On this page, you will find a large number of reviews from the real HYCM If you are already working with If you are already working with HYCM please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

HYCM Review 2021

HYCM is one of the oldest brokers in the world, dating back to 1977. The company had been providing offline services for 30 years before introducing online services in 2007. The broker obtained four licenses for financial activity, including from respected regulators of the UK, Cyprus and the United Arab Emirates.

HYCM offers its customers access to CFD trading on 6 major groups of assets. In addition to standard currencies pairs, stocks and indices, the broker offers ETF contracts. HYCM offers classic trading platforms MT4 and MT5. In addition, you can work with trading robots. There are also excellent learning opportunities for novice traders on the HYCM website.

Over the years of its operation, the company received 25 awards, including from GBM as the Best Forex Broker 2019, from World Finance as the Best Forex Broker 2018, as well as Best Retail Trading Platform 2014 Award and others.

In the course of our review, we will compare HYCM with IC Market and City Index to help the readers see where HYCM offers better or worse conditions.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

Key features

| Regulation | UK, Cyprus, UAE, the Cayman Islands, Saint Vincent and the Grenadines |

|---|---|

| License | FCA №186171 CySec №259/14 CIMA №1442313 DFSA №F000048 |

| Level of commissions | Low (high for CFD on stocks) |

| Demo account | Yes |

| Minimum deposit | 100 USD |

| Inactivity fee | 0 USD |

| Timeframe for opening an account | 5-7 minutes |

| Leverage | 1:500 |

| Markets | Forex, CFD |

| Options for passive income | No |

| Customer support languages | English, German, Spanish, Italian, Arabic, Chinese, Vietnamese, Russian, Czech. |

| Withdrawal fee | Commission of the bank or payment system |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes |

| Account currencies | EUR, USD, GBP, AED, RUB |

| Deposit bonus | No |

Page content

Geography of broker’s customers

Asia is the key region for HYCM. The company is particularly well-represented in the Middle East and East Asia. Iran is the leader in terms of the number of the broker’s customers. Kuwait and UAE account for a large number of HYCM customers. In addition, the broker is actively expanding in other regions, Europe in particular.

| Country | Percentage of customers |

|---|---|

| Iran | 20.08% |

| Kuwait | 8.35% |

| UK | 5.62% |

| UAE | 3.98% |

| Czech Republic | 2.71% |

Commissions and fees

HYCM offers some of the best conditions for active trading on the Forex market. On other markets, which are available via CFDs, the level of commissions ranges from low to average.

In order to give you a better idea about the level of commissions on HYCM, we compared the broker’s conditions based on different account types. We also compared the trading conditions of the broker with its competitors – IC Markets and City Index.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of the broker’s system of commissions

| Asset | Commissions |

|---|---|

| EUR/USD | Average commission is $4 per lot on the Raw account, 1.2 pips – average spread on the Classic account |

| CFD on Apple | Average spread on the stocks of the US and EU countries – 0.1%-0.13% |

| CFD on S&P 500 | Average spread is 0.5 for the Classic and Raw account types, spread is 0.7 for the Fixed account. |

| CFD on BTCUSD | Average spread is 40.00 for the Classic and Raw account types |

| Non-trading commissions | Inactivity fee - $10 per month after 90 days of inactivity |

Commissions on Forex market

HYCM applies different approaches to charging commissions based on the account type:

- Fixed Account – a fixed spread of an average value is used.

- Classic Account – floating spread of an average value – from 1.2 pips for EURUSD.

- Raw Account – a combination of a low spread and a $4 commission per lot (per round) and market spread from the liquidity suppliers

To have a better understanding of the difference in the level of commissions, let’s look at the conditions for execution of a standard lot of EURUSD on three account types. The table includes all expenses and all figures are converted in USD.

| Fixed Account | Classic Account | Raw Account | |

|---|---|---|---|

| EURUSD | $18 | $14 | $6 |

| GBPUSD | $28 | $20 | $12 |

As we can see, the advantage of the Raw Account is evident, which is why this account type is best suitable for active trading.

We also compared conditions of HYCM, City Index and IC Market. As an example, we calculated how much a trader will have to pay for a standard lot of 100,000 units of base currency (per round). The table includes the average amount in USD a trader will have to pay.

| HYCM (Raw) | City Index (Retail clients) | IC Markets (Raw Spread) | |

|---|---|---|---|

| EURUSD | $6 | $8 | $4.5 |

| USDJPY | $9.7 | $7.68 | $7.3 |

| EURGBP | $19.7 | $22.24 | $12.7 |

| GBPUSD | $12 | $18 | $7.5 |

| AUD/CAD | $23.8 | $32.8 | $9.6 |

| USDZAR | $13.9 | $101.34 | $18.4 |

Conclusions: HYCM offers a low level of commissions, although they are still higher than on the similar account on IC Markets in the majority of positions.

