On this page, you will find a large number of reviews from the real ForexTime (FXTM) If you are already working with If you are already working with ForexTime (FXTM) please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

FXTM Review 2021

FXTM (ForexTime) is a CFD and Forex broker that was established in 2011. The broker holds four licenses issued in Cyprus, UK and also the Republic of Mauritius.

ForexTime provides customers access to Forex pairs, stocks and contracts for differences. Here, you will find user-friendly trading platforms, a wide selection of trading instruments and analytical materials. The new traders can take a learning course. The broker also offers many methods to deposit and withdraw funds.

Over the period of its operation, FXTM received 43 awards, including the Best ECN Broker 2020, and was recognized as the best broker of China, Nigeria, Russia, Asia and Africa.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

Key features

| Regulation | Cyprus, UK, SAR, Mauritius |

|---|---|

| License | CySec №185/12 FSCA №46614 FCA №600475 FCA №777911 C113012295 |

| Level of commissions | Low |

| Demo account | Yes |

| Minimum deposit | 10 USD |

| Inactivity fee | 5 USD per month after six months of inactivity |

| Timeframe for opening an account | 15-20 minutes |

| Leverage | Up to 1:2000 |

| Markets | Forex, Stocks, CFD |

| Options for passive income | - |

| Customer support languages | English, Greek, Hindi, Indonesian, Korean, Malay, Thai. |

| Withdrawal fee | Fees of payment systems |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | Yes |

| Deposit from electronic wallets | Yes |

| Account currencies | USD, EUR, GBP, NGN, BTC |

| Deposit bonus | - |

Page content

Geography of broker’s customers

FXTM is an international broker providing services across 190 countries. The company enjoys the biggest popularity in Africa, particularly in Nigeria and South Africa. ForexTime is also popular in Asian countries. The broker’s Asian audience is mostly made up of customers from Iran and Vietnam. In terms of European countries, customers from the UK are the broker’s core audience.

| Country | Percentage of customers |

|---|---|

| Nigeria | 9.59% |

| Vietnam | 9.18% |

| UK | 6.96% |

| Iran | 6.30% |

| South Africa | 5.51% |

Commissions and fees

FXTM (ForexTime) offers a wide selection of trading accounts and the principles of charging commissions and fees on them are different. For the majority of account types, the broker uses average or high spread. On the ECN account, the broker charges a commission on the traded volume, while the spread is close to the market level.

In order to establish the account with the best conditions, we will compare them between each other. Also, in the course of this review we will compare FXTM commissions with those of its competitors – OctaFX and XM.

All commissions and calculations are based on the rates valid as of 04.01.2021. For more accurate information, visit the broker’s website or contact customer support.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of the FXTM commissions

| Asset | Commission |

|---|---|

| EUR/USD | On the Standard account – average spread 1.9 pips. On the ECN account – average spread 0.3 pips plus $2 commission per lot. |

| Apple shares | No commissions |

| CFD on S&P 500 | Average spread – 1 pips |

| Non-trading commissions (if any) | $5 per months after six months of inactivity |

Commissions on Forex market

FXTM commissions on the Forex market depend on the type of the trading account. First, let’s see which of the broker’s accounts offers the best conditions and then compare them with OctaFX and XM.

As an example, let’s see how much a trader will have to pay for execution of a standard lot of 100,000 units of base currency. The values in the table will include an average spread. On the ECN account, also the commission on the traded volume is included.

Comparison of commissions on different account types of FXTM

| Standard | ECN | |

|---|---|---|

| EURUSD | $19 | $5 |

| EURGBP | $31.5 | $8.6 |

| USDZAR | $89.2 | $55.2 |

As we can see, an ECN account is more preferable for active trading of currency pairs. If the size of the commission is more important to you than the diversity of trading instruments, this account is your best choice.

Let’s also compare the trading conditions of FXTM (ECN account) with the competitors. The conditions are the same – execution of a standard lot of 100,000 units of base currency.

Comparison of FXTM commissions with other brokers

| FXTM (ECN) | XM (ULTRA Low) | OctaFX (ECN) | |

|---|---|---|---|

| EURUSD | $5 | $8 | $10 |

| GBPUSD | $7 | $11 | $11 |

| USDJPY | $5 | $7.8 | $7.8 |

| EURGBP | $8.6 | $14.4 | $9.8 |

| AUDJPY | $8.8 | $18.4 | $13.6 |

| USDZAR | $89.2 | $64 | Not traded |

FXTM offers special conditions for the customers with high trade turnover. The bigger the equity and the trading volume, the lower the commission will be per each million dollars of the volume.

| Equity (USD) | Trading Volume (million USD) | |||

|---|---|---|---|---|

| Less Than 100 | 100 - 150 | 150 - 250 | Over 250 | |

| 0 - 2,999 | 20 | 19 | 18 | 15 |

| 3,000 - 4,999 | 19 | 18 | 17 | 14 |

| 5,000 - 19,999 | 18 | 17 | 16 | 13 |

| 20,000 - 49,999 | 17 | 15 | 13 | 11 |

| 50,000 - 199,999 | 16 | 13 | 11 | 9 |

| 200,000 - 499,999 | 14 | 12 | 10 | 8 |

| 500,000 - 999,999 | 13 | 10 | 8 | 6 |

| 1,000,000 - 4,999,999 | 12 | 9 | 6 | 4 |

| Over 5,000,000 | Determined on an individual basis. | |||

Swaps

FXTM offers low rates of swaps, which enables traders to use medium and long-term strategies on the Forex market. As a reminder, swap emerges due to the difference in the interest rates of the central banks that issue currencies in the currency pair.

