On this page, you will find a large number of reviews from the real XM customers. If you are already working with XM, please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

XM.com Review 2021

XM (XM.com) is one of the world’s top CFD and forex brokers. The company has been operating on the market since 2009. The broker operated based on three licenses issued by Cyprus Securities and Exchange Commission (CySec), Belize International Financial Services Commission (IFSC) and Australian Securities and Investments Commission (ASIC).

XM primarily targets retail traders. This platform offers a wide choice of CFDs on various assets and provides direct access to the stock exchange. The company offers a functional trading platform and attractive commissions on CFD trading.

Over the period of its operation, XM.com received a number of awards, including Best FX Service Provide for 2020 of City of London Wealth Management Awards, as well as Best Customer Service Provider awarded by Capital Finance International Magazine (CFI.co) 2019 and UK Forex Awards 2018 of Shares Magazine. Overall XM holds 35 different awards.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features

| Regulation | Cyprus (CySec) Belize (IFSC) Australia (ASIC) |

|---|---|

| License | CySEC 120/10 IFSC №000261/106 ASIC №443670 |

| Level of commissions | Low for CFD Average for Forex |

| Demo account | Available |

| Minimum deposit | 5 USD |

| Inactivity fee | 10 USD per month. Charged after 3 months of inactivity. |

| Leverage up to | 1:888 |

| Markets | Forex, CFD, shares |

| Options for passive income | Unavailable |

| Customer support languages | English, Greek, Simplified Chinese, Traditional Chinese, Malay, Indonesian, Korean, Russian, French, Spanish, Italian, German, Polish, Hindi, Arabic, Portuguese, Czech, Slovak, Bulgarian, Romanian, Bengali, Urdu, Thai, Nepali.. |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes |

| Account currencies | EUR, USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD |

| Deposit bonus | - |

Geography of broker’s customers

The geography of XM customers may seem a bit surprising. Despite being registered in Cyprus, the broker is not popular in Europe. Meanwhile, it is quite popular in Asia and Africa. According to our research, the core audience of the broker from the developing countries of Southeast Asia, in particular Thailand, Malaysia and Philippines. There is also a share of customers from Latin American countries.Let’s review the map of XM.com customers as of July 2020 in more detail.

| Country | Percentage of customers |

|---|---|

| Thailand | 37.94% |

| Malaysia | 21.45% |

| South Africa | 6.91% |

| Colombia | 3.46% |

| Philippines | 2.91% |

Let’s compare the geography of XM customers with the broker’s competitors – Saxo Bank and Swissquote. There companies are also registered in Europe – Denmark and Switzerland respectively. Their audience, however, closely matches their places of registration. In particular, the lion’s share of Saxo Bank clients come from Europe. The broker does have customers from Southeast Asia, but Saxo Bank targets developed countries in the region – Japan and Singapore.

Swissquote clearly targets European countries, with China being the only Asian country, where the broker is popular.

Regional restrictions

XM has certain regional restrictions. However, there is one important thing to keep in mind here. XM.com is under management of several companies, providing services in different regions. Each management company has its own regional restrictions. That is why, we advise you to contact customer support to find out about the broker’s restrictions in the region, where you reside and pay taxes.

Commissions

Commissions policy on XM is quite diverse. XM.com is an CFD broker. The broker applies fixed fees only for trading real stocks, while spreads are used for all other trading instruments. Spread is the difference between Bid and Ask. The narrower the spread the more beneficial the trade.

The company offers very beneficial commissions, far better than those of competitors, on some types of assets. The broker has especially beneficial conditions for CFD trading. Also, XM charges rather attractive non-trading commissions.

However, there are some drawbacks in the commissions policy of the broker. This is primarily related to Forex trading. The spreads for currency pairs are quite high. In addition, the broker charges inactivity fee, and its conditions are less beneficial than those of competitors.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of XM’s system of commissions

| Asset | Commissions |

|---|---|

| EUR/USD | Commission is included in the spread with a typical value of 1.7 pips |

| US stocks | 0.04 USD per share, but no less than 1 USD per lot |

| CFD on Brent | Commission is included in the spread with a typical value of 0.5 pips |

| CFD on S&P 500 | Commission is included in the spread with a typical value of 0.7 pips |

| CFD on gold | Commission is included in the spread with a typical value of 0.35 pips |

| Non-trading commissions (if any) | 10 USD per month after three months of inactivity |

Review of broker’s commissions on Forex market

Trading commissions on the Forex market charged by XM can be considered average. There are companies that offer more beneficial conditions. The broker’s spreads depend on the type of trading account. The minimum size on Standard account starts at 1 point, for Ultra Low account, the minimum spread is 0.6 points.

The average spreads for trading pairs are understandably higher. The company applies floating spreads; they change continuously, depending on the situation at the exchange. For example, the average spread for EURUSD, the most popular pair, is 1.7 pips. Let’s review the spreads on the main pairs in more detail and compare them to the broker’s key competitors – Saxo Bank and Swissquote.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| EURUSD | 1.7 | 1.2 | 1.7 |

| USDJPY | 2.6 | 1.2 | 2 |

| EURGBP | 2 | 1 | 2.1 |

| AUDJPY | 3.1 | 1 | 2.3 |

| USDZAR | 14 | 58.8 | 93.5 |

As we can see, XM has average spreads compared to the competitors on EURUSD pair. The broker is behind Saxo Bank in this market, but at the same level as Swissquote.

Swaps on ХM

XM.com offers swaps. Swap is charged on the rollover of the position to the next day. It is charged if the trader did not close his position by 00:00 Server time. The swap depends on the currency pair and is calculated by the broker based on interest rates of central issuer banks in the currency pairs. If the swap is negative, it will be written off the account, if it is positive – it will be deposited on the account. Let’s review swaps of XM for different currency pairs.

| Long | Short | |

|---|---|---|

| EURUSD | -5.58 | -0.78 |

| GBPUSD | -4.05 | -3.15 |

| USDJPY | -1.76 | -4.03 |

| USDRUB | -178.86 | -24.86 |

Swap free trading is possible on XM.com, but this option is only available to clients who opened Shares Account.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Swap free | YES (Islamic account) | No | No |

Commissions on stock market

XM.com provides access to stock market. The broker charges fixed commission on trading real stocks. It varies depending on the stock market you are working on. Stock trading is available only on special trading account – Shares Account.

Marginal lending for stock trading is unavailable on XM.com. Short position on stocks is also unavailable, which is why you can only work in Long position. It is possible to trade in Short position only using CFDs.

| Commission | Minimum per trade | |

|---|---|---|

| USA | 0.04 USD per share | 1 USD |

| UK | 0.1% of the volume traded | 9 USD |

| Germany | 0.1% of the volume traded | 5 USD |

Let’s also calculate the trading fee for the purchase of a USD 4,000 lot of shares. The values are specified taking into account that each broker charges a minimum transaction fee on standard types of accounts.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| USA | 1 USD | 10 USD | 30 USD |

| UK | 9 USD | 10.4 USD | 39.6 USD |

| Germany | 5 USD | 11.8 USD | 35.5 USD |

Therefore, XM is suitable even for clients who buy a small volume of shares. If you are purchasing a big lot with fixed commission, you will not have to pay a big fee. Saxo Bank and Swissquote use the same system.

