On this page, you will find a large number of reviews from the real FOREX.com customers. If you are already working with Forex.com, please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Forex.com — Review 2021

Forex.com is a global broker established in 2001, providing access to Forex and CFD trading. Forex.com is owned by GAIN Capital, which is publicly listed on NYSE (ticker: GCAP). In turn, GAIN Capital is a wholly-owned subsidiary of StoneX Group listed on Nasdaq (ticker: SNEX).

As a broker, Forex.com is regulated by several top level financial authorities, including Financial Conduct Authority in the UK, and Commodity Futures Trading Commission in the U.S. The broker also holds a license of an offshore regulator (Cayman Islands).

Despite the license in the Caymans, Forex.com can be considered a safe broker, as it has a long history, and the stocks of its two mother companies are traded at the stock exchanges.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features of the broker

| Regulation | USA: Commodity Futures Trading Commission (CFTC) National Futures Association (NFA), and also FCM, RFED Canada: Investment Industry Regulatory Organization of Canada (IIROC) UK: Financial Conduct Authority (FCA) Japan: Financial Services Agency (FSA) The broker also holds licenses of the regulators of China, Singapore, the Cayman Islands. |

|---|---|

| Commissions and fees | Average or lower than average |

| Demo account | Yes, up to 30 days |

| Minimum deposit | 100$ |

| Inactivity fee | 15 USD (or equivalent in another currency) after 12 months of inactivity |

| Period for opening an account | 2-3 business days |

| Leverage | Depends on the instrument and branch, in which the account is being opened. For example, in the UK jurisdiction, the leverage ranges from 1:2 to 1:33 to 1 |

| Markets | Only Forex and CFD |

| Options for passive income | No |

| Support languages | In addition to English, support is also available in Russian, Polish, Spanish, Arabic, Chinese. |

| Withdrawal fee | No |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes, only PayPal (methods of deposit may vary depending on the jurisdiction of the account) |

| Supported currencies of the account | 6 currencies – EUR, GBP, USD, AUD, CHF, JPY (also can vary depending on the jurisdiction of the account) |

| Deposit bonus | No |

Geography of broker’s customers

Forex.com targets the residents of the U.S. with over half of its customers being the citizens of the United States. They are followed by the citizens of Canada, UK and Japan.

| Country | Percentage of customers |

|---|---|

| USA | 54,5% |

| Canada | 8% |

| UK | 6% |

| Japan | 3% |

| UAE | 1% |

The share of the Americans in the broker’s customer database is gradually decreasing, which can be seen as an expansion of Forex.com to the audience of other countries. The general interest towards the broker’s services is one the rise. Interestingly, this is mainly the audience from developed rich countries.

Commissions and fees

In the majority of cases, Forex.com charges commission in the form of the spread, regardless of the markets. This means not only Forex, where this practice is quite commonplace for all brokers, but also stock market.

There is, however, an exception in the form of a professional Forex account DMA (Direct Market Access), where a small near-market spread is applied with the commission on traded volume, which is directly linked to your market activity.

Overall, we described Forex.com level of commissions as average on the Forex and cryptocurrency market and low on the majority of other CFD markets from indices to metals.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on Forex.com

| Asset | Commissions |

|---|---|

| EUR/USD | Commission is included in the spread, which is typically 1.4 pips On DMA account – standard spread is 0.3 pips plus traded volume commission – from $20 per $1 million traded to $60. On the account with fixed commission – 5 USD per USD 100,000 traded. |

| Apple CFD | 1.8 cents per share, but no less than 10 USD per transaction. |

| CFD on S&P 500 | Commission is included in the spread, which is typically 0.6 pips |

| CFD on BTC/USD | Commission is included in the spread, which is typically 35 pips |

| Spot gold - XAU/USD | Average spread – 0.45 pips. |

| Non-trading commissions | Inactivity fee in the amount of 15 GBP or equivalent amount is charged after 12 months of inactivity (no trades on the account). |

Review of the broker’s commissions on Forex market

The level of commissions charged by Forex.com on a standard account of Forex market is average or higher than average, depending on the trading pair. It is possible to substantially reduce the expenses using DMA account, which offers substantial discounts for active traders.

As an example, let’s review the standard spreads of Forex.com and its two competitors – eToro and XTB.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| EURUSD | 1.4 | 1 | 0.9 |

| USDJPY | 1.3 | 1 | 1.8 |

| GBPUSD | 2.1 | 2 | 2.5 |

| EURGBP | 1.8 | 1.5 | 2.1 |

| EURCAD | 3.6 | 5.6 | 5.3 |

| USDRUB | 12.4 | 16 | Not available |

We can conclude that commissions on Forex.com are generally less beneficial for trading the most liquid major pairs, while the broker offers better conditions than its competitors for cross rates and exotic currency pairs.

As an illustration, let’s review an example of the commission to be paid per trade of 1 standard lot of 100,000 units of base currency of each of the pairs. All commissions and spreads have been taken into account.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| EURUSD | 14 USD | 10 USD | 9 USD |

| EURGBP | 22.84 USD | 19.04 USD | 26.65 USD |

| USDRUB | 162.44 | 209.6 USD | Not available |

Account with a fixed commission

In addition to an account with a spread, Forex.com offers an account with fixed commission at USD 5 per USD 100,000 traded, which allows to slightly reduce the expenses. Let’s review an example of reduction of the expenses below in comparison of the accounts.

Forex.com commissions on DMA account

To reduce market expenses, big clients with a balance over USD 25,000 can also use DMA (Direct Market Access) account on Forex.com to trade on the Forex market. The commissions on this account are lower on average. Moreover, active traders can also expect their expenses to decrease, as they directly depend on the traded volume.

| Monthly traded volume | Commission per $1 million traded | Reduction of expenses on commissions |

|---|---|---|

| 0M - 100M USD | 60 USD | 0% |

| 100M - 250M USD | 40 USD | 33% |

| 250M-500M USD | 35 USD | 42% |

| 500M-1B USD | 30 USD | 50% |

| 1B-2B | 25 USD | 58% |

| 2B+ | 20 USD | 67% |

Theoretically, using this system of reduction of commissions, the users can save up to 67% on expenses, which is equivalent to around USD 2 commission per 1 standard EURUSD lot. Based on this, let’s compare how much a trader will have to buy for a purchase of a standard lot, taking into account the spread and commissions on a Standard account and on DMA account. As an example, let’s use the traded volume of 100-250M per month.

Comparison of Forex.com account by the size of the actual commission

| Standard account | Account DMA | Account with a fixed commission | |

|---|---|---|---|

| EURUSD | 9 USD | 7 USD | 8 USD |

| EURGBP | 22.84 USD | 10.4 USD | 11.4 USD |

| GBPUSD | 21 USD | 14 USD | 13 USD |

This is the approximate difference in the level of commissions on different types of accounts. With trading volumes over 250M per month, the traders will be able to reduce their expenses even more.

Rate of financing on forex

The rates of refinancing on Forex.com are quite attractive for holding long positions, ranging within 2.5% annual. However, they can differ significantly depending on the rate of the central issuer bank of each currency.

The broker charges rollover fee at 5:00 pm. There are no fees charged for trading within one day. Below is an example of rollover of 10,000 units of base currency to the next day. If the swap is negative, the amount will be written off the account, if it is positive, it will be accrued to the account.

| Forex.com | ||

|---|---|---|

| Instrument | Swap long | Swap short |

| EURUSD | -1.43 | -0.26 |

| EURGBP | -1.31 | -0.15 |

| USDRUB | -1.33 | 0.76 |

The broker also provides an option of swap free trade for Muslim customers. To use this option, you will need to contact Forex.com support team.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Swap free | Yes | Yes | Yes |

Commissions on CFD

The broker provides the majority of trading instruments through contracts for differences (CFDs). Let us remind you that this is a high risk marginal instrument we recommend to use with caution.

Forex.com commissions on CFDs can generally be considered low, although, as usual there are nuances. Below, we provide commissions on all main CFD markets with examples. We review CFDs on indices and energies separately, as the approaches to charging commissions there are similar. CFDs on stocks and cryptocurrencies will be studied separately.

Noteworthy, the broker provides CFDs on bonds of the governments of different countries. The commissions are charged in a similar way to CFDs on stock indices.

Commissions on different classes of CFDs

| Asset | Spread |

|---|---|

| CFD on S&P 500 | Standard spread is 0.6 pips |

| CFD on FTSE 100 | Standard spread is 1 pip |

| CFD on Brent | Standard spread is 0.05 pips |

To make it clearer, below is factual commission a trader will have to pay for the purchase of three types of CFDs for the amount of USD 5,000 on Forex.com, eToro and XTB.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| CFD on S&P 500 | 0.89 USD | 1.05 USD | 0.89 USD |

| CFD on Brent | 5.55 USD | Not traded | 5.12 USD |

Overall, Forex.com commissions on different classes of CFDs can be considered low. The broker has better conditions in terms of this indicator than eToro, and is practically at the same level as XTB.

CFD on stocks

The broker’s commissions on CFDs on specific stocks are low. The only disadvantage here is the minimum commission per lot, which makes it more beneficial to purchase large volumes.

Let us also remind you that CFDs on stocks is a speculative instrument, created for profiting on price volatility. They do not provide ownership right to a part of a company and are not considered a classic investment instrument.

| CFD on stocks (country, account or class) | Conditions | Minimum commission per trade |

|---|---|---|

| CFD on US stocks | 1.8 cent per share | 10 USD |

| CFD on UK stocks | 0.08% of volume traded | 10 GBP |

| CFD on EU stocks | 0.08% of volume traded | 10 EUR |

| CFD on Hong Kong stocks | 0.15% | 15 HKD |

| CFD on Australian stocks | 0.08% of volume traded | 5 AUD |

| CFD on Japanese stocks | 0.05% | 1 000 JPY |

| ETF | 1.8 cent per share | 10 USD |

As an example, let’s use the purchase of 1 lot of CFD on stocks in the amount of USD 4,000. We will compare the conditions with XTB.

| Forex.com | XTB | |

|---|---|---|

| CFD on Apple stocks | 10 USD | 8 USD |

| CFD on Adidas AG | 11.7 USD | 9.36 USD |

| CFD on Barclays | 12.7 USD | 9.36 USD |

Noteworthy, excluding the minimum commission, Forex.com and XTB charge practically identical commissions that are considered low.

CFD on cryptocurrencies

Forex.com commission rates on CFDs on cryptocurrencies are low and much better than those of its direct competitors from our review. For example, the standard spread on Bitcoin is 35.0.

| Cryptocurrency | Standard spread |

|---|---|

| Bitcoin | 35.0 |

| Litecoin | 0.5 |

| Bitcoin Cash | 2 |

| Ethereum | 1.2 |

As you can see, Forex.com conditions for trading cryptocurrency are not just better; they are times better than eToro and XTB for specific positions.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Bitcoin | 6.64 USD | 11.22 USD | 20 USD |

| Ethereum | 7.03 USD | 35 USD | 40 USD |

| Litecoin | 21.98 USD | 40 USD | Not available |

Non-trading commissions

Non-trading commissions on Forex.com are generally low. The only exception is the inactivity free, charged after 12 months of inactivity on the trading account.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Inactivity fee | 15 USD (or an equivalent in another currency) after 12 months of inactivity | 10 USD after 12 months of inactivity | 10 USD after 12 months of inactivity |

| Withdrawal fee | No | 5 USD | 2% to e-wallets; 20 USD for withdrawals less than 100 USD |

| Deposit fee | No | No | No |

As we can see, the broker lags behind its competitors only in terms of inactivity fee, while compares favorable in terms of withdrawal fee.

Reliability and regulation

Overall, Forex.com, based in the U.S. is a reliable partner for transactions with currency pairs and CFD financial instruments.

Licenses of Forex.com

The question is whether the conditions for all customers are the same. Is the deposit insurance available? We thoroughly examined these issues.

Below is the table with detailed information about the license and security of Forex.com.

| Customer’s country of residency | Legal entity. Broker’s branch. | Regulating authority | Deposit insurance |

|---|---|---|---|

| USA | GAIN Capital Group LLC | Commodity Futures Trading Commission (CFTC) National Futures Association (NFA), and also FCM, RFED | No |

| Canada | GAIN Capital - FOREX.com Canada Limited | Investment Industry Regulatory Organization of Canada (IIROC) | 1 million CAD |

| European Union | GAIN Capital UK Ltd. | Financial Conduct Authority (FCA) | 85,000 GBP |

| Japan | Gain Capital Japan Co. | Financial Services Agency (FSA) | No |

| Other countries | GAIN Global Markets Inc. | Cayman Islands Monetary Authority (CIMA) | No |

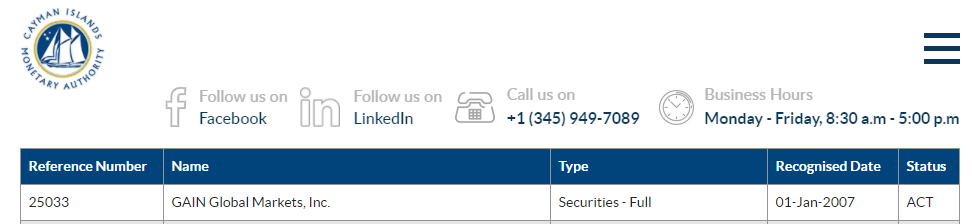

In terms of security, a lot depends on the jurisdiction, in which an account is opened. The broker’s system automatically determines the country of the website’s visitor. So, it is possible that in your case, the account will be opened in the jurisdiction of an offshore regulator. The broker does indeed hold the license of the Cayman Islands and it’s been valid since 2007.

