On this page, you will find a large number of reviews from the real EXNESS customers. If you are already working with Exness, please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Exness Review 2021

Exness group of companies was founded in 2008, at the height of forex popularity. Since then, the company has become one of the market leaders in a number of regions of the world.

The company’s commitment to the forex market is the broker’s identifying feature. It is one of the leaders by the number of the currency pairs offered for trading and low fees.

The broker is registered in the Seychelles, while its core activity in recent years has been concentrated in the developing countries in Asia, Europe and Africa. As recently as several years ago, the broker had strong positions in the Russian market, although these positions have weakened in the past few years.

Among the most known marketing campaigns of Exness is sponsorship of Real Madrid, one of the most popular teams in the world.

Let’s look into the benefits that have contributed to the broker’s growth in the competitive market over the past 12 years. To gain a better understanding of whether Exness indeed offers a decent level of services, we will compare the offers of the broker with its strong competitors in the course of the entire review.

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features of Exness broker

| Website | www.exness.com |

|---|---|

| In which countries is regulated | the Seychelles (FSA), Cyprus (CySEC), UK (FCA) |

| Trading fees | Low |

| Inactivity fee charged | No |

| Minimum deposit | $1 |

| Leverage up to | 1:2000 |

| Markets | Forex, CFD for shares, indices, raw materials, energy goods, metals, cryptocurrencies |

| Support languages | 15 |

| Withdrawal fee | No |

| Deposit and withdrawal via cryptocurrencies | Bitcoin |

| Withdrawal to credit/debit card | Visa, MasterCard |

| Deposit from electronic wallets | Yandex Money, Neteller, WebMoney, PerfectMoney, Skrill |

| Trading platforms | MetaTrader 4, MetaTrader 5, Web Terminal |

| Demo account | Available |

| Deposit bonus | No |

Geography of broker’s customers

The broker services over 60,000 active accounts with $200 billion monthly turnover. Therefore, Exness is positioned as a rather large broker.

We also decided to check the broker’s customer geography and found it quite interesting.

| Country | Percentage of customers |

|---|---|

| Thailand | 45.35% |

| Vietnam | 17.29 % |

| South Africa | 6.39% |

| India | 4.07% |

| Uganda | 3.76% |

In each of the aforementioned countries, a rather sharp increase of customers has been observed – by dozens percent.

NOTE! Since October 2019, Russian citizens cannot be clients of the Exness.com platform. Existing clients of the broker continue to be serviced as usual.

Citizens of which countries cannot become customers of Exness

Due to the regulatory restrictions on exness.com portal, the broker does not work with a number of countries, including:

- EU countries, UK and its overseas territories.

- Russia.

- USA and Canada.

- Australia and New Zealand.

EU citizens can use the services of the broker by using exness.eu. For the citizens of the UK, the access to the services is possible through exness.uk platform. However, the conditions of those platforms differ from the ones on exness.com platform, which is the subject of our review.

Exness trading fees

The broker offers several types of accounts for the novices and advanced users. All accounts have their pros and cons and differ not only by the level of commissions, but also approaches to charging them.

In particular, the novices are provided with an opportunity to practice their trading skills on the standard account. Professionals, who perform many trades, can forecast their trading expenses using professional accounts with near-zero spread and predictable trading fees.

| Pros |

|---|

|

| Cons |

|---|

|

Brief review of Exness commission system

Exness applies different practices of charging trading fees. In particular, on Standard, Standard Cent and Pro accounts, a variable spread is used, which depends on the current market situation. On Raw Spread accounts , a combined system of small spread and fixed commission per trade is used. For Zero accounts, there is either no or minimum spread and there is a fixed commission per trade. ECN account features a combination of turnover commission and variable spread of average value.

To make it simple, let’s summarize the available information for the forex market and EUR/USD pair.

| Standard | PRO | Raw Spread | Zero | ECN | |

|---|---|---|---|---|---|

| Spread | 1 point | 0.6 points | 0 | 0 | 0.6 points |

| Commission per lot/side | 0 | 0 | 3.5 USD | 3.5 USD | 0 |

| Turnover commission | 0 | 0 | 0 | 0 | 25 USD per $1 million |

*All commissions and spreads are provided as of 13.07.2020. The broker updates the values of average spread and several other parameters daily. To receive updated information, please visit Contract Specifications page on the broker’s website.

Comparison of Exness trading fees with the competitors

In order to understand how attractive Exness commission levels are, let’s compare them with competitors from eToro and Forex.com. For this, we will take several most popular trading instruments and an average spread on standard accounts.

| Exness* | eToro | Forex.com | |

|---|---|---|---|

| EURUSD | 1 | 3 | 1.2 |

| GBPUSD | 1.5 | 4 | 2.1 |

| CFD on Nikkei Nikkei 225 | 10.2 | 10 | 13 |

*All data provided as of 13.07.2020.

Trading fees on the forex market

As the practice of trading fees of the brokers is quite different, the issue requires detailed study. In the example above, we only reviewed EUR/USD spread, while there are many special features in different markets and types of accounts.

In order to obtain a full picture about which trading account is more beneficial for a specific market, let’s look into every case. This will allow potential customers to choose the best option for their needs.

