On this page, you will find a large number of reviews from the real IG Markets If you are already working with If you are already working with IG Markets please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

IG Review 2021

IG is a broker that has operated in the financial markets of the world since 1974. The company introduced online trading services in 2003. IG operates based on the licenses issued in the UK (FCA), Germany (BaFin), USA (CFTC and NFA), Australia (ASIC) and Bermuda. This provides grounds to consider the broker reliable and secure.

The key feature of IG is the huge number of trading instruments. In many categories of assets, the broker surpasses even large banking brokers, which are considered leaders in this area. IG offers its customers a huge number of trading pairs, non-standard types of commodity assets, many stock indices and more.

Over the period of its operation, IG has earned several prestigious awards, including Shares Awards 2017 in the nomination the Best CFD Broker, ADVN International Awards 2017 in the nominations the Best Multi-Platform Provider and Best Finance App. The company also received Online Personal Wealth Awards 2017 in the nomination Best Trading Platform.

For better understanding, we will compare IG with its competitors Oanda and City Index in this review.

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features of the broker

| Regulation | UK (FCA), the USA (CFTC and NFA), Germany (BaFin), Bermuda (BMA) |

|---|---|

| License | BMA 54814 |

| Level of commissions | Low or average |

| Demo account | Yes |

| Minimum deposit | 0 USD |

| Inactivity fee | 12 USD per month, charged after 2 years of inactivity |

| Period for opening an account | 15-20 minutes |

| Leverage | Depends on the branch |

| Markets | Forex, stocks, commodities, CFD, options |

| Options for passive income | Bonds, structural portfolios |

| Customer support languages | English, German, Russian, Spanish, Italian |

| Withdrawal fee | 0% |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes |

| Account currencies | USD, GBP, AUD, EUR, SGD, HKD |

| Deposit bonus | No |

Geography of broker’s customers

Mostly traders from developed countries use the services of IG. In particular, residents of the UK account for the majority of the broker’s customers, although their share has dropped slightly in the past month. Meanwhile, the share of Australian customers is on the rise, currently second on the customer map of IG. Also the residents of the U.S. and Germany actively use the broker.

In fact, the geography of the broker’s customers is quite extensive. Jurisdictions from four different continents – Europe, Asia, Australia and North America, are on top of the list. IG can therefore be considered a real global broker, not a regional one, like the majority of its competitors.

| Country | Percentage of customers |

|---|---|

| UK | 31.13% |

| Australia | 11.38% |

| USA | 7.19% |

| Germany | 4.87% |

| Hong Kong | 4.53% |

Commissions and fees

IG offers low spreads on Forex trading, which makes trading major currency pairs and cross rates with this broker beneficial.

IG also offers good conditions for CFD of different classes from stock indices to gold. The commissions on CFD on stocks and on trading real stocks are not beneficial for the customers planning to perform low amounts of trades in small lots. It’s all about high minimum commission per trade.

IG’s non-trading commissions are low. The broker does not charge deposit and withdrawal fees. Inactivity fee is charged, but only in rare cases, after two years of inactivity.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on IG

| Asset | Commission |

|---|---|

| EUR/USD | Floating spread with an average value of 0.7 pips |

| CFD on US stocks | 2 cents per 1 CFD, but no less than 15 USD per trade |

| Trading real US stocks | With a certain number of transactions – from 0 USD |

| CFD on S&P 500 | Floating spread with an average value of 0.5 |

| Options | 0.1 USD per contract |

| BTC | Floating spread with an average value of 35.00 |

| Non-trading commissions | Inactivity fee, charged after 2 years of inactivity. |

Broker’s commissions on Forex market

Review of the IG system of commissions and comparison with the competitors have shown that the broker offers low spreads on the forex market. This is particularly true of the most liquid currency pairs, such as EURUSD and USDJPY. The conditions for them are excellent.

For better understanding, let’s compare a typical average spread for three classes of currency pairs – major, cross rates and exotic ones, offered by IG and Oanda and City Index.

| IG* | Oanda | City Index | |

|---|---|---|---|

| EURUSD | 0.7 | 1 | 0.8 |

| USDJPY | 0.79 | 1.2 | 0.8 |

| EURGBP | 0.9 | 1.5 | 1.7 |

| AUDJPY | 1.36 | 1.6 | 2.8 |

| USDPLN | 50.93 | 17.0 | 30.9 |

| USDZAR | 117.74 | 106.0 | 168.9 |

* The broker may charge a fee for limiting the risk, which is incurred in case of execution of a stop order with a price guarantee function. We also recommend you to review the conditions on the broker’s website or contact customer support

For better understanding, let’s also see how much a trader will have to pay in US dollars for execution of an order of 100,000 units of base currency. The spreads and commissions of the brokers are included.

| IG | Oanda | City Index | |

|---|---|---|---|

| EURUSD | 7 USD | 10 USD | 8 USD |

| EURGBP | 11.47 | 19.1 | 21.66 |

| USDPLN | 131.38 | 43.86 | 79.72 |

As we can see, in the majority of positions, IG rates are either lower than those of competitors or at approximately the same level with them. The only exception is the exotic pairs, where Oanda offers better conditions.

Rates of financing

We estimated IG’s rollover conditions as low. IG charges swap in case of transfer of the position to the following day. For calculation of the swap, a corresponding rate at the interbank is used, which depends on the rates of the banks that issue currencies. The broker adds $2.5 annual to this rate as its own rollover fee. This means that if the interbank rate for a long position is 0.1% annual, you will be charged 2.6% annual.

Rollover fee is charged at 22:00, UK time.

