On this page, you will find a large number of reviews from the real Interactive Brokers customers. If you are already working with Interactive Brokers, please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Interactive Brokers Review 2021

Interactive Brokers is one of the oldest international brokerage firms, providing services in nearly all countries of the world. The company was created in the U.S. over 40 years ago and has been a pioneer of technical innovation in the financial markets all throughout its history

Today, the company is one of the most successful and technology-based brokers in the world, performing around 2 million transactions of the clients per day. In 2019-2020 alone, Interactive Brokers received a number of prestigious international awards in the following nominations: Best Commissions and Fees, Best Broker for Active Traders, Best Options Broker, etc.

The broker’s security is confirmed by the licenses of some of the most respected regulators in the world, including the United States Securities and Exchange Commission (SEC) and the UK’s Financial Conduct Authority (FCA).

Pros and cons

Interactive Brokers generally offers very beneficial commissions and fees for active traders. In fact, it is one of the best brokers on the market in terms of this indicator. The platform has a huge number of instruments for passive income, including dozens thousands of bonds, funds and managed portfolios. There is, however, one negative aspect – a rather high inactive account fee, especially for the investors with less than $2,000 on their account.

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features

| Regulation | USA, UK, Australia, Canada, Japan, Hong Kong, India |

|---|---|

| Fees | Low |

| Demo account | Available |

| Minimum deposit | 0 USD |

| Period for opening an account | 1-3 business days |

| Inactivity fee charged | 20 USD for an account with a balance lower than $2,000, 10 USD for an account with a balance over $2,000 |

| Leverage up to | Up to 1:40 |

| Markets | Forex, Stocks, Cryptocurrencies, Commodities, CFDs, Bonds, Managed portfolios, Mutual funds, ETFs, Futures, Options, other markets |

| Options for passive income | Stocks, Bonds, ETFs, Mutual Funds, Hedge Funds, Managed Portfolios |

| Support languages | English, French, German, Spanish, Russian, Italian, Japanese, Chinese |

| Withdrawal fee | No |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | No |

| Supported currencies | 22 currencies of the account |

| Deposit bonus | No |

Geography of broker’s customers

IB structure features several legal entities with separate client’s structure. We built a separate client map of two of the most popular entities.

Legal entity: Interactive Brokers LLC, USA

Domain: Interactivebrokers.com

| Country | Percentage of customers |

|---|---|

| USA | 46.59% |

| Canada | 12.11% |

| Hong Kong | 3.41% |

| Singapore | 2.77% |

| Germany | 2,65% |

Legal entity: Interactive Brokers U.K. Limited, UK

Domain: interactivebrokers.co.uk

| Country | Percentage of customers |

|---|---|

| Russia | 10.49% |

| UK | 9.20% |

| Germany | 6.77% |

| Spain | 6.30% |

| UAE | 4.88% |

Interestingly, Russia ranked first by the number of clients, confirming the broker’s reputation as one of the most popular in the country. The top five also includes UAE, which even geographically is not Europe.

Regional restrictions

IB is an international broker working with citizens of over 200 countries. There is no indication of regional restrictions on the broker’s website. For more information about the broker’s operation in your country, please contact the broker’s customer support.

Commissions and fees

Interactive Brokers is considered a discount broker with the level of commissions and fees for most assets either lower than the market level or at the same level as competitors. In this review, we will compare the fees of Interactive Brokers with influential European competitors Swissquote and Saxo Bank.

The biggest drawback is the financial ‘sanctions’ of the broker for absence of trading – there is a fixed account inactivity fee if there were no trades on the account for over one month. This condition is unfavorable for long-term investors and beginners, who do not want to make many trades.

| Pros |

|---|

|

| Cons |

|---|

|

You will also learn from our review the commissions and fees the broker charges on the largest markets and also non-trading commissions, such as no activity fee.

NOTE! All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Summary

Let's also compare the broker's commissions for the main types of assets with competitors. For comparison, let's select the trading conditions of the intermediaries FXTM and Oanda. The differences in minimum commissions for these organizations are significant. For example, for the EUR / USD pair, the minimum spread on Saxo Bank is significantly lower than that of Oanda, and is almost identical to the FXTM intermediary.

| Asset | Commissions and fees |

|---|---|

| Forex | Commission is charged as 2 basis points from the volume. |

| US stocks | Two systems of commissions. The first one is volume-tiered. The second one has fixed rates - from $0.005, but not more than 1% of trade value. |

| Options | Low level of commissions. For the U.S. market – $0.65 per contract with 1 index option. |

| Mutual funds | Thousands of U.S. funds can be traded commission-free. |

| Bonds | Low. 0.002% of the nominal value for U.S. Treasuries trading. |

| Non-trading commissions | No activity fee for an account with a balance less than $2,000 – 20 USD. For accounts with larger amounts – 10 USD. |

Trading commissions on Forex (spot)

Interactive Brokers’ commissions on the Forex market are low. Noteworthy, the broker provides forex trading both directly at the interbank exchange (spot) and using currency derivatives, including CFDs. In this section, we will discuss direct market trading (spot).

Interactive Brokers commission on the Forex market does not depend on the type of the account, but is strictly related to the trading volume. The higher the volume the less you have to pay. There is also a minimum commission for all Forex trades.

Noteworthy, the broker works with 14 largest liquidity suppliers (large banks). At that, Interactive Brokers does not add its spread to the quotations, which is why the spread rarely exceeds 0.1 points. This system is quite convenient for active and algorithmic traders, as they can quite accurately predict that trading expenses.

Below is a table showing the commissions based on the monthly volume.

| Monthly trade amount | Commissions | Minimum per order |

|---|---|---|

| USD <= 1,000,000,000 | 0.20 basis point* | USD 2.00 |

| USD 1,000,000,001 - 2,000,000,000 | 0.15 basis point* | USD 1.50 |

| USD 2,000,000,001 - 5,000,000,000 | 0.10 basis point* | USD 1.25 |

| USD > 5,000,000,000 | 0.08 basis point * | USD 1.00 |

* For a trade of a standard lot of 100,000 EURUSD, the commission is USD 2, but cannot be lower than USD 2 for the trades of smaller lots.

In case of large lot trading, the commission of Interactive Brokers will be rather beneficial. A trader will have to pay only USD 2 for a EURUSD lot. However, the same cannot be said for smaller lots. Let’s take an example of 0.1 standard EUR/USD lot trade of each of the three brokers without the use of margin. The spreads of Saxo Bank and Swissquote have been recalculated for this purpose.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| EURUSD | 2 USD | 1.7 USD | 1.7 USD |

| EURGBP | 2 USD | 2.0 USD | 2.0 USD |

| AUDUSD | 2 USD | 1.31 USD | 1.31 USD |

Conclusion: Interactive Brokers’ commissions are low compared to its competitors only if you buy large lots, otherwise you end up paying the ‘minimum commission’ anyway.

Trading commissions on stocks, ETFs

Interactive Brokers is most beneficial to work with on the stock market, where the clients are offered some of the most beneficial conditions for trading a wide range of stocks and ETFs in different countries. The broker here offers two plans:

- Tiered. It is beneficial for big volumes of trading, as the commission decreases depending on the growth of the monthly volume.

- Fixed rate. Commissions are fixed, which is more suitable for retail clients with small trading volumes.

The broker has a special offer for the US clients – IBKR LITE, where it does not charge commission for trading or inactivity.

In this review, we will consider international commissions and first, let’s compare the two plans in more detail using the example of US stocks and EFTs trading fees.

Interactive Brokers’ commissions for stocks, ETFs trading

| Tiered | Interactive Brokers | |

|---|---|---|

| US stocks. | from USD 0.0005 per share for trading volume over 1 million shares per month up to USD 0.0035 for trading volume of less than 300,000 shares per month | USD 0.005 per share |

| US stocks. Minimum per order | 0.35 USD | 1 USD |

| Maximum per order | 1% of trade value | 1% of trade value |

| US ETFs | Zero commission | Zero commission |

| Exchange fees and other additional charges | Not included | Included |

Although, at first glance, the Tiered plan looks more beneficial even for the beginners, it does not include additional exchange fees that could account for a substantial part of the general expenses. That is why we would recommend you to consider a Fixed rate plan, which we will review in more detail.

