On this page, you will find a large number of reviews from the real Tickmill If you are already working with If you are already working with Tickmill please leave your review to help other traders gain a correct understanding of the company. We are proud not to have any censorship on reviews on our website – ForexUp has been helping users choose brokers for the past five years, while remaining unbiased and independent.

Tickmill Review 2021

Tickmill Group is a young brokerage company from London, providing services for Forex traders from all across the globe.

According to the statement of Tickmill Group:

- 160,000 clients with opened 350,000 accounts work with the company;

- The broker executed 275 million traders

- The group employs 150 people.

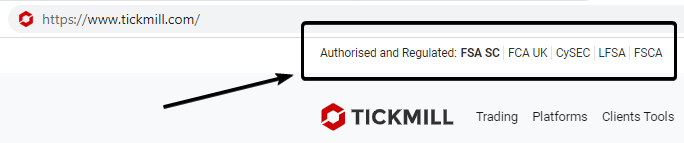

NOTE! At the time this review was prepared, Tickmill Group had several legally separate branches, regulated by 5 different organizations. We will focus our review on Tickmill, which is regulated by the FSCA SC (the Seychelles).

This branch:

- Opens on the broker’s ‘main domain’ at tickmill.com;

- Offers the most beneficial conditions;

- Is the most popular among the broker’s customers.

In some cases, we will specify the differences in conditions between different branches.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

According to available information, real traders, who have an inside knowledge of the needs of a Forex trader, are the creators of Tickmill.

If your strategy implies active intraday trading and narrow spreads and high execution speed are critical, Tickmill is certainly worth looking at. We hope that our review will help you make the right choice.

In the course of our review, we will compare Tickmill with such serious competitors as FXTM and IG.

Key features

| Regulation | Seychelles (FSCA SC), Cyprus (CySEC), UK (FCA), South Africa (FSCA), Malaysia (LFSA) |

|---|---|

| License number | FSA SC registration number 09369927, License number SD008 CySEC 278/15 FCA Firm reference number 717270 LFSA MB/18/0028 |

| Commissions and fees | Low |

| Demo account | Yes. Demo account is deactivated after 7 days of inactivity. |

| Minimum deposit | 100 USD |

| Inactivity fee | No |

| Period for opening a live account | Within 1-3 days |

| Leverage | Up to 1:500 |

| Markets | Forex and CFD. Futures are also available on Tickmill UK LTD. |

| Options for passive income | Yes, Copy-Trading service in combination with Myfxbook |

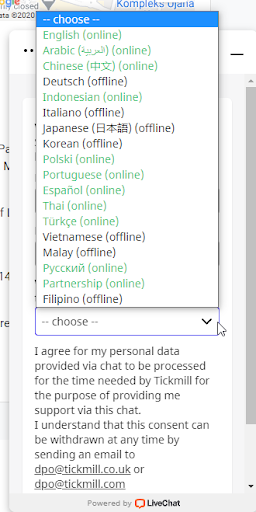

| Support languages | 17 languages – English, Arabic, Chinese, German, Indonesian, Italian, Japanese, Korean, Russian, Spanish, Polish, Portuguese, Thai, Turkish, Malay, Vietnamese, Filipino. The website is localized in 14 languages. |

| Withdrawal fee | 0% regardless of the withdrawal method |

| Withdrawal to credit/debit card | Yes |

| Deposit and withdrawal via cryptocurrencies | No |

| Deposit from electronic wallets | Yes |

| Supported currencies of the account | EUR, USD, GBP. Plus PLN (only for citizens of Poland) |

| Deposit bonus | No |

Page content

Geography of broker’s customers

According to our research, Tickmill customers from different parts of the world have different preferences. European mostly open accounts in the Cyprus jurisdiction (Tickmill.eu) or UK (Tickmill.co.uk), while the rest of the world prefers to be serviced in the offshore territory in the Seychelles.

| Country | Percentage of customers |

|---|---|

| Malaysia | 9,8% |

| South Africa | 8,5% |

| Vietnam | 5,1% |

| Thailand | 4,8% |

| Brazil | 4,4% |

Commissions and fees

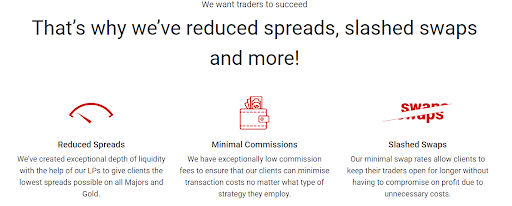

Tickmill offers some of the lowest commissions on the Forex market. The spreads on the most popular CFDs are low or average.

In the course of this review, we will compare commissions of Tickmill and its competitors – FXTM and IG to find out how much a trader will actually have to pay for a specific trade, taking into account direct commissions and the spread.

All commissions and trading conditions are valid as of 11.01.2021.

| Pros |

|---|

|

| Cons |

|---|

|

Summary of commissions and fees on Tickmill

| Asset | Commissions* |

|---|---|

| EUR/USD | On the PRO account – $2 (or 2 units of another base currency) fee per standard lot plus an average spread of 0.1 pips |

| CFD on S&P 500 | Average spread 0.39 pips |

| CFD on Brent Oil | Average spread 0.04 pips |

| XAUUSD | Average spread 0.09 pips |

| Non-trading commissions | No |

* as of 11.01.2021.

Review of the broker’s commissions on Forex market

Tickmill will be interesting for active players on the Forex market thanks to minimum commissions on major trading pairs on the Pro and VIP account types. The broker charges a small commission per lot, while the spread is rather of a market level.

We compared how much a trader will actually have to pay for execution of a standard lot of 100,000 units of base currency on Tickmill, IG and FXTM. The table features the amount in USD, including the commissions and spreads of the brokers.

| Tickmill (PRO) | IG | FXTM (ECN) | |

|---|---|---|---|

| EURUSD | $3 | $7 | $5 |

| GBPUSD | $5 | $15.2 | $7 |

| USDJPY | $3 | $7.5 | $5 |

| EURGBP | $7.3 | $17.6 | $8.6 |

| AUDJPY | $8.55 | $12.9 | $8.8 |

| USDZAR | $51.48 | $76.5 | $89.2 |

The comparison showed that FXTM offers more beneficial conditions for active trading not only in major, but also exotic pairs.

