On this page, you will find a large number of reviews from the real Saxo Bank customers. If you are already working with SaxoBank, please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Saxo Bank Review 2021

Saxo Bank is a licensed broker that has been operating since 1992. The company provides services based on the license issued by the Danish FSA and British FCA.

Saxo Bank offers trading opportunities with 182 Forex pairs and 140 forward contracts as well as over 19,000 stocks, several thousands of ETFs, bonds and other assets. The trading takes place on the bank’s own platforms – SaxoTraderGO (for mobile devices) and SaxoTraderPRO (for desktop). The organization also offers OpenAPI for the traders to develop their own apps for trading automation. Or, you can also use third-party tools.

Saxo Bank is a popular European broker. Over the years of its operation, the company received 21 awards, including as the Best FX retail platform, Best platform for the active trader, Best Boutique Prime Broker, etc.

Pros and cons of Saxo Bank

Saxo Bank is one of the largest European banks, which is why there is no reason to doubt reliability of the namesake broker. The bank, essentially, is the main supplier of liquidity. Saxo Bank also works with other major financial organizations.

Saxo Bank uses its own trading platform. It boasts a large set of functions and is convenient for the traders. It is also possible to use trading automation and API for development of own apps.

Saxo Bank also offers a truly vast number of assets for trading. In fact, the list of assets will satisfy the needs of 99.9% of professionals.

Saxo Bank, however, also has some drawbacks. In particular, the platform is focused mainly on large traders, with a minimum deposit at $10,000. For some assets, the trading fees are rather high. Trading on the platform takes place only on business days and technical support operates 24/5.

Saxo Bank presentation

| Pros |

|---|

|

| Cons |

|---|

|

Page content

Key features of Saxo Bank

| Regulation | Denmark (DFSA) and the UK (FCA). |

|---|---|

| License | DFSA – No. 1149 FCA – No. 551422 |

| Fees | Average (high on futures) |

| Inactivity fee charged | For UK users – GBP 25 per month after 3 months of inactivity. For users from other countries - $100 per month after 6 months of inactivity. |

| Minimum deposit | $10,000 |

| Leverage up to | Up to 1:40 |

| Markets | Forex, stocks, indices, raw materials, energy, metals, commodities, derivatives, bonds, ETF, mutual funds |

| Support languages | 21 |

| Withdrawal fee | No |

| Withdrawal to credit/debit card | Visa, MasterCard |

| Deposit from electronic wallets | Not supported |

| Supported currencies | 26 |

| Trading platforms | SaxoBank Pro, SaxoBank Go |

| Demo account | Available |

| Deposit bonus | N/a |

Geography of broker’s customers

Saxo Bank offers broker services all across the globe. However, the company specifies that any brokerage agreement is concluded directly with the mother bank. Therefore, it will be regulated by the law of Denmark.

What is the audience of Saxo Bank? We will check it using a special service. This broker is registered in Denmark, so there is no surprise that this country accounts for the lion’s share of users – a total of 23%. The difference between the second and third place is minor – customerts from the UK (12.06%) and Singapore (10.14%) are only 2% apart.

Let’s compare the audiences of Saxo Bank and some competing companies. For this, we will use Oanda and FXTM. Please see the table below.

| Saxo Bank | Oanda | FXTM | |||

|---|---|---|---|---|---|

| Jurisdiction | Percentage | Jurisdiction | Percentage | Jurisdiction | Percentage |

| Denmark | 23.16% | USA | 21.87% | Iran | 11.94% |

| UK | 12.06% | UK | 9.13% | Vietnam | 9.85% |

| Singapore | 10.14% | Germany | 7.85% | Nigeria | 9.07% |

| Japan | 4.76% | Canada | 4.54% | USA | 7.70% |

| France | 3.48% | Italy | 3.25% | SAR | 5.57% |

It is evident from the table that Saxo Bank broker primarily focuses on progressive and financially stable audience of Europe and Asia. For comparison, Oanda is promoted among European and North American countries. FXTM is chosen by the clients from less wealthy states, with the exception of the USA. Clearly, none of the brokers focuses on East European or Central Asian countries. The list does not include China, probably due to its Forex market regulations.

Fees

Saxo Bank trading fees differ by the rate of attractiveness depending on the type of assets, most of them are at a low level. For example, the trading fee is included in the spread for EURUSD pair trading. The spread for the specified trading pair starts at 0.6 pips (equivalent of $6 per $100,000 lot), which is beneficial even for active day trading. Let’s look at the trading fees for main types of assets at Saxo Bank in more detail.

| Type of assets (Forex pairs) | Trading fees for standard accounts | Trading fees for VIP |

|---|---|---|

| EUR/USD | Minimum spread is 0.6 pips. There are no fees. | Minimum spread is 0.4 pips. There are no fees. |

| Stocks of American companies | The trading fee is $0.02 per share, but no less than $10. | The trading fee is $0.02 USD per share, but no less than $3. |

| Mutual funds | No commission | No commission |

Pros and cons of Saxo Bank commission system

Overall, Saxo Bank commissions are at the market level, while for some positions it offers even better options. However, there are markets, when Saxo Bank is lagging behind its direct competitors.

| Pros |

|---|

|

| Cons |

|---|

|

Saxo Bank trading fees on Forex market

Let’s also compare the broker’s fees for main types of assets with those of the competitors. For comparison, we will use trading conditions of FXTM and Oanda. The minimum fees of these brokers differ significantly. For example, the minimum spread of Saxo Bank is much lower than of Oanda and practically identical to FXTM.

| Currency pair | Saxo Bank | Oanda | FXTM |

|---|---|---|---|

| EURUSD | from 0.7 pips | from 1.4 pips | from 0.4 pips |

| GBPUSD | from 0.8 pips | from 1.7 pips | from 1.0 pips |

| EURJPY | from 1.0 pips | from 1.8 pips | from 0.8 pips |

| USDJPY | from 0.7 pips | from 1.3 pips | from 0.4 pips |

| AUDUSD | from 0.5 pips | from 1.3 pips | from 0.5 pips |

Average commissions for major currency pairs

It is also worth taking a look at the average fees on benchmark pairs. Benchmarks are the most popular and most heavily traded pairs. The calculations below take into consideration not only average real spreads, but also fixed fees per trade or standard account turnover fees.

Compared to the competitors, Saxo Bank offers quite beneficial average fees. In particular, this broker offers beneficial conditions for EURUSD and EURGBP. Let’s look into Forex trading pairs in more detail. Let’s consider a purchase of 1 standard lot of given pairs, taking into account the spread and commissions.

| Saxo Bank | FXTM | Oanda | |

|---|---|---|---|

| EURUSD | 11 USD | 17.5 USD | 15.9 USD |

| GBPUSD | 12.8 USD | 15.25 USD | 11.9 USD |

| AUDUSD | 13.7 USD | 13.8 USD | 8.3 USD |

| EURGBP | 10.2 USD | 11.5 USD | 12.2 USD |

| USDJPY | 10.3 USD | 19. 6 USD | 12.8 USD |

Stocks trading fees

Saxo Bank stocks trading fees are strongly graded depending on the type of the trading account and stock exchange. In particular, the conditions on VIP account for trading on the US stock market are twice more beneficial than on the classic account. In this matter, the broker clearly focuses on attracting very big clients, as the minimum deposit for the VIP account is $1 million.

| S.E. | Classic | Platinum | VIP |

|---|---|---|---|

| New York Stock Exchange | 0.02 USD/share, but no less than 10 USD | 0.015 USD/ share, but no less than 7 USD | 0.01 USD/ share, but no less than 3 USD |

| Deutsche Börse (XETRA) | 0.10%, but no less than 10 EUR | 0.07%, but no less than 8 EUR | 0.05%, but no less than 6 EUR |

| London Stock Exchange | 0.10%, but no less than 10 GBP | 0.07%, but no less than 7 GBP | 0.05%, but no less than 5 GBP |

| Tokyo Stock Exchange | 0.15%, but no less than 1500 JPY | 0.12%, but no less than 1000 JPY | 0.1%, but no less than 1000 JPY |

The possibility to trade real stocks on beneficial conditions is an undisputable edge of Saxo Bank over FXTM and Oanda. The broker provides direct access to world’s leading exchanges. Noteworthy, the majority of Forex brokers offer only CFDs. For example, it is impossible to trade securities on Oanda, with only CFDs available. FXTM has CFDs on stocks, but the conditions of the broker are much less beneficial than those offered by Saxo Bank. Members of Saxo Bank VIP club additionally receive sizeable discounts. We added Interactive Brokers to the comparison table, as it is known as one of the leaders of stock market services.

General conditions

| Saxo Bank | Interactive Brokers | FXTM | Oanda |

|---|---|---|---|

| from 0.02 USD per share, but no less than 10 USD. | 0.005 USD per share, but no less than 1 USD. | Only CFDs are available. | Stock trading is unavailable. |

Saxo Bank conditions for trading stocks are much more beneficial for large lots, as there is minimum trading fee at $10 on standard account, which makes small trades unbeneficial. However, if you trade large volumes from 1,000 shares, the conditions of this broker are quite competitive, also less attractive than Interactive Brokers offers.

