On this page, you will find a large number of reviews from the real TeleTrade If you are already working with If you are already working with TeleTrade please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

TeleTrade Review 2021

TeleTrade is one of the largest brokers in Eastern Europe. The company has been in the market since 1994, providing not only access to financial markets, but also extensive educational services. Over time, the company has gone beyond the East European market, although remaining most popular in the former Soviet countries.

TeleTrade offers several types of trading accounts with different conditions and a rich program for learning how to trade. Financial analytics is one of the key features of the broker, more specifically a large number of videos of own production.

Over the period of its operation, the broker received 35 different awards, including Most Reliable Forex Broker of 2017 by Masterforex V EXPO, Best Broker of the CIS 2017 by IAFT Awards (International Association of Forex Traders), and Best Forex Broker for Beginners by KROUFR in 2016, etc.

The weakest spot of TeleTrade is absence of the license. The company’s license issued by the Central Bank of Russia was revoked due to the violations and since then the broker has been operating based solely on its own regulations.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

Key features of the broker

| Regulation | |

|---|---|

| Commissions and fees | |

| Not regulated | Average |

| Demo account | |

| Not regulated | Yes |

| Minimum deposit | |

| Not regulated | 1 USD |

| Inactivity fee | |

| Not regulated | Inactivity fee may be charged for withdrawal of funds. The size of the fee is unknown |

| Period for opening an account | |

| Not regulated | 5 minutes; taking into account verification – up to 2 business days |

| Leverage | |

| Not regulated | Up to 1:500 |

| Markets | |

| Not regulated | Forex, CFD |

| Options for passive income | |

| Not regulated | Copy trading |

| Support languages | |

| Not regulated | Russian, English, Spanish |

| Withdrawal fee | |

| Not regulated | Depends on the payment system |

| Withdrawal to credit/debit card | |

| Not regulated | Yes |

| Deposit and withdrawal via cryptocurrencies | |

| Not regulated | Yes |

| Deposit from electronic wallets | |

| Not regulated | Yes |

| Account currencies | |

| Not regulated | USD, EUR, GBP, BTC |

| Deposit bonus | |

| Not regulated | 100% |

| Regulation | Not regulated |

|---|---|

| Commissions and fees | Average |

| Demo account | Yes |

| Minimum deposit | 1 USD |

| Inactivity fee | Inactivity fee may be charged for withdrawal of funds. The size of the fee is unknown |

| Period for opening an account | 5 minutes; taking into account verification – up to 2 business days |

| Leverage | Up to 1:500 |

| Markets | Forex, CFD |

| Options for passive income | Copy trading |

| Support languages | Russian, English, Spanish |

| Withdrawal fee | Depends on the payment system |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | Yes |

| Deposit from electronic wallets | Yes |

| Account currencies | USD, EUR, GBP, BTC |

| Deposit bonus | 100% |

Page content

Geography of broker’s customers

Eastern Europe is the key market for TeleTrade. The broker has its roots in Russia, which is why there is no surprise that the customers from Russia are its main audience. In addition, TeleTrade has a branch and many customers in Ukraine. These two countries account for the core audience of TeleTrade. The broker also has customers in other countries, although their number is smaller. In particular, TeleTrade works with customers from Kazakhstan, Bulgaria and Romania. Over the past year, the broker has actively worked on expanding in the Southeast Asia market, increasing the audience in Malaysia, Thailand and India.

| Country | |

|---|---|

| Russia | |

| Percentage of customers | 35.12% |

| Ukraine | |

| Percentage of customers | 12.65% |

| Kazakhstan | |

| Percentage of customers | 5.06% |

| Romania | |

| Percentage of customers | 3.11% |

| Bulgaria | |

| Percentage of customers | 2.98% |

| Malaysia | |

| Percentage of customers | 1.71% |

| Thailand | |

| Percentage of customers | 1.23% |

| India | |

| Percentage of customers | 1.17% |

| Country | Percentage of customers |

|---|---|

| Russia | 35.12% |

| Ukraine | 12.65% |

| Kazakhstan | 5.06% |

| Romania | 3.11% |

| Bulgaria | 2.98% |

| Malaysia | 1.71% |

| Thailand | 1.23% |

| India | 1.17% |

Commissions and fees

TeleTrade offers an average level of commission on Forex and CFD markets. The commission system of the broker is based on the spread, although also commission on traded volume is applied on the ECN and NDD accounts. We have analyzed all types of the broker’s accounts, compared them with each other and with the competitors. Let us share the results of our analysis.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

Summary of commissions and fees on TeleTrade

| Asset | |

|---|---|

| EUR/USD | |

| Commissions* | Average spread on the Standard account is 1.8 pips, on the NDD account – 1 pips +0.007% of the traded volume, on the ECN account – 0.4 pips + 0,008% of the traded volume. |

| Apple | |

| Commissions* | The broker’s commission on the Standard account is included in the floating spread, on the NDD account – 0.1% + floating spread |

| CFD on S&P 500 | |

| Commissions* | On the Standard account – floating spread with an average value of 1.5, on the NDD account – 0.007% commission + floating spread with an average value of 1.4 |

| BTC/USD | |

| Commissions* | On the Standard account – floating spread with a minimum value of 36.2, on the NDD account – 0.1% commission + floating spread with a minimum value of 28.5 |

| Non-trading commissions | |

| Commissions* | There is a withdrawal fee that depends on the payment system. Inactivity fee may be charged during the withdrawal of funds at the broker’s discretion. |

| Asset | Commissions* |

|---|---|

| EUR/USD | Average spread on the Standard account is 1.8 pips, on the NDD account – 1 pips +0.007% of the traded volume, on the ECN account – 0.4 pips + 0,008% of the traded volume. |

| Apple | The broker’s commission on the Standard account is included in the floating spread, on the NDD account – 0.1% + floating spread |

| CFD on S&P 500 | On the Standard account – floating spread with an average value of 1.5, on the NDD account – 0.007% commission + floating spread with an average value of 1.4 |

| BTC/USD | On the Standard account – floating spread with a minimum value of 36.2, on the NDD account – 0.1% commission + floating spread with a minimum value of 28.5 |

| Non-trading commissions | There is a withdrawal fee that depends on the payment system. Inactivity fee may be charged during the withdrawal of funds at the broker’s discretion. |

* Information in the Commissions section has been taken from teletrade.org website. Please note that the broker has regional domains, where the conditions might slightly differ.

Commission on Forex market

We have determined TeleTrade’s commission on the Forex market as average or higher than average. At that, for different types of accounts, not only the size of the commissions, but also the approaches to charging them differ.

TeleTrade MT4-Standard account. Floating spread is used.

TeleTrade MT4-NDD account. Floating spread and 0.007% commission on the traded volume.

TeleTrade MT5-ECN account. Floating spread and 0.008% commission on the traded volume.