NOTE! Below, all fees will be specified in a unified value. We calculated how much it will take to pay for one standard lot in US dollars. The calculation was performed based on the size of the purchase and sale of 1 lot of 100,000 units of base currency as of 13.07.2020.

| Standard | PRO | Raw Spread | Zero | ECN | |

|---|---|---|---|---|---|

| EURUSD | 10 USD | 6 USD | 3.5 USD | 3.5 USD | 8.5 USD |

| GBPUSD | 15 USD | 9 USD | 6.5 USD | 4.5 USD | 11.5 USD |

| USDCAD | 16.95 USD | 10.31 USD | 7.18 USD | 5 USD | 11.34 USD |

| USDJPY | 10.27 USD | 6.54 USD | 3.5 USD | 3.5 USD | 9.03 USD |

| USDCHF | 15.93 USD | 9.55 USD | 6.68 USD | 4.5 USD | 11 USD |

| NZDUSD | 20 USD | 12 USD | 9.5 USD | 6.5 USD | 13.5 USD |

| EURGBP | 20.16 | 12.6 | 8.54 USD | 9 USD | 13.84 USD |

| GBPAUD | 19.51 | 11.85 | 8.37 USD | 6.5 USD | 12.95 USD |

| USDHKD | 50.05 | 31.34 | 19.95 | 22.56 USD | 9.46 USD |

| USDRUB | 467.41 | 291.87 | 231 USD | 231 USD | n/a |

Overall, we estimate the level of Exness commissions in the forex market as better than the market average. It surpasses the offers of the competitors, which have already been mentioned in the review. On some accounts, the broker has one of the best offers.

Raw Spread and Zero accounts are the most attractive types of accounts Exness offers in terms of commission for the forex market. They can be interesting for trading with robots and expert advisors, as they allow us to calculate the costs better.

Commissions on the cryptocurrency market

There is a total of 7 cryptocurrency pairs on the platform. They are available not for all types of trading accounts. The digital currency market, by all signs, is not a priority for Exness broker. Nonetheless, the broker’s commissions for cryptocurrency CFDs are quite competitive.There is a total of 7 cryptocurrency pairs on the platform. They are available not for all types of trading accounts. The digital currency market, by all signs, is not a priority for Exness broker. Nonetheless, the broker’s commissions for cryptocurrency CFDs are quite competitive.

| Standard* | Raw Spread | Zero | |

|---|---|---|---|

| BTCUSD | 10.68 USD | 3.5 USD | 3.5 USD |

| BCHUSD | 2.8 USD | 0.5 USD | 0.5 USD |

| ETHUSD | 1.21 USD | 0.5 USD | 0.5 USD |

| LTCUSD | 0.99 USD | 0.44 USD | 0.25 USD |

| XRPUSD | 0.73 USD | n/a | n/a |

*there is no cryptocurrency trading on Exness Pro and Exness ECN accounts.

For comparison, we recalculated the spreads and commissions on standard accounts in dollars. This will help determine the real costs for purchasing or selling 1 BTC. Also, we are adding the offer of Binance cryptocurrency exchange, which is one of the leaders in the industry, to the table for better understanding of the situation.

| Exness | eToro | Forex.com | Binance | |

|---|---|---|---|---|

| BTCUSD | 10.68 USD | 70 USD | 35 USD | 9.2 USD |

On Zero account, with a fixed commission of 3.5 USD the broker greatly surpasses the offer of Binance. However, one must remember that the trading on Exness platform is conducted by risky CFDs, not real cryptocurrency, as in the case with the exchange.

Trading fees on the stock market

In spring 2020, the broker announced the launch of trading of some instruments via CFD contracts. For now, the stock market is represented on the platform fragmentarily.

For ECN account this asset is unavailable.

| Standard | Raw Spread | Zero | |

|---|---|---|---|

(Appl) (Appl) |

19 USD | 10 USD | 4.2 USD |

(AMZN) (AMZN) |

144 USD | 84 USD | 36 USD |

(FB) (FB) |

14 USD | 8 USD | 4.2 USD |

(GOOG) (GOOG) |

144 USD | 9 USD | 54 USD |

(MSFT) (MSFT) |

14 USD | 8 USD | 3.6 USD |

*Price of a lot depends on the price of the shares. 1 lot equals to the current price per share multiplied by 100. For Amazon, that’s 327,000 USD as of 13.07.2020.

The logic of all markets remains the same – the broker offers the lowest commissions for the professional account Zero.

Having compared the offer on the market and Exness offer, we received the following result for the standard lot of Apple (AAPL) shares. We also added American broker Interactive Brokers, one of the leaders on the stock market, to the table.

| Exness Zero | eToro | Forex.com | Interactive Brokers | |

|---|---|---|---|---|

(Appl) (Appl) |

4.2 USD | 0 USD | 7 USD | 1 USD |

As we can see, eToro’s offer is unreachable at the moment.

Trading fees on the index trading

Index trading is always popular among the traders, as it allows to reduce the risks of volatility of some securities. Exness offers a small choice of CFDs for the indices of shares of some developed countries. Commissions for the trades can be characterized as average. They are less favorable than classic brokers from the U.S. market, but at the level of key competitors in general.

Let’s compare conditions for trading one of the most liquid instruments – S&P 500, a wide index of shares of the USA and Dow Jones 30, index of manufacturing companies.

| Exness Zero | eToro | Forex.com | Interactive Brokers | |

|---|---|---|---|---|

| Index S&P 500 (US500) | 0.5 USD | 1 USD | 0.6 USD | 1 USD |

| Dow Jones 30 (USTEC) | 4.25 USD | 6 USD | No such instrument available | 1 USD |

Non-trading fees of Exness

As a reminder, non-trading commissions include fees for the services that are not directly related to the process of transaction completion. As of the date of the review (13.07.2020) deposit and withdrawal fees, inactive account commission and similar payments were not charged. In terms of this, the broker stands out among its competitors.

| Exness Zero | Raw Spread | Zero | |

|---|---|---|---|

| Inactive account commission | 0 | 10 USD per month after 12 month of inactivity on the account | 15 USD per month after 12 month of inactivity on the account |

| Withdrawal commission | 0 | $ 5 USD | |

| Conversion commission | At the current Forex rate | 50 points | At the current Forex rate +0.5% |

Reliability and regulation

Exness is a company with average level of reliability. Registration of the main platform in an offshore is compensated by licenses in Europe and extensive experience of operation.

| Benefits |

|---|

|

| Drawbacks |

|---|

|

Exness.com website specifies that Nymstar Limited, registered in the Seychelles, is authorized to conduct activity under the brand and trademarks of Exness. Nymstar Limited holds the dealer license No. SD025 issued by Seychelles Financial Services Authority (FSA). Information of Nymstar Limited is confirmed on the website of FSA. The difference between the dealer and broker is that the dealer can perform transactions only with its own money.