Commissions on CFDs

XM offers a rather wide choice of CFDs. In particular, you can work with derivatives on shares, commodities, indices, precious metals and energies. Commission on CFDs is charged as the spread and is calculated separately for each trading instrument.

However, the system of commissions on CFDs at XM is not flawless. The spreads may change, which is why it could be difficult for a trader to calculate the exact amount of trading expenses.

As an example, let’s use an approximate commission charged by XM on the purchase of a USD 5,000 lot for the purchase of CFDs of different classes. Spreads can widen with increasing volatility.

| Asset | Commission |

|---|---|

| CFD on Apple | 4.54 USD |

| CFD on Google | 13.88 USD |

| CFD on oil Brent | 6.25 USD |

| CFD on gold | 0.91 USD |

| CFD on S&P 500 | 1.01 USD |

| CFD on US Cocoa | 29.37 USD |

Rates of marginal lending

XM applies fixed rates for marginal lending. The margin is the amount of the collateral required to cover credit risks arising during trading.

The broker charges rates based on short-term interest rates at the interbank. If the rate is 1.5%, then 1.5% annual is charged on the rollover of the position to the next day. To receive the exact amount, you will need to divide 1.5% by 365. Contact the broker’s customer support for updated rates.

Non-trading commissions

XM charges rather beneficial non-trading commissions. In particular, no commissions are charged for servicing the account and there is no deposit fee.

| Commission type | Conditions |

|---|---|

| Inactivity fee | 10 USD per month. The broker charges the fee after three months of inactivity. Inactivity period is the period without completed trades. The broker begins to charge the fee after three months of inactivity. |

| Withdrawal fee | 15 USD per transaction, if the withdrawal amount is lower than or equals USD 200. No commission is charged if the withdrawal amount exceeds USD 200. |

| Deposit fee | No |

| Account servicing fee | No |

One of the advantages of XM system is that it is universal for all users. For example, Saxo Bank has two types of inactivity fee – there are separate rates for residents and non-residents of the UK. The broker’s withdrawal fee can be considered low. For example, Swissquote charges a higher withdrawal fee. However, the very fact of the withdrawal fee can be considered a drawback for XM.com.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Account servicing fee | No | No | No |

| Inactivity fee | 10 USD per month. Charged after 3 months of inactivity. | For UK residents – 25 GBP per month. Charged after 3 months of inactivity. For residents of other countries – 100 USD per month. Charged after 6 months of inactivity. | No |

| Deposit fee | No | No | No |

| Withdrawal fee | 15 USD for withdrawals under 200 USD No commission is charged for withdrawal of more than 200 USD | No | 10 USD |

Reliability and regulation

XM can generally be considered reliable and safe thanks to its experience in the market since 2009 and three licenses. However, not all licenses offer the same degree of customer protection.

| Pros |

|---|

|

| Cons |

|---|

|

XM is owned and managed by Trading Point Of Financial Instruments. The organization is registered in Cyprus. The registration number is 251334, legal address – 12, Richard & Verengaria Str, Araouzos Castle Court - 3rd Floor, CY-3042 Limassol / P.O.Box 50626, CY-3608 Limassol.

Licenses

XM bases its operations on three licenses, including:

- Cyprus – CySEC 120/10

- Belize – IFSC №000261/106

- Australia – ASIC №443670

The Australian license is issued by a reliable regulator, while there are questions about the other regulators. Cyprus once used to be considered one of the world’s biggest offshore jurisdictions. However, a number of changes that have been introduced in the jurisdiction in the past three years have improved the level of trust towards the regulator. Belize is an offshore jurisdiction that does not exchange tax information and does not disclose data on ultimate beneficiaries. The license issued in Belize cannot be considered reliable. Before entering into an agreement with the broker, find out which legal entity you are being offered to work with.

Were there scandals involving XM?

XM.com has been operating since 2009. Over this period, the company has not been linked to any high-profile scandal. The financial company is known for its good reputation and the customers from different countries trust it.

Segregated accounts and compensation of deposits

The company keeps customer funds on segregated bank accounts. This is a major advantage of the organization, as the money of the customers are thus separated from the money of the company, XM.com does not have access to it and cannot perform any financial transactions with it without the consent of the customers.

However, in case of the broker’s bankruptcy, the users are not protected in any way. XM.com is not a member of deposit guarantee fund of any country. There is also no deposit insurance. Therefore, if XM is recognized as insolvent, you will not be able to recover your funds.

Markets

The choice of trading instrument and assets for trading on XM is average. The CFDs make up the lion’s share of the instrument. The broker offers a wide choice of CFDs. The choice of other assets is much smaller. You can trade on Forex market and work with real shares here. The choice of shares is comparatively small, but the very fact of their availability can be considered the broker’s advantage.

The key drawback of XM is that it offers a minimum number of instruments for investment. Only the stocks are essentially available to the customers. XM.com also does not have social trading. In addition, many types of assets and trading instruments, for example options, are not available.

| Pros |

|---|

|

| Cons |

|---|

|

By the number of trading assets and available markets, XM is behind many of its competitors. For example, Saxo Bank and Swissquote offer a much wider choice of assets. The competitors also offer wider opportunities for investment compared to XM.com. That is why the number of markets and assets cannot be considered a strong point of the broker.

Markets

| ХM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Futures and options | Yes* | Yes | Yes |

| Commodities (oil, metals, wheat, gas, ores, etc.) | Yes** | Yes | Yes |

| Mutual funds | No | Yes | Yes |

| ETF | No | No | Yes |

* in the form of CFDs

** in the form of CFDs

Forex

The choice of currencies on XM is rather wide. There are 57 currency pairs in total. The broker primarily targets popular currencies trading (EURUSD, GBPUSD, USDJPY) and cross rates (GBPCHF, EURJPY). Exotic currencies are traded mainly in pairs with USD, EUR and GBP. You can work with such exotic currencies as SGD, DKK, SEK, NOK, ZAR

| ХM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Number of currency pairs | 57 | 182 | 78 |

The advantage of Saxo Bank and Swissquote is achieved primarily through availability of larger number of exotic pairs. However, not all traders work with them. Nonetheless, there are few trading pairs with Asian currencies on XM, which is surprising considering the broker’s target audience.

Stocks

The choice of stocks on XM can also be considered basic. There are only three markets, which are divided geographically. The total number of stocks for trading in this company is merely 100. The broker offers trading securities only of the largest US and European companies, such as Apple, Google, Daimler, Adidas, etc.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Number of markets | 3 | 36 | 60 |

| Number of available stocks | 100 | 19 000+ | 20 000+ |

Therefore, the broker is suitable for customers, who prefer conservative investment strategy and purchasing only the shares that can be considered low-risk. It would be wise for the broker to add shares of technology, biological, pharmaceutical startups to the list. While the investments into them involve rather high risks, the potential income could also be quite substantial. XM.com’s competitors, Saxo Bank and Swissquote, offer incomparably greater choice of stocks and markets and better opportunities for traders.