Interactive Brokers’ commissions differ by country. The broker provides the most beneficial conditions of trading for the U.S. stocks:

| General conditions | Minimum per order | Maximum per order | |

|---|---|---|---|

| USA | 0.005 USD per share | 1 USD | 1% of the volume |

| UK (for trade value less than GBP 50,000 | GBP 6 (fixed). | 6 GBP | 6 GBP |

| UK | GBP 6 +0,05% of trading volume at the trade value over GBP 50,000 | 6 GBP | 29 GBP |

| Germany | 0.1% of trade value | 1.25 EUR | 99.00 EUR |

| Japan | 0.08% of trade value | 80 JPY | No |

| Australia | 0.08% of trade value | 8 AUD | No |

| Hong Kong | 0.08% of trade value | 18 HKD | No |

Noteworthy, Interactive Brokers commission is very beneficial if the trade value is not high, which cannot be said about the competitors. For example, Saxo Bank has beneficial fees in general, but the minimum fee is USD 10 for U.S. stocks. As an example, let’s take stocks purchase for the amount of USD 4,000*.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| USA | 1 USD | 10 USD | 30 USD |

| UK | 7.92 USD | 10.56 USD | 39.6 USD |

| Australia | 5.84 USD | 5.84 USD | 36.5 USD |

| Germany | 4.7 USD | 11.8 USD | 35.5 USD |

*all rates are converted at the USD rate as of 03.09.2020

Trading commissions on CFDs

Interactive Brokers’ commissions on CFDs differ depending on the selected market: CFDs on stocks, CFDs on indices and CFDs on currencies. In all three cases, their level is low and suitable for active trading.

CFD on stocks

The commission depends not only on the chosen stock market, but also the number of contracts traded per month. We have compiled a summary table to provide you with an idea about general principles on the most popular markets.

CFD on U.S. stocks

| Monthly volume | Commission per share | Minimum per order |

|---|---|---|

| <= 300 000 | 0.0050 | 1.00 USD |

| 300 001 - 3 000 000 | 0.0045 | 1.00 USD |

| 3 000 001 - 20 000 000 | 0,0040 | 1.00 USD |

| 20 000 001 - 100 000 000 | 0.0035 | 1.00 USD |

| > 100 000 000 | 0.0030 | 0.65 USD |

On the European market of CFDs on stocks, Interactive Brokers counts the trading volume not in contracts, but in EUR. The higher the amount that you trade in the equivalent, the lower is the commission.

CFD on European stocks

| Monthly value in EUR* | Volume commission | Minimum commission per order in EUR | Minimum commission per order in GBP | Minimum commission per order in USD |

|---|---|---|---|---|

| <= 10 000 000 | 0.05% | 3 | 3 | 3 |

| 10 000 001 – 100 000 000 | 0.03% | 2 | 2 | 2 |

| > 100 000 000 | 0.02% | 1 | 1 | 1 |

* Visit the broker’s website or contact the broker’s customer support for more accurate and updated information on your currency and currency of the account.

CFD on indices

Interactive Brokers charge average trading commissions on CFDs on indices. They are fixed and depend on the market and specific index. As an example, we will use the most popular indices.

| Per transaction | Minimum per order | Example: order of 25,000 in base currency | |

|---|---|---|---|

| S&P 500 (IBUS500) | 0.005% | 1 USD | 1.25 USD |

| Dow 30 (IBUS30) | 0.005% | 1 USD | 1.25 USD |

| Nasdaq 100 (IBUST100) | 0.010% | 1 USD | 2.5 USD |

| FTSE 100 (IBGB100) | 0.005% | 1 GBP | 1.25 GBP |

| DAX 30 (IBDE30) | 0.005% | 1 EUR | 1.25 EUR |

As an example, let’s comparу how much a trader will have to pay for an index CFD lot of USD 5,000 on Interactive Brokers and its competitors. For Saxo Bank and Swissquote, the spreads on the standard account are taken into account.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| S&P 500 (IBUS500) | 1 USD | 1.01 USD | 1.66 USD |

| FTSE 100 (IBGB100) | 1.32 USD | 1.12 USD | Not available |

| DAX 30 (IBDE30) | 1.18 USD | 0.46 USD | 0.77 USD |

СFD on Forex

Commissions are identical to the spot market.

Trading commissions on options

Low trading commissions on derivative financial instruments, such as futures and options contracts are the key features of Interactive Brokers. It is particularly beneficial to trade these instruments on the American market. For options trading, two plans are used:

Tiered - the commission depends on the trading volume and does not include exchange fees and other transaction fees.

Fixed - the commission does not depend on the trading volume and includes exchange fees and regulatory fees.

In our review, we will use Fixed plan of commissions as an example, as it is more understandable for the beginners and generally has beneficial conditions. We also compared the broker’s commissions with those of the competitors and Interactive Brokers is a confident leader here, if you take standard plans of the competitors for comparison.

Interactive Brokers’ commissions for option trading

| Commission per trade with 1 index option | Interactive Brokers | Saxo Bank | Swissquote |

|---|---|---|---|

| US market | 0.65 USD | 6 USD | 1.99 USD |

| German market | 1.5 EUR | 6 EUR | 1 EUR |

| UK Market | 1.7 GBP | 5 GBP | Not available |

Trading commissions on futures

For futures trading, Interactive Brokers also offers two plans. The commissions may vary depending on the market and asset. As an example, we take a standard commission. For more information, please study the corresponding section of the broker’s website.

Standard commission per one contract on index futures.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| USA | 0.85 USD | 6 USD | 1.99 USD |

| Germany | 2 EUR | 6 EUR | 5 EUR |

| UK | 1.7 GBP | 5 GBP | Not available |

Investment assets

Interactive Brokers offers a huge choice of investment instruments, including dozens thousands of bonds, ETFs and Mutual funds. Also, the investors have an opportunity to invest in hedge funds and managed portfolios. On thousands of positions, the broker does not charge any commission for transactions, while overall, the level of commissions is low.

Bonds

The level of commissions on the markets with fixed income is low, but depends on the volume of transactions and a specific instrument.

Trading commissions of Interactive Brokers on bonds market

| Volume | Commission | Minimum | Maximum | |

|---|---|---|---|---|

| US Corporate | Up to USD 10,000 of Face value | 0.1% of Face value | 1 USD | The smaller of $250 or 1% of trade valu |

| Over USD 10,000 of Face value | 0.025% of Face value | No | The smaller of $250 or 1% of trade value | |

| US Treasuries | Up to USD 10,000 of Face value | 0.002% of Face value | 5 USD | Нет |

| Over USD 10,000 of Face value | 0.0001 | 5 USD | No | |

| Europe | Up to EUR 50,000 of Face value | 0.1% of trade value | 2 EUR | No |

| From EUR 50,000 of Face value | 0.035% of trade value | 2 EUR | No |

Let’s compare a purchase of US Treasuries for the amount of USD 10,000 from the three brokers. Taking into account that the broker, as well as its competitors, has a minimum transaction fee, the amount charged by Interactive Brokers is much more beneficial.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| US Treasuries | 5 USD | 94.4 USD | Not available |

Mutual funds

Thousands of mutual funds may be purchased with no transaction fee on Interactive Brokers, while for others very low commission is charged.

| Method of charging commission | |

|---|---|

| US Mutual funds (free) | 0%. Thousands of transactions are commission-free. |

| US Mutual funds (the rest) | Lesser of 3%* of trade value or USD 14.95 per transaction |

| Mutual funds of other countries | 0%. Thousands of transactions are commission-free. |

| Mutual funds of the countries (the rest) | 4.95 EUR per transaction |

* For more accurate figures, please contact the broker’s customer support.

ETF

Interactive Brokers’ commissions on ETF trading are similar to the trading commissions on stocks. The majority of American funds are available for trading commission-free.

Interactive Advisors

Interactive Advisors is the broker’s own interactive platform for investment. Using this option, you can invest into dozens of already built and professionally managed portfolios. This option is particularly attractive for the beginners and investors, who do not have the time for independent selection of a portfolio.

The minimum reasonable volume of investment is USD 5,000, however, if you invest a larger amount you possibilities expand and relative expenses decrease. The management fee ranges from 0.08% to 1.5%. The commissions on managed portfolios are on average lower than the competitors. In particular, Saxo Bank offers managed portfolios with an average commission from 0.98%.