CFD trading fees

As for CFDs, Saxo Bank offers a wide selection of them. The platform has CFDs on indices, stocks, precious metals. For comparison, Oanda does not offer a possibility of CFD trading on stocks. FXTM has a much smaller choice of CFDs on stocks.

However, Saxo Bank does not always offer the best trading fees on this category of trading instruments. We provide a comparison table for better understanding. All calculations are done in US dollars for convenience, the spreads of FXTM and Oanda have been recalculated, taking into account the factual payment per 1 contract of standard lot in stocks.

| Saxo Bank | FXTM | Oanda | |

|---|---|---|---|

| S&P 500 CFD (US 500) | 0.7 USD | 1.8 USD | 1 USD |

| Europe 50 CFD (EU) | 2 USD | 2.5 USD | 0.9 USD |

| Apple (AAPL) | 10 USD | 17 USD | Not traded |

| Bank of America (BAC) | 10 USD | 12 USD | Not traded |

Futures trading fees

Saxo Bank’s futures trading fees can be considered high. For example, the trading fees for S&P500 futures are $4 per 1 contract on an American index. Other brokers offer more attractive conditions for index trading. We added Interactive Brokers to the following table, as FXTM and Oanda do not have spot tools.

| Asset | Saxo Bank | Interactive Brokers |

|---|---|---|

| Futures for US indices | 4 USD | 0.25 USD |

| Futures for UK indices | 2.1 USD | 2.04 USD |

Options trading fees

Options trading is available on Saxo Bank. This trading instrument is provided for Forex pairs and also for gold/dollar (XAUUSD) trading pair. Options is a rather rare instrument among Forex brokers, and many brokers do not offer it. For example, this instrument is unavailable on Oanda and FXTM. Let’s review the comparison table of 30-day spreads for all types of trading accounts on Saxo Bank. All fees are specified in spreads.

| Trading pair | Classic | Platinum | VIP |

|---|---|---|---|

| EURUSD | 5.0 | 4.0 | 3.0 |

| USDJPY | 7.0 | 6.0 | 5.0 |

| GBPUSD | 10.0 | 9.0 | 7.0 |

| AUDUSD | 5.0 | 4.0 | 3.0 |

| EURJPY | 11.0 | 10.0 | 8.0 |

| XAUUSD | 150.0 | 130.0 | 125.0 |

Trading fees for investment products

Saxo Bank offers a variety of investment tools. Here, you can invest in the following types of assets:

- Bonds;

- ETFs;

- Mutual Funds;

Let’s review the trading fees for each category of investment assets in more detail.

Trading fees on bonds market

Saxo Bank offers an opportunity to directly purchase bonds. The banking broker allows for working with the government bonds of the USA and EU, and also bonds of developing markets. In addition, Saxo Bank offers an opportunity to purchase corporate bonds of American and European companies.

The possibility to purchase bonds is one of the advantages of Saxo Bank over its competitors. For example, Oanda offers CFDs on bonds. FXTM does not have this instrument altogether. The trading fees of Saxo Bank on standard account is 0.2% of the turnover, but no less than EUR 80 – USD 94 at the rate as of 12.08.2020. This is very high, which makes purchases of this low-profit instrument for small amounts unprofitable. For example, let’s see how much the commission will be for the purchase of American government bonds for the amount of $10,000.

| Saxo Bank | Interactive Brokers | |

|---|---|---|

| US bonds | 94 USD | 19.96 USD |

94 USD from 10 000 USD - that’s nearly 1%, while the yield of 10-year US Treasury bonds is 0.7% as of the middle of July 2020. When trading large amounts, this factor becomes less significant.

ETF trading fees

Investment into ETF is also available on Saxo Bank. The broker opens access to the world’s leading exchanges. Using the broker, you can invest into low-yield and average-yield ETFs, linked to different types of assets. Saxo Bank’s trading fees on ETF differ depending on the type of the trading account. Overall, they can be considered as market average, but when trading lots from $50,000.

| Exchange | Classic | Platinum | VIP |

|---|---|---|---|

| NASDAQ | 0.02%, but no less than 10 USD | 0.15 USD, but no less than 7 USD | 0.01 USD, but no less than 3 USD |

| New York Stock Exchange | 0.02%, but no less than 10 USD | 0.15 USD, but no less than 7 USD | 0.01 USD, but no less than 3 USD |

| Deutsche Börse (XETRA) | 0.10%, but no less than 10 EUR | 0.07%, but no less than 8 EUR | 0.05%, but no less than 6 EUR |

| London Stock Exchange | 0.10%, but no less than 8 GBP | 0.07%, but no less than 7 GBP | 0.05%, but no less than 5 GBP |

| BME Spanish Exchange | 0.10%, but no less than 12 EUR | 0.07%, but no less than 8 10 EUR | 0.05%, but no less than 8 EUR |

Non-trading fees

Saxo Bank offers rather beneficial conditions in terms of non-trading commissions. There is a fee only for an inactive trading account, and it is rather high. In particular, a user from the UK will have to pay GBP 25 for three months without trades. If the client lives and works in Denmark or any other country (except for the UK), the service costs $100 for 6 months. This is higher than Oanda and FXTM charge.

Other non-trading commissions of the broker are quite attractive. The broker does not charge any fees for opening and servicing of the account. There is no deposit or withdrawal commission. Let’s compare these conditions with other brokers.

| Type of commission | Saxo Bank | Oanda | FXTM |

|---|---|---|---|

| Inactive account commission | 25 GBP for 3 months for the UK residents 100 USD for six months for residents of other countries | 10 USD per month, charged after 2 years of inactivity | 5 USD per month, charged after 6 months of inactivity |

| Account maintenance commission | No | No | No |

| Deposit commission | No | No | No |

| Withdrawal commission | No | No | No |

Reliability and regulation

In terms of reliability, Saxo Bank is one of the top options on the European investment services market.

| Pros |

|---|

|

| Cons |

|---|

|

Saxo Bank is registered in Denmark, registration number of the legal entity – 15731249. Legal address: Philip Heymans Alle 15 2900 Hellerup Denmark. The broker is licensed by reliable regulators. The broker has the following licenses:

- Denmark. Danish Financial Supervisory Authority (DFSA) – No. 1149

- The United Kingdom. Financial Services Authority (FSA) – No. 551422

In addition to licenses, Saxo Bank also has the authorization in several countries, including:

- Czech Republic;

- Italy;

- The Netherlands;

- Cyprus.

The organization has been providing broker services since 1992. Over this period of time, there have been no serious complaints against Saxo Bank. Also, there have not been any scandals related to break-ins or non-payments.

In terms of reliability, Saxo Bank can be easily considered one of the best brokers on the European financial market.

Security of investor assets at Saxo Bank

The company guarantees negative balance protection, although this option is available only for the clients from EU countries and also some states and regions in Asia, in particular Shanghai, India, the United Arab Emirates.

The only drawback of the broker is that the Saxo Bank securities are not traded at the stock exchanges. Saxo Bank has not issued shares at the stock exchanges.

Protection of investor money

Saxo Bank is one of the most reliable brokers in Europe. The broker guarantees reliable protection of funds. In particular, it is a member of the Danish Guarantee Fund and a number of other European countries. Therefore, in case of bankruptcy, the clients are entitled to the state reimbursement. The maximum guarantee amount varies, depending on the resident state of the trader.

| Country | Guarantee amount | Regulator |

|---|---|---|

| European Union | EUR 100,000 for cash EUR 20,000 for securities |

Danish FSA |

| France | EUR 100,000 | Bank of France |

| Italy | EUR 100,000 | Commissione Nazionale per le Società e la Borsa (CONSOB) |

| UK | GBP 85,000 | Financial Conduct Authority (FCA) |

| Switzerland | CHF 100,000 | Swiss Federal Banking Commission |

Protection of client securities

Also, there are rules on the broker’s website on the return of securities in case of default of Saxo Bank. The broker guarantees White Label return, if it can be obtained from Saxo Bank’s depositary. The broker guarantees the return pursuant to Section 72 of the Danish Act on Financial Services, which is why, when investing securities in the company, you can be confident that your shares and bonds will be returned to you.

Markets and products

The undoubtful advantage of Saxo Bank is that the broker provides access to all types of markets. This is a broker for those traders that require a maximum choice of assets. Below is the comparative table of markets available on Saxo Bank and its competitors.

| Market type | Saxo Bank | Oanda | FXTM |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| ETF | Yes | No | No |

| Stocks | Yes | No | No (only CFDs) |

| Bonds | No | No (only CFDs) | No (only CFDs) |

| Options | Yes | No | No |

| Futures | Yes | No | No |

Pros and cons of trading instrument diversity

| Pros |

|---|

|

| Cons |

|---|

|

Forex

The selection of currency pairs on Saxo Bank is impressive. There are 182 currency pairs. The company offers a huge number of pairs, including major pairs, such as EURUSD, GBPUSD, cross pairs (EURGBP, EURCHF, etc.) and a huge number of exotics (such as DKKRUB, SVKCZK and other).