We have calculated how much a trader will have to pay for a trade of 100,000 units of base currency. In the table below, we provide the amount, which includes all spreads and commissions.

| EURUSD | |

|---|---|

| Standard | 18 USD |

| NDD | 19.2 USD |

| ECN | 12 USD |

| USDJPY | |

| Standard | 18 USD |

| NDD | 18.4 USD |

| ECN | 13.7 USD |

| GBPUSD | |

| Standard | 21 USD |

| NDD | 22 USD |

| ECN | 17.39 USD |

| AUDJPY | |

| Standard | 37 USD |

| NDD | 18.3 USD |

| ECN | 18.03 USD |

| EURCHF | |

| Standard | 31.7 USD |

| NDD | 29.2 USD |

| ECN | 23.63 USD |

| USDZAR | |

| Standard | 65.6 USD |

| NDD | 61.34 USD |

| ECN | 56.24 USD |

| Standard | NDD | ECN | |

|---|---|---|---|

| EURUSD | 18 USD | 19.2 USD | 12 USD |

| USDJPY | 18 USD | 18.4 USD | 13.7 USD |

| GBPUSD | 21 USD | 22 USD | 17.39 USD |

| AUDJPY | 37 USD | 18.3 USD | 18.03 USD |

| EURCHF | 31.7 USD | 29.2 USD | 23.63 USD |

| USDZAR | 65.6 USD | 61.34 USD | 56.24 USD |

As you can see, the broker’s commissions do not differ much on different accounts, which is why other parameters must be taken into account, when choosing the account type. For example, ECN accounts are distinguished by increased reliability due to the minimum interference of the broker in the trading and better quotations on the market. ECN is a centralized system of liquidity suppliers and traders, which many professional traders prefer to choose. In addition, the broker offers the MT5 platform for the ECN account, which is better suitable for trading with advisors.

In order to understand how much TeleTrade commissions differ from its competitors, we compared them with those of Forex Club and RoboForex. We used the purchase of a lot of 100,000 units of base currency on Standard accounts of each other broker as an example. All commissions and spreads of the brokers have been included.

| EURUSD | |

|---|---|

| TeleTrade | 18 USD |

| Forex Club | 7 USD |

| RoboForex | 16 USD |

| EURGBP | |

| TeleTrade | 21 USD |

| Forex Club | 7 USD |

| RoboForex | 23.26 USD |

| USDZAR | |

| TeleTrade | 65.6 USD |

| Forex Club | 50 USD |

| RoboForex | 57.48 USD |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| EURUSD | 18 USD | 7 USD | 16 USD |

| EURGBP | 21 USD | 7 USD | 23.26 USD |

| USDZAR | 65.6 USD | 50 USD | 57.48 USD |

As you can see, TeleTrade charges much higher commissions than Forex Club, but they are at approximately the same level as RoboForex. The difference is that RoboForex has special accounts with much lower commissions, while all types of accounts on TeleTrade have similar conditions.

SWAP

As a reminder, a swap is a rollover interest that you earn or pay for holding your positions overnight. It is caused by the difference in the rates of financing of the issuer banks of the currencies in a currency pair. Brokers can also charge an additional service fee on top of swap. If the swap is positive, the money is accrued on your account, if it is negative – the funds are written off. Long-term investors try to work with positive swaps.

We estimated TeleTrade swap as average in the market, which makes medium-term trading with this broker justified.

| Instrument | |

|---|---|

| EURUSD | |

| Swap long rate | -2.84 |

| Swap short rate | 0.69 |

| EURGBP | |

| Swap long rate | -2.36 |

| Swap short rate | 0.36 |

| USDJPY | |

| Swap long rate | -0.48 |

| Swap short rate | -1.61 |

| Instrument | Swap long rate | Swap short rate |

|---|---|---|

| EURUSD | -2.84 | 0.69 |

| EURGBP | -2.36 | 0.36 |

| USDJPY | -0.48 | -1.61 |

Many brokers offer traders from Muslim countries a swap free option, as it is prohibited to receive profit on interest in Islam. In this case, the swap can be replaced with a fixed fee.

Swap free option on TeleTrade and its competitors

| Swap free | |

|---|---|

| TeleTrade | Yes* |

| Forex Club | Yes |

| RoboForex | Yes |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Swap free | Yes* | Yes | Yes |

* This option is not specified on the broker’s website. To receive advice on opening an Islamic account, we advise you to contact customer support.

Commissions on metals (Spot)

TeleTrade offers precious metals trading in pairs with some major currencies. The estimated the spreads on the market as average. As an example, let’s company how much a trader will have to pay for the purchase of a XAU/USD lot in the amount of 0.1 contract (10 Troy ounces) on the Standard account on TeleTrade, Forex Club and RoboForex.

| XAU/USD | |

|---|---|

| TeleTrade | 4.5 USD |

| Forex Club | 2.85 USD |

| RoboForex | 3.8 USD |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| XAU/USD | 4.5 USD | 2.85 USD | 3.8 USD |

In case of precious metals trading, comparison of commission, once again, does not speak in favor of TeleTrade.

Commissions on CFDs

Contracts for differences (CFDs) make up the bulk of the trading instruments offered by the broker. As a reminder, it is a high-risk marginal product, which should be regarded with caution. We will review CFDs on stocks and cryptocurrencies in separate sections.

As for the level of TeleTrade commissions on the CFD market, we determined them as higher than average. The commission system is based on the floating spread on the Standard account, and the floating spread and commission on traded volume on the NDD and ECN accounts.

Let’s compare the commissions on CFDs on three types of broker’s accounts. As an example, we will use the purchase of a $5,000 lot. The amount includes both the average spread and the commission on traded volume.

Comparison of commission on different accounts on TeleTrade

| Market | |

|---|---|

| CFD on S&P 500 | |

| Standard | 2.37 USD |

| NDD | 2.43 USD |

| ECN | 1.44 USD |

| CFD on Brent | |

| Standard | 17.88 USD |

| NDD | 17.09 USD |

| ECN | 17.09 USD |

| Market | Standard | NDD | ECN |

|---|---|---|---|

| CFD on S&P 500 | 2.37 USD | 2.43 USD | 1.44 USD |

| CFD on Brent | 17.88 USD | 17.09 USD | 17.09 USD |

Let’s also compare the level of TeleTrade commissions with those of Forex Club and RoboForex. For comparison, we also used the purchase of a $5,000 lot on the same markets.

| Market | |

|---|---|

| CFD on S&P 500 | |

| TeleTrade | 2.37 USD |

| Forex Club | 1.5 USD |

| RoboForex | 1.33 USD |

| CFD on Brent | |

| TeleTrade | 17.88 USD |

| Forex Club | 6.5 USD |

| RoboForex | 6.78 USD |

| Market | TeleTrade | Forex Club | RoboForex |

|---|---|---|---|

| CFD on S&P 500 | 2.37 USD | 1.5 USD | 1.33 USD |

| CFD on Brent | 17.88 USD | 6.5 USD | 6.78 USD |

Conclusion: TeleTrade commissions on the CFD market are much higher than those of the competitors.

CFD on cryptocurrencies

The broker’s commission on the cryptocurrency market consists of the floating spread and also commission on the traded volume on the NDD account. This asset cannot be traded on the ECN account. We determined the level of commissions as low for the BTCUSD pair and average for other digital assets.

Noteworthy, this market carries an increased risk for the traders due to high volatility and also the factor that TeleTrade operates only Monday through Friday, while the trading on cryptocurrency exchanges does not stop on the weekends. Due to the possibility of a sharp change of the price over the weekend, a trader can get a price gap on Monday, which threatens large financial losses. Due to this, we do not recommend trading cryptocurrencies with a big leverage or leave positions for the weekend.

Let’s compare how much a trader will have to pay for the purchase of a $2,000 lot in cryptocurrency on TeleTrade and its competitors, on the Standard account. The commission amount includes both the spreads and other commissions.

TeleTrade commissions on cryptocurrency trading

| BTCUSD | |

|---|---|

| TeleTrade | 7.14 USD |

| Forex Club | 8 USD |

| RoboForex | 8.56 USD |

| ETHUSD | |

| TeleTrade | 12.23 USD |

| Forex Club | 8 USD |

| RoboForex | 8.22 USD |

| LTCUSD | |

| TeleTrade | 22.85 USD |

| Forex Club | 19.24 USD |

| RoboForex | 8.36 USD |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| BTCUSD | 7.14 USD | 8 USD | 8.56 USD |

| ETHUSD | 12.23 USD | 8 USD | 8.22 USD |

| LTCUSD | 22.85 USD | 19.24 USD | 8.36 USD |

We have established that trading bitcoin on TeleTrade is quite beneficial and the commission is lower than the one charged by the competitors. At the same time, RoboForex and Forex Club offer better conditions for the majority of other cryptocurrency pairs.

