 version, or Mac OSX), Web, Android, iOS.

- Cryptocurrency trading is available only on the MT4 platform.

- ECN-type accounts – trading with liquidity suppliers and other players directly, without interference of the broker.

MT5 platform from IC Markets

- Raw Pricing system on the basis of 50 providers, including top banks and hedge funds. This ensures EURUSD spread at the level of 0.1 pips for the majority of time.

- Order execution with less than 1 ms delay thanks to the server at the data center in New York.

- No restrictions on trading styles: scalping, trading inside the spread and hedging are allowed.

- The platform is available for all main types of devices: desktop (Win older than 7 version, or Mac OSX), Web, Android, iOS.

- CFD on stocks trading is available only on the MT5 platform.

- ECN-type accounts – trading with liquidity suppliers and other players directly, without interference of the broker.

cTrader platform from IC Markets

The platform is designed for the fans of active trading, including high-frequency trading. There is also a special app for algorithmic trading.

- Raw Pricing on the basis of 50 providers, including top banks and hedge funds. This ensures EURUSD spread at the level of 0.1 pips for the majority of time.

- An app for algorithmic trading.

- The orders are executed at weighted average price (VWAP). cTrader shows all available volumes for each level of price at each moment of time. This provides the trader with full understanding of the situation and a possibility to analyze the volume flows.

- Order execution within less than 1 ms. The server is located at the LD5 IBX Equinix data center in London. It is mutually connected to the broker’s network, which ensures maximum security and reliability.

- No restrictions on trading styles: scalping, trading inside the spread and hedging are allowed.

- Smart Stop-Out function performs partial closing of a position to the level of margin adequacy.

- The platform is available for all main types of devices: desktop (Win older than 7 version, or Mac OSX), Web, Android, iOS.

- ECN-type accounts – trading with liquidity suppliers and other players directly, without interference of the broker.

Analytics

IC Markets Analytics section gets a high rating. The broker has quality information in the corresponding section on the website and a whole set of special apps and indicators for in-depth market analytics for MT4 platform.

| Pros |

|---|

|

| Cons |

|---|

|

Market analytics

This section is available on MT platform and on the broker’s website.

The following information is available:

- Daily analytical articles with analysis of the charts and news on the major currency pairs, indices and metals. We estimated the depth of the market analysis as excellent;

- Fundamental market analysis;

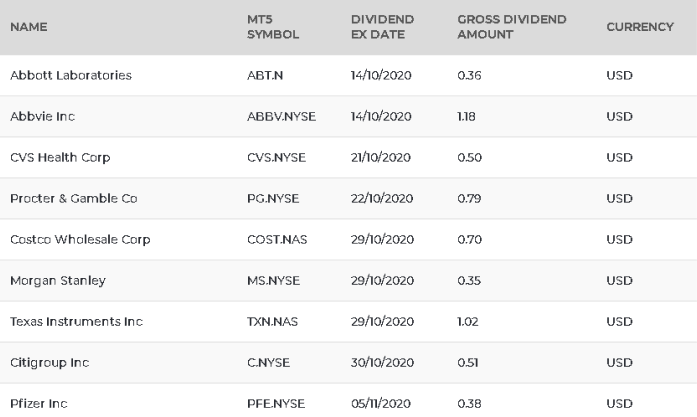

- Lists of dividend stocks;

- Schedule of statements of companies.

Applications for MT4

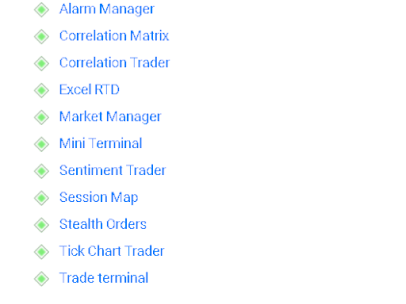

We gave a high assessment to the option for advanced analytics on the MT4 platform, offered by IC Markets. The broker added over 20 different additional applications and indicators to the platform, substantially improving the basic set of functions.

For example:

Alarm Manager is a personal advisor that sends signals on the market situation even on social media.

