On this page, you will find a large number of reviews from the real Just2Trade If you are already working with If you are already working with Just2Trade please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Just2Trade Review 2021

Just2Trade is a universal European brokerage company.

It has a mixed Russian-American background and is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 281/15. The broker complies with the directives of the European Securities and Markets Authority (ESMA). Additionally, Just2Trade is a member of the Investor Compensation Fund.

The company has offices in eight countries, servicing the accounts of 155,000 customers in total (as of the time this review was being prepared).

Competitive commissions and fees and a wide range of available markets are the key advantages of Just2Trade.

The broker is suitable for many people with different qualifications and tasks:

- Active traders on Forex;

- Stock, futures, bonds traders within short and medium-term strategies;

- Investors.

In this review, we will analyze the features and services the broker provides, outline its strong suits and weaknesses and also compare the broker with such strong competitors as Degiro and Swissquote.

NOTE! Just2Trade claims it provides services for customers from 130 countries. However, the selection of products and services differs for each country. In this review, we will focus on the products and services Just2Trade offers for the customers from the former Soviet Union, as they are the core customers of the broker.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

* When preparing this review, we had to contact customer support on more than one occasion in order to obtain more accurate information, as there wasn’t enough available on the website. In particular, you can discover that the following on the website:

The broker is aware that the website can be confusing at times, which is why you can see “The information provided is for guidance only and may be incomplete or outdated” message on several pages:

We are hoping that these discrepancies did not affect the quality of the review, which we try to maintain at a high level for Forex-Up, but in any case, we recommend customer support and not the website as a source of the most updated information.

Key features of the broker

| Regulation | Cyprus |

|---|---|

| License number | CySEC 281/15 |

| Commissions and fees | Low |

| Demo account | Yes, valid for 2 weeks |

| Minimum deposit | 100 USD |

| Inactivity fee | Yes, after 6 months of inactivity for Forex |

| Timeframe for opening an account | Within one day |

| Leverage | Maximum 1:500 for professional traders on Forex |

| Markets | Stocks, Futures, Forex, CFD, Bonds, Options, Cryptocurrencies |

| Options for passive income | Yes |

| Support languages | English, Russian, Spanish, Chinese, Polish The website is localized into 8 languages. |

| Withdrawal fee | from 0% to 2.5% depending on the withdrawal method |

| Withdrawal to a debit/credit card | Yes |

| Deposit and withdrawal via cryptocurrencies | Yes |

| Deposit and withdrawal via electronic wallets | Yes |

| Supported currencies of the account | USD, RUB, EUR |

| Deposit bonus | Within a short-term promo offers at the time of the review – yes, but only for Standard Forex accounts |

Page content

Geography of broker’s customers

According to our analysis, the majority of Just2Trade customers come from Russia and its neighbor countries.

| Country | Percentage of customers |

|---|---|

| Russia | 39,0% |

| Ukraine | 13,2% |

| Montenegro | 12,1% |

| Belarus | 4,1% |

| Kazakhstan | 3,2% |

Commissions and fees

Just2Trade offers its customers an impressive choice of trading instruments at several dozen exchanges of the U.S., Asia, Russia, and EU. We estimated the commissions and fees on the majority of markets as low or market average. At that, the commissions on trading stocks of EU companies are high.

Just2Trade applies different approaches to charging commissions on trading with different exchanges. At the stock market, it could be a commission per share (NYSE, Nasdaq), or per trade (EURONEXT, LSE) On the Forex market, the broker charges a low fixed commission per lot. The company offers special conditions for investment portfolios.

To help understand Just2Trade commissions on each available market better and unify information, we will calculate the size of the commission on each market, using real examples. For example, we will calculate how much a trader will have to pay for a USD 5,000 lot. Also, in the course of the review, we will compare Just2Trade commissions with competing European brokers – Swissquote and Degiro.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on Just2Trade

| Asset | Commissions and fees |

|---|---|

| EUR/USD | On Forex and CFD Standard accounts – floating spread from 0.5 pips. On ECN type of accounts - $3 commission per lot, on MT5 Global account – $2 per lot. |

| Apple | $0.01 per share, but no less than $2.88 per trade |

| BTC/USD | 0.35% on the volume of the trade |

| U.S. futures | from $1 per contract |

| Investment portfolios | 20% of the earned profit |

| Non-trading commissions | $5 account service fee per month is charged if the customer hasn’t had any traders in the specific month. |

Commissions on stocks

Just2Trade offers direct access to several dozen international stock markets. The approaches to charging commissions differ in different regions. In particular, there is a commission per share for the U.S. stock market, which we estimated as low. In the majority of other markets, the broker charges commission as a percentage of the trade volume, while its size ranges from average to high.

To begin with, below is a table of the broker’s commissions on each market, excluding exchange and clearing fees. Then, we will use examples to see how beneficial they are compared to other brokers.

| Market | Just2Trade commission | Minimum commission per trade |

|---|---|---|

| USA (Nyse/Nasdaq) | 0.01 USD per share | 2.88 USD |

| UK (LSE) | 0.35% of transaction amount | 30 GBP |

| Germany (XETRA) | 0.5% of transaction amount | 30 EUR |

| France (Euronext) | 0.5% of transaction amount | 30 EUR |

| Russia (MICEX) | 0.06% of transaction amount | 45 RUB |

| Japan (TSE) | 0.26% of transaction amount | 150 JPY |

| Hong Kong | 0.26% of transaction amount | 30 HKD |

| Singapore (STI Index securities) | 0.4% of transaction amount | 5.5 USD |

| Mexico (MXSE Index securities) | 0.4% от объема сделки | 110 MXN |

| Thailand (SET Index securities) | 4.6% of transaction amount | No |

| Ukraine (most liquid securities) | 3.4% of transaction amount | No |

For better understanding, let’s see how much a trader will have to pay for a $5,000 lot of US, UK and German stocks on the platforms of Just2Trade, Degiro and Swissquote.

Comparative table of commissions

| Just2Trade | Swissquote Bank | Degiro | |

|---|---|---|---|

| Apple (USA) | $2.88 | $25 | $0.67 |

| Barclays (UK) | $38.7 | $30 | $2.45 |

| Adidas (Germany) | $35.4 | $27.5 | $6.7 |

| Gazprom (Russian) | $3.8 | Not traded | Not traded |

As you can see, Just2Trade offers beneficial conditions for trading US stocks, which can only be comparable to Degiro, the discount broker. In the majority of other markets, we estimated the broker’s commissions as high due to a considerable minimum commission per trade. This makes trading small lots of UK, German, Japanese and other countries’ stocks unprofitable.

Commissions on Forex market

We estimated Just2Trade commission on the Forex market as very low. They are excellent for active trading.

The broker offers several account types, but the commissions on them are similar in general. On MT5 Global and Forex ECN account types, the broker charges $2 and $3 commission per standard lot of 100,000 units of base currency respectively. The traders also need to take into account the market spread, which is received from the liquidity suppliers. As a rule, the spreads on Just2Trade are very low due to high liquidity received from large banks. On the Forex and CFD Standard accounts, the broker uses a small spread on top of the market spread as a commission.

Let’s review a specific example of how much a trader will have to pay for the execution of a standard lot of 100,000 units of base currency in popular trading pairs of different classes. The final figures specified in the table include the spread and all commissions and fees charged by Just2Trade and Swissquote. Degiro does not provide access to Forex.

| Just2Trade (ECN)* | Swissquote Bank | |

|---|---|---|

| EURUSD | $5 | $14 |

| USDJPY | $8 | $13.37 |

| GBPUSD | $7 | $19.52 |

| AUDJPY | $7.78 | $16.24 |

* The brokerage commission for closing the transaction is charged instantly when the position is opened. Only the value of the commission for opening the transaction is specified in the table.

As we can see, there is a big difference in the rates of Swissquote Bank and Just2Trade in favor of the latter.

Swaps on Forex

Swaps are charged for holding positive overnight. This is due to the peculiarity of Forex market functioning. The size of the swap depends on the interest rates of the central banks that issued the currencies in the currency pair. In case of positive swap, a certain number of points is accrued to the account, and in case it is negative – the points are written off the account.

We established that the swap on Just2Trade is average. This makes it attractive for using medium-term trading strategies. For long-term investment, many professional traders choose trading towards positive swaps.

Swaps on Just2Trade

| Своп long | Своп short | |

|---|---|---|

| EURUSD | -6,3000 | 0,3000 |

| USDJPY | 0,0000 | -2,6000 |

| GBPUSD | -3,3800 | -1,9500 |

| AUDJPY | -1,3700 | -2,5400 |

A number of brokers offers their customers from Muslim countries a swap free option. To connect such an option, you need to contact the broker.

| Just2Trade | Swissquote | Degiro | |

|---|---|---|---|

| Swap free option | Yes | Yes | No |

Commissions on futures

Just2Trade provides access to an excellent choice of futures in the US, EU and Russia’s markets. We estimated the broker’s commissions as average in the market. The broker offers the most beneficial conditions in the US market.

| Just2Trade | Swissquote | Degiro | |

|---|---|---|---|

| CME, CBOE (USA) | from $1 per contract | from $1.5 per contract | from $0.50 per contract |

| GLOBEX, EUREX (EU) | $2.88 per contract | from $2.36 per contract | $2.95 EUR per contract |

| Futures market of Russia | $0.13 за контракт | Не предлагает | Не предлагает |

* Excluding exchange and clearing fees.

Commissions on options

The broker provides access to trading options on US exchanges. The broker’s commission depends on the volume of trading – the higher the number of the contracts, the lower the commission. Below is a table to help you understand the nuances.