Swaps on Tickmill

As a reminder, a swap is caused by the difference in the interest rates of banks that issue currencies in the currency pair. Some brokers also charge additional fee for position rollover, which is why the values of the swaps may differ.

When the swap is positive a certain number of points are accrued to the account in case of a position transfer to the following day, and when the swap is negative, a certain number of points is written off the account.

| Swap Long | Swap Short | |

|---|---|---|

| EURUSD | -5.3 | 0.5 |

| GBPUSD | 0.3 | -3.8 |

| USDJPY | 0.1 | -0.8 |

The size of the swaps on FXTM is close to the market level, which makes application of not only short-term, but also medium-term strategies beneficial. Long-term investors also have an opportunity to trade towards a positive swap.

| Tickmill | IG | FXTM | |

|---|---|---|---|

| Swap free | Yes | Yes | Yes |

Commissions on CFD

The majority of available trading instruments on Tickmill are CFDs, while the commission is ‘built into’ the spread.

We compared how much a trader will have to pay for execution of a $5,000 lot in CFD of different classes on Tickmill, IG and FXTM. The table features an average value, including commissions and the spread of the specified brokers.

| Tickmill | IG | FXTM | |

|---|---|---|---|

| CFD on S&P 500 | $0.6 | $0.6 | $1.41 |

| CFD on BRENT Oil | $4.7 | $2.65 | $5.95 |

| CFD on gold (XAUUSD) | $0.24 | $0.65 | $0.24 |

As we can see, Tickmill’s commission on key markets is on the same level as its competitors or lower.

Non-trading commissions

Tickmill does not charge deposit and withdrawal fees. Also, the broker covers the bank’s fees for the amount of up to $100.

Inactivity fee is not charged, but the broker may charge account maintenance fee at its own discretion, if there is no trading activity on the account.

| Tickmill | IG | FXTM | |

|---|---|---|---|

| Inactivity fee | No | Yes | Yes |

| Withdrawal fee | No | No | No |

| Deposit fee | No | No | No |

Reliability and regulation

We estimated the company’s level of reliability as high.

Tickmill Group was established in 2014. The group includes several branches with regulation in different jurisdictions; each branch (a separate legal entity) has its own website.

- tickmill.com (mirrors on tickmill.online and tickmill.net) – the main branch Tickmill Ltd is regulated by the Seychelles Financial Services Authority (FSA SC);

- tickmill.co.uk – the London branch Tickmill UK Ltd is regulated by the Financial Conduct Authority (FCA). The headquarters are located in the City, the financial block of the capital of the UK). Tickmill UK Ltd is a member of the Financial Services Compensation Scheme (FSCS). The FSCS’s objective is to pay compensation to investors up to the value of £85,000 per client.

- tickmill.eu – European branch Tickmill Europe Ltd is regulated by CySEC, Cyprus. Tickmill Europe Ltd is a member of the Investor Compensation Fund (ICF). The client’s funds are protected for an amount of up to EUR 20,000.

In addition to the listed branches, the following also belong to the main website Tickmill.com:

- Tickmill South Africa with headquarters in Cape Town is regulated by the Financial Sector Conduct Authority (FSCA);

- Tickmill Asia Ltd with headquarters on the offshore island of Labuan, which is a part of Malaysia, is regulated by the Financial Services Authority of Labuan Malaysia (LFSA).

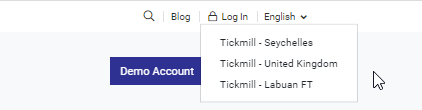

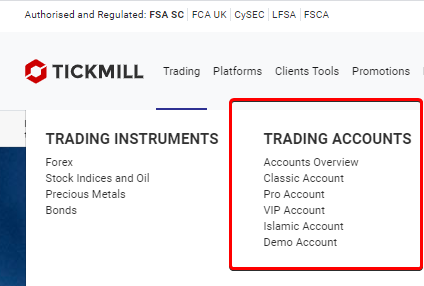

All websites of the broker are of the same type and structure. In the upper part of the pages, you can find a sort of selector. By clicking on the abbreviations of the regulators, the visitors can switch between the broker’s branches, thus changing jurisdictions. This is important when you are opening an account and studying the conditions.

A similar set of features with the selection of the branch can also be found on the login page.

Tickmill is also registered with:

- FFSA (Federal Financial Supervisory Authority, Germany);

- CONSOB (Commissione Nazionale per le Società e la Borsa, Italy)

- ACPR (Autorité de Contrôle Prudentiel, France)

- CNMV (Comisión Nacional del Mercado de Valores, Spain)

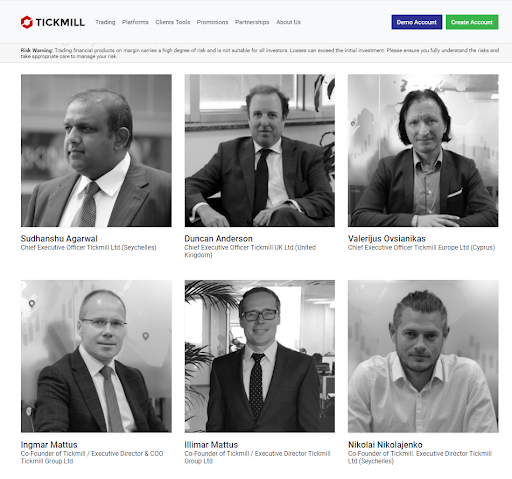

High professional qualities of the brokers have been confirmed multiple times by different awards, which Tickmill receives every year.

We estimate the broker’s reliability as high.

The strong suits speaking in favor of Tickmill include:

- Clean reputation

- A number of licenses issued by different highly respected regulators

- Client funds are kept on segregated accounts

- Negative balance protection

- Transparency of information about top management.

The gentlemen from Tickmill management know how to build a successful broker. The results of the broker’s operation speak for themselves.

