On this page, you will find a large number of reviews from the real eToro customers. If you are already working with eToro, please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

eToro Review 2021

eToro is one of the world’s largest CFD and Forex brokers. The company has been operating in the world of trading since 2007, providing services based on the licenses of three financial regulators – Cyprus (CySec), UK (FCA) and Australia (ASIC).

The key distinguishing feature of eToro is its social investment platform, the largest in the world. This platform enables investors to use trading strategies of experienced traders and earn income, copying trades. eToro offers own trading platform, mobile applications and also OpenBook social investment platform, along with its CopyTrader feature.

Over the time of its operation, eToro received over 20 awards. OpenBook platform was received Finovate Europe Award in the Best of Show nomination in 2011 and 2013. Also, in 2011, eToro received the Best Trading Platform award from Star Awards. In 2012, the broker won in the Best Social Trading nomination, etc.

Pros and cons

eToro boasts competitive advantages, but also has drawbacks. Below is their short summary.

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features of eToro

| Regulation | Cyprus UK Australia |

|---|---|

| License | CySec No.109/10 FCA No.7973792 ASIC No.491139 |

| Fees | Low |

| Demo account | Available |

| Minimum deposit | 200 USD |

| Inactivity fee charged | 10 USD per month |

| Leverage up to | 1:30 |

| Markets | Forex, Stocks, Cryptocurrencies, CFDs, ETFs |

| Options for passive earning | Social trading |

| Support languages | English, Spanish, Italian, Russia, Chinese, Japanese and others. 21 languages in total. |

| Withdrawal fee | 5 USD |

| Withdrawal to credit/debit card | Available |

| Deposit and withdrawal via cryptocurrencies | Not available |

| Deposit from electronic wallets | Available |

| Account currencies | USD |

| Deposit bonus | - |

Geography of broker’s customers

eToro is an international broker and its audience is not restricted to one specific territory. The broker’s clients are rather evenly spread among several countries.

| Country | Percentage of customers |

|---|---|

| UK | 9.93% |

| Germany | 8.33% |

| Italy | 7.99% |

| Taiwan | 6.62% |

| Spain | 5.23% |

Europe accounts for the larger part of eToro’s audience. The main share of traders works out of the UK and developed countries of the EU. Taiwan is the only exception in this case. This region is also considered quite rich. Based on the statistics, it can be assumed that eToro is a broker for the residents of developed countries and territories.

Regional restrictions of the broker

eToro has substantial regional restrictions. The company operates in 78 countries; eToro does not provide services in 119 countries and territories. Factually, the company only provides services in European countries (with the exception of several states in Central and Eastern Europe), some Asian countries and in Australia. Let’s highlight some known countries, where eToro does not operate:

Albania

Albania

Armenia

Armenia

Belarus

Belarus

Bosnia and Herzegovina

Bosnia and Herzegovina

Canada

Canada

China

China

Cote d’Ivoire

Cote d’Ivoire

Moldova

Moldova

North Macedonia

North Macedonia

Serbia

Serbia

Turkey

Turkey

Montenegro

Montenegro

Japan

Japan

eToro also prohibits access to trading for the residents of disputed territories. For example, the broker is not available in the Republic of Crimea, although it provides services for the traders from other regions of Ukraine and from Russia. Also, the U.S. citizens living outside the country cannot use the services of the broker.

Fees

eToro offers a rather attractive system of commissions and fees. The main feature of this broker is that it does not charge fees for stock and ETF trading. In addition, the company offers attractive conditions for trading for certain classes of CFDs. Another important advantage of eToro is low non-trading commissions.

The biggest drawback of the eToro commission system is that there is a withdrawal fee. The fee is fixed and comparatively low, but the very fact of it considered a drawback.

NOTE! All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Let’s compare the advantages and drawbacks of the system of commissions in the table below.

| Pros |

|---|

|

| Cons |

|---|

|

Let’s look at the broker’s fees in more detail and compare them with the competitors. We will use popular brokers Swissquote and XM.com for comparison.

Stock and ETF trading fees

eToro is often chosen by the investors for trading shares and ETFs. The main advantage of the company in terms of working with these assets is absence of any fees, including for transferring positions to the following day. eToro is, therefore, one of the world’s stock market leaders in terms of trading conditions.

eToro’s competitors offer less beneficial conditions for stock trading. In particular, you will have to pay from $30 in fess when trading lots up to $10,000 on Swissquote. XM.com does not provide direct access to the exchanges, which is why we will review the fees of Saxo Bank. The broker does charge a fee for stock trading, although it can be considerably low. The actual fee for the trade of the lot worth from $2,000 to $10,000 is specified below.

| eToro | Swissquote | Saxo Bank | |

|---|---|---|---|

| Stocks of US companies | 0 USD | 25 USD | 10 USD |

| Stocks of UK companies | 0 USD | 30 USD | 9.6 USD |

| Stocks of German companies | 0 USD | 27.5 USD | 11.0 USD |

CFD on shares and ETF

eToro allows you to earn not only from long (purchase), but also short (sale) trades. However, all sale traders open as CFDs. The fee for opening a short position on shares or ETFs is 009%. The fee is fixed and is applied for all types of stocks and ETFs.

Cryptocurrencies

eToro has average level of fees for cryptocurrency trading. By this indicator, the organization beats many brokers, providing access to the cryptocurrency market, but is far behind the cryptocurrency exchanges, for example Binance. For cryptocurrency trading, the broker applies a turnover fee instead of a fixed fee. The percentage depends on the asset liquidity. The higher the liquidity of a cryptocurrency asset, the lower the fee.

Compared to competitors, eToro can be considered an optimal choice in terms of combination of the fees and the number of cryptocurrencies. However, the broker still has a long way to go to the top cryptocurrency exchanges. For example, there are 5 cryptocurrencies on Swissquote, but the trading conditions depend on the amount of the purchase. XM.com has zero commission, but the cryptocurrencies there are only available as CFDs. On Binance, the fee is calculated based on the turnover in BTC and is from 0.1%. The higher the turnover, the lower the fees. At that, the exchange has thousands of trading instruments.

| eToro | Swissquote | Binance |

|---|---|---|

| BTC – 0.75% | 1% for the purchase up to 10,000 CHF. | Turnover less than 50 BTC – Taker – 0.1%, Maker – 0.1%. |

| ETH – 1.90% | 0.75% for the purchase from 10,000 to 50,000 CHF. | Turnover 50 – 500 BTC – Taker – 0.1%, Maker – 0.09%, etc. |

| BCH – 1.90% | 0.5% for the purchase from 50,000 CHF | |

| LTC – 1.90% | ||

| ETC – 1.90% | ||

| XRP – 2.45% | ||

| XLM – 2.45% | ||

| DASH – 2.90% | ||

| ADA – 2.90% | ||

| MIOTA – 4.5% |

You will have to pay $11,400 for the purchase of 1 BTC*

| eToro | Swissquote | Binance |

|---|---|---|

| 85.5 USD | 85.5 USD | 11.4 USD |

*Price listed as of 27.08.2020, according to coinmarketcap.com

As you can see, the advantage is clearly not on the side of the Forex brokers.

Cryptocurrency short

As in the case with stocks and ETFs, eToro offers CFDs on cryptocurrencies. You will also be able to open short positions using CFDs on cryptocurrencies. The fees are identical to the purchase transactions.

CFDs

eToro offers a wide choice of CFDs for 4 classes of assets:

- Currency pairs;

- Exchange commodities;

- Indices;

- Stocks and ETFs.

For CFDs, not the standard fees, but spreads are applied – differences between the prices of Bid and Ask. Let’s review eToro spreads in more detail.