CFD on stocks

Stock market on TeleTrade is available through CFDs. On the Standard account, the commission is included in the floating spread, which on the NDD account, an additional commission of 0.1% on the traded volume is applied. We determined the level of the broker’s commissions on the Standard account as low and on the NDD account as average.

As an example, let’s compare a purchase of CFDs on popular stocks via TeleTrade, Forex Club and RoboForex for the amount of $5,000. The specified commission amount in the table includes the spread and commission of all three brokers.

TeleTrade commissions on stock trading

| USA. CFD on Apple | |

|---|---|

| TeleTrade | 1.77 USD |

| Forex Club | 14.62 USD |

| RoboForex | 2.65 USD |

| USA. СFD on Coca-Cola | |

| TeleTrade | 3.06 USD |

| Forex Club | 7.59 USD |

| RoboForex | 4.08 USD |

| USA. CFD on IBM | |

| TeleTrade | 3.69 USD |

| Forex Club | 5.65 USD |

| RoboForex | 3.69 USD |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| USA. CFD on Apple | 1.77 USD | 14.62 USD | 2.65 USD |

| USA. СFD on Coca-Cola | 3.06 USD | 7.59 USD | 4.08 USD |

| USA. CFD on IBM | 3.69 USD | 5.65 USD | 3.69 USD |

Copy trading service

Investing into the copy trading service is the key option for passive income on TeleTrade platform. The service enables traders to connect to the accounts of the most successful traders via their personal account and copy their trades.

Financial conditions for copy trading on TeleTrade:

- The broker does not set a charge for the use of the service for the investors;

- The investor pays a set commission based on the profit to the trader, which ranges from 1% to 50%. The standard commission is 10-30%. The commission is set by the trader;

- The broker charges a commission per trade and 40% of the trader’s profit.

Non-trading commissions

The broker has a rather unorthodox approach to charging the inactivity fee. The fee is not specified directly, however, the customers may be charged with an additional fee when they withdraw funds. “If you request to withdraw funds without trading activity, TeleTrade retains the right to charge additional commissions,” reads the broker’s statement.

Deposits via wire transfers are not charged with a fee, but there is a withdrawal fee regardless of the method you choose.

| Inactivity fee | |

|---|---|

| TeleTrade | Yes |

| Forex Club | No |

| RoboForex | No |

| Withdrawal fee | |

| TeleTrade | Yes |

| Forex Club | No |

| RoboForex | No |

| Deposit fee | |

| TeleTrade | No |

| Forex Club | No |

| RoboForex | No |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Inactivity fee | Yes | No | No |

| Withdrawal fee | Yes | No | No |

| Deposit fee | No | No | No |

In terms of non-trading commissions, TeleTrade does not compare favorably with the competitors. RoboForex and Forex Club offer methods of deposit and withdrawal with no fees, and also do not charge inactivity fee directly or indirectly.

Reliability and regulation

Broker’s reliability is one of the key factors of choice. Experience in the market since 1994 speaks in favor of TeleTrade. However, there are issues with all other criteria. By this indicator, TeleTrade is ranked low.

The broker is managed by Teletrade D.J. Limited, registered in Saint Vincent and the Grenadines. This country is one of the top world’s offshore territories for financial companies. TeleTrade does not provide a scanned copy of its state registration, but does publish the number of the document – 20599 IBC 2012. Also, the legal address of the company is known – First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

As for the licenses, there are some serious questions here for TeleTrade. Up until 2018, the broker operated based on the license for financial activity issued by the Central Bank of Russia. However, in 2018, the Central Bank of Russia revoked the licenses of the largest non-banking brokers and TeleTrade was on the list. The reason was the numerous violations by the brokers. There is no information about other licenses of the broker on its official website. Also, financial regulators of Ukraine and some other countries have issued warnings about TeleTrade operating without the license.

We contacted TeleTrade’s customer support to clarify the situation with the licenses. The broker’s representatives responded that Saint Vincent and the Grenadines jurisdiction, where the managing company is registered, allows it to operate without additional licenses for financial activity. Thus, a conclusion can be drawn that TeleTrade does not have a license. Therefore, the customers of the organization are not protected in any way.

The broker has Stop Out at the level of 0% of the deposit. The company is not a member of a deposit guarantee fund.

Markets and products

TeleTrade offers its customers access to currency pairs on Forex and CFDs on a wide range of assets. The broker provides access to the cryptocurrency market, which is a rare thing among classic brokers and definitely an advantage. There is also a good choice of stocks and commodities here.

The biggest disadvantage of TeleTrade is absence of direct access to the markets. All types of trading assets the broker offers are available as contracts for differences. Let us remind you that CFDs are a high risk marginal instrument and the rules of risk management must be strictly observed when trading them.

Also, it is worth pointing out a small number of instruments for passive income in the range of the broker’s services. Factually, there is only one – copy trading service.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

Overall, the choice of trading instruments on TeleTrade is sufficient for the beginners, but for the professional players, the number and depth of the market access is at an average level.

Comparison on the market availability on TeleTrade, Forex Club and RoboForex

| Forex | |

|---|---|

| TeleTrade* | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Stocks | |

| TeleTrade* | No |

| Forex Club | No |

| RoboForex | No |

| CFD | |

| TeleTrade* | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Crypto | |

| TeleTrade* | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Bonds | |

| TeleTrade* | No |

| Forex Club | No |

| RoboForex | No |

| Futures and options | |

| TeleTrade* | No |

| Forex Club | No |

| RoboForex | No |

| Commodities (oil, metals, wheat, gas, ores, etc.) | |

| TeleTrade* | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Mutual funds | |

| TeleTrade* | No |

| Forex Club | No |

| RoboForex | No |

| ETF | |

| TeleTrade* | No |

| Forex Club | Yes |

| RoboForex | No |

| TeleTrade* | Forex Club | RoboForex | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | No | No | No |

| CFD | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Bonds | No | No | No |

| Futures and options | No | No | No |

| Commodities (oil, metals, wheat, gas, ores, etc.) | Yes | Yes | Yes |

| Mutual funds | No | No | No |

| ETF | No | Yes | No |

* – available only as CFDs

Forex market

TeleTrade offers access to many Forex pairs. Their total number is 59. Here, you will find all major currency pairs, such as EURUSD, USDJPY, USDCHF, GBPUSD, and also a rather wide selection of cross rates. For example:

- NZDCHF;

- GBPNZD;

- GBPJPY;

- EURJPY;

- EURCHF;

- EURGBP etc.

Exotic pairs on TeleTrade are better represented than on the competitors’ platforms from today’s review. For example, TeleTrade has the trading pairs with the following types of currencies:

- NOK;

- SGD;

- RUB;

- HUF;

- SEK;

- CNH;

- DKK;

- PLN;

- TRY.

The number of trading pairs on TeleTrade is higher than average. The broker compares favorably with RoboForex, which mainly has popular trading pairs and cross rates, but nearly no exotic currencies. In addition, TeleTrade offers more pairs than Forex Club, winning thanks to the rare pairs.

| Number of trading pairs | |

|---|---|

| TeleTrade | 59 |

| Forex Club | 5 |

| RoboForex | 40 |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Number of trading pairs | 59 | 5 | 40 |

CFD market

The broker also offers a wide selection of CFDs. The total number of types of contracts is 161. Let’s review the types of derivatives on different assets.