Geography of stock market

Geography of markets on XM features only three countries – USA, Germany and UK. This limits the possibilities of investors to some extent.

| Рынки | |

|---|---|

| USA | Yes |

| Germany | Yes |

| UK | Yes |

| China | No |

| Russia | No |

| Poland | No |

CFD

XM offers a rather wide choice of CFDs. Contracts for differences are the main trading instrument traders can work with. In particular, there is a rather good choice of CFDs on stocks here – over 1,000 types of securities of companies, operating in 18 countries, including Finland, Russia, Brazil.

The broker also has a good choice of CFDs on indices. Overall, the company offers derivatives on 18 different stock indices, including such popular instruments as S&P500, EU50, JP225 and other. The choice of other types of derivatives is smaller:

- 8 types of CFDs on commodities;

- 5 types of CFDs on energies;

- 2 types of CFDs on precious metals (gold and silver).

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| CFD on stocks | 1,140 | 8 800 | No |

| CFD on bonds | No | 5 | 3 |

| CFD on Commodities | 15 | 19 | 17 |

| CFD on ETF | No | 675 | No |

| CFD on indices | 18 | 29 | 26 |

The broker’s choice of CFDs can be considered average. Saxo Bank, for example, offers a wider choice of CFDs on stocks. XM would be wise to add at least CFDs on bonds and ETFs, as the broker does not provide an opportunity to work with these assets directly, while they are available on the platforms of its competitors.

Opening an account

It is rather quick and simply to open an account on the XM.com website. Most likely, the customers will not experience any difficulties.

The organization practically does not have regional restrictions. The list of the countries, the residents of which cannot work with the broker, includes only four jurisdictions. The minimum deposit of the broker is also quite low at USD 5. The company offers a sufficient number of base currencies of the account.

When opening an account on XM, you need to take into consideration one important thing. Verification is mandatory on the broker’s website and you will have to wait for around 24 hours for the document review and verification procedure to be completed in order to begin trading.

Pros and cons of the system of opening an account on XM

| Pros |

|---|

|

| Cons |

|---|

|

What is the minimum deposit on ХM?

Conditions for starting trading on XM are quite simple. The broker’s minimum deposit is set at USD 5. The conditions are suitable for professional traders as well as the beginners, who do not wish to risk large amounts of money when they are still learning how to trade.

XM.com has one of the lowest minimum deposits in the industry.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Minimum deposit | 5 USD | 10 000 USD | 1000 EUR |

Based on the trading conditions, Swissquote and Saxo Bank are more suitable for experienced traders with big deposits. XM is the best option for the users, who are only starting to trade or do not have a lot of money at their disposal for any reason.

The amount of minimum deposit on XM.com depends on the chosen trading account. The broker has three types of accounts. The conditions for all accounts are quite appealing.

| Micro | Standart | XM Zero | |

|---|---|---|---|

| Minimum deposit | 5 USD | 5 USD | 100 USD |

Residents of what countries cannot trade using XM?

The situation with regional restrictions on XM.com varies depending on the company that manages the broker. XM is managed by several legal entities in different regions of the world and each of them has specific regional restrictions. That is why, we recommend you to contact the broker’s customer service for more details on the restrictions for the company, managing XM in your region.

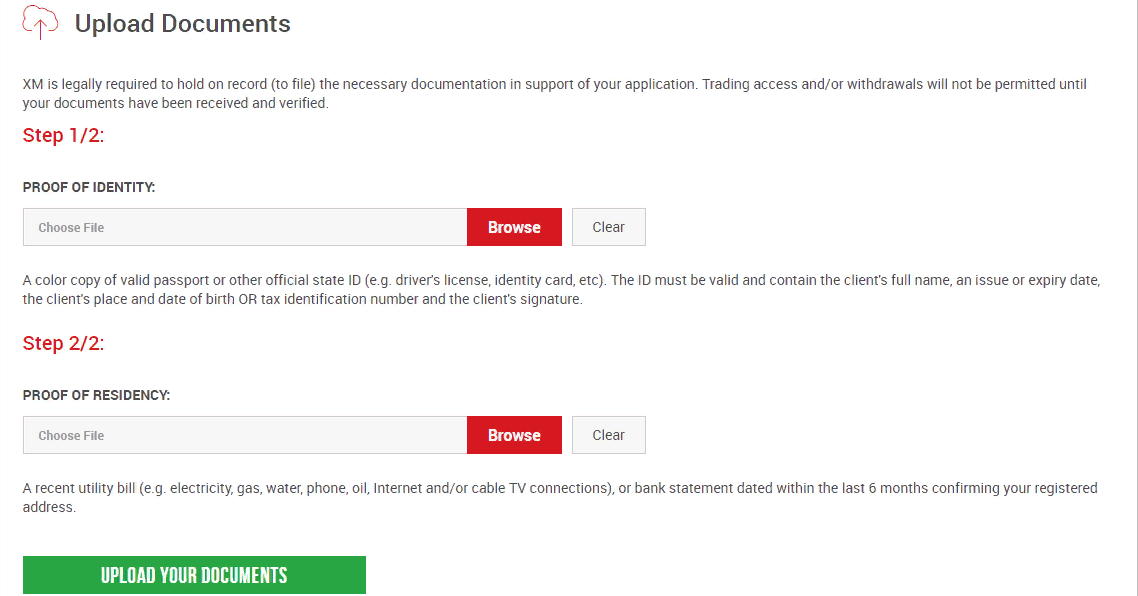

What documents do I require for opening an account?

XM has requirements for verification. The company operates in compliance with AML/KYC policy, so you will have to prepare specific documents. First of all, you need to confirm your identity. The following documents can be used for this:

- National passport;

- Foreign passport;

- Driver’s license;

- National Identity Card (ID),etc.

The document must specify first name, middle name (patronymic), last name of the trader, date of issue and date of expiry, date and place of birth.

You will also need to confirm your place of residence. For this, you can upload one of the following documents:

- Utility bills;

- Bank statement.

The document must be issued within the past 6 months and must specify your address.