US Indices Options

| Trading volume | Brokerage commission* |

|---|---|

| Base rate | $2.15 per contract |

| Over 500 contracts per month | $1.50 per contract |

| Over 2,500 contracts per month | $1.00 per contract |

| Over 5,000 contracts per month | Upon request |

* the broker’s rates specified in the table do not include exchange and clearing fees

Noteworthy, the minimum deposit for trading US options on Just2Trade is $3,000. We estimated the broker’s conditions on the options market as average. However, for large volumes of trading, the commissions are low.

Commissions on bonds

Bonds is a new instrument for Just2Trade introduced in 2020. They ensure fixed passive income for the investors. To start trading, a trader needs to have $3,000, while the brokerage commission is from 0.125% of the transaction volume, but no less than $10.

As an example, let’s compare the conditions of Just2Trade and Swissquote on purchasing US Treasuries for the amount of USD 10,000.

| Just2Trade | Swissquote | Degiro | |

|---|---|---|---|

| US Treasuries | $12.5 | $8.72 | US Treasuries not available |

As you can see, the conditions of Just2Trade are worse than those of its competitor.

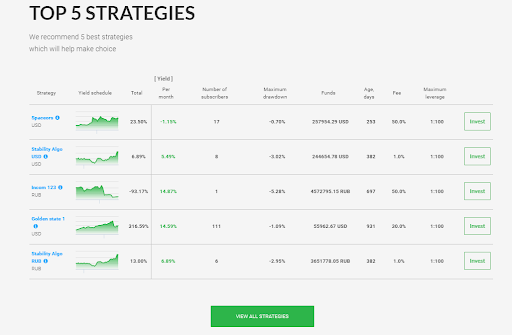

Commissions on investment services

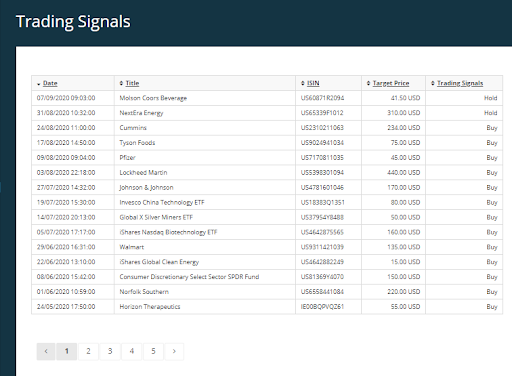

Just2Trade offers an excellent choice of investment services: PAMM accounts, advisory management on US exchanges, trust management, individual investment portfolios and investment in IPO.

Let’s review how much a trader will have to pay for these sorts of services.

| Base commission | Entry threshold | |

|---|---|---|

| PAMM | Account manager commission, on average 10-50%. | No |

| Trading signals from professional traders on tariff plans USA VIP and USA Exclusive | Shares — $0.02 per share Options — $5 per contract |

$10.000 |

| Managed portfolios on the US market | Account management fee depends on the client’s account balance: If the amount is less than $100,000 — 25% of profit If the amount is more than $100,000 — 20% | $80.000 |

| Robo-Advisor | $4.95 for portfolio composition | $500 |

| Investment in IPO | 4% of the bid amount | $1000 |

| Individual investment portfolios | Upon request | $5000 |

We estimated the selection of investment products on Just2Trade as excellent and the commissions as average in the market.

Commissions on cryptocurrencies

Just2Trade offers beneficial conditions for trading cryptocurrencies compared to the majority of classic brokers. The commission depends on the turnover and is 0.35%. Degiro does not provide access to digital assets, which is why we compared conditions with Swissquote. As an example, we used the purchase of Bitcoin for the amount of $2,000.

| Just2Trade | Swissquote | |

|---|---|---|

| BTCUSD | $7 | $20 |

Noteworthy, compared to cryptocurrency exchanges, the brokers offer worse conditions. In particular, Binance charges only 0.1% of the turnover.

Financing rates

Also, we decided to analyze how beneficial it will be to hold marginal positions on different markets. As a reminder, a marginal position means that you purchase securities not only with your own money, but also borrow from the broker.

| ПInterest rate per day | Annual interest | |

|---|---|---|

| Stock market of USA, Germany, France, UK, Hong Kong, Singapore | 0,0227% | 9,86% |

| Russian stock market | 0.044% | 16.06% |

| Futures market Europe (GLOBEX, EUREX) and Russia | 0,0712% | 25.99% |

| Forex | 0.016% | 5.84% |

| Cryptocurrencies | 0.06% | 21.9% |

Conditions of Just2Trade for holding marginal positions cannot be considered attractive for developed markets. In particular, the rate is 0.0227% per day (slightly higher than 8.29% annual) on the US stock market and stocks markets of European countries, while top American and European brokers provide financing at 1-3% annual interest.

For the Russian securities market, the rate is 0.044% per day (16.6% annual). These conditions are higher than the average in the market. A number of top Russian brokers are ready to provide financing for the purchase of shares at less than 10% annual interest.

Non-trading commissions

We estimated non-trading commissions of Just2Trade as low. The broker does not charge a deposit fee on all available methods and there is zero withdrawal fee on withdrawals to the account at FINAM bank and UnionPay payment system. Account service fee is $5 per month, but it is only charged if the customer hasn’t had any trades within the specific month.

| Just2Trade | Swissquote | Degiro | |

|---|---|---|---|

| Inactivity fee | Yes | Yes | No |

| Withdrawal fee | No | No | No |

| Deposit fee | No | No | No |

Reliability and regulation

We estimated the broker’s reliability as high, but not as high as possible.

Just2Trade obtained the license in Cyprus in 2015.

The regulator’s website confirms that the license is valid. We have not discovered any confirmed facts or scandals that blemish the broker’s reputation. The regulators of other countries, for example British FCA, where Just2Trade ONLINE LTD offers its services, are aware of its operation.

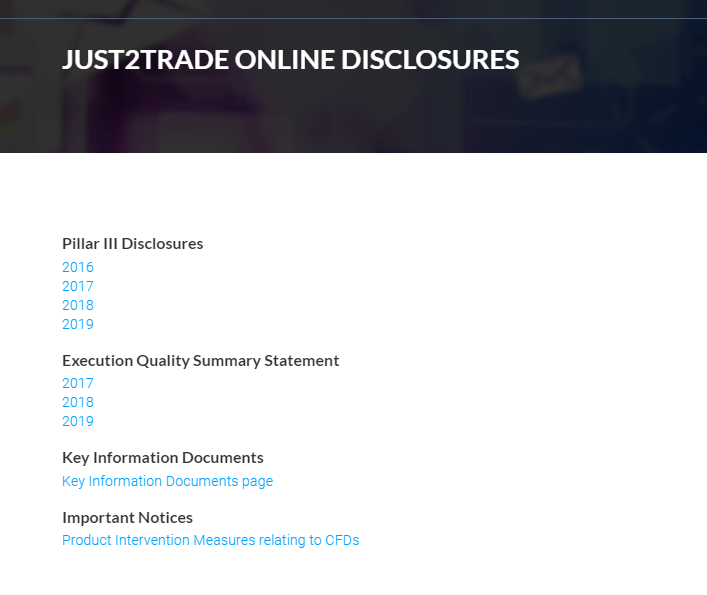

The level of transparency and availability of information about the company is average.

On the one hand, the broker does not disclose information about owners, top managers, profit and other data. This is a drawback.

On the other hand, there is a document archive on the website going back several years with important figures about the operations and contracting parties. This is an advantage.

Two-factor authentication is available, but not on all resources of the broker. By default, you can access your account using simplified login procedure without two-factor authentication.

However, this does not mean that the broker does not care about the security of data of its customers, because after simple login (using only username and password), you will be able to only download a trading platform. All other important actions (such as changing password, withdrawing funds), will require additional confirmation (via SMS, for example).

However, this does not mean that the broker does not care about the security of data of its customers, because after simple login (using only username and password), you will be able to only download a trading platform. All other important actions (such as changing password, withdrawing funds), will require additional confirmation (via SMS, for example).

Here are three more important facts that speak in favor of the broker’s reliability:

- Customer funds are kept on segregated accounts.

- As Just2Trade is a member of the Investor Compensation Fund, the funds of the customers are insured for the amount of EUR 20,000.

- Formally, there is no negative balance protection, but the customer support team assures that the probability of such outcome is extremely low, and even if the balance turns out to be negative, the customer can contact customer support of Just2Trade and the company will compensate for the negative balance

Short history and other important facts

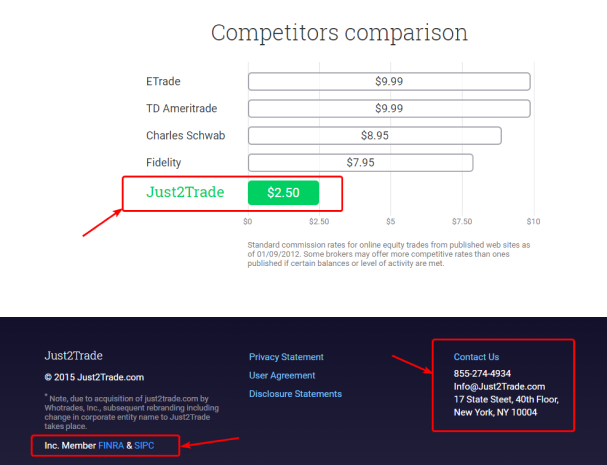

As we discovered, the history of Just2Trade brand started in 2007. At that time, Just2Trade was a branch of Success Trade Securities, Inc with the headquarters in Washington, USA and regulation by FINRA and SIPC.

The website Just2Trade.com was created back then. Its visitors (US audience) were offered to open brokerage accounts for trading shares at low commissions – $2.5 per trade, which means that the company positioned itself as a discount broker, offering commissions that were lower than those of competitors. Just2Trade began to grow.