CFD on stocks

TeleTrade offers 105 CFDs on stocks. In the list, you will find the stocks of top American, European and Russian corporations. There are Asian companies on the list as well, but not many.

| Number of CFDs on stocks | |

|---|---|

| TeleTrade | 105 |

| Forex Club | 152 |

| RoboForex | 52 |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Number of CFDs on stocks | 105 | 152 | 52 |

Conclusion. The choice of CFD on TeleTrade is average, although the broker is behind its competitor, Forex Club, by this indicator. However, it offers twice more contracts than available on the Standard account on RoboForex. The one thing should be added, however. RoboForex provides a possibility to trade over 10,000 real shares via RTrader platform.

CFDs on stock indices

TeleTrade also offers derivatives on indices. Their number is average, at 13. For example, on TeleTrade, you can use the following types of trading instruments from this group:

- US500;

- US30;

- USTech100;

- Eur50;

- CHN_H50 and others.

| Number of CFDs on indices | |

|---|---|

| TeleTrade | 13 |

| Forex Club | 24 |

| RoboForex | 4 |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Number of CFDs on indices | 13 | 24 | 4 |

The choice of CFDs on stock indices on TeleTrade is good, but not the best. For example, Forex Club offered almost twice as many options, although compared to RoboForex, TeleTrade does offer a good choice.

CFD on cryptocurrencies

Diversity of cryptocurrencies is also worth mentioning. There are 19 trading pairs in total. The broker offers access to trading the following types of cryptocurrencies:

- BTC;

- BCH;

- ETH;

- IOT;

- LTC;

- XLM

- XRP;

- TRX etc.

However, it is worth noting that only the trading pairs of the cryptocurrencies with USD are available.

| Number of cryptocurrencies | |

|---|---|

| TeleTrade | 19 |

| Forex Club | 10 |

| RoboForex | 50 |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Number of cryptocurrencies | 19 | 10 | 50 |

Conclusion. Compared to the competitors, market availability is average. TeleTrade offers more cryptocurrencies than RoboForex, but fewer than Forex Club.

Commodities

Commodities on TeleTrade are represented with metals, raw materials and energies. Noteworthy, all types of commodities available for trading are available only as CFDs.

The broker offers access to three types of energies – Brent oil, natural gas and WTI oil. There are 8 types of contracts on raw materials and agricultural commodities. In particular, you can trade the following types of instruments:

- Cocoa_US;

- Cocoa_UK;

- Coffee_AR;

- Coffee_R;

- Cotton;

- Orange;

- Sugar_R;

- Sugar_W.

There are 24 instruments and trading pairs in commodities on TeleTrade. By this indicator, the broker compares favorably with many competitors. In particular, the number of contracts on commodities on TeleTrade is bigger than on Forex Club and much bigger than on RoboForex.

| Number of commodities | |

|---|---|

| TeleTrade | 24 |

| Forex Club | 17 |

| RoboForex | 8 |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Number of commodities | 24 | 17 | 8 |

Opening an account

You will need only a minute to open an account on TeleTrade. The procedure is elementary, fully automated and does not involve any difficulties. In addition, TeleTrade has many types of trading accounts, including ECN and cryptocurrency accounts. Also, a demo account is available.

There is only one drawback in terms of this aspect of the broker – low number of base fiat currencies. It is hard to find other substantial drawbacks in terms of registration and trading accounts on TeleTrade.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

What is the minimum deposit on TeleTrade?

There is no minimum deposit requirement on TeleTrade. You can start trading with $1. The broker also does not have any restrictions on minimum transactions, depending on the payment methods. Therefore, TeleTrade is well suited for the beginners and customers with small capital.

Absence of requirements for minimum deposit, however, cannot be considered a serious advantage of TeleTrade. For example, Forex Club also does not have any requirements, while the minimum deposit on RoboForex is set at mere $10

Minimum deposit on TeleTrade, Forex Club and RoboForex

| Minimum deposit | |

|---|---|

| TeleTrade | 1 USD |

| Forex Club | 1 USD |

| RoboForex | 10 USD |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Minimum deposit | 1 USD | 1 USD | 10 USD |

Citizens of which countries cannot trade on TeleTrade

TeleTrade has several branches, and each of them has its own regional restrictions. To find out more, we recommend that you contact TeleTrade customer service.

Documents required for opening an account

Verification is mandatory on TeleTrade. You won’t be able to perform financial transactions on the platform without it. In order to verify your account, you will need to upload proof of identity. TeleTrade accepts the following types of documents:

- passport;

- ID card;

- Residence permit.

You need to provide the number of the document the first time you fund your account and upload a scanned copy of it to the service after that. Noteworthy, proof of residence is not required.

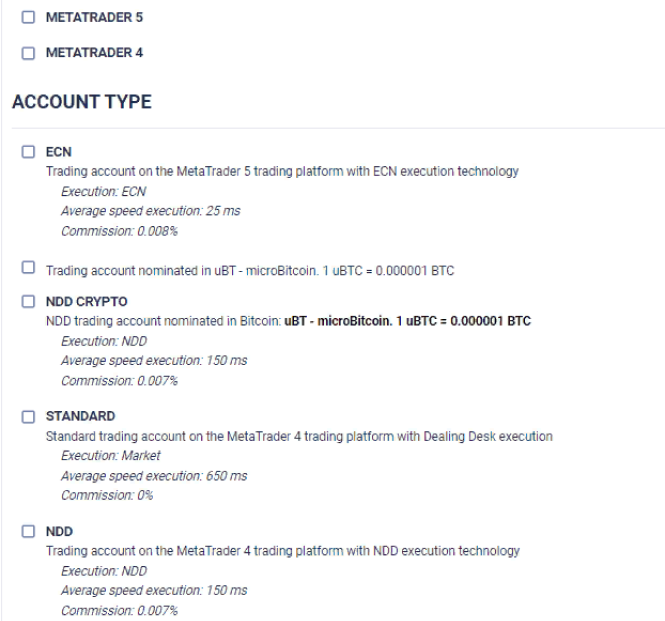

Account types

TeleTrade offers its customers four types of real accounts, including:

- Cent;

- NDD;

- Sharp ECN;

- Cryptocurrency account.

The first type of the account, Cent, envisages a possibility to trade with a small deposit. By depositing $10 on your account, you receive 1,000 cents and can use them to trade

NDD (No Dealing Desk) (trading account provides access to interbank liquidity, although there are spreads and commissions here. In addition, marginal trading becomes available to the users on this account.

The third account type – Sharp ECN provides customers with expanded possibilities. The users, who open this type of account can use additional timeframes, analytical instruments, indicators and receive access to two systems of order accounting.

The special feature of TeleTrade is the cryptocurrency account. You can use Bitcoin as the base currency. The trading conditions on the cryptocurrency account correspond to the conditions of the Professional account.

Demo account

Demo account is available to customers on TeleTrade. The company provides it for free and without any time limits. It takes one minute to open a demo account. The registration form is very simple. TeleTrade provides the following options for a demo account:

- MT4 – Cent;

- MT4 – NDD;

- MT5 – Sharp ECN.

This way, you can test all types of trading accounts without opening a real account. The Demo Account button stands separately from the main registration. Demo account can be opened without opening a real account.

Trading account

TeleTrade offers four main types of accounts for its customers. Below is a detailed review of each of them.

Cent

- Trading platform: МТ4

- Base currency options: USD, EUR.

- Instruments: 59 currency pairs, CFDs on cryptocurrencies, stocks, commodities.

