On this page, you will find a large number of reviews from the real FxPro If you are already working with If you are already working with FxPro please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

FxPro Review 2021

FxPro is a CFD and Forex broker that has been in the market since 2006, currently providing services in 170 countries. The company holds four licenses, including the UK, Cyprus, The Bahamas and the South African Republic.

FxPro provides customers excellent opportunities with over 260 trading instruments. In addition, the company offers automated trading options, good choice of trading platforms, and education for the beginners. The broker operates in compliance with the EU standards, ensuring a high level of security.

FxPro received the 2017 UK’s Most Trusted Forex Brand award by the Global Brands Magazine. In addition, the broker is the first company in the world within its industry to become an official partner of a Formula One team.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

Key features of the broker

| Regulation | The UK, Cyprus, The Bahamas, SAR |

|---|---|

| License number | FCA №509956 CySEC №078/07; FSCA №45052; SCB SIA-F184. |

| Commissions and fees | low |

| Demo account | Yes |

| Minimum deposit | 100 USD |

| Inactivity fee | No |

| Period for opening an account | 15-20 minutes |

| Leverage | SCB regulation clients 1:500, other regulators Retails clients 1:30 and Pro clients 1:500 |

| Markets | Forex, CFDs |

| Options for passive income | No |

| Support languages | English +18 languages |

| Withdrawal fee | 0% |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes |

| Account currencies | USD, EUR, GBP, PLN, CHF, AUD, ZAR, JPY |

| Deposit bonus | - |

Page content

Geography of broker’s customers

FxPro has a very wide geography of customers. The broker is represented all around the world. The core audience is concentrated in Vietnam and South Africa. There are also many clients from the European countries, the UK and the Netherlands being the leaders.

The company is actively promoted practically in all markets. In particular, the increase of customers is observed in all jurisdictions from the Top 5. The broker’s growth is particularly active in Southeast Asia.

| Country | Percentage of customers |

|---|---|

| Vietnam | 11.77% |

| SAR | 10.73% |

| UK | 8.67% |

| Netherlands | 4.34% |

| Taiwan | 4.24% |

Commissions and fees

On the most beneficial FxPro account – cTrader, the broker uses a combination of the low spread and commission. The level of commissions is low, or average in Forex and CFD markets. On the MT4 and MT5 types of accounts, spread is used as a commission, which we estimated as average.

In this review, we will compare FxPro commissions with the competitors – Forex4You and TeleTrade, and provide specific examples of how much a trader will have to pay per lot with each of the brokers.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on FXPro

| Asset | Commissions |

|---|---|

| EUR/USD | Average spread is 1.7 pips on MT4 account. $45 per $1,000,000 traded volume plus 0.37 pips average spread on cTrader account. |

| CFD on Apple | Average spread 0.62 on MT4 account |

| CFD on S&P 500 | Average spread 0.83 on cTrader account |

| CFD on Brent | Average spread 0.08 |

| Non-trading commissions | No |

Forex market

Forex is the key market for FxPro. On the account types with Instant Execution, the broker uses a fixed spread as a commission, and on the accounts with Market Execution – a floating spread, while on cTrader account a combination of the commission on traded volume and a small floating spread is charged. As we believe the Market Execution to be an important factor of a broker’s reliability, we will only analyze the accounts with Market Execution in this review.

The broker has three such accounts and the commissions on them vary. First, let’s see which FxPro account is the best to be used for forex trading. As an example, we will use the cost of a standard lot of 100,000 units of base currency in the currency pairs of different classes.

| MT4 | MT5 | cTrader | |

|---|---|---|---|

| EURUSD | $17.1 | $15.1 | $9.57 |

| EURGBP | $24.14 | $23 | $16.24 |

| USDPLN | $48.55 | $66.41 | $24.78 |

As you can see, the cTrader account is much more beneficial for trading all classes of currency pairs.

Let’s also establish the commission FxPro charges as compared to its competitors. We took into account all commissions and the spread of FxPro (cTrader account), Forex4You (ProSTP account) and TeleTrade (ECN account) The lot is 100,000 units of base currency.

| FxPro | Forex4You | TeleTrade | |

|---|---|---|---|

| EURUSD | $8.2 | $9 | $12 |

| EURGBP | $15.5 | $16.3 | $19.4 |

| USDPLN | $24.78 | Not available | $48.57 |

Conditions offered by FxPro are on average better or at the same level as competitors.

Swaps on Forex

As a reminder, a rollover of a position to the following day causes the emergence of a swap on the Forex market. It is charged based on the interest rates of banks that issue currencies in the currency pair. When the swap is negative, a certain number of points is written off the account; when the swap is positive, they are accrued to the account.

On top of that, brokers may also charge additional commissions, which is why the sizes of the swaps could be different with different brokers. Below are the swaps for the cTrader account. We estimated the swaps as average, which makes short and medium-term strategies beneficial when trading with this broker. The drawback is the absence of a positive swap on major currency pairs, which the long-term investors might not like.

Swaps on FxPro

| Instrument | Swap long rate | Swap short rate |

|---|---|---|

| EURUSD | -4.7156 | -0.8982 |

| EURGBP | -3.7133 | -0.7427 |

| USDJPY | -3.0859 | -2.0476 |

A number of brokers offer Muslim traders an opportunity to trade without swaps, replacing them with different kinds of commissions. FxPro offers the swap free trading option. To activate the service, you need to contact the broker’s customer support.

| FxPro | Forex4You | TeleTrade | |

|---|---|---|---|

| Swap free | Yes | Yes | Yes |

Commissions on CFD market

Different types of CFDs make up the largest class of assets on FxPro, while the level of commissions on them is mostly low. Below, we will consider trading conditions for CFDs on indices, energies and metals on FxPro and its competitors. On the accounts of MT4 and MT5 types, the broker uses spread as the commission. On cTrader account, it is a combination of a small spread and commission on the traded volume.