Swap free option on IG

| IG | Oanda | City Index | |

|---|---|---|---|

| Swap free | Yes* | No | No |

* only for Muslims in case the contract is signed with the office in Dubai

Commissions on stocks

IG offers the residents of the UK and Australia not only CFD on stocks, but also real stock trading. In some cases, no commission will be charged for US stock trading. For this, a trader needs to perform more than 3 traders on their account per month. The expenses for UK stock trading can also be reduced in the same manner – from GBP 8 to GBP 3 per trade.

| Market | Commission | Minimum commission |

|---|---|---|

| US stocks in case more than 3 trades were performed in the previous calendar month | 0 | 0 |

| US stocks in case 0-2 trades were performed in the previous calendar month | 10 GBP | 0 |

| US stocks in case of manual currency conversion | 2 cents per share | 15 USD |

| UK stocks in case more than 3 trades were performed in the previous calendar month | 3 GBP | 3 GBP |

| UK stocks in case 0-2 trades were performed in the previous calendar month | 8 GBP | 8 GBP |

| Stocks of Ireland, Germany, Netherlands, Belgium, Austria | 0.1% | 10 EUR |

| Australian stocks | 0.1% | 10 AUD |

* Please contact the broker’s customer support to find out whether this option is available for your region.

Commissions on CFD

CFDs are the main trading instrument on IG. It is not surprising that the broker offers rather enticing commissions on many positions in this market. We have analyzed the general system of commissions and will provide examples of the commissions on trading a specific volume of an asset. We will review commissions on CFDs on stocks and cryptocurrencies separately.

So, as an example, let’s take the purchase of CFD for the amount of $4,000. The final amount of commission includes the spread and other commissions of the broker.

| IG | Oanda | City Index | |

|---|---|---|---|

| CFD on S&P 500 | 0.58 USD | 0.6 USD | 0.6 USD |

| CFD on gold | 0.65 USD | 1.03 USD | 0.65 USD |

| CFD Brent Oil | 2.65 USD | 3.04 USD | 4.76 USD |

IG offers the best conditions for CFD trading on the majority of indices, precious metals and energies among the three brokers.

CFD on stocks

CFD on stocks is a separate large class of assets (over 12,000 positions) offered by IG, which requires a separate analysis. The commissions here are charged based on a different principle and differ by countries.

Commissions on CFD on stocks by countries

| Market | Commission per trade | Minimum commission per lot |

|---|---|---|

| USA | 2 cent per 1 CFD | 15 USD |

| UK | 0.10% | 10 GBP |

| Belgium, Ireland, Finland, France, Germany, Netherlands, Portugal, Spain | 0.10% | 10 EUR |

| Italy | 0.10% | 5 EUR |

| Denmark | 0.10% | 100 DKK |

| Norway | 0.10% | 100 NOK |

| Sweden | 0.10% | 99 SEK |

| Switzerland | 0.10% | 10 CHF |

| Greece | 0.475% | 25 EUR |

| Australia | 0.08% | 7 AUD |

| New Zealand | 0.09% | 7 AUD |

| Singapore | 0.10% | 15 SGD |

| Japan | 0.20% | 1500 JPY |

| Hong Kong | 0.18% | 50 HKD |

| SAR | 0.20% | 100 ZAR |

| Canada | 3 cents per 1 CFD | 25 CAD |

| Depositary receipts for the stocks of Russian companies | 0.15% | 15 USD |

At first glance, it may see that the broker’s commission is low. However, the minimum commission neutralizes this advantage for the majority of traders, who perform trades in the amount of up to USD 10,000.

As an example of a typical trade on different markets, let’s take a purchase of CFD on stocks of US, UK and Germany on IG and City Index in the amount of USD 4,000. The final amount of commission is specified in the US dollars, commissions and the spread included.

| IG | City Index | |

|---|---|---|

| CFD on Amazon | 15 USD | 10 USD |

| CFD on Rio Tinto PLC (UK) | 12.7 USD | 12.7 USD |

| CFD on Adidas AG | 11.6 USD | 11.6 USD |

Commissions charged by IG and City Index on CFD on stocks are similar due to practically the same minimum commission. In both cases, this is not the best option for small customers, who have small trades.

CFD on cryptocurrencies

Digital assets are gaining popularity among traders, which is why IG also offers its customers access to them via contracts for differences. We determined the level of commission on cryptocurrencies as high. As an example, let’s take a purchase of different CFD on cryptocurrencies for the amount of USD 2,000 on IG and City Index. Oanda does not offer this class of assets. The amount includes all commissions and fees.

| IG | City Index | |

|---|---|---|

| Bitcoin | 13.37 USD | 6.71 USD |

| Ethereum | 14.68 USD | 7.75 USD |

| Litecoin | 26.91 USD | 24.69 USD |

As you can see, for some positions IG’s commission is twice higher than that of its competitor.

Commissions on options

In this section, we will review commissions on barrier and vanilla options, which are low. The competitors in our review do not offer this kind of product.

As a reminder, a vanilla option is a standard option, and a barrier option is a type of option where the payoff depends on whether the underlying asset reaches or exceeds the level of a predetermined price within a specific period of time. This level is viewed as a ‘barrier’, upon reaching which the option either becomes active or is ‘turned off’.

| Market | Minimum spread | Commission |

|---|---|---|

| Forex | 0.6 | 0.1* |

| Indices | 0.4 | 0.1 |

| Commodities | 0.3 | 0.1 |

* Commission in the units of the contract currency. For example, 0.1 USD, 0.1 GBP, etc.

Commissions on investment products

The broker offers several options for conditional passive investment. These options include CFD on bonds, IPO and Smart Portfolios. However, all instruments are available via marginal derivative financial instruments (CFD) that come with high risk, which does not allow us to view them as full-fledged assets for passive investment.

Non-trading commissions

One of the pleasant advantages of IG is practically the total absence of additional non-trading commissions. In particular, the broker does not charge deposit or withdrawal fees. The inactivity fee is charged, but in quite exceptional cases, after 24 months of inactivity on the account, which is highly improbable.

| IG | Oanda | City Index | |

|---|---|---|---|

| Inactivity fee | 12 USD per month after 24 months of inactivity | 10 USD per month after 24 months of inactivity | 12 GBP per month after 12 months of inactivity |

| Withdrawal fee | No | No | No |

| Deposit fee | No | No | No |

Reliability and regulation

We gave IG a high rating for reliability.

The broker is a part of IG Group Holdings. IG International LTD provides international brokerage services within the group. The company operates based on the license issued by the financial regulator of Bermuda, which is an offshore territory. The number of the license is 54814.

