On this page, you will find a large number of reviews from the real Oanda If you are already working with If you are already working with Oanda please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Oanda Review 2021

Oanda is a classic Forex and CFD broker with headquarters in the USA, focusing not only on providing access to a large variety of products, but also on the quality of service and beneficial trading conditions.

The company offers high reliability, supported by its 24-year experience of operating in the market and regulation in the USA and the UK.

In our review, we will compare the services offered by Oanda with those provided by its competitors – XM and XTB, in order to show the benefits and drawbacks of the broker in a more efficient way.

Pros and cons

Reliability, high quality of information and analytical services and low commissions and fees are the key advantages of the broker. As for the diversity of the trading instruments the broker offers, there is a lot of room for improvement.

| Pros |

|---|

|

| Cons |

|---|

|

Key features of the broker

| Regulation | USA, Canada, UK, Singapore, Australia, Japan |

|---|---|

| Level of commissions and fees | Low |

| Demo account | Yes |

| Minimum deposit | 0 USD for Standard account, 20 000 USD for Premium account |

| Inactivity fee | Up to 10 GBP per month after 12 months of inactivity and without open positions. |

| Period for opening an account | 1-3 days |

| Leverage | Up to 1:30 |

| Markets | Forex/Commodities/Indices/CFDs/Bonds/ |

| Options for passive income | Bonds |

| Support languages | English |

| Withdrawal fee | No |

| Deposit from and withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes |

| Account currencies | USD, EUR, GBP, AUD, CHF, SGD, JPY, HKD, CAD |

| Deposit bonus | No |

Page content

Geography of broker’s customers

We have analyzed information about the geography of the broker’s customers in August 2020. The American registration of Oanda shows, as the majority of the broker’s customers are from the U.S., although the traders from Germany, UK, Canada and Italy also account for a considerable share of customers.

| Country | Percentage of customers |

|---|---|

| USA | 19.4% |

| Germany | 8.37% |

| UK | 8.04% |

| Canada | 5.85% |

| Italy | 3.59% |

Good statistics in the European countries, the U.S. and Canada is quite logical, as the broker holds licenses in these regions and has concentrated its efforts on attracting customers there.

Regional restrictions

Oanda does not specify on its website that the broker may refuse service to a customer due to a specific residency. To learn more about whether you can become the broker’s customer, contact its customer support.

Commissions and fees

Oanda has low trading commissions on Forex and CFD markets, which is one of its benefits. The peculiarity of the system of charging commissions is that in the majority of cases, they are built into the spread. In this review, we will specify how much a trader will actually have to pay per trade.

We will also review the broker’s non-trading commissions on the key markets and provide standard examples of expenses for transactions on different markets.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on Oanda

| Asset | Commissions |

|---|---|

| EUR/USD | The commission is included in the spread. In general, the level of the floating spread is low with an average value of 1 point. |

| CFD on Brent | The commission is included in the spread. Standard value – 0.03. |

| CFD on S&P 500 | The commission is included in the spread. In general, the level of the floating spread is low from 0.4 pips |

| Deposit fee | No |

| Withdrawal fee | Only in case of a wire transfer |

| Inactivity fee | Up to 10 GBP per month after 12 months of inactivity and without open positions. |

Commissions on Forex market

Oanda targets the Forex market, which is why the level of commissions here is low. The minimum value of the spread starts from 0.6 pips for the EURUSD pair, which is equivalent to $6 per one standard lot. The broker’s commissions are built into the floating spread, which can change under the impact of volatility, but does not depend on the turnover.

Below is a standard level of spread on Oanda for three classes of currency pairs: major, cross rates and exotic. The average spread is specified for the Standard account.

| Spread | |

|---|---|

| EURUSD | 1 pips |

| USDJPY | 1.2 pips |

| EURGBP | 1.5 pips |

| AUDJPY | 1.6 pips |

| USDPLN | 17.0 pips |

| USDZAR | 106.0 pips |

Let’s compare the commissions for a standard lot of 100,000 units of base currency on the Forex market charged by Oanda and its competitors – XM and XTB. The spread and other possible commissions and fees are included.

| Оanda | XM | XTB | |

|---|---|---|---|

| EURUSD | 10 USD | 17 USD | 9 USD |

| USDJPY | 11.3 USD | 15.07 USD | 17 USD |

| EURGBP | 19.25 USD | 25.66 USD | 27 USD |

As you can see, Oanda’s commissions on the Forex market are low; the broker compares favorably with the specified competitors on the majority of positions.