All key indicators registered growth in 2019.

In terms of drawbacks of protection, account login is not sufficiently secure. In particular, there is no two-factor authentication.

Markets and products

Tickmill offers rather a narrow choice of financial markets. Mainly forex pairs and CFDs are available.

| Pros |

|---|

|

| Cons |

|---|

|

“It’s not about the quantity, but about quality!”

It seems that is the principle Tickmill operates by. There are indeed not many instruments – these are either Forex pairs or CFD; however, execution and spreads deserve positive assessment.

| Tickmill | FXTM | IG | |

|---|---|---|---|

| Forex | Yes | Yes | Yes |

| Stocks | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes |

| Crypto | No | No | Yes |

| Bonds | Yes | No | Yes |

| Commodities (oil, metals, wheat, gas, ores, etc.) | Only CFD on metals and oil | Yes | Yes |

| Mutual funds | No | No | No |

| ETF | No | No | Yes |

Also noteworthy, customers of Tickmill UK Ltd have access to futures trading, which substantially increases market coverage, for example futures on bitcoin, natural gas, agricultural products, etc.

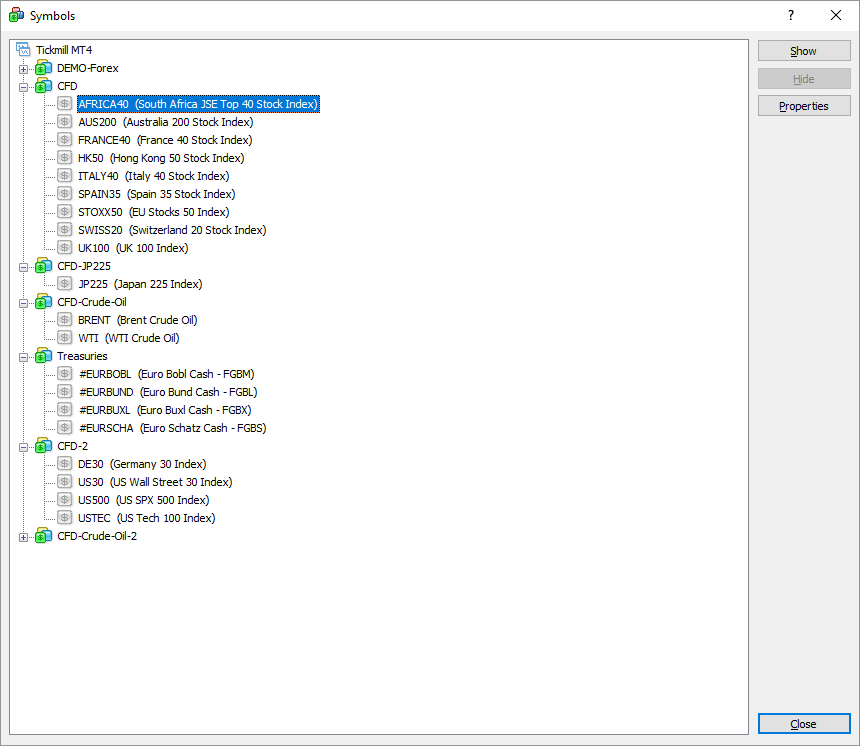

You can review the markets available on the offshore branch on Tickmill on the screenshot from MetaTrader platform below.

Absence of stocks – real or CFD is a big drawback of Tickmill.

Forex and CFD market

Trading CFD and Forex pairs is the fullest offer of Tickmill.

| Tickmill | FXTM | IG | |

|---|---|---|---|

| Number of trading pairs | over 60 | over 60 | 205 |

| CFD (stock indices, stocks, bonds, metals, oil) | 18 | over 200 | 12500* |

* - IG offers over 10,000 CFD on stocks alone.

Below, we list the markets, which are currently unavailable, but would be quite appropriate for adding to the line of products:

- Cryptocurrencies (real or CFD)

- stocks (real or CFD)

- gas, agro-industrial products, (real or CFD)

- ETF, mutual funds.

Futures market

Naturally, Tickmill is aware that the number of markets is the weak spot of the company, which is why in order to somehow tackle this drawback, the broker offered access to futures trading to its customers in 2020.

However, there are three important details:

- Futures markets are only available via Tickmill UK Ltd, the London branch;

- It is possible to trade futures only via CQG platform, which is paid for in the majority of its versions;

- The minimum deposit is 1,000 USD.

Having CQG platform and an account with a balance of USD 1,000 or more on Tickmill UK, the customers receive access to 5 futures markets – CBOT, CME, COMEX, NYMEX and EUREX.

| Exchange | Number of futures markets | Base assets |

|---|---|---|

| EUREX | 6 | Eurobonds, stock indices |

| CBOT | 12 | Interest rates, agro-industrial commodities, stock indices |

| CME | 19 | Forex rates, interest rates, agro-industrial commodities, stock indices |

| COMEX | 7 | Metals |

| NYMEX | 7 | Energies |

The futures market is not available for all other jurisdictions, in which the broker operates.

Conclusion. Access to futures markets of the USA is a rather standard service for well-respected brokers. However, Tickmill offers a rather ‘limited’ access to this service. We can write it off to the young age of the broker. Tickmill is only 5-6 years old, while IG, for example, has been around for 46 years.

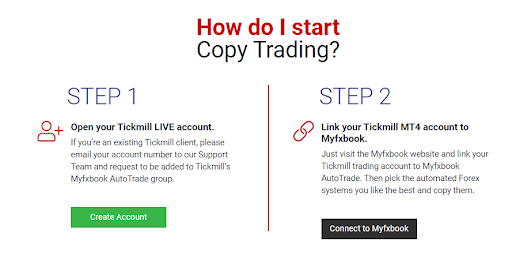

Copy Trading

Copy Trading service is a format of the service for creating a passive income source. Copy Trading service is not provided for the holders of the accounts, which were opened in the jurisdiction of FCA UK, CySEC.