Forex

eToro’s spreads on currency pairs are average. For example, the spread starts at 1 pip for EURUSD pair. The minimum spread is similar for the USDJPY pair. The conditions are quite attractive also for USDCHF and EURGBP trading pairs – from 1.5 pips.

eToro is behind its competitor XM.com in terms of attractiveness of trading conditions for currency pairs. The competitor has much better conditions. In the case of Swissquote, eToro’s spreads are slightly more attractive. Let’s compare the minimum spreads of the three brokers in the table below.

| Currency pair | eToro | Swissquote | XM.COM |

|---|---|---|---|

| EURUSD | 1 | 1.1 | 1.6 |

| USDJPY | 1 | 1.2 | 1.5 |

| USDCHF | 1.5 | 1.6 | 1.9 |

| EURGBP | 1.5 | 1.2 | 1.8 |

| GBPJPY | 3 | - | 3.6 |

If you convert the size of a spread into dollars, you will have to pay the following amount for the purchase of one standard lot of 100,000 units of base currency:

| Currency pair | eToro | Swissquote | XM.COM |

|---|---|---|---|

| EURUSD | 10 USD | 11 USD | 16 USD |

| USDJPY | 9.43 USD | 11.37 USD | 14.15 USD |

| USDCHF | 16.53 USD | 17.63 USD | 20.94 USD |

| EURGBP | 19.81 USD | 15.85 USD | 23.78 USD |

| GBPJPY | 28.29 USD | - | 33.95 USD |

Commodities

eToro offers its clients CFD on a number of commodities. In this case, the fee is also charged in the form of a spread, and starts from 5 pips – that is the spread for oil.

eToro’s competitors also offer CFDs on commodities. For clarity in dollar terms, you will have to pay the following amount for the purchase of commodities for $5,000*:

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Oil WTI | 5.75 USD | 5.75 USD | 5.75 USD |

| Gas | 19.34 USD | 59.46 USD | 67.03 USD |

| Wheat | 9.17 USD | - | 22.85 USD |

| Sugar | 31.7 USD | - | 35.71 USD |

*Calculated as pip value as of 27.08.2020

As you can see, eToro offers rather appealing conditions.

Precious metals

The choice of precious metals on eToro is also rather wide, but the trading conditions are not most enticing. As an example, let’s take a purchase of gold for $10,000 and calculate the average spreads of each of the brokers.*.

| Precious metals | eToro | Swissquote | XM.COM |

|---|---|---|---|

| Gold | 5.3 USD | 1.6 USD | 1.8 USD |

**Calculated as pip value as of 27.08.2020

Stock indices

eToro also offers users CFD trading on the most popular global indices. The trading conditions are average. For example, if you are working with the popular American index S&P 500, the spread starts from 75 pips. Let’s review the average spreads in more detail in the table below and recalculate them in dollar equivalent. A purchase of asset for $10,000 is taken as an example.

| Index | eToro | Swissquote | XM.COM |

|---|---|---|---|

| S&P 500 | 2.03 USD | 1.87 USD | 2.01 USD |

| NASDAQ 100 | 2.01 USD | 1.42 USD | 1.67 USD |

| Dax 30 | 1.9 USD | 1.9 USD | 1.9 USD |

*Data as of 27.08.2020

Marginal lending fees

eToro offers traders a marginal lending service. It is also charged with a fee. It is not fixed and is calculated separately for each class of assets. Let’s review the rates that were applied as of 27.08.2020.

| Class of assets | Annual interest rate |

|---|---|

| CFD on indices | 4.96% |

| CFD on metals | 1.5% |

| СFD on currencies | 1% |

Non-trading fees

eToro has rather beneficial non-trading commissions, although there are certain nuances you should be aware of before choosing this broker. On the positive side, there are no fees for opening and maintenance of the account. In addition, the company does not charge fees for replenishment of the account.

As for inactive account fee, eToro charges it, although it is comparatively low. You will have to pay $10 per month. The fee is charged only 12 months after inactivity. At that, there is one thing – signing into the account is considered an activity. Therefore, after you signed into the account, the 12-month period will be reset.

One of the drawbacks of the broker is the money withdrawal fee, although it is quite low at $5.

| Fee type | eToro | Swissquote | XM.COM |

|---|---|---|---|

| Account maintenance fee | No | No | No |

| Inactive account fee | 10 USD charged after 12 months of inactivity. Signing into the account is considered an activity, it is not necessary to make a trade. If the money on the account runs out, the account will be deactivated. | No | 5 USD charged after 3 months of inactivity. An activity is a completed trade. If the money on the account runs out, the account will be deactivated. |

| Deposit fee | No | No commission for a bank transfer. On card transactions – 2.2-2.5%. | No |

| Withdrawal fee | 5 USD per withdrawal transaction. The amount of the fee does not depend on the amount of the financial transaction | 10 USD per transaction. The amount of the fee does not depend on the amount of the financial transaction | 15 USD on withdrawals of less than 200 USD. No fee on withdrawals of more than 200 USD |

Reliability and regulation

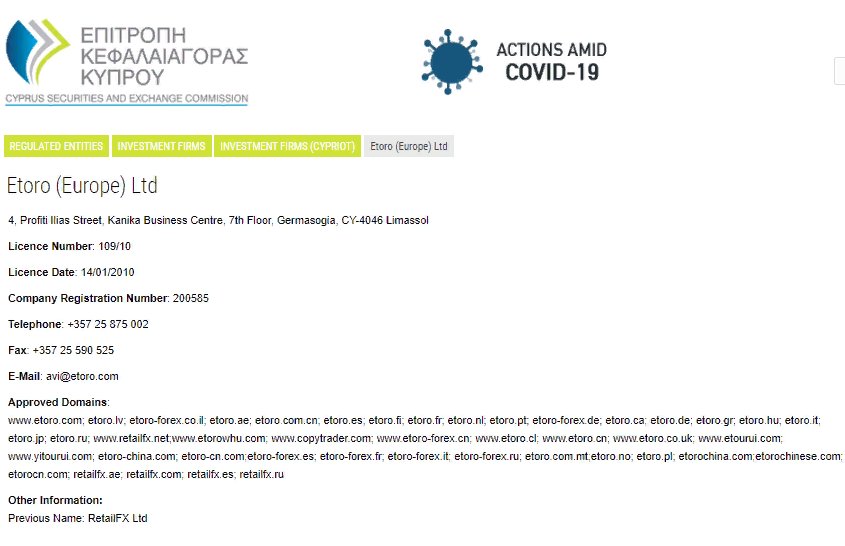

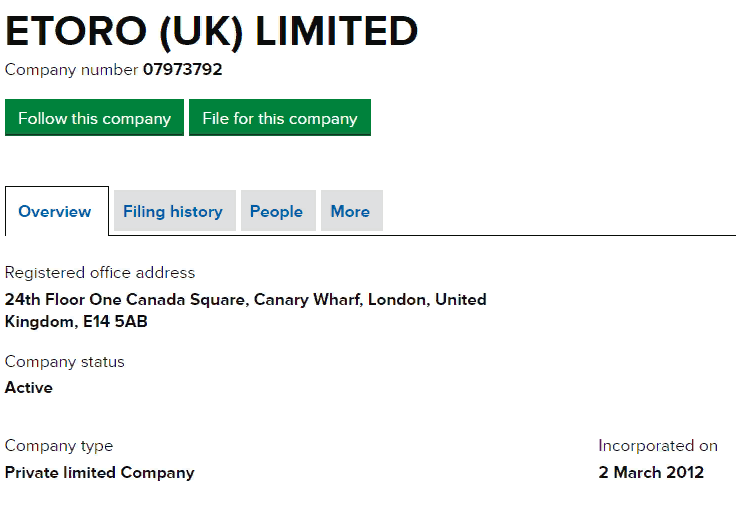

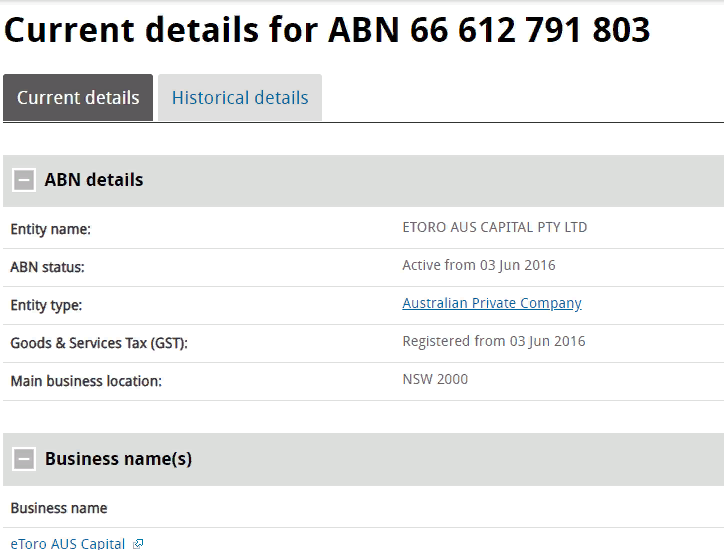

eToro is a tested, regulated and safe broker. The broker holds several licenses issued by the regulators of the reliable jurisdictions. eToro structure includes three organizations, operating in different states and territories:

- eToro (Europe) LTD – registered in Cyprus and provides services in the EU countries. Registration number – HE20058;

- eToro (UK) LTD – operates in the UK. Registration number – 7973792;

- eToro AUS Capital Pty LTD – offers services for the clients in Australia. Registration number of the legal entity – ABN 66 612 791 803.