NOTE! As a reminder, CFD trading involves high risk, which is why the traders need to strictly observe risk management rules!

To make the example clear for understanding, we checked how much a trader will have to pay for the execution of a USD 5,000 lot of CFDs of different classes, taking into account the spread and commissions of the broker. The below data is applicable for the following account types: FxPro сTrader, Forex4You ProSTP and TeleTrade ECN

| FxPro | Forex4You | TeleTrade | |

|---|---|---|---|

| CFD on S&P 500 | $1.19 | $1.57 | $1.44 |

| CFD on Brent | $8.8 | $4.01 | $17.09 |

| CFD on gold | $1.15 | Only spot | Only spot |

As you can see, FxPro has the best result among the competitors we specified in this review. The only exception is CFDs on oil, where Forex4You offers much lower commissions.

CFD on stocks

Stock trading at FxPro is available also via the contracts for differences. The level of commissions is high.

To make the example clear for understanding, we checked how much a trader will have to pay for a USD 5,000 lot of CFDs on top US stocks. FxPro offers CFDs on stocks only on MT4 account and platform, while the spread is used as the commission. We also took similar standard accounts of the competitors for comparison.

| FxPro | Forex4You | TeleTrade | |

|---|---|---|---|

| USA. CFD on Apple | $26.13 | $8.58 USD | $1.77 USD |

| USA. СFD on Coca-Cola | $10.98 | $8 USD | $3.06 USD |

| USA. CFD on IBM | $12.37 | $8.97 | $3.69 USD |

In this market segment, FxPro is behind its competitors with TeleTrade being the leader.

Non-trading commissions

We estimated the broker’s non-trading commissions and fees as low. FxPro does not charge deposit or withdrawal fees, which is why the customers only have to pay the commission of the bank or the payment system. The broker also doesn’t charge an inactivity fee.

| FxPro | Forex4You | TeleTrade | |

|---|---|---|---|

| Inactivity feeNo | No | Yes | Yes |

| Withdrawal fee | No | Yes | Yes |

| Any similar fees | No | No | No |

The absence of non-trading commissions sets FxPro apart from Forex4You and TeleTrade, which do charge withdrawal and inactivity fees.

Reliability and regulation

FxPro is officially regulated and can be considered reliable. The company holds four licenses for financial operations. The broker was issued the following documents:

- UK – FCA No.509956;

- Cyprus – CySEC No.078/07;

- SAR – FSCA No.45052;

- The Bahamas – SCB SIA-F184.

All broker’s documents can be easily checked. The company provides links to all licenses. The broker does not offer a deposit insurance system. FxPro has Stop Out and it depends on the branch. The level can be as follows:

- CySec – 50%;

- FCA – 50%;

- SCB – 20%.

FxPro has been operating in the market for 14 years. Over this period, the broker has not been involved in a single scandal. Therefore, the broker can be considered reliable.

Markets and products

FxPro provides its customers with a rather wide selection of markets and trading instruments. FxPro is a Forex and CFD broker, which is why they are all available via this derivative.

It is worth noting the diversity of CFDs on commodity futures. Also, there is a large variety of trading instruments by groups. The broker offers many currency pairs, a good choice of stocks and stock indices.

Lack of access to trading shares and futures on the spot market is the key drawback of FxPro. CFDs are a high risk marginal instrument, which is not suitable for all. Also, the broker does not have cryptocurrencies on its list of trading instruments.

| Pros |

|---|

|

| Cons |

|---|

|

Availability of CFDs on futures on the trading platform is the key distinction of FxPro over its competitors. Neither TeleTrade nor Forex4You offer this trading instrument, but they do provide access to cryptocurrencies.

| FxPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | No | No | No* |

| CFD | Yes | Yes | Yes |

| Crypto* | No | Yes | Yes |

| Bonds | No | No | No |

| Futures* | Yes | No | No |

| Commodities (oil, metals, wheat, gas, ores, etc.)* | Yes | Yes | Yes |

| Mutual funds | No | No | No |

| ETF | No | No | No |

* – only as CFDs

Forex Market

Forex market on FxPro is quite diverse. In particular, the broker offers access to 69 types of currency pairs, including all popular ones:

- EURUSD;

- USDJPY;

- CHFUSD;

- AUDUSD;

- USDCAD;

- GBPUSD;

In addition, the broker provides access to a large number of cross rates. On FxPro, you can trade pairs with popular global currencies, such as EURCHF, EURGBP, EURJPY, GBPJPY and others. However, the real advantage of FxPro in terms of Forex is a large selection of exotic trading pairs. The broker provides access to currency pairs with the following types of regional currencies:

- DKK;

- PLN;

- NOK;

- SGD;

- CZK;

- HKD;

- MXN;

- SEK;

- ZAR;

- RUB;

- THB

Thanks to the availability of a large number of exotic currency pairs, FxPro compares favorably with its competitors in terms of the number of trading instruments for Forex.

| FxPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Number of trading pairs | 69 | 59 | 50 |

CFD market

FxPro provides access to five different groups of CFDs. Here, you will find a large number of contracts on the stocks of the largest global companies. The choice of CFDs on stock indices is also very good.

The only serious drawback, compared to the competitors, is the absence of cryptocurrencies. In addition, FxPro is lacking investment instruments. In particular, the broker does not provide access to contracts on bonds, mutual funds and ETFs.

CFD on stocks

The number of available CFDs on stocks can be considered average. The broker provides access to 138 positions. The list includes the stocks of the most popular companies from the USA, Europe and China, such as:

- IBM;

- Danone;

- Google;

- Apple;

- Baidu;

- Goldman Sachs, etc.