Excerpt from the register of the regulator from the Cayman Islands

In which jurisdiction can a customer open an account? Theoretically, the customers do have a choice. It is important to pay attention to the “website footer”, where it is specified in grey letters, which legal entity you are dealing with. Below we provide an example of the page, which redirects you depending on the user’s country.

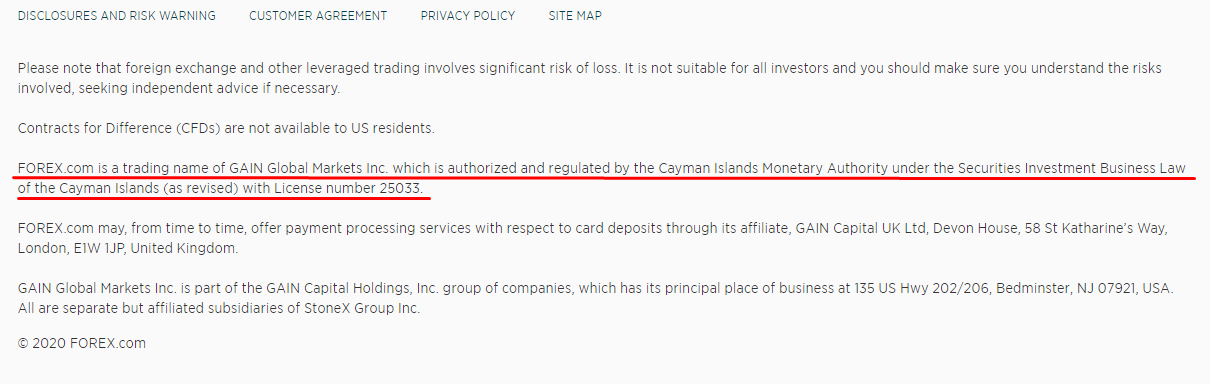

For example, forex.com/en/ is managed by GAIN Global Markets Inc. (license of the offshore regulator). The footer looks like this:

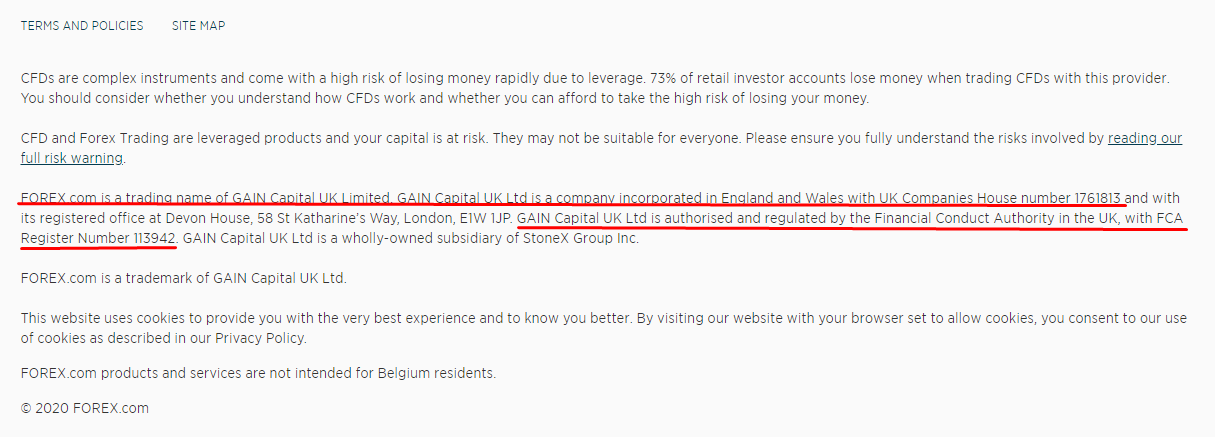

If you go to forex.com/en-uk/ , you will see that the footer has changed and you are in the British branch now.

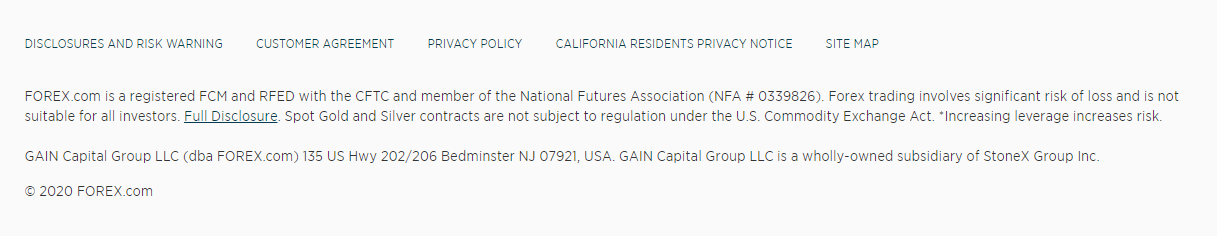

The screenshot below shows the footer on forex.com/en-us/

This part of the domain belongs to the American branch – GAIN Capital Group LLC.

Transitions between the branches are not very noticeable from the content of the upper part of the pages, but it is important to take notice of it. Why? For example, let’s take negative balance protection. This option is available, but only for retail traders from the EU, who opened their accounts under the jurisdiction of GAIN Capital UK Ltd (UK).

Other customers risk sustaining losses that exceed the balance of their account. The probability of this unpleasant situation, although very small, does exist. Despite that Forex.com strictly observes the requirements for marginal coverage of the account, the most unfavorable scenario could become a reality in the periods of extreme market volatility. For this reason, the broker insistently recommends that the customers thoroughly control the use of the leverage.

Forex.com domain is owned by Gain Capital. To evaluate the reliability of the broker, see the facts from the history of the mother company Gain Capital listed below.

GAIN Capital is a US-based provider of online trading services, headquartered in Bedminster, New Jersey.

Gain Capital Headquarters

The company provides market access and trade execution services in Forex and contracts for differences (CFDs) to retail and institutional investors. The company also owns advisory business, SALT Invest, and futures provider, Daniels Trading.

GAIN Capital provides services for the customers from over 140 countries and gains over half of its revenue from outside the USA. The company has offices in London, Sydney, Hong Kong, Tokyo, Singapore and Seoul.

The company was founded in 1999. In 2010, the company went public with an IPO; its shares are listed at the New York Stock Exchange (NYSE:GCAP). In October 2014, the company acquired a UK-based competitor, City Index, for $118 million, expanding its business in the UK.

In 2017, Gain Capital agreed to acquire FXCM’s client base a date after the latter had been barred by the CFTC and NFA from doing business in the U.S. The company paid $7.2 million for these accounts.

Nonetheless, Gain Capital’s reputation is not entirely spotless.

- In May 2008, China Banking Regulatory Commission informed that Gain Capital had breached the rules that prohibit forex trading firms providing retail forex trading services through direct solicitation to Chinese residents through the Internet without a permit. The company did not accept Chinese clients until 2010, when the conflict was settled.

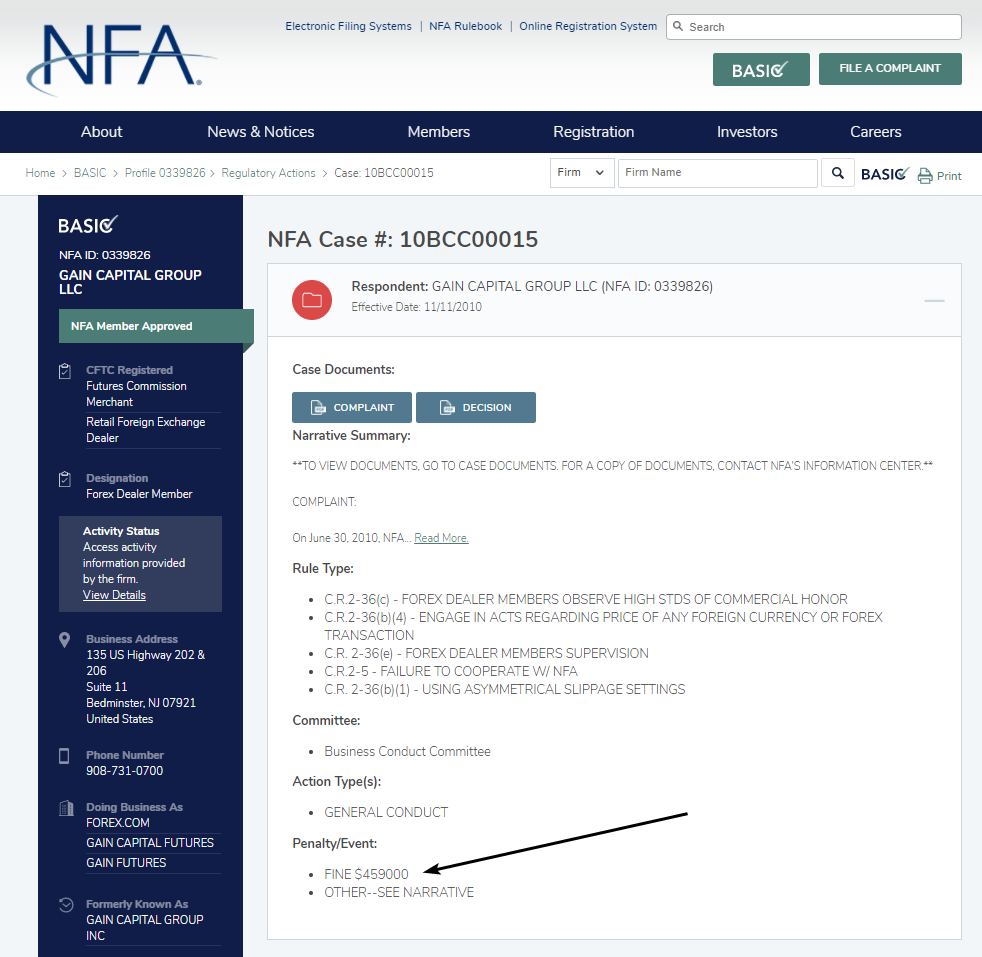

- In October 2010, Gain Capital was fined by the National Futures Association for allegedly engaging in margin, liquidation and price slippage practices that benefited Gain to the detriment of its customers. The company was fined $459,000, which is proven by the excerpt from the regulator’s register.

To the company’s credit, Gain Capital agreed to refund to customers the amount of negative slippage they experienced on the trades that were placed in their accounts between May 1 and July 31, 2010.

It has been 10 years since the last case and Gain Capital hasn’t had any ‘disputes’ with the regulators since.

In July 2020, a new period began in Gain Capital’s history. The company was acquired by a larger financial structure, StoneX (ranked 100th on Fortune 500, founded in 1978), servicing nearly 300,000 customers across the world. StoneX paid $236 million for the acquisition.

So, speaking about transparency, we can say that Forex.com is a unique broker, because it is managed by two public companies with open statements about their shareholders, revenues and incomes, etc.

Markets and products

The name and the domain of Forex.com quite unambiguously points to the markets the broker provides access to.

However, if you expect that Forex.com is only about trading currencies, you are in for a pleasant surprise. In addition to 80+ currency pairs, Forex.com customers can also trade CFDs on metals, indices, cryptocurrencies and popular stocks. There are also other thematic CFDs, which we will discuss later on. Overall, the broker provides access to over 300 markets.

Pros and cons of the broker’s market diversity

| Pros |

|---|

|

| Cons |

|---|

|

Market accessibility on Forex.com

| Forex.com* | eToro | XTB | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | No | Yes | Yes |

| CFD | Yes | Yes | Yes |

| Crypto | Yes* | Yes | Yes* |

| Bonds | Yes* | No | No |

| Futures and options | No | No | No |

| Commodities | Yes* | Yes | Yes* |

| Mutual funds | No | No | No |

| ETF | Yes* | Yes | Yes* |

* – only as CFDs

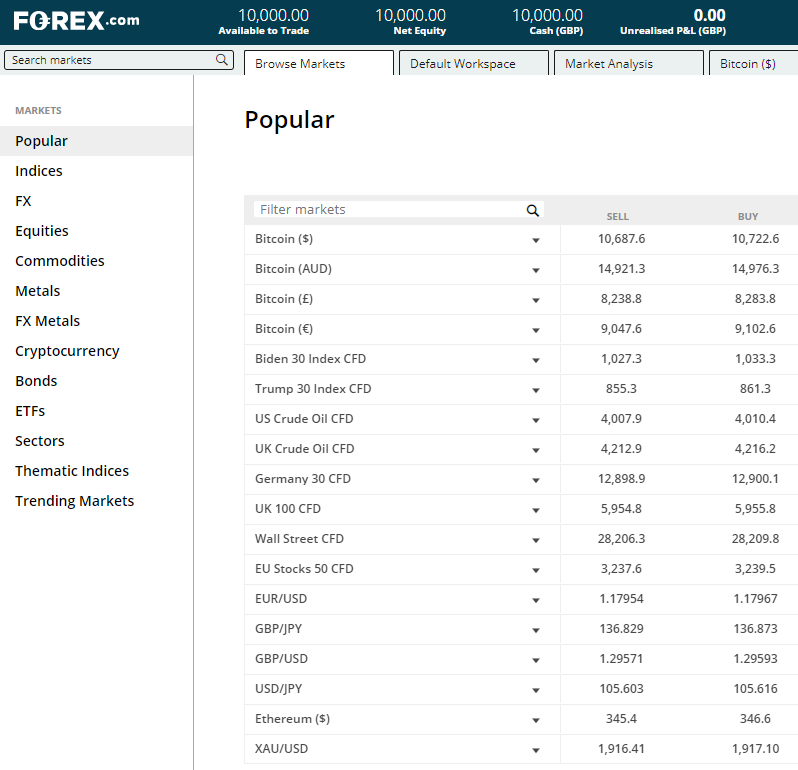

Below is the screenshot from Forex.com web platform, where you can see clearly the types of financial markets available for trading.