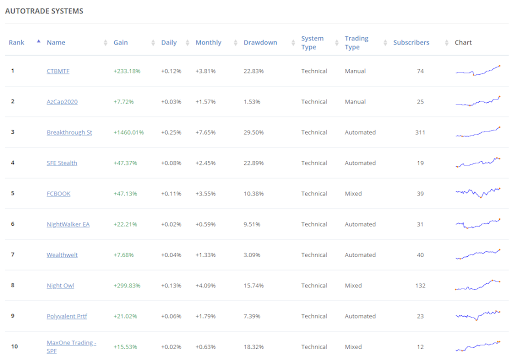

Tickmill provides copy trading service together with Autotrade by Myfxbook. To start using the Copy Trading service, you need to have USD 1,000 in your account.

Thanks to Copy Trading, any investor can connect their account to the account – supplier of traders. In this way, the traders that a successful trader performs will be copied to the investor’s account.

This format has benefits for all parties involved:

- An investor is not required to have a lot of knowledge or experience in order to profit from fluctuations of the exchange rates and prices on CFD

- An investor saves time and effort

- A trader earns additional profit as a percentage of the investor’s profit

- A broker earns additional profit through commission

Drawbacks:

- USD 1,000 may be a bit a lot for those who are only beginning to trade

- Successful trades in the past do not always guarantee profit in the future

- There are technical nuances – speed of copying, proportionality of capitals

- A comparatively small choice of strategies. We found 58 provides for copying.

Noteworthy, in order to become a signal provider within Autotrade from Myfxbook, a person needs to:

- have an account with a history of at least 3 months and a balance over USD 1,000

- the drawdown on the account should not exceed 50%

- perform at least 100 trades

- average position holding time – over 5 minutes

- for the system not to use risky trading methods.

As you can see, these conditions are quite tough and they can easily weed out unprofessional signal suppliers.

Conclusion. Copy Trading service is not a proprietary product of Tickmill. Nonetheless, the broker pays sufficient attention to the Copy Trading service, which looks attractive for those who wish to diversify their portfolio and/or start earning profit without trading themselves.

Geography of markets

With an account opened in Tickmill, registered in the offshore jurisdiction (the selection of markets for different accounts is identical), the broker’s customers can trade over 60 currency pairs and also CFD with base assets from different countries.

- America: CFD on stock indices Dow Jones, Nasdaq 100, S&P-500

- Europe: CFD on Euro Stoxx 50, and also on CFD on the stock index of Germany, Switzerland, Spain, France, UK. In addition, CFDs on European bonds are available.

- Asia: one CFD on stock index of Australia, Hong Kong, Japan each.

On the platform, we discovered a CFD on JSE40 (South Africa). It is a rather rare asset, so we decided to check. It turned out that it was a mistake. There is no information about this instrument on the website and a representative of customer support told us that JSE40 is not available and that we would pass the information about the error to the corresponding department.

Conclusion. Overall, the selection of markets is very limited. That is probably the biggest drawback of Tickmill. By opening an account in the UK, you can expect more diversity thanks to futures.

Opening an account

Despite that Tickmill LTD branch is based in an offshore territory, the procedure of opening an account on tickmill.com is more similar to opening an account in a more strictly regulated area. Overall, we estimated convenience and thorough approach to the procedure as the broker’s advantages.

Pros and cons

| Pros |

|---|

|

| Cons |

|---|

|

|

What is the minimum deposit on Tickmill?

For live accounts of Forex Standard type, the minimum deposit is $100.

| Tickmill | FXTM | IG | |

|---|---|---|---|

| Minimum deposit | 100 USD or an equivalent | 100 USD or an equivalent | 0 |

The low entry threshold is a benefit of Tickmill, as it attracts customers with low capitals.

Citizens of which countries cannot trade on Tickmill

Tickmill is unfortunately not available for everybody.

Citizens of the USA, Canada, Japan cannot open accounts in the offshore jurisdiction.

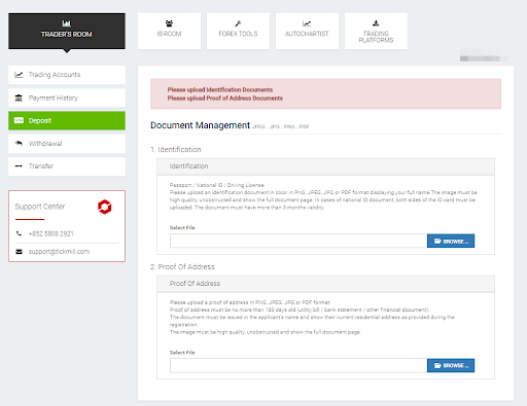

Documents required for opening an account

In order to open an account on Tickmill, you will need to provide two documents:

- Proof of identity

- vProof of address.

These must be two different documents. For example:

- As a proof of identity, you can provide Passport / National ID card / Driver’s License. The document must have more than 3 months validity.

- The document submitted as a proof of address must be not more than 180 days old (utility bills / bank statement / other official document containing the name of the client and the address).

You will need to upload the documents in PNG, JPEG, JPG or PDF format, with full name. the image must be of high quality, clear and display the full page of the document.

Account types

Tickmill LTD, registered under FSA (the Seychelles) jurisdiction, offers three types of live accounts:

- Classic (account without commissions)

- Pro (account with commissions, but with narrow spreads)

- VIP (account for large clients with deposits from USD 50,000).

The selection of base currencies (EUR, USD, GBP), settings of leverages and admissible strategies are similar for all account types.

In order to open an Islamic account, you first need to open and verify the account and then send a request to the customer support. Then, the account will be converted into an Islamic one.