If the swap is negative, a certain number of points are written off the account in case of a rollover, if it is positive – they are deposited on the account. Some brokers also charge a commission on top of the swap, which is why their value may differ.

Swaps on FXTM

| Swap long | Swap short | |

|---|---|---|

| EURUSD | -0.03 | -0.54 |

| EURGBP | -0.07 | -0.4 |

| USDJPY | -0.42 | -0.13 |

FXTM offers a swap free option only on the MT4 platform. In this case, the commissions differ from the basic ones.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Swap-free | Yes | Yes | Yes |

Commissions on stock market

Special conditions for trading over 300 stocks on the U.S. market is a new trading service ForexTime introduced in 2020. Direct stock trading was not charged with any commissions as of the end of 2020 and the spread was solely market. A trader needs to open a special account to receive access to this option.

NOTE! Direct stock trading is available only for non-EU residents.

Let’s compare stock trading conditions on FXTM and XM. As an example, let’s see how much a trader will have to pay for execution of a lot of popular US stocks for the amount of $5,000. OctaFX does not offer this service.

Comparison of FXTM commissions on stock trading with the competitors

| FXTM | XM | |

|---|---|---|

| Apple | 0 | $1 |

| Tesla | 0 | $1 |

| Coca-Cola | 0 | $1 |

As we can see ForexTime conditions are beyond comparison.

Commissions on CFD

CFDs of different classes are the key trading instrument of FXTM. We determined commissions on this market as low or average in the market.

As an example, let’s see how much a trader will have to pay for execution of a $5,000 lot on FXTM, XM and OctaFX. The table features factual amounts, including the spreads and commissions of the brokers.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| CFD on S&P 500 | $1.41 | $1 | $3 |

| CFD on BRENT Oil | $5.95 | $5.95 | $8.8 |

| CFD on Apple | $7.32 | $6.46 | Not traded |

| CFD on Adidas | $2.82 | $9.03 | Not traded |

As we can see, ForexTime offers a competitive level of commissions, which is either low or at approximately the same level as XM.

Commissions on cryptocurrencies

Cryptocurrencies are available on FXTM platform as CFDs. We estimated the commissions as average.

For better understanding of the commissions, we calculated the costs on purchase or sale of popular cryptocurrencies for the amount of $2,000 on FXTM and OctaFX.

| FXTM | OctaFX | |

|---|---|---|

| BTCUSD | $2.6 | $2.4 |

| ETHUSD | $8.8 | $8.8 |

| LTCUSD | $13.7 | $25.6 |

Non-trading commissions

ForexTime charges non-trading commissions. In particular, inactivity fee is $5 per month after six months of inactivity. Using the Neteller and Skrill payment system, customers can withdraw funds without fees, while the broker charges USD 3 or EUR 2 on withdrawals to a debit/credit card.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Inactivity fee | Yes | Yes | No |

| Withdrawal fee | No* | No | No |

| Deposit fee | No | No | No |

* for some payment systems

Reliability and regulation

FXTM operates legally and holds the required licenses and authorizations for financial operations. The company is a member of deposit guarantee funds and in case the broker seizes its operations, customers from the EU and the UK can receive compensations. FXTM has been operating since 2011 and has earned a good reputation. The company has not been involved in high-profile scandals.

The negative moments in terms of ForexTime reliability can be considered minor. The company has not issued securities and is not listed at the exchanges. The broker does not provide access to reporting, which is why it is difficult for the customers to understand the company’s financial condition at the end of the reporting year.

ForexTime has three branches, each providing services in their respective regions. Let’s review the company’s branches in more detail.

Forextime Limited

Forextime Limited provides services for the customers from the EU, UK and also South Africa. This branch of FXTM holds three licenses on financial activity, including:

- Cyprus – CySec No. 185/12;

- UK – FCA No. 600475;

- South Africa – FSCA No. 46614.

ForexTime Limited is a member of deposit guarantee fund. In particular, in case of issues, the customers from the European Union can receive a compensation of up to EUR 20,000, and customers from the UK – up to GBP 85,000.

ForexTime UK Limited

UK residents can work both with the European and British branch. FXTM registered a specialized branch that provides services directly to the UK traders. The branch operates on the license issued by the Financial Conduct Authority (FCA) No. 777911. ForexTime UK Limited is also a member of the deposit guarantee fund. Its customers can receive a compensation of up to GBP 85,000.

Exinity Limited

The customers residing outside the EU, UK and South Africa work with the international branch of ForexTime titled Exinity Limited. The company operates on the license issued by the Financial Services Commission of the Republic of Mauritius. The number of the license is C113012295. The international branch is not a member of the deposit guarantee fund.