Trading commissions on cryptocurrency market

Interactive Brokers does not offer direct cryptocurrency trading, only via derivatives, such as futures contracts on Bitcoin and Ethereum. The commission on CME on Bitcoin futures is USD 10 per contract, on CBOE – USD 5 per contract.

Lending rates at Interactive Brokers

Many traders use marginal trading. It is when you borrow money or securities from broker to increase profit potential. Usually, the interest rate depends on the rates on the market and broker’s rating and its possibility to attract financing. The marginal lending rates of Interactive Brokers are some of the most beneficial on the market, which is a great advantage.

The marginal rates of Interactive Brokers also depend on two factors – lending currency and volume of borrowed funds. The annual rate is provided. To calculate the amount, you will have to pay for a week of holding position, you need to split the amounts.

Annual rate for different currencies

| Currency | Rate |

|---|---|

| USD | 1.59% |

| EUR | 1.5% |

| GBP | 1.5% |

| JPY | 1.5% |

| AUD | 1.512% |

* Dependence of the rate in USD from the volume of a loan

Non-trading commissions

One of the substantial drawbacks of Interactive Brokers is the inactivity fee , which ranges from USD 10 to USD 20 per month. In terms of this indicator, the broker is behind its competitors. This size of the fee could be substantial for beginners, who have a small capital and are not ready to trade actively. However, Interactive Brokers advantage is that there is no charge for money withdrawal.

Conditions of charging the no activity fee on Interactive Brokers

| Deposit | Monthly commission * |

|---|---|

| Up to USD 2,000 | 20 USD |

| Over USD 2,000 | 10 USD |

| Clients younger than 25 | 3 USD |

* Charged as the difference between the monthly commission and no activity fee. If your monthly commission is USD 5, while your no activity fee is USD 10, you will have to additionally pay USD 5.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| No activity fee | from 3 to 20 USD after one month of inactivity | 100 USD from clients not from the UK after 6 months of inactivity. | No |

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | 10 USD |

Although Saxo Bank charges a higher inactivity fee, it is charged rarely as very few investor do not have transactions for six months.

Reliability and regulation

In terms of security, Interactive Brokers raises no concerns. The broker is licensed by the regulators in a number of countries, including USA, UK, Australia, Canada, Japan, Hong Kong, Luxembourg, India. The company operates under different legal entities in different countries, while the requirements of the regulator may also differ.

| Region | Regulator | Legal entity |

|---|---|---|

| USA | United States Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), Commodity Futures Trading Commission | Interactive Brokers LLC |

| UK, EU | Financial Conduct Authority. FCA register entry number 208159 | Interactive Brokers (U.K.) Limited |

| Australia | Australian Securities and Investments Commission ASEC. Register entry number 453554 | Interactive Brokers Australia PTY LTD |

| Canada | Investment Industry Regulatory Organization of Canada (IIROC) and Canadian Investor Protection Fund (CIPF) | Interactive Brokers Canada Inc. |

| Luxembourg, EU | Commission de Surveillance du Secteur Financier (CSSF). Member of the Luxembourg Investor Compensation Scheme (Système d’indemnisation des investisseurs, SIIL). | Interactive Brokers Luxembourg SARL |

| Hong Kong, China | Hong Kong Securities and Futures Commission | Interactive Brokers Hong Kong Limited |

| India | Securities and Exchange Board of India (SEBI), registration number INZ000217730 | Interactive Brokers (India) PVT. LTD. |

| Japan | Kanto Local Finance Bureau (Registration No.187) and is a member of Japan Securities Dealers Association and The Financial Futures Association of Japan. | Interactive Brokers Securities Japan Inc. |

The analysis shows that the broker is registered in very reliable jurisdictions with high level of control over the operation of financial organizations.

Capital protection

Protection of capital from unforeseen circumstances is quite high on Interactive Brokers. The broker is a member of a number of deposit guarantee systems in case of bankruptcy and fraud. However, the compensation system is often quite confusing and differs significantly for residents of different countries.

Interactive Brokers UK Limited operates under the UK jurisdiction, services the majority of clients from the European Union. The capital of investors is protected in the amount of up to 85 000 GBP.

Interactive Brokers LLC works with the US clients. The investor capital is protected in the following amounts: up to USD 250 000 in cash and up to USD 500 000 in general.

Interactive Brokers Canada Inc. works with the clients from Canada. The investor capital is protected in the amount up to 1 000 000 CAD.

NOTE! To receive the most updated information about protection of investment at Interactive Brokers in your country, please contact the broker’s customer support.

Negative balance protection

The broker ensures only partial negative balance protection. This option is available only for the clients from the European Union, who work on the Forex market.

Scandals involving the broker

In 2020, Interactive Brokers paid USD 38 million within the settlement of the accusations by the American authorities on the financial services market. The broker was accused of violating the KYC/AML rules on counteraction to money laundering.

The regulators believed that in 2013-2018, a number of client accounts were opened without proper screening of their income sources. The company did not have a monitoring system of such accounts or even competent personnel. The company promptly fixed the violations, although a number of clients suffered within the framework of the settlement deal. Their accounts were closed due to suspicions of a number of different violations.

Markets and products

In terms of depth and range of the markets, Interactive Brokers is one of the leaders in the world of trading. The fact that you can gain access to 135 exchanges in 33 countries with a single account speaks most eloquently to the investment opportunities the company has to offer.

Pros and cons of the broker’s market diversity

| Pros |

|---|

|

| Cons |

|---|

|

Depth of the markets on Interactive Brokers and its competitors

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| CFDs | Yes | Yes | Yes |

| Crypto | Yes* | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes |

| Options | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Mutual funds | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Managed investment portfolios | Yes | Yes | Yes |

| Robo-advisors | Yes | Yes | Yes |

* Only futures contracts on Bitcoin and Ethereum

As we can see, the competitors are approximately equal in terms of products offered for trading. However, further examination of the issue shows that Interactive Brokers provides a wider list of trading instruments for each class.

Geography

| Country | |

|---|---|

| USA | Yes |

| Canada | Yes |

| Mexico | Yes |

| Germany | Yes |

| UK | Yes |

| France | Yes |

| China | Yes |

| India | Yes |

| Poland | Yes |

| Russia | Yes |

| SAR | Yes |

| Brazil | Yes |

| Total countries | 33 |

Stock market

Interactive Brokers has a truly humongous choice with securities on 135 exchanges in 33 countries are available for trading on a single investment account.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Number of stock markets | 135 | 37 | 30 |

The most fully represented are the stock markets of the U.S., UK and West European countries, although there is also access to the promising markets of developing countries, such as Poland, Mexico, India, SAR and Brazil. Needless to say, there are all sectors of the global economic available through dozens thousands of securities.

In terms of stock market availability, Interactive Brokers is a clear leader, also with some of the lowest commissions.

Forex market

The broker provides access to spot trading on the forex market and to currency CFDs. Overall, there are 23 currencies in 105 currency pairs available for trading.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Number of trading pairs | 106 | 180 | 80 |

Saxo Bank offers a wider choice of currency, although the majority of additional options are exotic pairs with low liquidity volume. At the same time, Interactive Brokers offers the most liquid currencies. The broker indicates that its liquidity suppliers account for 60% of the global forex transactions. This allows to provide the best quotations with the narrowest spreads.

Other key features of Forex market on Interactive Brokers:

- Market structure akin to ECN allows to merge orders on different markets and execute them even between the broker’s clients. This facilitates maximum liquidity, quick precision of order execution;

- Possibility of direct conversion of 23 currencies under special conditions;

- Trading all FX instruments (spot, currency futures and options) from single window;

- Optimized FXTrader interface.

CFD market

CFD is a favorite instrument of many traders, which allows trading derivatives with a big leverage on any other type of assets. Interactive Brokers platform offers an average choice of CFDs, as the broker is more focused on investment instruments.

The biggest choice of CFDs is on shares – over 7,000, while there are no CFDs on bonds and ETFs.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Crypto | No | No | Yes |

| CFDs on ETF | No | Yes | No |

| CFDs on indices | Yes | Yes | Yes |

| Commodities | No | No | Yes |

Some features of CFD trading on Interactive Brokers:

Smart-routing system provides for more accurate quotations without losing in price;

Comparison of CFD orders and Hedge orders in the exchange book;

You can simultaneously open positions in CFD and base asset from a single trading window.

NOTE! Interactive Brokers warns on its website that CFDs are a high-risk derivative. Over 60% of the broker’s clients suffer losses when trading CFDs.