All companies operating under eToro brand are interconnected and operate by the broker’s common rules. In terms of security of funds and regulation, eToro also has some advantages and drawbacks. Let’s review them in more detail.

| Pros |

|---|

|

| Cons |

|---|

|

eToro Europe

Cyprus regulator allows for checking the license for financial activity of the company. The document was issued to the broker on January 14, 2010. The license for the broker activity also includes the legal address of eToro (Europe): 4, Profiti Ilias Street, Kanika Business Centre, 7th Floor, Germasogia, CY-4046 Limassol.

eToro UK

eToro (UK) was founded in the United Kingdom. You can check information about the organization on Companies House, the website of the British registrar. The legal entity with the specified name does exist. According to Companies House, eToro (UK) was established on March 2, 2012. The registration number of the legal entity is 24th Floor One Canada Square, Canary Wharf, London, United Kingdom, E14 5AB.

eToro Australia

We also checked information about registration of the Australian branch. The registration license can be found on the website of the state registrar of Australia. The date of establishment of the company is June 3, 2016. The legal address is Level 26, 1 Bligh Street, Sydney NSW 2000, Australia.

Age and reputation of the broker

eToro states that it began its operation in 2007. This information can be found in the section Company, Information block. We checked and saw that the company’s domain was registered in 2004.

The year 2012 marked restructuring of the company, when separately-run business units were registered with separate organizations – European, British, Australian and Asia-Pacific – appearing. eToro, however, discontinued the license of its Asia-Pacific business.

As for the reputation, eToro boasts a good one. We have failed to find any information about high-profile scandals involving the broker. There have not been any cases of hacks, theft of money or other serious problems with this broker. There is also no information about litigations.

Does the company have segregated accounts?

eToro offers trading with the use of segregated account. However, they are used only for cryptocurrency or token trading.

Protection of investor money on eToro

eToro is not a member of a deposit guarantee fund. Therefore, if the broker announces bankruptcy, most likely, you won’t be able to retrieve your money. There is also no deposit insurance system.

The only ‘bonus’ for eToro clients is negative balance protection. The company has Margin Call. This means that if the user’s balance becomes negative, all open positions will be automatically closed.

Markets and products

Overall, the choice of trading assets on eToro is quite good, although there are certain nuances. The platform allows you to work on the Forex market via CFDs. Also spot stock, ETFs and cryptocurrencies are also available here. In addition, the broker offers several highly useful functions for passive trading, such including:

- social trading;

- copying trading strategies;

- promotion of own fund (CopyPortfolio function).

Long positions on purchase of stocks, ETFs and cryptocurrencies open with the use of real trading assets. If you open a short position, CFDs and leverage are used.

| Pros |

|---|

|

| Cons |

|---|

|

However, the diversity of the markets is not so high, and eToro is behind its competitors in some positions. For example, Swissquote provides a possibility to work with bonds, options and futures. eToro does not offer such possibilities. XM.com offers a larger number of currency pairs than eToro.

Overall, the choice of markets on eToro is optimal for a retail trader. If you are planning to be involved in investments, which requires a wider choice of investment instruments – funds, bonds, larger number of stocks, etc., eToro may not be suitable for you. Let’s compare the choice of markets of eToro, Swissquote and XM.com.

Markets

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | No |

| CFD | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Bonds | No | Yes | No |

| Futures and options | No | Yes | No |

| Commodities (oil, metals, wheat, gas, ore, etc.) | Yes | Yes | Yes |

| Mutual funds | No | Yes | No |

| ETF | Yes | Yes | No |

Forex market

Forex market on eToro is not very extensive, but you will find all key instruments here. Overall, the broker works with 47 currency pairs, including the top ones, such as EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, USDCAD, etc. In addition, there are also cross rates, such GBPJPY, EURGBP, EURCHF, etc. As for the exotic pairs, their number is comparatively small, for example USDZAR, NOKSEK, ZARJPY, CHFHUF.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Trading pairs | 47 | 78 | 57 |

Stock market

eToro has a very wide choice of stocks – 2,042. All stocks are broken down by exchanges. The broker works with 17 exchanges, including:

- NASDAQ;

- NYSE;

- London;

- Frankfurt;

- Paris;

- Madrid;

- Milan;

- Zurich;

- Oslo;

- Stockholm;

- Copenhagen;

- Helsinki;

- Hong Kong;

- Lisbon;

- Brussels;

- Amsterdam;

- Saudi Arabia.

On eToro platform you can purchase stocks of a huge number of popular companies, including Apple, Amazon, Palmolive, Aecom, Aflac and others. Also, you can trade stocks of leading European companies. For example, Adidas, Volkswagen, Bayer, BMW, Commerzbank and many others are traded at the Frankfurt Stock Exchange.

Nonetheless, eToro does not hold the record for the number of available exchanges. Swissquote features 60 markets.

| eToro | Swissquote | |

|---|---|---|

| Markets | 17 | 60 |

| Available stocks | 2042 | 20 000+ |

Geography of markets

eToro markets geography is not very wide. The broker mainly focuses on American and European markets. In particular, two main American exchanges NYSE and NASDAQ are represented here. There are also 9 European markets and two Asian (Saudi Arabia and Hong Kong).

Among the drawbacks of the broker, we can note absence of several leading exchanges. For example, you won’t find Chinese or Japanese markets here. There is also no Australia on the list.

| Country | Yes/No |

|---|---|

| USA | Yes |

| Germany | Yes |

| UK | Yes |

| China | No |

| Other countries | Denmark, Belgium, Sweden, Italy, Spain, France, Saudi Arabia, Hong Kong, Switzerland. |

CFD market

The choice of CFDs on eToro is quite wide, which is why the traders will be able to find practically all necessary trading instruments. Availability of CFDs on stocks, ETFs and cryptocurrencies is an undisputed advantage, as thanks to this these assets are easy to use not only for medium and long-term investments, but also for trading. CFDs provide an opportunity to earn also using short position. As for other types of derivatives, exchange commodities and indices are also available on eToro.

The broker’s competitors do not offer quite as many CFDs. For example, Swissquote is more focused on working with real assets, while XM.com does offer CFDs, but their number is lower than eToro.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Forex | Yes | No | No |

| Stocks | 2042 | No | 1200 |

| Bonds | No | 3 | No |

| Crypto | 16 | No | 5 |

| Futures and options | No | No | No |

| Commodities (metals, food products, raw materials) | 14 | 17 | 15 |

| Other | ETFs | No | No |

Therefore, the broker is perfect for traders interested in working with CFDs.

Investment products

eToro does not have many investment products, but they are quite unique. The company offers its clients both classic and original solutions. The choice of classic investment instruments is comparatively small. The company is primarily focused on trading stocks, and it is indeed beneficial here, as the traders are not charged with fees. ETFs are also considered an investment instrument and eToro offers 145 of them.

By the number of investment instruments, the company is behind some competitors. In particular, Swissquote offers a wider variety, including bonds and funds. The investment instruments eToro offers are not enough to consider the company a fully universal broker. Bonds and funds are important for diversification of the investment portfolio. As for XM.com, the broker is fully focused on trading and does not have investment instruments as such.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Bonds | No | 55 000 | No |

