On this page, you will find a large number of reviews from the real Swissquote If you are already working with If you are already working with Swissquote please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Swissquote Review 2021

Swissquote Group Holding SA is a Swiss banking group specializing in the provision of a wide range of financial services. The company was set up in 1996; its shares have been listed on the SIX Swiss Exchange under the ticker symbol SQN since May 29, 2000. The group’s headquarters are located in Gland, Switzerland. The company also has offices in Zurich, Bern, Dubai, London, Luxembourg, Singapore, Hong Kong and Malta. The group employs over 700 specialists.

Swissquote will be a preferred option for:

- Forex and CFD traders, who are prepared to trade on average spreads, but in return receive high quality of order execution with a reliable broker. For this, you need to open an account with Swissquote LTD, regulated by FCA (UK)

- Big investors, with a trading account in a Swiss bank with access to three million financial instruments suitable for their status. For this, you need to open an account with Swissquote Bank, regulated by FINMA, but also be prepared for high expenses.

Inside Swissquote Group Holding SA headquarters in Switzerland

The Swiss office is the main branch; it provides the fullest range of services, including Forex trading. That is why, we will favor this branch within our review

However, in terms of active CFD and Forex currency pair trading, London’s daughter Swissquote LTD offers better conditions.

In the course of the review, when speaking about commissions, licenses and other important information, we will make clarifications. Let’s agree that:

- When we speak about the main swiss office, we will use Swissquote Bank.

- And when we discuss London’s office, we will write Swissquote London.

To make the review more demonstrative, we will compare Swissquote with eToro and Degiro.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

Key features of the broker

| Regulation | Swissquote Bank SA holds the banking license and is regulated by the Swiss Financial Market Supervisory Authority FINMA. The London office is regulated by FCA (UK). Also, Swissquote Bank holds the licenses of such regulators, as MFSA (Malta), DFSA (Dubai), SFC (Hong Kong), MAS (Singapore). These licenses have been issued to the broker’s main Swiss office. |

|---|---|

| License number of Swissquote LTD London | FCA 562170 |

| Commissions and fees | Average to high, low on CFD market |

| Demo account | Yes |

| Minimum deposit |

|

| Inactivity fee | No |

| Timeframe for opening an account | Demo - instantly Real – 1-3 business days for consideration of the documents for opening a real account |

| Leverage |

|

| Markets | Forex / Stocks / Cryptocurrencies / Commodities / CFD / Bonds / ETF / Futures / Options / Investment products |

| Options for passive income | Special AI-based algorithm Robo-Advisor, bonds, real estate and other assets |

| Support languages | 8 languages: English, German, Czech, Polish, Italian, Arabic, French, Spanish. There are also Russian-speaking specialists in the support team of Swissquote Bank. |

| Deposit | Wire transfer (up to one business day) or Visa, Mastercard debit/credit card (up to 2 hours). For the customers of Swissquote London, there is an additional option – deposit via Skrill (in the personal account of ePortal). |

| Deposit fee | Swissquote does not charge a deposit fee if:

|

For deposits via Visa / Mastercard, the fees start from 2.2% and depend on the country of the bank that issued the card.

| Withdrawal | The standard default method is the wire transfer. The wire transfer is performed by a simplified procedure, using a personal IBAN at the Swiss bank. This method is the same for all accounts. Additional method – withdrawal of cryptocurrency to a private wallet; this method is only available for the Swissquote Bank Trading Account. For the customers of Swissquote London, there is an additional option – withdrawal via Skrill (in the personal account of ePortal). |

| Withdrawal fee | The standard withdrawal fee is around 2 CHF / EUR per withdrawal via a wire transfer. No withdrawal fee is charged on withdrawal of cryptocurrency to a private wallet. Also, no fee is charged on withdrawal via Skrill. |

| Deposit and withdrawal via cryptocurrencies | Holders of Swissquote Bank Trading Account can fund their account with Bitcoin and Ethereum. Transfers from personal wallets and also cryptocurrency exchanges Coinbase, Bittrex, Kraken, Bitstamp, and Gemini are available This option, however, is unavailable for Forex accounts. |

| Supported currencies of the account | On Swissquote Bank Trading Account types, 21 currencies are supported: EUR, USD, GBP, CHF, JPY, AUD, CAD, NZD, PLN, SEK, DKK, NOK, HUF, TRY, ZAR, SGD, MXN, HKD, THB, ILS, AED. |

| Deposit bonus | No |

Page content

Geography of broker’s customers

According to our research of the broker’s geography, Swissquote is particularly popular in its homeland. The Swiss take up more than half of the broker’s customer map. Also, the broker is quite popular in China, Germany, France, Ukraine and the USA. The map of the broker’s customers looks as follows:

| Country | Percentage of customers |

|---|---|

| Switzerland | 54,97% |

| China | 5,36% |

| Germany | 2,96% |

| France | 2,94% |

| Ukraine | 2,54% |

| USA | 2,52% |

| Italy | 2,44% |

| Saudi Arabia | 2,34% |

| Russia | 1,74% |

Regional restrictions of Swissquote

Swissquote positions itself as a Swiss company with a focus on the residents of Europe and Asia being its strategic development priority. In particular, Swissquote does not hold licenses of North American regulators. Accordingly, citizens of the U.S. and Canada cannot be customers of Swissquote London or Swissquote Bank.

There is no specific list of the countries Swissquote does not work with as such. There is, however, a list of available countries, which appears in the pop-down menu in the interface for opening an account. This list includes Japan, Russia, China, Australian and practically all countries of Europe and Asia.

Commissions and fees

Overall, Swissquote commissions and fees are average, or even higher than average. You do have to pay extra for the Swiss quality, reliability and confidentiality of financial affairs. This principle generally applies to the entire pricing policy on products and services of Swissquote.

Below, we will review commissions and fees of Swissquote in more detail, separately by offices, account types and sets of instruments.

Pros and cons of Swissquote commission system

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on Swissquote

Swissquote Bank states in the description of its conditions for forex products that the spread is used as a commission in the majority of cases. However, in some cases, also other types of commissions are applied.

Let’s review the spreads and commissions of Swissquote for the key markets.

| Instruments | Commissions |

|---|---|

| Forex, EURUSD pair | The commissions are zero for the majority of the accounts and are included in the spread. The exceptions are the Professional and Elite accounts of Swissquote London. In them, a EUR 2.5 commission per lot is charged. Also, there may be commissions for the Professional type of accounts; they are opened based on individual conditions. Spreads:

|

| CFD | Just as for the forex instruments, the commissions here are zero for the majority of the account types. The spreads vary depending on the instrument and jurisdiction. For example, for the CFD on S&P-500 the spreads are as follows:

|

| Stocks | Stock trading is unavailable for the customers who opened their accounts for trading Forex and CFD. In order to buy / sell shares of companies, you need to open a trading account at Swissquote Bank. Overall, the level of commissions is higher than average. Examples of the broker’s commission:

|

| Options and futures | Futures and options trading is available only to the holders of the Swissquote Bank Trading Account. The commissions on trading futures and options:

|

| Cryptocurrencies | The commissions on cryptocurrency transactions depend on the volume and range from 0.5% to 1.0% per trade. |

| Thematic investment, transactions involving ETF and DOTs | Themes are a financial product or portfolio of securities composed based on a thematic feature. Commissions on Themes Trading transactions are simple: 9 CHF/EUR/GBP/USD per trade plus 0.7% for management. There is also a fixed commission at 9 CHF/EUR/GBP/USD for such investment products as Swiss DOTS (around 90,000 products) and ETFs No commission is charged for servicing the Swissquote Bank Trading Account. However, custody fees are charged quarterly on customer accounts – from 15 to 50 Swiss francs. |

| Other expenses | Swissquote Bank also charges the following fees:

|

Commissions on Forex market

Absence of commission is an important feature of Forex accounts on Swissquote. All broker’s expenses for performing transactions of the customers are built into the spreads.

Below, we compare the spreads of Swissquote Bank and Swissquote London, also adding eToro to the comparative table, as the broker also uses the model with zero commission. Degiro does not provide access to forex.

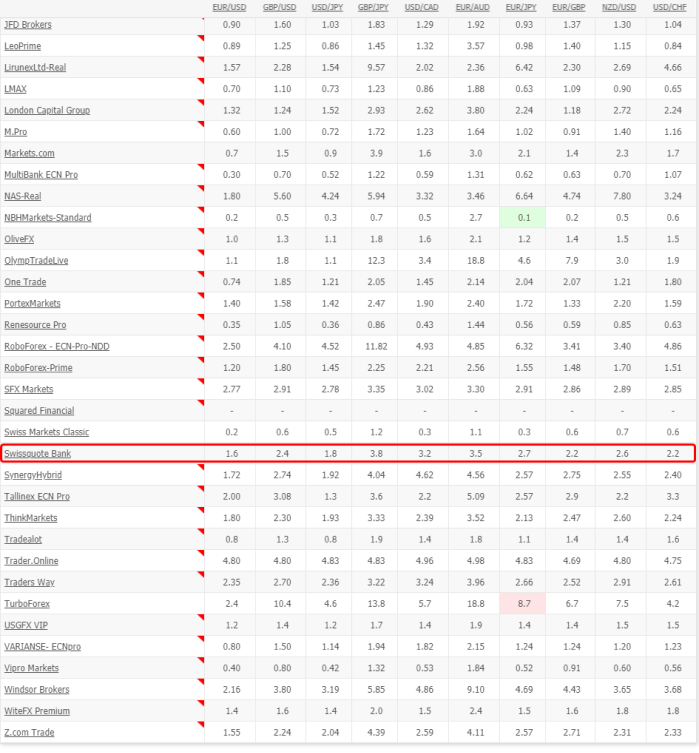

Average spread comparison table

| Swissquote Bank | Swissquote London LTD | eToro | |

|---|---|---|---|

| EURUSD | 1.4 pips | 1.2 pips | 1 pip |

| USDJPY | 1.4 pips | 0.9 pips | 1 pip |

| EURGBP | 1.5 pips | 1.3 pips | 1.5 pips |

| AUDJPY | 1.7 pips | 1.3 pips | 2 pips |

| USDRUB | 90 pips | 54 pips | 3 pips |

| USDZAR | 80 pips | 32 pips | 50 pips |

Swissquote spreads differ, as they depend on the account type. The bigger the account, the lower is the spread.