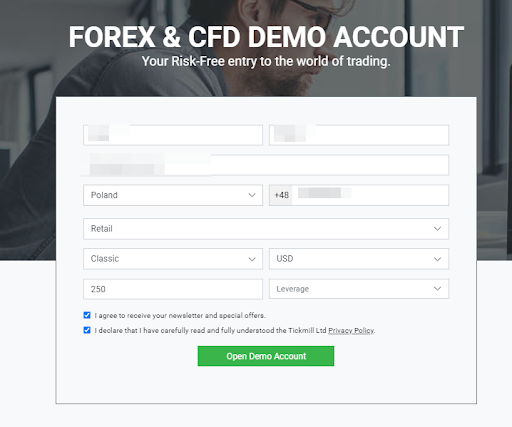

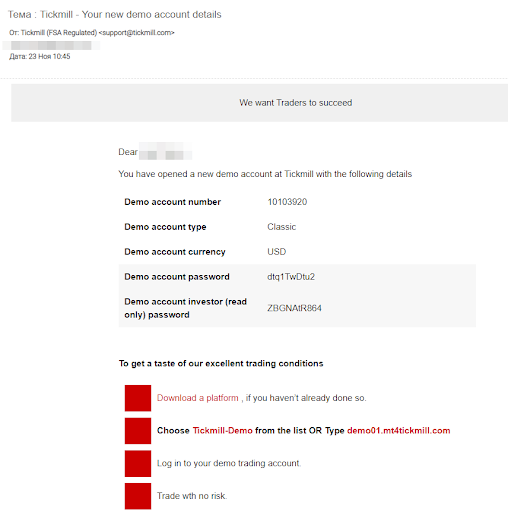

Demo account

It is really easy to open a demo account on Tickmill.

You need to:

1. Press Demo Account button in the upper right corner of the website

2. Fill out the form for opening a demo account, which means choose the account type (Classic or Pro), account currency, the amount of virtual deposit on the account, leverage

3. Confirm that you’ve read the broker’s Privacy Policy and then press Open Demo Account.

That’s it! Within seconds, you will receive a letter to your email address.

The letter will contain information for logging into the demo account via MetaTrader 4 platform: username, password, server’s address.

According to the rules of Tickmill, demo accounts that have not been used for more than 7 days are automatically deactivated.

Trading accounts

| Account type | Classic | Pro | VIP |

|---|---|---|---|

| Minimum deposit | from 100 USD | from 100 USD | 50 000 USD |

| Trading platform | MT4 + Webtrader | MT4 + Webtrader | MT4 + Webtrader |

| Stock, bond, futures trading | No | No | No |

| Forex and CFD trading | Yes | Yes | Yes |

| Commissions | No | Average | Low |

| Spreads | 1.6 pips | 0 pips | 0 pips |

| Trading with leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

Any type of account can be converted into an Islamic account. Any trading strategies can be implemented on any account type.

How to open an account on Tickmill: step-by-step guide

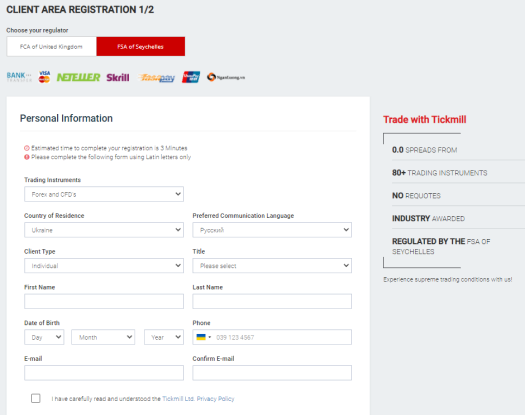

The procedure of opening an account takes place fully online. To start it, press APPLY (Create Account). It is a green button on the top right corner of Tickmill.com website.

The procedure of opening a live account consists of two steps:

- Account registration

- Account verification

Step 1. How to register an account

There are two steps in the account registration. It starts with filling out a questionnaire.

Please note that in the upper part of the questionnaire, there is the so-called ‘jurisdiction selector’. As a broker’s customer, you can choose the regulator, for example FCA (UK) and FSA (Seychelles).

The advantages of registration with FCA include:

- Customer funds are protected by the FSCS

- There is an option to trade futures via CQG platform

- FCA is a highly respected regulator.

The drawbacks of FCA regulation include:

- Small leverage for non-professional clients

- Some features are not available, for example bonus program, copy trading service.

We are registering an account in the Seychelles (FSA).

After you fill out basic information (phone number, email, first and last name, date of birth), we move to the second step.

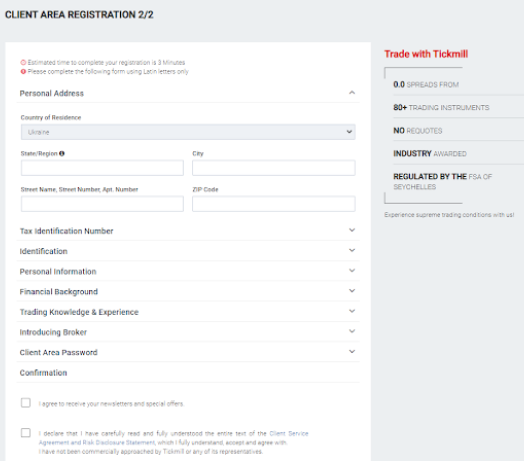

During the second step, the system will ask you to provide the following:

- Personal address;

- Tax identification number (can be entered later on);

- Citizenship (may be dual);

- Financial background;

- Trading knowledge and experience

- Password for accessing your account on the broker’s website.

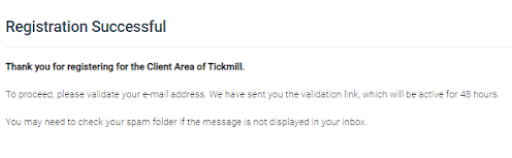

After you confirm that you’ve read and agree with the Client Service Agreement, the registration of your personal account is completed.

In order to access it, you need to go to your mail and click on the link to validate your email address.

After you validate your email address, your personal trader account on Tickmill will open.

However, you won’t be able to do anything in your account, except for upload documents. The broker requests you to provide two documents to confirm your identity and address.

This ends step 1 of the account registration and then Step 2 follows.

Step 2. Verification

For verification of our account, we uploaded and sent the following:

- Driver’s license as the proof of identity;

- Bank statement with the address (you cannot make a screenshot from your bank’s online account, you need to go to the branch of the bank, order a statement on the bank’s template with the seal and then take a photo of it.)

The next day we received a reply that our documents have been accepted and our account – verified.