In terms of variety, Saxo Bank surpasses the majority of other brokers, whose choice is much smaller. Let’s compare the number of trading pairs with other brokers:

| Saxo Bank | Oanda | FXTM |

|---|---|---|

| 182 | 71 | 48 |

Stocks and ETF

The list of stocks on Saxo Bank platform is huge – 19,000 securities on 37 stock exchanges across the world. In particular, it is possible to trade numerous securities on the following platforms:

- USA: NYSE, NASDAQ, AMEX

- UK: LSE

- Germany: FFT

- Poland: WSE

Also available are stock exchanges of China, Singapore, Czech Republic, Switzerland, Sweden, Spain, Japan, Italy, Canada, etc.

The possibility to directly trade stocks is a rarity for forex brokers. The majority of them offer only CFDs. For example, FXTM offers a possibility to work with derivatives on stocks. Some brokers do not offer this option at all.

| Saxo Bank | Oanda | FXTM |

|---|---|---|

| 37 exchanges, 19,000 stocks | — | 166* |

* – only CFDs on shares are available.

On Saxo Bank, you can also use ETFs for your investment portfolio. There are many of them – around 3,100 EFTs for investments. Oanda and FXTM do not have such options available.

Bonds

Also, investments into bonds are available on Saxo Bank. The selection of bonds is simply amazing. There are 40,000 types of bonds available, which are traded both at the exchanges and outside the exchanges. The broker offers both public and corporate securities, of both American and European organizations.

Brokers do not often offer such instrument as bonds. More often, the brokers offer investments into CFDs on bonds. For example, derivatives are available on Oanda.

| Saxo Bank | Oanda | FXTM |

|---|---|---|

| 40 000+ | 6* | — |

Options

The number of options on Saxo Bank is quite good. You can work with options at the largest exchanges, such as CBOE or Euronext. In addition, the traders have access also to less known exchanges, such as SEHK. The total number of exchanges a trader can work with is 23.

Futures

Futures trading is available on Saxo Bank. The total number of trading instruments of this type available on Saxo Bank is over 200 on 23 platforms. The futures on the following types of assets are available:

- American funds;

- indices;

- raw-material assets (beans, cocoa, coffee);

- energy carriers (oil, gas, gasoline);

- currency pairs (EURUSD, EURGBP).

The company allows to buy and sell futures directly, which is an undisputed advantage. The broker also has CFDs on futures available.

CFDs

The choice of CFDs on Saxo Bank is huge. The company offers a huge number of trading instruments, divided into the following five categories:

- CFDs on stocks – 8800;

- CFDs on ETFs – 675;

- CFDs on indices – 29;

- CFDs on raw material assets – 19;

- CFDs on bonds – 5.

The total number of CFDs derivatives on Saxo Bank is 9328. This is significantly more than many competitors. Let's compare the number of trading instruments of this type at Saxo Bank, Oanda and FXTM.

| CFD type | Saxo Bank | Oanda | FXTM |

|---|---|---|---|

| Stocks | 8800 | No | 166 |

| ETF | 675 | No | No |

| Indices | 29 | 16 | 11 |

| Commodities | 19 | 31 | 6 |

| Bonds | 5 | 6 | No |

Cryptocurrencies

The broker allows to trade cryptocurrencies, although there are certain nuances with these instruments. In particular, they are available only via a special program Trader One. The trades with digital assets are carried out only via NASDAQ OMX Stockholm. The broker works only with two types of cryptocurrencies:

- Bitcoin;

- Ethereum.

Through Saxo Bank, you can work with the trading pairs BTCEUR, ETHEUR, BTCSVK и ETHSVK. BTCUSD and ETHUSD pairs are not available. Let’s compare the number of cryptocurrencies with other brokers.

| Saxo Bank | eToro | FXTM | |

|---|---|---|---|

| Total number | 2 | 16 | 4 |

| BTC availability | Yes | Yes | Yes |

| ETH availability | Yes | Yes | Yes |

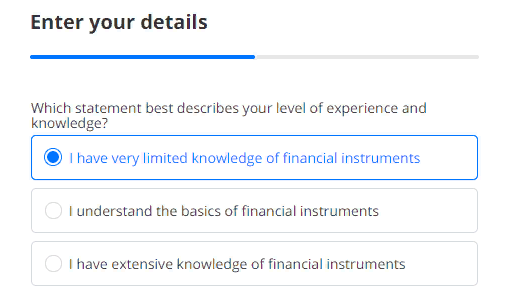

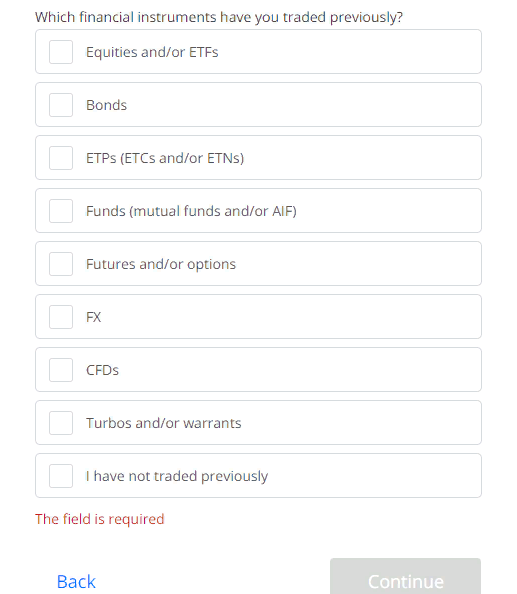

Account opening

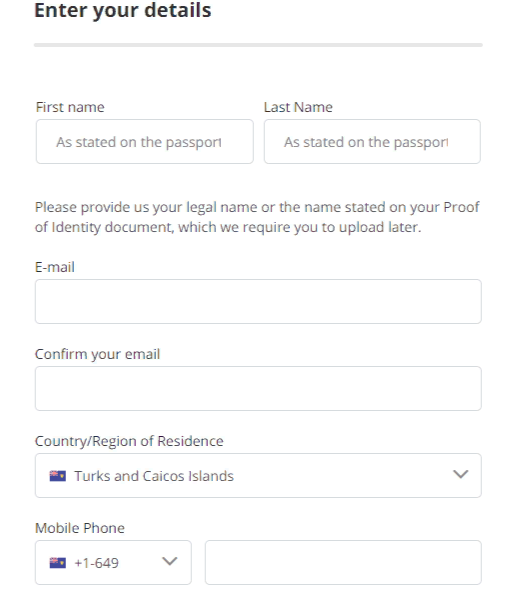

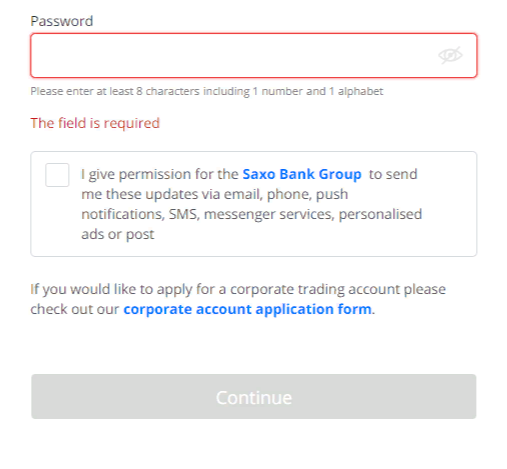

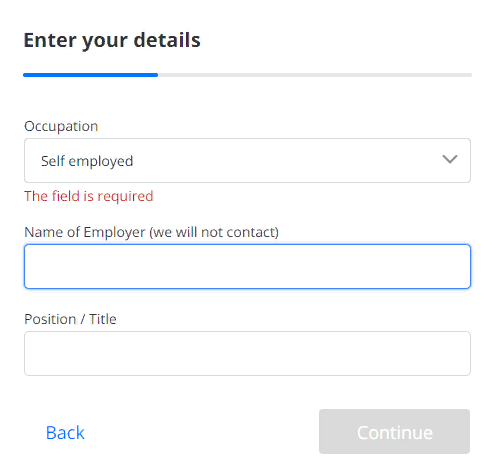

Saxo Bank operates in compliance with AML/KYC policy. This is why opening an account will take some time. Open account button is in the upper right corner. The registration form is divided into seven blocks:

- 1-5 blocks – for filling out personal information;

- 6 block – confirmation of registration via text message;

- 7 block – uploading scanned copies of documents.

The next block opens after you fill out the current one and press Continue. You will be granted access to the account after you fill out the registration form and after information from the documents is checked.