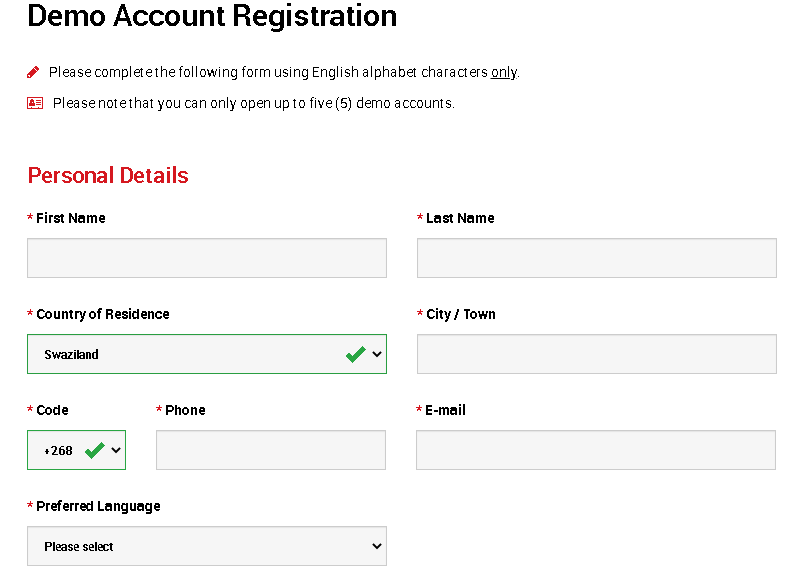

Demo account on XM

Demo account on XM is provided for free. To use this option, you are not required to register a real account at the broker. The form for opening a demo account is available on the home page of the broker’s official website. To open a demo account, you need to provide the following standard information:

- First name;

- Last name;

- Country of residence;

- City/Town;

- Code;

- Phone;

- E-mail;

- Preferred language.

You can also choose the currency of the demo account, account type, type of trading platform and the leverage. In addition, you can specify the planned amount of investment and the company will automatically select the preferred amount for your demo account.

Trading accounts

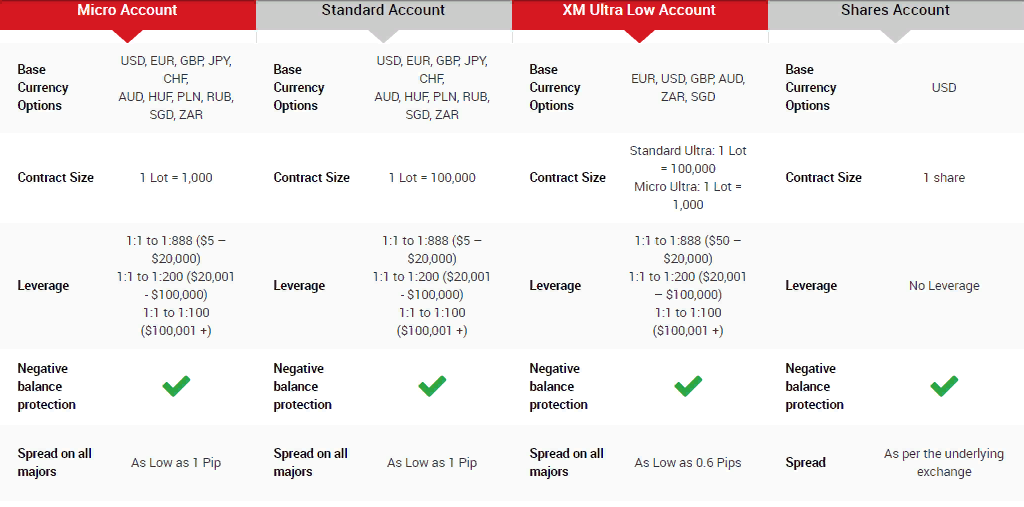

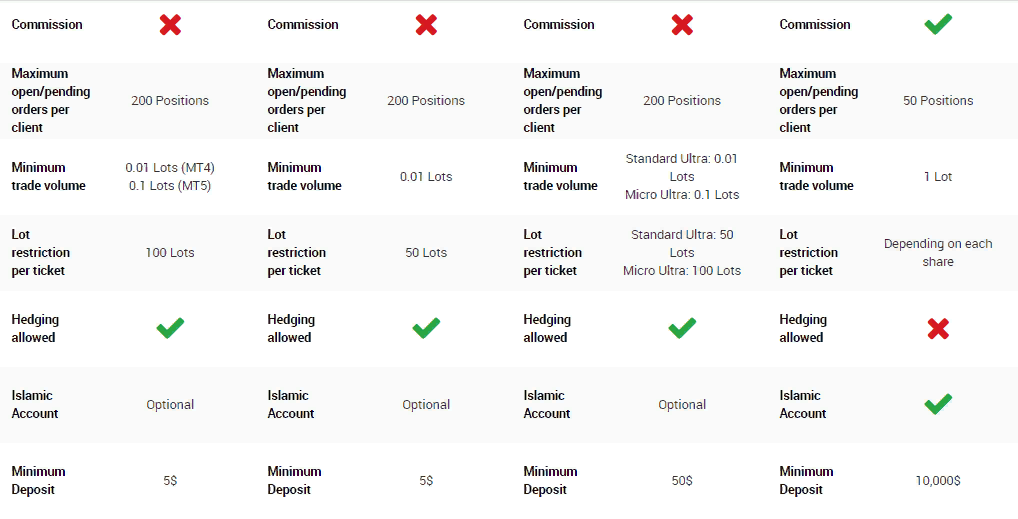

Trading accounts of XM are quite diverse. The broker offers options both for new traders and experienced traders. The company has five trading account types.

- Micro.

- Standard.

- XM Zero.

- XM Ultra Low.

- Shares.

Please note that XM.Zero account and XM Ultra Low and Shares accounts are provided for different jurisdictions. For restrictions regarding the use of an account, please contact the broker’s customer support.

Review of trading accounts on XM

Micro Account is best suitable for beginners. The lot here equals to 1,000 units of base currency. On other accounts, the size of the lot is 100,000.

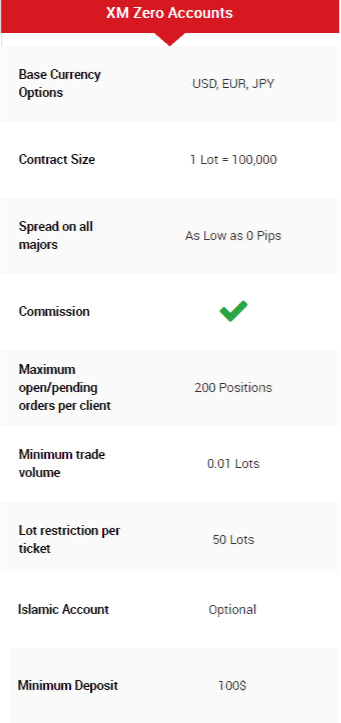

The company also has a special XM Zero account, where you can work with a spread from 0 points. On other accounts, the spreads start from 1 point. However, you should keep in mind that instead of spreads, there is a commission charged on XM Zero account.

Ultra Low account provides the customer with an opportunity to choose the size of the contract. There are two options here:

- Standard Ultra – 1 lot = 100,000;

- Micro Ultra – 1 lot – from 1,000.

The broker also has one more type of account – Shares. This is a specialized account for stock trading. The minimum deposit on this account is USD 10,000 and there is only one base currency option – USD. One lot here equals 1 share. The Shares Account provides access only to stock trading, while other accounts allow you to work with trading instruments, other than shares. You can open up to 8 trading accounts linked to your personal account on the broker’s website simultaneously.