IG also passed authorization in 10 countries with high levels of legal protection. The company is under control of the regulators in the following countries.

- UK (FCA)

- Germany (BaFin)

- Switzerland (FINMA)

- USA (CFTC and NFA)

- Australia (ASIC)

- New Zealand (FMA)

- Singapore (MAS)

- Japan (FSA)

- South Africa (FSCA)

- UAE (DFSA)

IG has a good reputation. In the years of its operation, the company has not been involved in any high-profile scandals. The broker has a huge experience. IG has been in the market since 1974; online services were introduced in 2003. The company is listed on the London exchange, which is another important point in its favor. Therefore, the broker can be considered reliable, although the license of the international branch issued by Bermuda, an offshore territory, is still an issue.

Is the broker a member of a deposit guarantee fund?

IG is a member of a deposit guarantee fund in several jurisdictions. In particular, in case of bankruptcy of the company, the customers in the following jurisdictions can receive compensation:

- European Union – 20 000 EUR;

- UK – 85 000 GBP;

- Switzerland – 100 000 CHF.

Other branches of the holding are not members of deposit guarantee funds, including its international branch. The broker does not have its own deposit guarantee system.

Markets and products

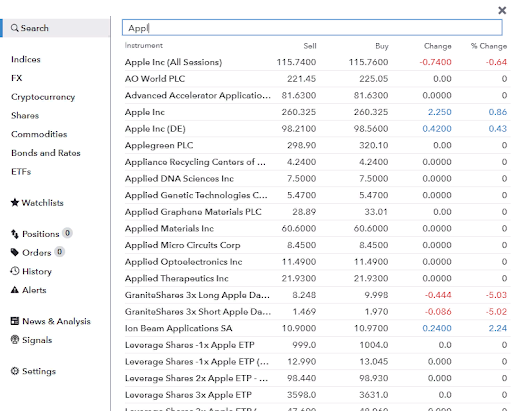

IG provides access to over 15,000 trading assets, mostly CFD. The broker also offers a huge number of Forex trading pairs, indices and commodities. Cryptocurrencies are also available. IG also offers a special option for its customers – participation in IPO. You can purchase shares in an initial public offering using the company’s platform.

The possibility of trading real shares available for the customers of some countries is a definitive advantage of the broker. However, the customers of authorized IG subsidiaries can work with them, except for the international branch. If the user is not a resident of one of the countries, where IG is authorized, they only have access to CFD on stocks.

Pros and cons of market diversity on IG

| Pros |

|---|

|

| Cons |

|---|

|

It is very difficult to compare market availability of this broker with the competitors, primarily because different types of assets are available for residents of different countries. For example, the broker offers a huge choice of assets for traders from the UK, the U.S., Australia, Ireland and some other countries, while the choice of assets is smaller for those working with the international branch of the broker. However, if we consider the number of assets in general, the choice is quite impressive.

| IG | Oanda | City Index | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | No | Yes |

| CFD | Yes | Yes | Yes |

| Crypto | Yes | No | Yes |

| Bonds | Yes | No | Yes |

| Options | Yes | No | Yes |

| Commodities (oil, metals, wheat, gas, ores, etc.)* | Yes | No | Yes |

| Mutual funds | No | No | No |

| ETF | Yes | No | Yes |

Geography of markets

IG has a rather extensive geography of markets, covering 23 countries. The list includes the following markets:

USA;

USA; UK;

UK; Italy;

Italy; Denmark;

Denmark; Norway;

Norway; Sweden;

Sweden; Switzerland;

Switzerland; Greece;

Greece; Australia;

Australia; New Zealand;

New Zealand; Singapore;

Singapore; Japan;

Japan;

Hong Kong;

Hong Kong; South Africa;

South Africa; Canada;

Canada; Belgium;

Belgium; Ireland;

Ireland; Finland;

Finland; France;

France; Germany;

Germany; The Netherlands;

The Netherlands; Portugal;

Portugal; Spain.

Spain.

In addition, the broker provides access to the International Order Book. IOB are depositary receipts offered at the London Stock Exchange. IOB depositary receipts of different markets, including developing ones, such as Russia, are available here.

Overall, the number of markets IG provides access to is bigger than many other brokers offer. For example, IG offers access to more markets than eToro, where the stocks are the priority trading asset for the customers. However, IG cannot compare favorably with large banking brokers.

| IG | eToro | Saxo Bank | |

|---|---|---|---|

| Number of markets | 23 | 19 | 36 |

Forex market

The choice of trading pairs on IG is one of the best in the market. In particular, the broker provides access to 205 trading pairs. The biggest feature of IG is the huge number of exotic trading pairs. For example, you can work with the following non-popular assets:

- MXNJPY;

- SEKJPY;

- GBPILS;

- USDHUF;

- INRJPY;

- USDKRW etc.

The choice of currency pairs the broker provides is indeed outstanding, especially if you compare it to the competitors from our review. For example, Oanda has almost three times fewer trading pairs.

| IG | Oanda | City Index | |

|---|---|---|---|

| Number of trading pairs | 205 | 71 | 84 |

CFD Market

The choice of CFD on IG is also impressive. Their total number exceeds 12,500. There are particularly many CFD on stocks – around 10,500. Also noteworthy is the number of derivatives on stock indices – 78. For comparison, Oanda offers 16 CFD on indices and City Index – 22.

IG also offers access to 13 types of CFD on bonds. Not all brokers offer the contracts for differences on bonds. IG has derivatives on cryptocurrencies too. There are only 8 of them, but the very fact that they are available can be considered the broker’s advantage. And, there is a rather high number of CFD on ETF – 1,900 in total.

| IG | Oanda | City Index | |

|---|---|---|---|

| Forex | No | No | No |

| Stocks | Yes | Yes | Yes |

| Bonds | Yes | No | Yes |

| Crypto | Yes | No | Yes |

| Indices | Yes | Yes | Yes |

| Commodities (metals, food products, raw materials) | Yes | Yes | Yes |

| ETF | Yes | No | Yes |

Commodities

Commodity markets are also widely available on IG. Both base assets (only for the customers from jurisdictions, which are provided with direct access to the markets) and CFD are available. The total number of these types of assets provided by IG is 47. The broker provides access to non-standard types of commodities, which are rarely available, in particular:

- CO2 emission quotas;

- residual fuel oil;

- cattle (live and for fattening);

- lumber;

- pork;

- oats;

- OJ;

- soy flour.