Pros and cons of the procedure

The registration on Saxo Bank has its pros and cons. Let’s look into them in more detail. Below is the comparison table.

| Pros |

|---|

|

| Cons |

|---|

|

How to open an account on Saxo Bank: step-by-step guide

The procedure of opening an account on Saxo Bank is quite lengthy. You will have to spend 20-30 minutes in order to register on the platform. The registration button is in the upper right corner of the home page. The registration procedure comprises of several stages. First you need to specify user information. This block includes the following:

- First name

- Last name

- Confirmation of email

- Country of residence

- Phone number

- Password (at least 8 symbols)

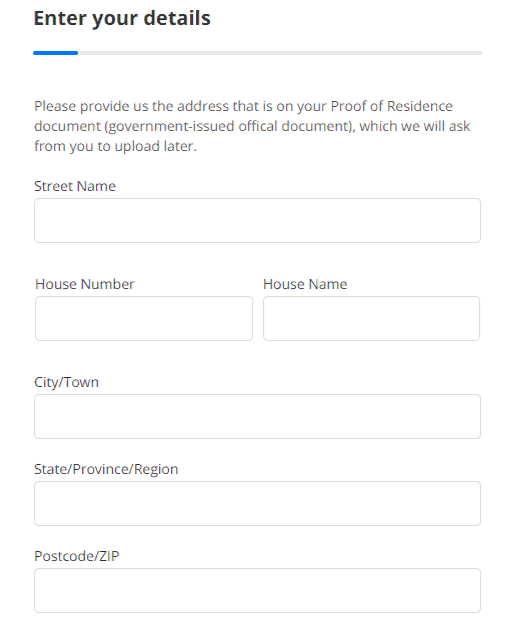

In the second block, the user needs to provide his/her address, filling out the following:

- Street name

- House number

- House name (if available)

- Postcode/ZIP

- State/Province/Region.

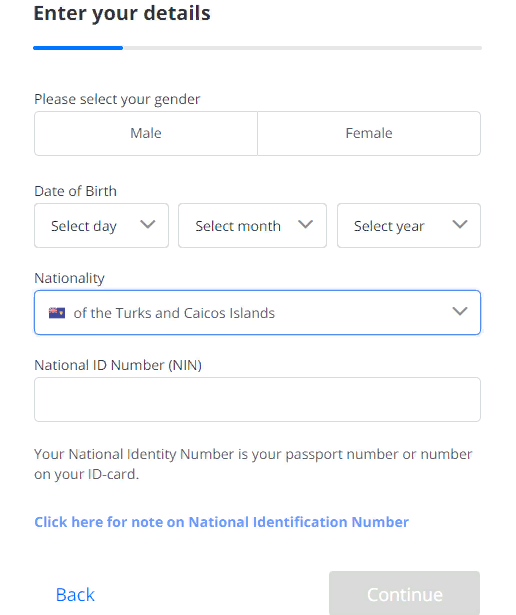

After that, you need to fill out the third information block, providing the following personal data:

- Sex

- Date of birth

- Citizenship

- Passport or other ID number

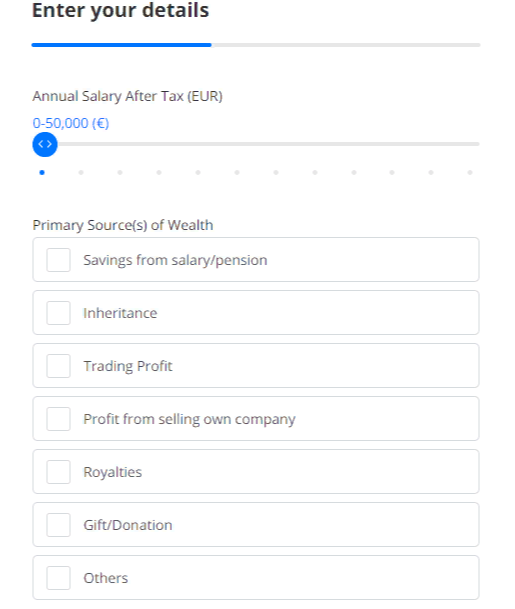

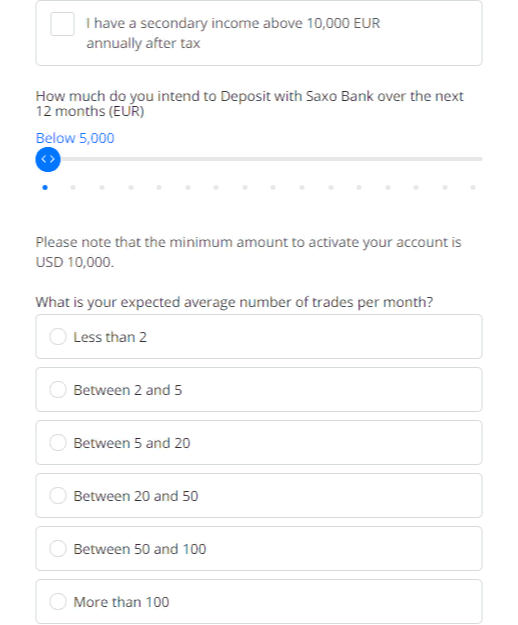

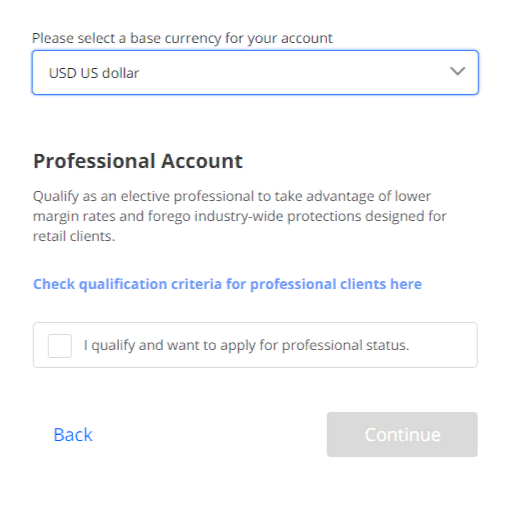

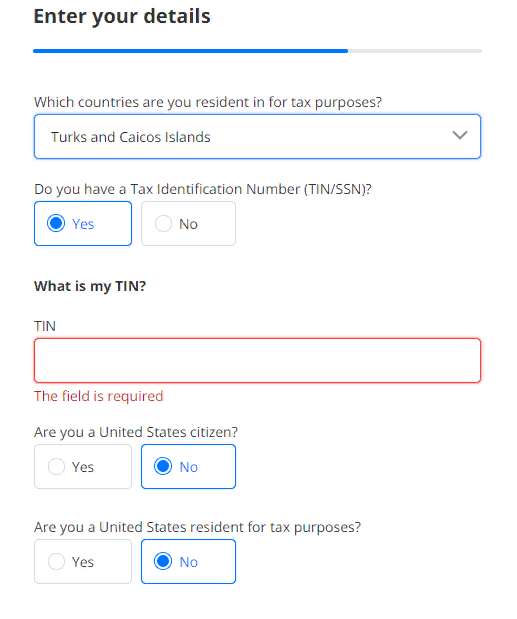

Also, the users need to provide tax information. In the fourth block, you need to fill out the following information:

- Place of employment (type and name of the authority or company);

- Income;

- Additional income exceeding EUR 10,000;

- Income sources (salary, pension, inheritance, investment income, royalty, etc.);

- Amount you plan to invest over the next 12 months;

- Country of tax residency;

- Taxpayer ID (if available, specify the number);

- Are you a U.S. citizen?

- Are you a U.S. tax resident?

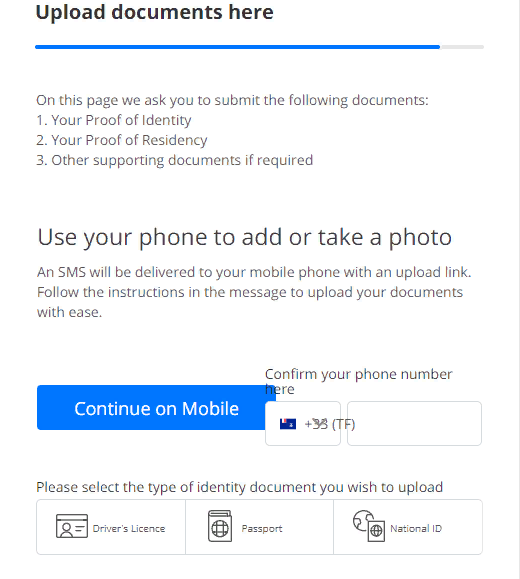

Then you need to upload photos or scanned copies of documents, confirming the information you provided during registration. The documents are uploaded in the following order:

- Passport (residence permit, ID card, other type of ID);

- Document confirming place of residence (bank statement, housing utility bills, where your name and address are specified);

- Taxpayer ID.

After you’ve uploaded all documents a text confirmation will be sent to your phone. Enter the code and the account will be registered on the platform.

Trading accounts

The trading system and conditions on Saxo Bank have both pros and cons. The pros include the following:

- Three types of trading accounts for a trader to choose the most suitable one;

- There are no regional restrictions, so you can trade from any part of the world;

- There is a free demo account, where you can explore the trading platform of the company and try out your own trading strategy.

There is only one drawback of the Saxo Bank system – high minimum deposit. In order to begin trading, you need to deposit at least $10,000 on the account. To become a VIP client, you need to deposit $1,000,000.

Let’s list the pros and cons in a table.

| Pros |

|---|

|

| Cons |

|---|

|

The size of the minimum deposit on Saxo Bank

The minimum deposit on Saxo Bank is very high. The broker is oriented toward large traders, which is why it is difficult for a novice to gain access. To start trading you need to deposit a minimum of $10,000 to your account. Saxo Bank competitors offer more beneficial conditions for the retail traders. Let’s compare their minimum deposit requirements in the table below.

| Saxo Bank | Oanda | FXTM |

|---|---|---|

| 10 000 USD | 0 USD | 500 USD |

Does Saxo Bank have regional restrictions?