In February 2015, Success Trade Securities sold its successful branch Just2Trade to WhoTrades, which was established in New York in 2010 by Victor Remsha (Russian businessman, founder of Finam holding). The sum of the transaction was not disclosed.

It is possible that by acquiring Just2Trade, Finam Investment Holding aimed to expand its business in Europe and the USA. The fact that the website under Just2Trade brand opens when you enter finam.eu speaks in favor of this assumption.

Below is a screenshot from Just2Trade website from the web-archive dated 2015, which we found interesting.

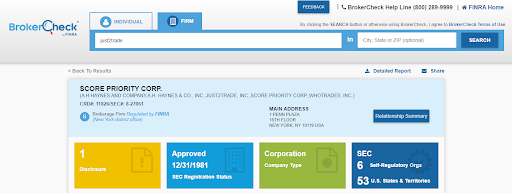

Be that as it may, there have been two legally different brokers since 2015, but with the same name of Just2Trade:

- European – Just2Trade ONLINE LTD with headquarters in Limassol. Its website is just2trade.online;

- American – Just2Trade LTD Incorporated with the office in New York. This legal entity holds the license of FINRA and is a part of Score Priority Corporation, which is confirmed by the entry in the regulator’s register. The website of this branch is just2trade.com.

Valid license issued by FINRA

In our review, we are focusing on the European branch Just2Trade LTD ONLINE. However, it would have been unprofessional not to mention the existing namesake company, particularly since the customers of the European branch receive access to the American stock market via Just2Trade LTD Incorporated (aka – Score Priority Corp, USA).

Markets and products

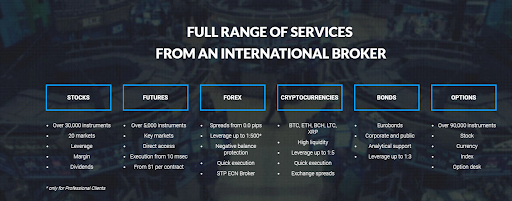

Just2Trade offers an excellent choice of financial markets.

| Pros |

|---|

|

| Cons |

|---|

|

Just 2 Trade successfully combines products and services of three areas:

- Forex and CFDs

- Stocks, futures, bonds

- cryptocurrencies.

This universal combination is designed to satisfy the demands of the majority of customers and make the broker stand out against the competition.

| Just2Trade | Degiro | Swissquote Bank* | |

|---|---|---|---|

| Forex | Yes | No | Yes |

| Stocks | Yes | Yes | Yes |

| CFD | Yes | No | Yes |

| Crypto | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Futures and options | Yes | Yes | Yes |

| Commodities (oil, metals, wheat, gas, ores, etc.) | Yes | Yes | Yes |

| Mutual funds | No | Yes | Yes |

| ETF | Yes | Yes | Yes |

* - information is provided for the Swiss office of Swissquote Bank, while Swissquote London focuses solely on Forex.

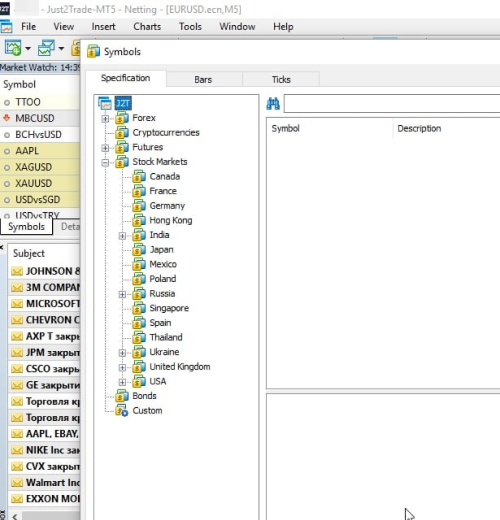

Geography of markets

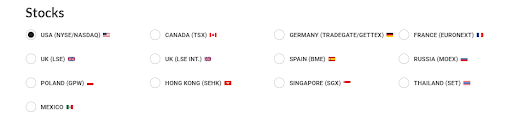

With an MT5 Global account (this is the main type of account, which we will review in detail below), Just2Trade customers can trade shares at 15 exchanges of different countries.

- America: NASDAQ and NYSE (USA), TSX (Canada), BMV (Mexico);

- Europe: LSE (London), BME (Spain), GPW (Poland), EURONEXT (France) TRADEGATE and GETTEX (Germany)

- Asia: SET (Thailand), SGX (Singapore), SEHK (Hong Kong), TYO (Japan).

- And, of course, MOEX (Russia).

Overall, the choice of markets is good, although since Just2Trade positions itself as a European broker, access to stock exchanges of Italy, Switzerland, Austria (these markets have been announced when the review was being prepared, but not available yet), Scandinavian countries could be added.

American OTC market is unavailable, judging by the absence of information about it on the website, although the customer support said that it is possible to trade OTC instruments, and explained that there is no information about them, because OTC trade at the rates of stocks.

Access to the exchanges of Asia and Oceania is average – only 4, albeit rather large, exchanges.

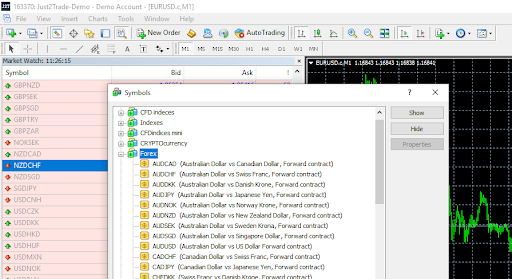

Forex and CFD market

Forex and CFD trading is a well-formed offer for the customers of Just2Trade.

| Just2Trade | Degiro | Swissquote Bank | |

|---|---|---|---|

| Number of trading pairs | 76* | 0 | 80 |

* We counted 76 on MetaTrade platform, although the website contains information about 64 pairs.

Noteworthy, Just2Trade has two types of Forex instruments – standard and ECN. For example:

- EURUSD – standard forex pair

- EURUSD.c – pair of ECN type. The instruments with a ‘.c’ suffix have narrower spreads. The order execution speed is high on both types of accounts.

The list includes all major pairs, cross rates and some exotic instruments, such as USDILS.

In addition to Forex pairs, CFDs are also available:

- 34 CFD on US stocks

- 22 CFD on Polish stocks

- 3 CFD on energies

- 7 CFD on stock indices

The above information is applicable to MT-5 Global account types, while there may be differences for Forex-ECN account types.

Stock market and ETF

Trading with Just2trade, you receive access to the most popular exchanges of the world.

Just2Trade has similar indicators as another discount broker Degiro. However, J2T still has a long way to go to Swissquote. Be that as it may, it is not the quantity, but the quality that counts.

| Just2Trade | Degiro | Swissquote | |

|---|---|---|---|

| Number of stock exchanges | 15 | 30 | 60 |

| Number of shares and ETF* | 30,000 | 25,000 | 87,000 |

* Just 2 Trade does not split shares and ETF, which is why we merged them into one line.

What makes Just2Trade special for stock market trading is ‘customization’ or expandable list of shares. This means that if you want to buy specific shares that are not on the list, you can contact the broker and ask for it to be added to the list and for permission to perform a transaction with it.

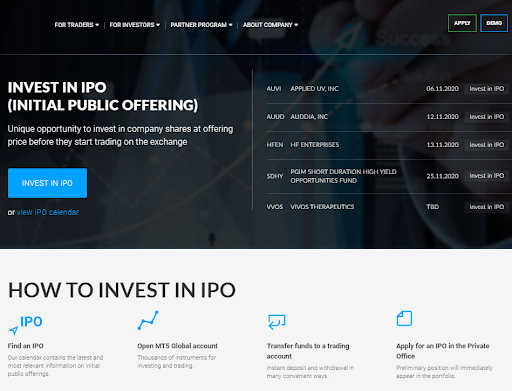

Access to Initial Public Offering (IPO) is another important advantage of Just2Trade.

The information about IPO is updated regularly on the website and the customers have access to purchase shares before they are in free circulation at the exchange.

Futures

A futures contract is a financial instrument, a derivative of the cost of the base asset. Futures serves for hedging and speculation.

Just 2 Trade allows to purchase and sell futures at 4 exchanges:

- MOEX (Moscow Exchange, Russia)

- CME (Chicago Mercantile Exchange, USA)

- CBOE (Chicago Board Options Exchange, USA)

- ICE (Intercontinental Exchange, USA).

| Exchange | Number of futures markets | Base assets |

|---|---|---|

| MOEX | 41 | Company shares, stock indices, metals, forex, energies and agroindustrial products |

| CME | 34 | Stock indices, metals, forex, energies and agroindustrial products |

| CBOE | 1 | Volatility index |

| ICE | 5 | Energies and agroindustrial products |

Conclusion. Access to US futures markets is rather a standard service, which many brokers offer. Meanwhile, trading futures on MOEX is less popular. In particular, customers of Degiro and Swissquote do not have access to this service.

Other financial instruments

In addition to the aforementioned markets, J2T provides access to transactions with cryptocurrencies, options and bonds.

In the table below, we compared the broker’s instruments with the competitors, although some positions cannot be properly compared, as the brokers provide data in different formats.

| Just2Trade | Degiro | Swissquote Bank | |

|---|---|---|---|

| Crypto | 12 coins | 4* | 12 coins ** |

| Mutual funds | No | 64 providers | 12,500 instruments |

| Bonds | 31 | 649 | 60,000 |

| Options | 90,000 | 12 exchanges | 6 exchanges |

* - On Degiro, you can buy coins only via derivatives, while both Swissquote and Just2Trade provide access to real crypto assets.

** - Swissquote Bank has the same number of coins available for trading / investment. However, if you compare the spreads, Just2Trade holds the advantage. We discovered that Just2Trade has direct connectors to different cryptocurrency exchanges and supplies average prices to its customers, which is why the spreads are not the lowest, but quite competitive.

