Interactive Brokers announces financial results for January 2024

Interactive Brokers has released its key operating figures for January 2024. The financial report shows strong growth for the company.

During the period, daily average revenue trades (DART) increased 12% month-over-month and 11% year-over-year to 2.201 million.

The company's client equity totaled $424.0 billion at the end of January, an increase of 26% compared to January 2023. This was flat compared to December 2023.

In addition, ending client margin loan balances reached $44.3 billion in January 2024, reflecting strong year-over-year growth of 12% and remaining roughly the same as last month.

The company recorded 2.63 million client accounts, up 23% year-over-year and 2% month-over-month.

The average commission per order cleared was $3.03, including exchange, clearing, and regulatory fees. The broker highlighted that for contracts that include options on futures, exchange, clearing, and regulatory fees account for 56% of futures commissions.

Also, in the interest of transparency, the broker reported that the average trade in US Reg-NMS stocks in January was $22,682.

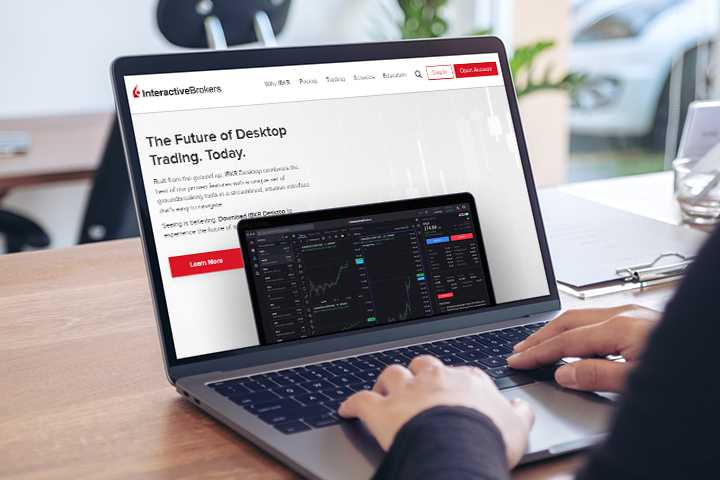

Interactive Brokers began operations in 1977 and has received many prestigious honors and awards. The company offers a wide range of services to its clients, allowing them to engage in both active trading and investing.