There is no information about regional restrictions for users on Saxo Bank. Therefore, we can conclude that the company provides services for the clients in all countries of the world, with the exception of states with strict Internet access restrictions (for example North Korea). Saxo Bank also offers services for the U.S. residents, while not all brokers offer this option.

Saxo Bank account types and their differences

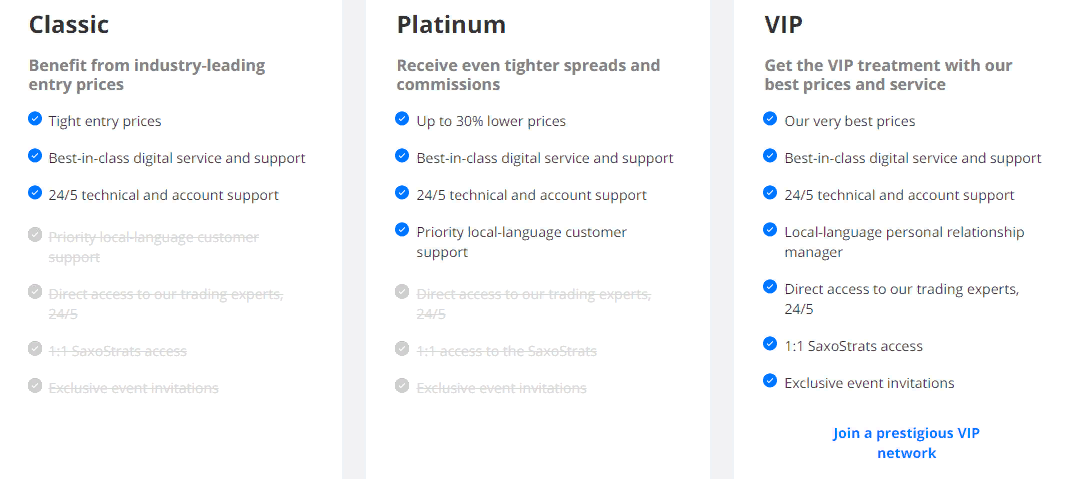

Before looking into trading accounts in detail, let’s simply list them first and summarize their key differences. Saxo Bank offers three types of accounts:

| Type of account | Minimum deposit |

|---|---|

| Classic | 10 000 USD |

| Platinum | 200 000 USD |

| VIP | 1 000 000 USD |

The differences between the trading accounts on Saxo Bank are substantial. In particular, the higher the status of the account the lower the spreads and fees are. Users with advanced accounts can receive support in their native language, use the services of personal manager, gain access to corporate events, etc.

Demo account on Saxo Bank

Saxo Bank offers a demo account. Anybody can use it, as it is available for free. To explore Saxo Bank platform, you need to fill out a simplified registration form, which includes the following:

- First name and last name;

- Email;

- Password;

- Country;

- Contact number.

After you submit the application, the platform will automatically generate an ID for you to access the platform. Use it as a login and use the password, which you specified during registration.

The company offers a demo account on SaxoTraderGO platform. The platform is available in the online version.

Detailed description of accounts

The first type of account on Saxo Bank is Classic. The minimum deposit for this type of account is $10,000. The set of options for the clients is quite modest. It includes:

- Low fees;

- “best in the industry” digital services and support;

- Customer support 24/5.

The second type of account on Saxo Bank is Platinum. The minimum deposit for this type of account is $200,000. In addition to options provided for classic account users, the company offers the following:

- fees lower by 30%;

- customer support in user’s language.

The third type of the trading account is VIP. The minimum deposit on this account is $1,000,000. In addition to the benefits of the previous accounts, the users of VIP account enjoy the following options:

- lowest fees;

- services of a personal manager;

- access to SaxoStrats experts;

- invitations to exclusive company events.

Deposit and withdrawal

Saxo Bank offers convenient ways to deposit and withdraw money. In particular, you can use a bank transfer, as well as deposit and withdraw funds using payment systems:

- Visa Electron;

- Visa Secure;

- Mastercard;

- Maestro;

- DK;

- Carte Bleue.

Another important and useful option for investors is a possibility of transfers using securities. You can transfer stocks and bonds to Saxo Bank platform, as well as to another broker, having purchased them through the Danish broker. You will find the corresponding button in Deposits and Transfers section. In the application, you need to specify details of the bank or the broker that will participate in the trade.

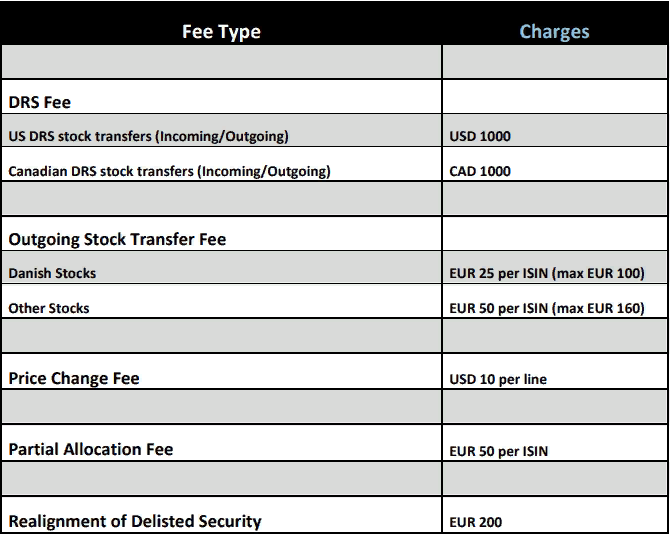

No commission is charged on money transfers on Saxo Bank. You will not have to pay for depositing and withdrawing funds. However, if you are transferring stocks, you will have to pay a commission. Its size varies depending on the transaction. Below is a review of rates for transfer of securities.

The broker, however, does have certain drawbacks. In particular, Saxo Bank does not allow deposit and withdrawal via e-wallets. There is also no cryptocurrency support.

| Pros |

|---|

|

| Cons |

|---|

|

Comparative table of conditions for deposit and withdrawal

Let’s compare deposit and withdrawal conditions of Saxo Bank and its competitors – Oanda and FXTM. Unfortunately, Saxo Bank is inferior to its competitors in many aspects. In particular, the broker does not support e-wallets and cryptocurrencies. Let’s review supported systems and deposit and withdrawal options in more detail.

| Index | Saxo Bank | Oanda | FXTM |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Bank cards | Yes | Yes | Yes |

| E-wallets | No | Yes (PayPal) | Yes (Neteller, Skrill, Alfa-Click, Yandex.Money, QIWI). |

| Cryptocurrencies | No | No | Yes (when depositing via Skrill) |

| Cash deposit | No | No | No |

| Stocks transfer | Yes | No | No |

| Personal payment card of the broker | No | Yes | No |

The brokers also have different conditions for withdrawal. In this case, Saxo Bank has an advantage. This broker does not charge commission on all types of withdrawal. Other brokers have less attractive conditions. Let's review them in the table below.

| Saxo Bank | Oanda | FXTM |

|---|---|---|

| 0 USD on all types of withdrawal | 20 USD on bank transfers 0 USD on bank cards and PayPal 15 USD on withdrawal from Oanda card |

3 USD on all types of withdrawal |

Base currency accounts on Saxo Bank

The list of supported currencies on Saxo Bank is quite long. The broker supports 26 currencies of the trading account. The list includes:

- US dollar (USD);

- euro (EUR);

- British pound (GBP);

- Russian ruble (RUB);

- Australian dollar (AUD);

- New Zealand dollar (NZD);

- Canadian dollar (CAD);

- Japanese yen (JPY);

- Swiss franc (CHF);

- Chinese yuan (CNH);

- Polish zloty (PLN);

- UAE dirham (AED);

- Czech koruna (CZK);

- Danish krone (DKK);

- Swedish krona (SEK);

- Norwegian krone (NOK);

- Hong Kong dollar (HKD);

- Hungarian forint (HUF);

- Israeli shekel (ILS);

- Lithuanian litas (LTL);

- Mexican peso (MXN);

- Malaysian ringgit (MYR);

- Norwegian krone (NOK);

- Romanian leu (RON);

- Singapore dollar (SGD);

- Turkish lira (TRY);

- South African rand (ZAR).