The broker’s drawback is the limited choice of CFDs on the stocks of companies from the developed countries in the Asia-Pacific region, with the exception of China. In particular, you won’t find many contracts on stocks of Japan, Korea, Australia, etc.

By the number of CFDs on stocks, the broker is lagging slightly behind TeleTrade, but significantly exceeds Forex4You.

| FxPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Number of CFDs on stocks | 141 | 161 | 50 |

CFD on indices

FxPro provides access to a rather impressive number of stock indices – 24. These are primarily CFDs on indices of the top world’s countries – the USA, Germany, China, Japan, the EU:

- USSPX500;

- US30;

- USNDAQ100;

- EURO50;

- Germany50;

- UK100;

- Japan225;

- China A50 etc.

By the number of available contracts, the broker also compares favorably with many competitors.

| FxPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Number of CFDs on indices | 24 | 13 | 15 |

Commodities

FxPro provides access to commodity trading mainly via CFDs on futures – over 20 positions, and also 10 CFDs on metals and energies.

By the number of contracts, the broker compares favorably with the other two brokers from today’s review.

Opening an account

The procedure of opening an account on FxPro is fully automated, but it requires a bit of time, approximately 15-20 minutes.

The broker offers six different types of accounts, including separate trading accounts for MT4 with fixed and floating spreads. Therefore, a trader can choose the best conditions that are most suitable for him. The minimum deposit of the broker is totally affordable.

The broker, however, has certain drawbacks. In particular, there are different types of trading instruments available on different types of accounts. For example, CFDs on stocks are not available on the FxPro MT5 account.

| Pros |

|---|

|

| Cons |

|---|

|

What is the minimum deposit on FXPro?

The entry threshold on FxPro is quite enticing for traders. In order to start trading, you need to deposit only $100, although the broker recommends to start with $500 for successful trading. At the same time, if you fund your account for an amount lower than $500, no restrictions will apply.

However, many competing brokers do not have any requirements for a minimum deposit. Neither TeleTrade nor Forex4You set any minimum deposits.

| FXPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Minimum deposit | 100$ | 1$ | 1$ |

Citizens of which countries cannot trade on FXPro

FXPro is a holding of several companies. Each company provides services in a specific region and their restrictions differ. To learn more about restrictions, we recommend that you contact the broker’s customer support.

Documents required for opening an account

Verification is mandatory on FxPro. You won’t be able to fund your account or perform trading transactions. In order to verify your account, you will need to upload two main documents:

- Proof of identity – passport, residence permit, driver’s license;

- Proof of residence – bank statement, utility bill issued not later than six months ago, etc.

All documents for verification must be uploaded directly at the broker’s website. The uploading is done via FxPro Direct service. You do not need to send documents in an email.

You can also watch a video on account verification on FBS:

Account types

FxPro offers its customers six types of trading accounts. Five of them have different trading conditions, but the same requirement for minimum deposit. The first type of account is MT4 Instant with fixed spreads. The spreads on the account indeed do not change and their level is lower than on some other account types. However, only 7 currency pairs are available for trading and nothing else.

The second type is MT4 Instant with floating spreads. The minimum level of spreads is rather high on the account, but the trading opportunities are wider. The broker provides access to trading all types of currency pairs and CFDs, available on the platform.

If you are interested in Market Execution, MT4 Market account will be suitable for you. All types of trading assets are also available on it, while the spreads are lower compared to the trading accounts with instant execution.

For the customers wishing to work with MetaTrade 5 platform, there is a special account – FxPro MT5. All types of trading instruments, except for CFDs on stocks are available on this account. The spreads here are even better compared to the previous types of trading accounts.

FxPro cTrader is an account that deserves special attention. This is a special type of a trading account that allows to work with cTrader with the low level of commissions. It also has Market Execution of orders.

The last type of the broker’s accounts is VIP. It is available if you deposit $50,000 and more. The company promises “30% discounts” on commissions and spreads, but does not provide information about their minimum values. All types of trading platforms are available for this account.

Demo account

The broker provides its customers a possibility to trade using a demo account. It is available for the customers with any account type. No time limits are applied to the demo account on FxPro. However, in order to use the demo account, you first need to open a real account. You cannot register a demo account separately from the main account.

Trading accounts

The broker’s trading accounts differ from each other. Below is a detailed analysis of the broker’s accounts.

FxPro MT4 Instant (fixed spread)

- Trading platform: MT4

- Base currency options: USD, EUR, GBP

- Instruments: EURGBP, EURJPY, EURUSD, GBPJPY, GBPUSD, USDCAD, USDJPY

- Order execution – Instant

- Minimum deposit — 100 USD

- Commission on traded volume: no

- Commission per lot: no

- Spread on EURUSD: fixed, 1.6 pips

- Minimum lot — 0.01 pips

- Leverage — up to 1:500

- Stop Out — 50% (CySec, FCA) 20% (SCB)

FxPro MT4 Instant (floating spread)

- Trading platform: MT4.

- Base currency options: USD, EUR, GBP

- Order execution – Instant

- Instruments: Forex, indices, energies, metals, stocks and futures

- Minimum deposit — 100 USD

- Commission on traded volume: no

- Commission per lot: no

- Spread on EURUSD: floating, from 1.71 pips

- Minimum lot — 0.01 pips

- Leverage — up to 1:500

- Stop Out — 50% (CySec, FCA) 20% (SCB)

FxPro MT4 Market

- Trading platform: MT4

- Base currency options: USD, EUR, GBP

- Order execution – Market

- Instruments: Forex, indices, energies, metals, stocks and futures.