Exness group also hold licenses in jurisdictions with higher level of regulation:

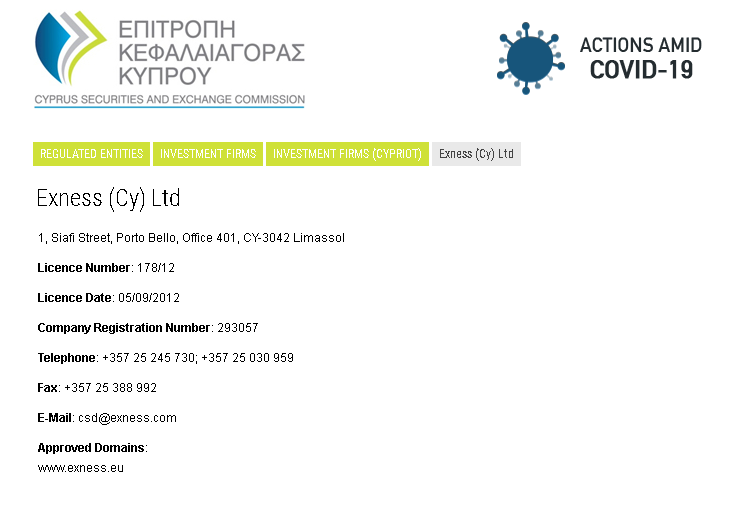

License Cyprus Securities and Exchange Commission (CySEC). No. 178/12. This legal entity operates on https://www.exness.eu. This information is confirmed on the website of the regulator.

License of the Financial Conduct Authority of the UK (FCA). No. 730729. This legal entity operates on www.exness.uk.

Noteworthy, the EU and UK markets have much stricter rules that restrict the level of risk of customers than in the offshore jurisdictions. In particular, it is prohibited to provide leverage higher than 1:40. Exness complies with these rules, while in the other markets the leverage can reach 1:2000. Leverage trade is the key risk for the beginner traders.

As we are analyzing Exness.com website today, the license of the Seychelles is relevant for it.

Markets and products

Exness is a classic broker with a focus on forex. Variety of types of accounts and currency pairs in this market is indeed impressive. In particular, the broker offers not only classic pairs and cross rates, but also a wide choice of exotic ones – with a total at 107 pairs.

In addition to currency pairs, contracts for differences (CFD) for cryptocurrencies, precious metals, shares, indices, and also key crude oil.

Noteworthy, there are no instruments for passive investment. The broker does not offer ETF, PAMM accounts and other comprehensive products. After all, active trading is not suitable for everybody.

In 2020, the broker has launched additional instruments, including CFDs for shares. It is possible that the trend will continue in the future.

| Pros |

|---|

|

| Cons |

|---|

|

| Exness Zero | eToro | Forex.com | |

|---|---|---|---|

| Currency pairs | Yes | Yes | Yes |

| Shares and CFD for shares | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | Yes |

| Commodity markets | 12 | 19 | 21 |

| Futures contracts | No | No | Yes |

| Options | No | No | No |

| ETF | No | 151 | No |

| PAMM services | No | No | No |

| Bonds | No | No | No |

| Comprehensive investment products | No | Yes | Yes |

Exness is behind eToro in terms of variety of markets, but almost on the same level as Forex.com. Let’s look into each market separately and the variety of instrument inside it.

Forex market

This market is represented on the platform in full. 107 currency pairs are split into three big categories:

-

Majors main currency pairs. There are traditionally 7 of those on forex. They are EURUSD, GBPUSD, NZDUSD, USDJPY, AUDUSD, CHFUSD. They are represented in all types of accounts of Exness.

Majors main currency pairs. There are traditionally 7 of those on forex. They are EURUSD, GBPUSD, NZDUSD, USDJPY, AUDUSD, CHFUSD. They are represented in all types of accounts of Exness. -

Secondary these are cross rates between the major world’s currencies. There is a total of around 30 pairs.

Secondary these are cross rates between the major world’s currencies. There is a total of around 30 pairs. -

Exotic it is a large layer of rare currency pairs, which, as a rule, consist of one major currency and one rare currency. Liquidity and spreads on them leave a lot to be desired, but they are quite useful for some strategies. This includes such combinations as Australian dollar to Danish krone (AUDDKK), Danish krone against Singapore dollar (DKKSGD). Overall, there are around 70 pairs. The majority of them are unavailable on the ECN professional account.

Exotic it is a large layer of rare currency pairs, which, as a rule, consist of one major currency and one rare currency. Liquidity and spreads on them leave a lot to be desired, but they are quite useful for some strategies. This includes such combinations as Australian dollar to Danish krone (AUDDKK), Danish krone against Singapore dollar (DKKSGD). Overall, there are around 70 pairs. The majority of them are unavailable on the ECN professional account.

| Exness Zero | eToro | Forex.com | |

|---|---|---|---|

| Number of currency pairs | 107 | 47 | 91 |

By the indicator of representation of the forex market, Exness is confidently surpassing its competitors.

Stocks

Stock market is represented in a limited way through CFD.

NOTE! Purchasing CFDs on shares, investors do not receive ownership rights to a part of company, and, therefore, cannot expect to receive dividends.