Rates of financing

If the position is transferred to the next trading day, Oanda charges a fee that depends on the interest rates of the central banks, issuing the currency, and administrative rate of the broker for a specific currency at the given moment of time. In the table below we provide the cost of transferring a position of 100,000 units of base currency to the following day in USD *.

| Instrument | Swap Long | Swap Short |

|---|---|---|

| EURUSD | -$2,19 USD | -$1.99 |

| EURGBP | -$5.75 | -$0.94 |

| USDJPY | -$4.12 | -$3.13 |

* The rates can change. Find out the latest values on the broker’s website or by contacting customer support.

Oanda does not offer a swap free option.

| Оanda | XM | XTB | |

|---|---|---|---|

| Swap free option | No | Yes | Yes |

Commissions on CFDs

Oanda offers a comparatively small selection of CFDs for speculative trading in the international financial markets with low level of commissions.

As in the case with the Forex market, commissions on CFDs are included in the spread. To make them more understandable, we will specify the standard commission for a purchase of CFDs for USD 4,000 and compare it with the competitors.

| Оanda | XM | XTB | |

|---|---|---|---|

| CFD on S&P 500 | 0.6 USD | 0.83 USD | 1.07 USD |

| CFD on gold | 1.03 USD | 0.72 USD | 0.72 USD |

| Brent Oil CFD | 3.04 USD | 4.99 USD | 5.06 USD |

As you can see from the table, Oanda compares favorably with its competitors on the majority of positions.

Commissions on investment assets

Oanda offers access to investment assets only via CFDs on U.S. Treasuries and UK government bonds. Overall, it is possible to purchase CFDs on 6% assets, with the commission included in the spread and at an average level. Oanda does not offer other opportunities for passive income. The broker’s competitors do not offer CFDs on bonds.

| Standard spread | |

|---|---|

| US 10Y T-Note | 2.6 pips |

| UK 10Y Gilt | 3 pips |

Noteworthy, CFDs on bonds are a more speculative asset than classic bonds. We do not recommend this instrument for new traders with no knowledge of the pricing in the bonds market.

Non-trading commissions

Oanda has low non-trading commissions, which are charged only in exceptional cases. The inactivity fee is charged only after 2 years of inactivity on the account (no trades). No fee is charged on withdrawals to PayPal or to a debit/credit card once a month. Wire transfer fee depends on the withdrawal currency.

| Оanda | XM | XTB | |

|---|---|---|---|

| Inactivity fee | Yes | Yes | Yes |

| Withdrawal fee | No fee for debit/credit cards and PayPal | Yes | No (for withdrawals over USD 100) |

| Deposit fee | No | No | No |

Therefore, Oanda’s conditions of charging non-trading commissions are rather standard and comparable to the competitors.

Reliability and regulation

Oanda gets a high grade for this criterion – the broker is reliable. A number of licenses issued by top regulators is the key instrument of protection of investors.

| Pros |

|---|

|

| Cons |

|---|

|

Review of Oanda’s licenses

The broker is registered and legally operates in six jurisdictions with high levels of investment protection. Below is a short review of the broker’s documents.

США. OANDA Corporation

The broker is registered and regulated by the U.S. Commodity Futures Trading Commission (CFTC), and the National Futures Association (NFA # 0325821).

Canada. OANDA Corporation ULC

The broker is regulated by the Investment Industry Regulatory Organization of Canada (IIROC). Individuals who have an open account at a Canadian bank can become the broker’s customers. The accounts in Canada are protected by the Canadian Investor Protection Fund.

UK. OANDA Europe Limited.

The legal entity is registered in England, No. 7110087. Control over the operation of the branch is carried out by one of the major financial regulators of the world - the Financial Conduct Authority (FCA) (License No: 542574)

Singapore. OANDA Asia Pacific Pte Ltd.

The company is registered under No. 200704926K. The branch holds the license for providing services in the equity market and is under the regulation of the organization that plays the role of the central bank and the main regulator of the financial market – the Monetary Authority of Singapore.

Australia. OANDA Australia Pty Ltd.

The broker is regulated by the Australian Securities and Investments Commission (ASIC), registration No. (ABN 26 152 088 349, AFSL No. 412981).

Japan.

The company holds a Financial Instruments license from the Japanese Financial Services Agency, registration with the Kanto Local Finance Bureau #2137, and is a member of the Financial Futures Association of Japan #1571Insurance of deposits

Only the customers of the Canadian and European branches of Oanda can expect full or partial compensation for the losses in case the broker is declared insolvent or in case of other unforeseen circumstances.

| Country | Insured amount |

|---|---|

| Canada | Up to 1 000 000 CAD. |

| Europe | Up to 85 000 GBP |

| USA | Is not a member of deposit guarantee fund |

| Australia | Is not a member of deposit guarantee fund |

| Singapore | Is not a member of deposit guarantee fund |

| Japan | Is not a member of deposit guarantee fund |

Negative balance protection

Only customers from the European Union are protected against negative balance.