The list of coins available on J2t is on the screenshot below (also support of Stellar XLM was announced). Trading and investment in crypto assets are a separate line and there is a dedicated domain for it j2tx.com, where you can conveniently buy cryptocurrency using a debit/credit card.

In addition to the standard BTC, ETH, XRP and other coins, we’d also like to point to JT2X Dividend Token. Judging by the name, it can yield investment income. In the next section we will look into it in more detail.

Investment products

The line of financial products for passive income is a very strong suit of Just2Trade. The broker offers six types of products.

| Investment products | Minimum investment |

|---|---|

| J2TD Dividend token | 10 USD |

| FX and МТ5 Investments (PAMM) | 100 USD |

| Trading signals | No requirements |

| Trust management | 80,000 USD |

| Robo-Advisor | 500 USD |

| Investment portfolios | 5,000 USD |

The selection is impressive and it makes Just2Trade stand out among the competitors. Degiro does not offer any similar products, while Swissquote only has Robo-Advisor (minimum 10,000 CHF) and Theme trading.

Let’s review investment products offered by Just2Trade in more detail.

J2TD Dividend token

J2TX is a young online platform with a multitude of functions. Legally, it belongs to Just 2 Trade Online LTD with the license in Cyprus.

Using J2TX the customers can:

- Buy cryptocurrency using a debit/credit card;

- Invest funds

- Receive dividends from J2TD tokens.

J2TD token is a digital asset issued by J2TX platform. The owners of the token can receive daily dividends through distribution of profit from:

- Operation of J2TX platform;

- Operation of Just2Trade broker.

At the time this article was being written, the price of the token was USD 10 (this price is changing). What is the size of the dividends?

We contacted customer support and learned that the size of the dividend is 0.0000002 ETH per one token per month, but with daily payouts.

So, if you buy 1,000 tokens for USD 10,000, the dividend will be… less than one cent per month.

Conclusion. The offer is not very beneficial. At least at the time the review was being prepared, and while the project is still in its initial stage. As the turnover grows, the dividends should increase.

NOTE! The calculator on the J2TX website may be misleading.

FX and MT5 Investments

FX and МТ5 Investments are essentially a copy trading service, or investment in the so-called PAMM accounts.

The customers can:

- Choose a strategy;

- Connect their account to follow it.

Then, the system will copy trades based on the original strategy to the customer’s account, charging a percentage as a commission for the strategy manager.

Just 2 Trade works with PAMM in two areas:

- Investment via MT5 accounts. This service is not active yet, as it is difficult to implement it technically, as this will involve copying traders via Metatrader 5 platform with connection to the global exchanges, such as Nasdaq, CME, MOEX. So, it is still under development. The customer support could not specify when the investment service on MT5 accounts will be introduced.

- FX Investments. The service uses technical functions of Metatrader 4 platform. This service has been available for many years, and the customers of Just2Trade with active Forex accounts can choose from many available strategies.

Advantages of this kind of investment:

- Affordable entry threshold (minimum USD 100).

- Protection against risk. In your profile, you can set Stop Loss for the strategy. If the manager allows a big decrease, the copy trading system will block reduction of the capital of the customer’s (investor’s), who connected to the strategy. The Stop Loss value can be flexible. For example, you invested USD 100 and set Stop Loss at 80 (-20%). The strategy increased your capital to 120. You can then reset Stop Loss at no-loss level.

- Diversification. By connecting his capital to several strategies, the investor distributes the risks.

- Saving time.

- High quality of execution, because the trades are copied through the use of ECN technologies. This means that within the FX Investments service, the broker does not divide the accounts into Standard and ECN.

- Simple set-up for the beginners, so that the people with no experience in Forex trading have an opportunity to benefit from professional traders.

Conclusion. FX Investments service helps create a source of passive income. When copy trading service on MT5 accounts is launched, it will further strengthen the broker’s positions against its competitors.

Trading signals

There is a page For Investors > Market Research on the broker’s website, which features information about Market Research and Analysis on the US Stock Exchanges.

However, analysis, research and signals are three different things in the world of financial markets. We contacted customer support for explanation and learned that the information on the page is slightly outdated.

At the time this article was being written (end of 2020), the Trading signals service essentially meant email notifications about potentially profitable opportunities on the financial markets. The signals are developed by the analysts of the partner (or, better, mother) company FINAM. You can see how the signals are sent and the examples of previous signals on the page by clicking on “Check Previous Ideas”.

To activate the service, you need to enter your email in the subscription form. When the signals arrive, the subscribers will get email notifications. However, there is a trial period. Usually, it is 2-3 signals and then the trial period ends. To renew the subscription, you need to have a ROX type of account (see more in the Account types section of this review) with a minimum of USD 3,000 on the balance.

Conclusion. This service will be useful to those focusing on the US Stock Exchanges. Professional analysts with a confirmed history of profitability will share their investment ideas in regards to promising securities of American companies.

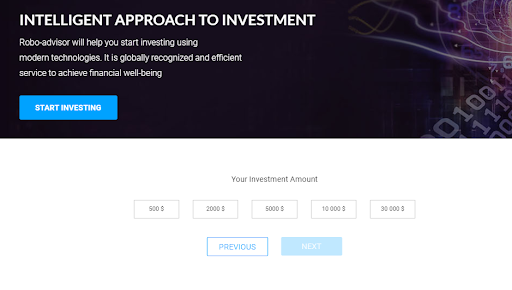

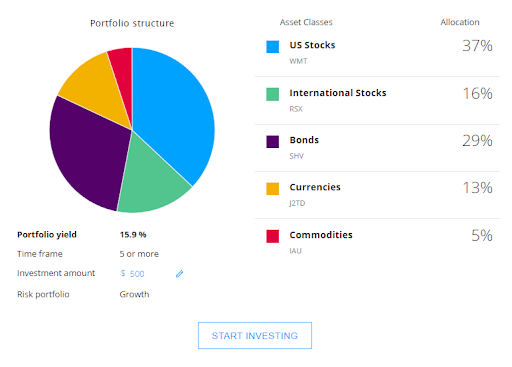

Robo-advisor

Robo-advisor is a service for automatic composition of an investment portfolio.

To use it, you need to have a balance of at least USD 500.

A customer who wants to create a portfolio needs to fill out an online questionnaire, providing the robot with information about:

- The period of investment;

- Investment experience;

- Desirable goals and admissible risks.

Based on this information, the robot will create a portfolio.

Robo-advisor service from Just2Trade strongly resembles the one offered by Swissquote Bank, which we are using for comparison in this review.

Let’s compare Robo-Advisor service of the two brokers (the names of the service are identical):

| Robo-Advisor от Just 2 Trade | Robo-Advisor Swissquote Bank | |

|---|---|---|

| Questionnaire | Simple | Simple, the questions are practically identical |

| Minimum threshold | USD 500 | CHF 10,000 |

| Speed of portfolio composition | Quick (within several seconds) | Lengthy, up to 1-2 minutes. Judging by the time, we believe that Swissquote algorithms involve a lot of important calculations. |

| Rebalancing | No, at least the information about rebalancing is not available on the website. | Possible |

| Backtesting | No | Yes |

| Extrapolation | Simple | More transparent “bracket of results” |

| Asset range | Average | Wide, including cash and securities related to real estate. |

We composed several portfolios and we did not like the fact that Robo-Advisor of Just2Trade obtrusively includes J2TD token.

Conclusion. Robo-Advisor service will be interesting to beginner investors with a capital from USD 500. However, we believe that the same service provided by Swissquote is more professional, although you do need 20 times more money to start to work with it.

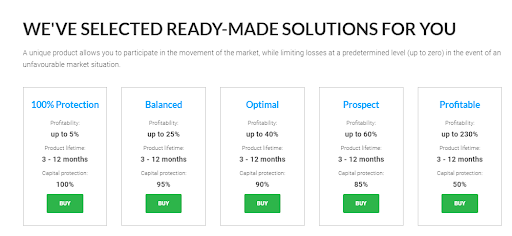

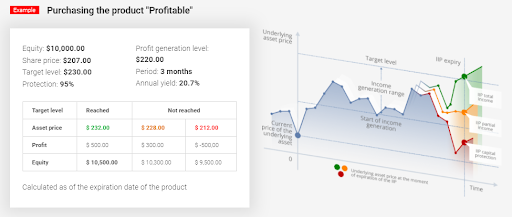

Individual portfolios

Individual portfolios is an offer to invest in one of five portfolios created by Just2Trade. A dedicated specialist from the customer support will be able to advise you on the instruments used for creation of these portfolios.

Key principle is benefit proportional to risk.

Features of the offer:

- Minimum period of investment – 3 months;

- Minimum risk – 0% (the broker guarantees that the customer will not lose money by investing in Protection portfolio);

- Maximum profit – up to 230% with a probability of 50% capital loss.

Conclusion. The service of investment portfolios seems rational. Investors who have USD 5,000 can choose the most suitable profitability/risk option.

Opening an account

The procedure of opening an account on Just2Trade is classic and similar to other brokers with regulation in Europe. Also, the broker allows the address registration stamp in a national passport as proof of residence. This is relevant for the citizens of the countries, where address registration is mandatory by the law.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

What is the minimum deposit on Just2Trade?

In order to open a real account of Forex Standard type, USD 100 is enough.

| Just2Trade | Degiro | Swissquote | |

|---|---|---|---|

| Minimum deposit | 100 USD or an equivalent | No | 1000 USD |

The low minimum deposit is the broker’s advantage over such competitors as Swissquote.

Residents of which countries cannot trade on Just2Trade

Just2Trade is not open for all, unfortunately.

There is exhaustive information about the restrictions on the website of the Cyprus regulator, as the source. At the time when this review was being prepared, citizens of 30 European countries could open an account with the broker.