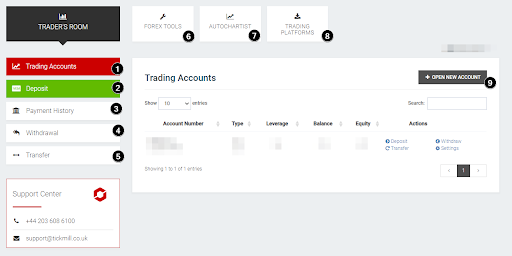

Review of personal account

After verification of documents, the trader is granted with full access to all functions of the personal account on Tickmill.

The interface is minimalistic and intuitive.

There is a separate button for each operation

1. Trading Accounts – summary of open accounts. It opens by default; the trader can set up the account, make a deposit / withdrawal / transfer of funds for the chosen account;

2. Deposits– a form for funding the account

3. Payment History– history of movement of funds on the account;

4. Withdraw– an application for withdrawal of funds;

5. Transfer– transfer to the website, where a user can view all available PAMM accounts, select an investment strategy;

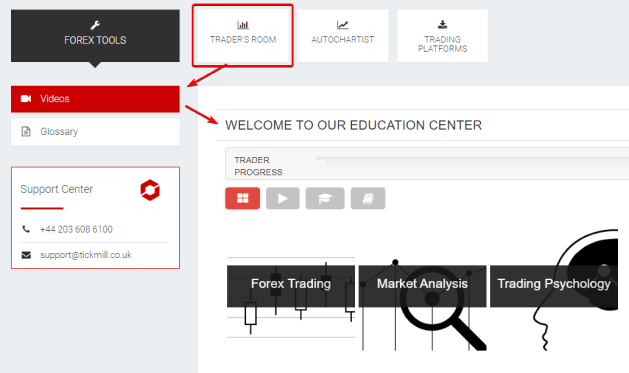

6. Forex Tools– a collection of video tutorials on forex trading for the beginners, and a trader’s glossary;

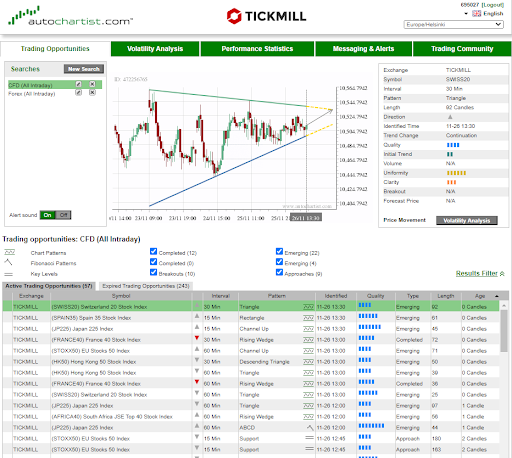

7. Autochartist– relevant information on chart patterns, which finds an algorithm from a third-party developer;

8. Trading platforms– this is where you can download Metatrader 4

9. Open Account– a button for opening a new account (there can be up to 10 accounts).

The contacts of the support center are placed in a separate banner.

Base currencies of the account

There are 3 base currencies on Tickmill – EUR, USD, GBP. There is also PLN, which is only available for the citizens of Poland.

If you fund your account using other currencies, the funds are automatically converted into the account currency.

One customer can open up to 10 accounts within one personal account on the website and each account can have a different base currency.

| Tickmill | FXTM | IG | |

|---|---|---|---|

| Number of base currencies | 3+1 | 5 | 6 |

Compared to other brokers, Tickmill does not compare favorably in terms of base currencies.

Deposit and withdrawal

| Pros |

|---|

|

| Cons |

|---|

|

Tickmill offers many ways to deposit and withdraw funds, including wire transfers, debit/credit cards, electronic wallets.

For the accounts in the Seychelles, 10 methods of deposit and withdrawal are available.

For the accounts in the UK, opened with Tickmill UK Ltd, 9 methods are available.

For the account in Cyprus – only 5 methods are available.

Methods and timeframe for deposits

The fees and the timeframe of the transfers are the same for all account types. As a reminder, the minimum deposit is 100 USD / EUR / GBP.

Here are some peculiarities:

- The broker does not accept deposits from third parties, otherwise a penalty may be imposed

- The broker reserves the right to request additional proof

- For deposits made with debit/credit card, the broker may request the photo of the card

- Payments made in a currency different from the account currency will be automatically converted.

The table below provides data for the accounts in the offshore jurisdiction.

| Method of deposit | Timeframe and currency | Fees and peculiarities |

|---|---|---|

| Wire transfer | USD, EUR, GBP within 1 working day | The broker does not charge any deposit fees regardless of the method of deposit |

| Visa / Mastercard cards | USD, EUR, GBP instant funding | |

| Skrill | USD, EUR, GBP instant funding | |

| Neteller | USD, EUR, GBP instant funding | |

| SticPay * | USD, EUR, GBP instant funding | |

| FasaPay * | USD, IDR instant funding | |

| UnionPay * | CNY within 1-2 hours | |

| Ngan Luong * | VND instant funding | |

| QIWI * | USD, EUR, RUB instant funding | |

| WebMoney * | USD, EUR instant funding |

* unavailable for deposits on the accounts opened in the British branch. However, PayPay, DotPay, PaySafeCard and Sofort are available in the UK branch

Deposits in cryptocurrencies are not available at any branch of the broker.

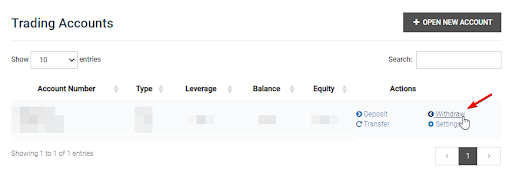

Methods of withdrawal and fees

In order to request withdrawal of funds a user needs to:

- access personal account

- choose the account

- press Withdraw

- specify the amount of withdrawal and the method that will be used to transfer the funds from your account to the specified payment details.

Most likely, you will be allowed to withdraw funds only using the same method you deposited them or based on the same payment details you provided. This is a standard condition for the exchange brokers prescribed by the anti-money laundering laws.