Cryptocurrencies

Cryptocurrencies on Interactive Brokers are available through different derivatives: futures and cryptocurrency indices. Overall, the broker allows trading of two cryptocurrencies: ETH and BTC. In terms of this asset, the competitors are not far ahead and are still far behind the cryptocurrency exchanges.

Number of cryptocurrencies on brokers’ platforms and on Binance exchange

| Interactive Brokers | Saxo Bank | Swissquote | Binance | |

|---|---|---|---|---|

| Number of cryptocurrencies | 2 | 2 | 5 | 726 |

Commodities

Commodity markets are fully represented on Interactive Brokers. The broker provides direct access to the Chicago Mercantile Exchange (CME), allowing clients to trade nearly all commodities:

- Precious and industrial metals

- Ores

- Industrial semi-finished products

- Energy

- Construction materials

- Agricultural products, etc.

Futures and options

Interactive Brokers provides a direct access to the largest platforms trading futures and options – American CBOE and CME. Their choice of assets is truly humongous, amounting to dozens of thousands and will satisfy even the most demanding clients. The futures and options market is not limited to that. Overall, trading of these instruments is available on 33 exchanges.

Investment products

We believe Interactive Brokers is one of the best financial brokers for long-term investments thanks to a wide availability of all key markets for passive investment. The broker offers dozens of thousands of bonds, ETFs and mutual funds for investment. As a nice bonus, there is a Robo-Advisor and an investment management platform with a minimum deposit from USD 5,000.

Interactive Brokers will not be awarded the status of a hands-down winner only due to the inactivity fee, which could be a substantial drawback for retail investors with less than USD 2,000 on their trading account.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Bonds | Over 1,000,000 bonds and 23 675 CDS (credit default swap – insurance against the issuer’s bankruptcy) | 38 000 | 56 000 |

| ETFs | 13 000 | 3 000 | 1 600 |

| Mutual funds or managed portfolios | 34,054 funds from top suppliers | 250 funds | 12 493 |

| Hedge funds * | Yes | ||

| PAMM accounts | No | No | No |

| Trade copying services | No | No | No |

| Robo Advisors | Yes | Yes | Yes |

| Portfolio management | Yes | Yes | Yes |

* This option is available only for qualified investors. Minimum investment is from USD 25,000. For details, contact the broker.

As we can see, Interactive Brokers has an unrivaled number of investment instruments. In terms of this indicator, the company is far ahead of even large European bank brokers.

Several facts about investing with Interactive Brokers:

- Over a million of investment instruments in 33 countries all available from a single trading account;

- Bonds issued by the governments of the countries with high credit rating and also hundreds of thousands of municipal and corporate securities are available on the platform;

- Interactive Advisors has a special scanner for qualified selection of instruments by risk and profitability parameters;

- Interactive Advisors, a platform for automated portfolio management, with a minimum deposit from USD 5,000 and low management fees allows to easily invest without special knowledge and ready open trading and passive strategies.

Opening an account

Any trader can open an account on Interactive Brokers; however, the registration procedure may take up to 3 days. Before registering an account with the broker, you need to fill out an application, which will be sent for review. You will need to provide a lot of information in your application and the registration will take some time. The registration procedure in the company is fully automated and each new page of the application you need to fill loads within 1-2 seconds. Interactive Brokers operates in over 200 countries, which is why customers practically to any regions of our planet can work with the service. In addition, there is no minimum deposit for the majority types of trading accounts. There are, however, requirements on minimum commission per month.

Pros and cons of registration procedure

| Pros |

|---|

|

| Cons |

|---|

|

Minimum deposit

There is no minimum deposit for trading accounts on Interactive Brokers. In terms of this, the broker has an advantage over Saxo Bank and Swissquote, which have a minimum deposit that could be inconvenient for beginners.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Minimum deposit | Zero (there is a minimum commission system for traders) | Denmark – zero UK – GBP 500 Norway – NOK 10,000 Switzerland – CHF 2,000 France, Netherlands – EUR 2,000 Australia – AUD 3,000 China – USD 2,000 Hong Kong – USD 2,000 Singapore – SGD 3,000 Other countries – USD 10,000 |

EUR 1,000 |

Citizens of which countries cannot trade on Interactive Brokers

Interactive Brokers is available for traders from over 200 countries. This means that the broker practically does not have regional restrictions, although there may be nuances when working with countries, which are under international or American sanctions. It is recommended that you contact the broker’s customer support to learn about the services and requirements for your country.

Documents required for opening an account

In order to register on Interactive Brokers, you need to submit an application and provide a full list of required documents. Otherwise, your application will be rejected. In order to register on the broker’s website, you will need to provide the following documents:

- ID – passport, national identity card, alien identification card, driver’s license;

- Confirmation of the place of residence – housing utility bill, bank statement, insurance receipts, tax letters and notices, etc.

The user is also required to provide funding information. It may vary depending on the funding method you choose. For example, for wire transfer, you will need to provide the amount of intended deposit, bank name and bank account number. If it is a check, you will need to provide a check number and bank routing number. You can review the list of all required documents and information on the Interactive Brokers website.

Types of accounts

The broker does not have division of account types by trading conditions as such. There is a classification based on the type of the customer. Below is a short summary of the trading accounts of the company.

Interactive Brokers account classification

| Type of account | Description |

|---|---|

| Individual | A single account holder. Account holder has access to all functions, but he/she can add additional users with a Power of Attorney. Cash, Reg T and Portfolio Margin are available. |

| Joint accounts | Two account holders. Can be one of these types: Tenants with Rights of Survivorship, Tenancy in Common, Community Property, or Tenancy by the Entirety. Additional users with a Power of Attorney can be added. Cash, Reg T and Portfolio Margin are available. |

| Trust | A legally established entity in which assets are held by one party for the benefit of another party. One or more trustees have access to all functions. Cash, Reg T and Portfolio Margin are available. |

| Retirement Account (IRA) | Individual Retirement Account, available to individual US tax residents only. The characteristics are identical to individual account. |

| UGMA/UTMA | An individual or entity who manages an account for a minor until that minor reaches a specific age. Available to US residents only.Cash accounts only. Margin is not available. |

| Friends and Family | Account managed by an advisor who is exempt from registration and has 15 or fewer clients, the profit is split between the account owners. |

| Family Office | An individual who is a Family Office Manager has access to the account. The client markups feature % of equity, flat fee, % of P&L, fee per trade, and manual billing. Family Office Manager can access some or all accounts or functions. Client users can trade and directly fund and view statements. |

| Small Business | Any representative of a small business can become a client. This type of account has a single account. The client can have a Manager access the account. |

| Advisor | This account is for individuals that manage both client administration and client’s money. A master account can be linked to an unlimited number of client accounts. Also, Advisors have the ability to add an Advisor account with clients, a Multiple Hedge Fund account with fund or SMA accounts, or a Separate Trading Limit account (STL) under the master account. |

| Money Manager | Accounts of advisors and clients can be linked to this account. Only trading is available here; this account cannot be replenished. The margin depends on the type of client’s account. Pre-trading placement is also available for this account. |

Demo account

Interactive Brokers provides a demo account. This function is free. The company provides a possibility to replace the demo account with a real one without re-registration.

On the demo account, you will receive full access to Interactive Brokers trading platforms. The prices of assets are real, but for the demo account, they are supplied with a 10-15 minutes’ delay. The organization provides access to some free insight that will help you gain a better understanding of the market. In addition, there are comprehensive trading instruments on the demo account, which are also available on the real account. Therefore, you get practically full access to the functions of a real account.

How to open an account: step-by-step guide

The procedure of opening an account in the company is rather lengthy and will require some time from you. Let’s review a step-by-step guide on how to open a real trading account on the broker’s website.