Therefore, IG is suitable for the customers who want to trade more than just the standard set of commodities. The majority of competitors do not offer ‘exotic’ commodities, while the average number of assets offered by the competitors ranges within 15-25.

| IG | Oanda | City Index | |

|---|---|---|---|

| Number of Commodities | 47 | 19 | 22 |

Options

IG offers access to the options market, but with certain restrictions based on the region. In particular, they are available for the following countries:

Austria;

Austria; Denmark;

Denmark; France;

France; Germany;

Germany; Italy;

Italy; Ireland;

Ireland;

Portugal;

Portugal; Sweden;

Sweden; Netherlands;

Netherlands; Romania;

Romania; Norway;

Norway;

This market on IG includes daily, weekly options, options on futures, indices and stocks. In addition, Digital 100 contracts are also available.

Opening an account

Opening an account on IG will require certain time. In particular, you will need 15-20 minutes to fill out the registration form. The organization complies with AML/KYC requirements, which is why you will need to pass verification, which will take another 2-3 business days. You will not be able to perform any financial transactions on the platform unless your account is verified.

IG offers good minimum deposit conditions and it is also possible to test your trading skills on a demo account.

The biggest drawback of the broker is the lack of diversity of trading accounts, so you will not be able to receive more beneficial conditions if you fund your account for a large amount.

| Pros |

|---|

|

| Cons |

|---|

|

What is the minimum deposit on IG?

The broker does not have a minimum deposit requirement. There are, however, some peculiarities related to the limits on deposits via different methods of payment. There is no restriction for a minimum deposit only for the customers funding their account via a wire transfer. For other payment methods, the minimum deposit is limited to the minimum transaction amount.

IG is not the only broker that does not have a minimum deposit requirement. For example, Oanda also doesn’t have a minimum deposit. City Index does have a minimum deposit requirement, although it is quite low.

| IG | Oanda | City Index | |

|---|---|---|---|

| Minimum deposit | 0 USD | 0 USD | 100 USD |

Citizens of which countries cannot trade on IG

The broker is managed by IG Group Holdings PLC, which includes 15 branches regulating the operation in different regions. Each branch has a list of regional restrictions. We recommend that you contact the broker’s customer support to find out whether IG operates in your country.

Documents required for opening an account

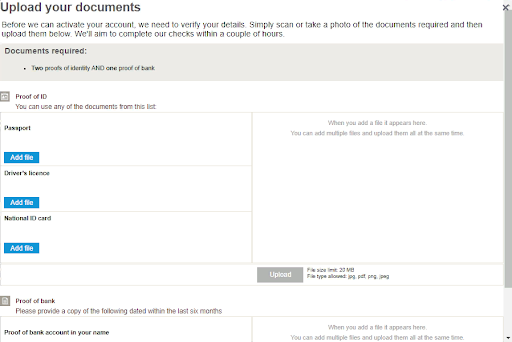

Verification is mandatory on IG. The traders, who did not provide proof of identity, cannot fund their account or trade on a live account. The verification procedure of the broker does not differ much from its competitors. In order to verify your account, you need to upload the following documents to the platform:

- Proof of identity (passport, driver’s license, national ID card);

- Proof of residence (utility bill, bank statement, tax notice, etc.).

The documents are uploaded during the last step of registration. If the broker does not have any claims, you will be granted access to all functions of the platform.

Account types

IG has few trading accounts. There is actually only one live account in this company. This is both an advantage and a drawback. On the one hand, all traders are in the same, equal conditions, regardless of the deposit amount, while on the other hand, a trader cannot expect to receive better trading conditions, increased leverage, lower spreads.

Key features of an IG trading account:

- Trading platforms: proprietary, MT4.

- Base currency options: USD, GBP, AUD, EUR, SGD, HKD.

- Instruments: 205 currency pairs, stocks, CFD, options

- Minimum deposit — 0 USD.

- Commission on traded volume: no.

- Commission per lot: no

- Minimum spread on EURUSD: floating, 0.75 pips.

- Minimum lot — 0,1, maximum lot — 10,000.

- Leverage — depends on the branch.

Demo account

IG also offers a demo account. It is provided for free and with no restriction on the term of use. The functions of the demo account are the same as of the live account, which is why you will have an opportunity to fully test the trading platform and assess its options. The amount of virtual funds on the demo account is USD 10,000.

How to open an account on IG: step-by-step guide

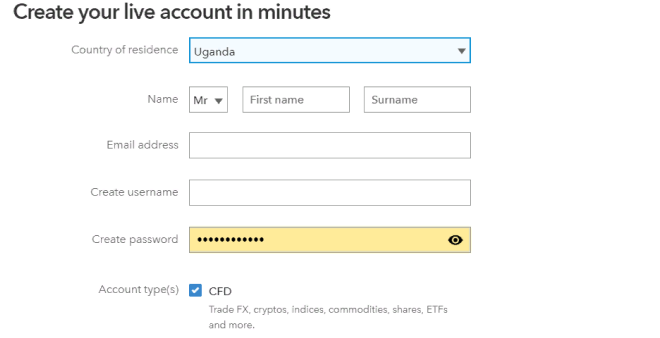

The procedure of opening an account on IG is standard for large brokers. It includes 5 steps. Let’s review them in more detail.

Step 1 – Personal details

During the first stage, you will need to provide basic information about yourself. There are 7 fields to fill out here:

- Country of residence

- Date of birth

- First name

- Surname

- Username

- Password

- Email address.

At the bottom of the page you will see a CFD line with a checked box by default. This button allows you to make a choice between the account that allows you to work with CFD and real trading assets. The residents of the countries, where the broker allows to work with real stocks, commodities, options can uncheck this box. On this page, you will also find the company’s internal documents. You can review the Terms of Use and Privacy Policy.