- Minimum deposit — 10 USD.

- Commission on traded volume: no.

- Commission per lot: no

- Spread on EURUSD: floating, 1.8 pips.

- Minimum lot — 0,1.

- Leverage — unavailable.

- Stop Out — 0% of the deposit amount.

NDD

- Trading platform: МТ4

- Base currency options: USD, EUR.

- Instruments: 59 currency pairs, CFDs on cryptocurrencies, stocks, commodities.

- Minimum deposit — 1 USD.

- Commission on traded volume: no.

- Commission per lot: 0.007%

- Spread on EURUSD: floating, 1.0 pips.

- Minimum lot — 0,1.

- Leverage — 1:500.

- Stop Out — 0% of the deposit amount.

Sharp ECN

- Trading platform: МТ5

- Base currency options: USD, EUR

- Instruments: 59 currency pairs, CFDs on cryptocurrencies, stocks, commodities.

- Minimum deposit — 1 USD.

- Commission on traded volume: no.

- Commission per lot: 0.008%

- Spread on EURUSD: floating, 0.4 pips.

- Minimum lot — 0.1.

- Leverage — 1:500.

- Stop Out — 0% of the deposit amount.

Cryptocurrency

- Trading platform: МТ4

- Base currency options: BTC.

- Instruments: 59 currency pairs, CFDs on cryptocurrencies, stocks, commodities.

- Minimum deposit — 1 BTC.

- Commission on traded volume: no.

- Commission per lot: 0.007%

- Spread on EURUSD: floating 1.0.

- Minimum lot — 0.1.

- Leverage — 1:500.

- Stop Out — 0% of the deposit amount.

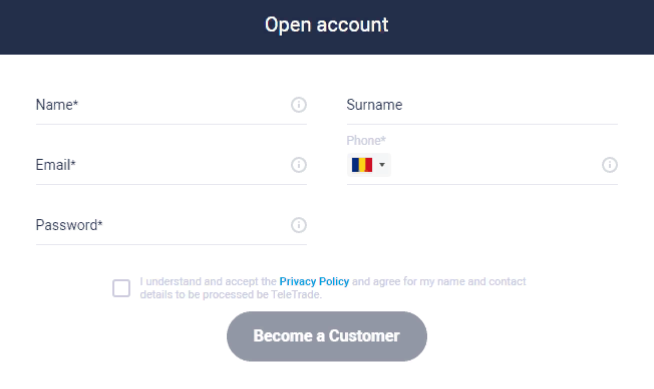

How to open an account on TeleTrade: step-by-step guide

It is very easy to open an account on TeleTrade. There are only two steps. Let’s review the procedure in more detail

Step 1. Create an account

In order to register with the broker, you need to fill out a simple form. It includes the following boxes:

- Name

- Surname

- Password

- Phone number

You also need to accept the Privacy Policy of the broker and press Become a Customer button. You will be offered to confirm your phone number using a code that will be sent to you as a text message. To activate the account, you need to follow the link that will be sent to you in an email.

Step 2. Choosing the account type

After you register, you need to choose your account type. For this, you need to go to the Fund Account tab, where the broker will offer you to choose a suitable account. In addition, you can choose here the suitable platform (MT4 or MT5), preferred leverage and account currency.

Step 3. Account verification

To start trading, you need to verify your account and provide the broker with the scanned copies of the documents. We’ve already described the procedure and list of documents above.

Base currencies

There are only three base currencies on TeleTrade. The list includes:

- USD;

- EUR;

- GBP.

Deposits and withdrawals in other currencies will cause conversion expenses.

TeleTrade, however, does offer one important edge – you can use Bitcoin as a base currency. The competitors do not offer this option. In addition, it is possible to fund the account, using the currencies of some Asian countries: IDR, MYR, VND, THB. These currencies, however, cannot be used as base; they are automatically converted into the base currency that you chose.

Noteworthy, the broker has not adjusted the list of currencies to suit its core audience. For example, there are no RUB or UAH on TeleTrade despite the fact that the majority of the broker’s customers come from Russia and Ukraine.

| Number of base currencies | |

|---|---|

| TeleTrade | 4 |

| Forex Club | 3 |

| RoboForex | 15 |

| List of base currencies | |

| TeleTrade | USD, EUR, GBP, BTC |

| Forex Club | USD, EUR, RUB |

| RoboForex | USD, EUR, GBP, GOLD, BTC, Tether OMNI, TRON, BCH, BSV, DASH, EOS, ETH, LTC, XMR, NEO |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Number of base currencies | 4 | 3 | 15 |

| List of base currencies | USD, EUR, GBP, BTC | USD, EUR, RUB | USD, EUR, GBP, GOLD, BTC, Tether OMNI, TRON, BCH, BSV, DASH, EOS, ETH, LTC, XMR, NEO |

RUB is available as a base currency on Forex Club, while gold and a number of cryptocurrencies in addition to BTC can be used on RoboForex.

Deposit and withdrawal

The choice of deposit and withdrawal methods on TeleTrade is comparatively small. In particular, you can deposit and withdraw funds via a wire transfer. The broker supports Visa and Mastercard debit/credit cards. Also three electronic payment systems are supported:

- Neteller;

- Skrill;

- FasaPay.

In addition, local wire transfers are available for the customers from Malaysia, Thailand, Vietnam and India. Deposit and withdrawal fees depend on the payment service you choose. Transactions via debit/credit cards or electronic wallets are instant, while a wire transfer will take some time (up to 3 bank days).

Overall, the choice of payment services is not so big on TeleTrade. The broker’s drawback is that it does not support several major payment systems, such as PayPal, WebMoney, Yandex.Money.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

Methods and timeframe for deposits

| Method of deposit | |

|---|---|

| Wire transfer | |

| Fee | 0% |

| Timeframe | From 2 to 3 days |

| Visa and MasterCard cards | |

| Fee | 3.5% |

| Timeframe | Up to 15 minutes |

| FasaPay | |

| Fee | 0.5% (max 5 USD) |

| Timeframe | Up to 15 minutes |

| Neteller | |

| Fee | 3.9% + 0.29 USD |

| Timeframe | Up to 15 minutes |

| Skrill | |

| Fee | 3.5% |

| Timeframe | Up to 15 minutes |

| Method of deposit | Fee | Timeframe |

|---|---|---|

| Wire transfer | 0% | From 2 to 3 days |

| Visa and MasterCard cards | 3.5% | Up to 15 minutes |

| FasaPay | 0.5% (max 5 USD) | Up to 15 minutes |

| Neteller | 3.9% + 0.29 USD | Up to 15 minutes |

| Skrill | 3.5% | Up to 15 minutes |

By the number of methods of deposit and withdrawal of funds, TeleTrade is behind its competitors, mostly due to the small number of payment systems it supports. TeleTrade has the support of only three, while Forex Club and RoboForex have six each.

| Wire transfer | |

|---|---|

| TeleTrade | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Visa and MasterCard credit/debit cards | |

| TeleTrade | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Electronic payment systems | |

| TeleTrade | 3 |

| Forex Club | 6 |

| RoboForex | 6 |

| Cryptocurrencies | |

| TeleTrade | Yes |

| Forex Club | No |

| RoboForex | Yes |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard credit/debit cards | Yes | Yes | Yes |

| Electronic payment systems | 3 | 6 | 6 |

| Cryptocurrencies | Yes | No | Yes |

Methods of withdrawal and fees

As for the withdrawal of funds, the same payment methods are available on TeleTrade as for deposit. The withdrawal fee is charged, and it is very high for the wire transfer – from USD 80. The minimum withdrawal amount via a wire transfer is set at USD 500. The timeframe is also rather long. Even for withdrawals via electronic wallets, you will have to wait for a least a day.