Scandals and litigations involving the broker

Oanda is an American broker with a good business reputation, which has been operating since 1996 and regularly passes audits by the major auditing companies. The broker has not been involved in any major scandals.

Other important remarks

Oanda is a CFD broker. As a reminder, CFDs are a high-risk financial instrument. Over 72% of Oanda’s customers lose money when trading CFDs.

Markets and products

Oanda provides a limited number of positions for trading. Forex currency pairs are the main trading instruments on Oanda. The company does not provide direct access to trading other assets. For example, you can trade bonds here only via CFDs, which are marginal instruments with high risk of losses.

| Pros |

|---|

|

| Cons |

|---|

|

Oanda does not provide a very big choice of assets. This broker certainly cannot compete with the market giants, such as Saxo Bank or Interactive Brokers, although within its niche, this broker is quite competitive. The choice of CFDs is rather good, which is why Oanda compares well with such brokers as XM or XTB. Below is a comparative table of market availability.

| Оanda | XM | XTB | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | No | Yes | Yes |

| CFD | Yes | Yes | Yes |

| Crypto | No | No | Yes |

| Bonds | Yes* | No | Yes* |

| Futures and options | No | No | No |

| Commodities (oil, metals, wheat, gas, ores, etc.) | Yes* | Yes* | Yes* |

| Mutual funds | No | No | No |

| ETF | No | No | Yes* |

Stock market

The broker does not provide direct access to the stock market. The stocks are not available even as CFDs.

Forex market

Forex market is well represented by the broker. Here, you will find all the necessary trading pairs. The total number of trading pairs Oanda provides access to is 79. The trader can use a wide selection of Forex instruments from the most popular pairs and cross rates to exotic pairs, such as TRY/JPY, SGD/HKD, USD/INR and others. The detailed list of currency pairs is available in the corresponding section on the Oanda’s website.

Oanda is excellent for Forex trading. Compared to XM and XTB, Oanda has a much better selection of currency pairs.

| Оanda | XM | XTB | |

|---|---|---|---|

| Number of trading pairs | 71 | 57 | 49 |

CFD market

Oanda also offers a good selection of CFDs. In particular, the broker provides access to CFDs on 8 raw material assets, 5 precious metals and 16 stock indices. The important advantage of the broker is availability of CFDs on bonds. This instrument is a rarity among brokers, which makes it an important benefit of Oanda. However, it is highly advisable that the new traders, who do not have knowledge of pricing of bonds, do not use this instrument.

The broker also has some serious drawbacks, primarily unavailability of CFDs on stocks. Taking into consideration that the broker does not offer access to real stocks as well, this reduces the possibilities for a trader.

| CFD Market | Оanda | XM | XTB |

|---|---|---|---|

| Stocks | No | Yes | Yes |

| Bonds | Yes | No | No |

| Crypto | No | No | No |

| Indices | Yes | Yes | Yes |

| Commodities (metals, foods, raw materials | Yes | Yes | Yes |

Opening an account

The procedure of opening a trading account on Oanda is simple and fully automated. Filling out an application takes about 30 minutes. The broker does not have a minimum deposit requirement, which means you can start trading even with 1 USD

However, there are also some drawbacks. In particular, the broker does not offer a choice of trading accounts – there is only one. In addition, verification procedure on Oanda is rather lengthy, and without confirmation of your personal data you cannot start trading.

Pros and cons of opening an account on Oanda

| Pros |

|---|

|

| Cons |

|---|

|

What is the minimum deposit on Oanda?

Oanda does not have any requirements for minimum deposit. You can start with any amount. Therefore, the broker is suitable for the beginners and traders, who cannot afford big deposits.

Absence of minimum deposit is an important factor for a new trader, which is why many brokers in this niche try to offer such conditions. In particular, XTB also does not have a minimum deposit requirement, while the minimum deposit on XM is only $5.

| Oanda | XM | XTB | |

|---|---|---|---|

| Minimum deposit | 0 USD | 5 USD | 0 USD |

Citizens of which countries cannot trade on Oanda

Oanda does not provide information about regional restrictions on its website. To learn more about regional restrictions, contact the broker’s customer support.