- Minimum deposit — 100 USD

- Commission on traded volume: no

- Commission per lot: no

- Spread on EURUSD: floating, from 1.58 pips

- Minimum lot — 0.01 pips

- Leverage — up to 1:500

- Stop Out — 50% (CySec, FCA) 30% (SCB)

FxPro MT5

- Trading platform: MT5

- Base currency options: USD, EUR, GBP

- Order execution – Market

- Instruments: Forex, indices, energies, metals, stocks and futures

- Minimum deposit — 100 USD

- Commission on traded volume: 45 USD per one million of traded volume

- Commission per lot: no

- Spread on EURUSD: no

- Minimum lot — 0.01 pips

- Leverage — up to 1:500

- Stop Out — 50% (CySec, FCA) 30% (SCB)

FxPro VIP

- Trading platform: MT4, MT5, cTrader

- Base currency options: USD, EUR, GBP

- Order execution – Market

- Instruments: Forex, indices, energies, metals, stocks and futures

- Minimum deposit — 50 000 USD

- Commission on traded volume: 30% discount

- Commission per lot: no

- Spread on EURUSD: 30% discount

- Minimum lot — 0.01 pips

- Leverage — up to 1:500

- Stop Out — 50% (CySec, FCA) 30% (SCB)

How to open an account on FxPro: step-by-step guide

The procedure of opening an account on FxPro is rather lengthy and detailed. You will need to spend around 20 minutes on it. Overall, you will need to fill out 10 blocks. Let’s review each of them in more detail.

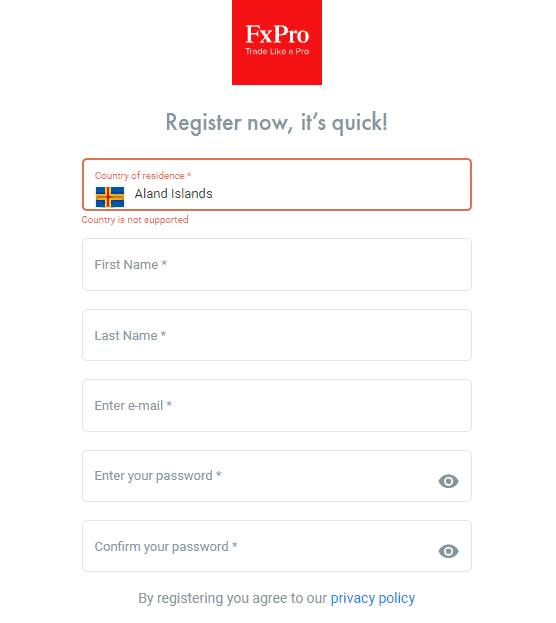

Step 1. Registration info

The first stage of the registration is standard – you need to specify basic information about yourself. It includes six fields, including:

- Country of residence;

- First Name;

- Last Name;

- Email;

- Password;

- Confirm your password.

The broker also warns that by registering you automatically agree to its Privacy Policy. You can review the policy in the same section.

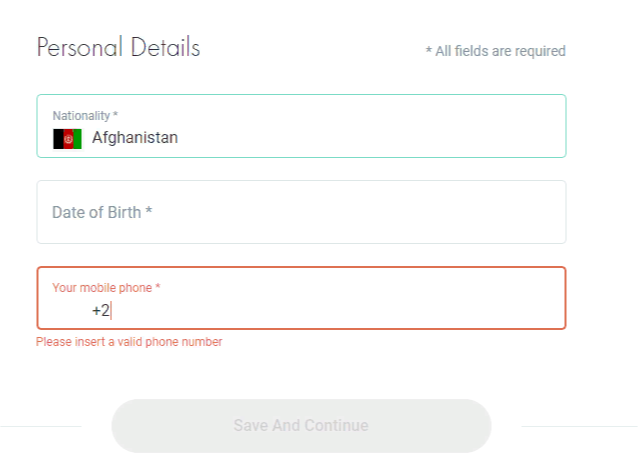

Step 2. Additional personal details

In the second block, everything is also rather simple. You need to specify your nationality, your mobile phone and your date of birth.

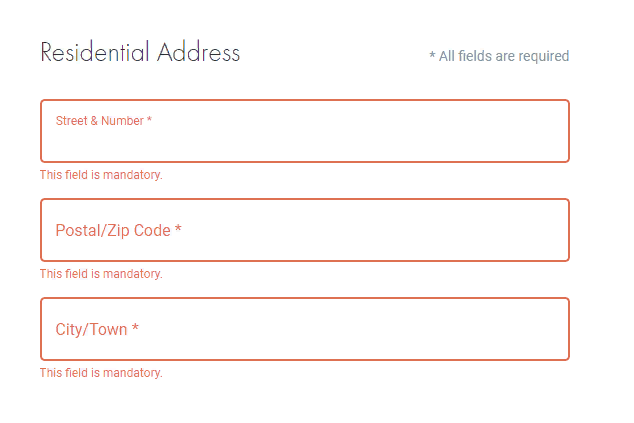

Step 3. Residential address

Then you need to specify your address. When you fill out this information, be attentive, because you will have to confirm it with documents. The broker will ask you to provide the city, the street and number and the zip code.