Swaps on HYCM

Swap fee is charged on the rollover of the position to the next day. It is linked to the difference in the interest rates of the central banks that issue currencies in the currency pair. If the swap is negative, a certain number of points are written off the account, if it is positive – they are deposited on the account. The broker can also charge a commission on top of the swap.

Although there are no positive swaps practically on all liquid trading pairs, the general level of swaps on HYCM is low and allows for using long-term strategies.

| Swap long* | Swap short | |

|---|---|---|

| EURUSD | -1.25% | -0.75% |

| EURGBP | -1.5% | -1.5% |

| USDPLN | -3.75% | -1.25% |

* the broker calculates the swaps in annual interest.

Also, some brokers offers their customers from Muslim countries a swap free option. HYCM also offers an Islamic account – in this case, a fixed commission is charged for the rollover instead of a swap.

| HYCM | City Index | IC Markets | |

|---|---|---|---|

| Swap free | Yes | No | Yes |

Commission on CFD

Contracts for differences (CFD) are the main trading instrument of HYCM. We estimated the commissions on this class of assets as low, or average in the market. Overall, the broker is well suited for active trading.

HYCM applies two approaches to charging commissions on CFD:

- Spread is used on the Fixed and Classic accounts for all markets. On the Fixed Account, it is fixed. On the Classic Account, the spread is floating, but its value is lower on average.

- There are some differences on the Raw Account. The conditions are similar to the Classic Account on CFDs on stocks, indices, cryptocurrencies and also ETFs. On CFDs on precious metals and spot oil, a combination of a small spread and $5 commission per lot (per round) is applied. We will review the stock and cryptocurrency markets in separate sections below.

As an example, let’s see how much a trader will have to pay for execution of a $5,000 lot on HYCM, City Index and IC Markets. The specified commissions include spread and other charges of the aforementioned brokers.

| HYCM (Raw) | City Index (Retail clients) | IC Markets (Raw Spread) | |

|---|---|---|---|

| CFD on S&P 500 | $0.7 | $0.86 | $0.86 |

| CFD on gold | $1.28 | $1.28 | $2.6 |

| CFD on Brent oil | $7.12 | $5.94 | $5.94 |

The commissions of HYCM are on average lower than those charged by the competitors or are at the same level.

Commissions on stocks (CFD)

HYCM uses spread as a commission on CFDs on stocks on all three types of its accounts. For the Classic and Raw accounts, the spread is identical, and on the Fixed account it is on average higher, but has a fixed value.

We estimated the general level of commission on the market as average. Another advantage of HYCM is that the broker does not have a minimum commission size, which many other brokers do. This nuance makes trading minimum lots beneficial.

| HYCM | City Index | IC Markets | |

|---|---|---|---|

| CFD on Apple | $6.95 | $10 | $1.32 |

| CFD on Facebook | $6.68 | $10 | $1.05 |

| CFD on Adidas | $6.09 | $11.8 | Not available |

| BNP Paribas | $6.24 | $11.8 | Not available |

As we can see, HYCM commissions are practically identical for trading American and European stocks. It is lower than those of City Index, but higher than on IC Markets.

Commissions on cryptocurrencies (CFD)

HYCM uses spread as a commission on cryptocurrencies on all three account types. On the Classic and Raw account types, the spread is identical, and on the Fixed Account, it is higher. HYCM’s commissions on cryptocurrencies are low.

As an example, let’s see how much a trader will have to pay for the purchase of popular cryptocurrencies for the amount of $2,000 on HYCM.

| HYCM | |

|---|---|

| CFD on Bitcoin (BTCUSD) | $3.69 |

| CFD on Ethereum (ETHUSD) | $5.68 |

| CFD on Litecoin (LTCUSD) | $6.94 |

Non-trading commissions

HYCM’s level of non-trading commissions is average. The broker charges $10 inactivity fee per month after 90 days of inactivity. In the majority of cases, the broker does not charge a deposit/withdrawal fee, but does not compensate the fees charged by the corresponding payment systems.

| HYCM | City Index | IC Markets | |

|---|---|---|---|

| Inactivity fee | Yes | Yes | No |

| Withdrawal fee | No | No | No |

| Deposit fee | No | No | No |

Reliability and regulation

HYCM has five main branches, each providing services in their respective regions. Let’s review them in more detail.