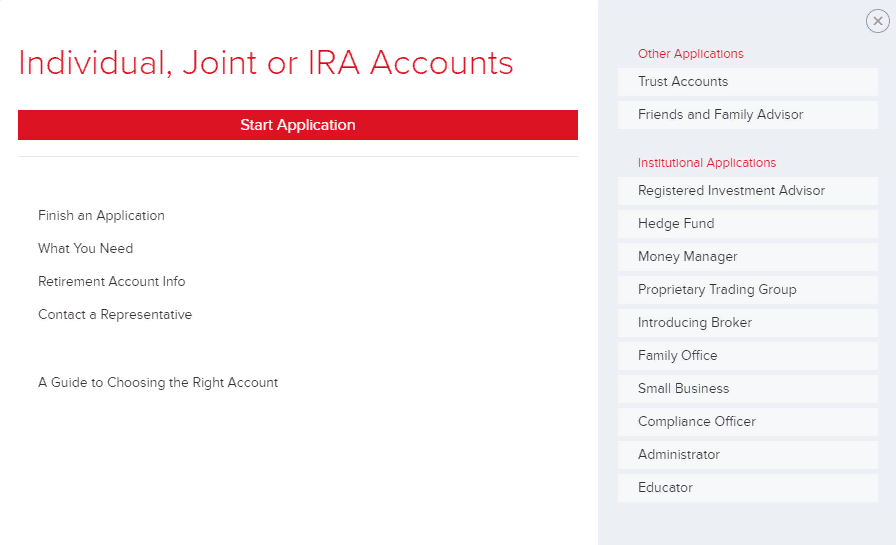

Step 1 – choosing account type

In order to register an account on the broker’s website, you need to press Open account button on the home page of the official website of Interactive Brokers. A window will open, offering you to choose the account type. If you need to open an individual account, just press Start Application. If you are interested in a different type of account, choose from the list.

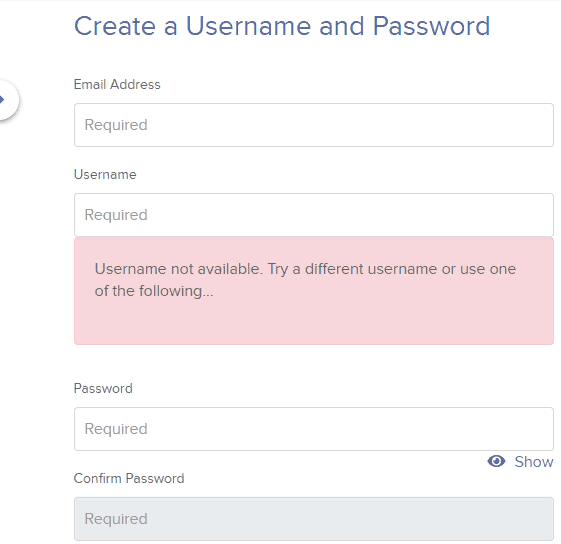

Step 2 – registration data

The registration begins with specification of the account data. Here, you need to provide the following information:

- email address;

- username;

- password;

- country.

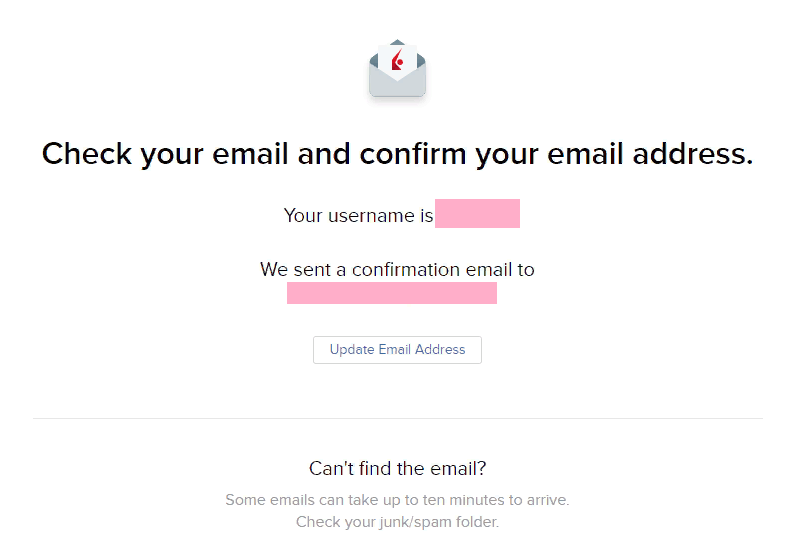

Step 3 – email address confirmation

After you filled out the form, you need to confirm your email address. A letter will be sent to your email with the confirmation link. Press the link to confirm and the broker will offer you to continue your application.

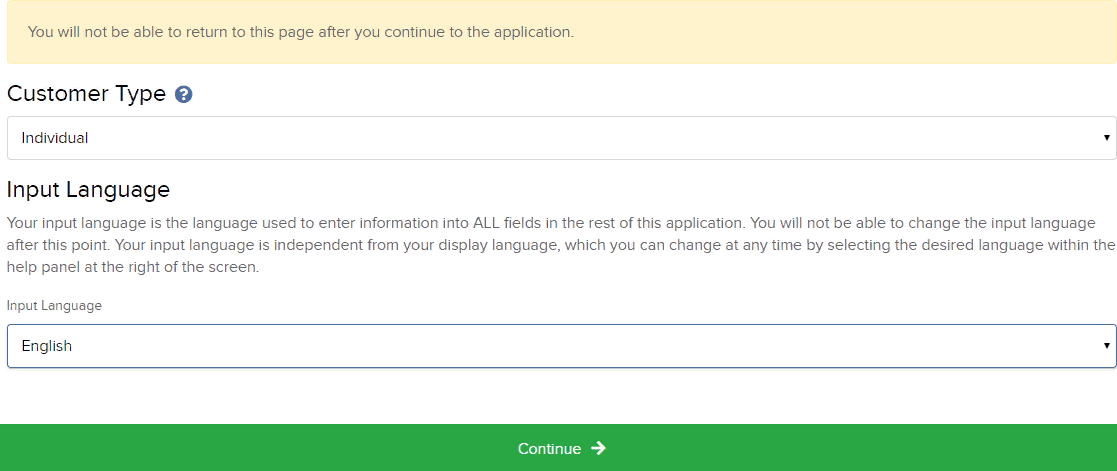

Step 4 – Customer type and input language

After confirmation of the email, we go to the next step. Next choose the customer type. When you are filling out an individual application, you can choose one of the three types:

- individual;

- joint;

- pension.

You will also need to choose the input language. English is set by default, but you can choose the one you prefer best.

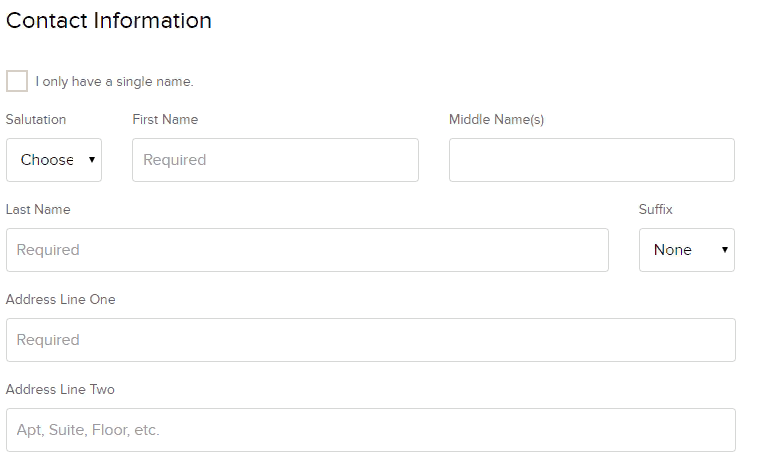

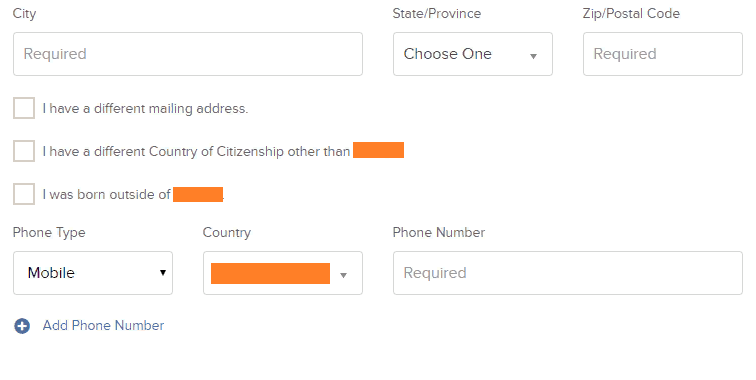

Step 5 – contact information

Then you need to fill out contact information. In this section, you provide basic information about yourself. Fill out the following boxes:

- First Name;

- Last Name;

- Middle Name;

- Address;

- City;

- Region/State/Province;

- Zip/Postal Code;

- Phone number.