Markets and products

FXTM provides customers a rather limited choice of assets. ForexTime is a Forex and CFD broker. The customers of the broker have access to currency pairs, stocks and contracts for differences.

| Pros |

|---|

|

| Cons |

|---|

|

FXTM is the best suitable broker for the traders working on the Forex market. The broker provides a big number of currency pairs to work with. In addition, there is also a good choice of CFDs on stocks, indices and commodities. FXTM provides access to stock trading, although the choice of stocks is rather limited.

The company’s customers cannot work with cryptocurrencies, bonds, futures, options. ETFs and mutual funds are also not available here.

Comparison of market availability on FXTM, XM and OctaFX

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | No |

| CFD | Yes | Yes | Yes |

| Crypto | No | No | Yes* |

| Bonds | No | No | No |

| Futures and options | No | Yes* | No |

| Commodities* (oil, metals, wheat, gas, ores, etc.) | Yes* | Yes* | Yes* |

| Mutual funds | No | No | No |

| ETF | No | No | No |

* only as CFD

FXTM provides access to a rather limited number of markets and is considerably behind its competitors. For example, OctaFX provides access to derivatives on cryptocurrencies.

Forex market

Forex market is widely available on FXTM. The total number of currency pairs is 62. The broker offers its customers 19 pairs with popular currencies (majors), including:

- EURUSD;

- AUDUSD;

- USDJPY;

- GBPUSD;

- NZDUSD;

- USDCHF and others.

Also, there are many minor pairs on ForexTime. In particular, you will find 21 pairs in this category. The list features cross rates and minor currencies in a pair with USD. For example:

- AUDJPY;

- EURSGD;

- GBPNZD;

- NZDCAD;

- USDSEK;

- SGDJPY and others.

In addition, there are 22 exotic currency pairs. FXTM website features exotic pairs with the following currencies:

- NOK;

- SEK;

- CNH;

- CZK;

- RUB;

- MXN;

- PLN;

- HUF;

- INR;

- DKK;

- TRY;

- HKD and others.

Therefore, the number of currency pairs available on the broker’s platform can be considered good.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Number of trading pairs | 62 | 57 | 28 |

Stocks

FXTM offers access to trading US and EU stocks directly (not only via CFD), but their choice is limited. ForexTime provides access to two stock markets, including:

- US market – 120 companies;

- European market – 40 companies.

Overall, the choice of markets and stocks available on the broker’s platform cannot be considered very big. It is bigger than, for example, on XM, but FXTM cannot compete with large brokers, such as Swissquote.

| FXTM | XM | Swissquote | |

|---|---|---|---|

| Number of markets | 2 | 3 | 60 |

| Number of available stocks | 160 | 100 | 20 000+ |

CFD market

Contracts for differences on stocks can be considered FXTM’s base instrument. There are quite many of them available. The broker also provides a good choice on indices (28). As for other types of derivatives, the number of instruments is at the basic level. For example, there are only 8 CFDs on raw materials.

In terms of availability of trading instruments, competitors of FXTM offer a wider choice, primarily thanks to cryptocurrencies. Both XM and OctaFX offer CFDs on cryptocurrencies. FXTM also lacks CFDs on bonds and ETF.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Forex | No | No | No |

| Stocks | Yes | Yes | Yes |

| Bonds | No | No | No |

| Crypto | No | Yes | Yes |

| Indices | Yes | Yes | Yes |

| Commodities (metals, commodities, raw materials) | Yes | Yes | Yes |

CFD on stocks

ForexTime offers a large number of CFD on stocks – 191. The company offers its customers 141 types of contracts on stocks of companies from the U.S. market and 50 stocks of companies from the European market.

FXTM’s choice of derivatives on stocks can be considered good in its niche, but it is much smaller than on XM.

| FXTM | XM | |

|---|---|---|

| CFD on stocks | 191 | 1240 |

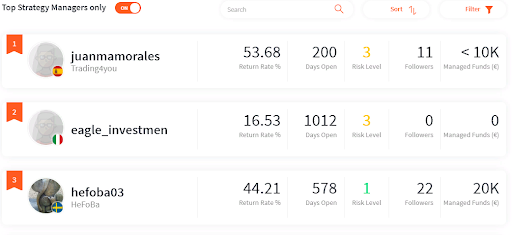

Investment Managers copy trading service

FXTM offers its customers a passive income service. It is titled Investment Managers. It essentially involves copying of trades of successful traders. The customers can connect to any trader and after that the traders of that trader will be automatically copied on the trading platform. The website features the rating of the best traders on FXTM. You can find information on the return rate of investment, risk level, number of followers there. Access to Investment Managers is free.

Opening an account

The procedure of account opening on FXTM is quite simple and quick. The broker provides easy registration, offers many account types and has quite affordable requirements for the minimum deposit.

| Pros |

|---|

|

| Cons |

|---|

|

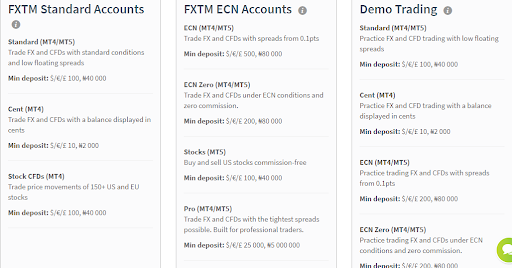

Registration and verification are fully done on the broker’s website, and there is no need to contact the office or send any documents by mail. ForexTime offers seven types of trading accounts, including four ECN accounts. The minimum deposit requirements on FXTM are very good for the beginners, and the users who do not have a big budget at their disposal to start with.