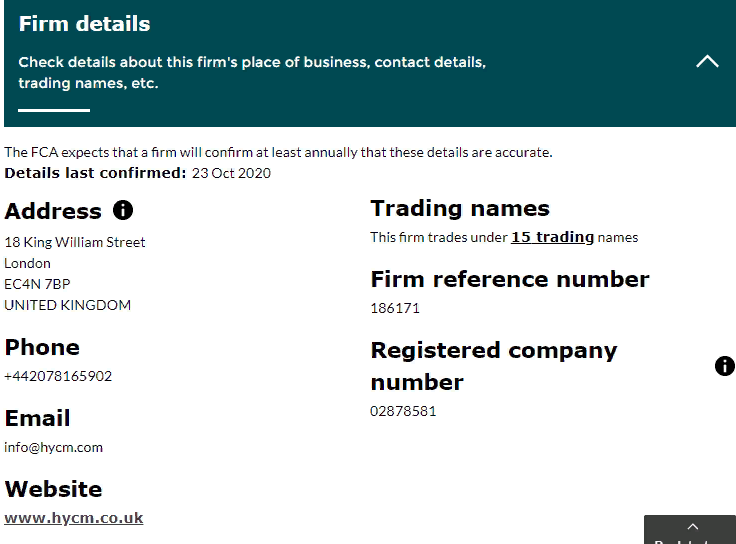

1. Henyep Capital Markets (UK) Limited is the company managed by the broker for the customers from the UK. Registered company number is 02878581. The legal address: 18 King William Street, London, EC4N 7BP, UNITED KINGDOM. License on financial activity – FCA No. 186171.

2. HYCM Europe Limited is the company providing services for the customers from Europe, except for the UK. Legal address: 47, Spyrou Kyprianou Avenue, The Noble Center, 4th Floor, Mesa Geitonia, CY-4003 Limassol, company registration number – 332868. License number – CySec No. 259/14.

3. HYCM LTD. The company is registered in the Cayman Islands and provides services for the Asia Pacific Region. License – CIMA No. 1442313. There is no information about the registration on the website of the company, the regulator does not allow to check the license.

4. Henyep Capital Markets (DIFC) Limited. The company provides services for the customers from Asia. Legal address: Tenancy 903, Level 9, Liberty House, DIFC, PO Box 506540, Dubai, UAE. License – DFSA No. F000048.

The broker is also registered in Saint Vincent and the Grenadines. This branch provides services in other regions. There is no information about the legal address of the company. The reference number of the company is – 25228 (IBC 2018).

The company is a member of deposit guarantee funds. In particular, the customers in the following jurisdictions can receive compensations:

- UK – up to 85,000 GBP (FCA);

- EU – up to 20,000 EUR (CySec).

The customers from other jurisdictions cannot expect to receive compensations for their deposits. The company also has negative balance protection.

Markets and products

The choice of markets and products on HYCM is not very big. HYCM is a forex and CFD broker focused on providing only the most popular trading instruments. The broker provides its customers with an opportunity to trade currency pairs, although there are not too many of them. In addition, derivatives on stocks, stock indices, cryptocurrencies, ETFs and commodities are available on HYCM.

| Pros |

|---|

|

| Cons |

|---|

|

The company provides a possibility to work with leverage, which differs depending on the groups of assets that you have chosen. The maximum leverage is provided for currency pairs on Forex. Noteworthy, CFDs on cryptocurrencies and ETFs are trading instruments that are not very often offered by the brokers.

There is actually only one drawback – the broker does not provide access to real assets. That is why you will only be able to work with the contracts for differences here. You will not be able to buy real shares and cryptocurrencies. In addition, some other important groups of instruments, for example bonds are also not available on the platform.

IC Markets and City Index mostly offer a similar selection of assets. Please see the table below.

| HYCM | City Index | IC Markets | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | No | No | No |

| CFD on stocks | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes |

| Crypto* | Yes | Yes | Yes |

| Bonds* | No | Yes | Yes |

| Futures and options | No | No | No |

| Commodities* (oil, metals, wheat, gas, ores, etc.) | Yes | Yes | Yes |

| Mutual funds | No | No | No |

| CFD on ETF* | Yes | Yes | Yes |

* – only as CFD

Forex market

HYCM provides wide access to the Forex market. The total number of currency pairs on the platform is 68. First of all, you will find many popular currency pairs here, including:

- EURUSD;

- GBPUSD;

- USDJPY;

- USDCAD;

- AUDUSD, etc.

Also the company offers a large number of cross rates. The broker has over 20 of them. In particular, HYCM offers the following types of cross rates:

- AUDJPY;

- GBPNZD;

- CADJPY;

- EURGBP;

- EURAUD;

- GBPCHF and others.

As for exotic pairs, there are also many of those on the platform. In fact exotic currencies in pairs with other exotic pairs are available here and not only with USD or EUR. For example, you can work with the following trading pairs here:

- NOKSEK

- HKDJPY

- NZDSGD;

- GBPSEK;

- GBPPLN;

- USDRUB, etc.

A large number of currency pairs is an important advantage of HYCM over many other brokers, for example over IC Markets. However, the number of trading instruments on HYCM is not the biggest in the industry, and there are brokers that offer a wider choice.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| Number of trading pairs | 68 | 61 | 84 |

CFD market

As a reminder, CFD is a high risk marginal instrument. The majority of traders lose money trading CFDs. Due to this, you need to be aware of the risks and avoid using a very big leverage.