Documents required for opening an account

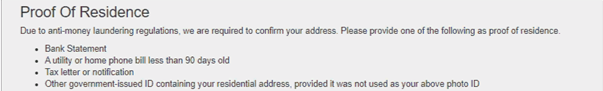

Verification is mandatory on Oanda as the broker operates in full compliance with the AML/KYC policy. To verify your account, you will need to provide two main documents:

- Proof of identity – national or foreign passport, residence permit;

- Proof of residence – utility bill, bank statement, etc.

The documents are uploaded at the stage of account opening. You can upload scanned copies or high-resolution images.

Account types

There are only two types of accounts on Oanda – real and demo. The real account is common for all customers. The trading conditions do not differ for the traders. This can be considered a drawback for big customers, as they cannot expect better conditions. But it is also an advantage for the beginners, as the conditions are the same for all users.

The important advantage of the broker is that a user can have up to 19 sub-accounts. The company allows opening of a sub-account in different currencies. Therefore, you can have one account in USD, another one in EUR, or use one account for Forex trading and another for CFDs on bonds, and third for CFDs on commodities, etc. You can thus save on conversion and create more flexible trading strategies.

Demo account

Oanda provides its customers a demo account, where you can practice trading or test new strategies. Demo account is free. It is not required to open a real account in order to use a demo account.

The amount of virtual funds you can work with on the demo account is unlimited. You can choose it yourself. The company says that all quotations on the demo account are real and there is no delay. The broker also provides access to all types of trading platforms.

Trading accounts

As we’ve already said, the broker has only one trading account. Let’s analyze it in more detail.

- Trading platforms: МТ4, МТ5, web, iOS, Android.

- Base currency options: USD, EUR, GBP, AUD, CHF, SGD, JPY, HKD, CAD

- Instruments: 71 currency pairs, 53 types of CFDs.

- Minimum deposit — no.

- Commission on traded volume: 5 USD per one million of traded volume.

- Commission per lot: no

- Average spread on EURUSD: floating, average value – 1 point.

- Minimum lot — 0.1, maximum lot — 10,000.

- Leverage — up to 1:30.

How to open an account: step-by-step guide

The process of filling out information for opening an account on Oanda takes 15-30 minutes. Verification takes one to three business days. To open an account with the broker, you need to pass several stages. Let’s review them in more detail.

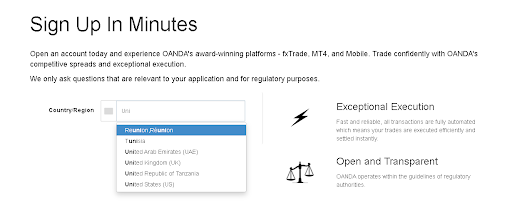

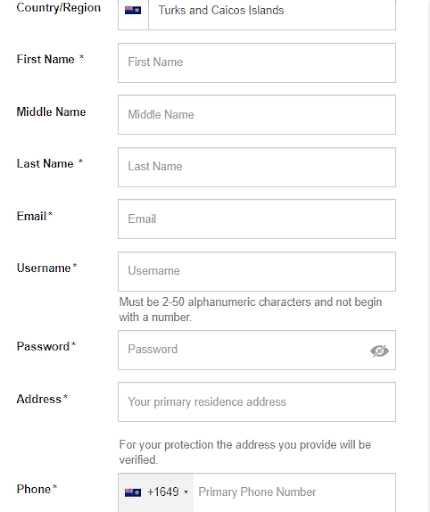

Step 1 – personal information

First, a person opening an account on Oanda needs to press the Start trading button and fill out the form, specifying personal information.

First, you need to choose your Country. After selecting your country of residence, you will see the full questionnaire.

It includes the following

- First name

- Middle name

- Last name

- Username

- Password

- Address

- Phone

Under the registration form, there is a list of documents you are recommended to review during registration, including Terms of Use, Privacy Policy, etc.

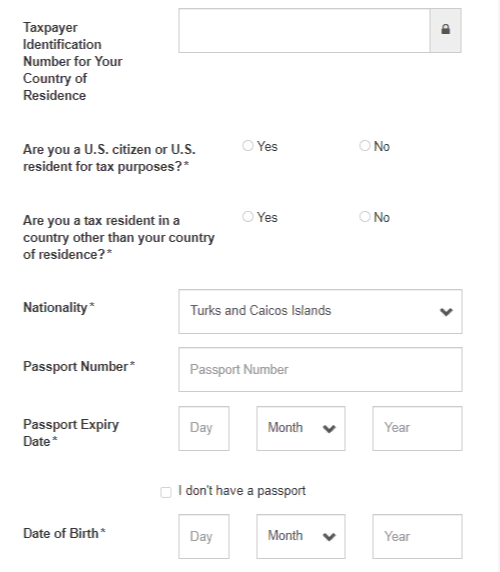

Step 2 – Tax information

Oanda requires its customers to provide tax information and passport data. You will need to verify the password data later on. Here, you need to provide the following:

- Taxpayer identification number

- Citizenship

- Passport series and number

- Passport expiry date

- Date of birth.