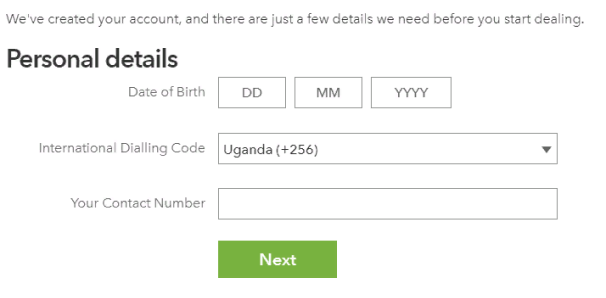

The next form is a continuation of the first one. Here, you will need to provide more personal information, including your date of birth and your contact number.

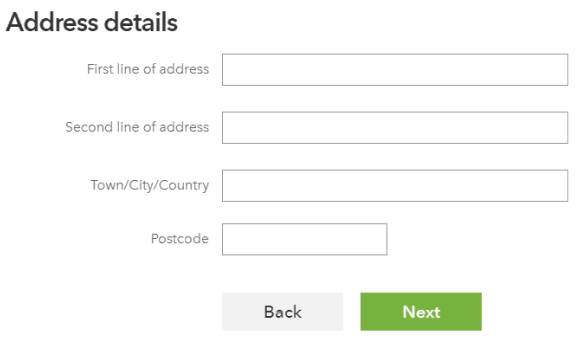

Step 2 – address details

When you register on IG, you need to provide your address details. Please, make sure that the information you provide here is correct, as it will be confirmed during verification.

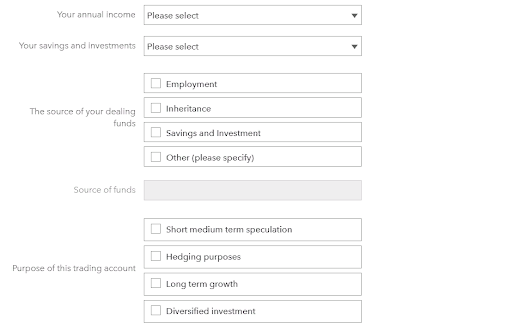

Step 3 – financial information

In this section, you need to provide information about the source of your funds and your annual income. You also need to provide the amount of your savings. In addition, the broker will ask you to specify the purpose of your trading account and the types of traders you plan to perform – short or medium term speculations, hedging, long-term traders or diversified investment.

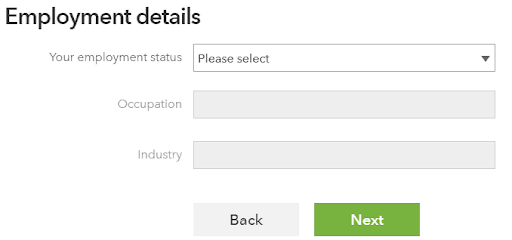

Next, you will need to provide information about your employment, your occupation, the company and the industry.

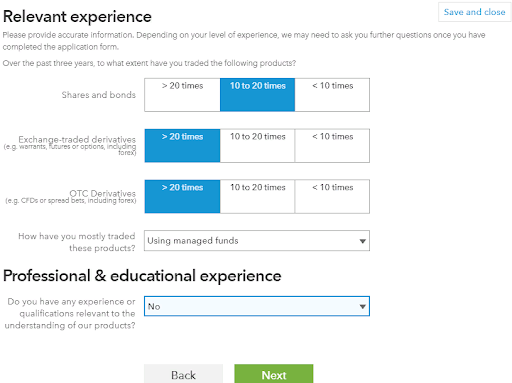

Step 4 – Your trading experience

You will also need to fill out a small questionnaire about your level of trading experience. You will need to specify how many trades you performed with specific types of assets. In addition, the broker asks you specify whether you have an educational experience in finance

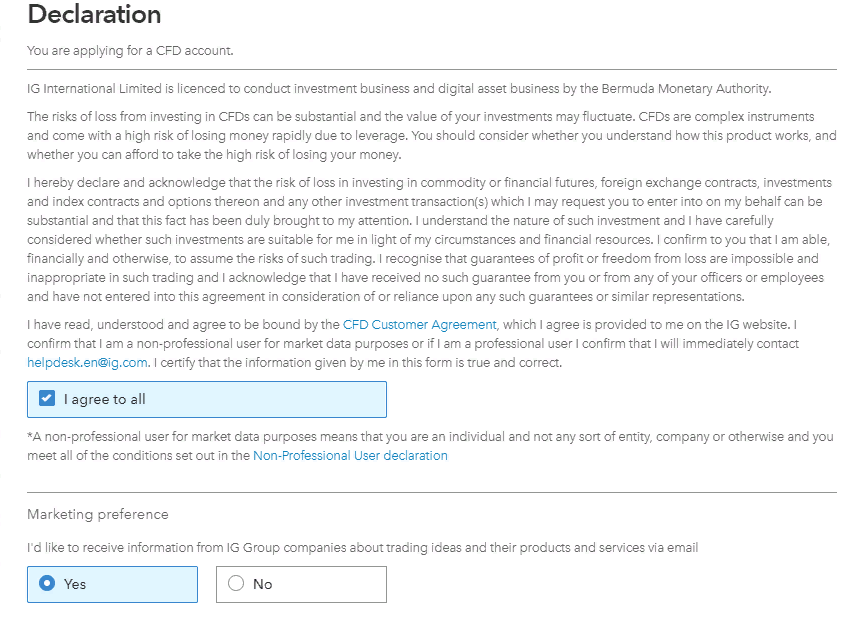

Step 5 – declaration

Before completing the registration, you need to agree to the declaration, in which the broker warns you that trading financial instruments comes with a high degree of risk. The residents of the countries, in which the broker is authorized, sign the declaration with the local branch. The residents of other countries sign the declaration with the international branch registered in Bermuda.

IG also offers its customers to subscribe to newsletters and trading ideas via email.