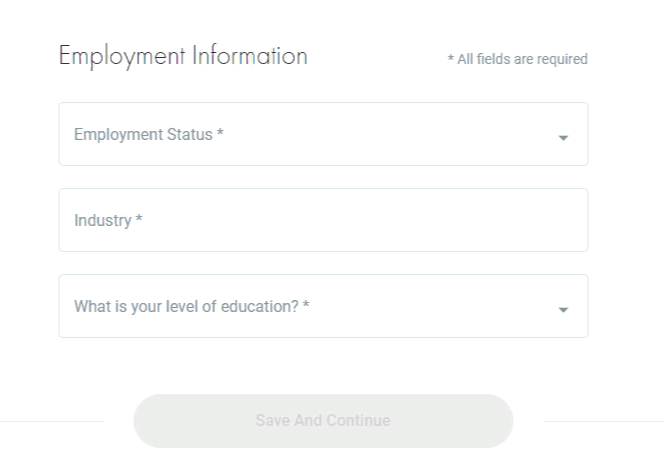

Step 4. Employment information

The broker requires the customers to provide information about their employment status. First, you need to specify if you are employed, self-employed, retired, unemployed or choose a different status. If you choose “employed” or “self-employed”, you need to also provide your position. Then, you need to specify the industry you work in and your level of education.

Step 5. Financial information

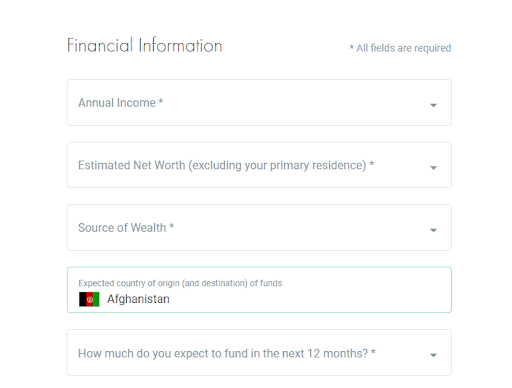

FxPro requires its customers to provide financial information. In particular, you will be asked to provide information about your income, source of your wealth, expected country of origin and destination of funds, etc. In addition, you will need to specify the amount you are planning to invest.

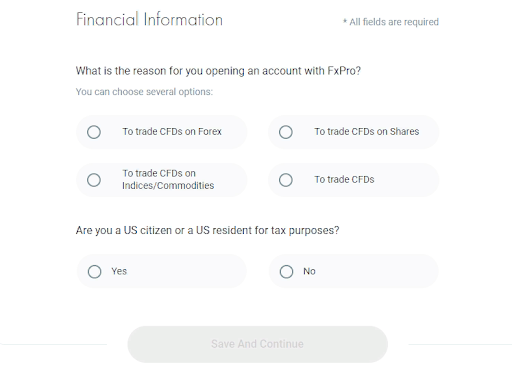

Step 6. Preferred trading instruments

During the registration, FxPro will ask you to specify the trading instruments you intend to work with. You can select specific instruments or select all. The types of the accounts available to you after registration will depend on your choice. In addition, at this stage, you will need to specify whether you are a US resident or citizen for tax purposes.

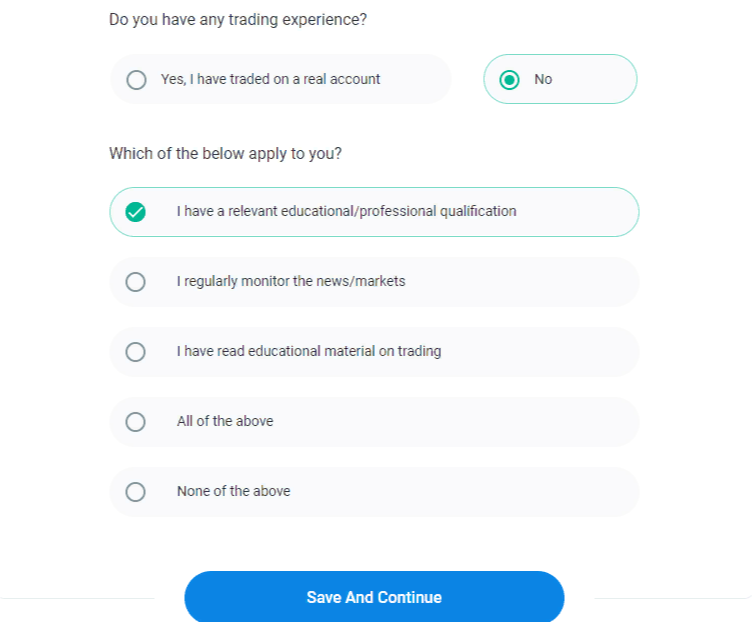

Step 7. Trading experience

Also, you will need to share information about your trading experience. In particular, you will need to specify whether you have (or had) real trading experience, and also the sources of your knowledge – whether you’ve obtained professional education, took courses, etc.

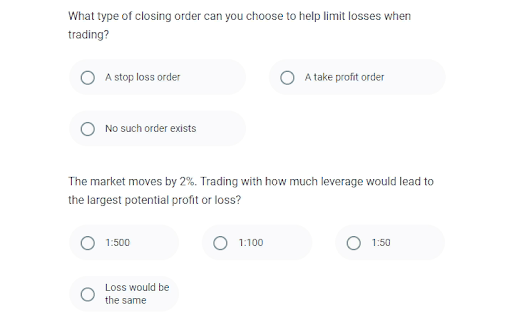

Step 8. Questionnaire on professional knowledge

In order to register with the broker, you need to fill out a questionnaire that features five questions. They are related to the level of qualification of customers in the area of trading and investment: the use of leverage, types of orders, etc.