Detailed information about trading accounts

The Micro account is best for first-time clients. Its peculiarity lies in the fact that the size of 1 lot here is equal to 1,000 units of the base currency. On other accounts, the lot size is 100,000.

The company also has a special XM Zero account. Its peculiarity is that here you can work with a spread of 0 pips. On other accounts, spreads start at 1 pip. However, here you need to take into account that XM Zero charges a commission instead of spreads.

The Ultra Low trading account allows the client to independently choose the size of the contract. There are two options here:

Micro

- Trading platforms: MT4, MT5

- Base currency options: USD, EUR, GBP, JPY, CHF,

- AUD, HUF, PLN, RUB, SGD, ZAR

- Instruments: 57 currency pairs, CFD.

- Contract size: 1 lot = 1,000

- Minimum deposit: 5 USD or equivalent

- Average spread for EURUSD: floating, from 1.7 pips.

- Commission on trade volume – no.

- Minimum lot – from 0.01 for MT4, from 0.1 for MT5.

- Leverage — depends on the jurisdiction. Maximum – 1:30 or 1:888.

Standard

- Trading platforms: MT4, MT5

- Base currency options: USD, EUR, GBP, JPY, CHF,

- AUD, HUF, PLN, RUB, SGD, ZAR

- Instruments: 57 currency pairs, CFD.

- Minimum deposit: 5 USD or equivalent

- Contract size: 1 lot = 100,000

- Average spread for EURUSD: floating, from 1.7 pips.

- Commission on trade volume – no.

- Minimum lot – from 0.01.

- Leverage — depends on the jurisdiction. Maximum – 1:30 or 1:888.

XM Ultra Low (Available only in non-EU countries)

- Trading platforms: MT4, MT5

- Base currency options: EUR, USD, GBP, AUD, ZAR, SGD

- Instruments: 57 currency pairs, CFD.

- Instruments: 57 currency pairs: 50 USD or equivalent

- Contract size: Standard Ultra: 1 lot = 100,000, Micro Ultra: 1 lot = 1,000

- Average spread for EURUSD: floating, from 1.2 pips.

- Commission on trade volume – no.

- Minimum lot – from 0.01.

- Leverage — depends on the jurisdiction. Maximum – 1:30 or 1:888.

Shares (Available only in non-EU countries)

- Trading platforms: MT5

- Base currency options: USD

- Instruments: shares.

- Instruments: 57 currency pairs: 10 000 USD.

- Contract size: 1 lot = 1 share

- Average spread per share: depends on the exchange

- Commission on trade volume – from 0.04 USD per share on US market, from 0.1% on UK and US markets.

- Minimum lot – depends on the shares.

- Leverage — no.

XM.Zero (Available only in EU countries)

- Trading platforms: MT5

- Base currency options: USD, EUR, JPY

- Instruments: 57 currency pairs, CFD.

- Minimum deposit: 100 USD or equivalent

- Contract size: 1 lot = 100,000

- Average spread for EURUSD: from 0 pips

- Commission on trade volume – 3.5 USD per 100,000 USD traded

- Minimum lot – from 0.01.

- Leverage — up to 1:30.

How to open an account on XM: step-by-step guide

It is quite simple to open account on the broker’s website. The Open Account button is found on the main page. Let’s review a step-by-step guide on how to open a real account with the broker.

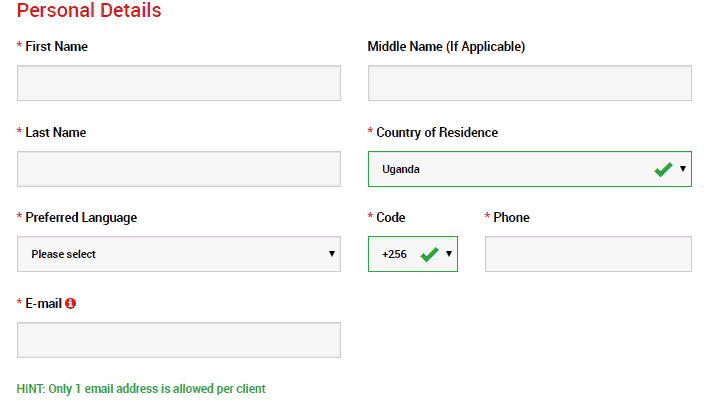

Step 1. Personal details

The procedure of opening an account begins with filling out the form. To open it, press Open Account button on the main page of the broker’s official website. The form has the following information to be filled out:

- Last Name;

- First Name;

- Middle Name (if applicable);

- Country of Residence;

- Phone Number;

- Preferred Language;

- E-mail.

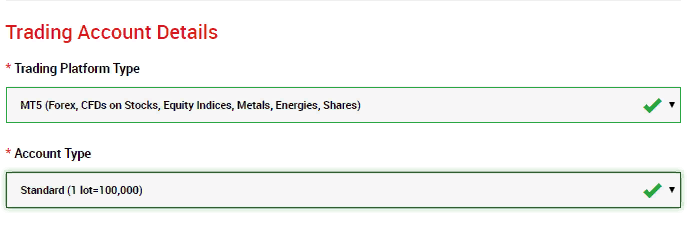

Step 2. Account information

Then you need to provide information about the account. The broker offers to choose the suitable type of the trading account and also the trading platform – MetaTrader 4 or MetaTrader 5.

Step 3. Verification

Verification of a trading account is mandatory on XM.com. Otherwise, you will not be able to deposit or withdraw funds. In order to pass verification, you need to upload the following documents:

- Proof of identity;

- Proof of residency.

Opening XM account video tutorial

Base currencies of the account

The broker has 11 base currencies of the account. The company does not accept other currencies and there is no automatic conversion available. Only fiat currencies are used as base currencies. It is impossible to deposit and withdraw funds in cryptocurrency here.

The choice of currencies on XM is average with all main currencies present. The only currency the broker is really lacking is Chinese yuan. Also, it would be advisable to add the currencies of the countries, where the traders trust XM.com the most, namely Thai Baht and Malaysian ringgit.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Number of base currencies | 11 | 26 | 15 |

| List of base currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR | AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, LTL, MXN, MYR, NOK, NZD, PLN, RON, RUB, SEK, SGD, TRY, USD, ZAR | GBP, EUR, CHF, AUD, JPY, PLN, CZK, HUF, USD, CAD, TRY, SEK, NOK, SGD, XGD |

Deposit and withdrawal methods

The number of deposit and withdrawal methods on XM can be considered average. The company supports a large number of payment systems, which is why it is quite easy here to deposit funds using debit/credit cards. The broker supports the following systems:

Visa;

Visa; Visa Electron;

Visa Electron; Master Card;

Master Card; Maestro.

Maestro.

In addition, several e-wallets are also available here. Their list, however, is quite basic, including:

Neteller;

Neteller; Skrill;

Skrill; Webmoney.

Webmoney.