In terms of supported currencies, Saxo Bank has an obvious advantage over its competitors. This helps clients save on conversion during deposit and withdrawal. The list of types of currencies the broker works with is wide and diverse. Below is the comparative table by the number of supported currencies on Saxo Bank, Oanda and FXTM.

| Indicator | Saxo Bank | Oanda | FXTM |

|---|---|---|---|

| Supported currencies | 26 | 9 | 4 |

| Types of currencies | USD, EUR, GBP, PLN, CHF, CNH, CAD, AUD, CZK, DKK, HKD, HUF, ILS, JPY, LTL, MXN, MYR, NOK, NZD, RON, RUB, SEK, AED, SGD, TRY, ZAR | USD, EUR, GBP, CHF, CAD, AUD, HKD, JPY, SGD | USD, EUR, GBP NGN |

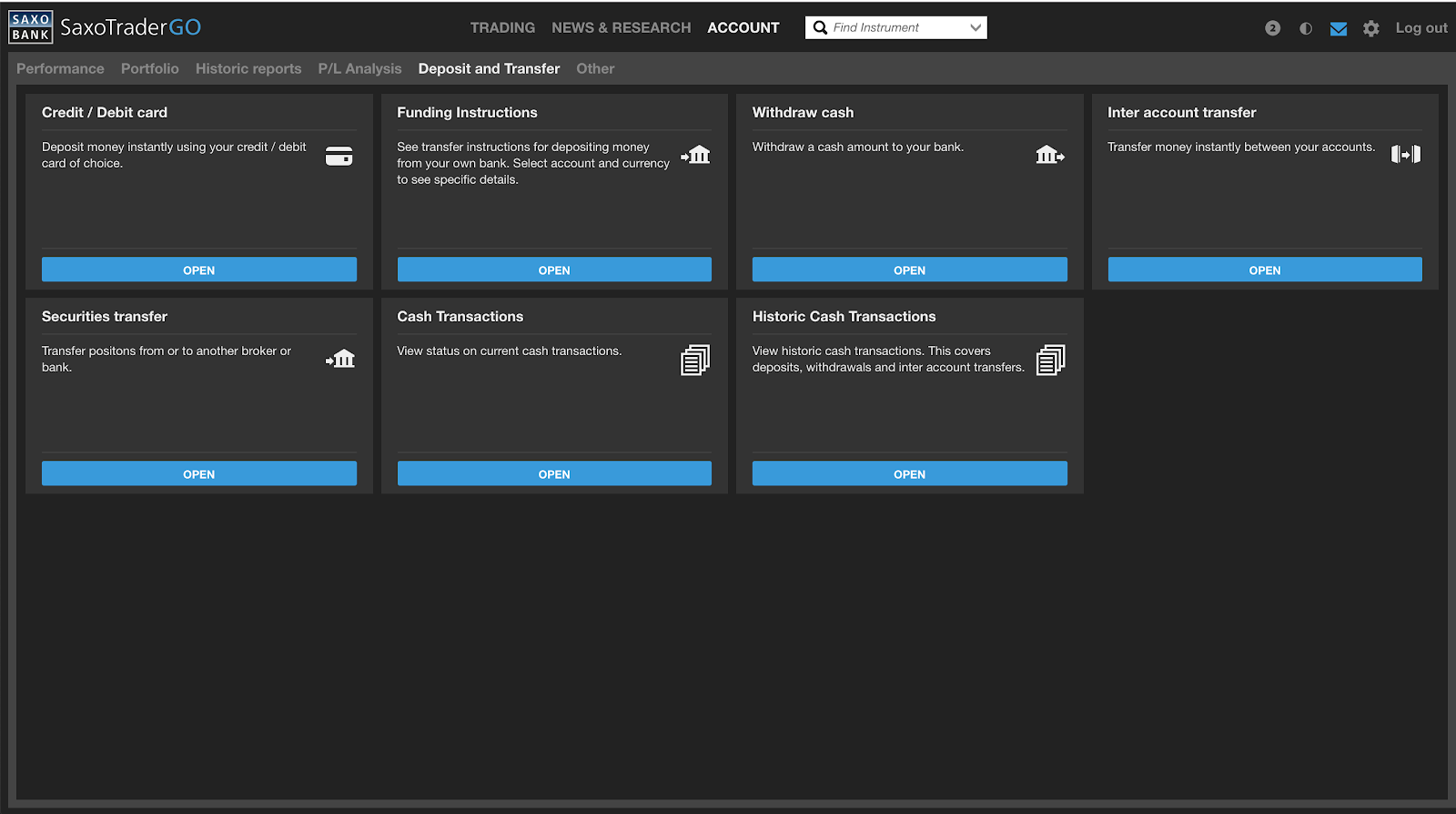

How to deposit and withdraw money on Saxo Bank

The deposit and withdrawal procedure on Saxo Bank is quite simple. After registration, you need to access the account, go to Account section in your account, then choose Deposit and Transfer. There, you will see several sections:

- Credit/Debit Card. In this section, you can deposit or withdraw money using your credit / debit card of choice;

- Funding Instructions. Here you will find answers to questions about deposits;

- Withdraw Cash – withdrawal of money to your bank account;

- Inter Account Transfer – transfer of money between the accounts;

- Securities Transfer – depositing or transferring securities to another broker;

- Cash Transactions – viewing status on current transactions;

- History Cash Transactions – viewing history of cash transactions.

In order to top up your account on the platform, choose Credit/Debit Card. Then specify the details of your card, which you are using to replenish your account or to withdraw money. If you want to deposit money via a bank transfer, you will find the necessary information in Funding Instructions section. As for withdrawing money via a bank transfer, choose Withdraw Cash, then specify the details of the bank account you want to transfer money to.

NOTE! Deposit and withdrawal of money using a credit / debit card is possible from and to embossed cards.

Trading platform

Saxo Bank offers its clients its own trading platform. The company uses the following exclusive platforms:

- SaxoTraderGO – platform version for smartphones and also web version (available for Chrome, Firefox, Opera, Safari browsers);

- SaxoTraderPRO – desktop version of the trading platform.

The company’s trading platform has a user-friendly interface. It is very simple to use with a possibility to adjust the interface for a specific trader. In addition, the security system is very deliberate with a two-factor authentication account access.

As for the drawbacks, there is only one and it is rather insignificant. In order to explore the demo version of the trading platform, you need to register on the platform (thankfully, for the demo account registration is simple). Otherwise, the trading platform is very convenient and highly stable. Below is the comparison table of pros and cons of Saxo Bank platforms:

| Pros |

|---|

|

| Cons |

|---|

|

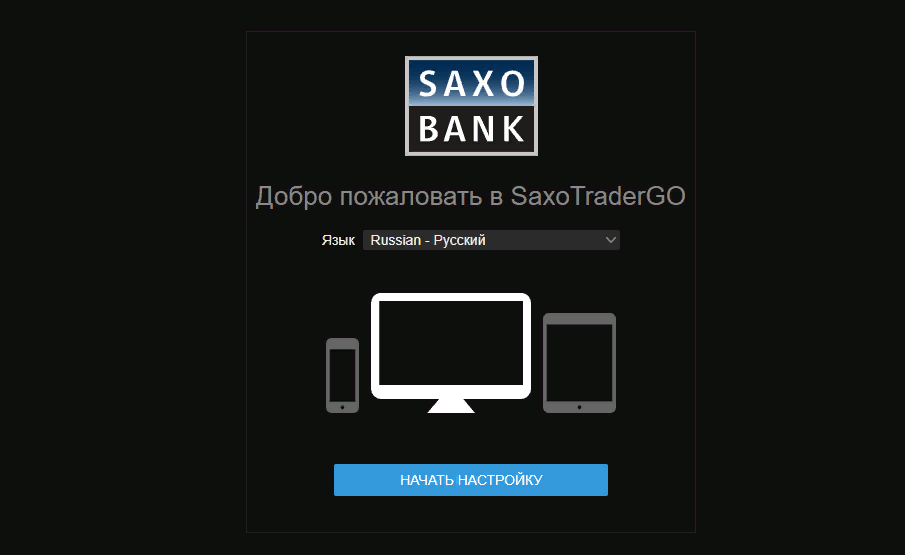

Trading platform settings

Let’s review how to set up the trading platform using the example of the broker’s demo account. After you’ve registered, a Demo Account button will appear on the upper right part of the screen. You need to log into your account using your login and password. Saxo Bank will offer you to download new versions of browsers for your computer. You can either download the update or skip it. Then you will be offered to set up the trading platform. Choose the language of the trading platform and press Start.

The settings are split into two parts:

- Regional Settings;

- Trading Products.

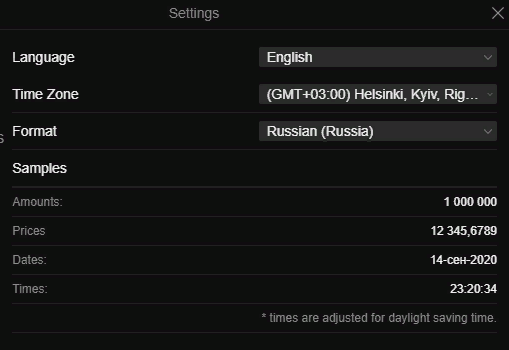

In the Regional Settings, you need to specify the following information:

- language;

- time zone;

- format (language version of the trading platform).

Then press Send and you will be directed to the second part – Trading Products.

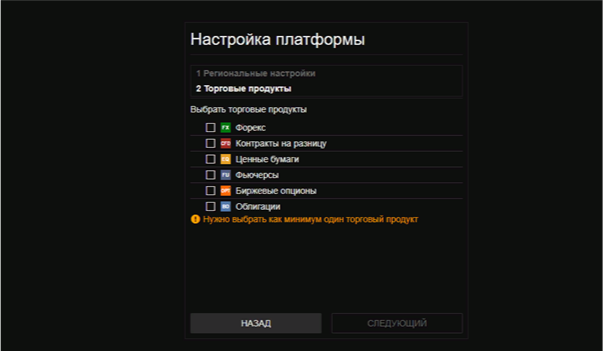

In the Trading Products section, you can choose assets you plan to work with. This list includes:

- Forex;

- CFDs;

- securities;

- futures;

- listed options;

- bonds.