You will also need to answer the questions of whether you are a U.S. citizen and whether you are a tax resident of your country of residence.

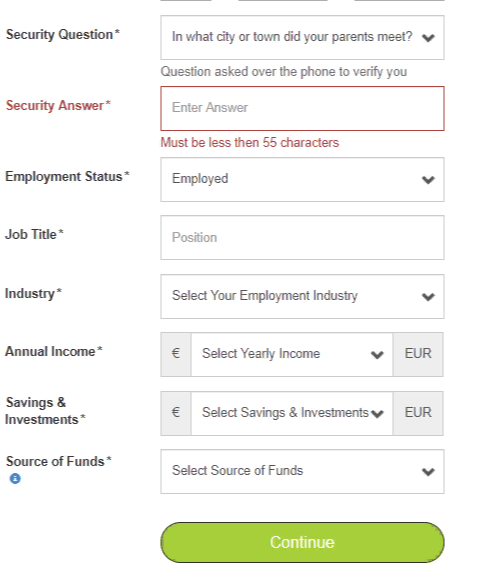

Step 3 – Security question and information about salary

During this stage, you will need to choose a security question and answer. You may require this information when contacting customer support, for access recovery, etc. There are 9 options for security questions. For example, you can select one of the following:

- City, where you parents got married

- You shoe size

- You favorite teacher’s name

- The name of your first pet, etc.

You will also need to specify your employment status and fill out the following:

- Employment status

- Job title;

- Industry;

- Annual income;

- Savings and investments;

- Source of funds.

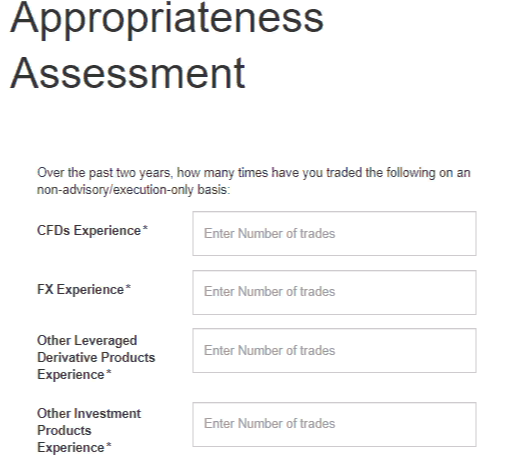

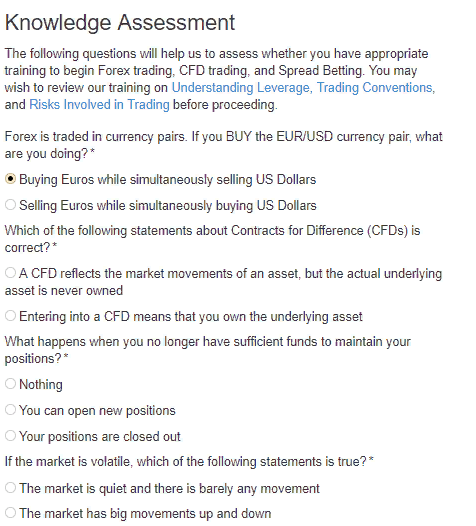

Step 4 – Experience and knowledge assessment

Before opening an account, the broker will ask you to specify your trading experience. IN particular, the company will ask you to tell you about your trading experience with CFDs, Forex, or other types of derivatives or investment instruments in general.

You will also have to fill out a small questionnaire that will help confirm your knowledge of the financial markets. In this way, the broker eliminates the users who do not have sufficient knowledge of the financial markets, and can limit the level of margin or even the list of offered instruments. In total, you need to answer 9 questions.

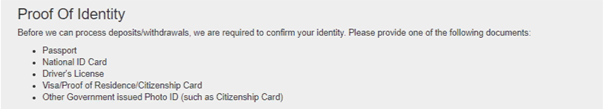

Step 5 – verification

The last step before completion of the registration is account verification. To confirm your identity, you need to upload the following documents:

- Proof of identity – passport, national ID card, driver’s license, visa, residence permit, etc.