The number of supported e-wallet is, unfortunately, not very big, lacking several major payment services, such as AdvCash, Payeer, ePayments, PayPal. In addition, the company is not supporting cryptocurrencies.

XM does not charge any deposit fee regardless of the method you are using. It is not so simple when it comes to withdrawals. There is no withdrawal fee, if the transaction amount exceeds USD 200. If you are withdrawing less than USD 200, the withdrawal fee is USD 15. As for the timeframe for processing the application, the company, unfortunately, does not provide any information.

| Pros |

|---|

|

| Cons |

|---|

|

Withdrawal fees

| Withdrawal method | Types and support | Withdrawal fee |

|---|---|---|

| Wire transfer | Not supported | - |

| Debit/credit cards | Visa Visa Electron MasterCard Maestro |

15 USD on withdrawals under USD 200. No fee on withdrawals over USD 200. |

| Electronic payment systems | Neteller Skrill Webmoney |

15 USD on withdrawals under USD 200. No fee on withdrawals over USD 200. |

| Bitcoin | Not supported | - |

By the number of deposit and withdrawal methods, XM surpasses Saxo Bank and Swissquote. The competing brokers offer their customers deposit and withdrawal only using bank methods – debit/credit cards and wire transfers. Also, only XM.com has the support of e-wallets out of the three.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| Wire transfer | No | Yes | Yes |

| Visa and MasterCard debit/credit cards | Yes | Yes | Yes |

| Electronic payment systems | 3 | No | No |

| Cryptocurrencies | No | No | No |

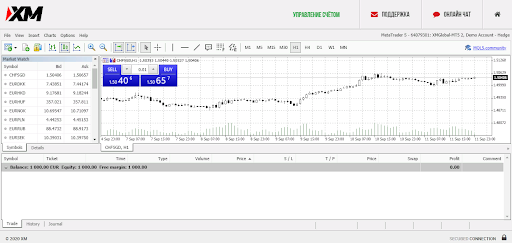

Review of trading platforms

XM uses standard trading terminals. The broker offers its customers two types of platforms:

- MetaTrader 4;

- MetaTrader 5.

The versions of the trading platform available on XM.com are:

- Webtrader;

- Windows;

- Mac;

- iOS and Android for mobile phones;

- iOS for iPad and Android for tablets.

MT5 is the main trading platform used by the broker. It is used for trading CFDs and currencies, and also shares, if you have Shares Account.

The platform’s interface is standard and there are no significant differences in XM’s version of MetaTrader 5.

The platform does not provide statistics. MT5 offers wide possibilities for customization. In particular, you can choose the chart interface out of the following:

- bars;

- Japanese candlesticks;

- Single lines.

XM.com offers two main types of orders – market execution and pending. Pending orders, in turns, are divided into six types:

- Buy Limit;

- Sell Limit;

- Buy Stop;

- Sell Stop;

- Buy Stop Limit;

- Sell Stop Limit.

The company provides possibilities for technical analysis. XM provides 10 instruments for drawing charges and also 31 indicators. You also have the possibility to add new indicators. However, you cannot build trading robots.

| Pros |

|---|

|

| Cons |

|---|

|

The choice of trading terminals on XM is standard, but not impressive in terms of level of options. For example, Swissquote also offers MT4 and MT5, but more advanced versions, with new indicators and instruments for technical analysis. Saxo Bank has a proprietary trading platform, which is more technology-intensive compared to MT4 and MT5, which are mainly designed for beginners.

| XM | Saxo Bank | Swissquote | |

|---|---|---|---|

| MT4 for PC | Yes | No | Yes |

| MT5 for PC | Yes | No | Yes |

| Android/iOS | Yes | Yes | Yes |

| Web-terminal | Yes | Yes | Yes |

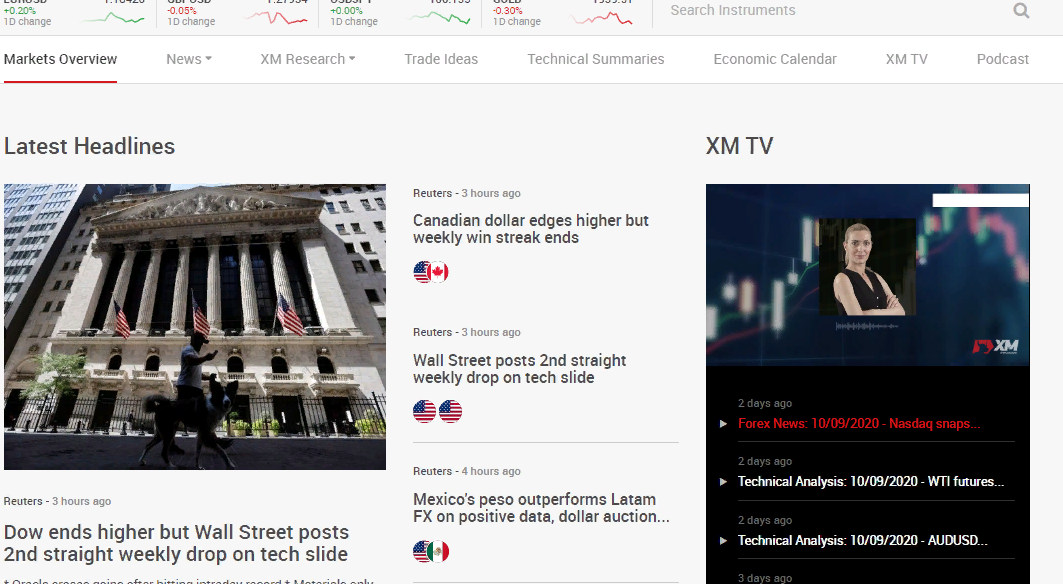

Analytics

Analytics section on XM.com is quite advanced. Here, you will find a wide variety of materials to help you study the market, analyze current situation and learn new information.

| Pros |

|---|

|

| Cons |

|---|

|

News and analytics

The News and Analytics section features a regularly updated newsfeed. You can also find reviews and articles of popular analysts here. The newsfeed is updated regularly with XM publishing up to 10 news items per hour. The number of news items may increase when important events occur in the world of economy and finance. The news items are divided by groups:

- Forex;

- indices;

- cryptocurrencies;

- stocks.

Analytics is also conveniently categorized into following sections:

- technical analysis;

- Forex announcements;

- Commentaries by experts;

- Reports;

- Stock market news

The analytical block features detailed market reviews and expert opinions on the current situation on the market, analysis of prospects, etc.