Step 9. Setting up the account

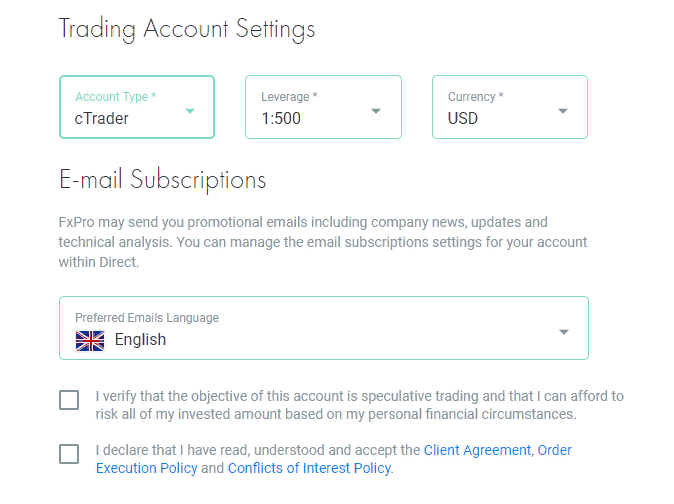

After completing registration, you will be directed to the trading account settings. In particular, you will be able to choose the account type, leverage, currency, notification language. You will also need to agree and accept the internal documents of the company.

Step 10. Verification

The last stage is verification. It is mandatory on FxPro. You will need to upload the copies of your passport and confirmation of your residence. The documents are considered within 3 business days.

Base currencies

FxPro offers an excellent choice of base currency options. The customers can choose from 8 options:

- USD;

- EUR;

- PLN;

- CHF;

- AUD;

- ZAR;

- JPY;

- GBP.

The list of currencies includes nearly all most popular global currencies, with the exception of CHN and RUB.

FxPro offers a better choice of base currencies than its competitors. For example, Forex4You supports only two currencies – USD and EUR. In addition to USD, EUR and GBP, TeleTrade supports only BTC.

| FXPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Number of base currencies | 8 | 4 | 2 |

| List of base currencies | USD, EUR, GBP, PLN, CHF, AUD, ZAR, JPY | USD, EUR, GBP, BTC | USD, EUR |

Deposit and withdrawal

FxPro does not offer its customers too many methods of deposit and withdrawal. You can use a wire transfer, with the transaction performed rather fast here. You can also use debit/credit cards of the following payment systems:

Visa;

Visa; Mastercard;

Mastercard; Maestro;

Maestro; American Express.

American Express.

In addition, the broker processes transactions performed via popular virtual payment services. In particular, the following e-wallets are supported:

Neteller;

Neteller; PayPal;

PayPal; Skrill;

Skrill; UnionPay.

UnionPay.

The broker does not charge deposit and withdrawal fees. The only exception is writing off funds without performance of transactions on the account. If you have not had any traders after adding funds to the account, a 2-2.6% fee can be charged for the transaction, depending on the payment system.

The funds are deposited rather quickly, while withdrawal may take some time. The broker lacks support of some electronic systems, for example WebMoney. In addition, cryptocurrencies are also not supported.

| Pros |

|---|

|

| Cons |

|---|

|

Methods and timeframe for deposits

| Method of deposit | Fee | Timeframe |

|---|---|---|

| Wire transfer | 0% | 1 business day |

| Debit/credit cards | 0% | 10 minutes |

| Neteller | 0% | 10 minutes |

| Skrill | 0% | 10 minutes |

| PayPal | 0% | 10 minutes |

| UnionPay | 0% | 10 minutes |

Overall, the conditions for deposits are rather beneficial, while the list of payment services can be considered good. FxPro supports more payment services than TeleTrade, and about the same as Forex4You.

| FXPro | TeleTrade | Forex4You | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard credit/debit cards | Yes | Yes | Yes |

| Electronic payment systems | 4 | 3 | 5 |

| Cryptocurrencies | No | Yes | No |

Methods of withdrawal and fees

| Method of withdrawal | Withdrawal fee | Timeframe |

|---|---|---|

| Wire transfer | 0% | 1 рабочий день |

| Debit/credit cards | 0% | 1 business day |

| Neteller | 0% | 1 business day |

| Skrill | 0% | 1 business day |

| PayPal | 0% | 1 business day |

| UnionPay | 0% | 1 business day |

Trading platforms

FXPro provides access to three types of trading platforms, primarily cTrader, In addition, the broker provides access to classical platforms, such as MetaTrader4 and MetaTrader5. FxPro provides the following versions of the trading platforms:

- Web;

- Desktop (for Windows);

- Mobile (for Android);

- Mobile (for iOS)

The trading platform depends on the type of the trading account you chose. This choice is made at the stage of registration.

Automated trading is one of the key features of FxPro. You can install trading robots for MT4 and MT5 platforms, and also download them from the official store for C-Trader. There are free and paid trading bots that operate both on simple and complex strategies.

There are no restrictions on trading strategies.

| Pros |

|---|

|

| Cons |

|---|

|

| FXPro | TeleTrade | Forex4You | |

|---|---|---|---|

| MT4 Desktop | Yes | Yes | Yes |

| MT5 Desktop | Yes | Yes | No |

| Android/iOS | Yes | Yes | Yes |

| Web-terminal | MT4, MT5, cTrader | MT4, MT5 | MT4, Forex4You |

cTrader platform review

At first glance, the platform makes a very nice impression. However, the broker’s drawback becomes evident at the very start. Factually, the platform uses only login and password for accessing the account. The broker does not have a separate login and password for logging onto the platform. There are no two-factor authentication, secret question or other security methods.

The interface of the trading platform is as below:

You can situate two charts simultaneously in one window and trace them at the same time. You can select the timeframe on the chart. The broker offers two options of timeframe settings:

- Standard – from 1 minute to 1 month;

- Tick – from 1 to 1000 ticks.

You can also select the chart interface from a number of options. The quotations can be shown as:

- Bar Charts;

- Candlesticks;

- Dots Chart;

- Heikin Ashi;

- HLC Chart;

- Line.

The platform does not feature technical analysis indicators by default. They can be added from the cTrader store. There are many free indicators available. You can add only those that you need for your trading strategy.

Over 30 different instruments for technical analysis – lines, figures, channels, Fibonacci, etc., are available on cTrader.