| ETF | 145 | 1500 | No |

| Mutual funds or managed funds | No | 340 | No |

| PAMM accounts | No | No | No |

| Trade copying services | Yes | No | No |

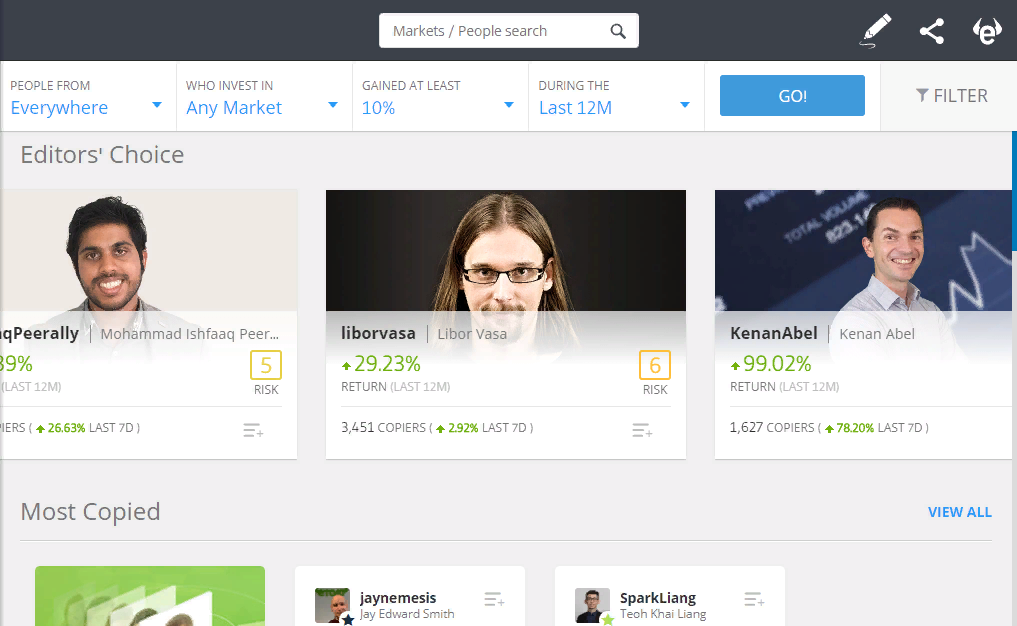

eToro’s trade copying service

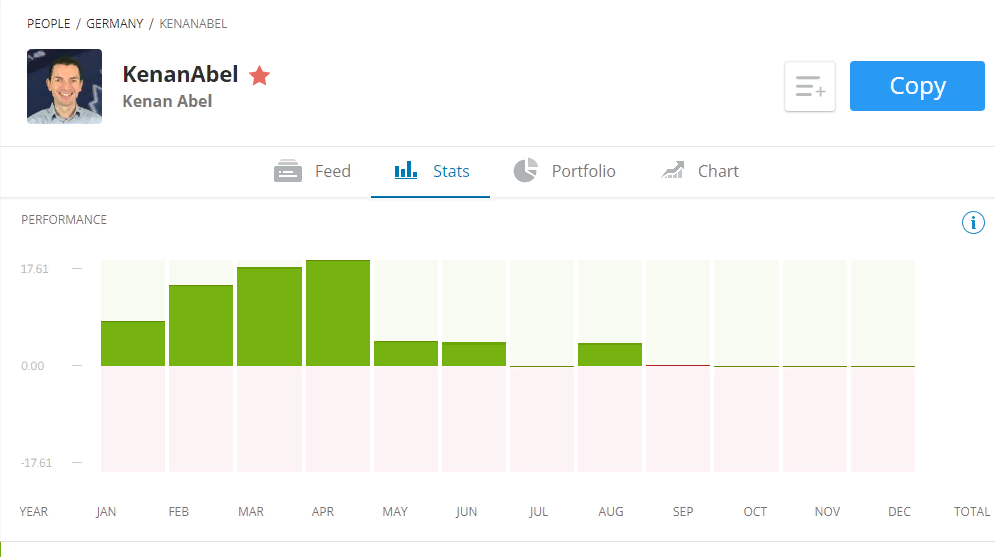

OpenBook, the social trading service, is eToro’s key instrument for passive income. The broker was initially established as the world’s largest social trading network and is currently the leader by the number of portfolios available for copying. To date, OpenBook includes over 50,000 traders, who share their trades.

It is very easy to use the social trading service. You need to sign into your account and select Traders. There, you will see a review of the most popular traders, where you’ll be able to find the one that is most suitable for you.

Then you just need to press Copy and the investment portfolio will be copied. You will be able to review the user’s portfolio before you connect to it. For this, you just need to click on his profile.

eToro also has a program for the users that provide their trades for copying. The broker pays 2% per year on the volume of managed funds. Thus, if the total amount of funds of traders connected to you is $10,000,000, your annual profit will be $200,000.

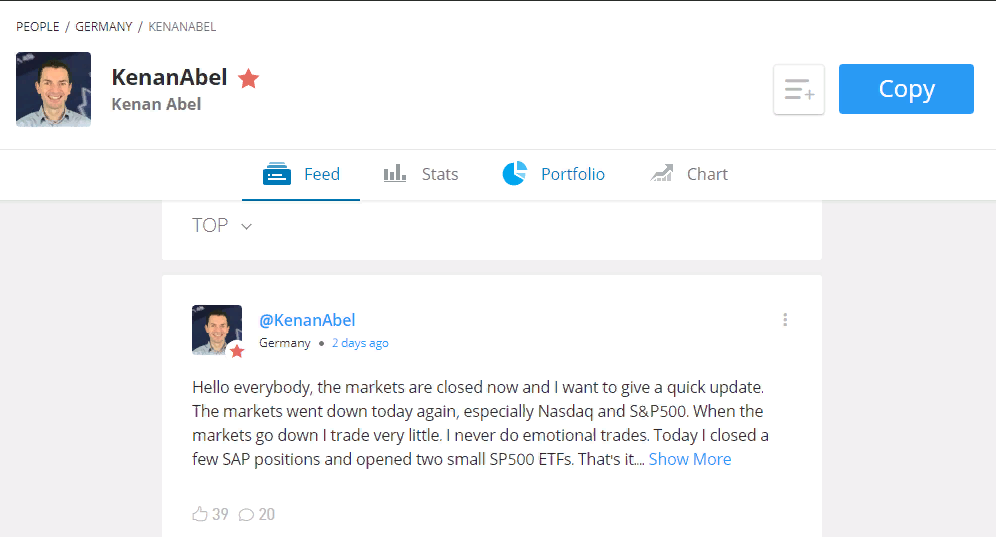

In addition, eToro also provides social newsfeed. It functions similarly to the classical social network. You can subscribe to traders and experts you trust, read their posts, make your own posts. The notifications can be delivered both to the trading platform and as Push-notifications on your mobile device.

Alec Baldwin represents how easy to invest with eToro CopyTrader

Opening an account

Opening a personal account on eToro website is a rather simple and quick procedure. There are some nuances, however, you need to be aware of. First of all, this concerns regional restrictions, which eToro has in abundance. Factually, the broker is available only in Europe, U.S. and some Asian countries. In addition, the minimum deposit for users from different regions is also different.

Pros and cons of the system

| Pros |

|---|

|

| Cons |

|---|

|

eToro’s minimum deposit

The minimum deposit on eToro differs depending on the jurisdiction you work in. The base value is $200.

- If you are a resident of Israel, the minimum deposit increases to $10,000.

- For tax residents of Russia, Taiwan, China, Hong Kong and Macao, the minimum deposit is $500.

- For traders living in Australia and USA, the minimum deposit is only $50.

The different minimum deposits is rather a drawback of the broker than an advantage. It is inconvenient, as it creates different rules for the traders from different countries. Overall, the minimum deposit of the broker can be considered low, which is why eToro is suitable not only for professionals, but also for novices. Some brokers ask for a higher deposit. For example, the minimum deposit on Swissquote is EUR 1,000. eToro’s other competitor XM.com has a lower minimum deposit at $100.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Minimum deposit | For the majority of jurisdictions – 200 USD. For Russia, Taiwan, China, Hong Kong, Macao – 500 USD. For Israel – 10 000 USD. For Australia and U.S. – 50 USD |

1000 EUR | 100 USD |

Types of accounts

There are only two real accounts on eToro – standard and professional. There is also a demo account. Right after you register, a standard account is opened for you. There are no limitations here, and right after registration and replenishment of the account for any amount (even minimum), you can use all possibilities eToro has to offer. In order to activate the professional account, you need to submit a corresponding application to eToro’s customer support.

eToro Standard Account

Standard account on eToro is restricted by the leverage. The maximum leverage for the standard account is 1:10. These are the specifications of the standard account:

- Trading platforms: own trading platform (online, Windows, iOS, Android).

- Available currency accounts – USD.

- Instruments: all available, including currency pairs, stocks, CFD, cryptocurrencies, ETF.

- Minimum deposit — 200 USD (can change depending on the jurisdiction).

- Average spread for EURUSD – floating from 1 point.

- Minimum volume of lots — 0,1, maximum — 10 000.

- Leverage — up to 1:10.

- Bonuses for deposit on the account – ?

Standard account is opened for all traders and you can only change it if you switch to professional account.

Professional account

The professional account can be opened by the traders that meet the requirements of eToro for qualification, volume of trades and frequency of opening orders.

Professional account almost does not differ from the standard, with the only exception being that the leverage is increased to 1:30. These are the specifications:

- Trading platform – own trading platform (online, Windows, iOS, Android).

- Available currency accounts – USD.

- Instruments – all available, including currency pairs, stocks, CFD, cryptocurrencies, ETF.

- Minimum deposit — 200 USD (can change depending on the jurisdiction).

- Average spread for EURUSD – floating from 1 point.

- Minimum volume of lots — 0,1, maximum — 10 000.

- Leverage — up to 1:30.

- Bonuses for deposit on the account – ?

You can submit an application for opening the professional account in the corresponding section of the website. As you fill out the application, you will need to confirm that you meet the requirements. In particular, eToro opens professional accounts for clients, who opened at least 10 trades a quarter over the past 4 quarters. The minimum amount of the trade must be as follows:

- CFDs on stocks – 10 000 USD;

- Indices and commodity CFDs – 25 000 USD.