As you can see, in many cases eToro offers more attractive spreads, all the while USD 200-500 is enough to open an account on eToro, and not nearly enough to open even the simplest Forex account on Swissquote.

In order to make it more understandable, below we have calculated how much a trader will actually have to pay for the purchase of a standard lot (100,000 units of base currency) on Forex on Swissquote and eToro. The provided amount includes all commissions and average spread of the brokers on standard accounts.

| Swissquote London LTD | eToro | |

|---|---|---|

| EURUSD | 12 USD | 10 USD |

| USDJPY | 11.37 USD | 9.43 USD |

| USDCHF | 17.63 USD | 16.53 USD |

| EURGBP | 15.85 USD | 19.81 USD |

In order to trade with better spreads on Swissquote, you will need to open a bigger account. Let’s review the level of commissions the broker offers for the accounts with a high minimum deposit.

| Swissquote Bank | Swissquote London LTD | |

|---|---|---|

| Beginner level | Standard account, Minimum deposit 1,000 USD Spreads from 1.7 pips | Premium account, Minimum deposit 1,000 USD Spreads from 1.3 pips |

| Higher level | Premium account, Minimum deposit 10,000 USD Spreads from 1.4 pips | Prime account, Minimum deposit 5,000 USD Spreads from 0.6 pips |

| Maximum level | Elite account, Minimum deposit 50,000 USD Spreads from 1.1 pips | Elite account, Minimum deposit 10,000 USD Spreads from 0.0 pips |

The broker also has Professional account in its Swiss branch. In order to open it, you need to have quite large volumes of funding for the transactions. The exact amount is not specified, but based on the scale of such a bank, it is possible that we are talking about more than EUR 10 million per month. In order to open this type of account, you need to submit an application and if Swissquote Bank considers it interesting, its representatives will offer you individual conditions on the spreads.

As we can see from the screenshot above, Swissquote spreads do not stand out particularly.

The conclusion here is that if the moderate pace of trading, holding positions for several hours, is your style, the difference in spreads will not be a critical factor for you.

Rates of financing on Forex

Swap rates (also known as overnight and rollover rates) are accrued or paid for holding the position overnight. Swissquote performs calculation on the overnight positions at 23:00 CET.

If the customer has a long position:

- If the swap is positive, it is written off the customer’s account;

- If the swap is negative, it is accrued to the customer’s account.

And the other way around. If the customer has a short position:

- If the swap is positive, it is accrued to the customer’s account;

- If the swap is negative, it is written off the customer’s account.

There are examples of swap values for Forex accounts in the table below. They are the same both for Swissquote Bank and for Swissquote London.

| Long Base | Short Base | |

|---|---|---|

| EURUSD | 0.00004243 | 0.00000477 |

| GBPUSD | 0.00002636 | -0.00001455 |

| USDRUB | 0.00990401 | 0.0058986 |

| XAUUSD | 0.077463 | -0.0149603 |

| NASDAQ100 | 0.8394088 | -0.74302545 |

Both Swissquote Bank and Swissquote London allow swap free trading. This information, however, is not available on the websites. The swap free option was discovered after our communication with the support team. It turned out that swap free accounts are available, but the information about them is provided upon request, as it is a special service and it is allowed only individually for large customers.

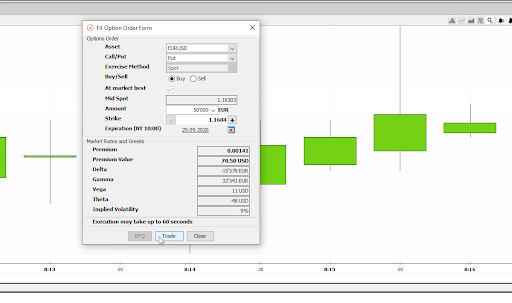

Commissions on Forex options

Option trading is an unusual service for forex traders, but it is available on Swissquote Bank. As a reminder, options are derivative instruments based on base assets. In case with Forex, option use the exchange rate as the base, for example EURUSD. We will not go into too many details about options and what their purpose is, as this is not what the article is about.

Peculiarities of trading forex options:

- This service is available only to professional traders, the minimum lot is 50,000 USD / CHF / GBP / EUR;

- The service is available only on Advanced Trader, proprietary platform of Swissquote;

- Forex option trading is available only at the main Swiss branch.

The commission is charged:

- At opening of the position

- At closure (expiry) of the position

The commission is USD 10 in case the lot is less than USD 500,000. If the lot exceeds this amount, the commission is zero. It is important to understand that you need security in order to maintain your position, so you have to make sure you have enough funds on your account as of the date of execution.

Commissions on stock market

Overall, the commissions on trading stocks are high. They will be acceptable for the investors executing large transactions based on long-term strategies, where the size of the commission is ‘diluted’ in the total volume. As for the speculators, who execute many small traders throughout the day, they need to find other partners.

Swissquote Bank has two methods of charging commission on the stock market:

- Depending on the volume of transactions. The higher the trader, the higher the commission;

- Flat Fee.

Below is a table of the commission per 1 trade depending on the traded volume:

| Traded volume | SIX Exchange (Bern), CHF | Exchanges in Europe, EUR/GBP | U.S. Exchanges, USD |

|---|---|---|---|

| 0 - 500 | 9 | 25 | 15 |

| 500 - 2’000 | 20 | 25 | 25 |

| 2’000 - 10’000 | 30 | 30 | 30 |

| 10’000 - 15’000 | 55 | 55 | 55 |

| 15’000 - 25’000 | 80 | 80 | 80 |

| >50’000 | 190 | 190 | 190 |

For example if you want to buy 100 shares of AAPL, which is traded at $120 at Nasdaq, your trade volume = 120*100 = $12,000. The commission will be (see table above) $55.

Is it a lot or a little? Let’s compare the commission on the purchase of 100 shares of AAPL to other brokers.

| Swissquote Bank | Degiro | eToro | |

|---|---|---|---|

| Purchase of 100 shares of AAPL | 55 USD | 18 USD | 0 USD* |

* for non-U.S. residents

Fixed commissions on stock market

If the method of calculating the commission based on the volume is not suitable for you, you can use Flat Fee service. In this case, the commission is calculated not based on the traded volume, but on the number of traders per year.

| Number of transactions | Commission |

|---|---|

| 20 trades | 39 СHF per trade |

| 50 trades | 35 СHF per trade |

| 100 trades | 29 СHF per trade |

| 200 trades | 25 СHF per trade |

| 500 trades | 19 СHF per trade |

This method is beneficial for those investors that operate large amounts. The benefits will be evident, if the trade volumes exceed 10,000 CHF.

Commission for participation in IPO

As a serious investment bank, Swissquote offers its customers access to purchasing shares during their initial public offering at the exchange (IPO).

In this case, the broker’s commission will amount to 0.25% of the trade, but no less than 50 CHF / USD / EUR.

Commissions on CFD

Overall, the commissions on CFD trading on Swissquote are low and are a part of the spread.

CFD trading is available on:

- Swissquote London

- Swissquote Bank Forex

The majority of CFDs are available as Forward contracts (with an expiry date) and as Spot/Synthetic contracts (without the expiry date, with the rollover rate). The level of commissions on this market is average.

As an example, let’s see how much a trader will have to pay for the purchase of different types of CFDs for the amount of USD 5,000, taking into account the spread and commissions of Swissquote Bank and eToro. Degiro does not provide access to CFD trading.

| Swissquote Bank | eToro | |

|---|---|---|

| CFD on S&P 500 | 1.87 USD | 2.03 USD |

| CFD on WTI | 5.75 USD | 5.75 USD |

| CFD on gold | 0.8 | 2.6 USD |

As you can see Swissquote Bank compares favorably with eToro by nearly all positions. If one were to compare the commissions of the broker’s branches, the commissions in Swissquote London are even lower, which is more beneficial for active trading.

Margin requirements

Margin requirements on different CFDs are in the table below and they differ at the 2 branches.

| Type of CFD | SQ-Bank requirements | SQ-London requirements |

|---|---|---|

| CFD on stock indices | 5-10% | 2% |

| CFD on energies | 4% | 10% |

| CFD on bonds | 4% | 20% |

Futures and options trading

Trading such derivatives as futures and options is available only through a trading account at Swissquote Bank. As a reminder, options and futures are standard financial instruments, which are simultaneously flexible and complex and are used on dropping as well as rising prices. They are used either for hedging or speculative purposes and are traded at specialized futures exchanges.

Commissions on futures and options

The broker’s commissions are not small. The rates for the European markets are provided in the table below.