Step 6 – Verification

Verification is the final step of the registration. You need to upload scanned copies or high-quality photos of the documents.

Base currencies

IG does not provide a very big choice of base currencies. In particular, you can use USD, EUR, GBP, AUD, HKD and SGD. The broker offers services in the European Union, but does not support the majority of the local currencies, such as HUF, PLN, SEK, CZK, etc. In addition, IG does not support such popular currencies as CHF and JPY.

IG competitors offer better base currency options. For example, Oanda has 9 and City Index – 8 base currencies. At that, both brokers support such popular currencies as CHG and JPY, and the currencies of some EU countries.

| IG | Oanda | City Index | |

|---|---|---|---|

| Number of base currencies | 6 | 9 | 8 |

| List of base currencies | USD, EUR, GBP, AUD, HKD и SGD | USD, EUR, GBP, AUD, CAD, CHF, HKD, JPY, SGD | EUR, GBP, USD, CHF, HUF, AUD, JPY, PLN. |

Deposit and withdrawal

The number of deposit and withdrawal methods available on IG is average. Only the ‘base’ package all brokers provide is available.

For deposits, wire transfer and Visa, Visa Electron and Mastercard debit/credit cards can be used. Also, it is possible to use a prepaid card. To activate them, you need to contact the broker by phone. As for the electronic wallets, IG supports only one payment service – PayPal.

The broker does not charge deposit or withdrawal fees, except for credit cards. In the majority of cases the money is accrued to the account or a debit/credit card instantly.

High level of limitations on minimum transaction can be a drawback of the broker. In particular, for all payments, except for wire transfer, the minimum transaction amount is USD 450. There are no limitations on deposits via a wire transfer. The broker also supports a very small number of electronic wallets. You cannot use WebMoney, Skrill, Neteller, ADVCash and other payment services here. It is also impossible to use cryptocurrencies as a base currency.

| Pros |

|---|

|

| Cons |

|---|

|

Methods and timeframe for deposits

| Method of deposit | Minimum deposit amount | Fee | Timeframe |

|---|---|---|---|

| Wire transfer | 1 USD | 0% | 2-5 business days |

| Debit cards | 450 USD | 0% | Instantly |

| Credit cards | 450 USD | 1.5% | |

| PayPal | 450 USD | 0% | Instantly |

| Prepaid cards | 450 USD | 0% | Instantly, after a call to the broker |

The list of deposit methods supported by IG coincides with many competitors. For example, Oanda and City Index offer the same payment services for their customers. They also support one type of electronic wallets – PayPal.

| IG | Oanda | City Index | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard credit/debit cards | Yes | Yes | Yes |

| Electronic payment systems | 1 | 1 | 1 |

| Cryptocurrencies | No | No | No |

Methods of withdrawal and fees

As for the withdrawal, the broker has no restrictions there. There is no minimum withdrawal amount and all payment methods are supported, except for the prepaid cards. Also, no withdrawal fee is charged.

| Method of withdrawal | Minimum amount | Fee | Timeframe |

|---|---|---|---|

| Wire transfer | 1 USD | 0% | 2-5 banking days |

| Debit cards | 1 USD | 0% | Instantly |

| Credit cards | 1 USD | 0% | |

| PayPal | 1 USD | 0% | Instantly |

Trading platforms

IG offers its customers two trading platforms. The first one is the broker’s proprietary platform and the second one is the classic MetaTrader4. The company offers several versions of the platforms for different devices, including:

- Proprietary platform for Web

- Proprietary platform for Desktop (Windows, Mac)

- Proprietary platform for Mobile (Android, iOS)

- Proprietary platform for tablets (Android, iPad).

- MetaTrader4 Web

- MetaTrader4 Desktop (Windows, Mac)

- MetaTrader4 Mobile (Android, iOS)

IG’s MT4 platform is standard, without any changes. That is why let’s review the broker’s proprietary platform in more detail.

| Pros |

|---|

|

| Cons |

|---|

|

Availability of MetaTrader 4 platform is an advantage of IG. For example, Oanda does not have this platform and its customers can only use the broker’s proprietary platform, and not every trader may like it. By the number of available trading platforms, however, IG is behind City Index, as it has three platforms.

| IG | Oanda | City Index | |

|---|---|---|---|

| MT4 Desktop | Yes | No | Yes |

| MT5 Desktop | No | No | No |

| Mobile (Android/iOS) | Yes | Yes | Yes |

| Web-terminal | Proprietary, MT4 | Proprietary | WebTrader, Advantage Web, MT4 |

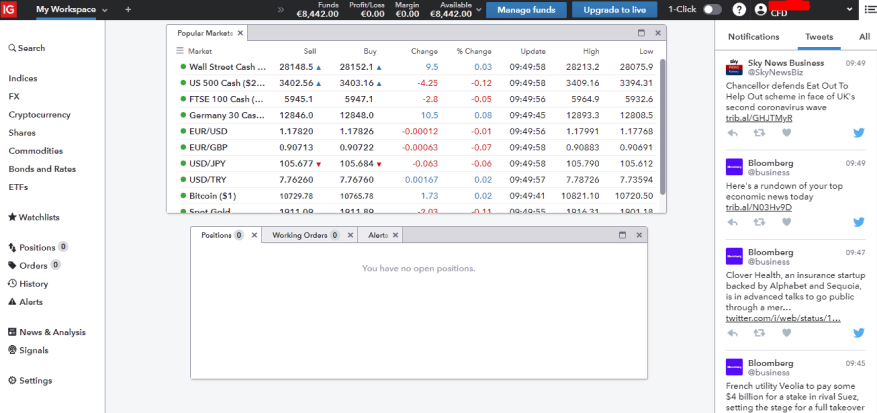

Access to the trading platform on IG can be considered secure. You can use not only username and password, but also two-factor authentication, which is currently one of the most secure methods, for access. After you enter the required data, you will see the trading platform’s interface:

To open a charge, you need to click twice on the asset or trading instrument. The platform allows you to customize the chart as follows:

- Japanese candle

- Line

- Heikin Ashi

- HLOC

- Mountain

To open the instruments for technical analysis, you need to click on the chart with the right button of the mouse and choose from the pop-down menu.