The broker mainly offers contracts for American securities from the first echelon:

| Technology sector: | Apple, Google, Microsoft, Intel Corporation и др. |

|---|---|

| Media: | Facebook, Netflix |

| Retail: | Amazon, Walmart, Alibaba |

| Financial sector: | Bank of America, Citigroup, JPMorgan Chase, Visa, Mastercard |

| Telecommunications: | AT&T, Verizon |

| Raw materials: | Exxon Mobil Corporation |

| Consumers goods and food products: | Coca-Cola, Procter&Gamble |

Entire sectors of the economy are non-existent on the platform. For example, there are no contracts for automotive companies, even super popular Tesla shares. In addition, there are no European and Asia stocks and ETFs.

| Exness Zero | eToro | Forex.com | |

|---|---|---|---|

| Number of instruments | 31 | over 1000 | 70 |

| Number of markets | 1 | 17 | 5 |

| ETF | 0 | 151 | 2 |

Indices

This segment is represented only by CFDs on the world’s leading indices.

| USA: | NASDAQ-100, S&P 500, Dow Jones 30 |

|---|---|

| Germany: | DAX |

| France: | CAS 40 |

| UK: | FTSE 100 |

| Europe: | Euro Stoxx 50 |

| Japan: | Nikkei 225 |

Taking into account the focus on forex, absence of dollar index and futures on other large currencies on the platform seems like an oversight. Such instruments would be useful for many traders for comprehensive strategies.

| Exness Zero | eToro | Forex.com | |

|---|---|---|---|

| Number of instruments | 9 | 13 | 18 |

Cryptocurrencies

Digital assets are represented with seven instruments – they are CFDs on pairs between fiat currencies (USD, KRW, JPY) and Bitcoin, and also dollar paired with Bitcoin Cash, Ethereum, XRP and Litecoin. Although the commissions on this market are rather pleasing, the variety of instruments clearly needs to be expanded. Also, it is worth noting that there are no cryptocurrency indices and futures.

| Exness Zero | eToro | Forex.com | |

|---|---|---|---|

| Number of instruments | 7 | 16 | 8 |

Commodity markets

Commodity markets are represented on the platform with the following assets:

- CFD on precious metals: gold, silver, palladium and platinum in pairs with dollar and euro.

- CFD on energy resources: WTI and Brent crude oil.

Agricultural goods markets, ore and industrial metals markets are not represented at all.

| Exness Zero | eToro | Forex.com | |

|---|---|---|---|

| Number of instruments | 12 | 19 | 21 |

Opening an account on Exness

The variety of account types, simple registration and customer-oriented approach in conditions of work left a pleasant impression. We established that in this category the broker provides services at the same or higher level as its competitors.

| Pros |

|---|

|

| Cons |

|---|

|

Exness minimum deposit

The broker has some of the most loyal requirements to the minimum deposit on the market, starting from $1 on Standard account. For other types of accounts and some services, the requirements for the minimum depositare higher.

| Account type | Minimum deposit |

|---|---|

| Standard | 1 USD |

| Pro, Raw Spread, Zero, ECN | 200 USD |

| Minimum deposit for VPS hosting connection | 500 USD |

Important specifications of the accounts

| Commissions compared to the market | Reliability | Markets | Types of execution of orders | |

|---|---|---|---|---|

| Standard | Average | Average | All | Market |

| Pro | Average | Low | All | Instant |

| Raw Spread | Low | Average | All | Market |

| Zero | Low | Average | All | Market |

| ECN | Average | High | Only Forex | Market |

Standard account

This type of account is suitable mainly for beginners, whose initial deposit is lower than $200. The spreads on this account are the highest of all, which is why there is pretty much not much sense in using it in other cases.

Key specifications:

- Trading platforms: МТ4, МТ5, WebTerminal on MT5, iOS, Android.

- Available currency accounts: over 60.

- Instruments: 107 currency pairs, CFD on cryptocurrencies, indices, metals, shares of American companies.

- Minimum deposit — 1 USD.

- Turnover commission – n/a.

- Commission per 1 lot - n/a.

- Spread — variable.

- Average spread for EURUSD - from 1 points.

- Maximum number of positions - unlimited.

- Minimum volume of lots — 0,01.

- Maximum volume of lots — 7:00 - 20:59 GMT+0: 200 lots, 21:00 - 6:59 GMT+0: 20 lots.

- Order execution – Market.

- Leverage — up to 1:2000.

- Stop Out — 0.

- Margin Call - 60%.

- Swap free– available.

- Bonuses for deposit on the account — n/a.

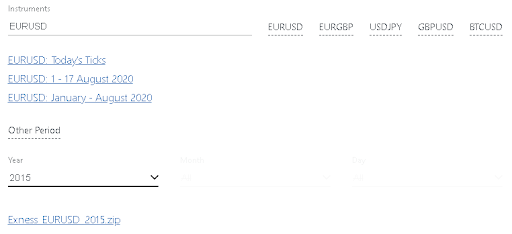

- Tick history: archive for previous years available.

Raw Spread

Raw Spread and Zero are similar by basic parameters and notable for very narrow spreads compared to the market. Practice of fixed commissions per trade is applied. Overall, they are lower than the market average, which is highly valued by the fans of trading robots, this parameter being one of the key parameters for success for them.

- Trading platforms: МТ4, МТ5, WebTerminal on MT5, iOS, Android.

- Available currency accounts: over 60.

- Instruments: 107 currency pairs, CFD on cryptocurrencies, indices, metals, shares of American companies.

- Minimum deposit — 200 USD.

- Turnover commission – n/a.

- Commission per 1 lot - up to 3.5 USD.

- Spread — variable, from 0 points.

- Average spread for EURUSD - from 0 points.

- Maximum number of positions - unlimited

- Minimum volume of lots — 0,01.

- Maximum volume of lots — 7:00 - 20:59 GMT+0: 200 lots, 21:00 - 6:59 GMT+0: 20 lots.

- Order execution - Market.

- Leverage — up to 1:2000.

- Stop Out — 0.

- Margin Call - 30%.

- Swap free for Muslim countries - available.

- Bonuses for deposit on the account — n/a.

- Tick history: archive for previous years available.

Zero

This is the most cost-saving account in terms of commissions, not only of Exness, but also one of the market leaders. The offer is better than that of the majority of those competing on the forex and cryptocurrency markets. On the stock market CFDs, the level of the offer is average.

Zero account implies zero spread. To be fair, there is a notion of natural market spread and there is broker’s spread. So, there is no broker spread on these accounts, while there can be market fluctuations in not the most liquid instruments.

- Trading platforms: МТ4, МТ5, WebTerminal, iOS, Android.