- Proof of residence – utility bill, bank statement or any other document containing your residential address, first and last name.

Now, all you have to do is wait for the information to be

Base currencies

Oanda offers its customers a comparatively large number of base currencies. There are 9 base currencies and you cannot use other currencies to deposit funds on the account. The company does not offer a possibility of conversion. That is why, if you wish to use any currency that is not on the list of base currencies, it is best to use a service that chargers low conversion fees (for example, Transferwise).

The number of base currencies on Oanda can be considered average for the segment. In particular, the company has fewer base currencies than, for example XM, but more than XTB. The list of Oanda base currencies includes major European, North American and Asian currencies.

| Oanda | XM | XTB | |

|---|---|---|---|

| Number of base currencies | 9 | 11 | 5 |

| List of base currencies | USD, EUR, GBP, AUD, CHF, SGD, JPY, HKD, CAD | USD, GBP, CHF, JPY, AUD, RUB, PLN, HUF, ZAR, SGD | USD, EUR, GBP, HUF, PLN |

Deposit and withdrawal

Oanda offers its customers many methods of deposit and withdrawal. Noteworthy, the list of methods of funding the account and withdrawal of funds differ depending on the region. The list is most extensive for the European users.

In particular, you can use debit or credit cards. Also, wire transfers using different payment services, such as BACS, CHAPS, SWIFT, SEPA and others, are available. In addition, the company supports payments via online banking, as well as transfers via PayPal.

However, a specific branch of Oanda services each specific region, which is why there are specific restrictions on deposit and withdrawal of funds in each region. Below is a comparative table showing support of deposit and withdrawal methods in different regions of the planet.

| Method | Europe | USA | Canada | Asia Pacific Region | Australia |

|---|---|---|---|---|---|

| Wire transfer | Yes | Yes | Yes | Yes | Yes |

| Credit cards | Yes | No | No | No | Yes |

| Debit cards | Yes | Yes | No | No | Yes |

| PayPal | Yes | No | Yes | Yes | No |

Oanda does not charge any deposit and withdrawal fees. The fee may be charged by the service used for deposit or withdrawal. Oanda does not provide information about the timeframe for deposits and withdrawals on its official website. From our experience, it could take from several minutes to 3 business days in case of a wire transfer.

Overall, the number of methods for deposit and withdrawal offered by the broker can be considered good. However, there are some drawbacks. In particular, only one electronic payment system is supported – PayPal. Such services as Neteller, Skrill, Webmoney and other wallets are not available here. Also, cryptocurrencies are not supported.

| Pros |

|---|

|

| Cons |

|---|

|

In terms of deposit and withdrawal, Oanda is comparable to its competitors.

| Oanda | XM | XTB | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and Mastercard cards | Yes | Yes | Yes |

| Electronic payment systems | 1 | 2 | 10 |

| Cryptocurrencies | No | No | No |

Trading platforms

Oanda has two versions of a trading platform:

- fxTrade, a proprietary platform;

- MetaTrader 4 platform.

Let’s review the broker’s proprietary platform. It looks like an upgraded version of MT4. The platform is simple and convenient with a user-friendly interface, which is why it will be easy even for a beginner to understand it. It features great options for customization and individual settings. The broker offers the following versions of the trading platforms:

- Web – proprietary;

- Android – proprietary;

- iOS – proprietary;

- Windows – proprietary;

- Windows – MetaTrader 4.

There is only one drawback of the company’s platform. It does not have notification on the price change. Otherwise, Oanda’s platform is quite convenient and will be great for both beginners and experienced users.

| Pros |

|---|

|

| Cons |

|---|

|

Comparative table with the competitors

| Oanda | XM | XTB | |

|---|---|---|---|

| MT4 desktop | Yes | Yes | Yes |

| MT5 desktop | No | Yes | No |

| Android/iOS | Yes | Yes | Yes |

| Web-terminal | Yes | Yes | Yes |

Authorization requires a username and password, and also features a two-factor authentication. You can enable it in the platform’s settings. The Google Authenticator application is used for authentication.

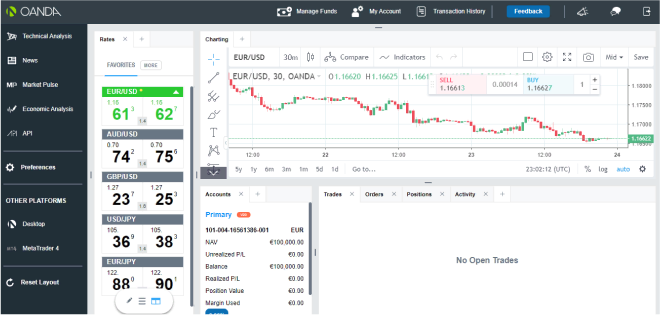

The interface of the trading platform looks as follows:

The interesting fact is that TradingView, the most popular service for chart analysis in the world that features an impressive set of functions, is the chart supplier for the platform. The chart can be viewed in full screen mode. The platform features are over 50 instruments for technical analysis and over 80 indicators.