The company provides 30 indicators for technical analysis and 19 instruments for drawing. You cannot add new indicators on the proprietary platform, but it is possible to do that on MetaTrader 4. You can also set up the chart timeframe from tick to 1 month.

The following types of orders are available on IG

- Market

- Limit

- Stop

- Trailing stop

- Guaranteed stop

The field for opening an order is on the right side of the screen. The broker also has the one-click function for opening orders.

There is a rather convenient search of assets on the platform. The menu is on the left side of the screen. You can select by groups of assets or search by name or ticker.

Trading automation is not available on the IG proprietary platform. However, if you use trading robots, you can use MetaTrader 4, which offers extensive opportunities for trading automation.

We also recommend you to watch a video review of key features and settings of the IG proprietary platform:

Analytics

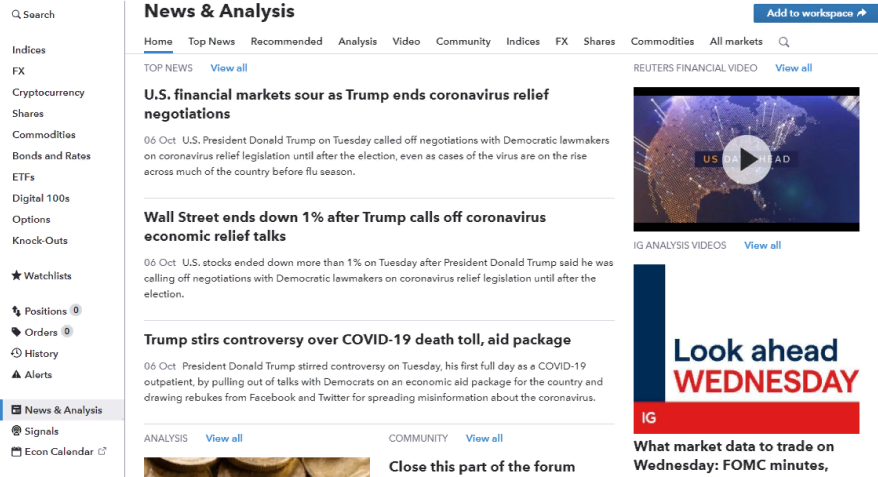

IG’s analytics section is not very diverse. All analytical information is available on the trading platform, while there is no important information on the main page of the broker’s official website.

The broker has a news and analytical materials section. Also trading signals are available for the customers. You can sign up to receive them only via email. The broker provides materials also on technical analysis. In terms of something useful for the traders, you can find regular video reviews, published by the economic channel of Reuters, here.

In terms of drawbacks, there is no quality stock screener, no data on fundamental analysis, except for newsfeed, low number of interesting technical solutions and plugins.

| Pros |

|---|

|

| Cons |

|---|

|

Economic news

The economic news section is rather extensive. Reuters is the main source of information for IG. The news are conveniently categorized by classes of assets. There is the Top News section with the most important events of the economic world. The broker publishes the materials from top analysts of Reuters in the Analysis section. There is also a Video tab featuring video news and reviews.

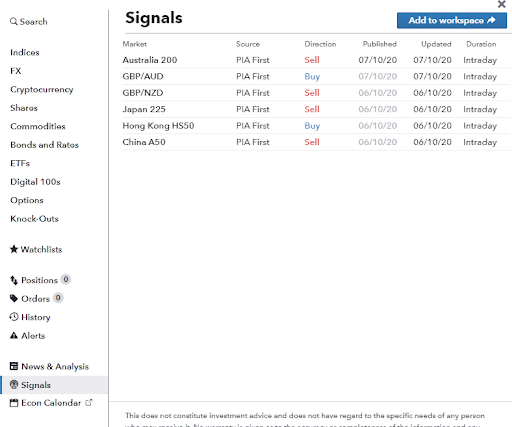

Trading signals

IG provides trading signals, although their choice is rather limited. At the time this review was prepared, there were only 7 trading ideas in this section, despite that the total number of assets and trading instruments exceeds 12,500. In the table, you will see the date of publication and date of update, duration, and the source of the trading signal. IG does not provide its own signals. During the registration, you can choose to subscribe to receive trading signals to your email.

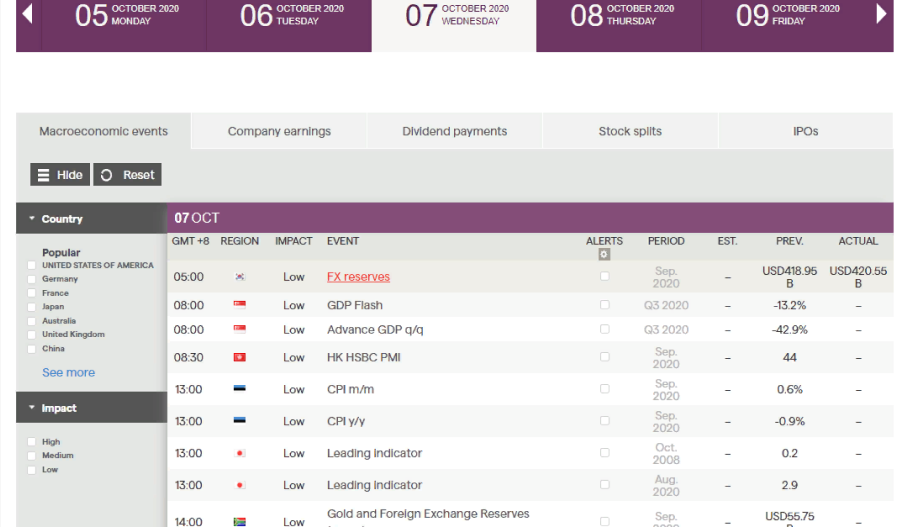

Economic calendar

Economic calendar is another useful function for the traders. IG offers a very detailed one, including not only the top economic events, but also the dates of release of the statements of large companies, dates of dividend payments on stocks, Stock Splits and even IPO dates. The economic calendar has tabs for different sections. There is also a search function to help you find specific events.