For online trades at Eurex exchange:

| Commission per 1 contract | Minimum commission | |

|---|---|---|

| Options on stocks | 1,5 CHF or 1 EUR | No |

| Options and futures on stock indices | 1,5 CHF or 1 EUR | 5 EUR or 5 CHF |

For performing transactions by phone (per contracts, without minimum):

| Euronext | LIFFE | |

|---|---|---|

| Options on stocks | 2 EUR | 2 GBP |

| Options and futures on stock indices | 1,5 EUR | 1.5 GBP |

Swissquote rates on trading derivatives on the U.S. markets

| Exchange | Product | Commission per 1 contract | Minimum |

| ISE | Options on stocks | 1,49 USD | No |

| CME | E-mini futures | 1,99 USD | 5 USD |

| E-miсro futures | 2,50 USD | ||

| Other futures | 5 USD | ||

| NYMEX | E-mini futures on oil | 1,99 USD | |

| COMEX | Futures on gold and silver | ||

| CBOT | Futures on bonds, E-mini Dow |

As you can see, the choice is quite good. Swissquote provides access to trading the most popular futures contracts and options. However, if you look at the size of the commission per trade, just as in many other cases, it will not be as competitive. Let’s compare with Degiro. eToro does not provide access to futures and options trading.

| Position | Swissquote Bank | Degiro |

|---|---|---|

| 10 futures E-mini on S&P-500 | 19,9 USD | 5 USD |

| 10 mini futures on German DAX | 11 USD | 8,3 USD |

The comparison is not in favor of Swissquote.

Commissions on cryptocurrencies

The level of commissions on cryptocurrency trading is high, and depends on the traded volume in CHF equivalent:

- 1% – from 5 CHF to 10,000 CHF

- 0,75% – from 10,001 CHF to 50,000 CHF

- 0,5% – from 50,001 CHF to 500,000 CHF

Noteworthy, it will not be possible to actively trade cryptocurrencies at such commission. That is why it is expedient to work with bitcoin and other coins via Swissquote for investment purposes.

Investment products

Investment solutions are an important area in Swissquote, which is natural, as we are talking about a Swiss bank here. Holders of a trading account in Swissquote Bank receive access to practically all financial markets of the world. We will delve into the products a bit later, and for now just outline the level of commissions.

| Investment product | Commission |

| ETF, ETN | from 9 CHF per one transaction |

| Bonds | from 9 CHF per one transaction |

| Swiss DOTs | from 9 CHF per one transaction |

| Thematic investment | from 9 CHF per one transaction |

| Robo-Advisory | 0.5% - Management commission plus Administrative commissions, the size of which depends on the size of the capital:

|

As you can see from the table, the level of commissions is high. However, it can be acceptable for the long-term investors with big capital, who particularly value Swiss precision, reliability and discretion.

We’d like to also point to the commission on cryptocurrency transactions. 1% is 10 or more times higher than the traders and investors pay at the cryptocurrency exchanges.

Marginal lending rates on Swissquote

Trading with loaned funds is not free. The broker has a system of interest rates for different currencies. In the table below, these rates (annual interest rate) are compared with Degiro.

| Swissquote | Degiro | |

|---|---|---|

| Loan interest rate in USD | 4,7% | 3,1% |

| Loan interest rate in GBP | 4% | 1,9% |

| Loan interest rate in EURO | 3% | 0,8% |

Non-trading commissions

The commissions that are not linked to trading are not high in general.

| Swissquote Bank Trading Account | Swissquote London Forex Account | Degiro | |

|---|---|---|---|

| Inactivity fee | No | 10 CHF per month after six months of inactivity | No |

| Deposit fee | No | No | No |

| Withdrawal fee | from 2 CHF via a wire transfer depending on the country | 0, if you withdraw via Skrill | No |

| Account servicing fee | No | No | No |

| Custody fee | 0.025% quarterly, minimum 15 and maximum 50 CHF. | - | No |

Addition to the table above:

- Despite that Swissquote does not charge a deposit fee, you need to keep in mind that the bank can charge their 2-2.5% fee;

- To avoid deposit/withdrawal fees, you can use cryptocurrencies, but this path is available only to the holders of Swissquote Bank Trading Account.

Security and regulation

Swissquote is a highly respected company. The fact that it is a part of the Swiss financial system speaks in favor of its reliability. The licenses were issued by reputable regulators – FINMA (Switzerland), FCA (UK), MFSA (Malta), DFSA (Dubai), SFC (Hong Kong), MAS (Singapore). There is not one license from the offshore territories (Belize, Grenadines, Marshall Islands, etc.).

Group structure

Here are several facts that speak in favor of Swissquote reliability:

- 360,000 customers (individuals and legal entities);

- CHF 32 billion on customer accounts;

- Company income in 2018 – CHF 214 million, in 2019 – CHF 230 million (+7,5% per year);

- Swissquote is the official partner of Manchester United.

In summer 2018, Ipsos conducted a study on general customer satisfaction with Swissquote. The results were quite high. 1,540 customers who agreed to participate in the study estimated the quality of the service at 5.6 out of 7.0 points. The level of trust towards Swissquote was 6.2 out of 7 points.

Deposits of Swissquote London customers are protected against negative balance and insured for the amount up to 85,000 British pounds. The funds of the Swissquote Bank customers are insured for the amount of CHF 100,000 in case of the company’s bankruptcy.

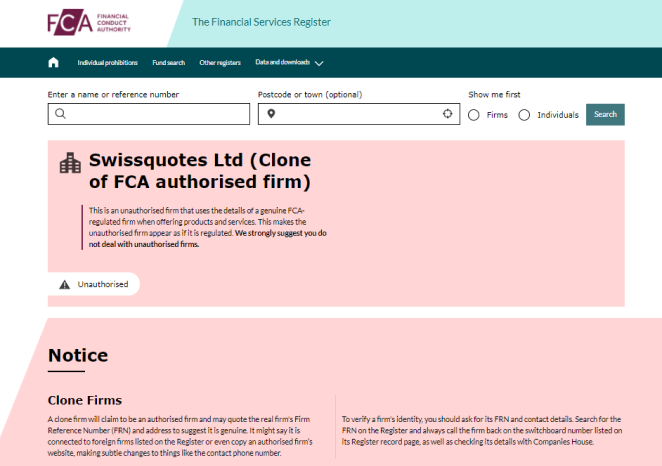

Interesting fact. There is information about a certain Swissquotes Ltd. in the Financial Conduct Authority register. It seems that fraudsters decided to benefit from the good reputation of Swissquote and set up a company with a similar name, adding an S in the end. Naturally, FCA cannot approve of such behavior and has issued a warning about possible fraud.

The fact that the scammers are creating clones to hide behind an original brand can also be considered a positive argument in favor of Swissquote.

Markets and products

Swissquote Bank Trading Account provides customers with access to millions of financial instruments for active trading and investment. The selection of products can be considered colossal – by this indicator, the bank is one of the top brokers not only in Europe, but in the world.

Holders of Forex accounts at the London branch can only trade currency pairs, metals and some CFDs. This account is more suitable for the speculators, who value lower expenses more than the choice of assets.

| Pros |

|---|

| A Trading account at the Swissquote Bank |

|

| A Trading account at Swissquote London for forex trading |

|

| Cons |

|---|

| A Trading account at the Swissquote Bank |

|

| A Trading account at Swissquote London for forex trading |

|

If your priorities include:

- Top level of reliability

- Widest selection of markets

Then Swissquote Bank is worthy of your attention, as you can perform transactions with over 3 million assets through the Trading Account at the Swissquote.

| Swissquote Bank | eToro | Degiro | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| CFD | Yes | Yes | Нет |

| Crypto | Yes | Yes | No* |

| Bonds | Yes | No | Yes |

| Futures and options | Yes | No | Yes |

| Commodities | Yes | Yes | Yes |

| Mutual Funds | Yes | No | Yes |

| ETF | Yes | Yes | Yes |

* At Degiro, you can purchase cryptocurrency only via ETN (exchange traded notes).

Stock market

The holders of the Trading Account at Swissquote Bank have the widest opportunities for trading stocks at the stock exchanges in over 30 countries:

- USA: NYSE, Nasdaq Amex, NYSE Arca;

- Switzerland: SIX;

- Europe: Euronext, exchanges in Germany, Italy (Milan Stock Exchange), Austria, Spain, Scandinavian countries;

- UK (London Stock Exchange);

- Canada.

Stock exchanges in Singapore, Australia, Hong Kong, Indonesia, Bulgaria, Czech Republic, Mexico, Japan, Russia (Moscow Exchange) and other countries are also available.

The important peculiarities include:

- Marginal trading (or trading with leverage) is not supported in stock trading;

- It is not possible to sell stocks without coverage (short). This means that the customers do not take debts and loans, but only invest the money they have in their pocket. On the one hand, this approach limits the possibilities, but on the other hand, it also reduces risks;

- Swissquote has several platforms for trading. Depending on the platform, some markets may not be supported.

- At some exchanges (for example, located in such regions as Abu Dhabi, New Zealand, the Baltic States), transactions can only be performed through an order to the manager given by phone;

- You have to place a request to access some exchanges.

| Swissquote Bank | Degiro | eToro | |

|---|---|---|---|

| Number of markets | 60 | 30 | 17 |

| Number of available stocks | 86,000 | Over 20,000 | around 2,000 |

Forex market

Swissquote Bank offers 80 currency pairs for trading. This may be insufficient for the traders that trade exotic cross rates. Nonetheless, all major pairs are available.

| Swissquote Bank | eToro | Degiro | |

|---|---|---|---|

| Number of currency pairs | 80 | 47 | n/a |

Swissquote Forex account can also be used to trade metals at the spot market: gold, silver, platinum, palladium.