- Forex trades – 50 000 USD.

The total amount of the investment portfolio must exceed EUR 500,000, both trades and investments may be performed both on eToro and on the website of any other broker.

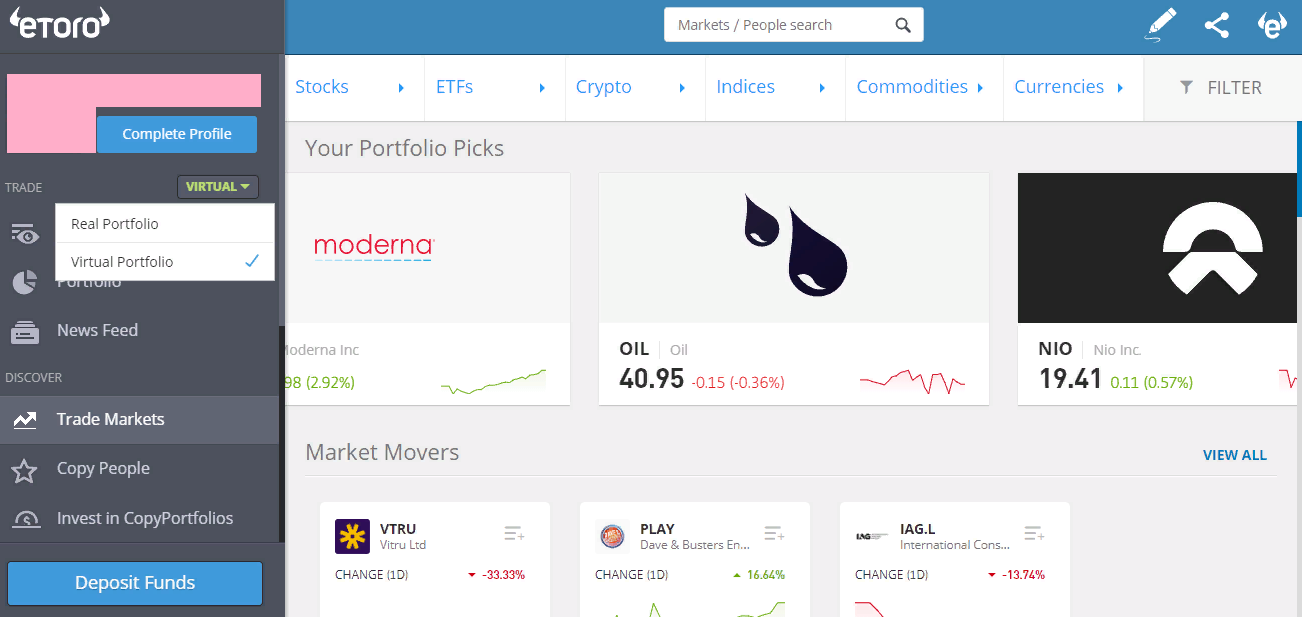

Demo account

eToro offers a free demo account with the amount of virtual money on it up to $100,000. It can be opened in your account after you complete registration. In the profile, there is a pop-up menu, where you can switch between the real and virtual investment portfolios. Virtual investment portfolio is the demo account.

eToro does not have any restrictions in terms of using the demo account. You can use demo account before passing verification.

How to open an account: step-by-step guide

It is rather easy to open an account on eToro. In order to register on the platform, you need to fill out a form with only three questions:

- User’s name;

- Email;

- Password.

After you specify this information and press Register, you will be directed to the account and will be able to explore its interface and key features.

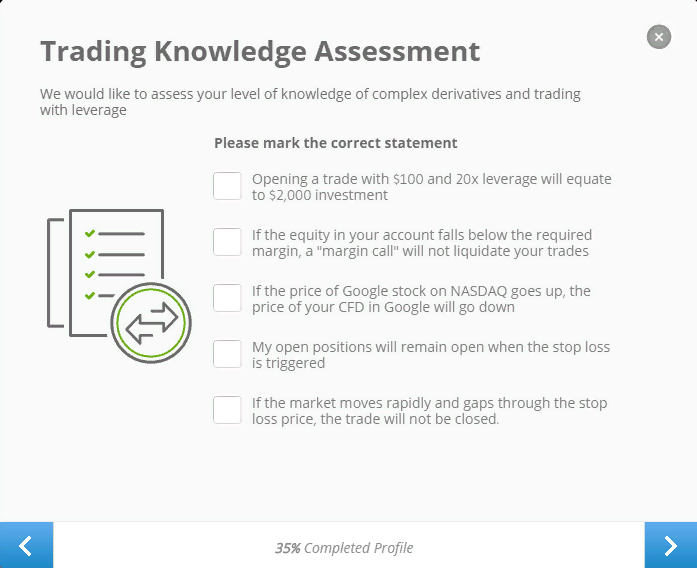

Verification on eToro

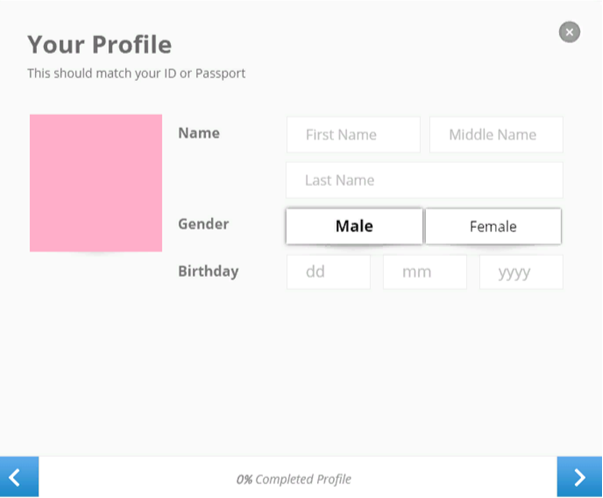

After registration, you need to go through verification. For this, you need to fill out your profile. At the first stage, you will need to specify your full name, sex and date of birth. Also, you can upload your avatar here (not required).

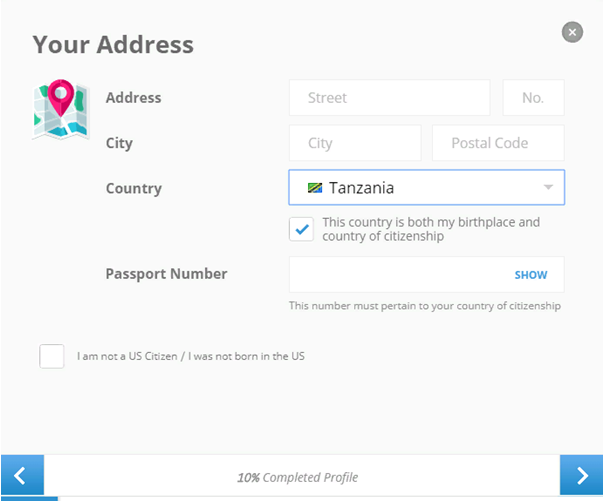

Then, you will need to provide information about your place of residence. Here, you need to specify the city of residence, country of residence, your full address. There is also a box here to specify the number of your ID.

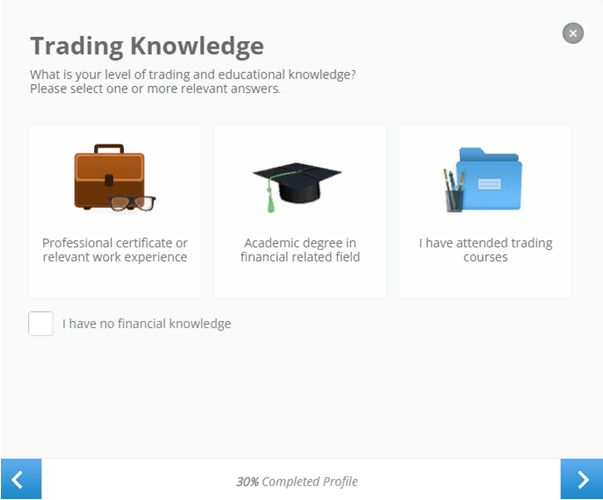

Then, eToro will offer you to specify your level of knowledge. You need to specify, whether you have specialized education and the level of your degree – diploma, academic degree or trader courses.