There is only one drawback – FXTM does not support many popular global currencies as a base currency of the account. The company also has certain regional restrictions, which is why the residents of some countries and territories won’t be able to trade with FXTM.

What is the minimum deposit on FXTM?

FXTM does not have high minimum deposit requirements. In particular, you can start trading with the broker with USD 20. By funding your account by this amount, you will be able to work with the cent account. In terms of standard accounts, the minimum deposit is USD 100.

The low entry threshold is FXTM’s advantage, although the competitors also offer rather beneficial conditions to start trading. For example, XM’s requirements for the cent account are even lower.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Minimum deposit | 20 USD | 5 USD | 100 USD |

For every account type, the minimum deposit is different. The broker has seven accounts, six of which are for retail traders and one for the professionals. The minimum deposit amount for professional traders is much higher and the requirements are stricter than for the rest of the account types.

| Cent | Standard | Stock CFD | Stocks Account | ECN Zero | ECN | Pro | |

|---|---|---|---|---|---|---|---|

| Minimum deposit | 20 USD | 100 USD | 100 USD | 100 USD | 200 USD | 500 USD | 25 000 USD |

Residents of which countries cannot trade on FXTM?

ForexTime has certain regional restrictions. They are the same for the entire company, regardless of the branch you are working with. The FXTM brand does not provide services to the residents of the following countries and territories:

- USA;

- Canada;

- Suriname;

- Japan;

- Mauritius;

- Haiti;

- The Democratic Republic of Korea;

- Puerto Rico;

- The Occupied Territory of Cyprus;

- Hong Kong.

FXTM does not provide services in these countries and territories and their residents cannot trade on the platform.

What documents are required for opening an account on FXTM?

Only the users that passed verification are allowed to trade on FXTM. Without verification, the broker’s customers won’t be able to fund their account and start trading. The verification procedure on FXTM is standard. You need to upload the following documents:

- Proof of identity – passport, ID card, driver’s license, residence permit;

- Proof of address – tax notice, utility bill, bank statement, etc.

The verification takes one working day. After your application has been reviewed, the broker will open access to financial transactions and from then on you can trade on the platform.

Account types

FXTM offers its customers a selection of seven account types. Of them, three accounts are standard and four are ECN accounts. On the official ForexTime website, the following account types are available:

Standard.

This is a basic type of account. All types of trading instruments, except for CFDs on stocks are available to the customers. The commission is charged as a spread. Trading with leverage is available.

Standard

- Trading platform – MT4, MT5.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: currency pairs, CFD on indices, commodities.

- Minimum deposit — 100 USD

- Commission on trading volume – no

- Commission per lot – no

- Spread for EURUSD: floating, from 1.3 pips

- Minimum lot — 0.1, maximum — 30.

- Leverage — up to 1:2000.

- Stop Out — 50% of the deposit amount

Cent.

Cent account is for the novice traders. You can start trading once you deposit USD 20 on your account, the limitation on the trading volume is 1 lot. There is also a limitation on the number of instruments for trading. Marginal trading is available to the holders of this account.

Cent

- Trading platform – MT4.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: 25 currency pairs, 2 CFD on metals.

- Minimum deposit — 10 USD

- Commission on trading volume – no

- Commission per lot – no

- Spread for EURUSD: floating, from 1.5 pips.

- Minimum lot — 0.1, maximum — 1.

- Leverage — up to 1:1000 for Forex and up to 1:500 for CFD.

- Stop Out — 50% of the deposit amount.

Stock CFD.

This is a specialized account for trading CFDs on stocks. Other types of trading instruments are not available on this account, except for the stocks. The leverage depends on whether you are trading American or European stocks.

Stock CFD

- Trading platform – MT4.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: CFD on American and European stocks.

- Minimum deposit — 100 USD

- Commission on trading volume – no

- Commission per lot – no

- Spread for CFD on stocks: floating, from 0.1 pips.

- Minimum lot — 0.1, maximum — 10.

- Leverage — up to 1:3 for European stocks, up to 1:10 for American stocks.

- Stop Out — 50% of the deposit amount.

Stocks Account.

This is a specialized account type for working with real stocks. The leverage is 1:1. No commissions are charged on trading stocks.

Stocks Account

- Trading platform – MT5.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: CFD on American and European stocks.

- Minimum deposit — 100 USD

- Commission on trading volume – no

- Commission per lot – no

- Spread – no

- Minimum lot — 0.1, maximum — 2000.

- Leverage — up to 1:1.

- Stop Out — 0%.

Zero ECN.

This is an ECN account without the fixed commission. Instead, a floating spread is used. The users have access to all types of trading instruments.

Zero ECN

- Trading platform – MT4, MT5.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: currency pairs, CFD on indices, commodities.

- Minimum deposit — 200 USD

- Commission on trading volume – no

- Commission per lot – no

- Spread for EURUSD: floating, from 1.5 pips.

- Minimum lot — 0.1, maximum — 100.

- Leverage — up to 1:2000.