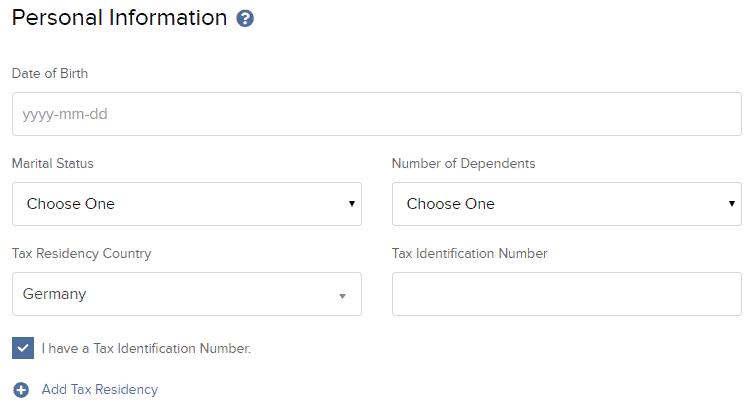

Step 6 – personal information

In the personal information section, you need to provide information about your family and tax residency. Fill out the next boxes:

- Date of Birth;

- Marital Status;

- Number of Dependents;

- Tax Residency Country;

- Tax Identification Number.

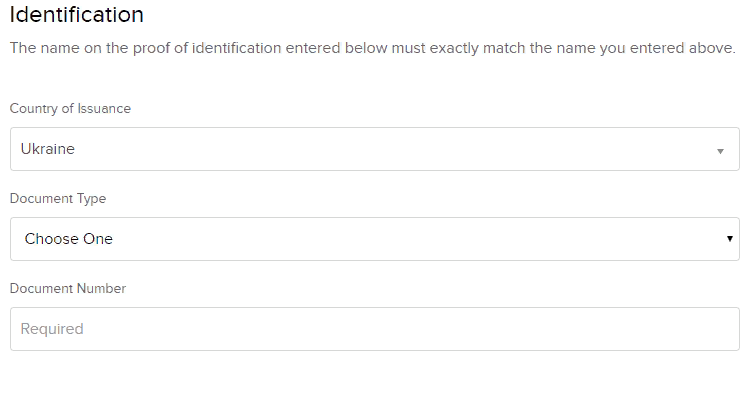

Step 7 – Identification

Identification is mandatory on Interactive Brokers and you need to provide documents when you are filling out the application, providing the following information:

- Country of issuance of the document;

- Document Type;

- Document Number.

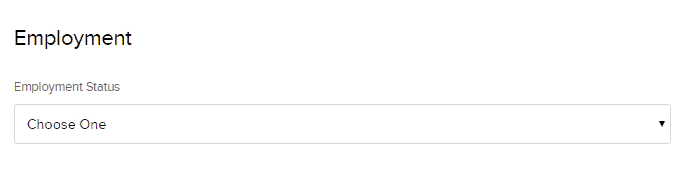

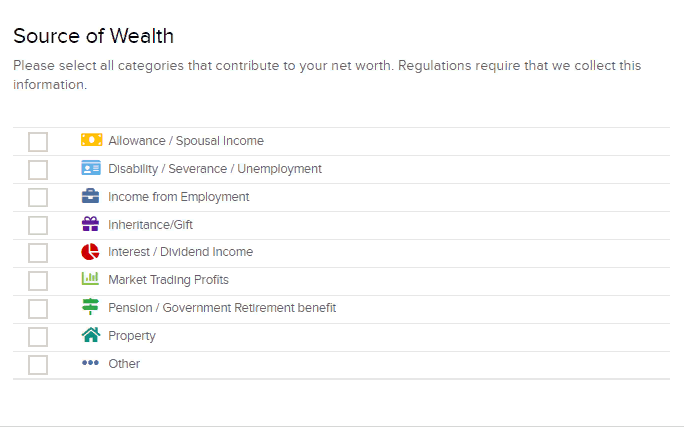

Step 8 – Sources of income

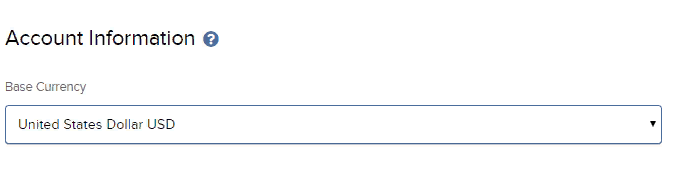

You also need to provide your current employment status. In particular, you need to specify if you are employed or not, or, maybe you are a pensioner or student or any other status. It is also mandatory to provide your sources of income (wealth), which you will use to fund your account. Also, you will need to choose base currency of the account in this section.

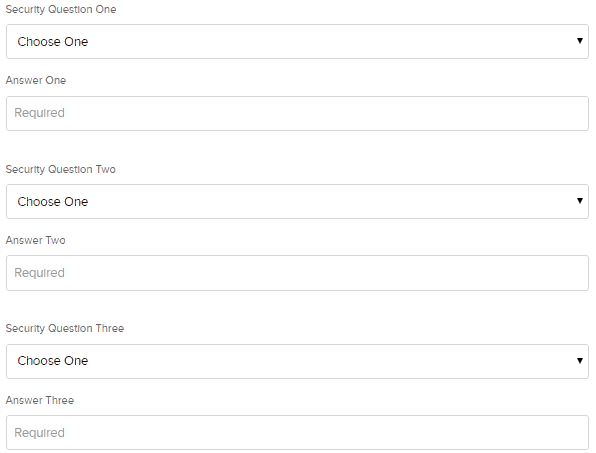

Step 9 – Security

The last step of the application is the security of the account. The company offers you to specify three secret questions. The broker offers 41 options of questions, for example:

- Your spouse’s middle name;

- First concert you attended;

- Your grandmother’s name;

- Your favorite cartoon character;

- Your pet’s name, etc.

You will need to provide the answer to each question, as this may be required for restoring access to your account, when you contact customer support, etc.

Base currencies of the account

Interactive Brokers supports a large number of base currencies. Their total number is 22. They can be used to deposit and withdraw funds in all countries, where the broker operates, with the exception of Indian Rupee. Rupee is available only on the territory of India; it cannot be used in other jurisdictions.

The list of base currencies on Interactive Brokers is comparable with the lists of other popular brokers. The broker works with practically all most popular currencies in the world. Regarding the lacking currencies, the company should add Brazilian Real and Turkish Lira.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Number of base currencies | 22 | 26 | 21 |

| List of base currencies | AUD, GBP, CAD, CNY, CZK, DKK, EUR, HKD, HUF, INR, ILS, JPY, MXN, NZD, NKK, PLN, RUB, SGD, ZAR, SEK, CHF, USD. | AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, LTL, MXN, MYR, NOK, NZD, PLN, RON, RUB, SEK, SGD, TRY, USD, ZAR. | EUR, USD, GBP, CHF, JPY, AUD, CAD, NZD, PLN, SEK, DKK, NOK, HUF, TRY, ZAR, SGD, MXN, HKD, THB, ILS, AED |

Deposit and withdrawal

Interactive Brokers offers a wide choice of methods of deposit and withdrawal of funds. There are two ways to deposit funds – direct deposit and a deposit notification. The notification is provided in case you are depositing funds via a wire transfer or check. A deposit notification does not actually move funds; you must make arrangements with your bank or broker to deposit the funds.