- Available currency accounts: over 60.

- Instruments: 107 currency pairs, CFD on cryptocurrencies, indices, metals, shares of American companies.

- Minimum deposit — 200 USD.

- Turnover commission – n/a.

- Commission per 1 lot - from 3.5 USD.

- Spread — from 0.

- Average spread for EURUSD - 0 points.

- Maximum number of positions – unlimited.

- Minimum volume of lots — 0,01.

- Maximum volume of lots — 7:00 - 20:59 GMT+0: 200 lots, 21:00 - 6:59 GMT+0: 20 lots.

- Order execution - Market.

- Leverage — up to 1:2000.

- Stop Out — 0.

- Margin Call - 30%.

- Swap free for Muslim countries - available.

- Bonuses for deposit on the account — n/a.

- Tick history: available.

ECN

This type of account is considered the most advanced in the market. The account will be suitable for customers, who value reliability over the size of commission. ECN account implies minimum influence of the broker on the trading and the highest speed of order execution. ECN system is an international decentralized network of suppliers of liquidity and traders.

ECN is the only account of the broker where the turnover commission is charged. It is 25 USD per $1 million (2.5 USD for a standard EURUSD lot). Also, in the majority of instruments, there are small spreads.

The drawbacks include a limited number of trading instruments – only 40 currency pairs, which is actually logical, as ECN is a system of the currency interbank exchange.

Trading platforms: МТ4, МТ5, WebTerminal on MT5, iOS, Android.

- Available currency accounts: over 60.

- Instruments: 40 currency pairs.

- Minimum deposit — 200 USD.

- Turnover commission - 25 USD per $1 million.

- Commission per 1 lot – n/a.

- Spread — variable, from 0.6 points.

- Average spread for EURUSD - 0.6 points.

- Maximum number of positions - unlimited.

- Minimum volume of lots — 0,01.

- Maximum volume of lots — 7:00 - 20:59 GMT+0: 200 lots, 21:00 - 6:59 GMT+0: 20 lots.

- Order execution - Market.

- Leverage — up to 1:2000.

- Stop Out — 50%.

- Margin Call - 100%.

- Swap free for Muslim countries – n/a.

- Bonuses for deposit on the account — n/a.

- Tick history: archive for previous years available.

Pro account

An outdated Instant Execution practice is used on the Pro account. This could lead to such consequences as requotes, which is when the quote is placed on the queue of the quotes of other customers of the broker and is not always executed. Also, the same practice is used by the brokers at Dealing Desk, which threatens with an unpleasant prospect of getting a broker as a contracting party.

- Trading platforms: МТ4, МТ5, WebTerminal, iOS, Android.

- Available currency accounts: over 60.

- Instruments: 107 currency pairs, CFD on cryptocurrencies, indices, metals, shares of American companies.

- Minimum deposit — 200 USD.

- Turnover commission – n/a.

- Commission per 1 lot – n/a.

- Spread — variable, from 0.3 points.

- Average spread for EURUSD - from 0.6 points.

- Maximum number of positions – unlimited.

- Minimum volume of lots — 0,01.

- Maximum volume of lots — 7:00 - 20:59 GMT+0: 200 lots, 21:00 - 6:59 GMT+0: 20 lots.

- Order execution – Instant.

- Leverage — up to 1:2000.

- Stop Out — 0.

- Margin Call - 30%.

- Swap free for Muslim countries – available.

- Bonuses for deposit on the account — n/a.

- Tick history: archive for previous years available.

Demo

Demo version is offered for different types of accounts, with the exception of Standard Cent. It is available for MT4 and MT5 terminals. At creation of the demo, the traders are given a virtual balance of US $10,000.

Demo is recommended for:

- Learning trading without the risk of losing your own money.

- Testing conditions of the type of the account before making the final choice.

- Testing of new trading strategies or signals.

How to open an account on Exness

The registration process on Exness platform is simple and takes no more than 10-20 minutes. The biggest difficulty is not opening an account, but verifying personal data. The broker supports KYC/AML international standards, which obligate financial organizations to confirm customer identity, and, if necessary, sources of their income.

What steps are included in the procedure of account opening?

-

Step 1

Step 1Choose a trading account. Read about this above.

-

Step 2

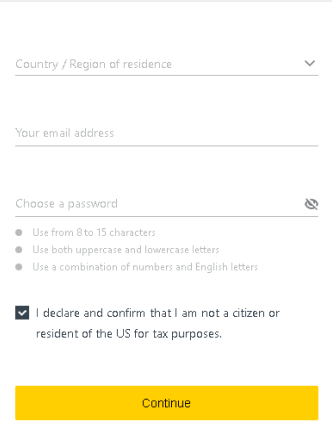

Step 2When you tap Open account button, the system will redirect you to the primary registration page.

At this stage, you need to:

- Review the provisions of the customer agreement and other documents (unfortunately, they are all available only in English);

- Specify your country of residence. In the section Broker Geography we confirmed that citizens of Russia, EU and USA and also a number of other territories cannot become customers of the broker.

- Specify your email and password for your personal account;

- Tick to confirm that you are not a citizen/resident of the USA.

-

Step 3

Step 3After registration you will be redirected to the trading platform. Demo account with $10,000 on the balance will be opened automatically.

-

Step 4

Step 4Confirm your personal data. This is the longest procedure, but without it you will not be able to fully trade. You need to send the broker copies of documents, confirming your citizenship and registration. Within two business days, the broker will confirm them.

There are guidelines on how to verify data in the short video in English.

Base currency accounts

Exness is one of the leaders by the number of offered account currencies – over 60. Why is it so important? Because it helps customers save on conversion. In particular, if the account is opened, say in Mexican peso, and you deposit money in peso, you will not lose on conversion of peso into dollars.

For example, eToro only has accounts in USD. The conversion rate is from 50 points of the base currency.