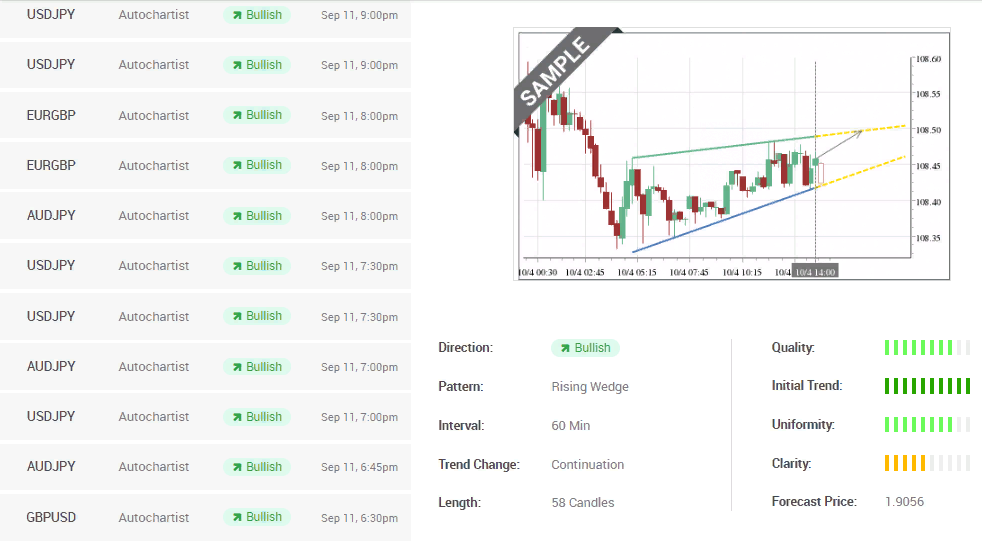

Trading ideas and signals

Trading ideas are presented on XM as tables with signals based on technical indicators. Here, you can select trading pairs or other assets and view ideas on each of them. The broker regularly updates this section, using different indicators of technical analysis. The broker also provides a table with information on the current trend, trend force, indicative point of support and resistance, etc.

Additional options

XM even has such interesting options as:

- XM.TV;

- Podcasts.

XM.TV broadcasts economic news and analytical shows, exclusively prepared by the broker’s professionals. The Podcasts section features discussions of the economic news by analysis in the audio version.

An own channel and podcasts are a great rarity even for advanced brokers. Thanks to them, the user can receive information in a way convenient for him. This is a big advantage of the company.

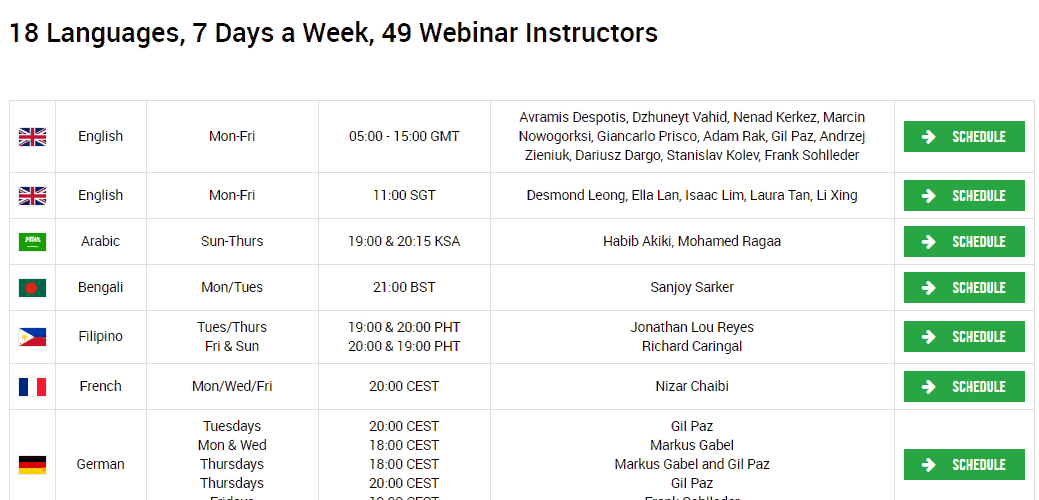

Education

The Education section on XM.com is not impressive. The broker does not provide much information here. The broker holds webinars on different topics regularly. They are held in different languages. The webinars are held 7 days a week by 49 instructors.

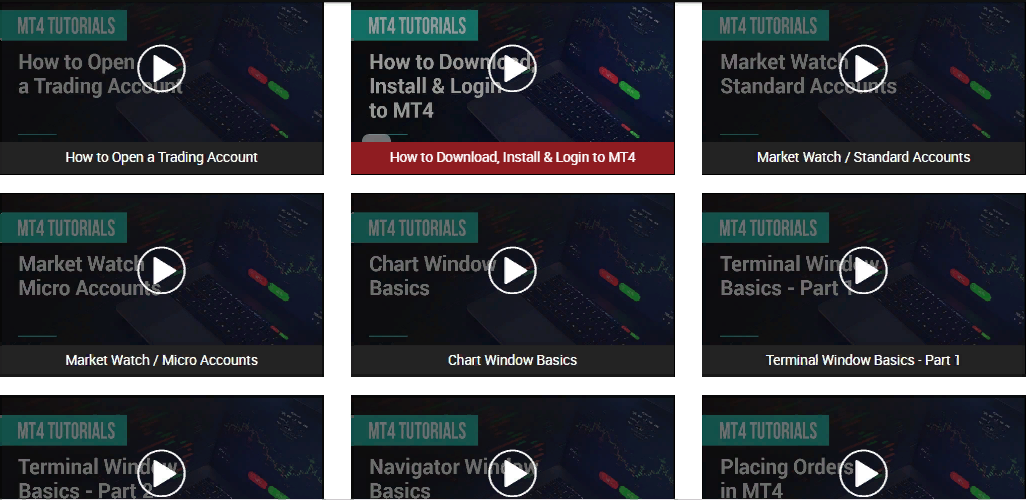

The company also has a detailed tutorial of the trading platform and possibilities of the XM.com website. There are detailed video tutorials on the platforms published on the website. Here, you can learn how to open a trading account, view quotations, customize MetaTrader 4 and MetaTrader 5 platforms.

However, the education the broker offers is still rather scanty. In particular, there are no educational articles here, video tutorials for beginners and experienced users. In addition, the broker does not have textbooks, a YouTube channel or a blog with useful materials. Therefore, the education section of the broker can be viewed as incomplete. There is still area for improvement here for XM.

| Pros |

|---|

|

| Cons |

|---|

|

Customer support

The broker’s customer support is available 24/5 and responds to requests quickly and effectively. Overall, we evaluable its operation as competent.

| Pros |

|---|

|

| Cons |

|---|

|

Channels of communication

The broker’s customer support operates round the clock, but only on weekdays – in the 24/5 format.

Online

email: support@xm.com

Live Chat in Contacts section

Phone Support

+501 223-6696

Address: No.5 Cork Street, Belize City, Belize, C.A.