- Stop Out — 50% of the deposit amount.

ECN.

This is a classic ECN account with a fixed commission. The broker also offers the users with this account type a minimum spread from 0.1 pips.

ECN

- Trading platform – MT4, MT5.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: currency pairs, CFD on indices, commodities.

- Minimum deposit — 500 USD

- Commission on trading volume – no

- Commission per lot – fixed, 2 USD

- Spread for EURUSD: floating, from 0.1 pips

- Minimum lot — 0.1, maximum — 100.

- Leverage — up to 1:2000.

- Stop Out — 50% of the deposit amount.

Pro.

This account is designed for professional traders. The entry threshold is very high, but the customers are also offered maximum opportunities, maximum leverage, no spread and no commissions.

Pro

- Trading platform – MT4, MT5.

- Base currency options – GBP, USD, EUR, NGN.

- Instruments: 43 currency pairs, 2 CFD on metals.

- Minimum deposit — 25,000 USD

- Commission on trading volume – no

- Commission per lot – no

- Spread for EURUSD: 0 pips.

- Minimum lot — 0.1, maximum — 100.

- Leverage — up to 1:500.

- Stop Out — 50% of the deposit amount.

For the standard accounts, only Instant Execution is available, for ECN accounts – only Market Execution. Also, the choice of the trading platform depends on the account type. In particular, MetaTrader 5 is available to the users, who opened the following accounts: Standard, Stocks Account, ECN, Zero ECN and Pro. Traders with Cent and Stock CFD accounts can only use MetaTrader 4 platform.

Demo account

ForexTime offers a demo account option. The demo account is provided for free. There are no limitations in terms of time and selection of instruments on the demo account. On the FXTM demo account, you can choose any of the broker’s trading accounts, except for the Pro.

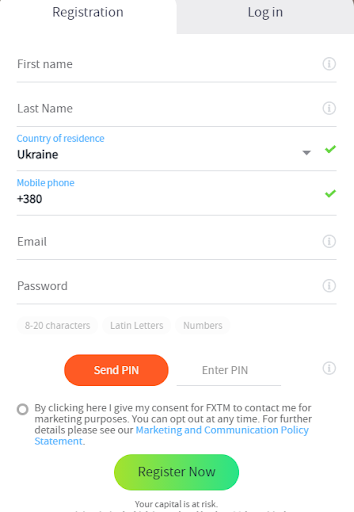

How to open an account: step-by-step guide

The procedure of opening an account on FXTM is fully automated, but it will take you a bit of time. The approximate time for registering an account is 15-20 minutes. Let’s review the registration procedure on ForexTime in detail.

Step 1 – Basic information

During the first step, a new customer needs to provide basic personal information. There are six fields to be filled out, including:

- First name;

- Last name;

- Country of residence;

- Mobile phone;

- Email;

- Password.

Then, you need to confirm your phone number. For this, you need to receive a PIN. Once you press Send Pin, you will receive an SMS with a 4-digit code. Enter PIN and press Register.

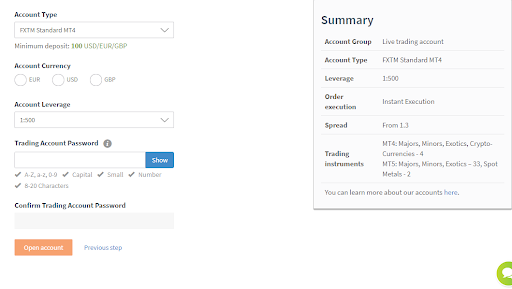

Step 2 – Selection of the trading account

Then, the broker will offer you to choose one of the available accounts. The main types of the account are available here – Standard, ECN or a Demo account. All you need to do is press Select.

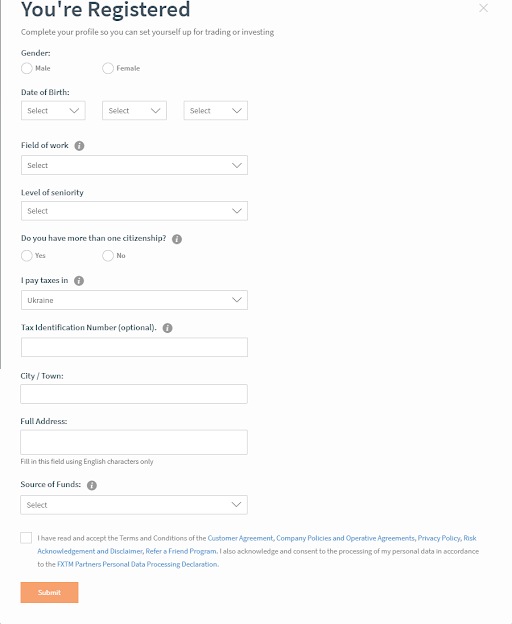

Step 3 – additional information

After you’ve registered and chosen the trading account type, you will need to complete your profile. FXTM will ask you to provide the following information:

- gender;

- date of birth;

- field of work;

- position;

- whether you have more than one citizenship;

- the jurisdiction where you pay taxes;

- tax identification number;

- city of residence;

- full address;

- source of funds.

Once you fill everything out, press Submit and go to the next step.