The choice of CFD offered by the broker is quite diverse. In particular, there are contracts on stocks, cryptocurrencies, indices, commodities and ETF. However, the availability of the markets is different. For example, HYCM does not offer too many stocks, while there is a rather impressive number of CFDs on indices.

The choice of CFD groups on HYCM approximately matches the choice offered by the competitors. In particular, IC Markets and City Index offer almost the same number of groups plus bonds.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| Stocks | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

| Commodities (metals, foods, raw materials) | Yes | Yes | Yes |

| ETF | Yes | Yes | Yes |

Stocks

The broker offers a rather limited selection of CFD on stocks – 153. These are mainly top global companies from the U.S. and Europe. Noteworthy, most derivatives are available on the MT5 platform. CFD only on 10 stocks are available on MT4.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| CFD on stocks | 153 | 110 | 4500 |

The selection of CFD on stocks offered by the broker is not very big. IC Markets offers a smaller amount of CFD than HYCM. However, the broker certainly cannot compete with City Index in this aspect.

Indices

HYCM offers its customers CFD on stock indices. The company provides access to 28 types of contracts. The broker has CFD on key types of indices – American, European, and also indices of the largest Asian economies – China, Japan, Hong Kong, India, etc.

By the number of contracts on stock indices, HYCM is one of the leaders among CFD brokers. For example, both IC Markets and City Index offer a smaller selection of them than HYCM.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| CFD on indices | 28 | 22 | 25 |

Cryptocurrencies

HYCM offers access to a large number of cryptocurrencies – a total of 65 pairs. However, it is worth noting that the broker provides only crypto-fiat trading pairs with the world’s major currencies – USD, EUR, GBP, JPY. There are no purely cryptocurrency pairs on the platform.

HYCM competitors also offer cryptocurrencies, but their choice is far less diverse. IC Markets and City Index have 6-7 times fewer cryptocurrencies compared to HYCM.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| CFD on cryptocurrencies | 65 | 10 | 6 |

Commodities

The broker does not provide a very wide selection of commodity markets. Only a large number of raw materials can be singled out. In terms of energies and precious metals, the choice is much smaller. The total number of commodities offered by the broker is 17.

The company lags behind many of its competitors due to the limited choice of metals and energies. For example, City Index offers almost twice more contracts.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| CFD on commodities | 17 | 20 | 29 |

Opening an account

The procedure of account opening on HYCM is quite simple and quick. It is fully automated, so we encountered no issues.

| Pros |

|---|

|

| Cons |

|---|

|

HYCM does have minimum deposit requirements, but they are quite adequate. You will need about five minutes in order to open an account on HYCM.

As for the drawbacks, there is no ECN account. In addition, the broker supports only six base account currencies, which is a quite low number.

What is the minimum deposit on HYCM?

HYCM has requirements for the minimum deposit, but they are quite low, starting from USD 100 on the Fixed and Classic account types. The minimum deposit for the Raw account is USD 200.

The broker does not have high minimum deposit requirements, but this cannot be considered a serious advantage. Other companies have similar requirements. For example, IC Markets has the same requirements, and City Index – slightly higher.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| Minimum deposit | 100 USD | 100 USD | 200 USD |

Residents of which countries cannot trade on HYCM?

HYCM does not work with the residents of the USA, Afghanistan, Belgium, Hong Kong, Sudan and North Korea. Citizens of the USA, Hong Kong, Sudan and North Korea cannot become customers of the broker even if they are currently residing in a different country.

Noteworthy, HYCM is divided into five branches. Each of the branches provide services in their respective region and each has their own regional restrictions. We recommend that you contact the broker’s customer support to find out whether the company operates in your country.

What documents are required for opening an account on HYCM?

To open an account, you will only need to fill out your personal data. However, in order to start trading on HYCM, you will need to pass verification. Without it, you won’t be able to perform any financial transactions. For verification, you will need to provide a standard pack of documents, including:

- Proof of identity – passport, ID card, residence permit, driver’s license.

- Proof of residence – bank statement, utility bill, etc.

Verification takes only 1-2 business days. After completion of the procedure, you will be able to use all functions of the HYCM trading account. Verification is performed after registration.

The broker provides a video tutorial on verification of personal data:

Account types

HYCM offers its customers an opportunity to open one of three account types. You can choose the trading account type during registration. The key differences include the minimum deposit amount, commissions and also spreads. The broker offers the following accounts:

- Fixed. It envisages a fixed spread and trading without commissions.

- Classic. This type of account has floating spreads. Trading is performed without additional commissions. Also, an additional option Expert Advice is available on this account.