Tick the trading products you want. You will need to choose at least one, or you can select all of them.

After this, the initial set-up of the trading platform is completed. You will be directed to a Welcome screen with three buttons:

- Start exploring;

- Enter;

- View account.

By pressing Start Exploring, you can briefly review all functions of the platform.

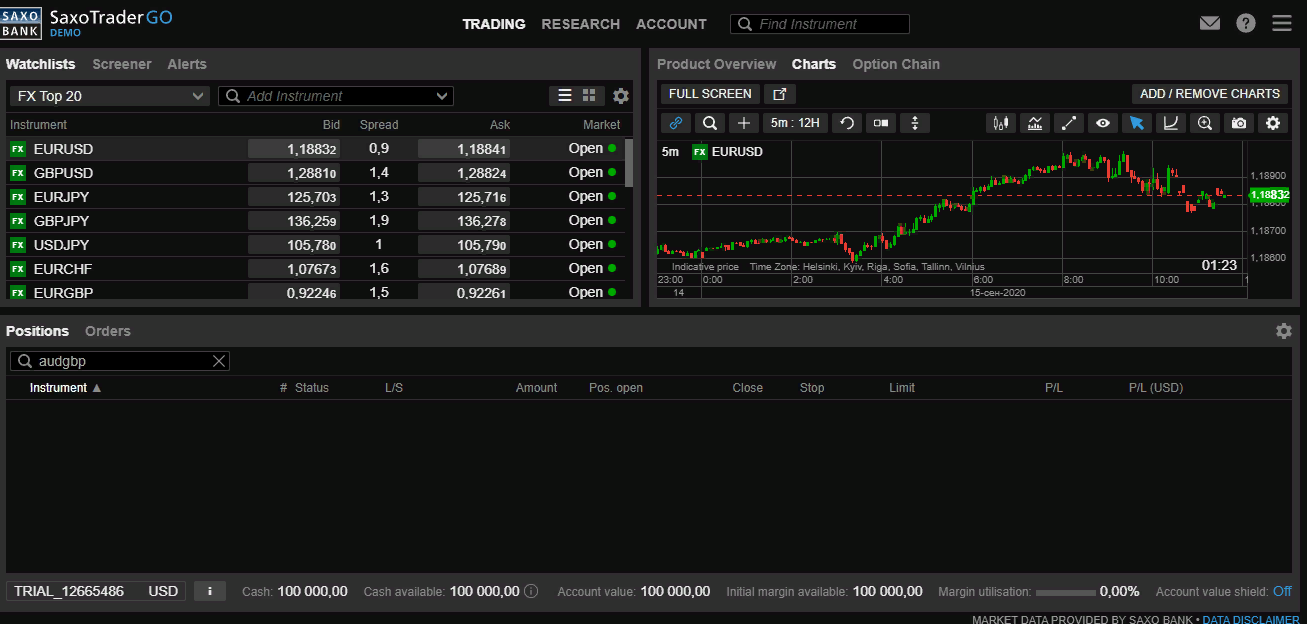

Review of SaxoTraderGO

SaxoTraderGo is easy to use. Below is a short overview of SaxoTraderGo platform.

On the right side of the screen you will see a diagram. You can zoom it out to full screen. You can also add several diagrams on the trading pairs or assets you are interested in.

The platform provides for a possibility to set up a timeframe of charts – from one minute to one month. You can view the current open position by choosing Show Trading Buttons. After you press it, you will see the following information:

- Net position;

- Profit/Loss;

- Orders.

You will also see current purchase or sale price, at which the order will be opened. Below is the interface of the chart.

You can also set up the chart and fit it to your strategy. The following types of charts are available on the platform:

- Single-line chart;

- Candlestick chart;

- Heikin-Ashi candlesticks;

- Hollow candlestick;

- OHLC chart;

- HLC chart;

- Step chart;

- Comparative chart.

You will find a great number of instruments and indicators for technical analysis on Saxo Bank. The total number of instruments is over 70. The company offers even a slide rule for particularly advanced strategies.

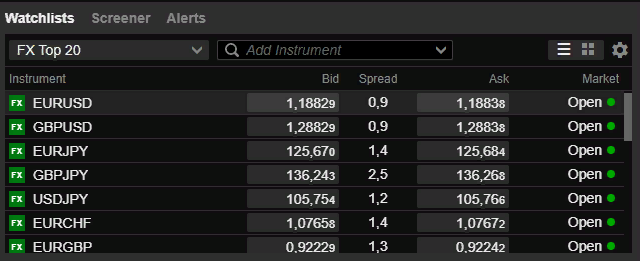

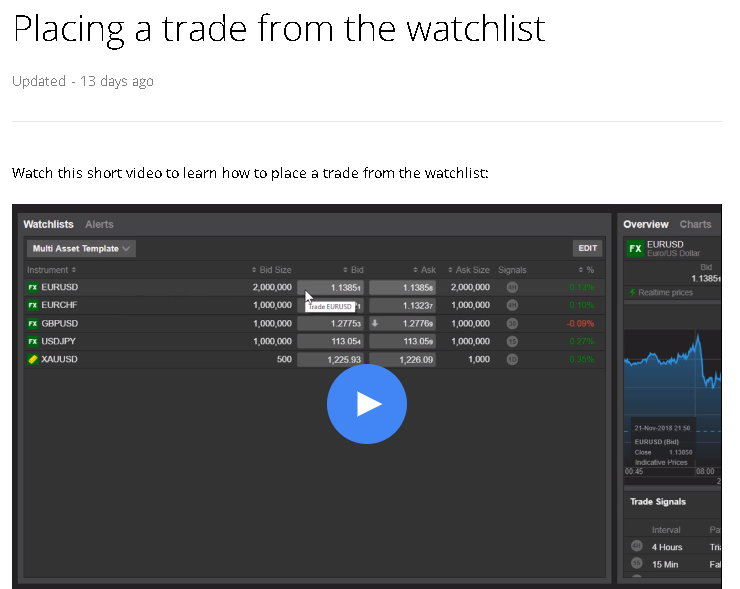

Selection and search of trading assets

The window for selection of assets for trading or investments is next to the chart window in the upper left part of the screen. The interface for choosing trading assets on Saxo Bank is quite convenient and deliberate. It is presented as a table, which includes the following:

- Instrument;

- Bid;

- Spread;

- Ask;

- Market.

You can quickly select assets on the trading terminal using a corresponding button. There is also Add Instrument option, which allows you to add the required Forex pair or trading asset to Favorites. For this you need to specify the name or ticker of the instrument.

SaxoTraderGO also has a search bar at the top of the screen. You can also find an instrument in the search bar on the assets screen – just type in the name or ticker.

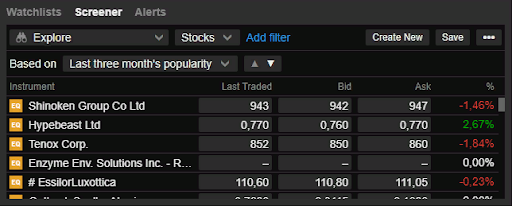

Screener

The broker also has a built-in asset screener. It is easy to choose a trading instrument for investments using it. To use it, you need to create a list of assets. Then choose the instruments you require – stocks, bonds, futures, CFDs on indices, ETFs, etc. You can also choose the range of the list of assets (from 10 to 250) and specify the criteria of selection.

The criteria are as follows:

- popularity (from 1 day to 3 months);

- percentage of change (from 1 day to 5 years);

- in alphabetical order;

- by market capitalization;

- by profit from dividends;

- by price;

- growth in sales volumes (over 1 year);

- improvement compared to projected profit.

In the table below you will see key indicators of an asset – Bid and Ask prices, the price of the latest trade and percentage of change.

Trading signals

You can also view trading signals on the Saxo Bank trading platform. In order to use this function, you need to connection the indicator for technical analysis. After you do this, the indicator will automatically appear in the Trading Signals section. The table includes the following information:

- current indicator;

- asset price;

- distance.

Thanks to this section, you can quickly determine indicators for your trading strategy and open trades much faster and more conveniently.

Analytics

Availability of amazing analytical instruments is another important advantage of Saxo Bank. Here, you will find not only the tools for technical analysis, but also a number of other services.

Saxo Bank analytical section has several advantages. In particular, reviews on assets can be found here. The broker provides fundamental information on stocks, bonds, etc. Here, you will find charts, diagrams, events, etc. There are also reviews of current and historic quotations.

The only drawback is that practically all analytical instruments on the service are paid-for.

Saxo Bank offers only analytical webinars for free. At that, it seems they take place quite rarely. In the Events and Webinars section, only one entry of a webinar can be found – the event took place April 6, 2020.