Step 4. Setting up your trading platform

At this stage, you will be offered to choose a specific trading account. The system will offer you three account types based on the category you chose during the Step 2. You will also choose account currency, leverage (up to 1:500) here and set up your password for accessing the trading platform.

This step completes the registration procedure. All you need to do is pass verification, fund your account and you can start trading. FXTM allows opening several accounts.

Base currencies of the account

The list of base currencies on FXTM is limited. The broker offers only 5 base currencies, four of which are fiat:

- USD;

- EUR;

- GBP;

- NGN.

Noteworthy, the broker supports cryptocurrencies as a base currency of the account, which is an important advantage. In particular, you can use BTC. The company also processes payments in other currencies, but they are converted into one of the base currencies at the exchange rate.

The broker’s number of base currencies can be considered low. XM offers more base currencies – 11, but OctaFX offers only three, although this broker also supports cryptocurrencies.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Number of base currencies | 5 | 3 | 11 |

| List of base currencies | USD, EUR, GBP, NGN, BTC | EUR, USD, BTC | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD |

Deposit and withdrawal methods

ForexTime offers its users a wide choice of deposit and withdrawal methods. The company ensures quick and convenient financial transactions for its customers.

| Pros |

|---|

|

| Cons |

|---|

|

FXTM provides its customers with a huge selection of deposit and withdrawal methods. There are many regional methods among them, but also more than 10 international ones. In particular, you can deposit or withdraw funds via a wire transfer or Visa, Maestro and Mastercard debit/credit cards. In addition, the broker supports 7 types of popular electronic wallets. You can perform transactions using the following types of virtual payment systems:

- FasaPay;

- Skrill;

- Neteller;

- Webmoney;

- QIWI;

- Yandex.Money;

- Perfect Money.

ou can also deposit and withdraw funds using any Bitcoin electronic wallet. With deposits using bank cards and electronic wallets, your account is funded instantly, while transactions involving wire transfers and cryptocurrencies take longer. There is no deposit fee. As for the withdrawals, the situation is different. There is a withdrawal fee on withdrawals via some payment methods. Processing of transactions may take up to 48 hours.

Methods and timeframe for deposits

| Method of deposit | Fee | Timeframe |

|---|---|---|

| Wire transfer | 0% | From 3 to 5 days |

| Debit/credit card | 0% | Instantly |

| FasaPay | 0% | Instantly |

| Skrill | 0% | Instantly |

| Neteller | 0% | Instantly |

| Webmoney | 0% | Instantly |

| QIWI | 0% | Instantly |

| Yandex.Money | 0% | Instantly |

| Perfect Money | 0% | Instantly |

| Bitcoin | 0% | Up to 24 hours |

FXTM offers very good methods of deposit and withdrawal of funds. The competitors are far behind FXTM in terms of the number of supported services. For example, XM supports only one electronic payment system and does not support deposit and withdrawals in cryptocurrencies. OctaFX supports cryptocurrency wallets, but does not support wire transfers.

| FXTM | XM | OctaFX | |

|---|---|---|---|

| Wire transfer | Yes | Yes | No |

| Visa and MasterCard debit/credit cards | Yes | Yes | Yes |

| Electronic payment systems | 7 | 1 | 1 |

| Cryptocurrencies | Yes | No | Yes |

Methods of withdrawal and fees

Withdrawal methods available on FXTM are the same as deposit methods. The conditions of withdrawal, however, are different. Let’s review them in more detail.

| Method of withdrawal | Fee | Timeframe |

|---|---|---|

| Wire transfer | 30 EUR | 24 hours |

| Debit/credit card | 2 EUR, 3 USD, 2 GBP | 24 hours |

| FasaPay | 0.5% | 24 hours |

| Skrill | 0% | 24 hours |

| Neteller | 0% | 24 hours |

| Webmoney | 2% | 24 hours |

| QIWI | 1.5% | 24 hours |

| Yandex.Money | 1.5% | 24 hours |

| Perfect Money | 0.5% | 24 hours |

| Bitcoin | 1% | 24-48 hours |

Trading platforms

FXTM offers its customers a standard selection of trading platforms. The broker’s customers can work with MetaTrader 4 and MetaTrader 5 platforms. ForexTime does not have proprietary platforms.

| Pros |

|---|

|

| Cons |

|---|

|

FXTM allows its users to trade from any device. The following versions of the trading platforms are available:

- MT4 Webtrader;

- MT4 Desktop (Windows, Linux, Mac);

- MT4 Mobile (Android, iOS);

- MT5 Webtrader;

- MT5 Desktop (Windows, Linux, Mac);

- MT5 Mobile (Android, iOS).

| FXTM | XM | OctaFX | |

|---|---|---|---|

| MT4 desktop | Yes | Yes | Yes |

| MT5 desktop | Yes | Yes | Yes |

| Android/iOS | Yes | Yes | Yes |

| Web-terminal | MT4, MT5 | MT4, MT5 | MT4, MT5, C-Trader |

Since the trading platforms the broker offers are standard, there is no sense in reviewing them in detail. Let’s see the short specifications of MetaTrader 4 on ForexTime:

- Security methods – username and password of the trading platform; there are no additional security methods;

- statistics – no;

- number of chart timeframes – 9, from 1 minute to 1 month;

- types of chart interface – bars, line, Japanese candles;

- technical analysis indicators – 32;

- technical analysis instruments – 52;

- number of orders – 4 (Buy Limit, Sell Limit, Buy Stop, Sell Stop);

- types of execution – Instant (for standard accounts), Market (for ECN accounts);

- news on the platform – no.