Example. If you deposited USD 100 using your debit/credit card, earned a profit of USD 1,000 and requested to withdraw USD 1,000, you will receive USD 100 back to the card you used to deposit the funds and the remaining USD 900 will be transferred based on the method you choose.

The table below provides data for the accounts in the offshore jurisdiction. The general requirement is that the minimum withdrawal amount is USD 25.

| Method of withdrawal | Withdrawal fee Timeframe | Peculiarities |

|---|---|---|

| Wire transfer | USD, EUR, GBP within 1 working day | The broker does not charge any withdrawal fees regardless of the method of withdrawal |

| Visa / Mastercard cards | USD, EUR, GBP within 1 working day | |

| Skrill | USD, EUR, GBP within 1 working day | |

| Neteller | USD, EUR, GBP within 1 working day | |

| SticPay * | USD, EUR, GBP within 1 working day | |

| FasaPay * | USD, EUR, GBP within 1 working day | |

| Skrill | USD, IDR within 1 working day | |

| UnionPay * | CNY within 1-2 hours | |

| Ngan Luong * | VND Instant funding | |

| QIWI * | USD, EUR, RUB Instant funding | |

| WebMoney * | USD, EUR Instant funding |

* - unavailable for the accounts at Tickmill UK Ltd.

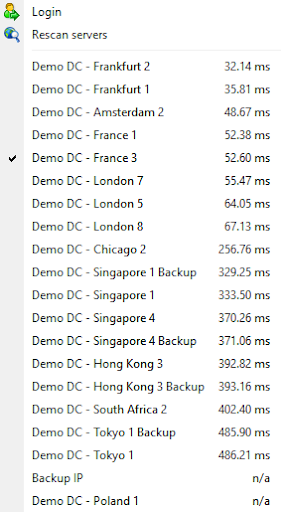

Trading platforms

Tickmill provides Forex and CFD trading services only via MetaTrader 4 platform. The exception is CQG platform, but it is available only for futures trading on the accounts with a balance over USD 1,000, opened at the British branch – Tickmill UK Ltd.

Since MetaTrader 4 platform by Metaquotes is widely known, we will not review it in detail. We will only focus on the peculiarities of using the platform with Tickmill.

- High speed of order execution – customer support claims the average time is 100 milliseconds.

- All types of strategies, including high-frequency scalping, are allowed.

- The broker offers the use of VPS, optimized to work with MT4 together with the partner company BeeksFX. Tickmill customers are offered 20% discounts on all packages from BeeksFX.

- A large number of servers around the world – we have counted 18 servers for demo accounts alone.

Analytics and market news

Analytical market reviews by Tickmill deserve a positive assessment.

| Pros |

|---|

|

| Cons |

|---|

|

|

Tickmill offers several informational services:

- Market news

- Fundamental analysis

- Technical analysis

The main information is supplied on the corporate blog at tickmill.com/blog/

The authors of the posts are staff experts and analysts of Tickmill.

Market news

Financial market news pieces are published once a day in the format of a short review. They contain:

- he most important headlines with the analysis of their impact on the prices

- The most interesting charts, according to Tickmill analysts

- And also suggestions (thoughts) on further development of events.

In terms of topics, the articles in the news section cover as much as possible – technical and fundamental analysis, educational texts, rumors and expert opinions.

Technical analysis

Technical analysis section on tickmill.com/blog/ contains materials focused on the analysis of markets from the standpoints of indicators, chart patterns, trend lines, support and resistance.

On average, two articles with technical analysis of the charts are published a day.

Fundamental analysis

Fundamental analysis section is focused on macroeconomics review, impact of politics on financial markets. Experts evaluate such events as statistical data, elections, speeches of officials, protocols of the meetings of leaders of the countries, etc.

Usually, one article with fundamental market analysis is published a day.

AutoChartist

Autochartist is a service for finding trading opportunities that are generated based on technical analysis patterns.

Tickmill provides the service together with the namesake company that developed the chart scanner for searching the setups. Both Forex pairs and CFD are available. The signals come from different timeframes.

A full-fledged portal is available at tickmill.autochartist.com. Patterns are also available in the personal account on Tickmill, but with slightly reduced functionality.

Autochartist can be classified as a trading signal service, because each discovered pattern contains an indication of further price increases.

The portal provides statistics claiming that some patterns bring profit in 70-80% of cases. Those are quite attractive figures. However, we advise you to check the profitability of trading by using Autochartist patterns on the demo account first. Thankfully, a lot of signals are delivered – several dozen a day.

You can learn more about this by watching a thematic webinar from the broker:

Education

Tickmill pays a lot of attention to educational materials, primarily focusing on the novice traders.

| Pros |

|---|

|

| Cons |

|---|

|

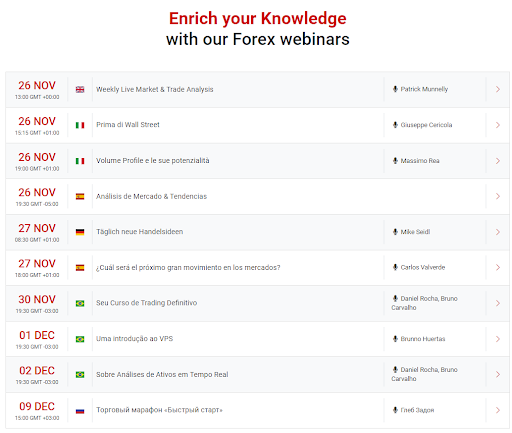

Webinars

Tickmill holds several webinars with speakers from different countries every week.

The webinars are available for viewing in streaming mode only to customers with verified accounts. The majority of them are designed for the beginners. However, there are webinars (for example on profile analysis) that will be useful to more experienced traders.

After the webinar ends, it is posted on the broker’s YouTube channel and is opened for public – youtube.com/c/TickmillGlobal/

As an example, here’s analytics of the week’s events, which the broker regularly uploads:

Seminars

Seminars are offline meetings in different formats. In 2020, they were not as frequent as in 2019, clearly due to the measures taken because of the pandemic.