Citizens of other countries can also open accounts on Just2Trade provided that the broker complies with the laws and regulations of such countries.

Noteworthy, there are USA and Israel on the list, although in truth Israeli and American residents will not be able to open an account on Just2Trade either due to the regulations of these countries or the list of permitted countries, which exists inside the broker’s organization.

The entry is allowed to Russians, Ukrainians, Belarusians and residents of many other countries. The broker assures that residents of nearly all countries can open accounts.

Documents required for opening an account

Two documents are required for opening an account on Just2Trade:

- Proof of identity

- Proof of residence.

Also, these must be two different documents. For example:

- You can upload your driver’s license as proof of identity and the page of the national passport with address registration stamp as proof of residence.

- Or you can upload your foreign passport as proof of identity, and a bank statement as proof of residence.

It is recommended that you prepare the documents in advance – scan or photograph them and save in good quality.

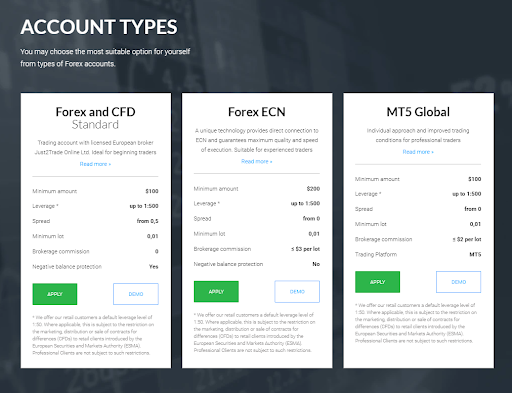

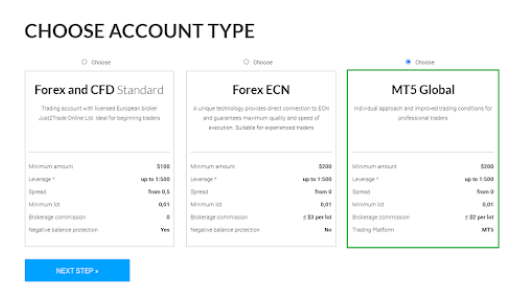

Account types

Just2Trade offers seven types of real accounts:

- Forex Standard

- Forex ECN

- MT5 Global

- Global Markets – account for trading via ROX platform

- Global Futures – account for trading via CQG platform

- Account for cryptocurrency trading

- PAMM accounts

The main ones are MT5 Global and Forex accounts.

MT5 Global account is the successor of the one earlier called Single Trading Account. The broker decided to reorganize the account structure and now it is impossible to open a Single Trading Account, although open positions are still supported on them.

There is some information about Single accounts left on Just2Trade website, but it should not confuse you.

Also, there is a good chance to get confused about the account, as one and the same account could have different names in different places. For example, on the website, the account’s name is US Exchanges, and inside your personal account – Global Markets.

Demo account

It is extremely easy to open a demo account on Just2Trade.

All you need is:

- Press Demo button in the upper right corner of the website;

- Choose the type of the demo account (for example, Forex Standard or MT5-Global);

- Fill out a simple form with contact information.

That’s it! You will be provided with a login to the demo account, which is a simplified version of the real personal account.

If you want to test demo accounts of different types, you can create a demo of one account, receive access to your personal account and then create a demo of another account type from there.

Important features:

- The validity term of a demo account for Forex is practically unlimited. After one month of inactivity of a Forex demo account, it will be closed.

- Demo accounts for МТ5-Global are valid for no longer than two weeks.

- The customer chooses the amount on the demo account during the procedure of demo account opening.

- Only one demo account can be opened for one account type. For example, you cannot open two demo accounts for Forex ECN.

- Demo for the CQG account is opened separately and is valid for two weeks.

Trading accounts

| Account type | Forex and Forex ECN | MT-5 Global | Rox ** | CQG ** | Crypto |

|---|---|---|---|---|---|

| Minimum deposit | from 100 USD * | From 100 USD | 3 000 USD | 5 000 USD | 100 USD |

| Trading platform | MT4 | MT5 | Rox | CQG + third party platform | J2TX |

| Stocks, bonds, futures trading | No | Yes | Yes | Yes | No |

| Forex and CFD trading | Yes | Yes | No | No | No |

| Cryptocurrency trading*** | Yes, as CFD | Yes | Yes, as BTC futures | Yes, as BTC futures | Yes |

| Trading with leverage | Up to 1:500 | Yes | Yes | Yes | No |

* – The minimum deposit for Forex ECN is USD 200.

** – accounts of ROX and CQG types have a special status in the structure of Just2Trade. They are serviced by a special department, including managers of customer support. Information about these accounts is not fully available on the website, most likely because these accounts are not designed for the wide audience. This is why, within this review, we will not focus on these accounts too much. However, if you are interested in them, we advise you to contact a manager of customer support to discuss this issue personally.

How to open an account: step-by-step guide

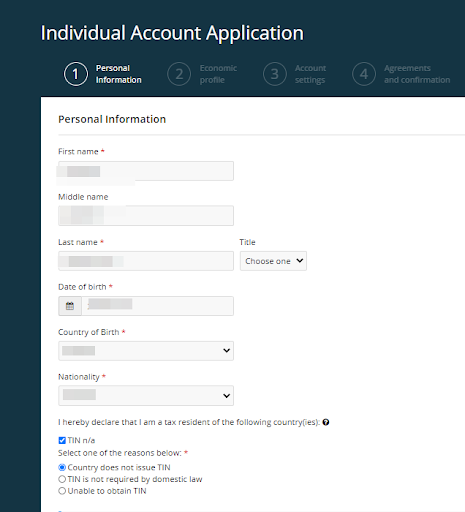

The procedure of opening an account is performed fully online. To start it, press the APPLY (Open Account) button. It is green and can be found at the top of just2trade.online website.

Before starting the procedure of account opening, you need to provide basic information (phone number, email, and full name).

Also, you need to specify the type of the account you want to open. Please note that you can open any type of account during registration, and then, in your personal account, you can open a different type of account, if necessary.

During the first step of account opening, the system will ask you to provide Personal Information – first, middle and last name, date of birth, nationality, tax residency, and also contact information, including your actual address.

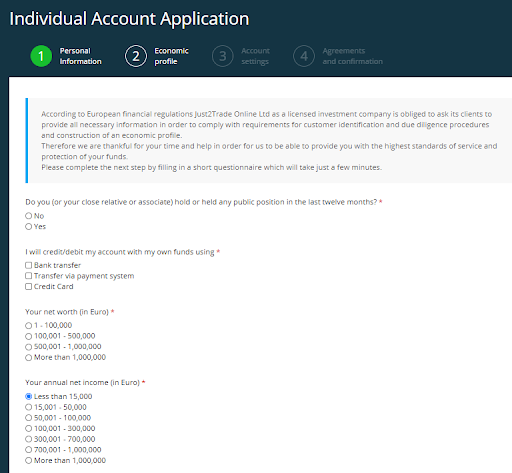

During the second step, which is titled Economic Profile, you need to specify information about your employment, level of income, trading experience in the financial markets.

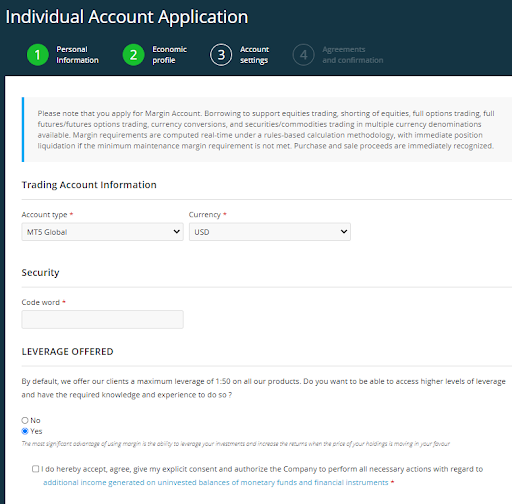

The third step is Account Settings, where you specify the account type, security word, and set up leverage.

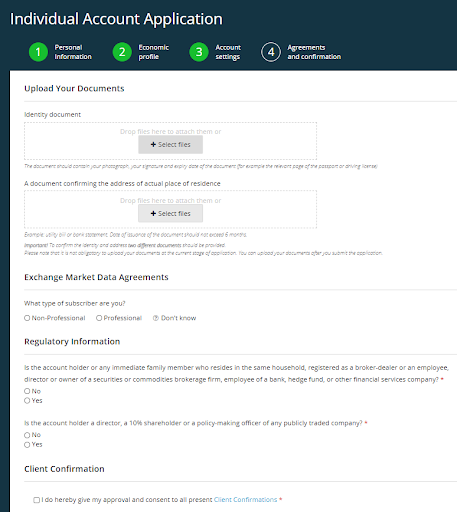

The fourth step is called Agreements and Confirmation. Here, you need to:

- Upload scans / photos of documents, confirming your identity and actual place of residence;

- Review terms of use;

- Set up newsletter parameters;

- Consent to the Client Confirmations and confirm that the data you provided is correct.

Then, your data is sent for verification.

The broker states that the accounts are opened within one day. A manager called us within 20 minutes, we discussed all issues and questions and our account was verified in an hour. This is one of the best results in terms of quickness of account opening among the brokers with European regulation.

Review of personal account

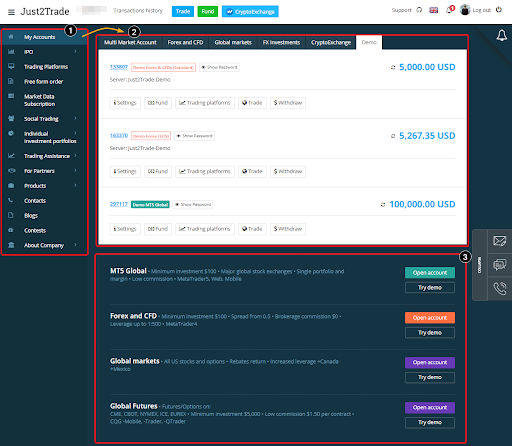

Personal account on Just2Trade might not be considered to have the purest design or be as user friendly as possible, but its structure is quite intuitive. You will need to spend a little bit of time getting to know where everything is. But after that, you will be able to easily navigate your account.