In addition, you can add other instruments to the broker’s trading platform. The service supports all types of instruments and indicators available for MetaTrader 4.

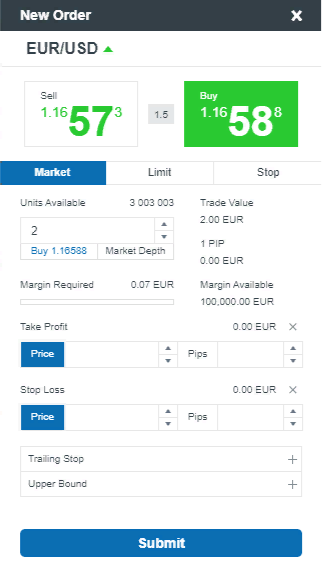

It is also very easy to open a trade. You just need to press the Buy or Sell button. The company provides three main types of orders:

- Market;

- Limit;

- Stop.

You will find many settings for opening a New Order. In particular, you can set the lot amount, Take Profit, Stop Loss. Also Trailing Stop is available. You can specify the order amount both by the price indicator and by pips.

We also recommend you to watch the review of fxTrade platform.

Analytics

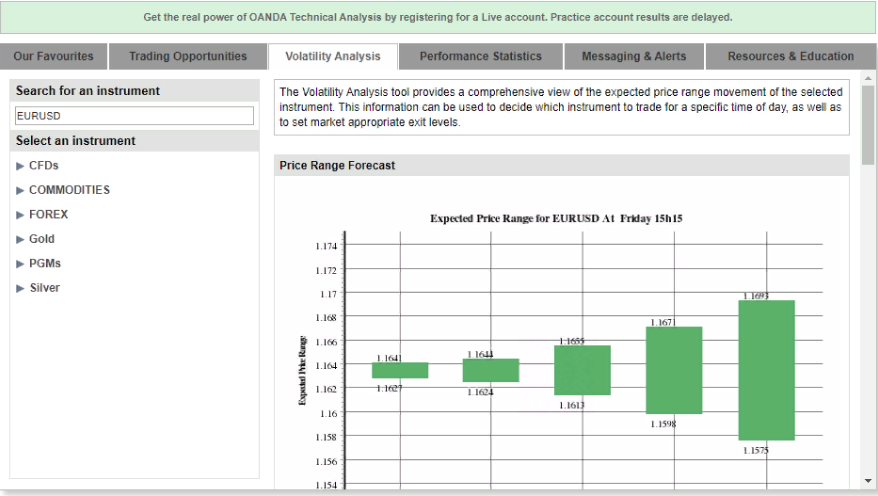

Oanda provides its users with an excellent choice of analytical instruments. Here, you will be able to find everything you may need for trading. The majority of the analytical services of the company are available directly on the trading platform. The company provides the following options.

| Pros |

|---|

|

| Cons |

|---|

|

1. Autochartist

Oanda provides its customers with Autochartist, an analytical platform that automatically analyzes shapes on the chart and offers the users the most probable development scenarios. Inside the program, you can set up a notification system, when specific patterns are in action. Also, the program analyzes the volatility level and many other parameters.

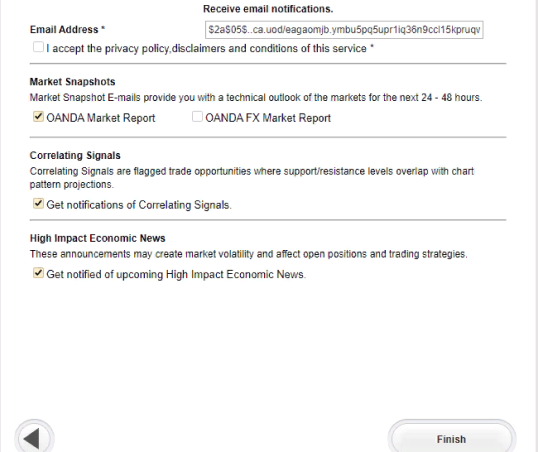

Also, Oanda sends newsletters with analytical reviews on technical analysis to customers’ emails. The company offers two types of reports:

- FX Market Report – for customers working on Forex market;

- Market Report – for customers trading CFDs

You can select one of these reports or both. The system also sends out correlating signals.