CFD market

CFD is not a priority of Swissquote, which is why the choice of available CFDs is not big.

| Swissquote Bank | eToro | Degiro | |

|---|---|---|---|

| CFD on indices | Yes, over 20 CFD | Yes, 13 CFD | No |

| CFD on stocks | No | Yes, over 2,000 | No |

| CFD on bonds | Yes, 3 CFD | No | No |

| CFD on сrypto | No | Yes, 16 CFD | No |

| CFD on сommodities (metals, products, raw materials) | Yes, over 10 CFD | Yes | No |

There are subtle differences in the Swissquote CFD specification, depending on whether the CFD is spot, synthetic or forward. This must be taken into consideration when planning a trade. The table below provides information on each type of CFD and on which platform they are available.

| Contracts | Base | Expiry | Swap/rollover | Commission | Platform |

| Spot | Indices | No | Yes | No | Advanced Trader, Metatrader |

| Synthetic | Commodities | No | Yes | No | Advanced Trader |

| Forward | Indices, commodities, bonds | Yes | No | Yes | Advanced Trader, Metatrader |

CFD is not the strongest suit of Swissquote. Of the special features, CFD on bonds can be noted, which is not a very popular option. Although, there are only 3 of them.

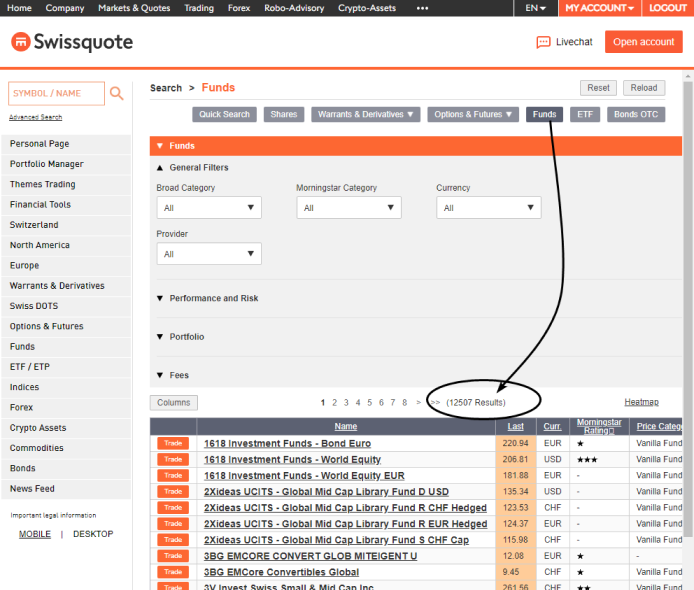

Mutual funds

Transactions with such investment products as mutual funds, are an important line at Swissquote Bank. Using its platform, the customers can purchase securities of around 12,500 funds from different distinguished partners – Credit Suisse, Black Rock, AXA and others.

Compared to the other brokers, Swissquote Bank stands out by the number of funds rated up to 5 stars by the Morning Star agency. The customers can diversify their portfolio by risks, sectors, profitability.

| Swissquote Bank | eToro | Degiro | |

|---|---|---|---|

| Fund providers | 340 | No | 64 |

Futures and options

Swissquote Bank provides traders with access to derivative exchanges of European and the U.S. The choice of trading instruments is very big. The main trading of futures and options in Europe for Swissquote customers takes place on the Eurex exchange (Germany). There is also access to the Euronext (Netherlands), LIFFE (London) exchanges.

For the transactions in the U.S., access to the exchange platforms that are part of the CME Group is open:

- CME and CBOT – major Chicago exchanges trading derivatives on stock indices, bonds and agroindustrial commodities;

- NYMEX – an exchange that specializes in trading futures on energies;

- COMEX – an exchange that specializes in trading futures on metals;

- ISE – a division of Nasdaq for transactions with derivatives.

| Swissquote Bank | eToro | Degiro | |

|---|---|---|---|

| Futures markets | 6 | No | 14 |

| Options markets | 6 | No | 12 |

Holders of Trading Account from Swissquote Bank have access to the key markets for trading futures and options on stock indices, stocks, bonds, commodities both in Europe and the U.S. Access to Swiss derivatives is an added bonus.

Cryptocurrencies

Digital assets are becoming increasingly established in the global financial system. In the past, Bitcoin and other coins were perceived with distrust, while in 2020, world-known investors and top banks have offered services related to cryptocurrencies. Swissquote also supports this trend.

In particular, Swissquote Bank customers can invest in 12 cryptocurrencies: bitcoin, ether, litecoin, ripple, bitcoin cash, ethereum classic, link, tezos, stellar, augur. Please not, it is not CFD, but cryptocurrencies that can be purchased at a Swiss bank.

Peculiarities of investing into cryptocurrencies with Swissquote:

- You can fund your Trading Account using Bitcoin and ETH. Also, you can withdraw these two cryptocurrencies from the account at Swissquote to your personal wallet.;

- You can trade crypto-crypto or crypto-fiat.

| Swissquote Bank | eToro | Degiro | |

|---|---|---|---|

| Number of supported cryptocurrencies | 12 | 18 | No* |

* At Degiro, you can purchase cryptocurrency only via ETN (exchange traded notes).

Thus, the banking broker offers a rather average choice of digital assets.

Investment products

Swissquote Bank offers a wide selection of investment products, both classic and innovative:

- ETF

- Bonds

- Swiss DOTs

- Thematic investment

- Investment into cryptocurrencies

- Robo-Advisory

Let’s review each of them in more detail.

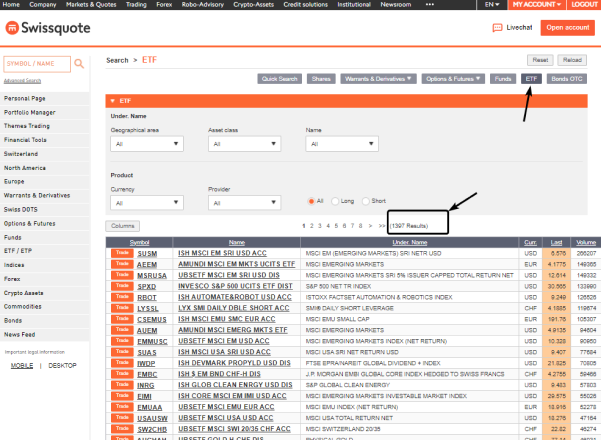

Investing in ETF with Swissquote Bank

The ETF has existed since 1993 and is a fast growing segment of the financial market. Swissquote Bank customers can invest in more than 9,000 ETF and ETN (Exchange Traded Notes are something similar to bonds and ETF), which are offered by professional financiers. The key players on the ETF market are:

- IShares from BlackRock (over 300 ETF)

- LYXOR from Société Générale (over 90 ETF)

- VANGUARD, UBS, Amundi, ComStage and many others.

Overall, around 1,400 ETF and ETN are available on the Swissquote platform.

Peculiarities of investing in ETF with Swissquote include:

- Wide choice, search by criteria. You can thus diversify your portfolio;

- Choosing the manner of the investment strategy – from conservative to aggressive.

Investing in bonds with Swissquote Bank

Investing in bonds is a path towards stabilization of an investment portfolio thanks to the reliability of this financial instrument with fixed payouts. The most popular bonds are:

- U.S. Treasuries (issued by the U.S. government and denominated in USD);

- German Bund (long-term debt instruments, issued by the federal government of Germany);

- UK Long Gilt (bonds issued by the UK government and denominated in British pounds).

Peculiarities of investing in bonds with Swissquote Bank:

- Low risks, secured by the Swiss bank;

- Wide selection – over 60,000 bonds in 28 currencies;

- Swissquote searches for the best prices among over 100 contracting parties.

Investing in Swiss DOTs

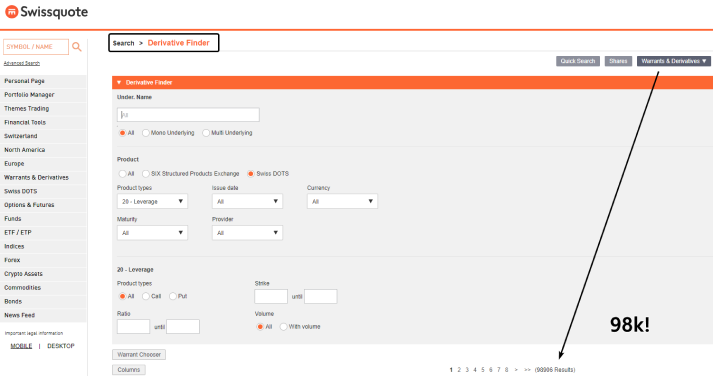

Swiss DOTS (Derivatives OTC Trading System) allows customers to trade products directly with the issuers. In reality, it is a huge universe for investors. The Search of Swiss DOTS provides nearly 100,000 securities.

Peculiarities of investing in Swiss DOTS:

- High reliability confirmed by partners UBS, Goldman Sachs, BNP Paribas and others;

- Support from Swissquote includes educational materials and videos on DOTS.

Thematic investment in bonds with Swissquote Bank

Themes Trading is a collection of thematic portfolios of stocks gathered by a specific principle. For example securities of:

- Football clubs;

- Cannabis producers;

- Waste management companies;

- AI developers;

- Sustainable energy companies, etc.

Peculiarities of investing in bonds with Swissquote Bank:

- Simple and intuitive investment;

- Around 60 thematic portfolios, each having a specific level of risk and profitability;

- The portfolios are formed by Swissquote experts.