| Method of withdrawal | |

|---|---|

| Wire transfer | |

| Withdrawal fee | 80-150 USD |

| Timeframe | From 2 to 3 days |

| Wire transfer (SEPA) | |

| Withdrawal fee | 1-15 EUR |

| Timeframe | From 2 to 3 days |

| Visa and MasterCard credit/debit cards | |

| Withdrawal fee | 2.35% + 1 EUR/1.30 USD |

| Timeframe | From 1 to 2 days |

| FasaPay | |

| Withdrawal fee | 0.5% |

| Timeframe | From 1 to 2 days |

| Neteller | |

| Withdrawal fee | 2% |

| Timeframe | From 1 to 2 days |

| Skrill | |

| Withdrawal fee | 1% |

| Timeframe | From 1 to 2 days |

| Method of withdrawal | Withdrawal fee | Timeframe |

|---|---|---|

| Wire transfer | 80-150 USD | From 2 to 3 days |

| Wire transfer (SEPA) | 1-15 EUR | From 2 to 3 days |

| Visa and MasterCard credit/debit cards | 2.35% + 1 EUR/1.30 USD | From 1 to 2 days |

| FasaPay | 0.5% | From 1 to 2 days |

| Neteller | 2% | From 1 to 2 days |

| Skrill | 1% | From 1 to 2 days |

Trading platforms

The choice of trading platforms on TeleTrade is standard. The company proves classic platforms MetaTrader 4 and MetaTrader 5. At that, they are available for different types of accounts. In particular, MetaTrader 5 is available only for ECN accounts. TeleTrade provides the following versions of the platforms:

- Web;

- Desktop (Windows);

- Mobile for Android;

- Mobile iOS;

- Mobile iPad;

- Mobile iPod Touch.

The use of classic trading platforms can be considered both a benefit and a drawback. On the one hand, we have simple and familiar to many users platforms, while on the other hand, the broker doesn’t offer anything new to the customers.

TeleTrade does not have any restrictions on trading strategies. You can also add trading robots.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

TeleTrade competitors also offer their customers MT4 and MT5, but both Forex Club and RoboForex offer a bigger choice. In particular, Forex Club provides access to three additional platforms – Libertex, WebTrader and Rumus. RoboForex has special platforms. The broker targets new technologies in trading and in addition to classic services, also offers proprietary ones – R Trader и R Web Trader.

| MT4 Desktop | |

|---|---|

| TeleTrade | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| MT5 Desktop | |

| TeleTrade | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Android/iOS | |

| TeleTrade | Yes |

| Forex Club | Yes |

| RoboForex | Yes |

| Web-terminal | |

| TeleTrade | MT4, MT5 |

| Forex Club | MT4, MT5, Libertex, Rumus, WebTrader |

| RoboForex | MT4, MT5, R Trader, R Web Trader |

| TeleTrade | Forex Club | RoboForex | |

|---|---|---|---|

| MT4 Desktop | Yes | Yes | Yes |

| MT5 Desktop | Yes | Yes | Yes |

| Android/iOS | Yes | Yes | Yes |

| Web-terminal | MT4, MT5 | MT4, MT5, Libertex, Rumus, WebTrader | MT4, MT5, R Trader, R Web Trader |

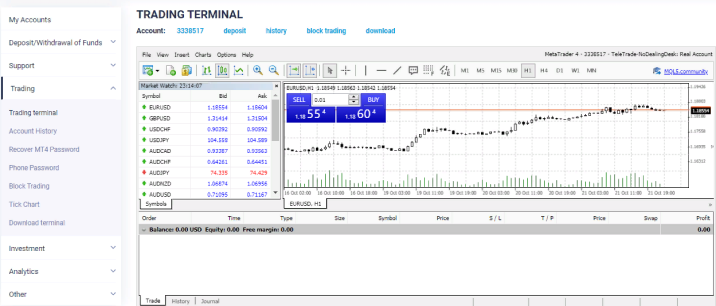

Review of MT4 trading platform on TeleTrade

As TeleTrade does not offer a proprietary platform, let’s review MetaTrader 4. The broker uses the classic version of the platform.

The security of the trading account features a standard username and password. There is no two-factor authentication, security question, confirmation of login via a text password or other additional security options. When you access the trading platform, you also need to enter the username (number of your trading account) and password. You can choose the password from MT4 directly in your personal account on TeleTrade.

The biggest drawback of the web version of the platform is that by default, it opens not in a full screen mode, but in a window. The main menu of the account remains on the left side of the screen. The platform’s interface looks as follows:

Chart

In the center of the screen, there is a chart with a review of quotations on the asset. The users can set the interface by choosing one of the options:

- Japanese candles;

- Bars;

- Lines.

You can also set a suitable timeframe. Timeframes from one minutes to 1 month are available on the platform. “One click trade” option is available. By default, TeleTrade offers 33 indicators and over 50 instruments for technical analysis. You can choose the instruments in the menu above the chart. You can also add other indicators available for MT4.

Choice of trading instruments

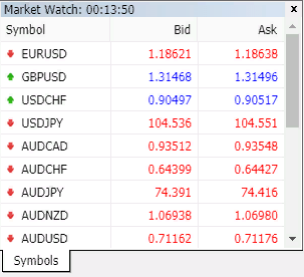

The menu of currency pairs or instruments for trading is on the left from the chart. The pairs and CFDs are shown here as a list. In addition to the name, you can see Bid and Ask. The price is highlighted with a color: blue for rising assets, red for falling

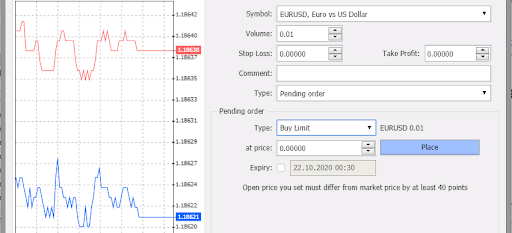

Opening an order

The broker offers its customers 6 types of orders, with two only available to the users, who opened the ECN account. The types of orders are as follows:

- Buy Limit;

- Sell Limit;

- Buy Stop;

- Sell Stop;

- Buy Stop Limit (only for ECN);

- Sell Stop Limit (only for ECN).

Also, you can choose one of the two types of order execution – Market and Pending order.

To open an order, you need to press the right button of the mouse on the chart and choose New Order. Then, the broker will offer you to specify the parameters. In particular, you need to specify the lot, Take Profit and Stop Loss values. For Pending orders, you can also specify the price and expiry.

Trading automation

TeleTrade does not prohibit automation. The users can use any trading advisors, developed for MT4. Installation of trading bots is standard. TeleTrade does not have a constructor of trading robots.

Analytics

Analytics available on TeleTrade is excellent. Here, you will find a large number of materials that can help you make decisions on trades. In particular, the broker has a newsfeed and a section with expert opinions on the current situations on the markets. You will also find trading ideas based on technical analysis, video news and many other options on the platform.