- RAW. This is a special type of a trading account on HYCM, which envisages a minimum fixed spread and a market entry commission. This account also features Expert Advice option.

In addition, all account types have the Islamic account with swap free option.

Demo account

HYCM provides its customers with a demo account option. Access to a demo account is free of charge; the company does not limit the period of use of the account. However, in order to use this option, you will need to open a live trading account with the company. You won’t be able to open a demo account without the live one. Using the demo account, you can learn trading, test trading strategies, review trading instruments provided by HYCM, etc.

Trading accounts

HYCM offers its customers three main account types. Let’s review their features.

Fixed

- Trading platforms: МТ4, МТ5.

- Base currency options: USD, EUR, GBP, AED, RUB.

- Instruments: Forex pairs, CFD.

- Minimum deposit — 100 USD.

- Commission on trade volume: no.

- Commission per lot: no.

- Average spread for EURUSD: fixed, 1.8 pips.

- Minimum lot — 0.01.

- Leverage — up to 1:500.

Classic

- Trading platforms: МТ4, МТ5.

- Base currency options: USD, EUR, GBP, AED, RUB.

- Instruments: forex pairs, CFD.

- Minimum deposit — 100 USD.

- Commission on trade volume: no.

- Commission per lot: no.

- Average spread for EURUSD: floating, from 1.2 pips.

- Minimum lot — 0.01.

- Leverage — up to 1:500.

RAW

- Trading platforms: МТ4, МТ5.

- Base currency options: USD, EUR, GBP, AED, RUB.

- Instruments: forex pairs, CFD.

- Minimum deposit — 200 USD.

- Commission on trade volume: no.

- Commission per lot: 4 USD.

- Average spread for EURUSD: fixed, 0.2 pips.

- Minimum lot — 0.01.

- Leverage — up to 1:500.

How to open an account: step-by-step guide

Opening a trading account on HYCM will not require too much time. You can open an account with the broker within 5-7 minutes. Verification takes up to 2 business days.

The procedure of opening a trading account on HYCM consists of 4 steps. Let’s review each of them in more detail.

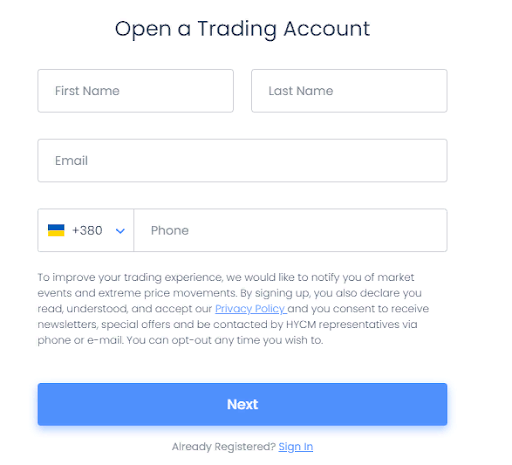

Step 1 – personal data

During this step, you need to provide basic information about yourself. The first form includes only four boxes to fill out, including:

- First Name;

- Last Name;

- Email;

- Phone.

At the bottom, the broker offers you to read its Privacy Policy.

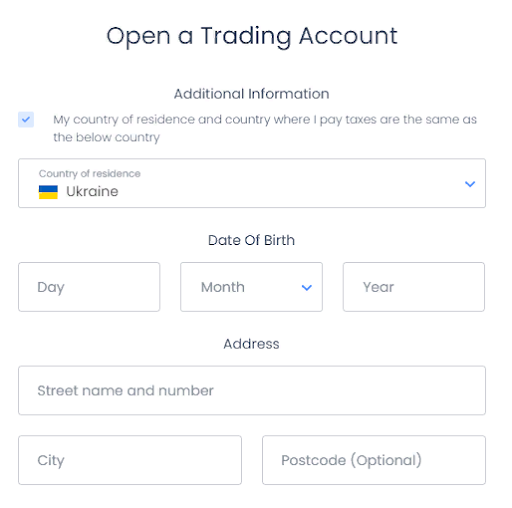

Step 2 – Residence

During registration, you must provide your address. Please make sure to fill everything correctly, because you will need to confirm this information. In this form, you need to provide the following information:

- Country of residence;

- Address;

- Postcode;

- City.

In addition, also here you need to provide your date of birth and confirm that you are a taxpayer in the country of your residence.

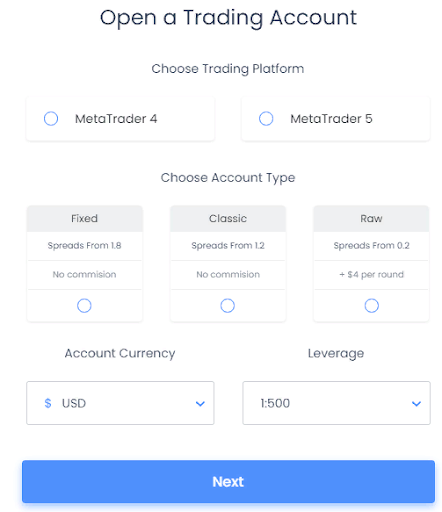

Step 3 – Setting up your account

The third step is also very important, because that is where you choose the main options of your account. In this form, you need to choose the following:

- Type of the trading platform;

- Type of the trading account;

- Account currency;

- Leverage.