The image below is the screenshot of the personal account. The language switch is in the upper right corner.

The navigation panel (1) is on the left side of the interface. By default, the first thing to open is My Accounts. The customer can see information about his accounts on the screen. The information is divided by tabs (2), which correspond to the account type.

Here, the customer can:

- Open an account (demo or real);

- Perform a transaction;

- Deposit/withdraw/transfer funds;

- Order a report;

- View/change account settings.

Let’s also review other features on the navigation panel and sections of the personal account that correspond to them:

- IPO – this section contains data about the shares of the companies that are about to go public. The customers can buy them before they become public. There is also information about past IPOs.

- Platforms – here, you can download desktop versions of the trading platforms, access web platforms.

- Free form order – here, you can send a request for changing personal data, for example. Or you can order a brokerage report, if you need a certified version. It is best to first send your requests to customer support and they will advise you on whether you need to send the free form order or email request is enough.

- Subscription – in this section, you can subscribe to exchange data newsletter (as a rule, from the American exchanges).

- Social Trading – here, you are redirected to the website, where you can view all available PAMM accounts, select a strategy for investment.

- Individual Portfolios – selection of an individual portfolio/product (Protection, Balanced, Optimal, Prospect, Profitable).

- Assistance – this is a big section, where you can read market analytics, view recommendations on stocks, economic calendar, review popular shares (see more below).

- For Partners – conditions on partnership programs. The customers can refer friends and get $9, if their friend opens and verifies an account.

- Products – this is a confusing section with the majority of lines redirecting you to the pages of the main website.

- Contacts – contact information, phone numbers.

- Blog – direct link to whotrades.com, which is currently branded under the logo of Score Priority. We have already mentioned this link between the companies in the history of Just2Trade.

- Contents – section with contests (was empty at the time this review was being prepared).

- About – public information about the company, documents, rates and announcements.

Base currencies

On Just2Trade, you can open an account in one of three currencies – EUR, USD, RUB. If you perform transactions in other currencies, they will be automatically converted into the account currency.

After you open an account, you cannot change the base currency, but it is possible to open an additional account in a different currency.

| Just2Trade | Degiro | Swissquote | |

|---|---|---|---|

| Number of base currencies | 3 | 9 | 21 |

Compared to other brokers, Just2Trade is significantly behind in terms of available base currencies. It is possible that the audience from the former Soviet countries will consider the choice of three currencies as sufficient, but, as a European broker, Just2Trade could have offered a wider choice for the Europeans, adding, for example GBP, CHF, PLN.

Deposit and withdrawal

| Pros |

|---|

|

| Cons |

|---|

|

|

As we already mentioned, ROX accounts types (it can also be called US Exchanges or Global Markets) and CQG accounts (aka Global Futures) are serviced by a special department inside the broker’s structure. They are less popular and the information about them is less extensive.

This is why, within this review, we focus on deposit and withdrawal methods for MT5-Global and Forex Standard/ECN accounts, which are the broker’s flagship accounts.

Methods and timeframe for deposits

Just 2 Trade offers different methods of deposit, depending on the customer’s account type.

Also, inside the personal account, customers can transfer funds from one trading account to another. Therefore, customers can choose the best suitable way to fund the account, and then transfer the money to another account type. However, this idea is unlikely to work, because if the broker detects such ‘maneuver’, it can charge additional commission on transfers between accounts.

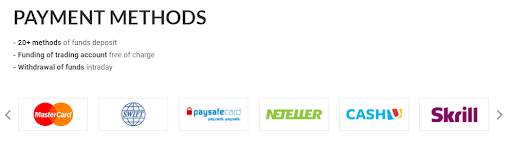

The broker states there are 20 methods of funds deposit.

The fees and the speed differ depending on the method and account type. The customers can deposit funds on 3 main account types (MT5 Global, Forex-Standard, Forex-ECN) using the methods listed in the table below.

| Method of deposit | Timeframe and currency | Fees |

|---|---|---|

| Wire transfer | EUR, USD, RUB. 2-3 business days | Customer’s bank’s fee |

| Finam Bank | EUR, RUB. 2-3 business days | Commission 0%. Commission may be charged for transfers in USD, contact the bank for information. |

| Debit/credit card * | RUB, USD, EUR instant funding | 3% commission on deposits on Forex-ECN |

| Russian banks (Alfa and Promsvyazbank) | RUB instant funding | 2.5% commission on deposits on Forex-ECN |

| Moneta.ru | RUB instant funding | 1.5% commission on deposits on Forex-Standard, 3% commission on deposits on Forex-ECN |

| QQIWI wallet | RUB instant funding | 4% commission on deposits on Forex-ECN and MT-5 Global |

| Webmoney | USD, EUR instant funding | 1.4% commission on deposits on Forex-ECN and MT-5 Global |

| Yandex.Money | RUB instant funding | 8% commission on deposits on Forex-ECN and MT-5 Global 4% commission on deposits on Forex-Standard |

| Post of Russia | RUB instant funding | 1% commission on deposits on Forex-ECN and MT-5 Global |

| Skrill | USD, EUR instant funding | 2.9% commission on deposits on Forex-ECN |

| Regional branches of Skrill ** | USD, EUR instant funding | 2.9% commission on deposits on Forex-ECN |

| Neteller | USD, EUR instant funding | 2.9% commission on deposits on Forex-ECN |

| Trustly | USD, EUR, MYR instant funding | 0% |

| UnionPay | USD instant funding | 0% |

* - the bank may charge a fee on deposits on Forex Standard and MT5 Global accounts, which is then compensated by the broker.

** - Regional branches of Skrill mean:

It is possible to fund the following accounts using cryptocurrencies:

- BTC – MT-5 Global, Forex Standard, Forex ECN

- ETH – MT-5 Global, Forex Standard, Forex ECN

- USDT – MT-5 Global, Forex ECN

No commission is charged on deposits in cryptocurrency, while the speed depends on the peculiarities of blockchain, although the broker claims ‘instant funding’.

Methods of withdrawal and fees

To order withdrawal of funds, you need to:

- Access personal account

- Select the account

- Press “Withdraw”

- Specify the amount you want to transfer and the method of withdrawal.

As a rule, Just2Trade charges a withdrawal fee, but it is low.

There are more methods of withdrawal on Just2Trade in addition to a bank transfer and in terms of this the broker compares favorably with Degiro.

| Method of withdrawal | Timeframe and currency | Fees |

|---|---|---|

| Wire transfer via Finam Bank | USD, EUR, RUB 2-3 business days | 0% commission |

| Swift | EUR, USD, RUB 2 days | EUR: 0% commission USD: 0.125%, min. $20, max. $40 RUB: 0.1%, min. RUB 1,500. Max. RUS 2,500. |

| Neteller | USD, EUR 2 days | 2% commission 5 USDT This method is available only for МТ5 Global and Forex Standard |

| Skrill | EUR within one day | 1% commission, minimum commission 1 EUR |

| Visa / MasterCard credit card | EUR / USD / RUB Usually 5-10 minutes from sending | 0% - for Forex и Forex ECN for МТ5- Global – 2.5% commission, min. €1/$1/₽50. Withdrawal commission is not charged, when refunding to the same card takes place. |

| Webmoney | EUR / USD / RUB 1-2 days | 1,8% commission, minimum commission €1/$1/₽50 |

| Yandex.Money | RUB 1-2 days | 1,5% commission, minimum commission ₽50 |

| QIWI Wallet | RUB 1-2 days | 1,5% commission, minimum commission ₽50 |

| AstroPay | Currencies of Latin American countries 2-3 days | 2.8% commission This method is available only for МТ5 Global and Forex Standard |

| Bitcoin | It depends on the speed at which a transaction gets included into the blockchain (within one day) | 0.0005 BTC |

| Ethereum | It depends on the speed at which a transaction gets included into the blockchain | 0.02 ETH |

| Tether | It depends on the speed at which a transaction gets included into the blockchain | 5 USDT This method is available only for MT5 Global accounts |

There are restrictions for some methods of withdrawal (for example, debit/credit cards). In particular, the customer can withdraw funds only to the same card that was used to fund the account. This is due to the anti-money laundering policy.

Trading platforms

The main accounts on Just 2 Trade envisage that the transactions are performed via the platforms developed by Metaquotes:

- Only Metatrader 4 is available for Forex Standard/ECN accounts;

- Only Metatrader 5 is available for MT5 Global accounts (which is clear from the name of the account)

| Pros |

|---|

|

| Cons |

|---|

|

Since the platforms of Metaquotes are widely known, we will review the CQG platform. This is a professional level software designed for trading futures on the American futures market.

By the way, this platform has a lot in common with the MT platforms:

- CQG platform, just as Metatrader, is widely known, and is an industry standard, to an extent;

- Its interface is ascetic, if not outdated. It is, however, possible that it is acceptable for the older generation of users;

- High operational speed. The platform is highly optimized and does not burden the computer. Although it takes long for the QTrader for Windows to load the first time, it then opens all windows very quickly and the whole set of functions operates easily, even in times of volatility spikes;

- A multitude of functions and possibilities of connecting additional plugins and drives;

- CQG can become an indispensable product for everyday work.