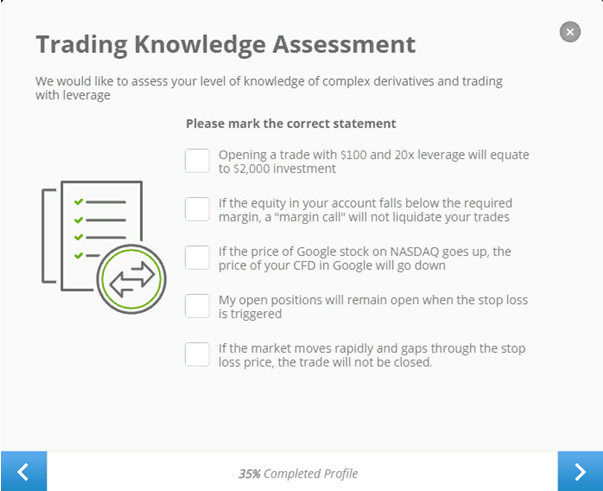

To confirm your level of knowledge, eToro will ask you a financial question. In particular, it is related to the use of the leverage.

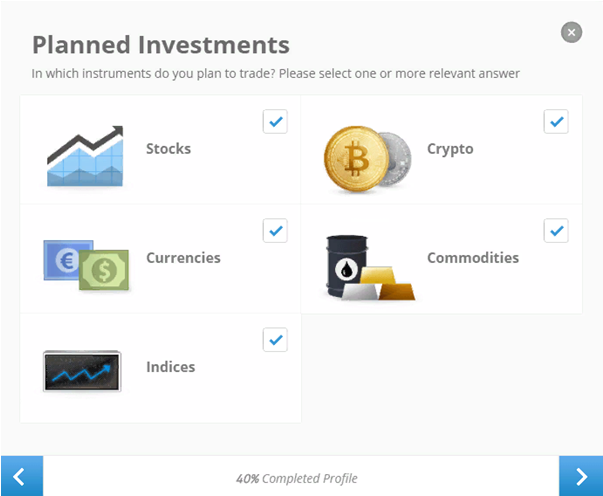

After that, the broker will offer you to select instruments you plan to use to achieve your financial goals. You can select one, several or all available on the list.

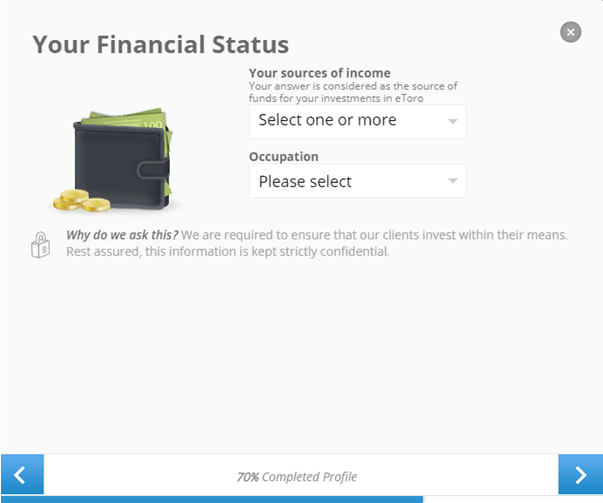

Then, the broker will ask you to specify your sources of income. Here, you need to specify all sources – salary, pension, investments, financial aid of relatives, etc., depending on your situation. If you are employed, you will need to specify the area of business, name of the company or public authority, your level of income.

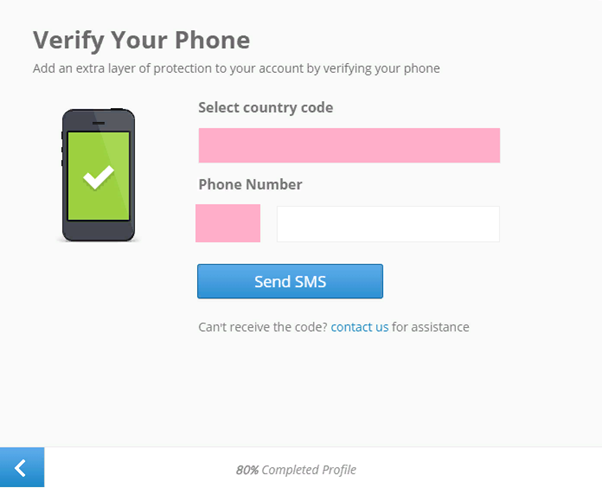

After you specify this information, the verification process begins. In order to verify your account, you need to confirm your phone number. A text message will be sent to your phone, which you will need to specify in the corresponding box.

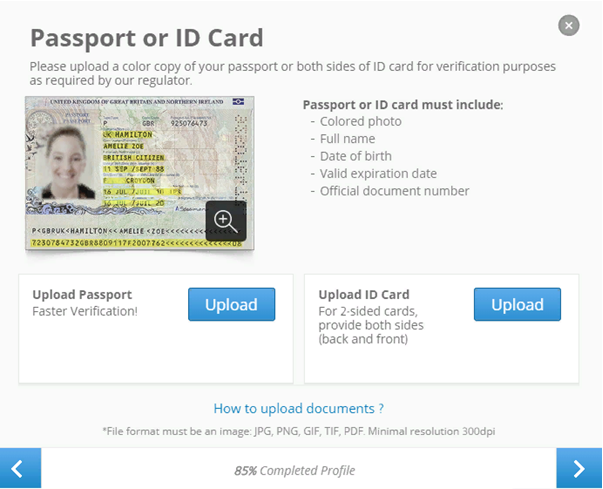

The last stage is the verification itself. Here, you will need to upload documents confirming your identity and place of residence.

After you pass all these steps, you will just need to wait for the confirmation of your account. As soon as the administration reviews your documents, you will gain full access to eToro and opportunities it offers.

Base currencies of the account

The number of base currencies of the account on eToro is not impressive. There is essentially only one currency – US dollar. At that, you can use other currencies for replenishment of the account, for example EUR, although eToro will then perform automation conversion to USD. The conversion fee is 0.46% of the total amount of deposit.

The small number of supported currencies is definitely a drawback of eToro. Competitors offer a much wider choice. For example, Swissquote supports 15 account currencies and XM.com – 11. Since eToro is focused on the audience from Europe, it would have been highly advisable to at least add EUR and GBP to the list of supported currencies.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Number of base currencies | 1 | 15 | 11 |

| List of base currencies | USD | USD. GBP, EUR, CHF, AUD, JPY, PLN, CZK, HUF, CAD, TRY, SEK, NOK, SGD, XGD | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD |

Deposit and withdrawal

There are quite many methods of deposit and withdrawal on eToro. The company supports:

- Visa, Mastercard, Diners, Visa Electron and Maestro debit/credit cards;

- PayPal, Neteller, Skrill, Yandex, Klarna electronic payment systems;

- Bank transfers.

As for the advantages, there is no deposit fee. Regardless of the method you decide to use to deposit money, you will not be paying any additional fees. Deposit form is quite simple and you can put money on your account or register an application for withdrawal within several minutes.

The biggest drawback of the deposit and withdrawal system on eToro is the withdrawal fee. It is fixed and is $5. In addition, the company limits the possibility of transactions from electronic wallets (except for PayPal). Electronic payment systems become available only after the first deposit. So, you will not be able to use e-wallets until you replenish your account via a bank transfer, credit/debit card or PayPal. Let’s review the pros and cons of the deposit and withdrawal system on eToro in the table below.

| Pros |

|---|

|

| Cons |

|---|

|

Methods and terms of deposit

The money is credited to the account on eToro quite fast. You will have to wait 4-7 days only in the case of a bank transfer. In all other cases, the money is credited nearly instantly. There are, however, certain limitations in terms of the amount of replenishment. Below you will find a table, where we will review key information on deposits on eToro using different payment services.

| Method of deposit | Fee | Limitation per transaction | Transfer currency* | Period for crediting money to the account |

|---|---|---|---|---|

| Bank transfer | No | No limitations | USD, EUR, GBP | 4-7 days |

| Debit/credit card | No | 40 000 USD | USD, EUR, GBP, AUD | Instantly |

| PayPal | No | 10 000 USD | USD, EUR, GBP | Instantly |

| Neteller | No | 10 000 USD | USD, EUR, GBP | Instantly |

| Skrill | No | 10 000 USD | USD, EUR, GBP | Instantly |

| Yandex | No | 5 000 USD | USD, EUR, GBP | Instantly |

| Rapid | No | 5 500 USD | USD, EUR, GBP | Instantly |

| Klarna | No | 30 000 USD | USD, EUR, GBP | Instantly |

| Online banking ** | No | 10 000 USD | MYR, IDR, THB, PHP и VND | Instantly |

* there is only one base currency on eToro – USD, all other currencies are converted into USD at the exchange rate as of the moment of replenishment.