In this last point, you are choosing the leverage for the Forex Market. The company offers you to choose a value within the range of 1:100 – 1:500.

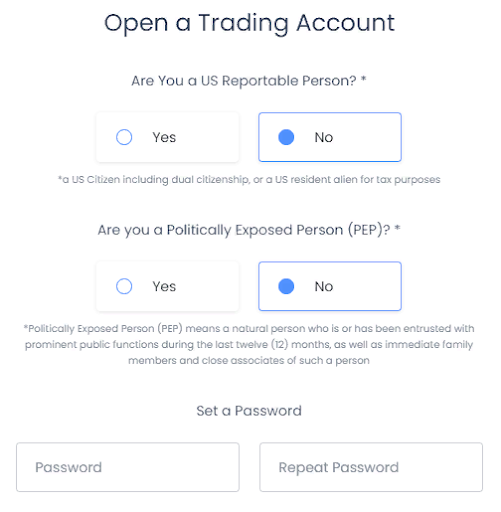

Step 4 – additional information and password

In the additional information, you need to specify, whether you are a U.S. tax resident and also whether you are a politically exposed person. In the same form, you need to come up with a password for your trading account. As a reminder, US residents cannot trade with the broker.

Base currencies of the account

HYCM supports only five account currencies:

- USD;

- EUR;

- GBP;

- AED;

- RUB.

This list looks quite limited, as it is missing a number of popular global currencies. For example, the broker does not support financial transactions with such currencies as CHF, JPY, CAD, AUD and others.

As a reminder, if the deposit and withdrawal currency differs from the account currency, additional conversion expenses incur.

The competitors of HYCM offer a much wider choice. For example, IC Markets supports CAD, AUD and SGD, while City Index supports CHF. Both competitors of HYCM support JPY.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| Number of base currencies | 5 | 10 | 8 |

| List of base currencies | USD, EUR, GBP, AED, RUB | EUR, USD, GBP, AUD, SGD, NZD, JPY, CHG, KHD, CAD | EUR, GBP, USD, CHF, HUF, AUD, JPY, PLN |

Deposit and withdrawal methods

The number of deposit/withdrawal methods available on HYCM is not very big. Nonetheless, the broker supports all main payment methods. Also, the broker’s commissions and fees policy is quite attractive.

| Pros |

|---|

|

| Cons |

|---|

|

HYCM supports four main methods of deposit and withdrawal. You can use a wire transfer, Visa and Mastercard debit/credit cards. Also, you can fund your account or withdraw money via electronic payments systems, such as:

- Neteller;

- Skrill.

However, the number of deposit and withdrawal methods can still be considered limited. The company does not support several popular electronic wallets, such as ADVCash, Payeer, PayPal, Perfect Money. Also debit/credit cards of Maestro and American Express payment systems are not supported.

HYCM is attractive as it does not charge deposit and withdrawal fees. The users only have to pay the fees charged by the payment system, if any. For example, for transactions via Neteller or Skrill wallets, a 1% fee for processing transactions for the amount over USD 5,000 may be charged.

Methods and timeframe for deposits

| Method of deposit | Fee | Timeframe |

|---|---|---|

| Wire transfer | The bank’s fee | from 1 to 7 days |

| Visa debit/credit cards | 0% | Up to 1 hour |

| Mastercard debit/credit cards | 0% | Up to 1 hour |

| Neteller | Fee charged by the payment system | Up to 1 hour |

| Skrill | Fee charged by the payment system | Up to 1 hour |

Methods of withdrawal and fees

The same methods are available for withdrawal on HYCM. However, processing of financial transactions takes longer, with the exception of wire transfers. The minimum withdrawal amount is USD 20. The minimum transaction amount for wire transfers is USD 300.

| Method of withdrawal | Withdrawal fee | Timeframe |

|---|---|---|

| Wire transfer | The bank’s fee | 1 business day |

| Visa debit/credit cards | 0% | 1 business day |

| Mastercard debit/credit cards | 0% | 1 business day |

| Neteller | Fee charged by the payment system | 1 business day |

| Skrill | Fee charged by the payment system | 1 business day |

Deposit and withdrawal: comparison table

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard credit/debit cards | Yes | Yes | Yes |

| Electronic payment systems | 2 | 6 | 1 |

| Cryptocurrencies | No | Yes | No |

By the number of supported payment services, HYCM is far behind IC Markets. In addition, IC Markets offers the option of transfers between brokers, which HYCM does not have. However, compared to City Index, the choice of payment services is better. In particular, the only electronic wallet City Index supports is PayPal.