Nonetheless, the broker does not have detailed statistical calculations and there are no screeners.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

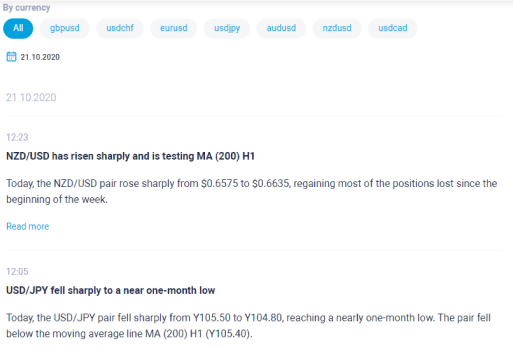

News and reviews

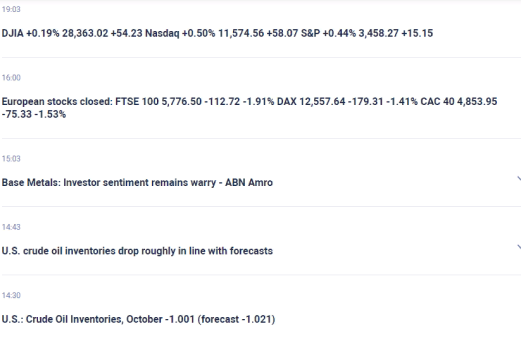

TeleTrade publishes a large number of reviews in text format. The information is published regularly with 5-6 detailed reviews coming out daily. Analytics is divided into three categories – stock market, Forex market and commodities market. You can also sort the reviews by dates. Noteworthy, the reviews are mainly published in Russian.

The newsfeed on the website is also very detailed. The information is published differently, depending on the version of the website. For the Russian version, 4-7 news items are published every hour on average, depending on the number of significant events on the market. For the English version, only the most important news pieces are published.

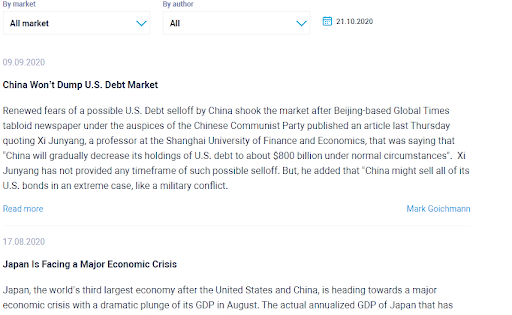

Trading ideas and signals

There is a Market Opinions section on TeleTrade website, where the authors publish a large number of analytical materials. The analyses are conducted by TeleTrade experts. They express their own opinions about the events in the economic world. TeleTrade has also envisaged an option of sorting by authors, which allows users to quickly find the texts of the expert they prefer the most.

The broker also has a section titled Technical Analysis. TeleTrade publishes information on technical analysis for different trading pairs and assets. The technical analysis is primarily based on the MA indicator with a period of 200 on H1 timeframe.

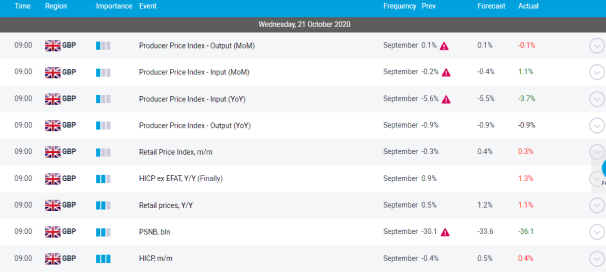

Economic calendar

TeleTrade also publishes an economic calendar with the most important events in the global economy. The calendar allows you to set different filters, choose a specific currency, region and important of an event.

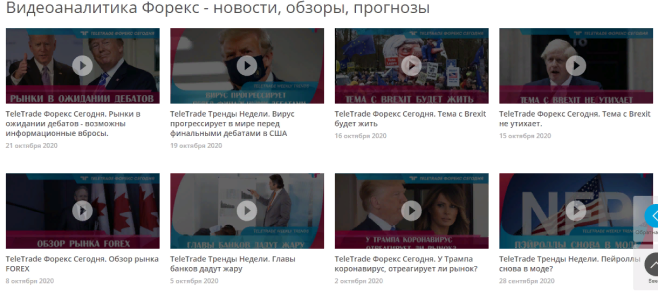

Video reviews

Video reviews are a special feature of the analytics from TeleTrade. The company produces videos on top events in Forex Today and Trends of the Week sections. The company has a YouTube channel, where the videos are published, and then they are also published in the sections. The length of the videos is different, mostly from 5 to 20 minutes. However, the important detail is that the video reviews are mostly in Russian.

Education

TeleTrade offers its customers excellent learning opportunities, preparing courses for the users with any level of knowledge. You can learn from video tutorials as well as online webinars. TeleTrade offers training in groups and individually. The learning materials are provided by the broker free of charge.

The educational section of TeleTrade, however, is primarily aimed at the Russian-speaking customers. The materials are not provided in other languages, including English. There are no educational blogs, articles with reviews of different strategies, etc.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

Training courses

TeleTrade offers two big courses. They are Forex for Beginners and Advanced Course. he first one introduces the beginners to the market peculiarities, provides information about simple strategies, finding a suitable point of entry to the market and withdrawal from the trade, etc.

Advanced Course allows users to learn about more complex strategies, including original ones from TeleTrade specialists. It contains information about the peculiarities of fundamental and technical analysis, progressive rules of working with trends, etc. In addition, the Advanced course provides an opportunity to speak with the traders, who have extensive experience.

As an example, we provide a short tutorial on an important statistical indicator in the U.S. economy – Nonfarm Payroll.

Seminars and webinars

Education on TeleTrade is available in the format of seminars and webinars. The seminars are held at the broker’s offices in the former Soviet countries. The webinars are held only as a part of the course; the broker does not provide additional classes online. You need to sign up for the seminars or webinars.

Books

Also, educational literature is available on the broker’s website. You will find three books here that you will be able to order for free. The books TeleTrade offers are as follows:

- The Art of Being Humble. The Mechanisms of Making Trading Decisions on Forex Market by Petr Pushkarev;

- Forex for Skeptics by Yan Art;

- Forex is Simple. Self-Taught by Irina Kaverina.

Additional learning materials on CDs are provided with the books.

Customer support

TeleTrade offers many ways to contact customer support:

- Feedback form on the official website

- Callback

- Phone

- Online chat

Customer support of the broker responds quickly. All the questions we had as we were preparing this review were quickly resolved. The response by email took about an hour, which can be considered a good result. The customer support is available in English, Russian and Spanish.

| Pros | |

|---|---|

|

| Pros |

|---|

|

| Cons | |

|---|---|

|

| Cons |

|---|

|

Channels of communication

| Communication channel | |

|---|---|

| Address | support@teletrade.global |

| Phone | |

| Address | 8-800-200-31-00 |

| Communication channel | Address |

|---|---|

| support@teletrade.global | |

| Phone | 8-800-200-31-00 |

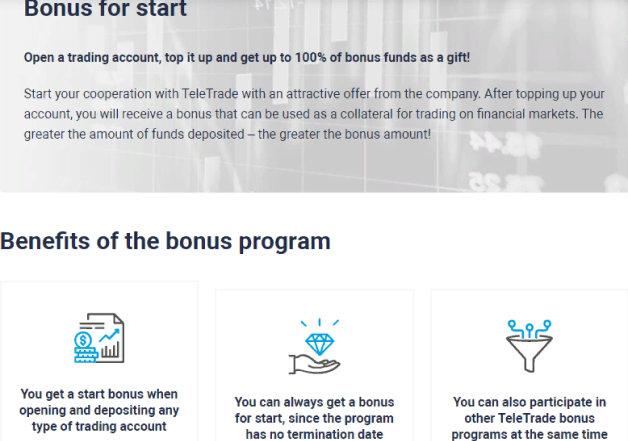

Bonuses and promo

At the time, when the review on TeleTrade was being prepared, the broker had one promo offer – 100% bonus on the first deposit. To receive the bonus, a customer needed to register on the website and fund the account. The company will double the amount deposited by the user.