Forex market

To the credit of forex.com domain owner, the number of available currency pairs is high, nearly twice as high as the competitors from our review.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Number of trading pairs | 91 | 47 | 47 |

The broker’s platform provides access to trading not only all classic pairs and main cross rates, but also many exotic pairs, such as Singapore dollar to Hong Kong dollar (SGD/HKD). This is Forex.com’s edge over the competitors.

CFD market

In terms of CFD instruments, there is a diversity of them, as the main markets/industries are covered. However, the choice of specific instruments inside the market/industry may be small.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| CFDs on stocks * | 220 | 2042 | 1800 |

| CFDs on bonds | 12 | No | No |

| CFDs on Crypto | 9 | 16 | 25 |

| CFDs on indices | 20 | 13 | 42 |

| CFDs on commodities | 16 | 14 | 22 |

| CFDs on ETF | 20 | 145 | 114 |

* CFDs on shares are the ‘weakest link’. This could be particularly inconvenient, if a share from the middle echelon is in movement and you want to trade, but it is unavailable in the CFD list.

However, the figure 220 (it is mentioned in many reviews, including on English-language landing pages of Forex.com) is not quite accurate, maybe because it is about securities for different countries. If you go deeper into the web platform, you can find thousands of CFDs on stocks of Asian companies. Then, the total number of available CFDs on stock will exceed 4,000 CFDs approximately.

Also noteworthy are several thematic CFDs. As of the time of this review, there were seven of them, but it can change as some information trends that could affect financial markets are becoming increasingly popular.

Essentially, thematic CFDs are derivative portfolios, collected from assets based on a specific feature. Such portfolios are composed by professional financiers and are fully capable of being a stable trends.

For example, below you can see Green Index chart.

This CFD correlated with the stocks of companies, operating in green energy, specifically production of equipment for renewable energy sources, alternative fuel, waste management, water purification, development of sustainable technologies, etc.

As you can see, this market is actively growing, and Forex.com customers and easily and beneficially invest in Green Index CFD instead of researching the statements of companies independently, forming and rebalancing the portfolio, which is much more complicated.

Geography of markets

Forex.com is a broker that targets financial instruments on the U.S. A vivid example of that is the US Presidential Election 2020. On the wave of popularity of the topic in the United States, Forex.com customers can now trade the broker’s election indices Trump-30 and Biden-30.

Assets from other countries are not uniformly represented. Details are in the table below

| North America | USA. The markets are sufficiently represented. Canada. The markets are thinly represented. There is no CFD on Canadian stock index, only one CFD on stocks of a Canadian company. |

|---|---|

| UK | The markets are widely represented. There are dozens of CFDs on stocks, three CFDs on indices. |

| Europe | Belgium, France, Italy, Netherlands, Portugal, Spain, Denmark, Finland, Norway, Sweden, Switzerland, Poland – assets associated with these countries are almost completely absent. There are, however, several instruments for Germany – CFDs on stocks, although no more than 20. Also, transactions with several CFDs on European bonds are available. |

| Asia | Hong Kong. The markets are sufficiently represented. Singapore. The markets are sufficiently represented. There are also CFDs on indices of stock exchanges of Japan and Australia, CFDs on bonds of Japan. |

As you can see, Europe is thinly represented.

Opening an account

The structure of accounts on Forex.com is quite simple. However, it does differ depending on the region. The minimum deposit allows you to start trading even if you have a small amount at your disposal. Overall, the broker is ranked highly in terms of this aspect.

Pros and cons of the structure

| Pros |

|---|

|

| Cons |

|---|

|

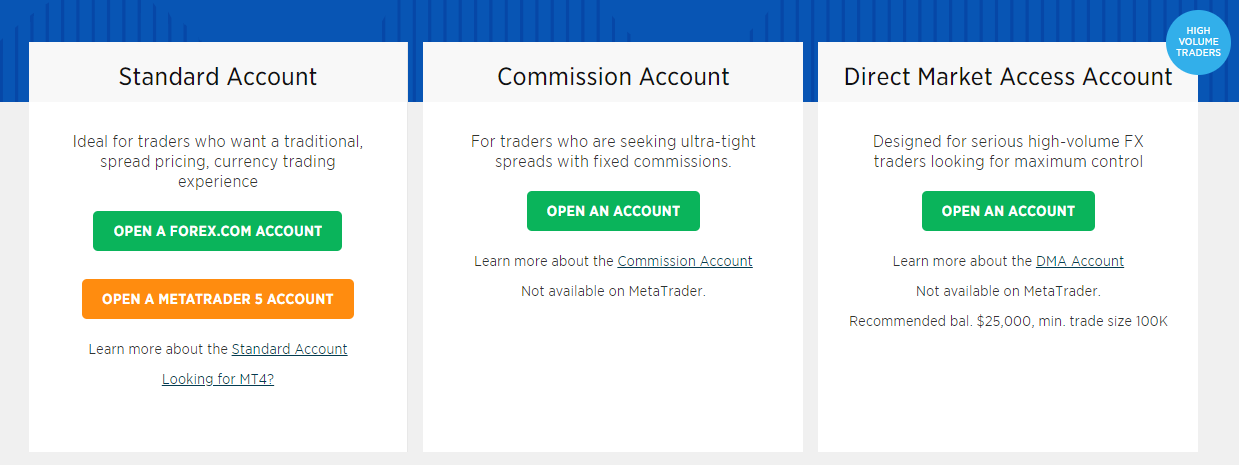

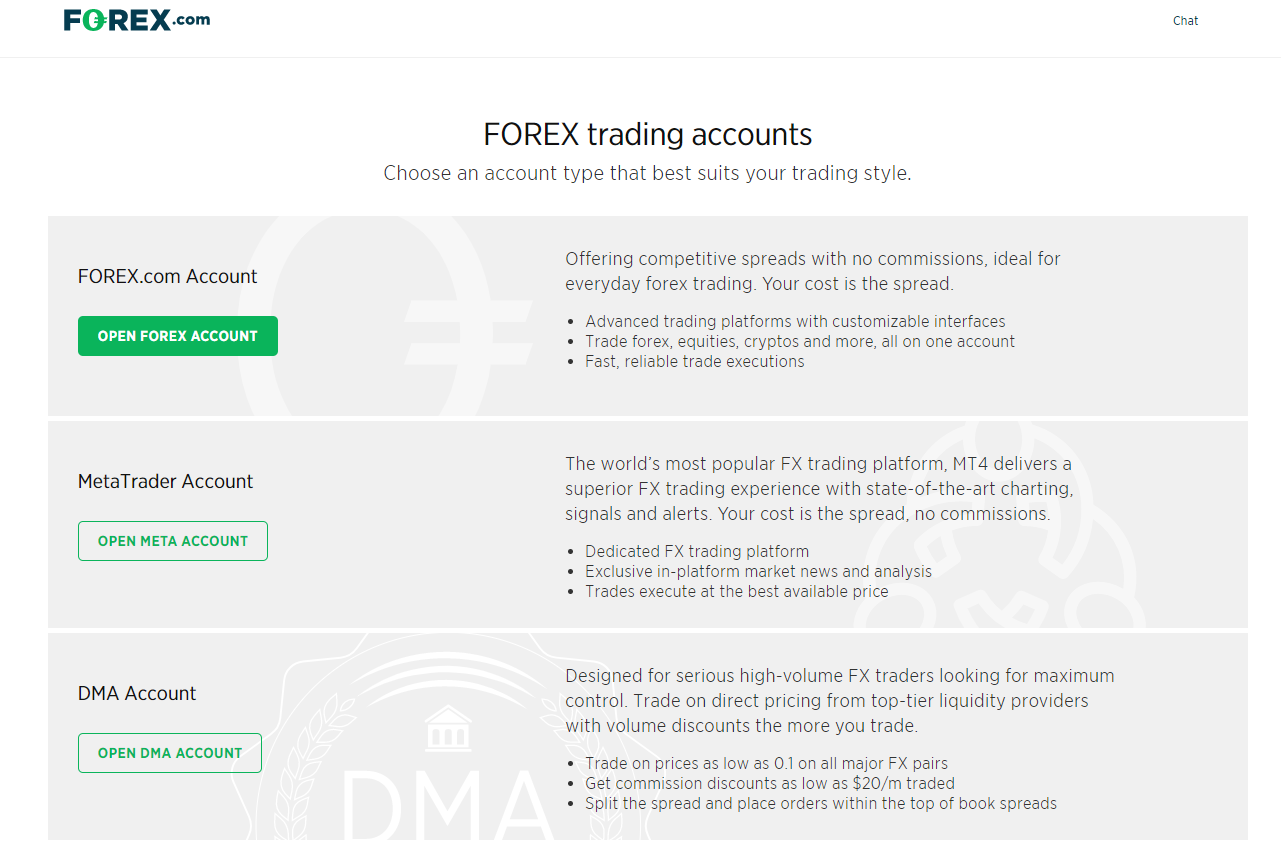

The image below shows how the pages for the branches regulated by the authorities of the USA and the Cayman Island look like:

Three types of accounts are available:

- Standard Account

- Commission Account – an account with fixed commission. There is a restriction here – you cannot trade via Metatrader.

- Direct Market Access (DMA) Account. This account is designed for high-volume traders. The minimum deposit on DMA account is USD 25,000.

The European version of the website (regulated by the UK’s FCA), has a different structure of accounts:

There is also division of account based on ownership. In particular, Forex.com offers the following options:

- Individual – an account owned by an individual

- Joint – an account owned by two or more individuals

- Corporate – an account owned by a legal entity

What is the minimum deposit?

The minimum deposit on standard accounts is $100. This applies to all accounts, except for DMA.

However, support in chat recommends opening an account starting from USD 2,500. Naturally, they may be more economic rationality in this actions, but if you only want to explore forex, it is best to do with minimum at first.

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Minimum deposit | 100$ | 200$ | No |

Overall, Forex.com offers attractive conditions for those, who have a small initial capital.

Citizens of which countries cannot trade on Forex.com

The restrictions by countries differ depending on the regional branch of Forex.com, where the account is being opened. This is due to the fact that broker’s branches are regulated by different authorities in different regions.

For example, the residents of the majority of European countries are automatically redirected to the page of GAIN Capital UK Ltd. It is regulated by the FCA. Residents of Belgium are prohibited from opening accounts in this jurisdiction.

Belgians, however, can open an account in the jurisdiction of the Cayman Islands, which is not allowed for the residents of the U.S.

If you go to forex.com/en-us/international/ , you will be able to choose your country from the pop-down menu and the system will redirect you to the corresponding branch.

Some interesting facts:

- The system redirects residents of Australia to City Index website (it is also a part of Gain Capital Group);

- The list does not have Syria, Iran and North Korea (which is expected) and also New Zealand (which is unexpected).

Documents required for opening an account

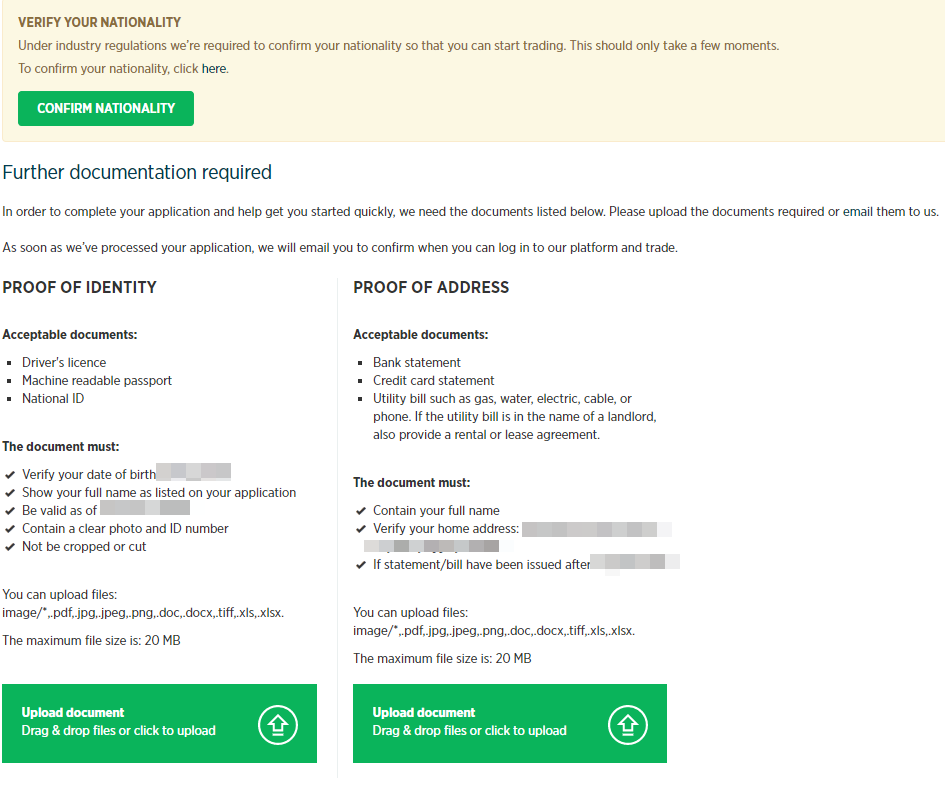

Forex.com is a respected broker from the U.S. and therefore complies with the international anti-money laundering policy AML/KYC, and also MIFID guidelines, which is why verification (proof of identity) is mandatory for opening a real account.