As for the deposit and withdrawal fees, the broker charges none. The period for the deposit and withdrawal transaction depends on the method that you are using. Instant crediting of funds to the account is possible only for payments via electronic payment systems. The biggest drawback of Interactive Brokers is that it does not support debit/credit cards and electronic wallets.

| Pros |

|---|

|

| Cons |

|---|

|

Methods and timeframe for deposits on Interactive Brokers

| Method of deposit | Timeframe | Peculiarities |

|---|---|---|

| Wire transfer | Up to 4 business days | Period of fund reservation – up to three business days. After this period, they become available for withdrawal. |

| US ACH transfer | Up to 4 business days | ACH deposit limit is USD 100,000 per 7 business days |

| Check | On the same business day, when the check was received | Checks are accepted only in USD, CAD and HKD |

| Online payment | Instantly | Withdrawal is possible in 3 business days |

| BPAY | Up to 4 business days | Available only for the residents of Australia. Three-day reserving of funds is applied. |

| Canadian cashless payment | Up to 3 business days | Available only for IB Canada customers |

| Canadian Electronic Funds Transfer (EFT) | Up to 4 business days | Available only for deposits in USD and CAD. The amount is limited to USD 20,000. |

Overall, the deposit system of the broker can be considered rather complex. The simplest and most popular methods, such as debit/credit card or e-wallet are not available here. Wire transfers must be confirmed. Compared to the competitors – Saxo Bank and Swissquote, the system is indeed complicated. The competitors at least support debit/credit cards.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard debit/credit cards | No | Yes | Yes |

| Electronic payment systems | No | No | No |

| Cryptocurrencies | No | No | No |

Methods of withdrawal on Interactive Brokers

As for the withdrawals, the broker also has the same complex system as with the deposits. Processing of applications, however, is faster, but it is linked to time. If the withdrawal is requested later than a certain time, you will have to wait for an additional day. There is no withdrawal fee. Let’s review the main methods and peculiarities of withdrawal of funds on Interactive Brokers.

| Method of withdrawal | Timeframe | Peculiarities |

|---|---|---|

| Wire transfer | Sent on the same day, if the withdrawal request was submitted by a specific time. If not, the request will be processed on the following day. | In case a large amount is withdrawn, there is additional verification in the form of a call to the customer |

| ACH transfer | 1-3 business days | Verification is performed by sending two test payments to ACH account and one – to the company’s account. |

| Electronic transfer | Instantly, after verification | After the request is submitted, the company sends a confirmation request to the application |

| Check | 1 business day | Only for US customers, only in USD. For requests processed after 9:30 ET, the checks are sent on the following business day. |

| EFT transfer | 1 business day | Processed only in USD and CAD. Maximum amount is USD 5,000,000. |

| Single Euro Payments Area (SEPA) | 1 business day | Maximum amount is USD 5,000,000. |

Review of the broker’s trading platforms

Interactive Brokers uses its own trading platform with an incredible set of functions. It has everything a trader might need. The company offers the following versions of its trading platform:

- web;

- mobile (Android, iOS);

- desktop (Windows).

The biggest peculiarity of the trading platform is its set of functions. In addition to standard chart and technical analysis tools, you will find market reviews and reports. There is a built-in stock screener and bond scanner. You can create lists of preferred assets. The news are aggregated by each asset. There is also an additional security layer here. You can turn on two-factor authentication for protection of the account.

However, the platform also has some drawbacks. In particular, there could have been more tools for technical analysis. Also, it is not very convenient to search for assets here and the interface looks too complicated at times, especially for beginners.

| Pros |

|---|

|

| Cons |

|---|

|

Interactive Brokers trading platform is best suitable for experienced users. It will be quite difficult to find their way around. Saxo Bank’s situation is similar. Swissquote offers its clients more customary MT4 and MT5, which are more convenient for beginners, for the people, who require a bigger number of instruments for automated trading.

| Interactive Brokers | Saxo Bank | Swissquote | |

|---|---|---|---|

| MT4 desktop | No | No | Yes |

| MT5 desktop | No | No | Yes |

| Android/iOS mobile platform | Yes | Yes | Yes |

| Web-terminal | Yes | Yes | Yes |

Description of Interactive Brokers trading platform

The entry to the trading platform is standard – you have to enter login and password. Also, you can turn one two-factor authentication in your profile. The interface of the platform looks as follows.

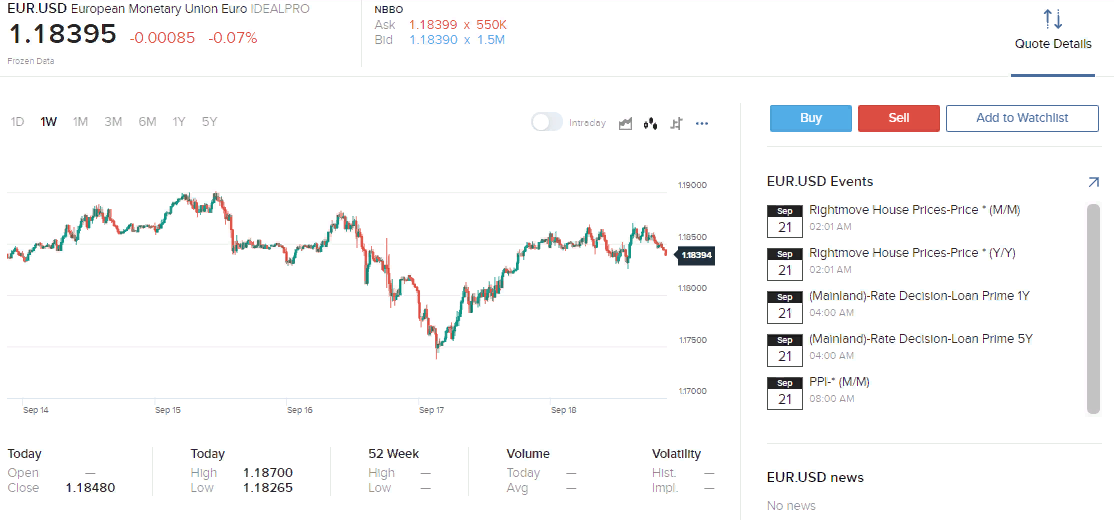

The statistics is provided for each asset individually. In order to view it, you need to choose an asset or a trading pair. You will see all required information – opening and closing prices for the day, minimums and maximums for different time periods.

You can also select the chart's interface. Interactive Brokers offer three options:

- bar;

- candle;

- single-line.

As for the orders, there are four on Interactive Brokers:

- limit;

- market;

- stop;

- stop-limit.

As for the technical analysis, the company offers rather modest opportunities. The broker offers 7 key indicators and 9 secondary indicators. There are no instruments for drawing on the chart. The company does not have automated trading.

How to open order in Interactive Brokers Trader Workstation (TWS) platform

Analytics

Interactive Brokers offers a rather big number of analytical materials. On the broker’s trading terminal, you will find all necessary information – analytical reviews, news, charts, diagrams. You can use both free analytics and paid versions with expanded possibilities.