** for residents of Malaysia, Indonesia, Thailand, Vietnam and Philippines.

eToro has a rather large number of options for deposit and withdrawal, surpassing many of its competitors. For example, Swissquote only has deposit through bank transfer. XM.com offers Visa, Mastercard, Maestro debit/credit cards, but the broker only has two electronic payment systems it accepts. In addition, XM.com does not allow deposits and withdrawals via a bank transfer.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| Bank transfer | Yes | Yes | No |

| Visa and MasterCard debit/credit cards | Yes | No | Yes |

| Electronic payment systems | 6 | No | 2 |

| Cryptocurrencies | No | No | No |

Withdrawal methods and fees

The same methods are available for withdrawal of money. The period for withdrawal and the fee is fixed on eToro. The broker claims that withdrawal takes one business day, although delays are possible resulting in withdrawal taking up to 8 days. eToro’s withdrawal fee is fixed at $5 regardless of the method of payment or the amount of transaction

Review of trading platforms

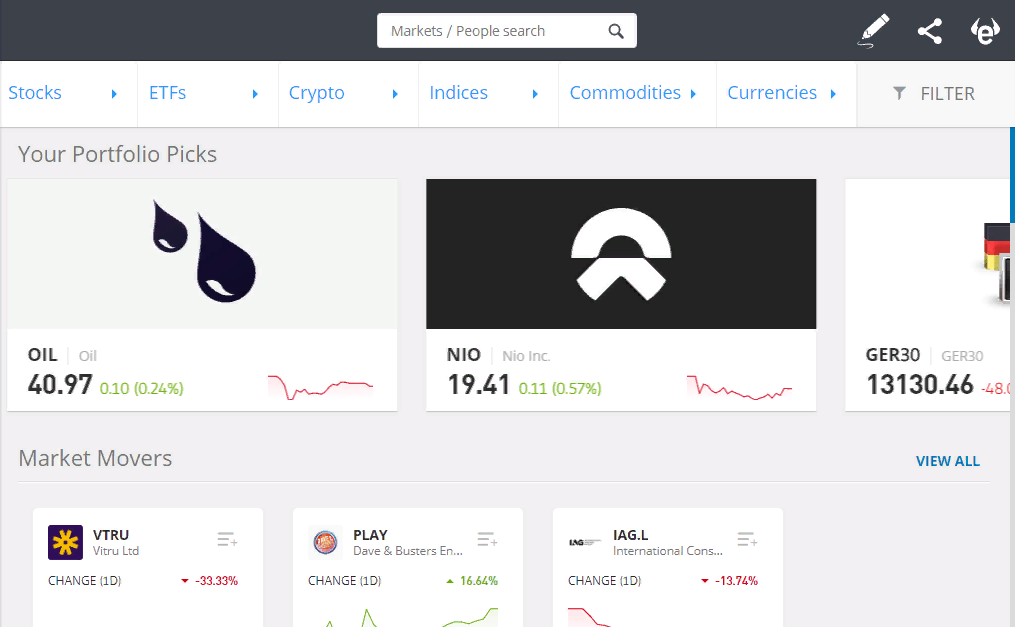

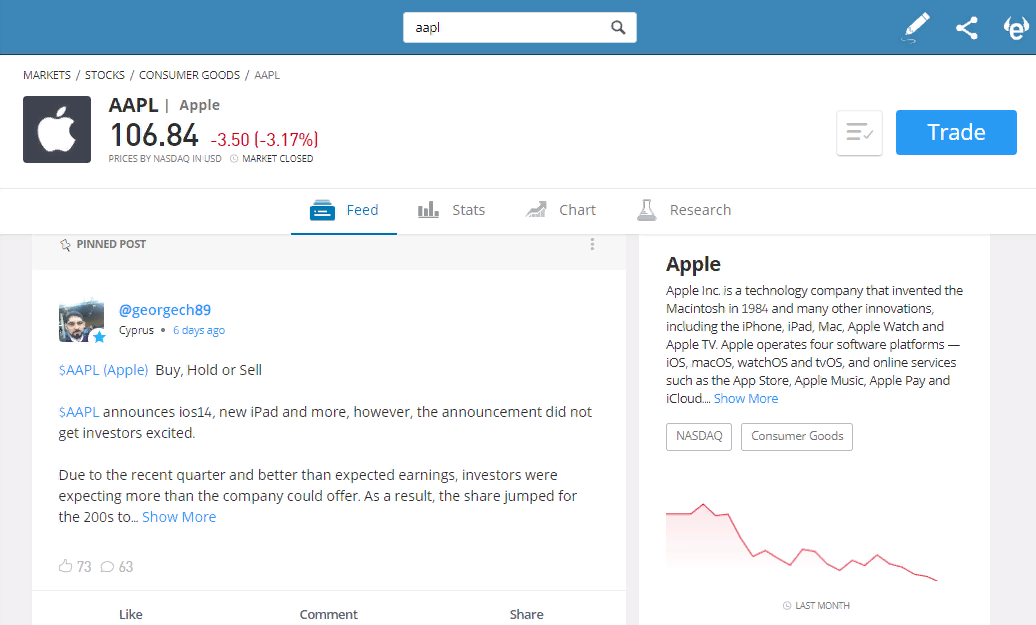

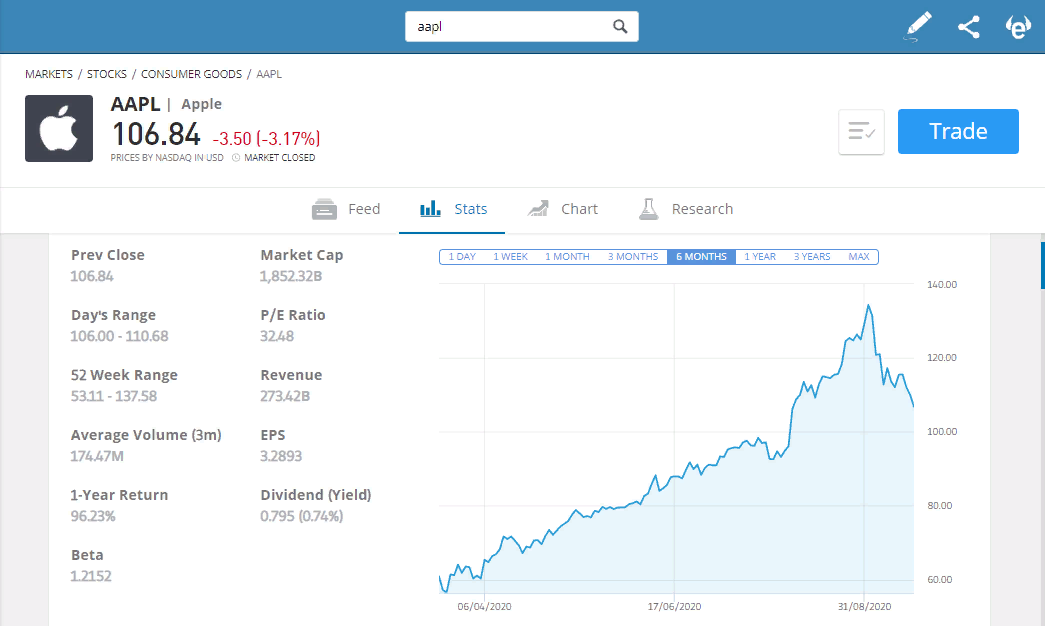

eToro has its own platform and for a trader, who is used to standard platform interface, it will look unusual. On MT4, the chart is the key element, while the choice of trading instruments is shown as a small list in the corner of the screen, while eToro’s interface looks very different. The selection of assets is primary here and it is very convenient to search them. You can review the chart after you select the required asset or trading instrument.

There is also analytics for stocks available on the platform. You can view latest news about stocks, review statistics for the past periods. For investors, using a real account, also market surveys are available. In order to find the assets that you require, you need to choose Markets. Here you will see all available markets and a search box, where you can search for the asset or trading instrument by name or exchange ticker.

Let’s review the features of eToro platform using Apple (AAPL) shares as an example, After you select the stocks, you will see a short description of the stocks and a menu that features:

- news;

- statistics;

- charts;

- surveys.

In order to gain access to all functions of the chart, you need to open full screen view. The chart offers a large number of instruments for settings and analysis. In particular, you can select the following views of the chart:

- candle;

- hollow candle;

- bar;

- single-line;

- mountain.

You can set the timeframe from 1 minute to 1 week. There are over 100 instruments and indicators for technical analysis on the platform.