Video tutorials

Video tutorials are 10 series of educational tutorials on different topics:

- Forex trading

- Market analysis

- Trading psychology

- Trading strategies

- Social trading

- Stocks

- Metatrader

- CFDs

- Technical indicators

- Managed accounts

The first two tutorials in each series are available on tickmill.com/education/video-tutorials

In order to watch other tutorials of the series, you need to be a verified customer. Then, the access to them will be granted inside your personal account, in the Tools section.

Ebooks

On tickmill.com/education/ebooks , you will find 5 publicly available books on trading:

- Introduction to Fibonacci Analysis

- Knowing your trading costs

- An In-Depth Look at Risk Management

- The Ultimate Guide to Becoming an IB

- Trading the Majors: Insights & Strategies

Of course, it is difficult to call them books, as they are too small. You can read everything within half an hour. They do, however, contain useful information, especially for those making their first steps in the markets.

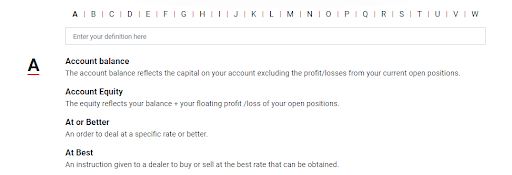

Forex glossary

Trader’s ABCs can be found at tickmill.com/education/forex-glossary/letter-a

It contains main terms of Forex traders to help beginners quickly immerse into the topic.

Customer support

We contacted the representatives of Tickmill customer support on more than one occasion and every time our issue was settled.

| Pros |

|---|

|

| Cons |

|---|

|

Channels of communication

There are three ways to contact customer support (we do not consider sending a request via a contact form on Contact Us page as a separate way of providing customer support):

- By phone.

- Via email (the response is delivered within 1 working day)

- Via online chat.

We recommend using chat. We believe it is the most convenient way.

In terms of drawbacks:

- Not all languages may be online (as a rule, an English-speaking manager is always available)

- If you choose a non-English speaking manager, you may have to wait.

Languages and operating hours of customer support:

| Location | Operating hours, email | Contacts |

|---|---|---|

| Tickmill.COM Regulation: FSA (Seychelles) | Mon-Fri 7:00 - 16:00 GMT support@tickmill.com | Customer support: +852 5808 2921 Sales line: +852 5808 7849 |

| Tickmill.COM Regulation: LFSA (Malaysia) | Mon-Fri 8:00 - 17:00 MST support@tickmill.com | Customer support: +6087-504 565 |

| Tickmill.CO.UK Regulation: FCA (UK) | Mon-Fri 7:00 - 16:00 GMT support@tickmill.co.uk | Customer support: +44 203 608 6100 Central Office: +44 (0)20 3608 2100 |

| Tickmill.EU Regulation: CySEC (Cyprus) | Mon-Fri 7:00 - 16:00 GMT support@tickmill.eu | Customer support: +357 25041710 Office: +357 25247650 |

Bonuses and promo

A distinguishing feature of Tickmill Group is its participation in different charity projects. Other brokers sign contracts with star athletes, while Tickmill spends its budget differently. The information about it can be found in the CSR (Corporate Social Responsibility) section on the broker website.

In particular, Tickmill Group supports:

- Students at public schools in Playa del Carmen, Mexico;

- Young homeless people through The Off Road Kids Foundation;

- Cancer-afflicted children through One Dream One Wish, a Cyprus-based association

Promotions

Tickmill’s policy differs greatly depending on the branch. In particular, there is no Promotions section on the menu of Tickmill.EU and Tickmill.CO.UK websites.

Meanwhile, in the offshore jurisdiction, where the regulation seems to be more loyal, we can find the bonus and promos programs offered by Tickmill. At the time when this review was prepared, there were three promotions:

- Trader of the month — a monthly contest of Forex traders. The most successful trader earns the reward of USD 1,000. The broker selects the winner.

- Predict the NFP Figure (Tickmill’s NFP Machine). Non-Farm Payrolls is an important statistical indicator of the U.S. economy. Those who guess correctly get a prize of $200.

- Spread compensation or cashback. The broker compensates a share of the commission to its clients. The more the customer traders, the more cashback he receives.

Summary

Tickmill’s slogan is “We want traders to succeed”.

This motivational statement is reflected on Tickmill in the broker’s beneficial conditions for trading, quick order execution. We can also find confirmation of that in the competitive spreads on the monitoring services that compare the spreads of brokers in real time. Tickmill is confidently among the leaders there.

On the other hand, Tickmill has a rather serious drawback – limited choice of instruments.

To summarize our review, we believe that trading with Tickmill will be a good option for those aiming at active trading in a small number of popular markets, for example algorithmic trading using advisors-scalpers, or news trading.

Real reviews of Tickmill 2025

Despite the fact that Tickmill is not included in the top brokers, I prefer this particular company. The British regulation inspires confidence and a positive reputation. In January, I earned more than $ 2,000 with this broker. On Kiwi, the conclusion is operational.

Tickmill is good for scalping. Spreads are tight and slippage is very rare. Fees are very low too. The quality of service suits me completely.

I tried to withdraw 350 dollars to Kiwi, so my application was rejected for some reason. With verification, everything is ok. One gets the impression that they want to deceive me!

Tickmill is good for active trading because fees are extra low. On the other hand, the transfer to a bank card takes a very long time (up to 10 business days). Tickmill is testing my patience. Once again there will be such a delay, I will refuse to cooperate with this company.

it works properly, nothing wrong with tickmill company, money withdrawing is ok and i am still not using their bonuses. i had some experience working with ‘em last year – something was good and i earned, but failed sometimes as well. now i am trading with my own money. 500 leverage is an obvious benefit, but sometimes i take even 1:200. i am telling u that in case they turn sour, i will switch to another broker. it’s good that you can change your broker any time you want. Too many of ‘em present days.

This broker is just another average company. Regular trading instruments, standard terminal... Well, I found no advantages or disadvantages. I spent several months trading with Tickmill, earned USD 200 and withdrawn it smoothly. Not surprised it’s not in top Forex brokers list.