Languages of customer support

English is the main language of the broker, but for the convenience of the customers, customer support via email can be provided in more than 20 most popular languages.

| Language | Contact info |

|---|---|

| English (international channel) | support@xm.com |

| Chinese | chinese.support@xm.com |

| Spanish | spanish.support@xm.com |

| German | german.support@xm.com |

| French | french.support@xm.com |

| Arabic | arabic.support@xm.com |

| Greek | greek.support@xm.com |

| Indonesian | indonesian.support@xm.com |

| Russian | russian.support@xm.com |

| Vietnamese | vietnamese.support@xm.com |

| Italian | italian.support@xm.com |

| Portuguese | portuguese.support@xm.com |

| Polish | polish.support@xm.com |

| Czech | czech.support@xm.com |

| Filipino | filipino.support@xm.com |

| Korean | korean.support@xm.com |

| Bangladesh | bangladesh.support@xm.com |

| Thai | thai.support@xm.com |

Bonuses and promotions

NOTE! Bonuses do not apply to ALL legal entities of the broker. Contact customer support for more information.

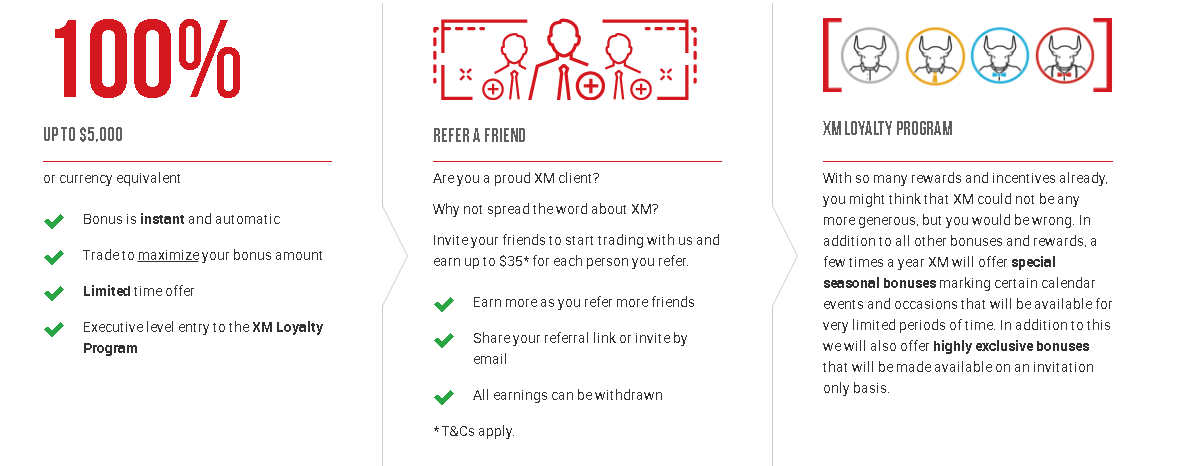

The company offers several bonuses for its customers. The first one is 100% deposit bonus. This bonus applies to all new users. To receive the bonus, you need to register and deposit an amount of up to USD 5,000 on your account. You can also participate in the Executive loyalty program from XM.

In addition, you can benefit from the broker’s partner program. The reward for attracting a new client is fixed and does not depend on the number of trades. After the new client deposits funds on his account, the bonus is rewarded to the referral account. The conditions are as follows:

- 1-15 invited friends – 25 USD for each user;

- 15-30 invited friends – 30 USD for each user;

- 30 and more friends – 35 USD for each user.

The company also has loyalty programs. The broker has four loyalty statuses. You get points per each lot, which can later be exchanged for real money that will be deposited to your trading account.

Summary

XM is considered a rather reliable broker among the users. The organization has obtained all required licenses and has not experienced any difficulties with withdrawal of funds. The broker has not been involved in high-profile scandals covered by media.

XM is suitable for new traders, who are not ready to invest a lot of money yet. The minimum deposit here is only USD 5, which is why the company is ideal for starting to trade on financial markets.

However, the organization grants access to a low number of markets, with the majority of assets here offered as CFDs. Access to stock market is very limited, which is why this broker is unlikely to attract long-term investors. There are practically no passive income instruments here – ETFs, bonds, RAMM accounts are not available on the platform.

NOTE! All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Real reviews of XM 2025

XM has a great loyalty program and bonus offers, so you can easily wager the bonuses. As for trading conditions, everything suits me, a small entry threshold, adequate analytics, a large selection of assets. I d more investing options. Their copy trading is lousy as for me....

I'm not happy with the collaboration with XM. There are few base currencies for the account, no conversion is provided Slippage occurs periodically on the platform, there is a high risk of losing the deposit.

Disappointed with XM, as the broker does not fulfill its obligations. Does not comply with the payment regulations. I put it on the card, I had to wait longer than a week! In addition, when withdrawing small amounts (up to $ 200), there is also a commission charged.

It is a pity that XM does not have the opportunity to receive passive income. I am an inexperienced trader, so I just lost my deposit here on CFD trading. I don't blame the broker. I just didn't have enough basic knowledge to make good deals.

XM is a broker suitable for CFD deals but not for Forex trading. Commissions are too high.

There were no problems with opening an account on the XM platform, but the verification process is really delayed. It took longer than 24 hours to check the documents! Why so long, I do not understand ....

I'm not going to trade with XM anymore! The company actually overestimates the spreads for currency pairs. Of course, everyone wants to make money, but the broker really rips off traders! For example, on EURGBP the spread is 2 times higher than in Saxo!

Payouts are stable in 2020. XM is generally reliable. In terms of fees their level is average.

I regularly watch XM live. There are many interesting educational and informational videos.

XM has good options for trading shares and some CFDs. Fees are especially low for big volume trading. On the negative side is a poor choice of shares to trade, they have just the most liquid.

Pretty positive and fair brokerage company. Just a mid-ranking one i would say Quite yound (established in 2012 if i am not mistaken) and hasn’t developed any solid reputation yet.. i am like spinning between good and bad review now, you know=)). Probably will submit it as a positive one. Nothing bad to say about this dealing center. They provide free of charge tutorials and store traders’ money on segregated accounts. Registration is neverending and requires a lot of documents to be sent by post (while other brokers require them only by email) and performs many different verifications, but i suppose it is for the best after all. Anyhow, if they do so it shows that they care about the safety and comfort of their customers. Get my + guys. Keep going like this!

Not the best choice at all! But not a bucket shop as well. What I can say for sure is that all payouts are stable. The support staff reacts fast and assists in addressing your problems if you have some. I am not placing big money at the moment, so my earnings are not to high as well. I like forex xm!

I’ve found ХМ broker just recently while surfing through some forex-dedicated site. So, I decided to try it by myself. Now I’ve been using my account for 3 weeks alreadyб but I think it’s still early to judge the profitability. Anyhow, I am satisfied about this broker so far.

They’ve very affordable minimum deposit level. I started with demo acc to practice, then I worked out a strategy and opened my first real account. I’m happy about this broker.

The XM company has the best execution of transactions among all the brokers I worked with. Great company despite a slightly higher spread

There are many reviews about XM and most of them are positive, I haven't decided yet, but terms look good.

A great company, I've been cooperating with them for a long time. XM provides fast withdrawal without any problems. No one will steal your money here, that's for sure!