2. Oanda FXNews

Oanda FXNews is a service featuring news about the events that could have an impact on the Forex market. Here, you will find information about economic events across the globe. However, only the news items released within 24 hours are published. As soon as the item is older than 24 hours, it is deleted from the service and you will no longer be able to find it on FXNews.

3. Market Pulse

Market Pulse is an economic news and reviews website linked to Oanda. Oanda FXNews service can be considered a sort of a “notebook” for a trader, while Market Pulse offers a wider selection of data. Here, the latest news of the global economy are published, which are linked not only to Forex, but also to other types of assets.

Unlike Oanda FXNews, information on Market Pulse is not deleted after 24 hours, so you will be able to find the data you are looking for in the archives. The service features news, detailed analytical reviews, opinion pieces of respected economists, experts, etc.

4. Podcasts

Oanda also offers podcasts, prepared by the project’s team. They are published on Market Pulse, but the links to them are published on Oanda’s official website. In the course of a podcast, Oanda’s experts share the latest economic events with the audience and also express their opinions about the impact a specific event could have on the market.

Education

Oanda offers learning opportunities for its customers. Here, you can learn to trade on the Forex and CFD market. Only registered users can gain access to the materials. The company offers three full video training courses.

- Basics.

- Instruments and strategies.

- Equity management.

The broker also holds webinars regularly. The company provides learning materials both for the beginners and experienced users wishing to improve their level of trading. In addition, there is an archive of webinars on the broker’s website. There are also Premium webinars, where the users are offered training and analytics for a charge.

| Pros |

|---|

|

| Cons |

|---|

|

Customer support

There are certain questions regarding Oanda’s customer support. First of all, it is very difficult to find the company’s contacts. Oanda has developed a customer support center with an extensive FAQ section, where you can find answers to your questions. However, you will have to seek ways to contact customer support here as well, and it will take some time.

The broker offers two ways to contact its customer support:

- Chat on the official website – the average response time is 15 minutes;

- email: [email protected] – the average response time is 2-5 business days.

The broker does not specify the operating hours of the customer support. The only thing that is known is that the support center operates 5 days a week, on business days. The list of languages supported by Oanda’s customer support is also unknown. We could not find the phone number for contacting the customer support on the broker’s website.

| Pros |

|---|

|

| Cons |

|---|

|

Bonuses and promo

As of today, Oanda does not provide any bonuses or have any promo offers for its customers.

Summary

Oanda –is a comparatively small, but high-quality niche broker. It provides access to trading Forex and different classes of CFDs.

Oanda is a broker that operates all around the world, with a separate regional company with a license providing services to the customers on each continent. That is why the broker can be considered quite reliable.

Our summary is that Oanda is suitable both for the beginners and experienced traders. The beginners will appreciate no minimum deposit requirement and rather simple interface of services as well as video tutorials. Experienced customers will appreciate low commissions, good analytical materials, a feature allowing to add trading bots and other available options. The company uses a proprietary platform, which is an improved version of MetaTrader 4 with additional analytical instruments.

Real reviews of Oanda 2025

Good broker! I like the fact that Oanda is constantly working on updating the product line. I recently heard about a new account for professional traders with increased leverage up to 1: 100 has appeared.

I will not praise Oanda just because this company does not try to work for customers. There are constant problems with support, so you shouldn't count on help. All questions have to be solved independently.

The quality of the Oanda support is disgusting! The broker does not provide phone numbers for communication, and you have to wait for a response by e-mail for several working days. It doesn't suit me.

Oanda pays out correctly. You can trust this company. On the other hand verification on Oanda exhausted all my nerves. They didn't want to accept documents. The company felt that they were of insufficient quality.

Broker Oanda has a limited choice of payment methods, in particular electronic systems. PayPal doesn't suit me, and Neteller, Skrill and others are not available here! I think this is a big flaw that needs to be fixed!

I traded with this broker for several months, but was not satisfied. The choice of assets does not suit me. I would like to see CFDs on stocks and cryptocurrencies, therefore had to look for an alternative.

Even at the start of cooperation with this broker, I had a lot of questions. Why such a long verification? Three days of waiting for the documentation verified!

I have been trading with this broker for several months already, everything is great! I liked the fact that there is one trading account and the conditions for all clients are equal, regardless of the size of the deposit. I did not notice any problems with the withdrawal, have already received more than 5,000 dollars on my bank card!