Investing with Robo-Advisor from Swissquote Bank

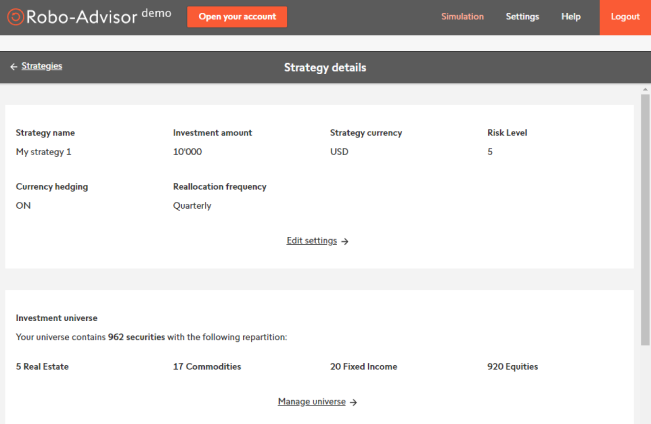

As you can tell by the name, Robo-Advisor is an automated investment manager, which creates individual investment portfolios for Swissquote Bank customers and controls it, continuously optimizing it to maintain the desired risk level.

A customer simply needs to specify his/her attitude towards the risk, select preferred securities or sectors (not mandatory) and let the Robo-Advisor do the rest. Its algorithms analyze thousands of securities, generating proposals for the customer’s portfolio.

Let’s use an example to show how it looks. After registration, the customer enters the advisor’s interface and creates a new strategy. After you create it, you need to select the following:

- Investment amount (minimum deposit is 10,000 CHF or an equivalent);

- Risk level from 1 (conservative approach) to 10 (high risk)

- Type of securities that can be combined to create the portfolio (the advisor can do it as well);

- Reallocation frequency.

Then, you need to let the robot work. Below are the results it showed in our case:

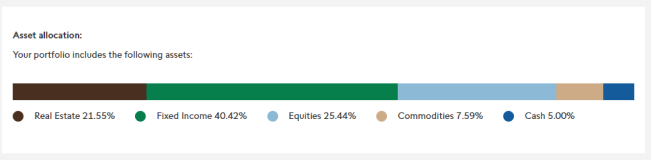

The robot included into the portfolio the following:

- securities from real estate (21,5%)

- bonds and other securities with fixed income (40,42%)

- equities (25,44%)

- commodities (7,59%)

- 5% – cash.

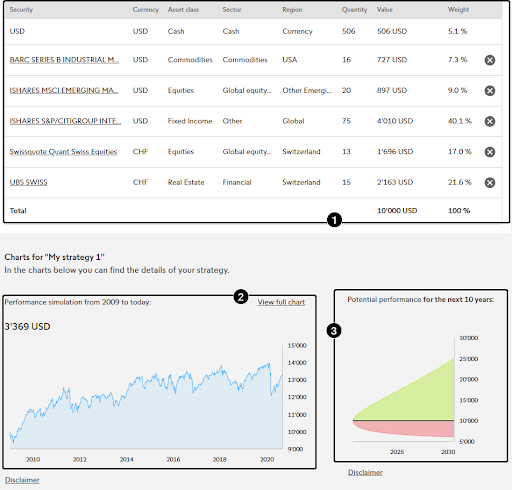

The images above show:

- 1 Example of the portfolio with specific securities;

- 2 History-based test. From 2009 to 2020, the profit was 33.69%;

- 3 Potential performance for the future. By 2030, the portfolio created by the robot can give from approximately -40% (in the worst case scenario) to +150% (in the best case scenario).

Advantages of Robo-Advisor:

- simple;

- powerful (quickly processes a multitude of options);

- profitability and risk compliance;

- fully transparent, giving the customer control over his investment;

- a fairly large spread in uncertainty.

Opening an account

Since Swissquote has a branched-out structure, the personal account for the banking trading account and for forex have different interfaces. Overall, the procedure of opening an account can be considered simple. However, the verification of documents may take a lot of time.

| Pros |

|---|

|

| Cons |

|---|

|

What is the minimum deposit on Swissquote?

Despite that there is no minimum deposit on Trading Account at Swissquote Bank, Forex Account is more suitable for active trading of several popular instruments (for example EURUSD, gold or CFD on a stock index). There is a minimum deposit on this account and it is comparatively high – from USD 1,000 or an equivalent amount. For more advanced conditions, you will have to pay up to USD 50,000.

Minimum deposit for different types of accounts on Swissquote

| Type of account, branch | Account currency Minimum deposit | Trading platform |

|---|---|---|

| Trading Account, Swissquote Bank | No minimum deposit. Multi-currency accounts with support of cryptocurrencies. | eTrading |

| Accounts for Forex and CFD trading, Swissquote Bank | From USD 1,000 to USD 50,000 or an equivalent amount. 15 currencies are supported | Metatrader 4, Metatrader 5, Advanced Trader, option of connecting via API |

| Accounts for Forex and CFD trading, Swissquote London | From USD 1,000 to USD 50,000 or an equivalent amount. 9 currencies are supported | Metatrader 4, Metatrader 5, Advanced Trader. |

| Account for investing via Robo-advisory | The minimum deposit is 10,000 CHF, but it is recommended to deposit 50,000. 3 currencies are supported: EUR, CHF, USD | Web interface of Robo-advisory |

Noteworthy, the minimum deposit of USD 1,000 is not the best option for the beginner, considering that the competitors set this amount at a minimum or even zero level.

| Swissquote | eToro | Degiro | |

|---|---|---|---|

| Minimum deposit | 1 000 USD | 200 USD | 0 |

Residents of which countries cannot trade on Swissquote

Swissquote London services residents of approximately 150 countries, while Swissquote Bank provides its services in around 120 countries. They include all European and the majority of large non-European countries, such as Australia and China.

However, you will not be able to open an account on Swissquote London, if you are from the U.S. or Japan. There are also some small countries, where the services of Swissquote are unavailable. The list of countries is available in the pop-down menu during opening of an account.

Documents required for opening an account

Swissquote complies with all international regulations on fighting money laundering, so everything is very strict here in terms of documents, just like in any other reputable bank.

You may need the following documents for opening an account:

- valid passport or another identification document. The photo and signature must be clearly visible.

- Document confirming your place of residence, specified in the application for opening the account. Utility bills, issued not later than 6 months, are considered sufficient proof.

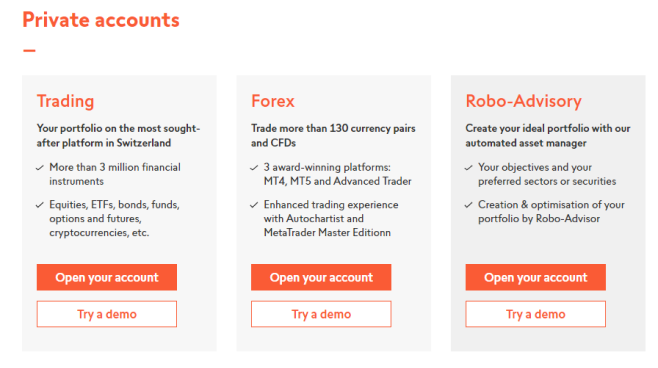

Account types at Swissquote Bank

Private clients can open three account types at Swissquote Bank:

- Trading Account. This is the most universal account. There is no minimum deposit on it and it offers access to millions of assets;

- Forex – Standard, Premium, Prime – these accounts with different minimum deposit requirements are designed specifically for trading currency pairs and CFD. Swissquote London also has similar accounts;

- Robo-Advisory, an investment account.

You can open a demo version of each of the real accounts.

Demo account

Opening a demo account is instant – you just need to press Try a demo. The instructions on gaining access will be sent to your email.

Demo accounts are valid for 30 days.

Account types on Swissquote London

At the London branch, focused on Forex and CFD, private clients can open three types of accounts:

| Premium | eToro | Elite | Professional | |

|---|---|---|---|---|

| Commissions | No commissions | No commissions | EUR 2.5 per lot | |

| Minimum deposit | 1,000 USD / EUR / CHF / GBP | 5,000 USD / EUR / CHF / GBP | 10,000 USD / EUR / CHF / GBP | 10,000 USD / EUR / CHF / GBP |

| Leverage | 1:30 (ESMA) | 1:30 (ESMA) | 1:30 (ESMA) | 1:400 (ESMA) |

| Spread | from 1.3 pips | from 0,6 pips | from 0,0 pips | from 0,0 pips |

| Stop out | 50% | 50% | 50% | 30% |

ESMA policy means that the maximum leverage available to ordinary traders is 1:30. To receive a possibility to trade with a leverage of 1:400, you need to provide documentary proof of trading large amounts for a lengthy period of time.

For all types of accounts on Swissquote London, the following is available:

- Metatrader 4, 5 Advanced Trader (all platforms have mobile and web versions);

- Access to over 80 forex instruments;

- Access to over 40 CFD.