To pass verification, you will need the following:

- Identification document, for example a national passport or driver’s license;

- Document confirming place of residence, for example a bank statement, utility bill, tax payment confirmation.

After you upload scans / high-quality photos of documents, Forex.com employees will review your application. This could take up to 2-3 business days (due to the high load of the broker’s services).

Overall, judging by the reviews online, the verification procedure on Forex.com goes smoothly, although in isolated cases, the broker may reject the application, without providing a reason.

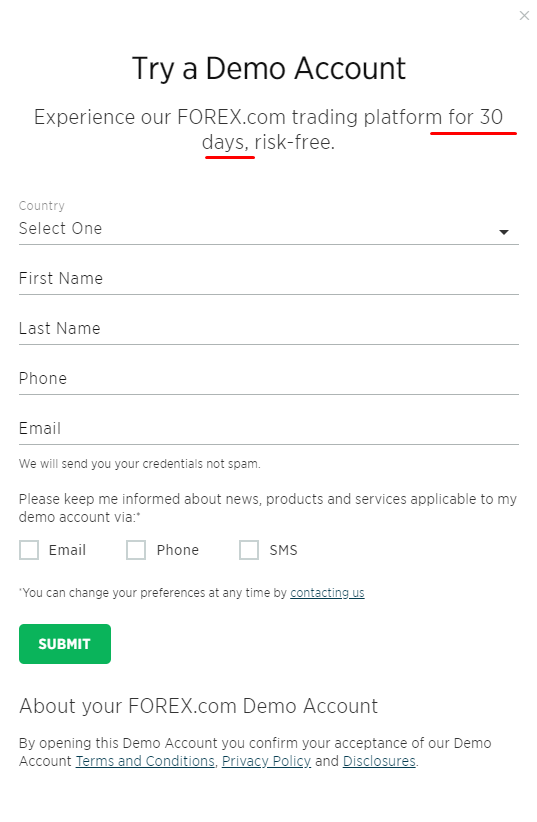

Opening a demo account

It is easy to open a demo account on the broker’s website. You need to choose the type of the demo account you want to open – for Forex.com platform or for Metatrader, and after you fill out a simple form (example is provided below), you will receive demo account access data to your email.

Demo account (both for Forex.com and Metatrader platforms) is active for 30 days. This period is enough to evaluable the quality of the services the broker provides.

Trading accounts

For convenience purposes, we put all features of the three types of accounts into one table (data for European branch – GAIN Capital UK Limited (London).

| Forex.com Account | eToro | XTB | |

|---|---|---|---|

| Minimum deposit | 100$ | 100$ | 25,000$ |

| Platforms | Proprietary platform Forex.com | Metatrader platforms | Proprietary platform Forex.com |

| Instruments | Maximum number of markets | CFDs on stocks trading is unavailable, there are restrictions on CFDs on commodities | Maximum number of markets |

| Spreads | Standard | Standard | Reduced, additional bonuses on trading volumes |

| Types of orders | Standard + Advance | Standard | Standard + Advance |

One individual can open not more than three accounts. However, you cannot quickly switch between the accounts.

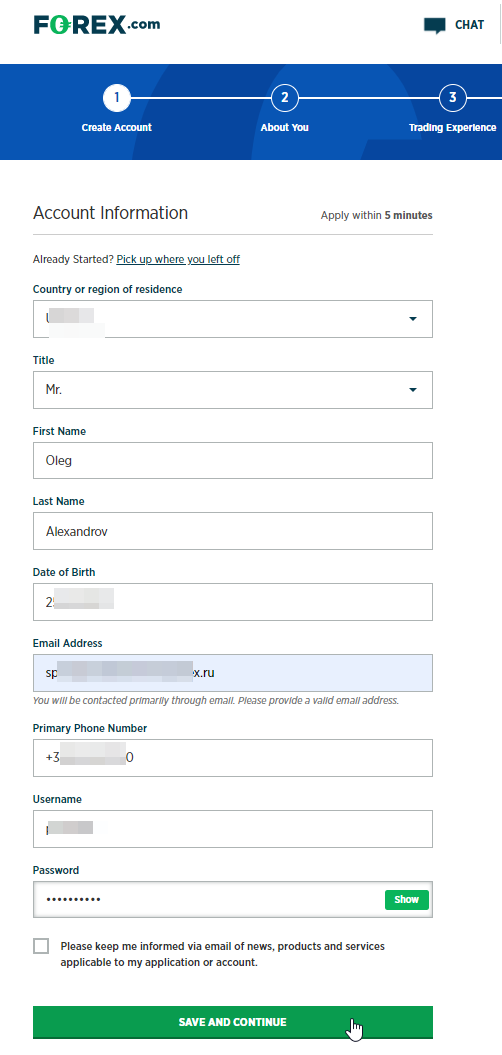

How to open an account: step-by-step guide

Opening an account on Forex.com is simply and fully online. The procedure consists of four steps + verification.

Before sharing the screenshots, let’s us specify that we were opening an account in the European jurisdiction.

Step 1. Creating an account.

You need to provide your first name, last name, email/password. Then, choose your country from the pop-down menu.

If the country is not in the list (European branch accepts nearly all countries), then select a different jurisdiction – USA, Cayman Islands. The procedure of opening an account in this case could be slightly different.

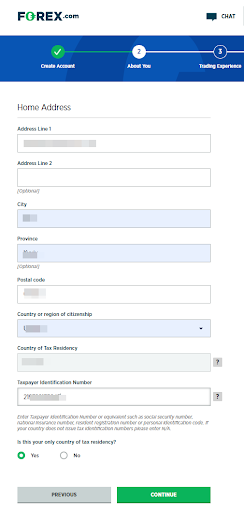

Step 2.

Then, you need to provide your address, taxpayer details, confirming the source of your funds.

Step 3.

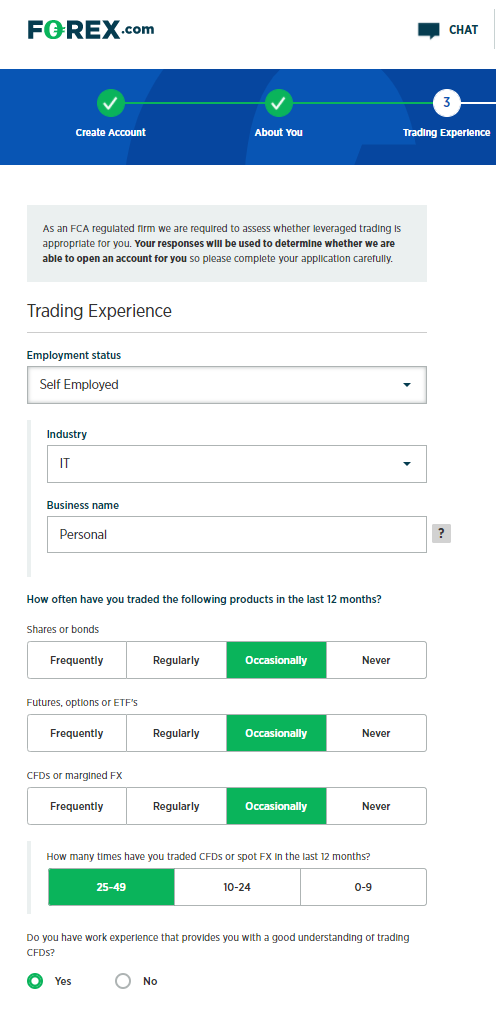

In this section, you need to answer the questions regarding trading and finance:

- Your employment status;

- Your trading experience and specify it;

- Your financial status – what you are worth and how much you plan to invest.

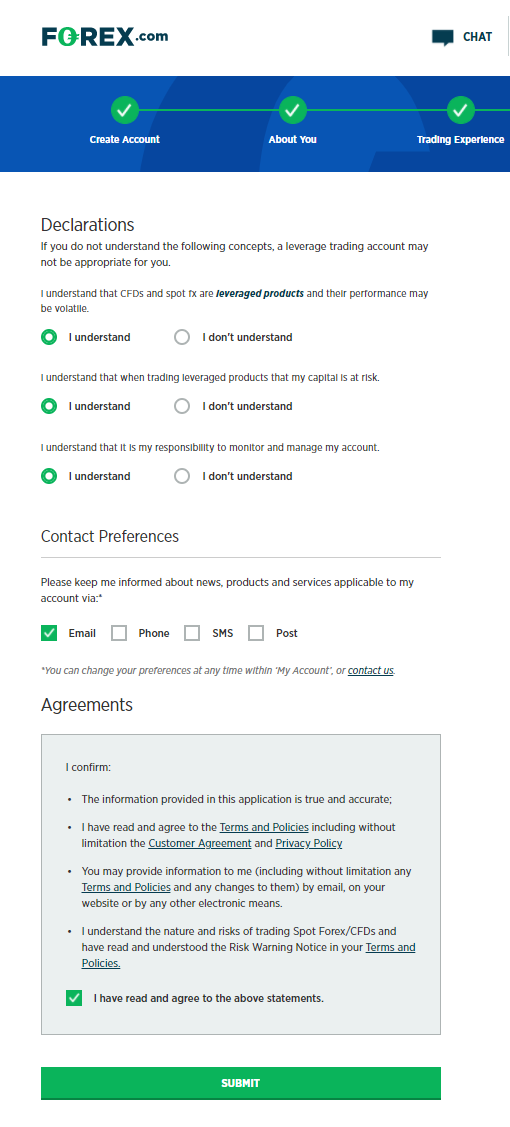

Step 4 is confirmation that the information provided in the application is true and correct. You also need to check the box, confirming that you agree with the broker’s policies and warnings.

After you confirm that you provided correct information, your profile will open. However, you won’t be able to access its full version until you provide the documents.

The system will ask you to confirm your nationality (passport details) and upload scans of two documents to verify your identity and address.

After you’ve uploaded the documents, all is left to do is wait for 2-3 business days for the company’s specialists to check your documents and approve your application.

Base currencies of the account

You can open an account in the UK jurisdiction (FCA) in three currencies. For other jurisdictions, there will be differences, for example, a possibility to have an account in yen, if you open the account via Gain Capital Japan Co. Overall, in all branches, including the offshore, you can have an account in one of six currencies.

The choice of account currency is important to avoid additional expenses on conversion.

| Forex.com (total for all regions) | eToro | XTB | |

|---|---|---|---|

| Number of base currencies | 6 | 1 | 5 |

| List of base currencies | EUR, GBP, USD, AUD, CHF, JPY. | USD | USD, EUR, GBP, PLN, HUF |

Thanks to expanded geography in the structure of the mother company Gain Capital, the holders of Forex.com accounts have some choice for their account currency. The competitors might not offer any choice at all.

Trading with leverage

Every account opened in the jurisdiction of GAIN Capital UK Limited (London) features a marginal trading (leverage) service by default. At that, firstly, the size of the leverage is set at the maximum level, and secondly, the leverage cannot be set up or cancelled.