Correlation Trader helps find a link between different trading instruments based on data analysis. This is a very useful function for advanced traders seeking opportunities for arbitration and hedging risks.

Sentiment Trader allows to assess market moods among different classes of players: professionals, amateurs, institutional funds.

The list of applications of IC Markets for MT4

Education

Education section on IC Markets is excellent, but the information is mainly suitable for the beginners. You can find dozens and educational articles, video tutorials on the broker’s website. The broker also offers a demo account, where you can trade without time restrictions.

| Pros |

|---|

|

| Cons |

|---|

|

The majority of educational materials are available in the special section on the broker’s website.

We would like to particularly point to the valuable video guides on working with the platform and account verification.

As an example, here’s a very easy-to-understand video guide on placing different types of orders

Customer support

IC Markets also receives a high ranking for customer support. We contacted the customer support for information using three channels of communication, and in all cases we received a response within several minutes.

| Pros |

|---|

|

| Cons |

|---|

|

Ways to contact IC Markets

There are three channels of communication:

1. LIve Chat is available on the majority of pages of the website. We received a response in the chat literally within minutes. Our request was sent in English. Support in other languages requires testing.

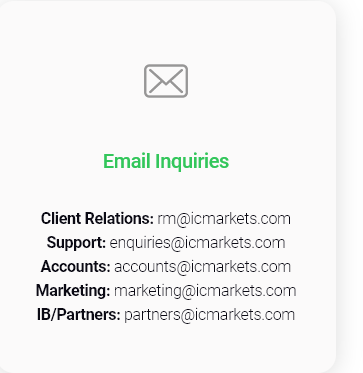

2. Email. This is another channel that we tested and that showed an excellent response speed. We will also attach the emails for addressing different types of issues.

3. By phone, you can contact both the Australian and international offices. We received a response quickly.

Bonuses and promo

The peculiarities of the broker’s regulation do not allow the company to use active marketing strategies. Due to this, the broker practically does not offer bonuses and promo, which does not diminish the overall high rating of the broker.

Summary

IC Markets is an excellent choice for active traders, for whom the size of commissions, order execution speed, absence of restrictions on trading styles and additional analytical functions are important. By all of these indicators, the broker has one of the best offers in the market.

The broker is well suited for the beginners. It is reliable, holding several licenses from the top regulators. There are many video tutorials and educational articles for the beginners as well as a demo account and rather easy-to-use platforms. In case of any difficulties, the support team responds within minutes to the majority of the inquiries.

The one category this broker is not the best option for is the professional investors, who require access to a large range of real stocks and funds. CFD are still a speculative instrument and their selection on IC Markets is not the best in the market.

Real reviews of ICMarkets 2024

Overall happy to trade with IC Markets, although there were several controversial issues in the trading process. The conditions are standard, but this company has a big plus - it honestly fulfills its agreements. I have been working with a broker for over a year, until I have not noticed any problems.

There are no problems with the execution of transactions in IC Markets. The company provides the comfort of trading.

I recommend immediately verifying your account on the IC Markets platform, then there will be no problems with withdrawal in the future. Yes, the procedure is long and dreary, because documents are checked scrupulously.

Although IC Markets is an international broker, not all regulators recognize it (for example, the site was blocked in Italy). It seems that the company has its own "skeletons in the closet." Although again, this is my personal opinion. After a detailed study of information about the company, I decided to refuse to cooperate with it.

no ecn here. another bucket shop and scammer, believe me!!! everything they say on their site is just a lie. they indiciate that scalping is allowed and high frequency trade is allowed too, but that’s not true. this dc keeps my 3000 bucks and gives no explanations. i checked several forums with ic markets reviews and most of the people write that ic markets tricks with customers, dash down stops and create delays and use virtual dealers. and their representatives and managers are clowns having no information about what is going on in their company. i wouldn’t recommend to deposit here! gool luck with forex…

Well, I’m afraid there are too many companies like this. That’s another bucket shop, really… And you know what!? Any experienced trader will get at the truth of this matter. So, I suggest you beginners to check out some reviews about ICM Brokers before doing your business with them. Don’t fall among thieves. Have a good trading!