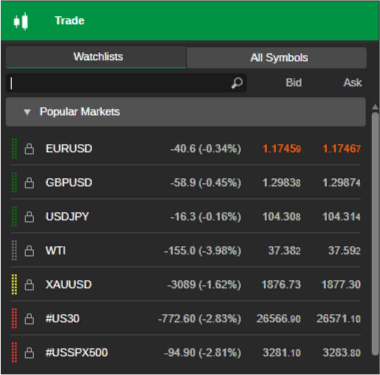

The search field for trading instruments is on the left part of the screen. It is divided into two tabs:

- Watchlists

- All Symbols

The first one includes the most popular currency pairs and trading instruments. In addition you can add pairs and CFDs you are interested in to this list. All Symbols tab features all types of instruments available for the trading platform and account type you have chosen. For example, currency pairs, energies, metals and indices are available for cTrader.

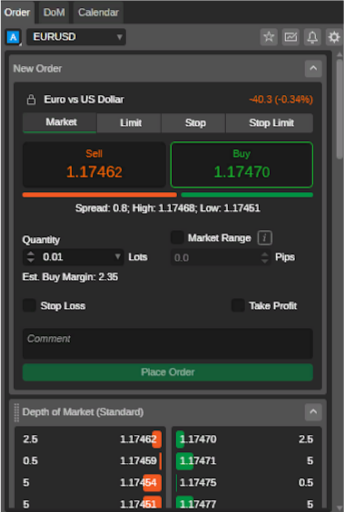

For the users working with cTrader platform, 4 types of orders are available:

- Market;

- Limit;

- Stop;

- Stop Limit.

To open a trade, you need to select the lot, set Take Profit and Stop Loss indicators. You can also choose Market Execution at the price and specify the price in pips.

In addition, you can view open positions and trade history, as well as set Price Alert on the broker’s trading platform.

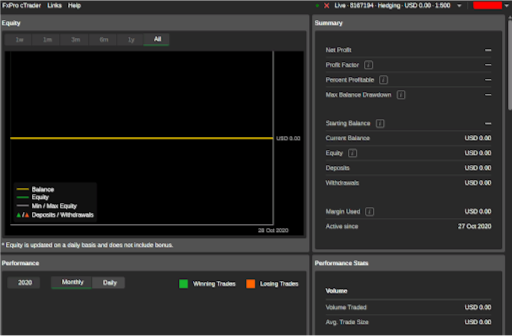

The service of your account data analysis is available on the platform. In particular, you can view net profit, percent profitable, profit factor, see the turnover, increase or decrease of deposit, etc.

Analytics

FxPro has an analytical section, which is actually a separate website, although it cannot be considered detailed or extensive. You will find analytical articles, economic calendar, currency calculator and other features on it.

We believe that there is not enough information. The broker does not have advanced instruments for statistical analysis, analytical reviews, quality infographics, etc.

| Pros |

|---|

|

| Cons |

|---|

|

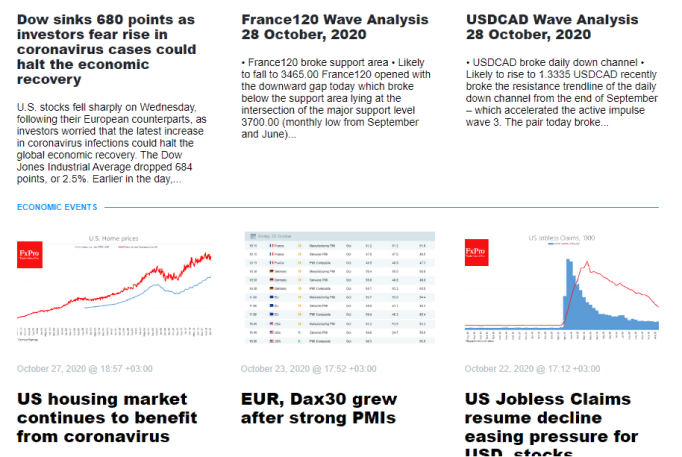

Reviews and researches

Analytical articles of the broker are divided into several categories. In particular, there are day’s events reviews, market reviews, a separate category of cryptocurrency news. The reviews are published on all types of assets the broker provides access to.

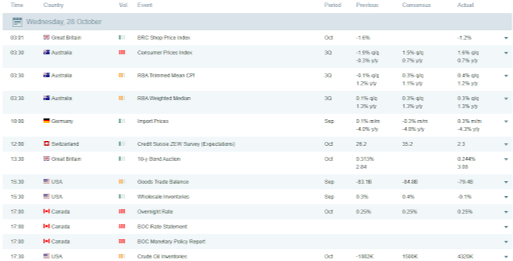

Economic calendar

The broker’s economic calendar is quite detailed. You will find main economic events for today, tomorrow, and the next week. In addition, you can select events for any date on the calendar. The economic calendar also features the latest information on the events and also projected values.

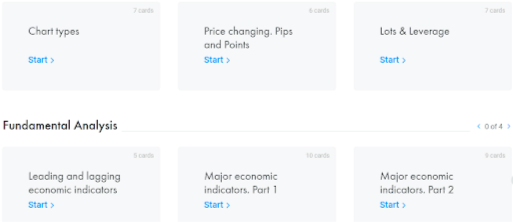

Education

Education is available on FxPro website. The broker offers several training courses for the users. The information is well-structured and provided as short articles. On the YouTube channel, the broker provides a variety of videos. The broker provides education for free, regardless of the user’s type of account.

| Pros |

|---|

|

| Cons |

|---|

|

Training courses

The company offers two training courses:

- For beginners;

- For advanced users.

The courses are divided into special cards. Each of them contains several articles – from 5 to 10. The courses feature all necessary information – basic knowledge, fundamental analysis basics, trader psychology, etc.