| Pros |

|---|

|

| Cons |

|---|

|

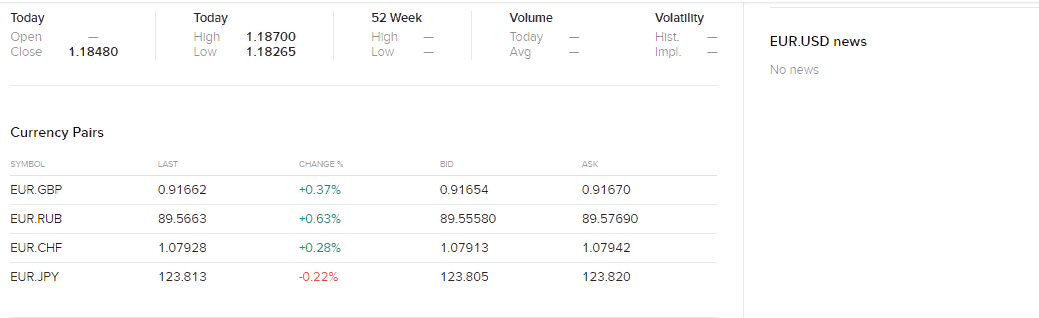

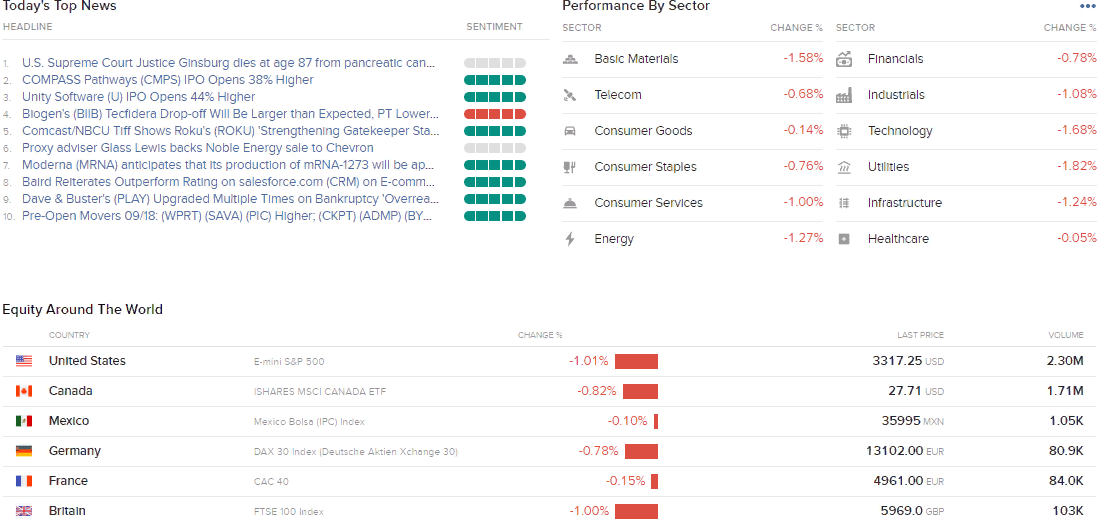

Reviews and surveys

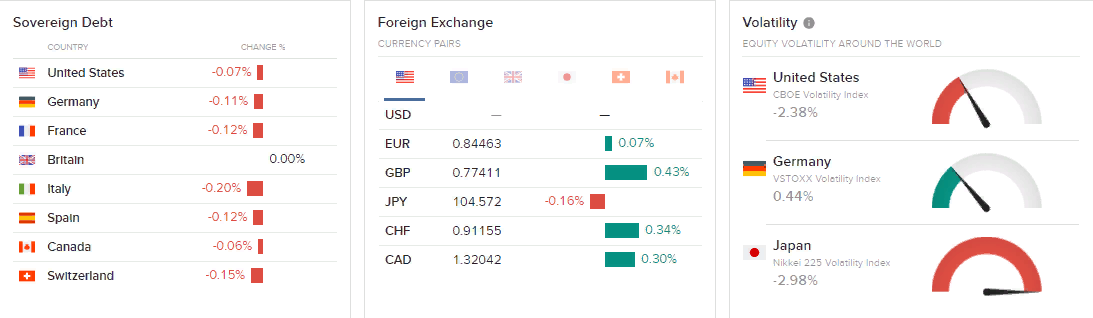

The company provides basic reviews on indices of different regions, key indicators by sectors, economic indicators of specific countries, etc. You will also find information on sovereign debt, volatility indicators, etc.

Advice and trading ideas

The broker offers access to expert advice. In the majority of cases, they are free, although there are some paid subscriptions. Also, the company has analytical instruments that will help produce new trading ideas – Validea and TheLeadingEDGE. Using them, you can obtain real-time data, reports, information about assets. They can be set up via the trading terminal.

Newsfeed

The newsfeed is also available as a free and paid version. The free version includes news from such sources as Thomson Reuters, Morningstar, Dow Jones, etc. The profile of each asset contains the new about it, and the Market section has the top news of the day.

Learning

Interactive Brokers offers its clients quality learning tools. Traders’ Academy of the broker will impress you with a wide variety of materials.

| Pros |

|---|

|

| Cons |

|---|

|

In particular, you will find detailed courses that include text and video materials and also quizzes. The total number of courses is 48. The courses are split by topics, including:

- Interactive Brokers trading tools;

- Investment products;

- Risk analysis;

- Investment analysis;

- Portfolio analysis;

- Taxes.

The company also offers access to webinars and short videos. The broker holds regular webinars on a diversity of topics, from learning to in-depth analytics.

In addition, there is Traders’ Glossary, where a user can learn key terms and notions of the world of trading and investments. There is also Traders’ calendar.

Customer support

Customer support of Interactive Brokers is available in five languages: English, Russian, Chinese, Hindi and Japanese. There are also many ways to contact customer support:

- Chat room;

- Phone support;

- email;

- fax/mail.

The only drawback is that the customer support is not available 24/7. It operates strictly during specific hours, depending on the region.

| Pros |

|---|

|

| Cons |

|---|

|

Contact numbers

The contact numbers of the company differ depending on the jurisdiction. There are different numbers for the U.S., UK, Canada, Europe, China and Japan. You can see them in the table below.

| Country | Language | Operating hours (UTC +1) | Contact number |

|---|---|---|---|

| USA | English | 23:30 (Sun.-Mon.) – 08:30 (Tue.-Sat.) | 1 (877) 442-2757 1 (312) 542-6901 |

| Canada | English | 14:00 - 23:30 (Mon.-Fri.) | 1 (877) 745-4222 1 (514) 847-3499 |

| Europe | English | 09:00 - 18:00 (Mon.-Fri.) | 00800-42-276537 +41-41-726-9500 +44 207-710-5695 (UK) |

| Russia | Russian | 09:00 - 18:00 (Mon.-Fri.) | 8-800-100-8556 free +41-41-726-9506 Russian |

| Hong Kong | Chinese, English | 02:00 - 11:00 (Mon.-Fri.) | +852-2156-7907 |

| Australia | English | 02:00 - 11:00 (Mon.-Fri.) | +61 (2) 8093 7300 |

| India | Hindi | 05:00 - 14:00 (Mon.-Fri.) | +91 22 61289888 +91 22 39696188 |

| China | Chinese | 03:00 - 12:00 (Mon.-Fri.) | +86 (21) 6086 8586 |

| Japan | Japanese, English | 01:30 - 10:30 (Mon.-Fri.) | +81 (3) 4588 9700 +81 (3) 4588 9710 |

Email address of the broker is not specified on the official website. In order to send a letter, you will need to go to Support section and select Send inquiry. The average time for processing a request submitted during working hours is 24 hours.

US customers can contact customer support via fax. Contact number is (312) 984-1017.

Bonuses and promo

Interactive Brokers does not offer any bonuses or promo offers to its customers. Due to peculiarities of regulation, the broker cannot provide special offers.

Summary

Interactive Brokers is a broker for professional traders with big capital. And it is also suitable for the beginners, as zero minimum deposit and a wide choice of educational materials is important to them.

The beginners, however, will have to spend some time to sort out all peculiarities and features of the platform. Interactive Brokers offers a large variety of analytical instruments. There are analytical services here that will be very useful for an experienced trader, although it will be difficult for a beginner to work it all out.

Overall, Interactive Brokers offers its customers a large number of assets for trading, and good investment opportunities. It is one of the most reliable brokers in the world. That is why, this company can be definitely recommended for trading.

NOTE!All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Real reviews of Interactive Brokers 2024

Trading with Interactive Brokers suits me perfectly. Special thanks for the high-quality terminal with an intuitive interface. There were no difficulties with mastering.

Disagree with negative comments about Interactive Brokers. An intelligent broker who does not fail in trading. Here I have earned over 10,000 dollars trading in securities. Payments are always prompt.

Withdrawals from Interactive Brokers are always difficult. Either the application is considered for several days, then the technical difficulties on the platform. There was also something that was accused of delaying the payment system. I'm tired of fighting these delays.

Interactive Brokers lacks popular payment options. For example, you cannot withdraw profit on an electronic wallet or in cryptocurrency. In turn, bank transfers take up a lot of time, and even check by phone is provided.

The Interactive Brokers attracted me no entry threshold, that is great for beginners! Instead, there are minimum commission requirements (it all depends on the type of account). So far, trading with this broker suits me. I did not notice the technical problems and slippages.

I wanted to trade with Interactive Brokers, but I was disappointed at the registration stage. It seems that the company is collecting dossiers on customers, and does not plan to cooperate with them. Opening a real trading account will take a lot of time. In other companies, the procedure is much easier!

I did not regret choosing Interactive Brokers because the company provides a comfortable trading experience. The terminal has all the information you need to timely analyze the market and make informed decisions. There are also expert recommendations that will not be superfluous. However, keep in mind that not all subscriptions are free, so calculate your budget.

They blocked my account for no clear reason. Support did not answer anything intelligible for a whole week! I turned grey during this week... Finally, I took my money after a damn dozen of chats and extra docs.

Their Workstation is complicated for a beginner. In other aspects, IBKR is the best choice for 2020. Huge range of markets, pretty low fees...

Guys, does this broker share backtesting datasets?

Be ready for new ID rules. They can ask extra financial docs to guarantee youa not a scammer or having dark affairs in your country. It took more than 2 weeks to prove I'm ok

IB is good for active trading. Fees are extra law. Huge choice of assets for any case.

Their Workstation is complicated for a beginner. In other aspects, I believe IBKR is the best choice for 2020. Huge range of markets, pretty low fees.