Leverage is as follows:

- 30:1 for major currency pairs (3.33% margin)

- 20:1 for minor currency pairs, gold and CFDs on main stock indices (5% margin)

- 10:1 for CFDs on commodities and minor stock indices (10% margin)

- 5:1 for CFDs on stocks (20% margin)

- 2:1 for CFDs on cryptocurrencies (50% margin)

Deposit and withdrawal

You should keep in mind that the methods of deposit and withdrawal may differ depending on the branch of the international company Gain Capital, which manages Forex.com. Within this review, we will examine methods of deposit and withdrawal of funds from the accounts opened under FCA jurisdiction (UK). Residents of practically all countries can open accounts here.

| Pros |

|---|

|

| Cons |

|---|

|

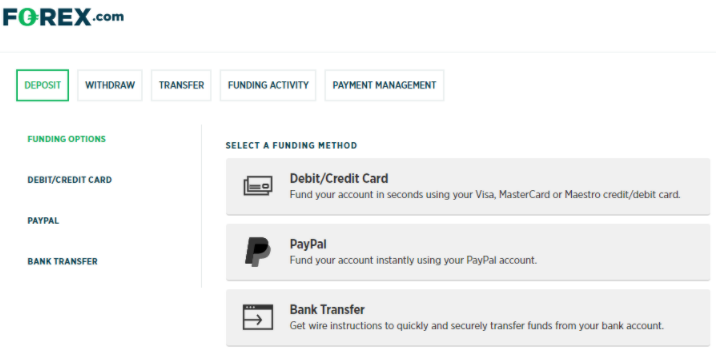

Methods and timeframe for deposits

There are three methods for holders of Forex.com accounts, opened in GAIN Capital UK Limited (London), to deposit funds.

| Method of deposit | Fee Timeframe | Peculiarities |

|---|---|---|

| Wire Transfer | No fee 1-2 business days | Transfers from 100 GBP are accepted. The maximum amount is not set. It is possible to transfer USD, EUR, CAD, JPY, CHF, AUD, GBP. They will be converted into the account currency. |

| VISA, MasterCard, Maestro debit/credit cards | No fee. The funds are credited within 24 hours. | Transfers from 100 GBP to 100,000 GBP are accepted. USD, EUR, CAD, JPY, CHF, AUD, GBP are accepted. |

| PayPal | The funds are credited instantly, but the broker specifies that a delay of up to 48 hours is possible. | Transfers from 100 GBP to 50,000 GBP are accepted. EUR, GBP, USD are accepted. |

| Bitcoin | No | - |

This choice of methods of deposit is average by number and lower than average compared to the market. For comparison:

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard debit/credit cards | Yes | Yes | Yes |

| Electronic payment systems | Only PayPal | 6 | PayPal, Skrill, Neteller and other. 9 in total. |

| Cryptocurrencies | No | No | No |

It would be advisable for Forex.com to increase the number of support e-wallets in order to keep up with the competitors.

Methods of withdrawal and fees

In the table below, we analyze how quickly the broker provides withdrawal of funds and sufficiency of the methods of withdrawal.

| Method of withdrawal | Withdrawal fee Timeframe | Peculiarities |

|---|---|---|

| Wire transfer | No fees. Wire transfers can take up to 2-3 business days. | No limitations on the amount |

| Debit/credit cards | No fees. Usually within 48 hours. | Up to GBP 100,000 |

| PayPal | Up to 48 hours. | Up to GBP 20,000 per one transfer. Your PayPal must support acceptance of funds. |

| Bitcoin | No | - |

Trading platforms

Forex.com proprietary platform is very user-friendly, boasts nice and sophisticated interface, which can be very flexibly customized.

| Pros |

|---|

|

| Cons |

|---|

|

Comparative table with competitors

| Forex.com | eToro | XTB | |

|---|---|---|---|

| Metatrader platforms | Yes, only MT4. Desktop, web, mobile versions | No | Yes, only MT4. Desktop, web, mobile versions |

| Proprietary platform | Forex.com Desktop, web, mobile versions | Yes, web and mobile versions | xStation 5 Desktop, web, mobile versions |

As Metatrader platforms are widely known, let’s focus on the Forex.com platform, especially since it deserves attention.

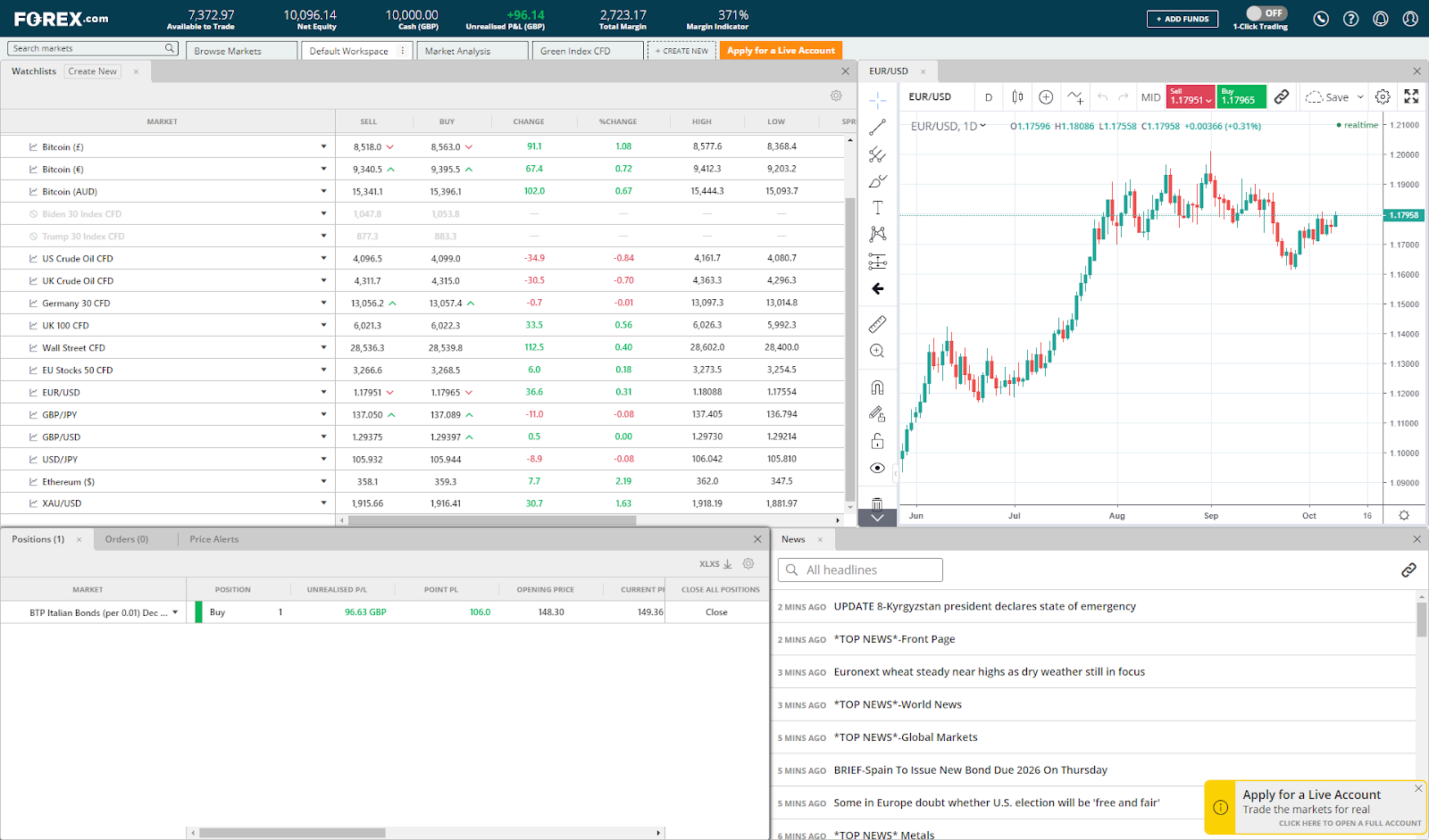

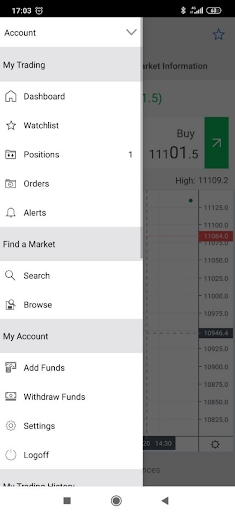

Forex.com web platform

Forex.com Web Trader, the main web platform, boasts an excellent design and is very user-friendly. It is located at the sub-domain webtrading.forex.com

Login to the platform is one-step, without additional confirmations, which is a drawback for the security.

The interface is customizable. By default, it is split into four sections:

- Top left – working with the list of instruments.

- Top right – chart with the possibility to mark and execute trades. By the way, a click on the list of instruments does not mean that the data on this instrument will automatically load onto the chart, which is not very intuitive.

- Bottom left – account data. Open and closed positions, etc.

- Bottom right – newsfeed.

The traders can easily add, delete or modify the size and location of the tabs to create their own space. They can also choose between light and dark themes.

Search features are very flexible. The instruments are grouped according to intuitive features. It is easy to Find/Filter what you are looking for.

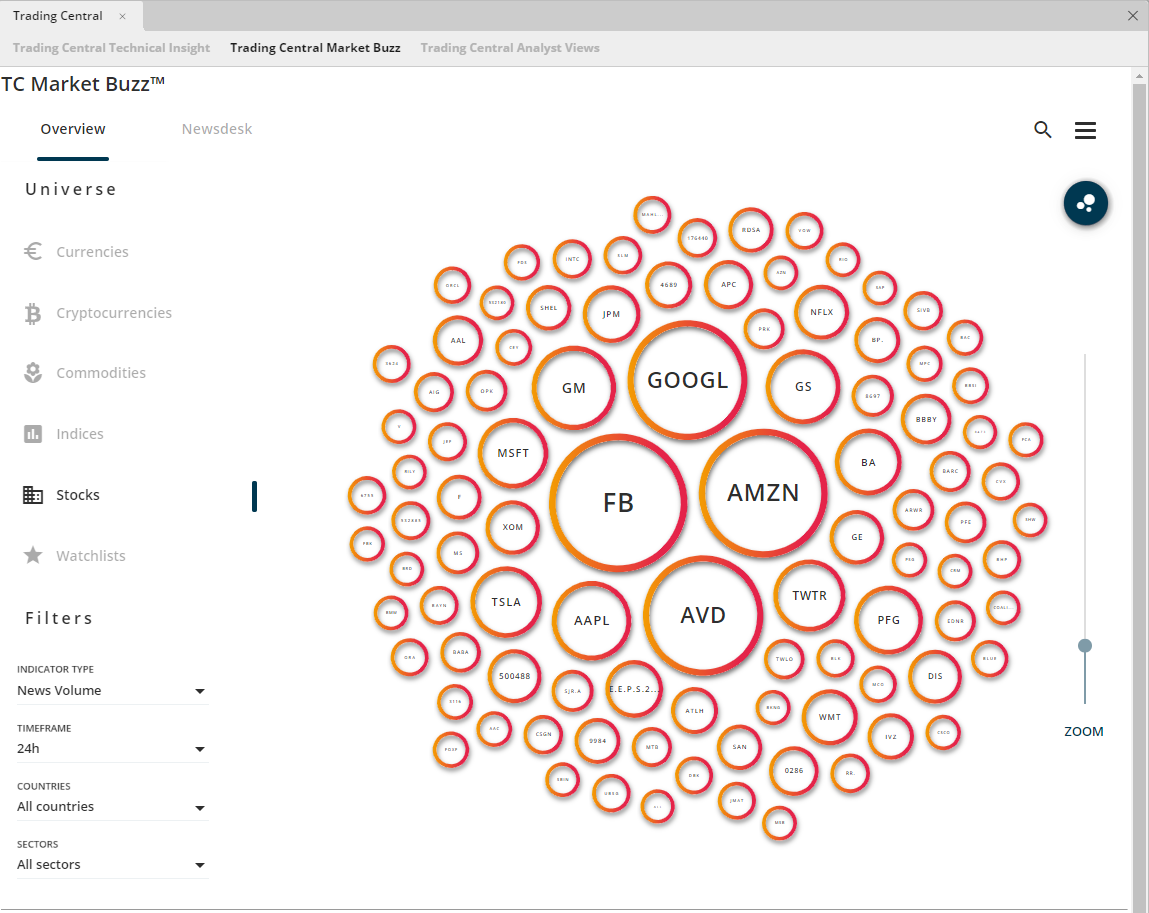

There is also a creative thing called Market Buzz. Judging by the name, this feature monitors external sources of information to determine the securities enjoying increased interest. The results of the monitoring are provided in the form of “circle map”. The bigger the circle, the ‘hotter’ the security. See example below.

On the day this screenshot was made, ADV securities spiked interest in addition to the traditionally active FB, AMZN, GOOG. Without the Market Buzz instrument, this could have been easily missed.