Automated trading is also available on FXTM. You can add trading robots. ForexTime does not have the option of building trading bots.

Analytics

The analytical section on FXTM is quite interesting. Noteworthy, ForexTime analytics is rather suitable for the beginners, while the choice and quality of the materials for the professionals is not impressive.

| Pros |

|---|

|

| Cons |

|---|

|

On the broker’s website, the users can read the latest economic news. In addition, there are featured opinions of staff experts, who regularly analyze the market for FXTM customers. You can read market reviews in text format, watch video reviews or listen to podcasts.

However, the broker lacks professional materials for in-depth market analysis. In particular, there are no analytical insights, infographics, stocks screener, etc.

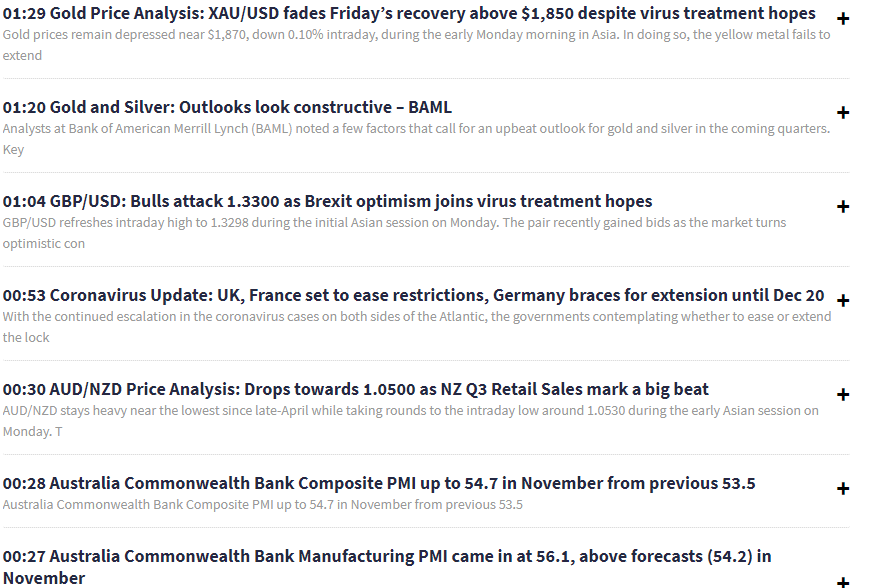

Economic news

There is an excellent news section on the FXTM website. The broker provides good quality newsfeed with reviews on all types of assets you can work with on FXTM, including currency pairs, metals, energies, stocks, etc.

The news section on FXTM is updated regularly, 7-8 news items are posted every hour. The newsfeed is updated 24 h. All news items you will find on the company’s website are published by FXTM specialists; the broker does not publish the news from third-party sources.

Analyst opinions

FXTM has its own analytics section. The company’s experts publish large and detailed reviews in video format on the key events happening in the world. FXTM analysts express their opinions about them and also make forecasts about the changes on the charts of the key global assets.

Market video reviews

FXTM also features market reviews in video format. The main section is the week’s events reviews in 60 seconds. Within a minute, a ForexTime expert talks about the key events in the economic world and shares their opinions about how they may impact specific assets. Earlier, the broker also published the same videos on its website, but now, the last published video there was dated April 27, 2020. Now, the videos come out only on the broker’s official YouTube channel.

Here’s an example of analytical review by FXTM:

Also on its YouTube channel, FXTM publishes videos about the top events in the world, reviews of ForexTime products and even company’s events.

Podcasts

Podcasts are another source of information from the broker. The company’s specialists record market reviews in audio format and you can listen to them at any time and place. FXTM experts publish podcasts on a regular basis.

Education

FXTM does offer education, but this section seems underdeveloped. It features the materials for the beginners, but their choice is rather limited. There is nothing interesting in this section for the professionals.

| Pros |

|---|

|

| Cons |

|---|

|

The broker does not have a big selection of courses, there are not in-depth courses, no materials for advanced traders. In addition, the broker does not have educational articles, strategy reviews, or other texts that could be useful both to the beginners and experienced traders.

Video course

There is a basic video course on the official FXTM website. The access is absolutely free; there is no need to register in order to view it. The videos can be found both on the website and the broker’s YouTube channel.

The course consists of two parts – introductory and analytical. Each part features 10 video tutorials, each 7-15 minutes long. The course provides basic information for the customers and several strategies. This video course can be used only to introduce yourself to the financial markets, but you will now acquire enough knowledge for successful work on the Forex market or with CFDs.

Webinars

ForexTime holds 2-3 webinars for the customers. Their schedule is posted on the broker’s official website. FXTM holds both educational and analytical webinars with market reviews. In terms of drawbacks, the events are held only in English or Vietnamese.

eBooks

An electronic library is an important advantage of education on FXTM. It is not big, but it does indeed have a lot of useful reading materials for the novice traders. In particular, by reading literature offered on FXTM, you can learn about new strategies, peculiarities of specific assets, learn to perform candle analysis, etc. All books can be downloaded for free in .pdf format.