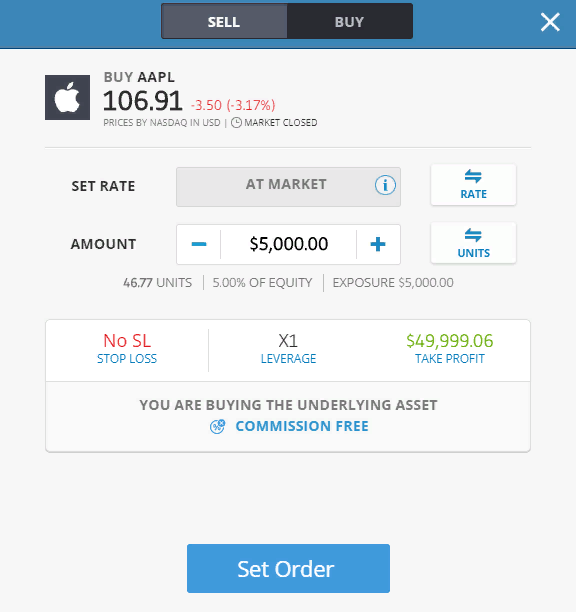

The Trade button is on the page with a short description of the stocks. After you press it, a pop-up window with settings will appear on the screen. There, you can select market or deferred order, specify the trade amount, set the Stop Loss and Take Profit and select the leverage.

eToro trading platform has its advantages and drawbacks. Let’s review them in the table below.

| Pros |

|---|

|

| Cons |

|---|

|

eToro’s competitors, Swissquote and XM.com offer more traditional solutions. In particular, Swissquote uses MetaTrader 4, while XM.com chose to use MetaTrader 5. Both companies have online, desktop and mobile versions.

| eToro | Swissquote | XM.COM | |

|---|---|---|---|

| MT4 platform, desktop | Yes | Yes | No |

| MT5 platform, desktop | Yes | No | Yes |

| Android/iOS | 6 | Yes | No |

| Web-terminal | No | MT4 | MT5 |

Analytics

eToro provides a large number of analytical materials. There is a special analytical block for each type of assets or trading instruments.

| Pros |

|---|

|

| Cons |

|---|

|

News

In the News section, you will find the latest posts, published by eToro’s project team or users of the social network.

Statistics

Statistics section features a review of prices for the past periods – for day, month, quarter, year. The statistics also contains information about the company (if you are searching stocks) – market capitalization, latest data on earnings, dividends, P/E ratio, etc. The Statistics also features charts on company reports and statements – income statement, balance, cashflow, etc.

Survey

Surveys section is also very interesting. Here, you will find useful charts and diagrams to help you evaluate the asset, analysts opinion, technical analysis data. This section, however, is paid-for.

You can also view analytics on eToro’s YouTube channel. The company regularly publishes new videos with interesting materials, market analysis, forecasts for assets and instruments, which all may be of interests for a trader.

Learning

eToro’s learning center offers great opportunities for beginner-level traders. The company offers the novices a basic video course to learn the fundamentals of trading. The broker also holds different webinars features useful information for the traders.

You can also find information for learning on the YouTube channel of the broker. The broker publishes not only educational videos, but also tutorials explaining in detail how everything works.

The only significant drawback is absence of advanced courses. If the trader does not need to learn from scratch, but instead wants to improve his knowledge, eToro has nothing to offer in this respect.

| Pros |

|---|

|

| Cons |

|---|

|

Customer support

Based on our experience, all issues were resolved quickly. However, we have stumbled upon some difficulties when trying to find contacts.

| Pros |

|---|

|

| Cons |

|---|

|

To contact eToro customer support is not an easy task. First, you have to find at least one channel of communication. The broker insistently offers you to solve your issues using the automated Help Center, where you can find answers to standard questions.

If you are not a current client of the company, you can contact the customer support via a ticket system. There is an online chat for the current clients, after they register on the website.

Bonuses and promo

The broker does not offer bonuses for the deposits due to the specific nature of regulation. However, it does have a partner program..

| Pros |

|---|

|

| Cons |

|---|

|

Let’s review partnership options with eToro:

The broker’s Affiliate Program allows partners to benefit from bringing clients to the broker. The members of the program can receive advertising materials and training and earn income per each client they attract.

eToro Club — the club members can expect to receive different exclusive services from the broker. Depending on the status, these could be webcasts featuring an in-depth market analysis, a personal manager or even an exclusive credit/debit card with special conditions.

Summary

eToro is one of the most popular European brokers for stock trading. The broker is universal and it is suitable for beginners as well as professionals. Low minimum deposit (only $200), learning materials, free demo account – these features make eToro attractive for beginners and clients with small capital.

The broker is officially regulated and has all required licenses. eToro has a good reputation and can be considered quite reliable.

eToro has a large number of regional restrictions, which is why before registering, it is recommended to review the list of countries, in which the broker operates. eToro is best suitable for the users from the EU and East European countries (with the exception of Moldova and Belarus, where the broker does not operate).

eToro is the best choice for medium and long term investment, for traders working with stocks. For short-term traders this broker is not very suitable due to the fees, which are average or even higher than average for other classes of instruments. The number of currency pairs here is comparatively small, while conditions for CFD trading are often not attractive. eToro’s key advantage is that it is the largest social trading network. The possibilities for social trading here are huge. At that, the broker offers not only convenient copying, but also beneficial conditions for the investors, who provide their strategies for copying.

NOTE! All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Real reviews of eToro 2025

Stay away from broker eToro! I invested a hefty $12,000, only to find myself trapped in a nightmare. They manipulated the trading platform during crucial trades, causing significant losses. When I tried to withdraw my remaining funds, they concocted absurd reasons to deny my request. It's blatant theft! Their customer service is a joke, offering nothing but empty promises and delays. This experience has been utterly devastating and financially ruinous.

Already earned over $ 20,000 with eToro copying other traders. There were never any problems with the withdrawal. The only thing: it is better to withdraw large sums. On small ones, you will lose on commissions.

I quarreled with eToro's support, as the employees of this company do not want to help with solving issues. Is the broker so poor that it cannot assemble a sensible team? It's eToro's reputation and the attitude of customers ... It's a pity, I made a big bet on eToro, but was not happy with the results of cooperation.

Copy trading with eToro was a real disappointment. I got a penny profit and just lost my time on this platform.

eToro – лицензированный брокер. Учитывая то, что у меня был негативный опыт работы с брокерами-мошенниками, я теперь уделяю большое внимание юридическим документам. С eToro у них полный порядок. Брокер дает вывести заработанные средства без проблем. Комиссия за снятие 5 долларов. Считаю, что это немного. Также обращу внимание на отличную площадку для торговли криптой. У них вы торгуете не CFD, а реальными активами, которые можно вывести на крипто кошелек.

In eToro, the initial deposit was $ 200, a friend told me. I decided to register, but the company raised the bar for clients from European countries to $ 1000. What do you think, should I register or not?

Trading stocks and ETFs is commission-free with eToro! Strictly speaking, that's why I came here.

EToro sets up a small initial deposit. I am a US resident, so it only took $ 50 to start trading. I know that for residents of other countries (for example, Israel, Russia) the entry threshold is higher. I don't understand why the broker introduces different rules for different locations ...

Copy trades bring good passive income for professionals. eToro pays 2% of the amount of funds managed. Last year, the amount of traders' funds was about $ 1,000,000, I earned $ 20,000 on my profile.

Too many questions to eToro. Had a problem with withdrawal funds because of "strange technical issues". What the hell! Their support is lazy and irresponsible, especially if you have some profit.

Before opening an account, think about how to validate your account! Otherwise, you may lose money.

Their support is slow! I waited for a day to fix a connection bug during high trading hours.

Have been testing autocopying for 3 months. Ready to share some first results. The total investment was $5000. The average profitability is 9.4% for today. Banks now give 0% interest.. I think it's a pretty good return.

Guys, you shouldn't expect 20-40% a month from social trading. Half of your profit will be taken by the trader, another part will go to the commission. Be realistic and diversify your portfolio!

Guys, you shouldn't expect 20-40% a month from social trading. Half of your profit will be taken by the trader, another part will go to the commission. Be realistic and diversify your portfolio!

I don’t understand how you can trust the money of such a company as etoro reviews gets it deservedly, because it is an ordinary office, which sells air and helps people lose money in the financial markets. It is immediately clear that some kidalova.

Caught on these scammers and lost money, these scammers appear to be a broker, but as it became clear they have nothing to do with it. The truthful ones are written about etoro reviews, they really breed customers and throw them for money.

I do not recommend investing this lousy company etoro reviews I leave to warn others. do not fall for their tricks. I invested money in them, lost the whole amount, they don’t return anything back, referring to my guilt.

it’s impossible to approach such offices and a cannon shot, because this will not end in anything good. better read about etoro reviews of real customers who these scammers leaked accounts to.

Well, I honestly can’t say that the methods that they use to drain the deposit are somehow special or tricky! Everything is like in an ordinary kitchen- art and output lock! Naturally what about etoro reviews and may not be good!