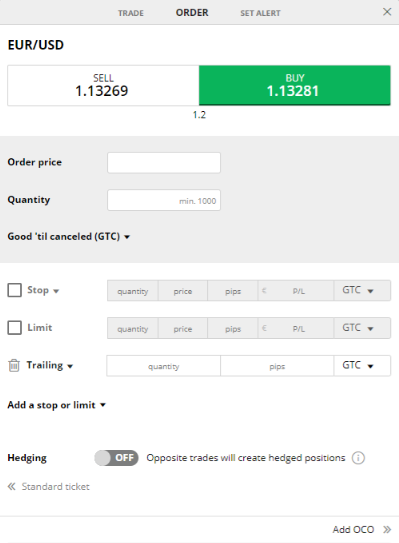

Placing orders

Forex.com platform features a diversity of order types. The traders can place the following types of orders:

- Market

- Limit

- Stop

- Trailing-stop

- One-cancels-the-other (OCO)

In addition, there are three order expiration types:

- Good 'til canceled (GTC)

- Good 'til end of the day (GTD)

- Good 'til time (GTT)

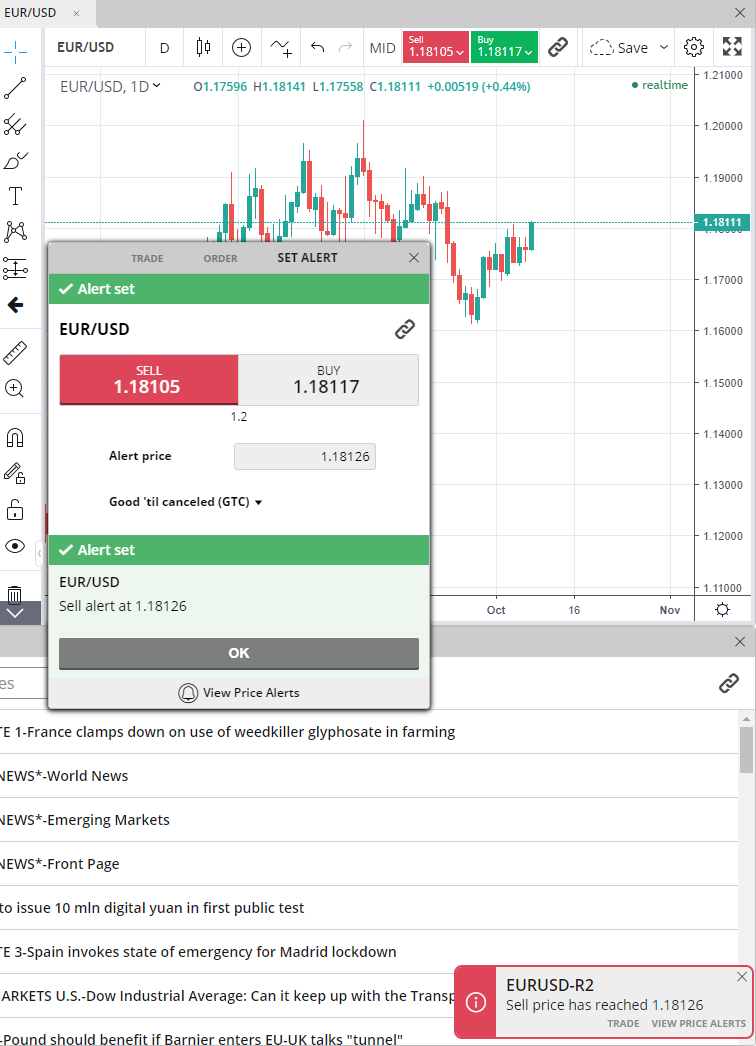

The platform allows to set up alerts. When the price reaches a specific level, the trader gets a push notification.

Mobile version of Forex.com platform

The applications are available for iOS and Android. Over 1 thousand users ranked the mobile version of the platform at three. The ranking on iTunes is slightly higher.

We tested the Android version and we believe threes and ones are underscored. The features of the mobile version are quite decent.

The features include:

- Working with orders / positions;

- Working with the account, viewing history;

- Working with charts, including set of instruments for technical analysis;

- Search of markets, tracing, alerts;

- Flexible settings.

The design is nice and user-friendly. The charts from TradingView fit well into the application, so the benefits are evident.

As for the drawbacks, there is no two-factor authentication during the login.

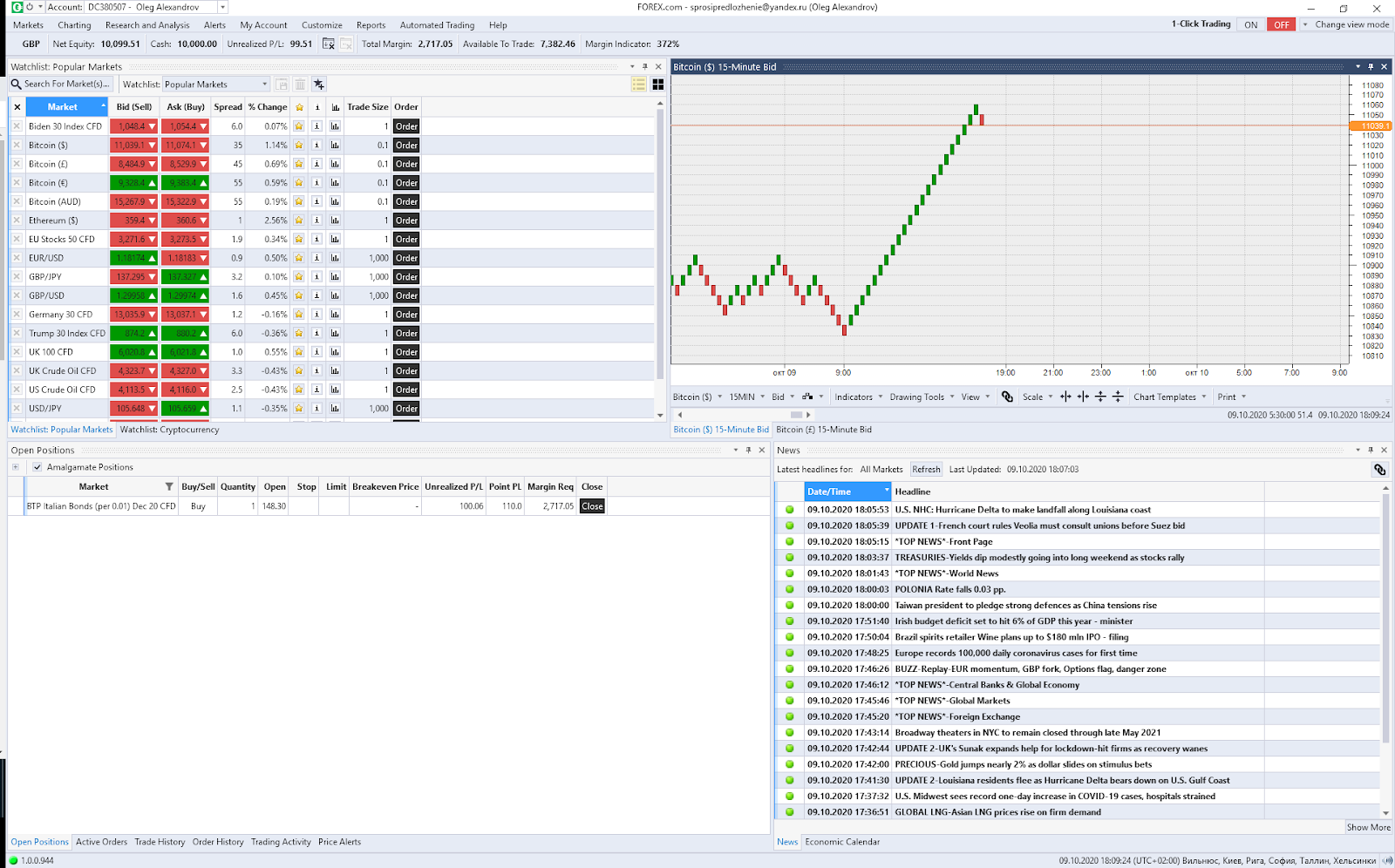

Desktop version of Forex.com platform

Desktop version of Forex.com platform is available only for Windows OS and supports quite a few languages, including English, German, Polish, Arabic, Chinese, Hungarian. The name of the platform

In order to explore it, you need to download the installation file, set up the platform and enter using the login and password, which is the same for all platforms.

Once again, just as in the other versions, there is no two-factor authentication during login on the desktop version as well.

The platform’s interface looks outdate, although the older generation might appreciate it.

The tabs (list of instruments, charts, newsfeed and table of positions/orders) is the same as in the web version.

The list of features is quite big:

- 16 timeframes from tick to annual (without a chance to add your own);

- A huge number of built-in indicators. There are 17 types of moving average indicators alone.

- There are original types of charts – Renko, noughts and crosses

- Wide choice of types of orders

- A set of features for working with chart templates, saved working spaces.

Overall, the platform has a solid content. If you are not discouraged by the ‘old school’ interface and you get used to managing tabs, you can successfully use it.

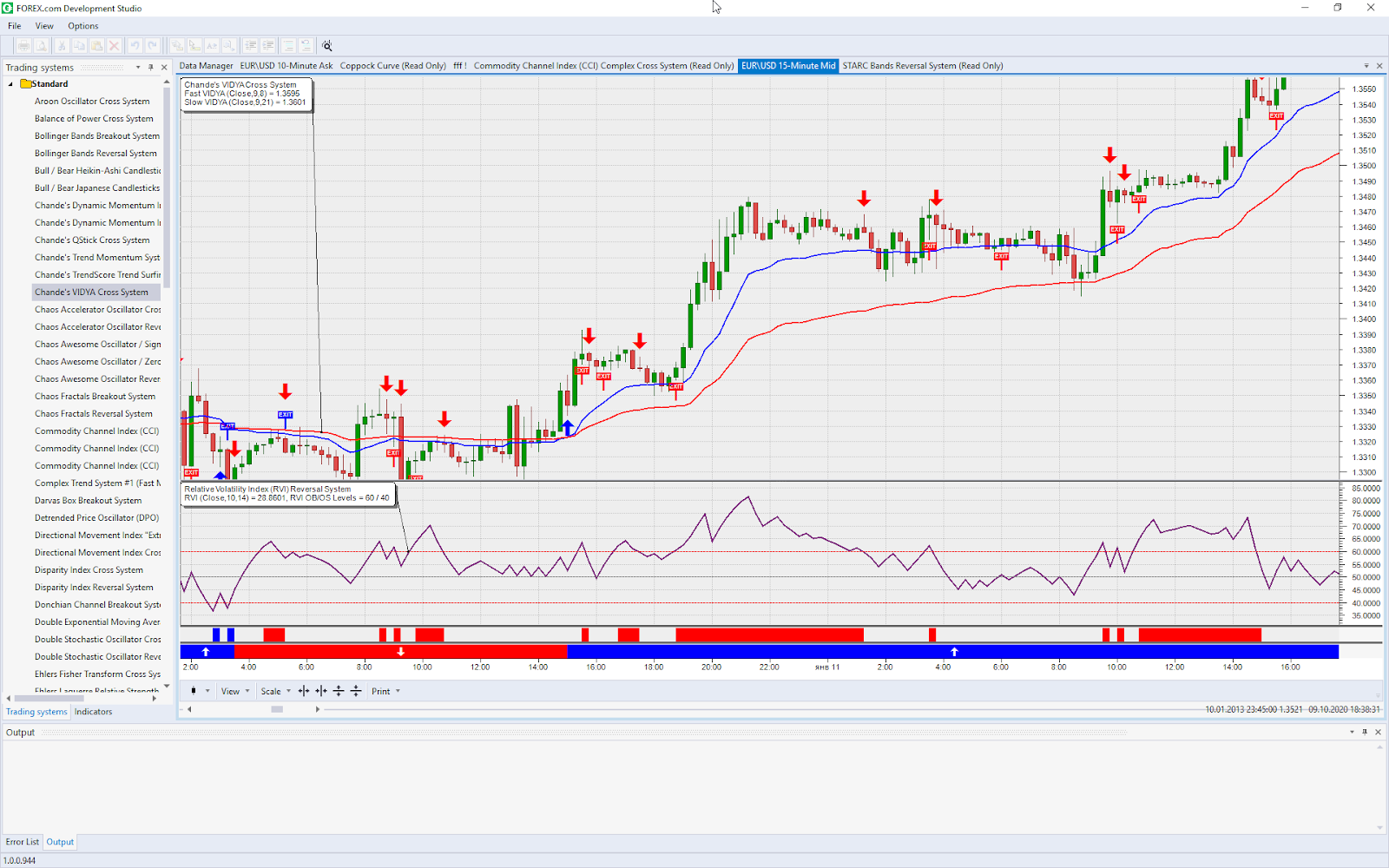

Builder of strategies is also worth mentioning. It is a very interesting space for algorithmic traders. The strategy constructor has a large number of ready solutions based on different indicators. See example below.

Moreover, the users have the option of programming their own system. This, however, requires knowledge of C#. If you are interested in algorithmic trading, you should look into this.