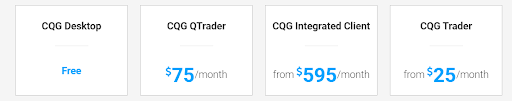

Customers of Just2Trade can use several version of CQG platform:

- CQG Desktop. Despite the name, this software is based on HTML5 technology and operates also on desktops, in operating systems and browsers. It is provided for free.

- CQG Trader. This is a simple platform for a PC (cost of use is USD 25 per month);

- CQG Q-Trader. Flagship version. (cost of use is USD 75 per month);

- Maximum version CQG Integrated Client (cost of use is nearly USD 600 per month). It is designed for professional and corporate customers. Among the latest upgrades is a set of functions to work with the reports of CFTC COT (Commitments of Traders), fundamental data of USDA and WASDE.

The benefit of CQG platform is that you can ‘link’ platforms of third-party developers to it to improve analysis and trading efficiency.

We counted around 40 of those, including Tradingview, Sierra, Volfix, ATAS, Multicharts, Jigsaw and other products for different trading styles.

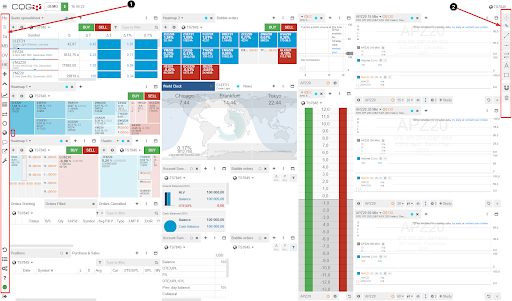

QTrader for Windows

QTrader from CQG Webtrader has a good old interface. The working space is a mosaic of customizable windows, which the user can arrange according to his preferences.

The screenshot above shows how the four windows are positioned on the workspace:

- Dom Trader window is where you can implement scalping strategies for trading futures within the day. Scalpers can make decisions on entry/withdrawal based on the depth of market dynamics (Level II). DOM Trader from CQG is equipped with the functions of one-click trading, quick position selection, ask and bid tracing, color chart customization, etc.

- Market review window.

- Chart window. Each instrument is available in a separate tab. You can change the instrument by typing the ticker on your keyboard. Candles, bars, noughts and crosses are available as well as many indicators and an exclusive CQG TFlow chart with a separation of the volume into purchase/sale and other types of charts.

- Search window for financial instruments with a separation by exchanges (over 40). Receiving data from these exchanges will likely require additional connections.

On the sides of the workspace, there are Toolbar panels with menu and quick access buttons. They are customizable. The traders thus can build their own workplace that fits best with their strategy.

QTrader allows to:

- Link windows. Changing the ticker in one window will lead to uploading of data for the specific instrument in the linked window.

- Send all popular types of orders, including Market, Limit, Stop Order, Stop Limit, Iceberg, Trailing, and also DOM-related order and algorithmic orders.

- Process data real-time in Excel

- Work with alerts

- Form reports

- Review the latest economic news, as the newsfeed is built into the platform

- Develop options trading strategies

- Connect algorithmic strategies

- Search answers in the database about working with the software, send requests to CQG customer support.

QTrader is continuously improved based on the requests of the traders. For example, its latest versions (at the time the article was being written), featured the following:

- Tracing the position of the order in the line of orders inside the depth of market;

- A function for working with seasonal trends (perfect for traders interested in agricultural markets).

Completing this short overview of QTrader, let us say that CQG Incorporated, as a company producing software for trading at the exchange, was established in 1980. And QTrader is a rather complex product with years of work behind it. In fact, a whole book can be written about the multiple functions of QTrader platform. However, this is not the purpose of our review, so let’s move to CQG Desktop.

Finally, if you are interested in CQG QTrader, you can learn about the possibilities of technical analysis on this platform by watching a video tutorial here:

CQG Desktop

Desktop is a web platform, despite the name. It is located on cqg.com domain, and written mainly in HTML5. It loads fast and the interface is modern and laconic. The theme is dark by default and during the first login, the system offers you to discover the platform’s interface.

The workspace is a table of the so-called widgets. The widgets are divided into categories:

- Chart widget. Bars, candles, lines, Heiken Ashi, Volume are available. You can add 25 classic indicators to the charts.

- Quotation widget. You can set up the market map, active instruments tables, difference observance lists and also Times and Sales feed.

- Order widget. You can view reports on the account, positions, order statistics. You can also activate the interface for sending trading orders here – both simple form and complex form with different conditions.

- Options widget.

- News Feed widget.

On the right side of the interface (2), there is a panel with drawing instruments. On the left side is a vertical panel for:

- Working with desktops (you can set up several desktops with different widgets);

- Widget launchers;

- Settings, Assistance files, connections monitoring launchers.

Compared to other web platforms, which we’ve seen, CQG Desktop has a wide set of functions, which continue to improve and increase. For example, its latest versions (at the time the article was being written), featured the following:

- Reverse option

- Notification about futures trading on the eve of expiration

- Possibility to create several orders simultaneously

- Impulse indicators and other improvements.

The advantages of CQG Desktop include DOM Trader, which is a rather advanced version for web platforms. With Internet access and a smartphone with a browser, any customer can use this module for intraday scalping in DOM (Depth Of Market).

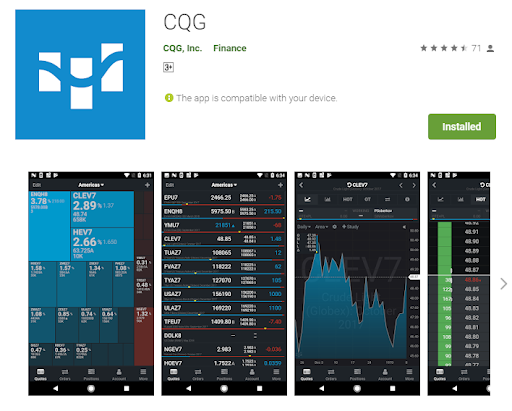

CQG Mobile

CQG Mobile is a platform for Android and iOS smartphones.

CQG Mobile has a very high rating of 4.5 on Google Play.

The interface is divided into five tabs:

- Quotes. The tables with the prices of exchange instruments, with a division by categories (there are not many instruments in the demo version, mostly futures).

- Orders. You can view active, inactive and executed orders.

- Positions.

- Account. Information on the balance, margin, floating result on current positions.

- Settings. You can discover the app, change settings of colors, currencies, notifications.

Overall, the family of CQG platforms presents a professional solution for working in the financial markets. It is unlikely to be suitable for the beginners.. The biggest disadvantage of CQG compared to Metaquotes products is a fee for use, although advanced traders will agree that quality software that provides an advantage in trader deserves to be paid for.

Analytics and market news

Analytical and news reviews are rather a strong suit of Just2Trade.

| Pros |

|---|

|

| Cons |

|---|

|

Just2Trade offers several information services:

- News by trading instruments

- Market news

- Economic calendar

- Trading Central

- Subscriptions to Analytical reviews

Let’s review each of them in more detail.

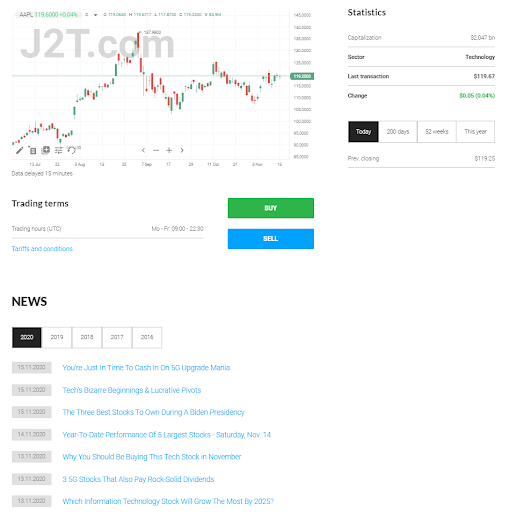

News by trading instruments

There are news items on the broker’s website, sorted by the tickers and available to all.

Here’s, for example, what you can find here: just2trade.online/tickerinfo/AAPL

Under the chart, you can read the list of news items by dates, which are related to AAPL. Taking into account that there are thousands of securities and the depth of the list is more than just one year, the customers thus receive a powerful resource for working with the news items.

More fundamental information could have been added for each ticker, but let’s admit that it is a rather specific and labor-intensive process, and the implementation costs of such a project could be borne by the consumers in the form of much higher commissions.

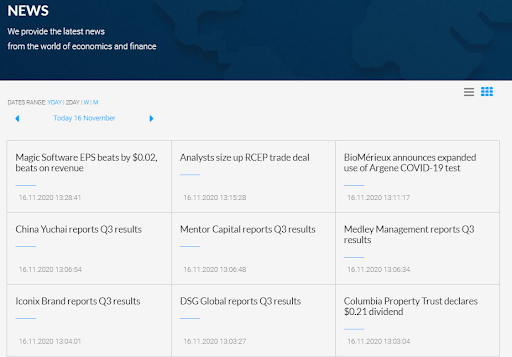

Market news

The newsfeed is also available to all here: just2trade.online/solutions/news/

The newsfeed is updated every hour. The only drawback is that some publications may be absolutely useless.

For example, below is a screenshot of the post, informing the users that Cosan reported Q3 2020 results:

As you can see, there is only the headline with no links. It seems that the broker rebroadcasts the news from a third-party source, but does it extremely ‘awkwardly’. We are hoping that the broker will soon eliminate this drawback.