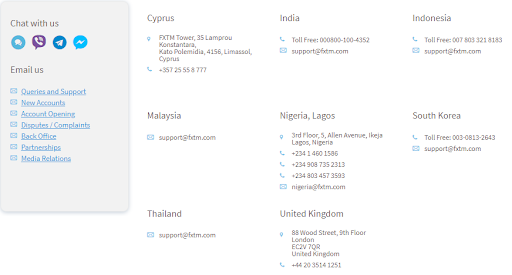

Customer support

There are several ways to contact FXTM customer support. You can contact a company representative at any convenient time, except for the weekends.

| Pros |

|---|

|

| Cons |

|---|

|

There are several ways for ForexTime customers to contact the broker’s customer support. The first one is the online chat on the website. You can also write an email, call, order a callback. In addition, FXTM provides support five four messaging apps, including:

- Viber;

- Telegram;

- WhatsApp;

- Facebook Messenger.

The broker’s customer support answers customer’s requests in seven languages. In particular, you can communicate with customer support in one of the following languages:

- English;

- Greek;

- Hindi;

- Indonesian;

- Korean;

- Malay;

- Thai.

The fastest response comes via the Live Chat or messengers. The broker’s representatives respond within 5-10 minutes. A call via the callback service is made within 60 seconds, but the time of the response can depend on the load of the operators. You may have to wait 5-7 minutes.

Languages and communication channels of customer support

The broker’s customer support operates 24/5. Let’s review the main ways to contact the broker’s representatives.

| Country | Support language | Phone number | |

|---|---|---|---|

| UK | English | support@fxtm.com | +44 20 3514 1251 |

| Cyprus (international branch) | English, Greek | support@fxtm.com | +357 25 55 8 777 |

| India | Hindi | support@fxtm.com | 000800-100-4352 |

| Indonesia | Indonesian | support@fxtm.com | 007 803 321 8183 |

| Malaysia | Malay | support@fxtm.com | - |

| South Korea | Korean | support@fxtm.com | 003-0813-2643 |

| Thailand | Thai | support@fxtm.com | - |

| Nigeria | English | nigeria@fxtm.com | +234 1 460 1586 +234 908 735 2313 +234 803 457 3593 |

Bonuses and promo

FXTM does not have an extensive bonus program. The broker has only two special offers for the customers and only the users who have been trading with the broker for some time can truly appreciate their benefits. Let’s review the special offers in more detail.

Loyalty program

ForexTime can benefit from the broker’s loyalty program. It features a weekly cashback. In order to become a participant of the program, you need to register on the platform and perform transactions.

The loyalty program has five levels and the amount of cashback increases at every stage. The minimum amount of cashback is USD 5 per week. The maximum amount is up to USD 10,000 per week. The money is accrued to your main account and you can use it for trading or withdraw it.

Partnership program

FXTM also offers bonuses for attracting new customers. The broker’s Refer a Friend program allows customers to earn an additional bonus. To become a part of the program, a customer needs to register and get a referral link.

As soon as the new customer registers and funds his account, the referral bonus is accrued to the account of the so-called partner. The broker pays USD 50 per each user, who registered using your referral link. The number of referrals is unlimited. The money is accrued once a week to the real account and it can be withdrawn.

Summary

FXTM is an CFD and Forex broker providing good opportunities for novice traders. The company offers a low minimum deposit, a large number of educational materials, several types of trading accounts, and classic MT4 and MT5 trading platforms.

There are not too many ‘perks’ for the experienced traders on FXTM. The broker does not have professional analytics, advanced trading platforms, investment instruments, etc.

The company operates fully officially. FXTM holds all required licenses and is a member of deposit guarantee funds. ForexTime is an international company providing services across 190 countries. It is particularly popular among the customers from Asia and Africa.

The broker offers its customers access to trading currency pairs, stocks and CFDs; there are many deposit and withdrawal methods available on the platform. Automated trading is also available; you can install trading robots. The broker does not impose any limitations on trading strategies, which is why scalping, intraday trading and long-term deals are available to the customers.

FXTM is not the largest broker. It can rather be considered a niche one. Nonetheless, it provides quality service and good reliability, which is why it can be recommended for trading.

Real reviews of ForexTime (FXTM) 2024

I have been working with FXTM not so long ago. In general, the conditions of this broker suit me, but the quality of support leaves much to be desired. It is difficult to reach out to the employees of this company, although they promised expert assistance in everything. Either I'm doing something wrong, or the support needs to learn how to work with clients.

I was pleasantly surprised by FXTM execution. Its terminal does not hang, everything is fine. Also, I would like to note the advantages of high-quality training and analytics. This really helps in making a profit.

Brokers’ rating is an awesome stuff. It brings a great possibility to compare companies. That’s how I chosen FXTM broker. Though it’s not the first, it’s still well worthy and respectable. Perfect trading conditions and no delays.

i ve just opened a demo account and now studying in this company, working under their affiliate program at the same time. btw, they offer quite a good % at payment… In future I count on some bonuses and then will open my first real account. today I am happy with this broker.