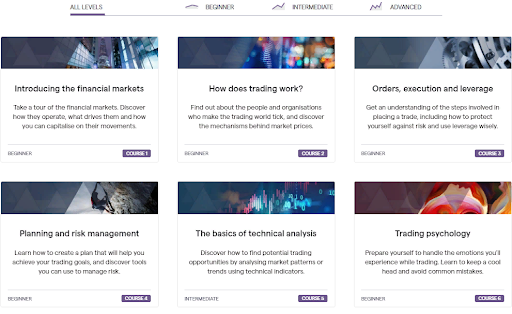

Education

Education section on IG is well developed and receives a high ranking. It features information both for the new traders and for the experienced one, who want to improve their skills. Academy section is also available on the trading platform.

All educational materials are divided into several categories, from beginners to advanced. They are only available only in video format. There are no educational articles, books or blogs.

| Pros |

|---|

|

| Cons |

|---|

|

Video courses

At the time of writing this review, the Video Courses section featured 8 courses, five of them for the beginners, 2 for intermediate level and 1 for advanced traders. There are not too many video courses, but IG will most certainly add more in the future.

The video courses are structured and include 7-15 lessons, each 3-10 minutes long. At the end of the course, a trader is given a test to check his knowledge.

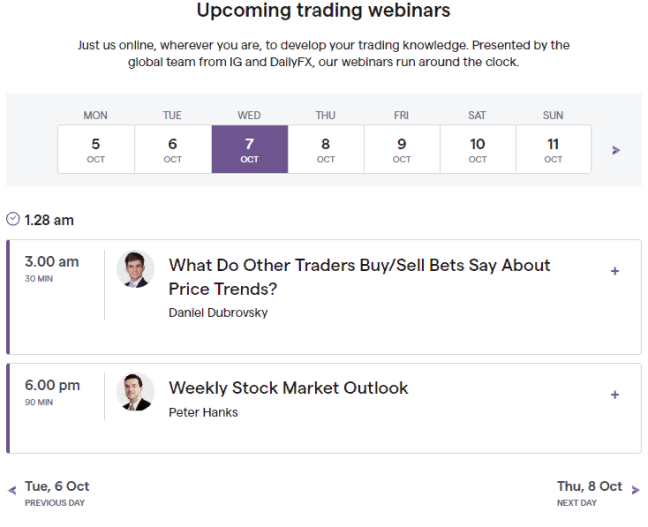

Webinars

The broker regularly holds webinars, involving its own experts. The topics of the events differ, from education for the beginners to detailed market analysis. The duration of the webinars ranges from 30 to 90 minutes. Academy section features the event schedule with the date, time and name of the expert holding the webinar.

Customer support

There are three ways to contact IG customer support:

- Online chat on the official website;

- Email;

- Phone.

Customer support of IG operates 24/7. Therefore, you can contact the support team at any moment.

| Pros |

|---|

|

| Cons |

|---|

|

|

Languages and operating hours of customer support

There is no single contact database for customer support on IG. Every branch has its own website, where the contacts of the customer support are provided. Below are the contacts of several branches:

| Language | Contact number | |

|---|---|---|

| English | helpdesk.en@ig.com | +61 3 9860 1799 |

| German | info.de@ig.com | 0800 181 8831 |

| Russian | support.ru@ig.com | +44(0)2076335477 |

| Spanish | info.es@ig.com | +34 91 787 61 61 |

| French | info.fr@ig.com | 01 70 98 18 18 |

| Italian | aperturaconto@ig.com | 800 897 582 |

Bonuses and promo

At the time of writing this review, the broker did not offer any promo or bonuses for the customers.

Summary

IG is great for the beginners. The broker does not have a minimum deposit requirements, but does have educational materials, free demo account, etc. IG also has something to offer to the experienced traders – a huge choice of trading instruments and rather competitive commissions.

Also noteworthy, the broker is suitable for the residents of the countries, where it is fully authorized, i.e. EU countries, the U.S., Australia, UAE, Switzerland, New Zealand, Singapore, Japan, SAR. The traders can expect better legal protection and a wider choice of assets for trading there.

As for the other countries, the international license of IG was issued by Bermuda, which is not the most reliable jurisdiction in the world. However, we do not see any great risks of working with IG, as the broker has been operating in the online trading market for 17 years and has a great reputation.

NOTE! All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Real reviews of IG Markets 2025

I recently registered on the IG platform. A friend recommended this broker to me. Among the advantages, I note the absence of commissions per lot, trading volume, deposits and withdrawals. I did not notice any slippage. I have already earned $ 5,000 trading with IG, there are no problems with withdrawing funds.

Registration and verification with IG is a complex process, however, it is a normal practice for brokers which are looking for long-term cooperation. The support is always in touch and is ready to help with the solution of emerging issues. I have no complaints about the broker.

I think IG is perfect even for beginners. Firstly, there is high-quality support and a good training base (I received a lot of useful information at the webinars). Secondly, there is no minimum deposit and zero fees. Everything is fine!

I have been using the services of this broker for 4 years and during this time I have not had any questions about the withdrawal at all. I don't understand why there is so much negativity about the broker. Yes, the commissions are not the lowest, but I understand what I'm paying for. There is a quality of service.

The broker has a huge number of trading instruments for any purpose. Basically, this is CFD, but I am not going to hunt dividends, so it's ok.

internet says that IG Markets brokerage company was established in 1974... are you fucking kidding me?)))) listen i understood that it is simple cheating stuff immediately after reading this information about the year)))) 74 lol))) yes, we know that forex is about 20 year old or something and we can surely trust companies with 20-years working experience, but not IG Markets that has no positive reviews in the web and traders on forums are talking about its fraud schemes!! I didn’t trade with this company, but even their official site made me distrust this broker!

This broker is a scam, guys!!! IG Markets is cheating all the time, stay out of it...

IG Markets Company really deserves its place in the black list of the forex brokers. They cheat with people and with their money. Shame and disgrace to such companies!!!