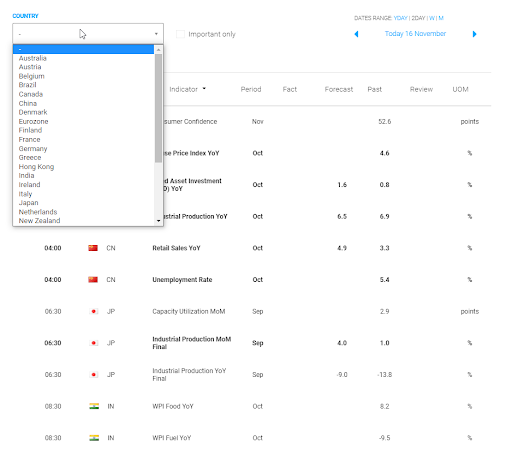

Economic calendar

Just2Trade has a rather advanced Economic calendar (just2trade.online/solutions/Calendar/). It contains more information than a usual Forex calendar. The users can sort the information in the calendar by countries and browse history.

Trading signals

Trading signals are available inside the personal account. Objectively, there is not much use for them, because:

- The signals are delivered very rarely (several signals a month or even none);

- The signals are delivered only for the American stock market.

In order to receive more ideas for trading shares, you need to have a ROX (Global Exchanges) account. The holders of these accounts can receive signals on US stocks more regularly.

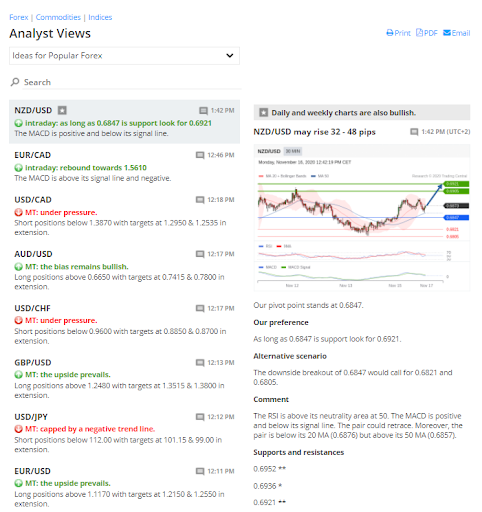

Тrading Central

Тrading Central is a much more active source of information than Trading Signals.

Тrading Central is available inside the personal account.

Analytical materials on Forex, commodity markets and stock indices are posted once a day, closer to the middle of the European session.

The broker’s customers can download a plugin for MT4 to use this information right on the chart of the platform.

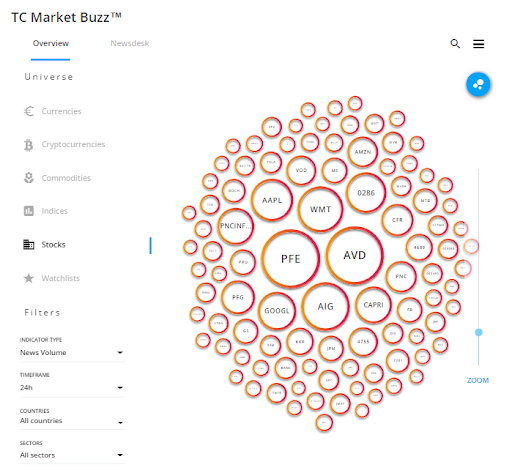

Market Buzz is another interesting solution for active stocks traders.

It is available inside the personal account of a Just2Trade customer and visually shows the map of ‘hot stocks’. The bigger the circle with the ticker, the more attention the stocks enjoy in the market. For example, from the screenshot above, it is evident that PFE is extremely active. This is due to the fact that at the time this review was being prepared Pfizer announced production of a Coronavirus vaccine, which is why its securities grew over 6% a day.

If you are following our reviews closely, you could notice that Market Buzz is also available on Forex.com platform and it looks absolutely the same.

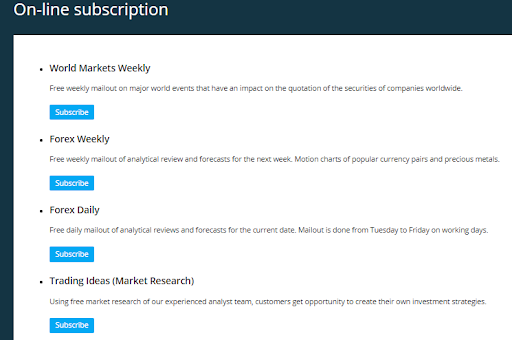

For the customers, who prefer to work via email, there are 4 subscriptions depending on the markets and frequency of newsletters.

Education

A small number of educational materials can be found in the Blog section on the broker’s website. However, these ‘tidbits’ for the beginners can unlikely be viewed as educational services.

We did not find the broker’s Youtube channel.

The only thing Just2Trade can offer in terms of education are video tutorials on MT4 and MT5 platforms. To receive them, you must be a broker’s customer and you must send a request to customer support. These tutorials are not mentioned anywhere, and we learned about their existence during our communication with a manager of customer support.

| Pros |

|---|

|

| Cons |

|---|

|

We can conclude that there are simply no educational materials, it is clearly the broker’s weak spot.

Customer support

We estimated customer support of Just2Trade as high.

| Pros |

|---|

|

| Cons |

|---|

|

Channels of communication

The broker offers four methods to contact customer support:

- By phone. There are two contact numbers – for consultations and for voice orders (Trading Desk);

- Email;

- Chat

- Internet telephony.

We recommend using internet telephony. With internet access, speakers and a microphone, you can receive responses from the managers of the support team within a minute on average after you click on the button with the phone receiver image. Technically, the call is supported by Zingaya, the call quality is good and the competence of the managers of the support team is high.

The main email of customer support is 24_support@just2trade.online. It is an advanced source of financial and technical assistance. If you can’t find the information on the website and the managers of the call center cannot help you, you need to write an email.

Languages and operating hours of customer support:

Just2Trade provides support in 5 languages:

- Russian

- English

- Spanish

- Polish (recently added)

- Chinese

| Location | Address | Phone numbers |

|---|---|---|

| For customers from Russia | 24_support@just2trade.online | Phone: +7 (495) 009-01-95 (switchboard) Trading desk: +7 (495) 796-92-68 |

| For customers from India (English) | 24_support@just2trade.online | Phone: +91 8041300555 Trading desk: +357 96 370242 |

| For customers from China | support@just2trade.cn | Phone: +86 (010) 5335-6041 Trading desk: +357 96 370242 |

| Whole world (English) | 24_support@just2trade.online | Phone: +357 25 030 442 Trading desk: +357 96 370 242 |

| For customers from Poland | 24_support@just2trade.online | Phone: +48 22 15 30 043 Trading desk: +357 96 370242 |

Email support is available 24h. The responses are sent either on the same or the following day.

Voice support in Russian and English has the longest operating hours:

- Starting from 10:00 pm of Sunday – 24h on weekdays;

- On Saturday – from 9:00 am till 4:00 pm Moscow time.

Voice support in Chinese, Polish, Spanish operates regularly, during working hours on weekdays, taking into account the region’s time zone.

There is also an additional email for customer support of ROX accounts holders – imarkets@just2trade.online.

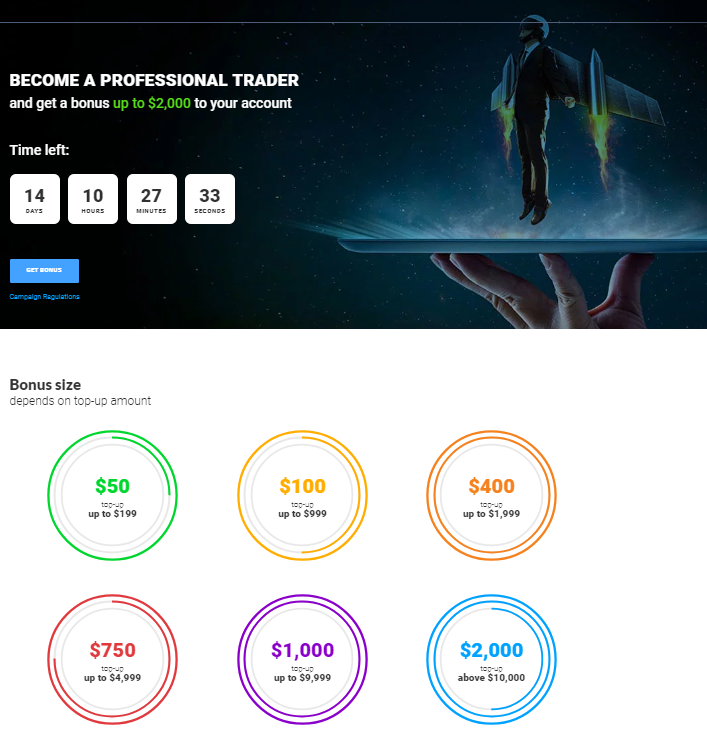

Bonuses and promo

Just2Trade does not implement many marketing campaigns with involvement of celebrities, with contests and prizes.

At the time this review was being prepared, there was only one promo offer. Within this promo, the new customers could get a bonus for topping up the account of Forex Standard type.

Partnership program is another way to receive additional bonus from working with Just2trade. If your friend opens an account with the broker upon your referral, the broker will give you a $6 bonus. And if your friend funds the account, you will get an additional bonus of $29. In fact, your bonus can be even higher, if your friend funds the account for a large amount.

Summary

Let’s summarize our review. The drawbacks that we discovered, specifically shortage of educational materials and broker’s ‘affection’ for Metatrader platforms, are fully compensated by its advantages.

We estimated Just2Trade highly due to the following reasons:

- level of commissions is lower than average;

- high quality of order execution;

- wide access to markets;

- quick account opening;

- convenient support (chat, online calls);

- a wide choice of investment opportunities.

Real reviews of Just2Trade 2025

I am pleased JUST2TRADE. A smart broker with a low initial deposit and the ability to integrate third-party trading programs through the Open API. For 10 months of cooperation with this company, my deposit has doubled! Also, they give access to IPO.

JUST2TRADE is not worthy of high marks! Too long verification, regular technical failures, problems with the execution of transactions - and these are not all the disadvantages of working with this broker.