As of July 2020, the following currencies are available for Standard account:

AED, AUD, ARS, AZN, BDT, BHD, BND, BRL, BYR, CAD, CHF, CLP, CNY, COP, CZK, DKK, DZD, EUR, GEL, GBP, GHS, HKD, HUF, IDR, ILS, INR, JOD, JPY, KES, KRW, KWD, KZT, LBP, LKR, MAD, MXN, MYR, NGN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, RUR(for MT4 accounts only), SAR, SEK, SGD, SYP, THB, TND, TRY, TWD, UGX, USD, UAH, UZS, VND, ZAR, MAUUSD, MAGUSD, MPTUSD, MPDUSD, MBAUSD, MBBUSD, MBCUSD, MBDUSD.

The following currencies are available for ECN account:

AED, AUD, ARS, AZN, BDT, BHD, BND, BRL, BYR, CAD, CHF, CLP, CNY, COP, CZK, DKK, DZD, EUR, GEL, GBP, GHS, HKD, HUF, IDR, ILS, INR, JOD, JPY, KES, KRW, KWD, KZT, LBP, LKR, MAD, MXN, MYR, NGN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, RUR, SAR, SEK, SGD, SYP, THB, TND, TRY, TWD, UGX, USD, UAH, UZS, VND, ZAR

| Exness | eToro | Forex.com | |

|---|---|---|---|

| Number of account currencies | Over 60 | Only USD | EUR, GBP, USD, AUD, CAD, CHF, JPY |

Methods of deposit and withdrawal

Exness provides a number of ways to deposit and withdraw money to satisfy the needs of the majority of customers. These include payment cards, electronic wallet, cryptocurrencies, etc. In some payment systems, instant withdrawal is available.

| Exness | eToro | Forex.com | |

|---|---|---|---|

| Bank cards | Yes | Yes | Yes |

| Bank transfer | Yes | Yes | Yes |

| Electronic wallet | Yes | Yes | Yes |

| Cryptocurrency | Yes | No | No |

-

How much time does it take to withdraw money from Exness?

In terms of the time required for withdrawal, it can range from several minutes to several days, depending on the chosen method. The broker set up automatic instant withdrawal for payment systems, while for bank cards and bitcoin the process may take time.

-

What is the minimum and maximum withdrawal amount on Exness?

Everything depends on the payment system.

-

Does Exness charge commission for deposit and withdrawal?

No, but payment system may charge their commission individually.

Let’s visualize information:

| Period for withdrawal | Maximum amount of withdrawal | Minimum amount of withdrawal | |

|---|---|---|---|

| Bank card (MasterCard, Visa) | from 3 to 5 business days. | 25000 USD | 3 USD |

| Skrill | Instantly | 10 USD | 12000 USD |

| Perfect Money | Instantly | 100000 USD | 2 USD |

| Webmoney | Instantly | 100000 USD | 1 USD |

| Neteller | Instantly | 10000 USD | 4 USD |

| Yandex Money | Within 24 hours | 100000 RUB | 1 USD |

| Bitcoin | Up to 4 hours | No restrictions | No restrictions |

Review of trading platforms

Exness offers standard and most popular forex platforms including MetaTrader 4, MetaTrader 5 and WebTerminal on the basis of MT5. MetaTrader terminals are available for Windows, Mac, Linux, and also mobile devices.

If one were to dream and look at the competitors, it would have been good to have software for automation of trade, which makes the work with statistics easier through automation of trade.

| Pros |

|---|

|

| Cons |

|---|

|

Traditionally, let’s compare what the competitors have:

| Exness | eToro | Forex.com | |

|---|---|---|---|

| MT4, MT5 | Yes | No | Yes |

| Web | Yes | Yes | Yes |

| Own software for automation of trade | No | Yes | Yes |

| Special tradingSpecial trading | No | Yes | No |

| Software for advanced data analysis | No | No | Yes |

We are not doing a detailed review of the MetaTrade terminals, as they are not the broker’s own software. Let’s just focus on the main things.

MetaTrader 4

This has been the main ‘workhorse’ of the forex trading for many years. The interface is user-friendly and easy to understand even during learning. It has established itself as reliable and not overloading the hardware. However, there is a lack of orders and flexibility of timeframe settings.

Specifications

- Analytics: 30 built-in indicators and 23 analytical objects.

- Possibility to program trading robots for automatic work.

- Development of own robots.

- Simplification of fundamental analysis by information received directly at the terminal.

MetaTrader 5 trading terminal

This is an upgraded version of MT4, which fixed some drawbacks of the previous version. In particular, the platform has more advanced system of order placement, improved functionality for timeframe analysis. The hedging system allows to open divergent positions in one instrument. It is suitable both for the beginner trading and for creation of advanced trading robots.

Main specifications:

- 4 types of order execution.

- 6 types of deferred orders.

- Newsfeed and statistics calendar.

- Analytics: 38 built-in indicators and 22 analytical objects.

- Improved security.

- Strategy testing.

- Availability of virtual hosting lease directed at the terminal.

- Specialized MQL5 environment.

WebTerminal

Operates on the basis of MT. The key feature – does not require installation on the computer.

Analytics

Analytics of Exness leaves a lot to be desired. Everything is quite modest in terms of relevant content, trading signals and technical perks. Also, the majority of the materials are only available in English. Taking into account that the broker is positioned as international and actively operating in the countries with weak knowledge of English, it is a significant drawback.

| Benefits |

|---|

|

| Drawbacks |

|---|

|

Analytical support of traders

The Insights and Analysis section features non-regular reviews of current events and technical analysis of some instruments. Reviews are of generally good quality and it is clear they are written by a competent writer. The disappointing thing is that they don’t come out regularly, not even every day. That is clearly not enough for a full-fledged analytical support of the customers.

Tick history

This is the most useful section out of all analytical information on the broker’s website. You can download the tick movement of base currency pairs for any month, starting from 2015 for free. Developers of trading robots will appreciate this option.

Web TV

There is a section with the news of the specialized video service Trading Central on the website. The broadcasts are not only in English, but also in Russia, Arabic and Chinese. However, a more or less full-fledged business channel broadcasts only in English.