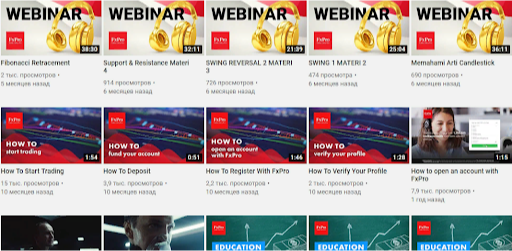

Youtube channel

The broker regularly publishes video tutorials on its YouTube channel. In addition, FxPro experts hold training webinars. All videos of the webinars are saved on the channel and can be viewed later.

We recommend you to check out one of the video tutorials by FxPro

Customer support

FXPro offers several ways to contact its customer support:

- online chat

- callback service

- by phone (in some countries)

Customer support of FxPro is quite efficient. On average, the representatives of the customer support respond within 30 minutes in case the inquiry is sent via the feedback form, and within 60 minutes if the question is sent via email.

The only drawback of customer support is that the broker does not have an international contact number.

| Pros |

|---|

|

| Cons |

|---|

|

Channels of communication

The main channels of contacting FxPro customer support are as follows:

Email – support@fxpro.com.

Contact number for the UK – 08000 463 050.

Contact number for Cyprus – +357 25 969 200.

Contact number in Monaco – +44 (0) 203 151 5550.

Contact number for the Bahamas – +1 242 603 2224.

Bonuses and promo

As of today, the broker does not have bonuses and promo offers.

However, the company is promoting its brand using other ways. In particular, FxPro is the official partner of McLaren F1 Team.

In addition, the broker is the official sponsor of Beda Sailing Team, a participant of Yacht Club de Monaco.

Summary

We believe that FxPro is a reliable and stable broker. The company’s long and rich history and the four licenses in trusted jurisdictions speak in favor of this conclusion. That is a great advantage of the company.

FxPro is an excellent option for the beginners. The company offers good opportunities for new traders – low minimum deposit, initial free training, simple, user-friendly trading platforms, news and economic reviews.

For experienced traders, FxPro does not offer as many opportunities. The trading arsenal is limited to CFDs, while options, cryptocurrencies and bonds are not available altogether. The only advantage for this category of customers could be the possibility of automated trading. You can install trading robots for MT4 and MT5 platforms and also download them from the official store for cTrader.

Real reviews of FxPro 2025

Servers reacting within milliseconds and high-tech platforms with flexible market analysis tools give me an edge in high-speed trading.

The ability to deposit via bank transfers, e-wallets, and credit cards provides flexibility and convenience in financial operations.

This trading platform excels with its advanced tools, aiding precise execution and analysis. The stellar customer support adds to its appeal. Overall, it's a reliable choice for traders seeking efficiency and professionalism

I value the opportunity to trade on global stock markets, giving me access to a vast assortment of instruments. Fast processing of deposits and withdrawals is simply indispensable for effective capital management.

The user-friendly nature of FXpro's trading platform is a standout feature. It offers an intuitive interface that simplifies the trading process, making it accessible even to those who are new to forex.

FXpro's range of account options caters to a diverse clientele, but I feel that reducing their commissions could make their services more attractive, especially for those conscious of trading costs.

Navigating through FxPro's trading platforms has been a learning curve, but their customer service team is always ready to assist, which is a huge relief for a newbie like me.

Starting with FxPro, I was pleased with their user-friendly account setup. However, the array of advanced trading tools was a bit overwhelming at first, but I'm gradually getting the hang of it.

Automated trading here is so well-thought-out. I can adjust everything to my liking. It offers me incredible flexibility.

Their mobile app is like my right wing. Speed, convenience, functionality — all at the highest level. I'm always in the loop, no matter where I am.

The customer service at FXpro is remarkable. Their staff's expertise and readiness to help set them apart. Additionally, their array of analytical resources helps me make informed trades, resulting in notable gains.

Trading with FXpro is an absolute delight. Their stringent security measures instill confidence in my funds and transactions. Their unwavering commitment to adhering to regulatory standards is commendable. FXpro's extensive selection of trading instruments and high liquidity sets them apart as a premier trading company.

I'm quite taken aback by the extensive range of trading instruments available on FxPro. They offer everything needed for portfolio diversification and effective trading.

The 0.01 minimum position size on FxPro accounts serves as a valuable risk management tool. It allows me to fine-tune my trade sizes according to my risk tolerance and market conditions.

I appreciate the simplicity and efficiency of FxPro's account registration process. Opening an account is straightforward, and the platform provides clear guidance throughout the application.

The broker is reliable in the first place. In the other aspects it’s pretty okayish. Trading conditions are market average.

I've been interacting with this brokerage company for 3 or 4 months already and it left only positive impression.

I adore here algo trading most of all. There are bots and advisors for several trading platforms, and that's magnificent!

I tend to trade manually, but when I am lazy as hell, I prefer to trade with cBots on the cTrader. It's one of the most fav platforms.

I really like FxPro as my broker. Their platform is easy to use and works well. I also appreciate their spreads and fast execution. The educational resources are helpful too. One question I have is about FxPro's advanced trading tools. Can someone tell me more about them and their advantages?

FxPro stands out as a top-tier broker with an outstanding reputation. The platform is intuitive and easy to navigate while also offering powerful trading tools at competitive prices. What's more, their customer support team consistently provides effective assistance for any inquiries you may have.

While FxPro is a reliable and trustworthy broker, I have not had any particularly standout experiences with them. The trading platform is user-friendly, and the customer service is prompt and helpful. However, I feel that their range of trading instruments could be expanded. Overall, a solid choice for traders, but not exceptional in any particular way.