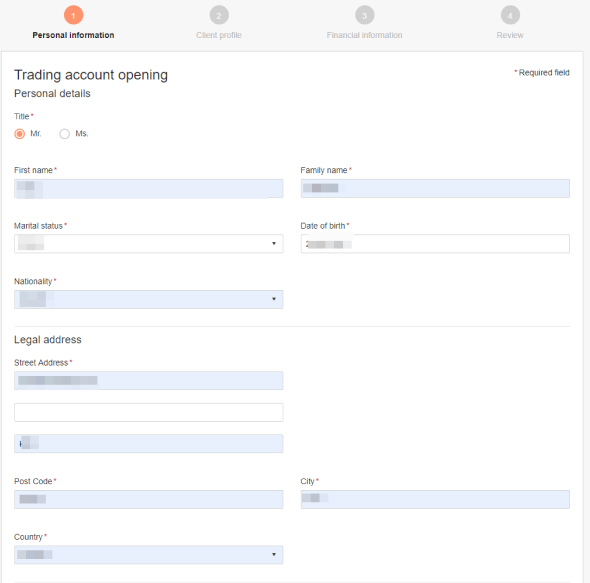

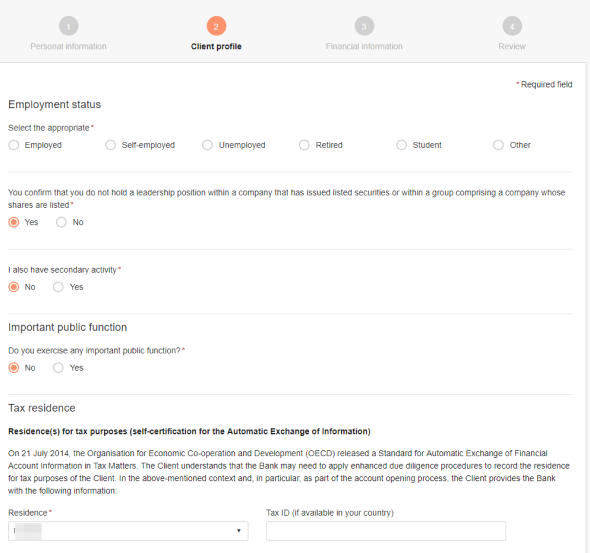

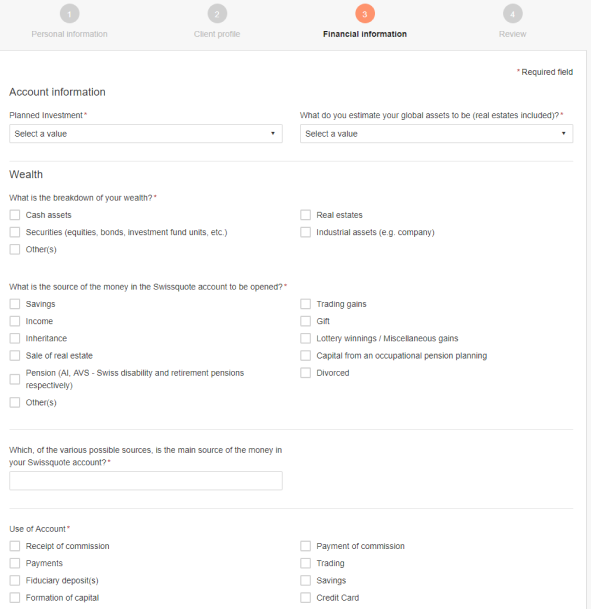

How to open an account: step-by-step guide

In order to open an account Swissquote Bank, you need to fill out an online application form, consisting of four steps.

Step 1. Provide personal information – first and last name, address, phone, marital status.

Step 2. Add information about your employment and tax data.

Step 3. Answer several questions about your wealth and knowledge of the markets.

Step 4. Confirm that the information you entered is correct.

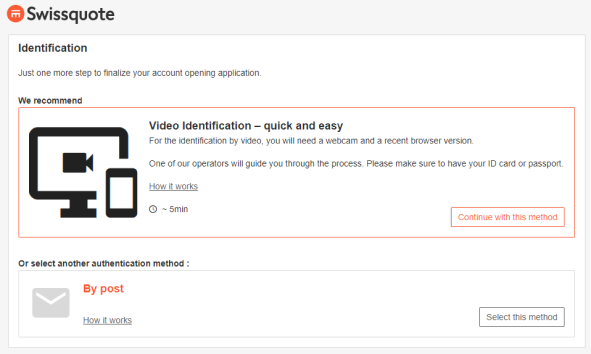

Then the process of proving the identity begins. It can be carried out by:

- Video;

- Post.

Confirmation by video is the recommended option. Judging by review on the Internet, no substantial problems occur and the process takes up to one hour.

In the case of sending the documents by email, you will need to certify copies of your documents with a notary public, print out and fill out additional forms. Naturally, this extends the period of opening an account to many days and depends on the speed of mail delivery.

Deposit and withdrawal

Deposit / withdrawal of funds on Swissquote runs smoothly like the Swiss watch. Several currencies and methods are available.

| Pros |

|---|

|

| Cons |

|---|

|

- The Trading Account at Swissquote Bank supports 21 currencies.

- The Forex account at Swissquote Bank supports 15 currencies.

- An account at Swissquote London supports 9 currencies

For comparison:

| Swissquote | eToro | Degiro | |

|---|---|---|---|

| Supported currencies | 21 | 9 | 1 (only USD) |

Methods and timeframe for deposits

| Method of deposit | Available for following accounts | Fee | Timeframe |

|---|---|---|---|

| Wire transfer | All accounts | Bank or broker’s fee | Several business days |

| Debit/credit cards | All accounts | from 2.2% to 2.5%, depending on your place of residence. or 0%* |

Up to 2 hours |

| Bitcoin, Ethereum | Only Trading Account at Swissquote Bank | 0 | Depends on a number of factors |

| Skrill | Only for Swissquote London | 0 | instantly |

* You can fund the account using Visa and Mastercard debit/credit cards with 0% fee only in two cases:

1. If the cards were issued by Swissquote

2. For accounts of Swissquote London

Let’s compare deposit methods with the competitors.

| Swissquote Bank Trading Account | eToro | Degiro | |

|---|---|---|---|

| Wire transfer | Yes | Yes | Yes |

| Visa and MasterCard debit/credit cards | Yes | Yes | Yes |

| Electronic payment systems | No | Yes, including PayPal, Skrill,Neteller | Yes |

| Cryptocurrencies | Yes | No | No |

Methods of withdrawal and fees

The number of withdrawal methods is a bit smaller. Swissquote withdrawal fee depends on the currency of the transaction and the country, where you are transferring funds.

| Method of withdrawal | Available for following accounts | Fee | Timeframe |

|---|---|---|---|

| Wire transfer | All accounts | 10 USD* | Several business days |

| Debit/credit cards | All accounts | not available | - |

| Bitcoin, Ethereum | Only Trading Account at Swissquote Bank | 0 | Depends on a number of factors |

| Skrill | Only for Swissquote London | 0 | instantly |

* Or 2 CHF, if the funds are withdrawn within Switzerland, Lichtenstein and SEPA countries (Single Euro Payments Area).

Let’s compare withdrawal conditions with the competitors.

| Swissquote Bank Trading Account | eToro | Degiro | |

|---|---|---|---|

| Wire transfer | Yes, USD 10 fee | 5 USD | Yes, zero fee |

| Visa and MasterCard debit/credit cards | No | 5 USD | No |

| Electronic payment systems | No | 5 USD | No |

| Cryptocurrencies | Yes, 0% fee | No | No |

Trading platforms

Swissquote Bank was started as an online service, providing quotations, which is why eTrading, its main web platform, looks very powerful and full, sometimes even too much.

| Pros |

|---|

|

| Cons |

|---|

|

Depending on the type of the account, different platforms are available to Swissquote customers. Accordingly, the set of instruments may also differ. In the table below, we reviewed the information about the platforms.

| Platform | Account | Versions | Instruments |

|---|---|---|---|

| eTrading Swissquote.CH | Only Trading Account at Swissquote Bank | Web version and mobile version | All, except for Forex and CFD |

| Advanced Trader | Only for Swissquote London and Forex accounts at Swissquote Bank | Desktop, web and mobile versions | Forex and CFD |

| Metatrader 4 | Only for Swissquote London and Forex accounts at Swissquote Bank | Desktop, web and mobile versions | Forex and CFD |

| Metatrader 5 | Only for Swissquote London and Forex accounts at Swissquote Bank | Desktop, web and mobile versions | Forex and CFD |

| Robo-Advisor platform | Only for investment accounts Robo-Advisor | Web version and mobile version | Stocks, bonds, ETF, money on the account – at customer’s choice |

Review of eTrading (Swissquote.CH) platform

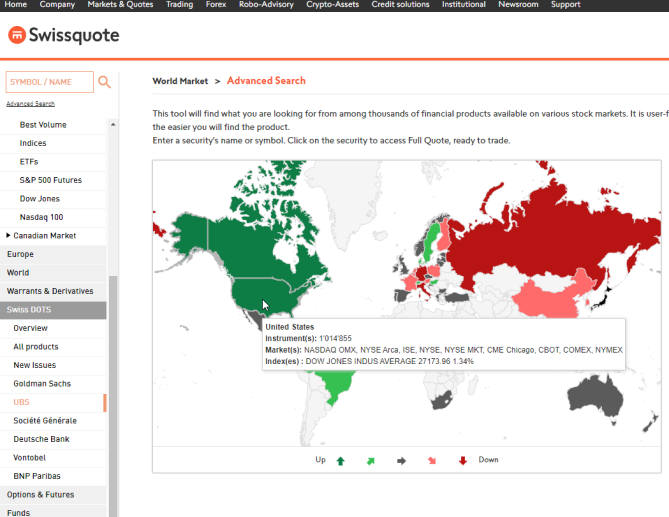

eTrading is a portal on Swissquote.CH domain, featuring information about 3 million financial instruments: quotations and fundamental information. The service also provides powerful search features across this financial universe, while the registered users can customize the settings: create observation lists, perform trades, set up notifications, etc.

It is worth noting that there are 2 web interfaces of eTrading – static and dynamic. The static one is essentially the main interface with the navigation column in the left part of the screen. To access it, you simply need to follow this link: https://swissquote.ch

In the image above, you can see a screenshot of the static interface. We selected the World item to see the heat map of the markets. This is one of the many features of the search option.