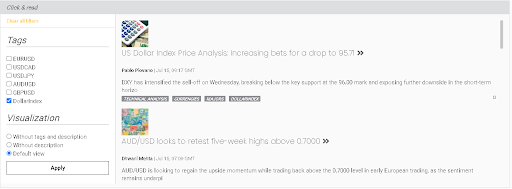

News

The website features an English-language newsfeed. The news can be filtered by tags. The news themselves are short messages on one of the currencies and timeframe with a very short commentary of a technical analyst.

There is also newsfeed in the corresponding sections of the terminals.

Trading alerts

Noteworthy, the broker practically did not provide a functionality for data analysis. In particular, the website does not have any automatic signal generation system, which has long become a part of ‘basic package’ for brokers.

Widgets

Calculator

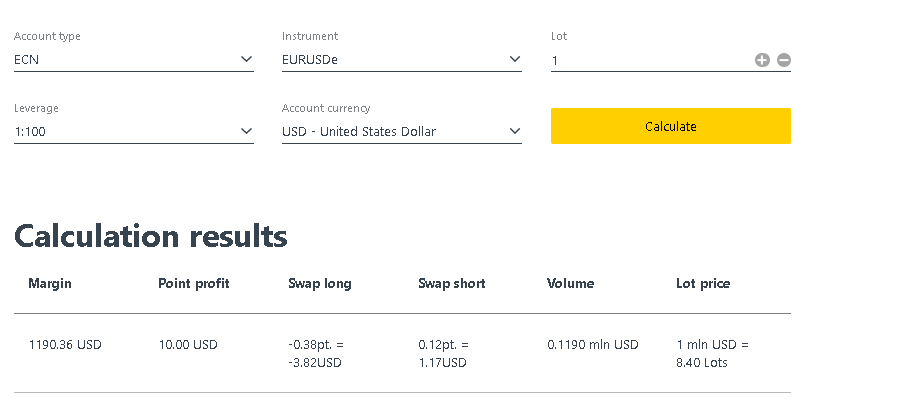

Out of the widgets, the trading calculator deserves mentioning, as it allows to calculate the key parameters of a trade. In a special template, you need to choose the type of account, instrument, lot and leverage and the system will calculate the parameters.

As for the drawbacks, the calculator does not provide the amount of all commissions on the trade, as, for example is done on RoboForex website.

Calendar

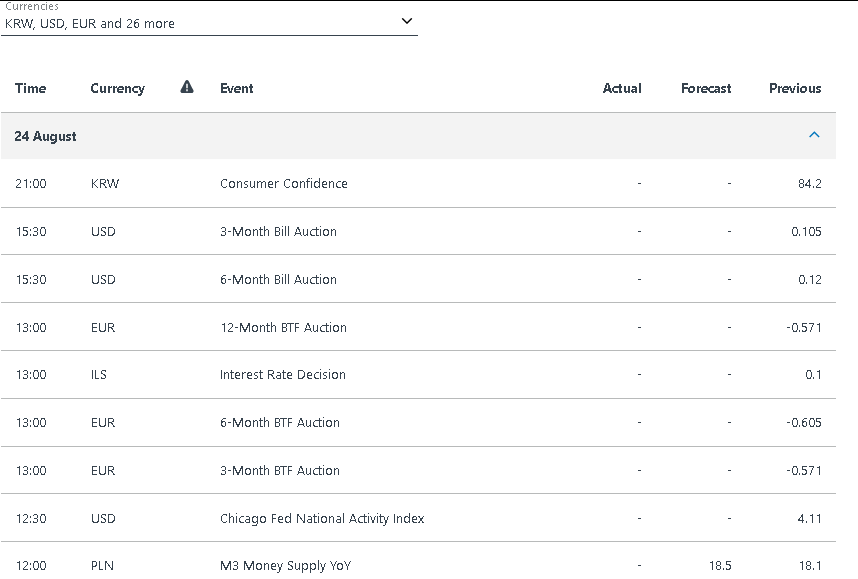

The calendar helps follow the relevant updates of economic statistics on the chosen currencies. There are also drawbacks here as well: there are no forecasts of analysts, the news items are not graded by importance, there are not filters to process information.

Learning

Just as the case with analytics, educational programs of Exness are rather superficial and unlikely to teach somebody how to trade. The majority of the materials are available only in English.

| Benefits |

|---|

|

| Drawbacks |

|---|

|

Academy

There is a small archive of short educational videos titled Academy on the website. It consists of videos ranging from 30 sec to 2 min, which introduce the basic notions of trading: what is bid and ask, what is balance and what is CFD. There are also several videos on basic mistakes in trading and psychological difficulties of trading.

The idea is good, but the material is so superficial that it can be useful only for the customers, who heard something about forex for the first time.v

Webinars

The broker holds webinars once a month in one of four languages: English, Arabic, Indonesian and Vietnamese. There is no video archive on the website, which is why we could not provide a substantial feedback.

Glossary

Just as the rest of the educational content of the broker, this section is not developed well enough. It consists only of several dozen terms with explanations containing only 1-2 sentences. That is clearly not enough not only to learn, but at least get an idea about the topic.