Review of the Forex.com trading platform (Video)

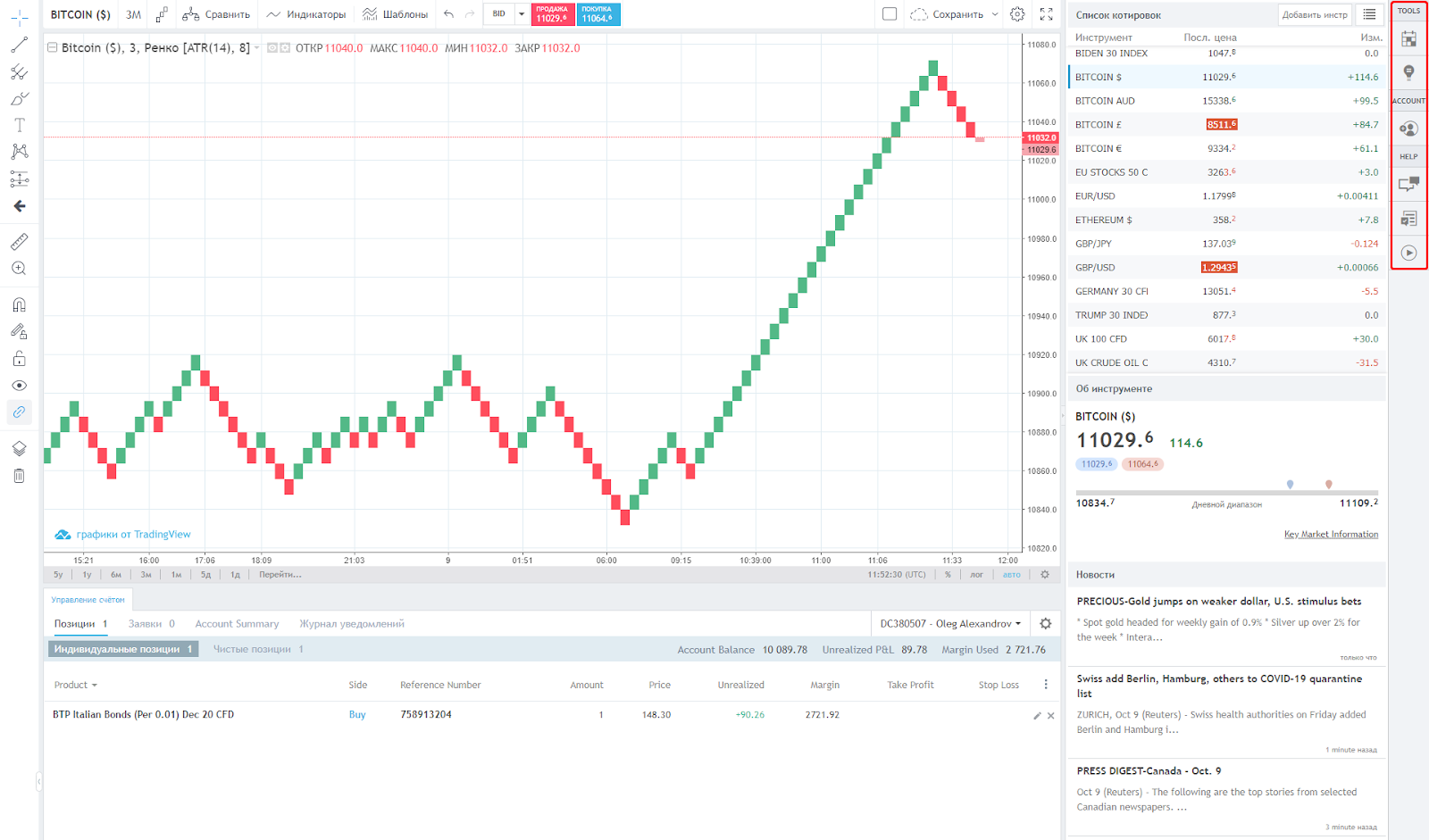

TradingView features

The broker’s customers can also use the features of a widely known platform, TradingView, for trading broker’s instruments.

For this, select TradingView tab in Login window, and after you enter login/password, you will be redirected to webtrading2.forex.com page, where you will find the platform.

The platform’s functionality has been significantly reduced. Lists of observations, scanner, social media feature, editor of own indicators/strategies, option to create timeframes and alerts are all unavailable. Another disadvantage is that there is no data on the volumes for all markets.

There is, however, a powerful set of tools for drawing on charts. Another advantage is that the customers can choose non-standard types of charts on intraday timeframes. As an example, above you can see a Renko chart on a three-minute timeframe. This is a paid feature on TradingView’s main website.

On the right side of the interface, there is a vertical panel (highlighted red on the print screen above); it is needed for access to forex.com – personal account, tutorials, chat with a specialist, etc.

Analytics

The broker gets a high grade for its Analytics section. Forex.com provides good instruments for building charts, broadcasts advice of technical analysts, publishes quality market reviews, built-in newsfeed.

The disadvantage is that the platforms do not provide a possibility to conduct analysis of specific fundamental data.

| Pros |

|---|

|

| Cons |

|---|

|

Analytical reviews

Forex.com users can use market analysis prepared by Forex.com research group. You can find the articles in the Market Analysis tab.

These reviews are based on simple technical analysis. Their advantage is, however, that they are quite specific and can be used as an addition to your own conclusions.

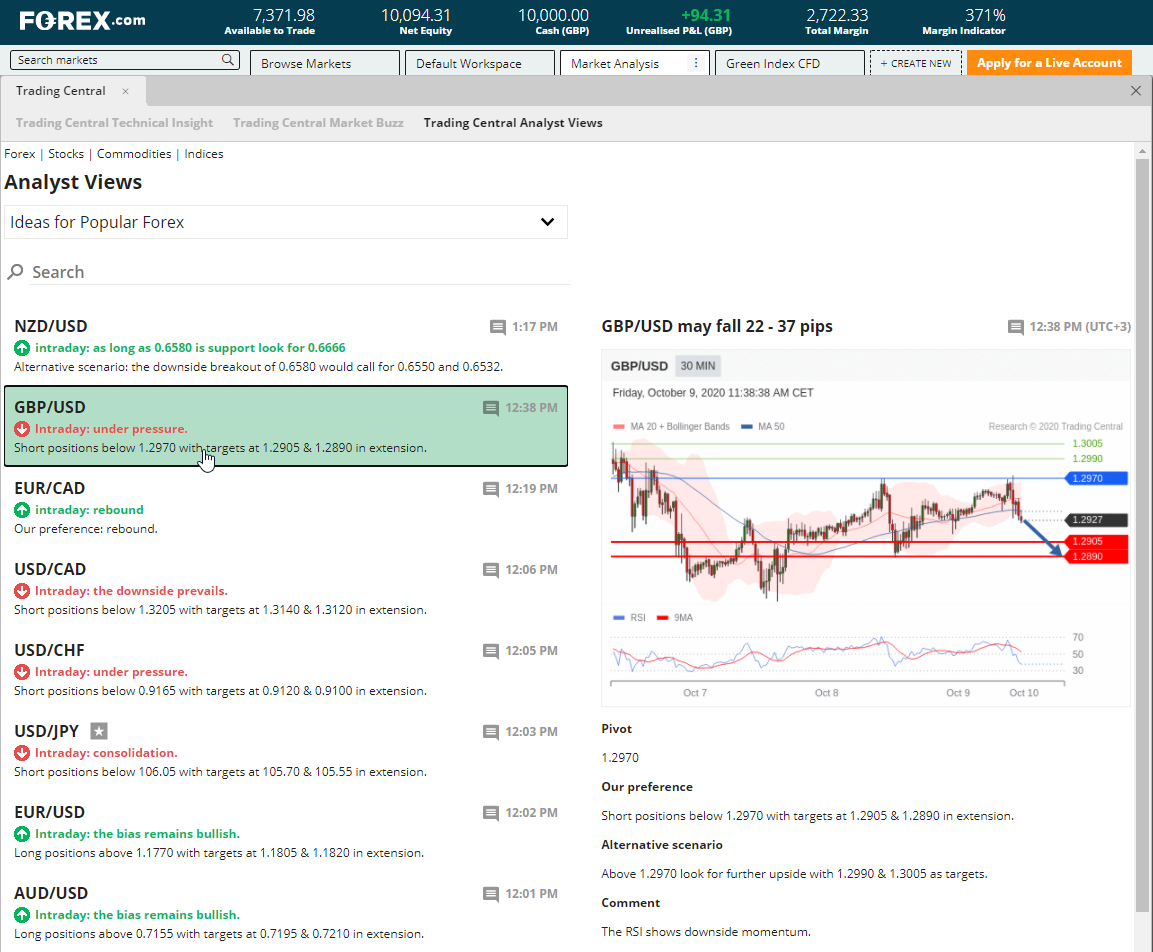

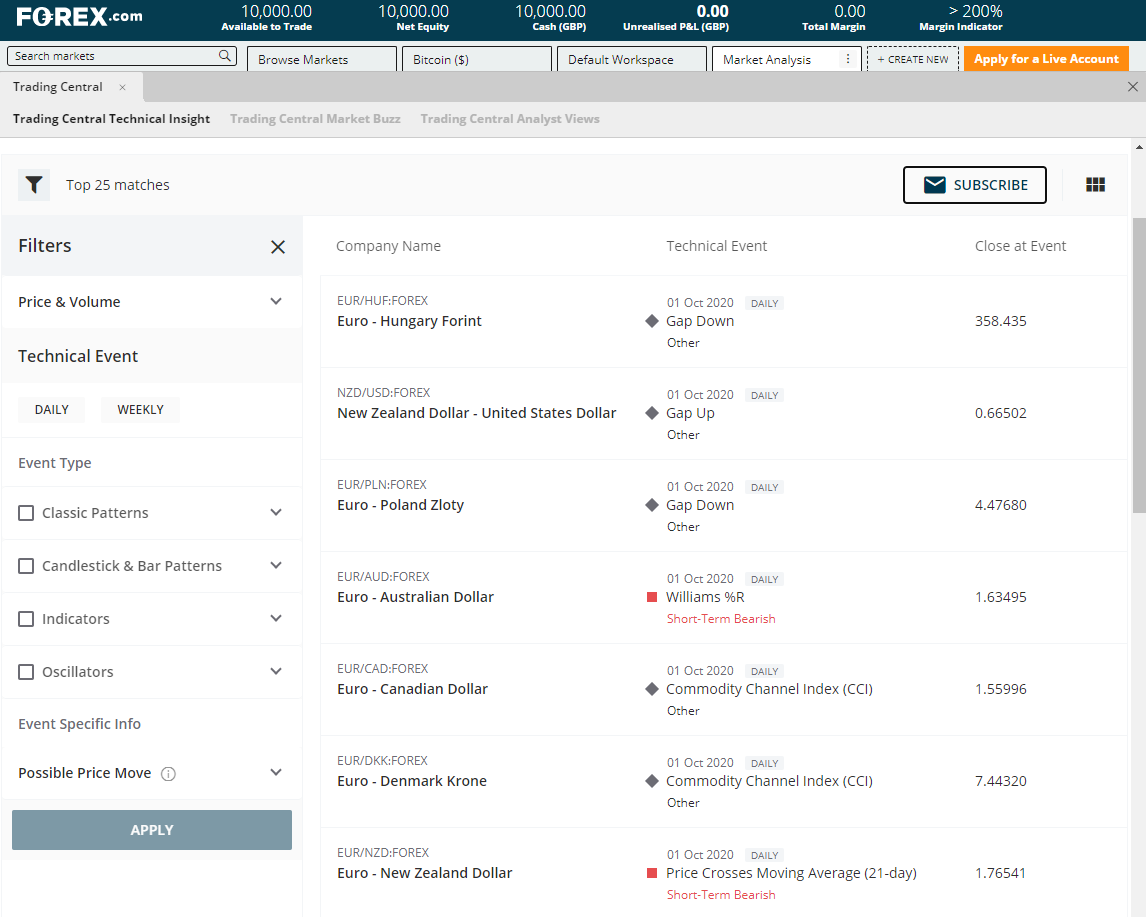

Trading ideas

You can find the trading ideas inside Forex.com platform. Just go to Trading Central and click on Trading Insights tab.

Of course, you won’t find confidential insights here, but there is a form for searching ideas with different filters (chart patterns, technical models, indicator signals). You can filter the ideas by period (trades over 2-6 weeks, long term), and by instruments (Forex, CFDs on stocks, indices, commodities).

You can set to receive signals by mail as they appear.

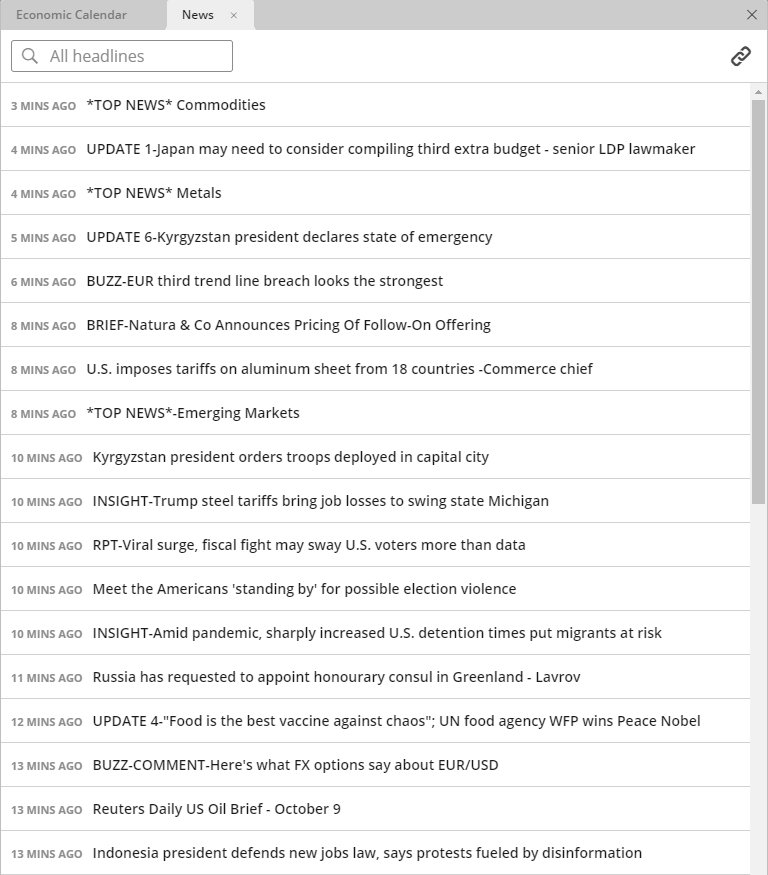

Newsfeed and calendar

Forex.com platforms feature a newsfeed and economic calendar with macro events, marked by importance and specific country. Choosing an event from the calendar, you can also view a short summary and check historical data.