Trading platforms

The broker offers a standard choice of trading platforms. The company offers its customers MetaTrader 4 and MetaTrader 5. HYCM does not have proprietary platforms.

| Pros |

|---|

|

| Cons |

|---|

|

HYCM provides version of trading platforms for different devices:

- MT4 Web;

- MT4 Desktop (for Windows, Mac);

- MT4 Mobile (for Android, iOS);

- MT5 Web;

- MT5 Desktop (for Windows, Mac);

- MT5 Mobile (for Android, iOS).

Noteworthy, the choice of trading instruments on MT4 and MT5 differs. In particular, the following are available on MT4:

- 43 forex pairs;

- 10 CFD on stocks;

- 16 CFD on indices;

- 5 CFD on cryptocurrencies;

- 15 CFD on commodities;

- CFD on ETF are not supported.

You can get the full set of trading instruments only on MetaTrader5.

Security

Username and a password are all that’s required to access the broker’s trading platforms. HYCM does not have other security methods, such as two-factor authentication or a security question.

Short review of MT4

Since the broker’s trading platforms are standard, we will not review them in detail. We will just provide a short review of features of MT4 trading platforms of HYCM:

- 3 types of chart interface – bars, line, Japanese candles;

- 9 time frames – from one minute to one month;

- 54 graphic instruments for technical analysis;

- 36 indicators for technical analysis;

- 2 types of order execution – Instant and Pending;

- 4 types of orders – Buy Limit, Sell Limit, Buy Stop, Sell Stop.

You can also set up a one-click trading option on the trading platform. In addition, automated trading is available. You can add trading robots of any type. However, HYCM does not offer a proprietary trading bots constructor.

In terms of trading software, the broker is not impressive. Many competitors, including City Index and IC Markets, have MT4 and MT5 platforms. However, in addition to standard platforms, City Index also has the Web Trader platform and Advantage Web, the company’s proprietary platform.

| HYCM | IC Markets | City Index | |

|---|---|---|---|

| MT4 desktop | Yes | Yes | Yes |

| MT5 desktop | Yes | Yes | Yes |

| Android/iOS | 2 | 6 | 1 |

| Web-terminal | MT4, MT5 | MT4, MT5 | MT4, MT5, Advantage Web, Web Trader. |

Analytics

HYCM has a small analytical section, and it features a very small number of useful materials. Actually, the section features only market news and a couple of other instruments for the traders.

| Pros |

|---|

|

| Cons |

|---|

|

The news section of the broker is actually the only instrument that the traders can use. HYCM does not have analytical reviews and expert opinions. There are also no materials for fundamental and technical analyses, trading ideas, etc. In addition, the broker does not offer video news or reviews. There are no analytical calculations, infographics. There is also no stock screener. Basically, there are no instruments for the customers.

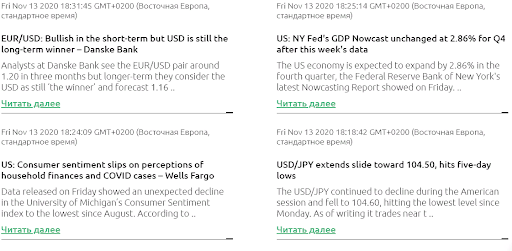

Economic news

The broker has a rather good economic news section. On average, 5-6 news pieces are published every hour. However, the news items are not written by the website’s authors. HYCM publishes the materials of the third parties. All materials are published only in English; the materials are not available in other languages.

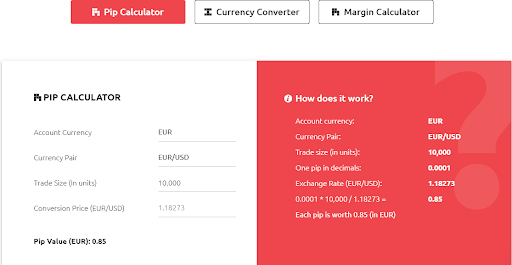

Forex calculator

The broker provides its customers with a Forex calculator, which features three additional instruments:

- Pip calculator;

- Currency converter;

- Margin calculator.

These instruments may be useful for the beginners, as it may be difficult for them to independently calculate margin requirements, quickly learn the current rate, etc.

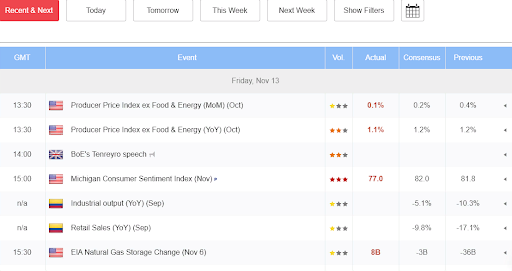

Economic calendar

There is also an economic calendar on the broker’s website, where you can follow the releases of major economic news. In addition, you can choose a timeframe – current day events, events of the following day, current or next week. The calendar also features useful filters, where you can sort events by the type, country, start and end date of the event. Overall, it is a basic set of features.