Customer support

Overall, we find the customer support of the broker of rather high quality. The specialists offer support in 15 languages. The main information of the website is available in 18 languages. The only drawback is that the support operates 24/7 only in English, Chinese and Thai.

| Cons |

|---|

|

| Pros |

|---|

|

To contact an operator call:

| Language | Operating hours (GMT0) |

|---|---|

| English, Chinese, Thai | 24/7 |

| Indonesia | Sun. 23:00 – Fri. 23:00 |

| Arabic | Sun. 23:00 – Fri. 23:00 Sat. - Sun. 12:00 - 20:00 |

| Hindi and Urdu | Sun. 23:00 – Fri. 23:00 Sat. - Sun. 04:00 - 20:00 |

| Bengali | Вс. 23:00 – Пт. 23:00 Сб. - Вс. 04:00 - 20:00 |

| Vietnamese | Sun. 23:00 – Fri. 17:00 Sat. - Sat. 03:00 - 11:00 |

| Japanese | Sun. - Fri. 23:00 - 15:00 |

| Korean | Sun. - Fri. 23:00 - 15:00 |

| French | Sun. 23:00 – Fri. 23:00 |

| Spanish | Sun. 23:00 – Fri. 23:00 |

| Portuguese | Sun. 23:00 – Fri. 23:00 |

| Russian | Mon.- Fri. 05:00 - 21:00 |

We have seen comments from the traders that when sending a request by email, they had to wait for response for several days on some occasions. Also, calling the broker on local number is not always successful. The broker explained that the delays could be due to the fact that the operation is not 24/7 for some languages.

Bonuses and promo

At the moment, Exness is not actively advertising bonus programs. In this way, the company is supporting the requirements of forex market regulators, which demand abandoning of such methods of increasing customer activity in many countries. So, this fact can be considered a positive feature.

The most known advertising campaign of recent years is the partnership with Read Madrid, one of the most popular teams in the world. In 2017, the broker signed a three-year sponsorship deal with the football club, which is also mentioned on the official website of the club.

Summary

Exness is a broker for specific goals. It is better suitable for the traders who consider the issue of commissions on the forex market important. The broker offers attractive trading plans, provides tick history and tries to create minimum issues during registration of an account and withdrawal of money.

However, diversity of trading instruments outside the forex market, advanced software and educational programs are not the qualities you will find in abundance on Exness. Regulation in the Seychelles also leaves questions, although, taking into account the 12-year experience and quite stable reputation, it is not critical.

Real reviews of EXNESS 2025

I liked the fact that Exness has some of the lowest fees on Forex, and on the crypto market too. Broker allows you to earn!

Exness talks about a bunch of clients and big strategic plans. Why should we value this broker? The choice of assets is scarce compared to other companies, there is no opportunity for passive income. Profit pays, but with delays. I think that this broker does not even reach 3 stars

Хотите торговать с Exness? Дважды подумайте перед регистрацией. Во-первых, с Россией, насколько мне известно, они так и не работают. У меня все шло хорошо пока не начал выводить деньги. И прошлось потратить кучу время доказывая, что я это я. История была, когда они прекратили работать с клиентами из РФ.

I am grateful to Exness for quality technical support. It is friendly and always ready to help with solving even complex issues.

Thanks to Exness support for help in trading. All issues are resolved promptly, there are many communication channels. I could not figure out the verification process in order to become a full-fledged client of the company, the technical support suggested the correct algorithm.

In Exness, I missed social trading like eToro. I think this is a big flaw. Automated trading would greatly simplify the process of making money.

In terms of commissions, the Exness Zero account suited me perfectly. Zero spreads and decent trading conditions. I doubled my deposit in a year.

I didn't want to risk it, so I opened a demo account on the Exness website. For trading, they give 10,000 virtual dollars. This amount is enough to practice and evaluate the functionality of the trading platform. The broker has an excellent payment discipline. Funds come to the WebMoney wallet instantly.

Exness is good for beginners. They don't have minimum deposit and charge low fees. Their multilingual support is very good too. However, for the advanced trader, there are few markets represented here.

Spreads are pretty tight on some account types, withdrawal is fast. In general, i'd add more stocks on platform and stock options. It seems Exness is not growing and the range of cfds is poor.

pretty good ecn provider. believe me newbies, it’s is a ver y important factor to check before you start trading with a broker which opens an access to the interbank. this one has everything arranged already, like good bridges and fast execution of pending orders. once i even asked them to send me some info about my order execution. just for the sake of curiosity, you know))) and theн did! sent me a report showing a lot of numbers and values. it was a greek to me haha))) but i also found there what i actually needed – i saw the nprovider’s name, which proves that they execute outside of their platfor. cannot say a word ‘bout other account types. never tried them.

I’ve chosen Exness broker because i got used to make business only with strong and serious partners without cheating and tricks. Open my account 3 months ago and have already withdrawn earning several times. Plus, a couple of day ago i got some bonuses and i am glad that this company is trying to improve its trading conditions. I’m gonna recommend this company to all my friends who are thinking about trying their hand on financial markets.

i placed 100 bucks just to test their withdrawal means and found no money after withdrawal request. i still have no idea where they took my money. actually i don’t give a fuck cause have no problems with money. i just tested them. another scammer. don’t deal with it.

yeap dudes. i confirm all those words you wrote above. the same shit happened with me. dunno what 2 do now((( probably someone here can help in my situation. i made depo and even traded with currency pairs, but not for long… then my friendz offered me to come to another dealing center with better conditions. why not?!?! and i placed a request for withdrazwals. but no such luck(( well, i’ve been waiting for 16 days already. one positive sign is that their support service answers my messages – they say they got problems with processin. but i dont believe ‘em. seems like they are hoodwinking me and promising jam tomorrow…

pleeeez help me out with that situation! maybe someone found a way to get money back! what should i do?

I can’t but agree that this rating contains only the best brokerage companies. Very big list and I guess everyone can find here a company to its taste. As for me, I like EXNESS. This company is very user-friendly and they really for people’s interests.

I work with EXNESS’s partner program and have no delays with money withdrawals. I’m happy with it and recommend it.

I’ve got my cent account on its platform, but aint doing any considerable trading at the moment. Well, that were recommendations and various reviews that made me chose this company.

I’ve got my cent account on its platform, but aint doing any considerable trading at the moment. Well, that were recommendations and various reviews that made me chose this company.

A reliable broker, I'm not really worried about my money. EXNESS is controlled by several regulators at once, so why bother? Colleagues, if you do not want your money to go far and away from you, choose EXNESS for cooperation - everything is safe here.

I'm also looking at Exness, I've read lots of reviews and they are mostly positive, although there are resources with negative client experience, anyway it's interesting reading))

I wonder what others will say.