However, it is possible to withdraw the money only in case all the rules of the offer are observed. The bonus must go through a specific turnover. The minimum number of lots for the turnover is 5. If you receive a $100 bonus, the traded volume must amount to 30 lots, and if you received a $1,000 bonus, the traded volume must be 300 lots, etc.

Summary

TeleTrade is one of the most popular brokers in the former Soviet countries. This company, however, gained its popularity mainly among the new traders. For this category of users, the broker offers a variety of training programs, simple and convenient trading platform and a low entry threshold.

As for the experienced traders, this company won’t be able to offer them something interesting. The broker does not provide access to trading real assets, the choice of markets is limited and there is no access to advanced platforms and statistical data.

Absence of the license is the biggest drawback of the broker. After the Central Bank of Russia revoked TeleTrade's license, the broker hasn’t obtained other licenses. Thus, the company’s customers are not protected in any way should the broker experience difficulties and stops paying money to its customers. There is no independent arbitrator to resolve the inevitable disputable moments. This drawback is somewhat compensated by the broker’s extensive experience of operation – TeleTrade has been on the market since 1994.

Real reviews of TeleTrade 2025

Absolutely horrendous experience with this Forex broker! Their platform is a complete joke – constant glitches, freezes at the worst possible moments, and customer service? Non-existent! They're quick to take your deposit but good luck getting any sort of assistance or your money back. It's like throwing your hard-earned money into a black hole. Stay away if you value your investment and peace of mind!

For me at one time Teletrade was just a gift from above. Now I myself recommend it to all beginners who are just going to or have recently started to engage in forex. Here everyone is given a mentor who will help both with organizations and with the trade itself, if a person wants. And if someone is worried that the manager will advise bad things, then you can either change him or just trade in your own way. Nobody will impose anything.

To be honest, now you can get lost in a large number of brokers .. they are everywhere and there are a lot of them. Now I think it is important that your broker has experience and trust on the part of traders. This is exactly the kind of company TeleTrade is. I recently started trading here and I liked everything .. Especially the tutorials. There are many of them and they are understandable even for a beginner. After trading on a demo account, I opened a trading account for $ 1000.

I think this is a great opportunity because with $ 1000 you are doing a business that can bring you good money in the first month!)

I work with Teletrade through their partner. So, partners have the opportunity to insure the deposit. So here money not only does not drain, but even helps to protect oneself "from a fool", in this case from oneself, if you mess up in trading or from the mistakes of another trader if you are an investor. I use insurance, it is convenient and the cost of it is paid off in full with profit. Although there have not yet been reasons for the insurance to work. The trader I have chosen to invest is profitable

"Sven Turner

What I like about TeleTrade is a large number of services. In particular, there is Synchronous Trading for copying trades. But I recently came across an interesting opinion on this subject. One guy wrote that copying trades is not always beneficial. That's because everyone copies trades differently. Some blindly and thoughtlessly, not trusting themselves one bit. Others analyze data from trading platforms and only then make their own decision. So I want to ask, is there any mechanism for choosing a Trader at TeleTrade?"

As I know, this broker has its own trading community. So, you can try to find a worthy piece of advice here.

I can’t say that I have a huge experience in trading, but I’m satisfied with TelleTrade’s approach to support beginners, as well as the trading conditions that the broker offers.

The platform is easy to understand, and it has lots of versions to trade from anywhere. Full range of asset classes makes my trading flexible. I also started selecting brokers to follow automatically as I need a learning-by-doing approach.

I can set a low proportion of the lot size to copy experienced traders, and I always keep monitoring their deals, trying to understand the reasons why they buy or sell an asset.

The company has excellent customer service. The guys answer questions instantly. And it's easy to find them anywhere: on social networks, in Play Market, on the site. All in all, I'm glad that at TeleTrade, I can quickly resolve any issue.

What I like about TeleTrade is a large number of services. In particular, there is Synchronous Trading for copying trades. But I recently came across an interesting opinion on this subject. One guy wrote that copying trades is not always beneficial. That's because everyone copies trades differently. Some blindly and thoughtlessly, not trusting themselves one bit. Others analyze data from trading platforms and only then make their own decision. So I want to ask, is there any mechanism for choosing a Trader at TeleTrade?

I am totally comfortable with my co-operation with TeleTrade because there are actually quite a few similar companies and it is not a problem to find something like that to work with permanently. But on the other hand they have adapted a good bonus system that I can use on a regular basis and I certainly like it a lot. About the demo and other tools I have special comments - it's organised in a standard way and of sufficient quality.

I like the fact that TeleTrade has no restrictions on the minimum deposit amount. For me, this is the first sign that you can trust the company. And I can say that I was not wrong in my assumptions. With this broker, I can earn money.

I rarely praise something, only after I have personally checked everything and received proof that everything offered - a product, service, or something similar - is entirely consistent with what was originally offered to me.

And I'm pleased to know that in the case of TeleTrade, everything turned out this way, and this broker really copes with the work of providing access to the market and even trains traders so that clients can act consciously and accurately from the first trade.

And for many traders, especially those who are not ready to invest large sums of money, the good news is that you can take regular bonuses or get bonus points for trading. Then it can become part of your principal - for trading and for withdrawing to your card.

I am sure this broker is worthy of attention and trust!

On their site, you can find a lot of free trading strategies with pictures. You can use them in your daily trading.

I can’t say anything bad about trading with this brokerage service. My trades are executed perfectly. I didn’t catch the broker manipulating quotes. Besides this, it honestly pays out my earnings. So, I perceive it as a reliable company.

I heard that it’s possible to earn up to $10k by simply staying with the company. So, they give points for activity and then you can exchange them for real money. However, I don’t think that earning $10k would be easy. I think it would be very time-consuming and it would be much easier for high-rollers.

I came here as a trader with experience. So I quickly got to grips with MTs and other technical parameters.

But I plan to continue learning the market - I see that there are such opportunities here - what should I choose? Please advise me.

The company has an excellent service for copy trading. I like the fact that you can start making profits even without much experience in trading. It's a perfect opportunity in TeleTrade.

For a long time I was struggling to find a reliable broker. I had some unpleasant experiences with brokers who prevented me from entering the market at the price I wanted. What’s more, their executions always gave a scratchy feeling smth is going totally wrong with them.

Fortunately, I occasionally discovered this broker. It turned out that it’s not only good for manual trading but it also offers an opportunity to copy trades of professional traders. The trading process gave me positive emotions. The broker didn’t try to violently intervene in my trading.

It's not the first brokerage company I tried to trade with and I can tell right away that without a stable and long-term check you can never make the right conclusions and choose the best conditions for you.

What have I noticed about this company? Of course the professional approach, no matter what your problem or question is, you can always get the answer or recommendation you need. It does not depend on the amount in the account either.

The next most important plus is the cashbacks, bonus points and other things from the company. It's all really accrued and used by almost all of the company's customers. This strengthens the capital and gives confidence in the future.

The bonus system is great here, of course.

But it's time to give up on MT, there are already much better platforms on the market.

I trust this broker more than any other in my trading career. I tell this not only because of the smooth and trouble-free trading process, but also because I appreciate its unique features.

Previously, I was used to trading manually. Of course, it’s not easy to do, but each time you forecast the market correctly, it gives you a thrill. However, sometimes, I feel exhausted especially when my trading day is full of breaking news. That’s why I decided to add a new passive income to my arsenal. That’s sync-trading provided by Teletrade. I don’t regret doing that because sync-trading brings me a steady income, although it’s smaller than what I earn manually. But it’s steady and it gives me an opportunity to take a rest from trading from time to time.

I don’t complain about the payment discipline of TeleTrade. I mostly take profit on Skrill, money comes very quickly. Usually within 5 minutes.