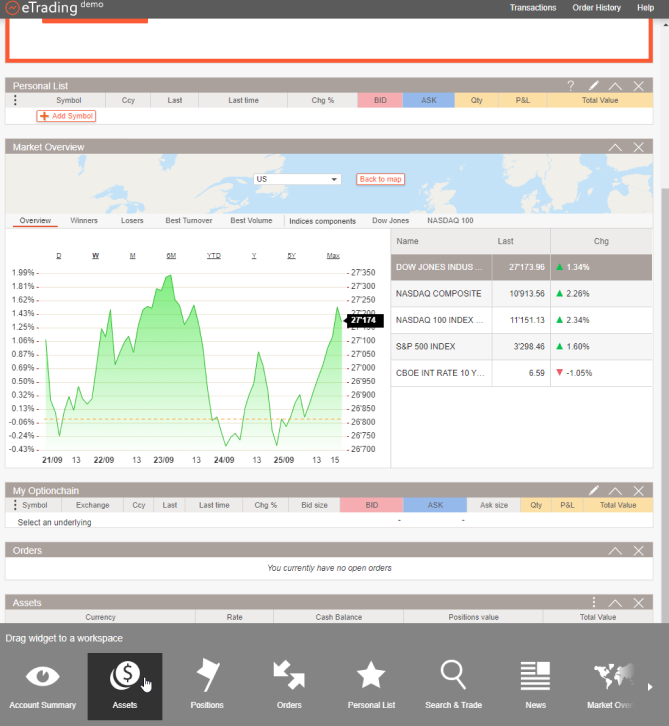

The dynamic interface of the eTrading platform is an area we accessed from one subpage on the main domain swissquote.com. The workspace of this interface can be completely constructed using widgets that are activated / deactivated and moved around as convenient for the user.

Noteworthy, the interfaces are different and look like separate programs, while being on the same domain and having an overlapping set of tasks. It is possible that the dynamic interface was designed as a tribute to the touch screen-inspired trend? Be that as it may, different interfaces with similar functionality are really confusing. Moreover, transitions between sections sometimes occur with logoff.

These are only some drawbacks. We will now review the peculiarities of eTrading platform as well as some other drawbacks.

Pros of eTrading platform

The benefits of eTrading platform include:

- Support of 3 languages: English, French and German;

- Flexible customization;

- Notification option;

- An option to set up secure authentication using a physical code card or mobile authentication. There have been no known cases of hacking or theft of funds. Everything is reliable, as it should be in a Swiss bank.

- 5 types of orders: limit, market, stop, stop limit, OCO.

The order form is clear and the quality of execution is high.

We’d like to say a few words about the search function. It is very important for the customers to be able to navigate the millions of instruments, which is why the developers made sure that they find what they need. The securities can be sorted by:

- markets,

- sectors,

- ratings,

- fundamental factors and other criteria.

There is a built-in newsfeed, and automatically updated Losers/Winners rating.

Drawbacks of eTrading platform

The quality of the charts is quite low. They are most certainly not designed for active traders.

In the static version of eTrading, only the broken line charts with the sole volume indicator are available. Only 7 timeframes can be selected.

In the dynamic version, you can choose candles, bars. There is a function for scaling the chart, a possibility to add 18 indicators, graphic elements. However, all work with the charts seemed outdated, because the design is outdated, the visual elements are poorly read and the interaction with the charts is not intuitive.

Strong emphasis on the Swiss financial market can also be considered a drawback of eTrading. In particular, securities of SIX exchange are higher in the menu than NYSE. Also, the American exchanges are hidden in the sub-menu North America.

Other financial products of Swissquote are also actively promoted in the menu – Theme Trading, Swiss DOTs, Forex accounts, Robo-Advisory accounts.

Based on the negative reviews about the platform that we found online, we’d like to single out the fact that it is relatively difficult to receive a clear answer about all the commissions paid. For example, a customer has to wait for 30 minutes to draw up an asset report.

Mobile version of eTrading

Swissquote allows its mobile customers the following:

- holders of Forex accounts have access to their funds via the mobile version of Metatrader platform;

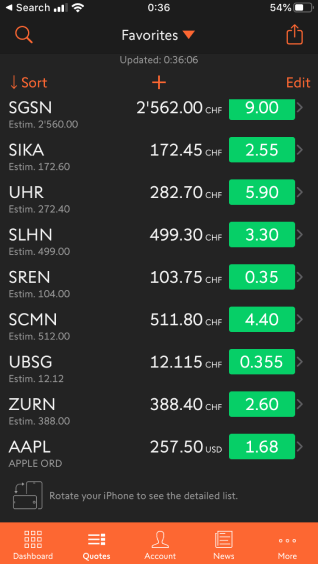

- holders of Trading Accounts at Swissquote can download the mobile app providing access to eTrading platform on their devices. The iOS and Android versions are available. Interestingly, on Play Market, the app has a low rating of 2.6. On the App Store, the rating is acceptable 4.4.

This difference of opinions is a bit confusing, as the mobile versions have similar interfaces. It seems you will have to form your own opinion.

We, on the other hand, believe that the mobile version is quite good.

Peculiarities of the mobile version of eTrading

- modern design, especially compared to the web version of eTrading;

- one-step login is set by default, but you can activate an additional PIN code or connect password management service, or set up biometric authentication;

- mobile platform is available in English, French, German and Italian;

- there is a financial news column;

- the search results show many Swiss assets (nothing new);

- you can set up notifications for different types of events.

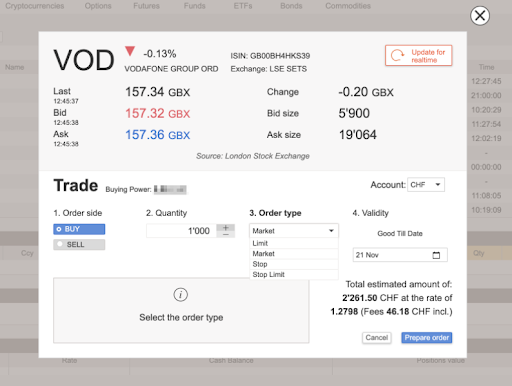

The customers can place market, limit, stop and stop limit orders. The process of placing an order is intuitive.

Review of Advanced Trading platform

Advanced Trading is a proprietary platform of Swissquote. It is designed for Forex and CFD trading. The traders in these markets can choose from Metatrader (4 and 5) and Advanced Trader.

In the table below, we provide a comparative description of the features of these platforms.

| Advanced Trading | Metatrader 4 | Metatrader 5 | |

|---|---|---|---|

| Forex pairs |  |

|

|

| Forex options |  |

|

|

| Precious metals |  |

|

|

| Spot CFD |  |

|

|

| Forward CFD |  |

|

|

| Synthetic CFD |  |

|

|

| Desktop version |  |

|

|

| Web version |  |

|

|

| Mobile version |  |

|

|

| Customizable interface |  |

|

|

| Timeframes | 8 |

9 |

21 |

| Technical indicators | 27 |

30 |

80 |

| Automatic pattern recognition |  |

|

|

| Algorithmic trading (expert advisors) |  |

|

|

| Copy trading |  |

|

|

| Hedging opportunities | At request |

|

|

| Complex types of orders |  |

|

|

| Customizable trading interface |  |

|

|

| Market news (Dow Jones) |  |

|

|

| FX Insider |  |

|

|

| FIX API |  |

|

|

| Multi Account Manager (MAM) |  |

|

|

Based on the table above, we can conclude that Advanced Trading is designed to satisfy the demands of the advanced traders and realize developments of the company:

- trading synthetic CFD and Forex options;

- application of complex types of orders;

- introduction of own special features – FX Insider and pattern recognition;

- API connection.

Let’s review the desktop version of Advanced Trading platform.

The design is outdated, just like in several other products of Swissquote. I may be biased, but big multi-colored buttons can look impressive only to the beginners. The good thing is that the workspace can be customized.

Other unique features of the desktop version of Advanced Trading:

- To access the platform you need a username and password, which are sent to email.

- There are second-based timeframes, and there are tick timeframes. There is an option of loading history for 30 years.

- In addition to standard charts, also Heiken Ashi and Dots are available.

- In addition to standard orders, also Trailing Stop is available. There are also OCO orders, If-Done and If-Done/OCO, which allow to build scenarios of cancellation/placement of the following orders after the previous are executed.

- There is a set of functions to build different financial reports and statements.

- You can see on the image above how the candle pattern recognition function works. The brighter the pattern, the stronger it is. This function may be useful to the beginners, who are learning candle analysis.

- There is no option board. Opening of a position is done through the menu (image below). Noteworthy, order execution may stretch to a full minute.

To learn more about the program we selected the Help menu. From there, we were redirected to the online User Guide in PDF format. To explore the functionality of working with charts we pressed on the Chart User Guide link and were redirected to a 404 page on the old version of swissquote.com

Overall, the platform leaves a mixed impression. On the one hand, it has some professional-level features, and on the other side, there are drawbacks (small number of indicators, no market profits and other modern tools, weak help files).

We also recommend watching the video guide on setting up the Advanced Trader platform. You can learn how to set up the view, search trading instruments, make traders, additional technical analysis instruments and other useful information.

Metatrader from Swissquote

Swissquote supports trading via both MetaTrader versions – 4 and 5. This platform from Metaquotes is probably the most popular in the world platform for online trading, which is why we will not go into its functions too deeply.

We will, however, point out two important features.