Let’s review a comparative table with a short summary of pros and cons of Saxo Bank analytics.

| Pros |

|---|

|

| Cons |

|---|

|

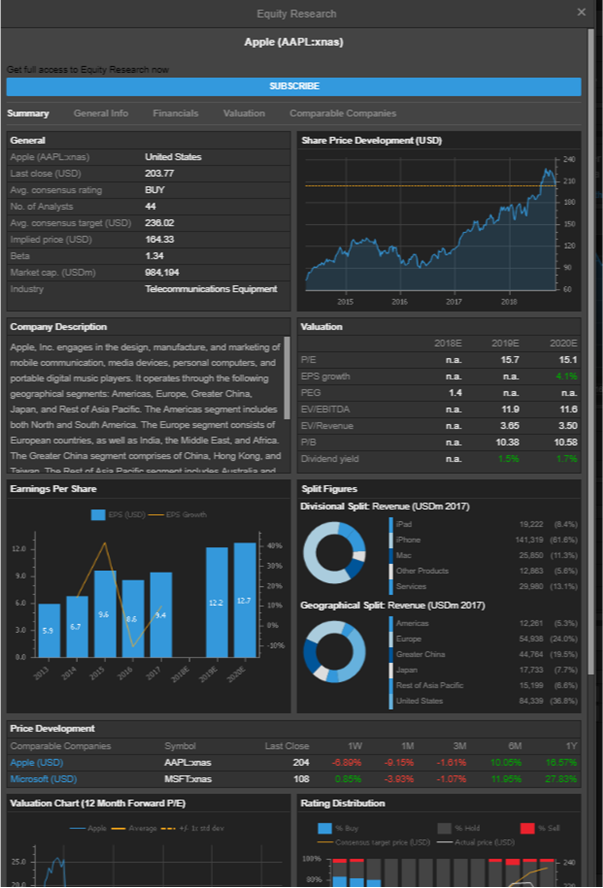

Reviews on stocks

Saxo Bank offers detailed analytics on stocks and securities. You will find a chart on value of stocks, sales diagram for the required period, information about the company, etc. Here, you will find a huge quantity of valuable data required for making trading decisions.

Saxo Bank trading strategies

Saxo Bank offers its clients ready trading strategies, which you can find in Products section on the website. As of today, the broker offers two trading strategies. Let’s compare them in the table below:

| Indicator | Macro Discretionary Trading | Macro FX Trading |

|---|---|---|

| Minimum deposit | 20 000 EUR | 20 000 EUR |

| Target | Positive returns regardless of market conditions | Positive returns from FX markets |

| Strategy | Trade-by-trade decision-making, capturing event- and volatility-driven opportunities | Trade-by-trade decision-making, driven by macroeconomics and central banks' policies |

| 5 Yrs. Total return | 239.2% | 66.8% |

| Risk level | Very high | High |

News reviews

There are also news reviews on Saxo Bank. The broker provides access to newsfeed and economic calendar. On the website of the broker, you will find news, analytics, commentaries of experts, long-term forecasts and expert findings. In addition, you can add news from additional sources, for example tradingfloor.com.

Learning

Saxo Bank offers a rather developed learning program designed to help beginners as well as professionals.

| Pros |

|---|

|

| Cons |

|---|

|

Let’s review the broker’s learning possibilities in more detail:

FAQ. In the answers to the questions, you will find a small number of articles that will help you learn about some aspects of trading and investment.

Webinars. The webinars are held regularly. You need to follow the updates on the website.

Video. There are quite a few top-level tutorials on how to work on the broker’s platform and on other topics.

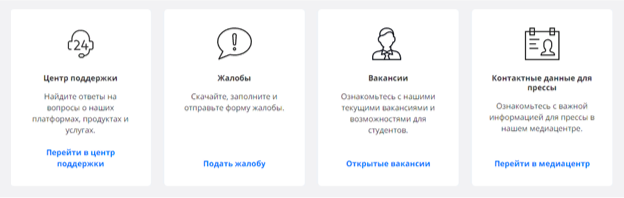

Customer support

You will find information about the company in About section; there you will also find Contact details button with contacts of the broker and forms for contacting customer support and other departments of the company. In particular, the following information can be found in this section:

- Support center;

- Complaints;

- Press contacts.

Also there, you can find current career opportunities and vacancies.

The website also provides contact information in different countries. Below is the table with the broker’s contacts in the countries with support centers.

| Country | Contacts |

|---|---|

| Denmark | +45 3977 4000 |

| Czech Republic | +420 226 201 580 |

| France | +33 1 78 94 56 40 |

| Italy | +39 02 3668 2929 |

| Netherlands | +31 20 333 2131 |

| Switzerland | +41 58 317 96 10 |

| UK | +44 (0)207 151 2000 |

| Australia | +61 2 8267 9000 |

| Shanghai | +86 400 0628 068 |

| India | +91 124 452 3000 |

| UAE | +971 4 5206999 |

Bonuses and promo

Due to the specific nature of financial market regulation in the European Union, Saxo Bank does not offer bonuses for the deposits and other similar programs.

Summary

| Saxo Bank is for you if | Saxo Bank is not for you if |

|---|---|

| You are ready to invest over $10,000, and ideally over $1,000,000. | You are a novice or an investor with limited financial possibilities. |

| You want to have access from one platform to all the best global markets. | You are a person who cannot confirm lawfulness of your income. |

| Your experience in investments is higher than beginner. |

Saxo Bank is one of the global leaders in the sphere of broker services. This broker operates under Saxo Bank financial institution and has required licenses and permissions from reliable regulators. In addition, the company guarantees return of deposits in case of bankruptcy (although it is available only for EU and UK residents).

The broker charges average trading fees. For example, it is beneficial here to work with currency pairs and CFDs. The stock trading fees are average. As for the drawbacks, the broker has high non-trading commissions and also a fee for benchmark on currency pairs.

The broker has its own trading platform, which is very functional and user-friendly. There is a big variety of instruments for technical analysis and the platform can be customized. Desktop and mobile versions are available, as well as a free demo account.

The biggest drawback of Saxo Bank is a high minimum deposit. In order to trade via this broker, you need to deposit a minimum of $10,000. To gain VIP status, you will need at least $1,000,000 on your account balance. The big clients on advanced accounts pay nearly 50% less fees.

Therefore, Saxo Bank is focused on large traders and investors. It will be inconvenient for a novice to work here due to high requirements for the minimum deposit, absence of educational materials and analytics. However, Saxo Bank is an excellent choice for professional traders, prepared to work with large amounts. There is no doubt about reliability of this broker.

Real reviews of Saxo Bank 2025

I regret ever signing up with broker Saxo Bank. Their platform constantly experiences technical glitches, especially during high-volatility trading hours. This has led to missed trading opportunities and significant losses. Customer support is practically non-existent; they either don’t respond or provide generic, unhelpful answers. If you’re serious about trading, avoid this broker at all costs.

I like a lot in terms of cooperation with Saxo Bank, but there are also significant disadvantages. Take, for example, analytical services - all are paid. Also, the help of a personal analyst is available only for VIP clients.

The author's terminal Saxo Bank is gorgeous! I have something to compare with, because I previously worked with MT4 and MT5. The Saxo Ban terminal has many more functions and ample opportunities for customization, taking into account individual preferences.

Saxo Bank focuses on professional traders, newcomers are not particularly welcome here. Look at the entry threshold - $ 10,000. I lost all desire to cooperate with this company at once.

I think this is a good licensed broker with a lot of assets. Large traders have a lot to turn around. In addition, I liked the fact that the broker provides opportunities for passive earnings. In a couple of months I managed to double my deposit.

I started trading with Saxo Bank recently, but I can already see the results. Withdrawn more than $ 10,000 in 3 months. Thanks to the support for the prompt help in resolving emerging issues. I think this is important.

Cooperation with Saxo Bank is not suitable for novice traders! Most analytical tools are not free. Also too high input threshold, that’s why I can only afford trading on a demo account

Saxo Bank has an excellent proprietary trading platform. I liked it, the terminal can be configured and it has an intuitive interface. There are no problems with trading!

I disagree that you can't make money with Saxo Bank. With this broker, I discovered the world of trading. I started with a demo account, and now I have already reached real income: plus 2,000 dollars per month. I think this is a good result. There are no problems with the withdrawal of funds.

Consider changing Saxo to some other broker, maybe IBKR or Degiro. Saxo is a good one, but expensive. They charge fee practically for any action.

Thinking about changing my broker. Saxo is a good one, but expensive. The charge fee practically for any action.

At Saxo, all services are made for large fish, so I would recommend for beginners to look for a more loyal broker

It is important for me to have access to all the top European and American markets at once from one terminal. In Europe, the offer of Saxo is the best option for me.

Saxo is an old and good broker, you can fully trust this company, but it doesn't mean this broker is for everyone. They charge fee practically for everything. Very expensive broker, especially for middle-size clients. Trading here with less then $500K is a bad idea. I'd rather advise looking at Interactive Brokers.

A good broker for traders with high turnover and deep understanding of the market. I was provided with special trading conditions and low commissions. There is an option to request sets of data for long periods for testing strategies, and also request various specific analytics. Some of it is provided for free, and some you have to pay for, but the information is worth it. This is not a place for small investors, IMHO.