Education

HYCM offers a diverse educational information for novice and advanced traders. The company holds regular seminars and webinars for the customers with different levels of knowledge and skills.

The majority of the materials are available only in video format. There are no educational articles on HYCM. All video materials are published on the official website. There is no YouTube channel with video tutorials.

| Pros |

|---|

|

| Cons |

|---|

|

Beginners course

The broker offers novice traders a video course with basic information on trading on financial markets. It is, however, very limited. It features only five lessons. The users can learn about basic terminology, simple strategies for the beginners, advantages of Forex trading, types of orders, etc.

Educational seminars and webinars

The company holds regular webinars for its customers. The broker holds webinars twice a week – on Mondays and Wednesdays. The Monday program features the weekly market review and the Wednesday one – educational video on skill improvement. In addition, the recordings of the past webinars are published on the broker’s official website. Participation in the HYCM webinars is free of charge, but you need to sign up for them. All webinars are held only in English.

The broker also holds educational seminars. However, they are held only in the United Arab Emirates and in Kuwait. The broker’s representatives hold seminars featuring basic information for the customers. The seminars are also held only in English.

Educational books

You will also find educational books on the broker’s official website. They are only available in the electronic format and you can read them only on the website. You cannot download them. The materials on different assets, trading strategies and other topics are available.

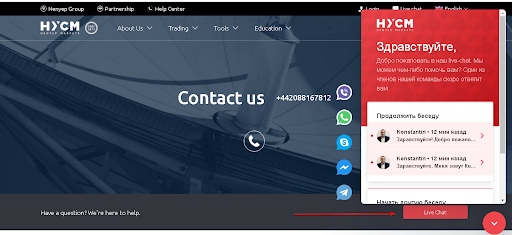

Customer support

HYCM provides both online and offline customer support. The company has offices in 6 countries. You can contact customer support using one of the three available methods, as well as via social networks and messengers.

| Pros |

|---|

|

| Cons |

|---|

|

You can contact customer support using one of the following:

- By email;

- Via an online chat on the official website;

- By phone.

You can also contact the broker’s representatives via messengers. The links to them can be found in the Live Chat:

Support languages

The broker provides support in many languages, including:

- English;

- German;

- Spanish;

- Italian;

- Arabic;

- Chinese;

- Vietnamese;

- Russian;

- Czech.

The only real drawback of this broker is the fact that the customer support does not work on the weekends. Customer enquiries are processed 24/5.

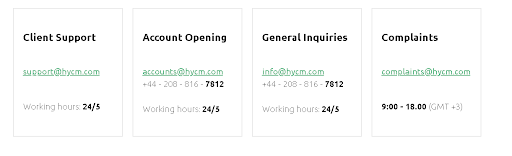

Contacts

HYCM offers the following ways of contacting customer support:

- E-Mail – support@hycm.com;

- Phone – +442088167812.

In addition, the customers can use the following contacts based on the nature of their questions:

In the Contacts section on the broker’s website, you can find addresses of the offices in 6 countries.

Bonuses and promo

At the time this review was being prepared, the broker did not offer any bonuses or promo offers for the customers.

Summary

HYCM will be well suited for the novice traders. Here, a beginner can find everything he needs – educational courses, simple trading platform, a sufficient choice of trading instruments. The broker has low minimum deposit requirements and offers three types of trading accounts to choose from.

HYCM will be good for scalpers. The company does not impose restrictions on trading strategies. The broker offers a wide selection of trading instruments, rather low commissions and options for trading automation. You can install any trading robots available for the MetaTrader platforms.

The broker is especially popular in the Asian countries, where it has the biggest audience. HYCM actively works with Muslim countries, which is why all of its accounts can be connected to the swap free option.

According to our assessment, HYCM is quite reliable, as it has been operating since 1977 and holds licenses issued by the countries with good business reputation, such as the UK.

In terms of drawbacks, the broker has a very small choice of trading instruments for advanced traders. Also, the broker does not offer acceptable methods of passive income. As a reminder, CFD is a high-risk marginal instrument. The majority of customers of this company lose money, trading CFD.

Real reviews of HYCM 2025

I registered on the HYCM website because this broker has a positive reputation and everything is fine with legal documents. I didn't have time to earn much here, because I started with the minimum tariff plan, but I already received the first $200. There are no problems with withdrawing profit, everything is prompt.

I have been trading with HYCM recently. The pros: the broker pays. However, there are also enough disadvantages: high leverage, smt lousy support...