- Master Edition

- Autochartist

Master Edition is an upgrade that expands standard features of MetaTrader. Those using Master Edition of MetaTrade from Swissquote will receive:

- The ability to use the correlation map;

- More options for working with the orders;

- Additional improvements to the platform’s interface.

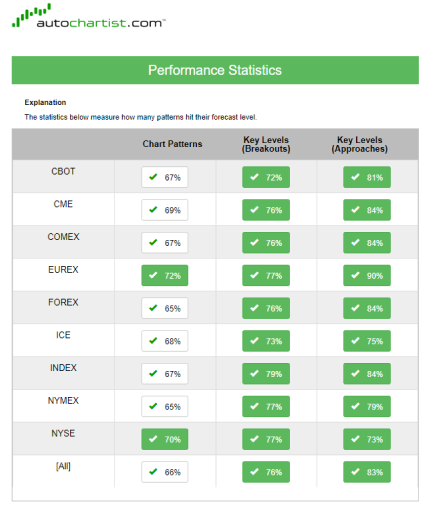

Autochartist is a plugin of the namesake company. Upon installing it in MT4 or MT5, the holders of Forex accounts from Swissquote receive a powerful market scanner. Autochartist continuously monitors the markets in search of technical analysis setups (such as chart patterns, support/resistance lines). It also does it on different timeframes.

Autochartist will be useful for the following purposes:

- Receiving a lot of ideas that can be customized based on various filters;

- Saving times and effort for searching setups;

- Obtaining skills of trading on financial markets, acquiring systematicity and discipline.

Based on the claims of the plugin’s developer, its signals have a high percentage of realization, so it is worth considering it. Thankfully, the plugin is available to Swissquote customers for free.

Analytics

Swissquote offers many news items from different sources in different languages. Some surveys are only available at an extra fee, which is kind of a drawback.

| Pros |

|---|

|

| Cons |

|---|

|

Analytical materials can be divided into three groups:

1. Corporate news – press releases and news about Swissquote

2. Forex analytics – reviews of charts with the specification of support and resistance levels with comments from Swissquote experts;

3. Fundamental news – short reviews of political and economic events.

Trading Central deserves separate mention. It is a plugin for Metatrader, which is exclusively available to Swissquote customers. After installing Trading Central on the platform, its users will immediately see important levels and forecast comments by the analysts of the company on the current charts.

Education

Swissquote offers a large number of materials that contain simple explanations about the following:

- The structure of financial markets, basic terminology

- Types of financial assets and what they are

- How to open accounts and perform traders

- How to use trading platforms

- How to manage risks, invest

| Pros |

|---|

|

| Cons |

|---|

|

Overall, Swissquote Bank is better than Swissquote London as the educational resource, since the main website features a large number of materials and they are localized in more languages.

Review of the resources:

- Youtube. There are almost 7,000 subscribers to youtube.com/user/SwissquoteBank/ In addition to ads, there are playlists on the channel divided by different languages, where the viewers can learn about the products / services of the bank, and about general topics related to active trading and investment in different markets.

- Webinars. There is a list of announcements on the future webinars in different languages at swissquote.com/education/webinars The users can register for these events.

- Tutorials. You can download small e-books about trading and investment at swissquote.com/education. They are intended for the beginners.

Customer support

When we were preparing this review, we contacted the customer support team via the online chat on the website.

| Pros |

|---|

|

| Cons |

|---|

|

Channels of communication

- Chat. To start a chat with an operator, press the button in the lower right side of the website.

- Global hotline.

- Main call center, which services all customers. There are also separate numbers for the calls from abroad.

- Local support by phone. There are regional call centers in the countries of Europe, Asia.

- Feedback form. Available for sending messages to the support team from your personal account.

- Email. We did not test this method, but judging by the online comments, the answers are not always full.

Languages and operating hours of customer support at Swissquote Bank:

Customer support at Swissquote Bank is available in several languages: Arabic, Chinese, Czech, English, French, German, Italian, Spanish and Russian.

Operating hours of customer support:

- Hotline operates 24/5.

- Main call center. From 8-00 till 22-00 CET, Monday through Friday.

- The department that services credit card holders; operates 24h.

Important contact numbers:

- +41 22 999 94 76 – Hotline for Swissquote customer supports for calls from abroad

- +41 44 825 88 88 – Mail call center

- +41 44 825 87 77 – customer support on Forex trading

Languages and operating hours of customer support at Swissquote London:

Customer support at Swissquote London operates in three languages: English, Italian and Spanish.

Operating hours of customer support:

- 08.00-18.00, London time.

Important contact numbers:

- +44 207 186 26 00 – call center in London

- The list of local numbers you can reach the London support team from different countries can be found here

Bonuses and promo

Swissquote is the official financial partner of Manchester United FC. This partnership allows the Swiss company to produce marketing materials featuring the stars of the renowned football club.

Evaluating bonus programs and promo offers, we can say that Swissquote does not offer too many prizes and additional benefits. On the one hand, this can be viewed as a drawback. However, we should keep in mind that excessive activity in attracting customers, promising them easy and big money, is a sign of unreliable organization. This does not apply to Swissquote. That is why the company’s bonus policy is conservative and has one clear social focus on attracting new customers.

Bonuses from Swissquote Bank:

Swissquote Bank offers trading credits in the amount of 100 CHF both for new customers and those who referred them. How does it work?

1. Let’s say you are a customer of Swissquote Bank; you like its services and you are ready to recommend it to friends. You fill out a form in your personal account and receive a personal Sponsorship number.

2. Your friend agrees to open an account. When opening an account, he must specify your Sponsorship number.

3. When your friend funds the account for the amount of 100 CHF, Swissquote will accrue 100 CHF of trading credit for him and for you.

Bonuses from Swissquote London:

Swissquote London is actively looking to attract new customers. In the highly competitive market of forex brokers, they offer a CPA marketing program, paying bonuses to the partners, who managed to attract real customers.

According to the conditions of this program, the partners can be assigned three levels, depending on the number of active customers they attracted. The more customers they attract, the higher are the bonuses.

| Number of trades per new introduced client | Silver (1-25 traders / month) | Gold (26-50 traders / month) | Platinum (+51 traders / month) |

|---|---|---|---|

| 10 lots | EUR 600 | EUR 700 | EUR 800 |

| 5 lots | EUR 500 | EUR 600 | EUR 700 |

Summary

Swissquote is a reliable Swiss bank and a large European broker with a positive reputation and licenses from reputable regulators. Based on the high commissions and requirements to the minimum deposit, we can rightfully conclude that Swissquote targets large customers, mainly from Switzerland and European countries.

This broker will be suitable for you, if:

- You need the Swiss reliability;

- You need a wide selection of markets (Trading Account at Swissquote Bank will suit you best);

- High quality of order execution of the interbank Forex market is important to you (Account for Forex and CFD will be most suitable for these purposes);

- You have large capital at your disposal for medium-term trading or long-term investment. In this case, the commission amounts will not impact the final result;

- You need investment strategies for long-term holding of positions (Swiss DOTs, Robo-Advisory, Theme Trading will be most suitable for these purposes).

NOTE! All fees, conditions and calculations are provided for demonstration purposes and may differ from the actual ones due to the changes in trading conditions, divergence of spreads or other factors. Contact the broker for more accurate and updated information on services and fees.

Real reviews of Swissquote 2025

What a complete scam! I invested 15,000 usd with this so-called broker, and they manipulated the spreads right before my eyes. Spreads shot up by over 10% during low volatility, wiping out my positions. And good luck trying to get customer support. Their reps are rude, clueless, and hung up on me when I asked for an explanation. It’s like they’re trained to steal your money and then vanish. I’ve seen amateur platforms run smoother than this garbage. You’d be insane to trust them with a single dollar!

What a nightmare dealing with Swissquote! They were all smiles when taking my usd 2,500 deposit, but when it came time to withdraw my 150% profit, suddenly their system ‘couldn’t recognize my account details.’ Phone calls go unanswered, and emails bounce back. Then, one morning, their website was just gone – vanished into thin air with my money and dreams. If you ever hear the name swissquote in forex, run the other way! These are not brokers; they are highway robbers with fancy websites.

I do not recommend cooperating with Swissquote, because the support here does not care about customers at all. I have to wait a long time for an answer and a solution to the problem.

Возможно, для долгосрочного инвестирования и крупного торгового оборота Swissquote и подходит, но новичкам сотрудничество с этим брокером “противопоказано”. Порог входа высокий, приходится пройти длительную и муторную процедуру регистрации, вывод профита длительный. Меня такой вариант не устраивает.

Swissquote charges high commissions, so I find it unprofitable for an active trader to work with this broker. Broker better passes to investors.

Swissquote has become a real salvation! Several times I got to second-rate Forex scam, where they just give empty promises. And in this company everything is stable: it provides the comfort of trading, payments are prompt. I have already earned more than $ 10,000.

I am just looking at Swissquote. The confusing structure frightens, I haven't figured it out yet (a bunch of domains, divisions). I heard positive reviews about this broker, but didn't even have the opportunity to rate my personal account! This requires opening a real trading account.

For intraday traders, Swissquote is not suitable because the commissions for transactions with securities are quite high. It is fair to say that for traders with long-term strategies, this broker can be a worthy partner.

Swissquote requires too large an initial deposit, cooperation is not available for beginners. A pity, I had plans to work with this broker.

I have been working with Swissquote for several months. In general, favorable impressions. They have a huge choice of assets in numerous markets from around the world and brilliant analytics. On the other hand, the fees are high. You should pay an extra fee for Swiss quality...