The newsfeed is quite dynamic:

It contains short posts with informative headlines as well as news items of different formats – from comments to full articles on politics, economy and finance.

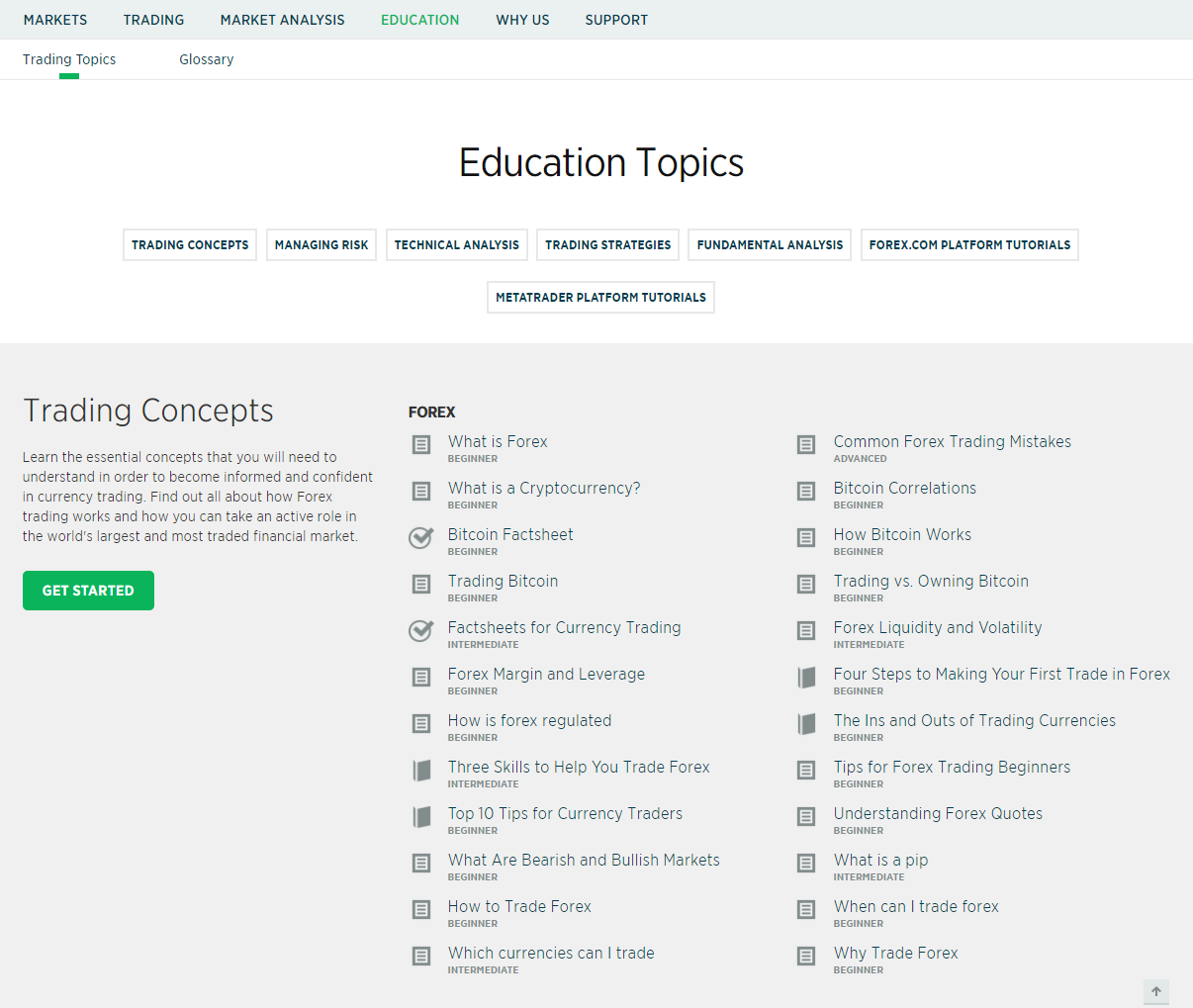

Education

The broker gets an average grade for the education section. It contains all required information for starting trading, but there are few good programs for developing skills.

| Pros |

|---|

|

| Cons |

|---|

|

The whole educational content is available on the broker’s website.

The content is divided:

- By levels – for beginners, intermediate level, and professional traders;

- By format – article or video;

- By topics – for example, technical analysis, or risk management.

There is also a glossary in a separate tab.

According to our assessment, the content targets primarily beginners. If you have been researching Forex for several years now, it is unlikely for you to find something useful here.

Forex.com also has a YouTube channel – youtube.com/c/forexcom. It mainly features tutorials, although there are not many of them and the new ones appear rarely. It seems that developing the channel is not a priority from the broker.

Customer support

In addition to the main language of customer support – English, customers of Forex.com can receive support in Russian, Polish, Spanish, Arabic and Chinese. Efficiency and quality of response gets the top grade from us.

| Pros |

|---|

|

| Cons |

|---|

|

Forex.com provides support in three ways:

- By mail

- By phone

- In a chat.

Regardless of the method, the operating hours of the customer support is the same – 24h on business days. Also, the number of languages is the same. There are 6 support languages – English (main), Chinese, Polish, Russian, Spanish and Arabic.

Channels of communication

Method 1. By mail: support@forex.com. Based on the reviews online, it may take some time to receive a response.

Method 2. By phone:

- +44 0800 032 1948 – support from the European branch, provided on the territory of the UK

- 1.877.FOREXGO (367.3946) – support from the branch in the U.S.

- 1 908 315 0653 – support from the branch in the Cayman Islands, but is provided from the territory of the U.S.

To receive support in the preferred language, inform the operation about it after you are connected. Reviews online are generally satisfactory.

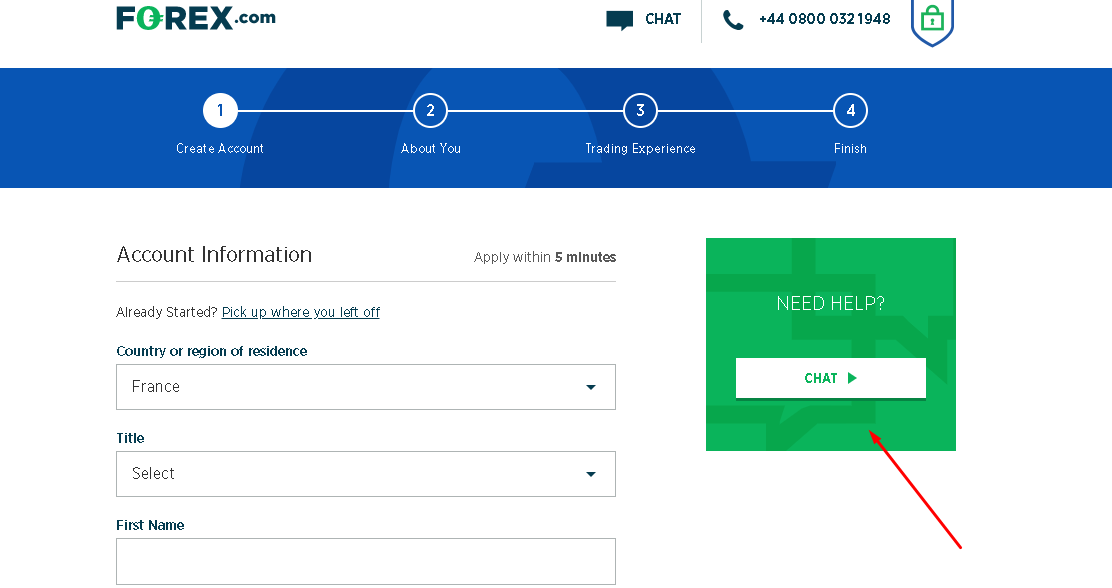

Method 3. Chat on the website.

This is a good method, but you will have to try hard to enter the chat with the operator.

The Chat button is not on the home page of Forex.com. If you go to support section on forex.com/en-uk/support/, that’s where you will find the button.

To enter the chat with a real person, you need:

- Begin the procedure of opening the account application.forex.com/en-uk-meta/step/1/, and press Chat;

- Access the trading platform and go to chat from there.

It seems that this is designed to take the load off the support specialists from the flow of same questions from new visitors of the website. On the other hand, once you learn how to access the chat, you will always be able to quickly receive qualified responses.

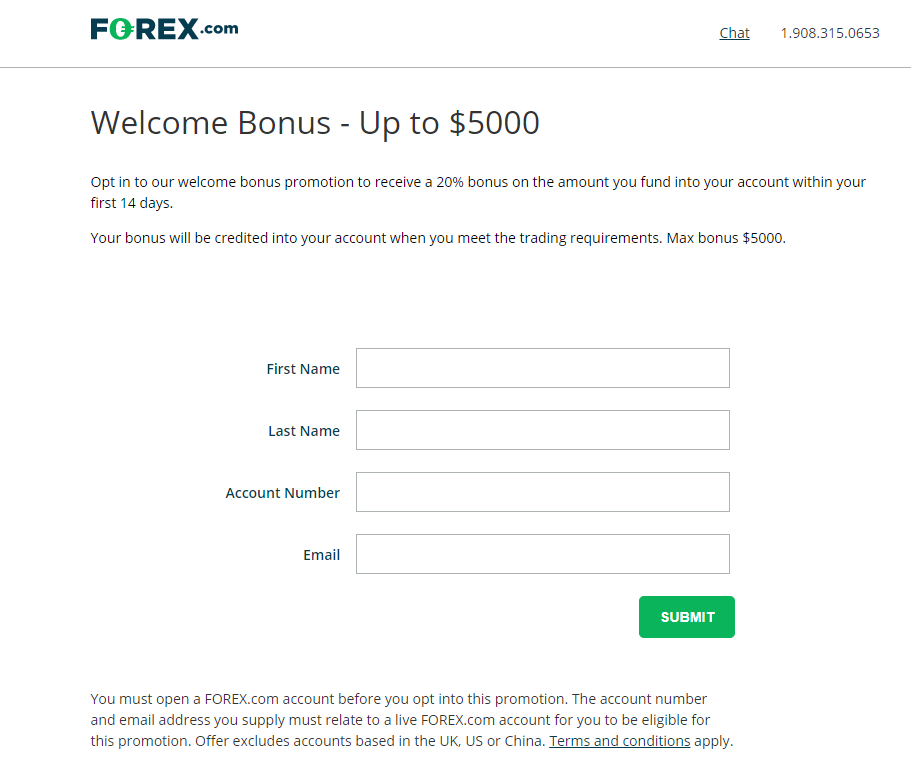

Bonuses and promo

Analyzing Forex.com website, we came to the conclusion that the broker follows conservative marketing policy. Abundance of inviting programs with bonuses, prizes, contests – that’s not here.

The only existing bonus is the Welcome bonus for new customers.

According to this program, new customers can receive 20% of bonus money from the amount of deposit to their account. However, there are restrictions:

- The account must be opened under the jurisdiction of the Cayman Islands;

- The amount of the deposit must be from USD 1,250;

- After depositing funds, you need to trade a certain volume.

Summary

Summing up our review, we can say with confidence that Forex.com is a reputable Forex and CFD broker, regulated by several financial authorities, such as FCA UK and CFTC USA. The shares of the mother companies – Gain Capital and StoneX, have been listed at the exchange for many years. So, there are no questions regarding reliability there, especially if you open your account not in an offshore territory.

The low commissions on Forex, wide choice of traded currency pairs, user-friendly web platform along with the standard Metatrader, low minimum deposit – all of this makes Forex.com a worthy partner in trading currencies at the interbank exchange. This broker is particularly good for beginners thanks to low minimum deposit and quite informative educational section for new traders.

There are, however, some drawbacks. Such popular assets as real shares and futures are not available, which could make this broker not the best option for professional traders.

Real reviews of FOREX.com 2025

I cannot understand why, but I was refused on Forex.com without explanation. At the same time, my friend was able to successfully create an account and is happy to trade with this broker.

I won't praise Forex.com because the broker doesn't pay attention to clients. You can't get through to the support for consultation, and on weekends the operators don't work at all! You can only chat with a robot...

I have not traded with FOREX.com, but my friend has been cooperating with this broker for a couple of years. He says that the commissions are below the market average, he did not observe any problems with withdrawing money. I would like to open a demo account here in order to test the platform without risks.

FOREX.com has a good selection of stock CFDs. Commissions are low, but there is a minimum commission per lot, so it is better to buy large volumes of contracts.

I like their Forex trading fees, execution is very fast too. But I don't understand why a broker with such a good reputation does not provide real stock trading. This is the main drawback for me.

Their native platform is more flexible than MT. I'd advise to try it.